Author: Quantcha Trade Ideas

-

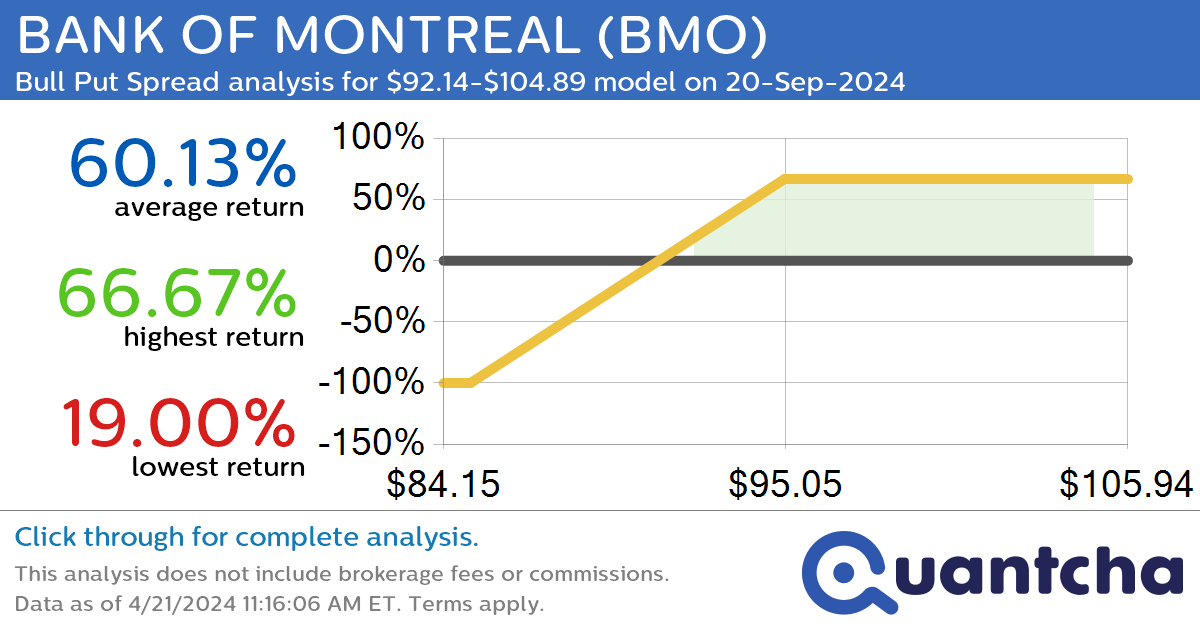

StockTwits Trending Alert: Trading recent interest in BANK OF MONTREAL $BMO

Quantchabot has detected a new Bull Put Spread trade opportunity for BANK OF MONTREAL (BMO) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BMO was recently trading at $92.14 and has an implied volatility of 21.56% for this period. Based on an analysis of…

