Author: Quantcha Trade Ideas

-

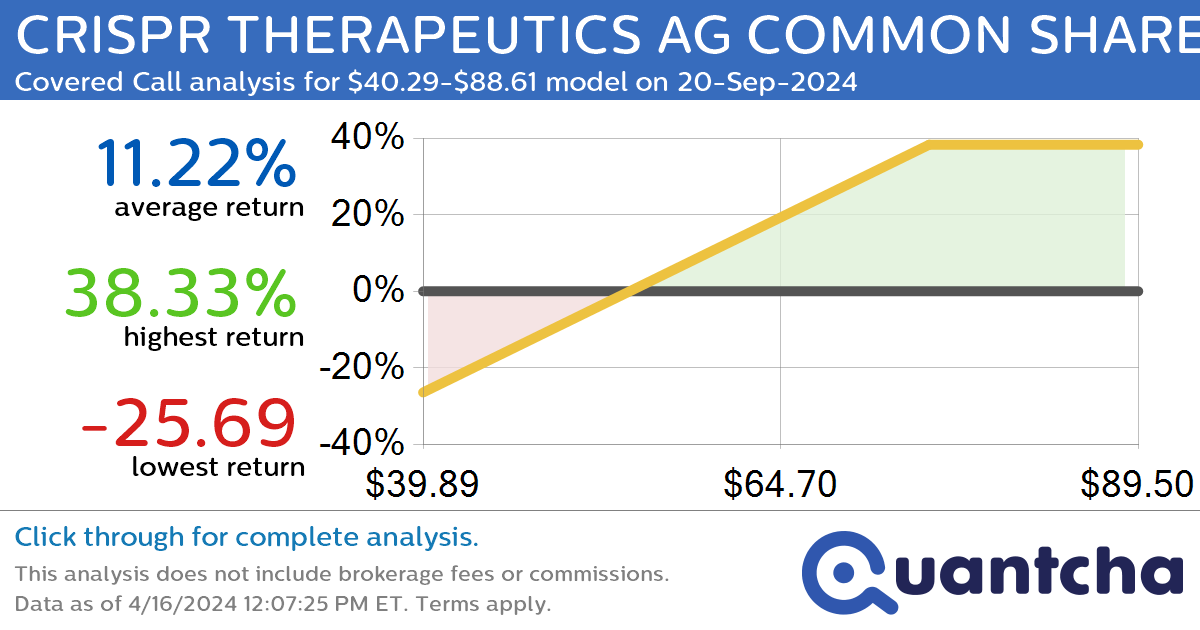

Covered Call Alert: CRISPR THERAPEUTICS AG COMMON SHARES $CRSP returning up to 38.58% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for CRISPR THERAPEUTICS AG COMMON SHARES (CRSP) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRSP was recently trading at $58.32 and has an implied volatility of 59.97% for this period. Based on an analysis…

-

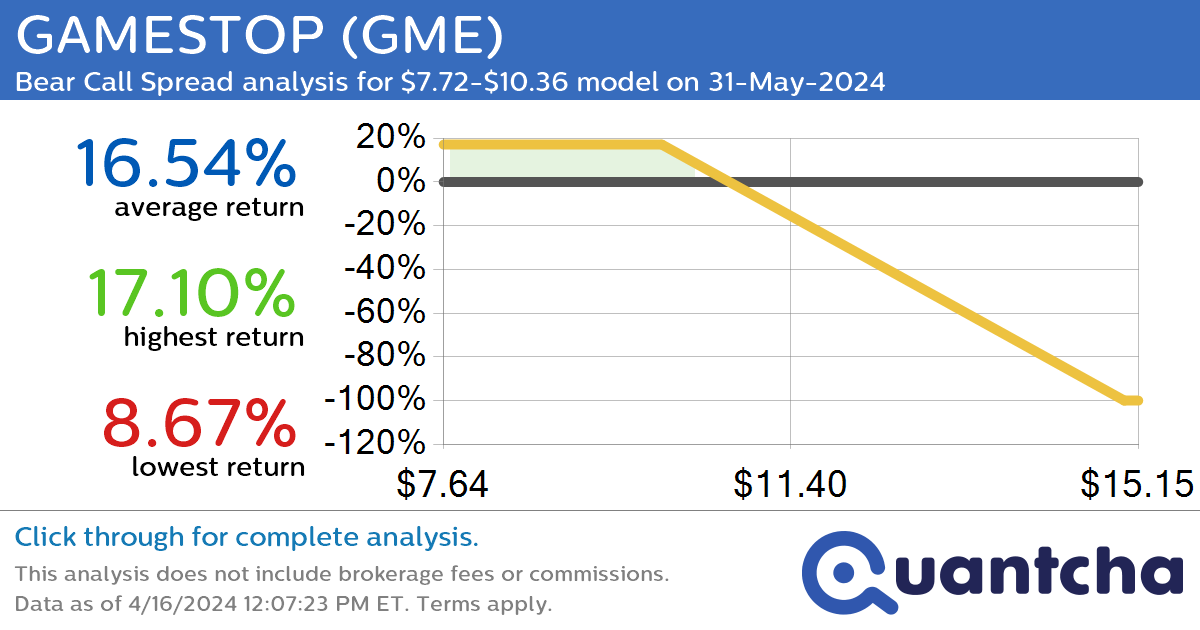

52-Week Low Alert: Trading today’s movement in GAMESTOP $GME

Quantchabot has detected a new Bear Call Spread trade opportunity for GAMESTOP (GME) for the 31-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GME was recently trading at $10.29 and has an implied volatility of 82.96% for this period. Based on an analysis of the options…

-

Covered Call Alert: TOAST INC $TOST returning up to 24.69% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for TOAST INC (TOST) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TOST was recently trading at $22.82 and has an implied volatility of 58.65% for this period. Based on an analysis of the options…

-

52-Week Low Alert: Trading today’s movement in WORKIVA INC $WK

Quantchabot has detected a new Covered Put trade opportunity for WORKIVA INC (WK) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WK was recently trading at $77.77 and has an implied volatility of 40.79% for this period. Based on an analysis of the options…

-

Big Loser Alert: Trading today’s -7.0% move in GAOTU TECHEDU INC $GOTU

Quantchabot has detected a new Bear Call Spread trade opportunity for GAOTU TECHEDU INC (GOTU) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GOTU was recently trading at $5.88 and has an implied volatility of 89.51% for this period. Based on an analysis of…

-