-

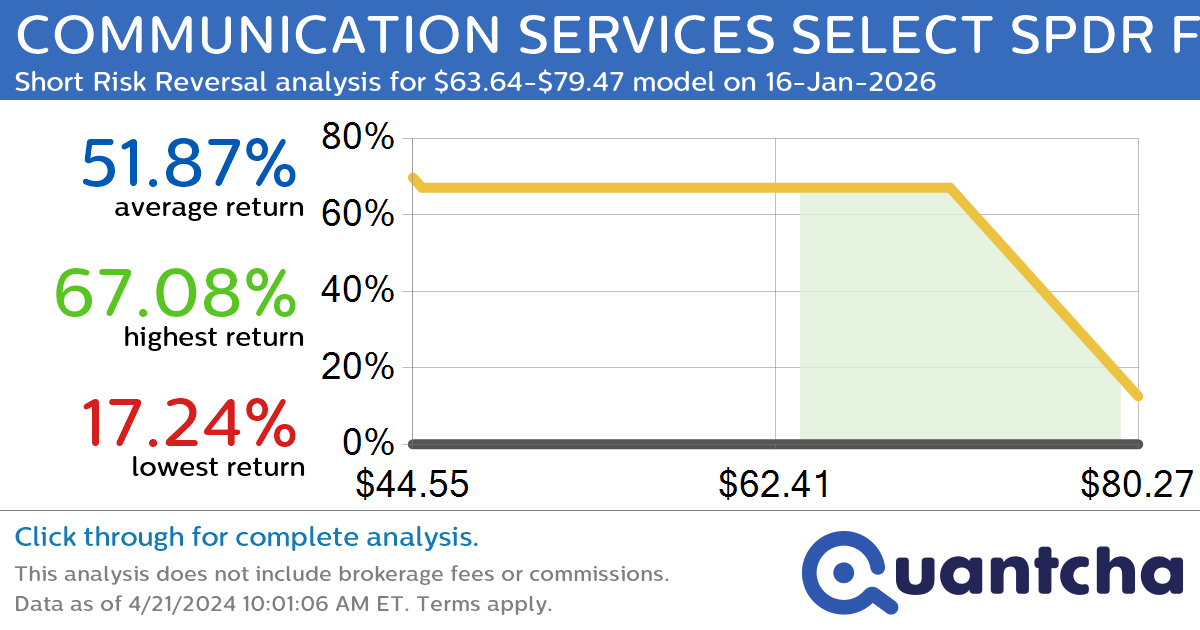

StockTwits Trending Alert: Trading recent interest in COMMUNICATION SERVICES SELECT SPDR FUND $XLC

Quantchabot has detected a new Short Risk Reversal trade opportunity for COMMUNICATION SERVICES SELECT SPDR FUND (XLC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XLC was recently trading at $79.47 and has an implied volatility of 23.83% for this period. Based on an…

-

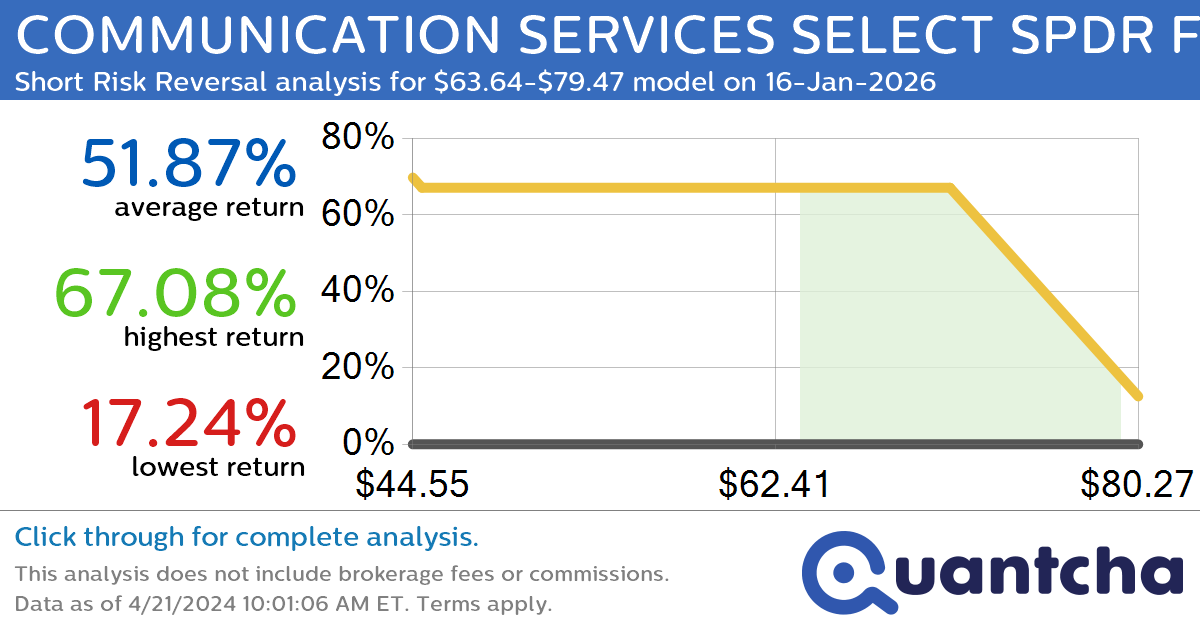

StockTwits Trending Alert: Trading recent interest in COMMUNICATION SERVICES SELECT SPDR FUND $XLC

Quantchabot has detected a new Short Risk Reversal trade opportunity for COMMUNICATION SERVICES SELECT SPDR FUND (XLC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XLC was recently trading at $79.47 and has an implied volatility of 23.83% for this period. Based on an…

-

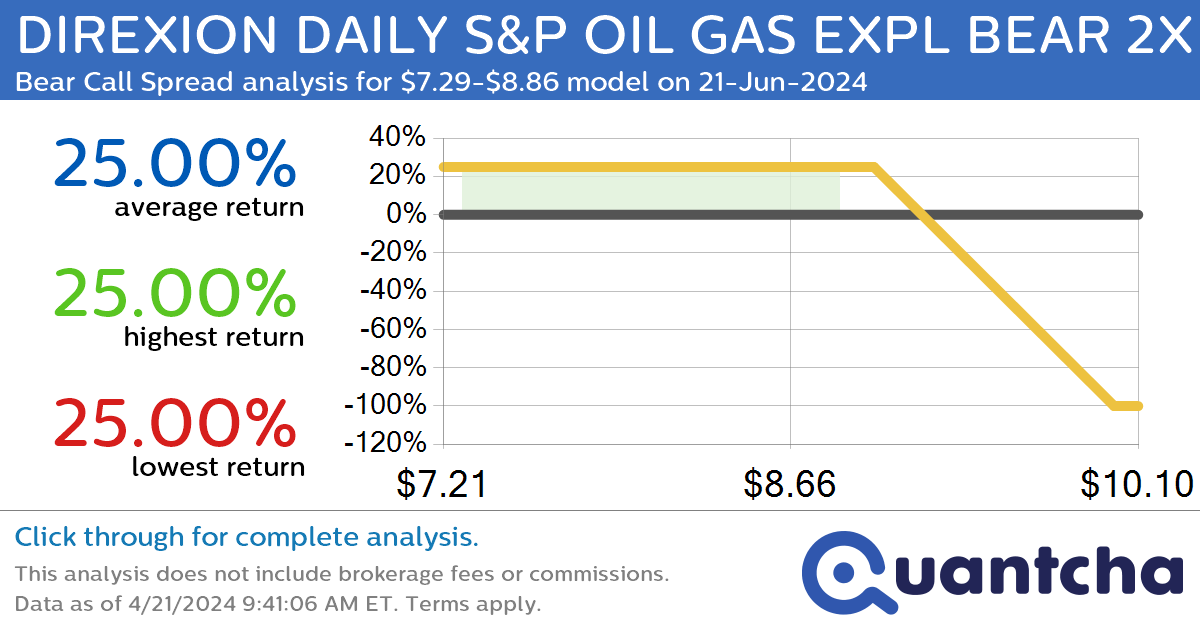

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY S&P OIL GAS EXPL BEAR 2X $DRIP

Quantchabot has detected a new Bear Call Spread trade opportunity for DIREXION DAILY S&P OIL GAS EXPL BEAR 2X (DRIP) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DRIP was recently trading at $8.86 and has an implied volatility of 49.77% for this period.…

-

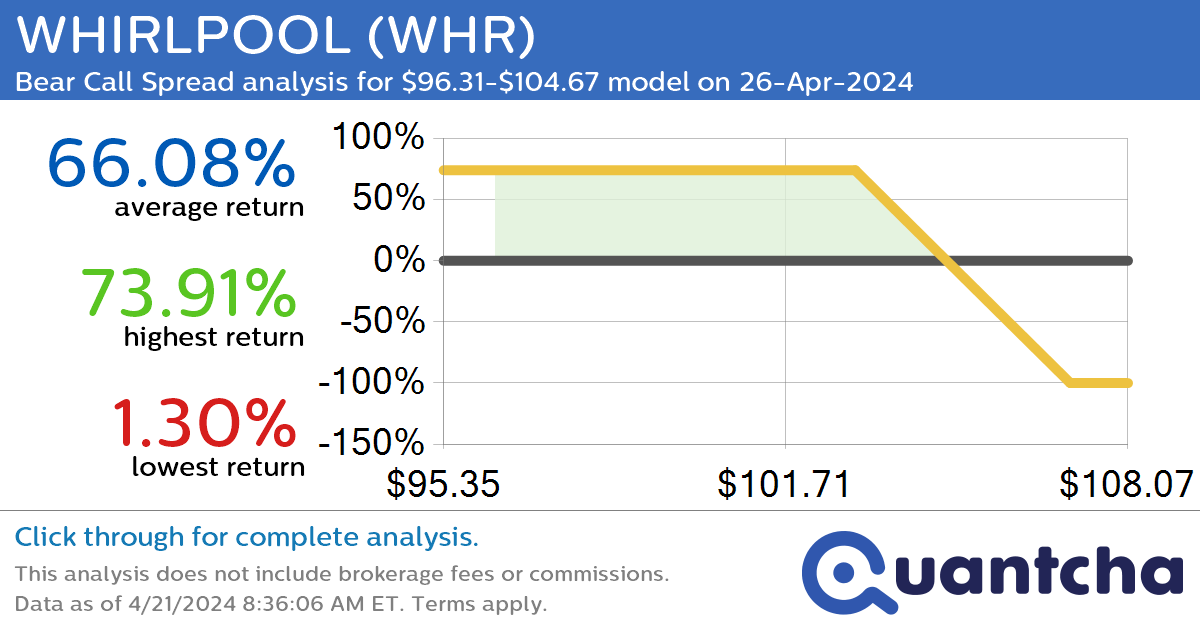

StockTwits Trending Alert: Trading recent interest in WHIRLPOOL $WHR

Quantchabot has detected a new Bear Call Spread trade opportunity for WHIRLPOOL (WHR) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WHR was recently trading at $104.67 and has an implied volatility of 66.73% for this period. Based on an analysis of the options…

-

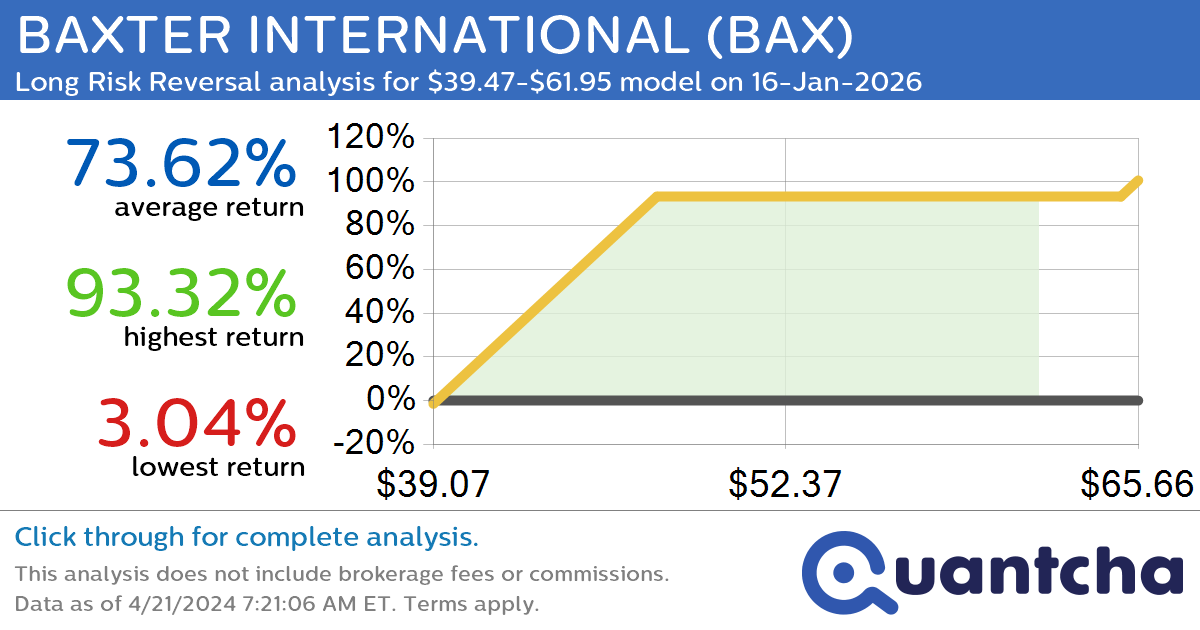

StockTwits Trending Alert: Trading recent interest in BAXTER INTERNATIONAL $BAX

Quantchabot has detected a new Long Risk Reversal trade opportunity for BAXTER INTERNATIONAL (BAX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BAX was recently trading at $39.47 and has an implied volatility of 27.15% for this period. Based on an analysis of the…

-

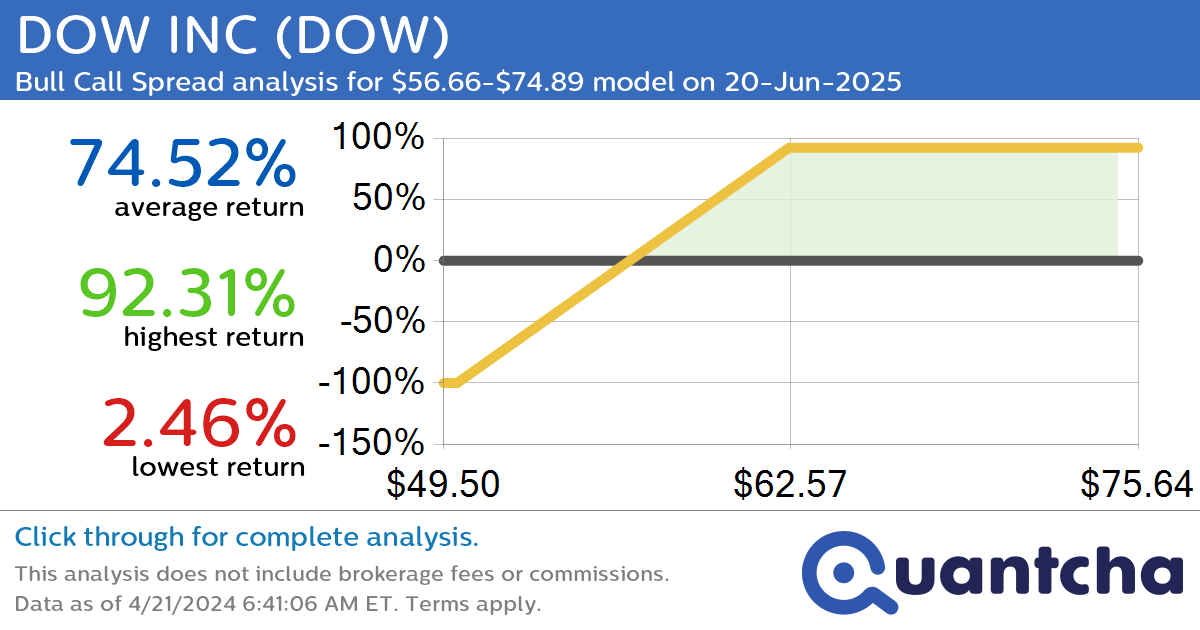

StockTwits Trending Alert: Trading recent interest in DOW INC $DOW

Quantchabot has detected a new Bull Call Spread trade opportunity for DOW INC (DOW) for the 20-Jun-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DOW was recently trading at $56.66 and has an implied volatility of 25.99% for this period. Based on an analysis of the…

-

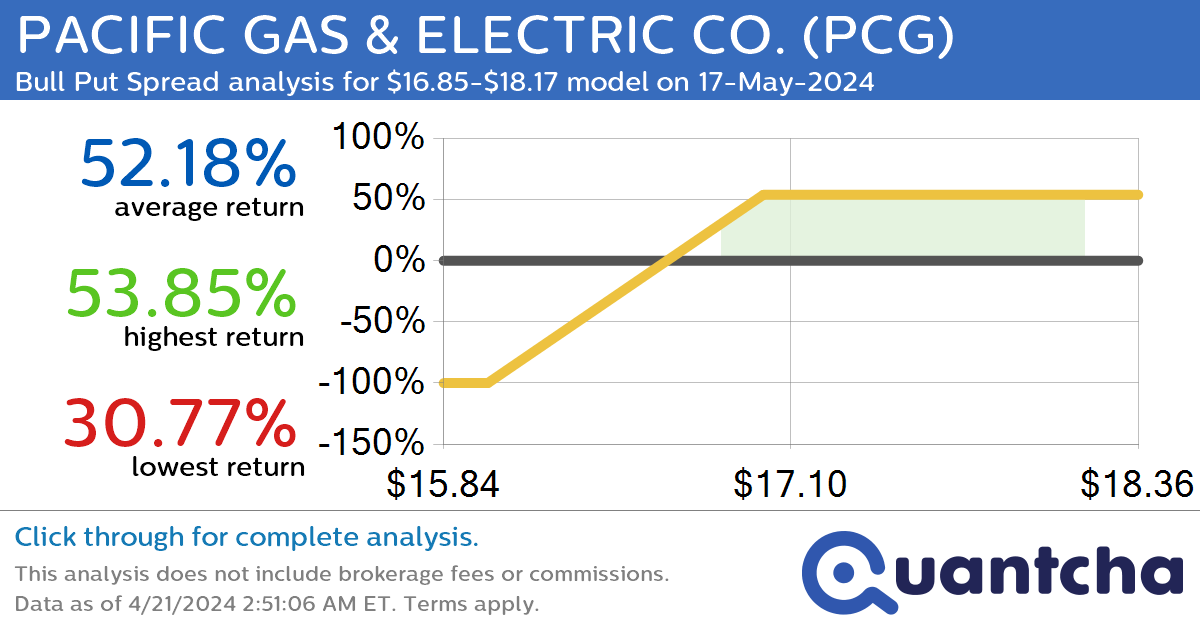

StockTwits Trending Alert: Trading recent interest in PACIFIC GAS & ELECTRIC CO. $PCG

Quantchabot has detected a new Bull Put Spread trade opportunity for PACIFIC GAS & ELECTRIC CO. (PCG) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PCG was recently trading at $16.85 and has an implied volatility of 26.15% for this period. Based on an…

-

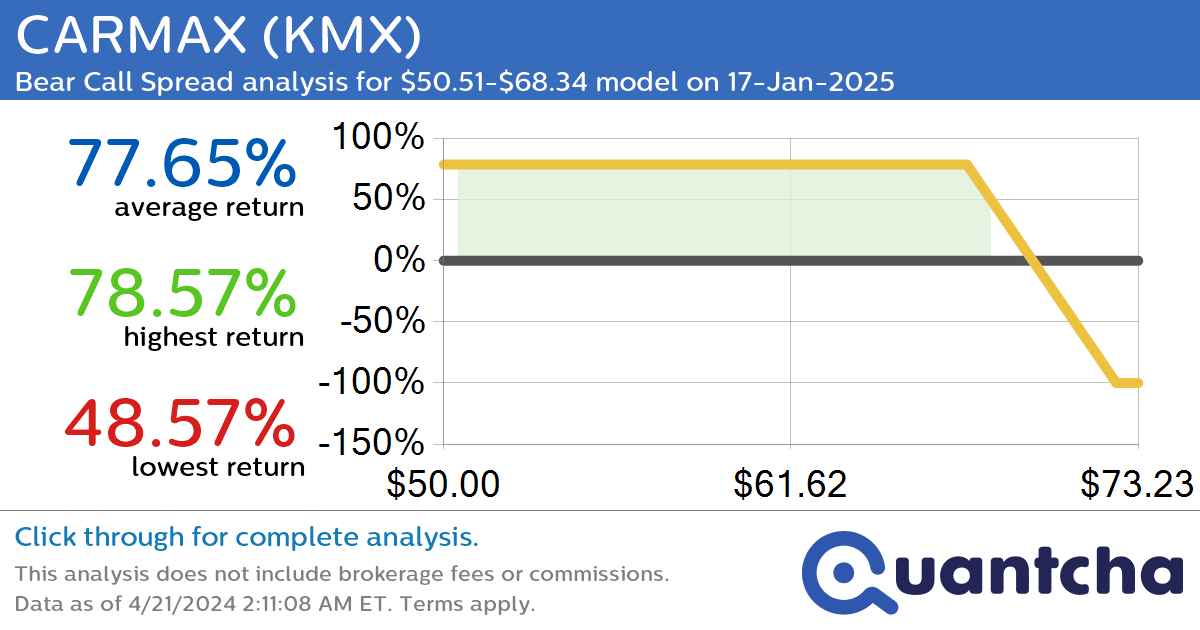

StockTwits Trending Alert: Trading recent interest in CARMAX $KMX

Quantchabot has detected a new Bear Call Spread trade opportunity for CARMAX (KMX) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KMX was recently trading at $68.34 and has an implied volatility of 39.79% for this period. Based on an analysis of the options…

-

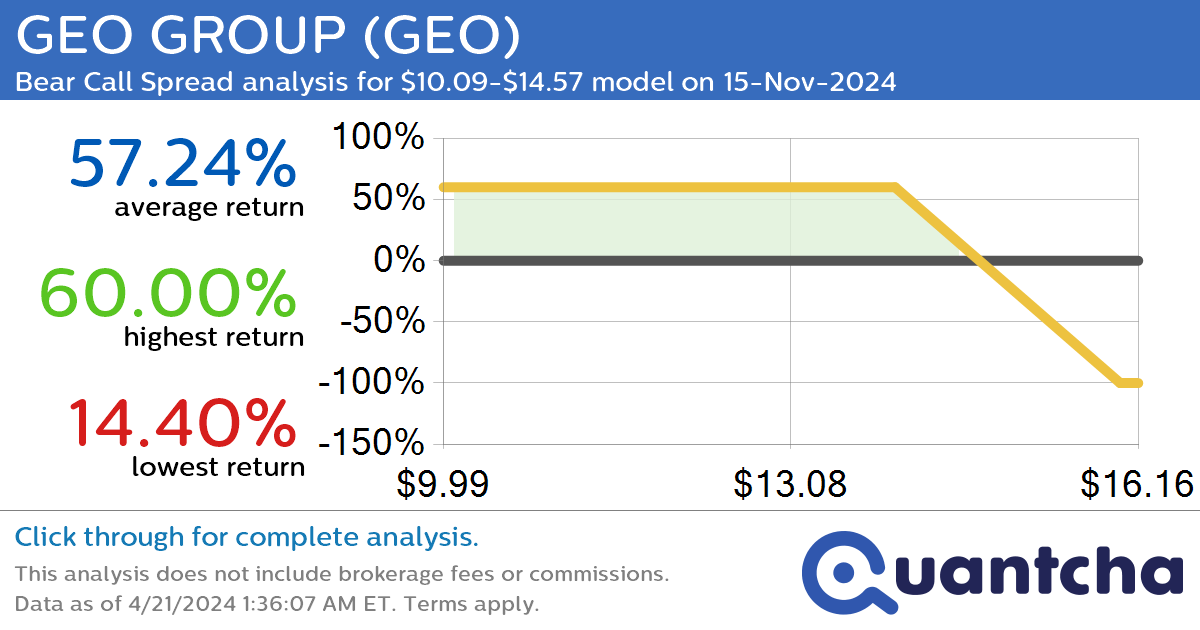

StockTwits Trending Alert: Trading recent interest in GEO GROUP $GEO

Quantchabot has detected a new Bear Call Spread trade opportunity for GEO GROUP (GEO) for the 15-Nov-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GEO was recently trading at $14.57 and has an implied volatility of 52.73% for this period. Based on an analysis of the…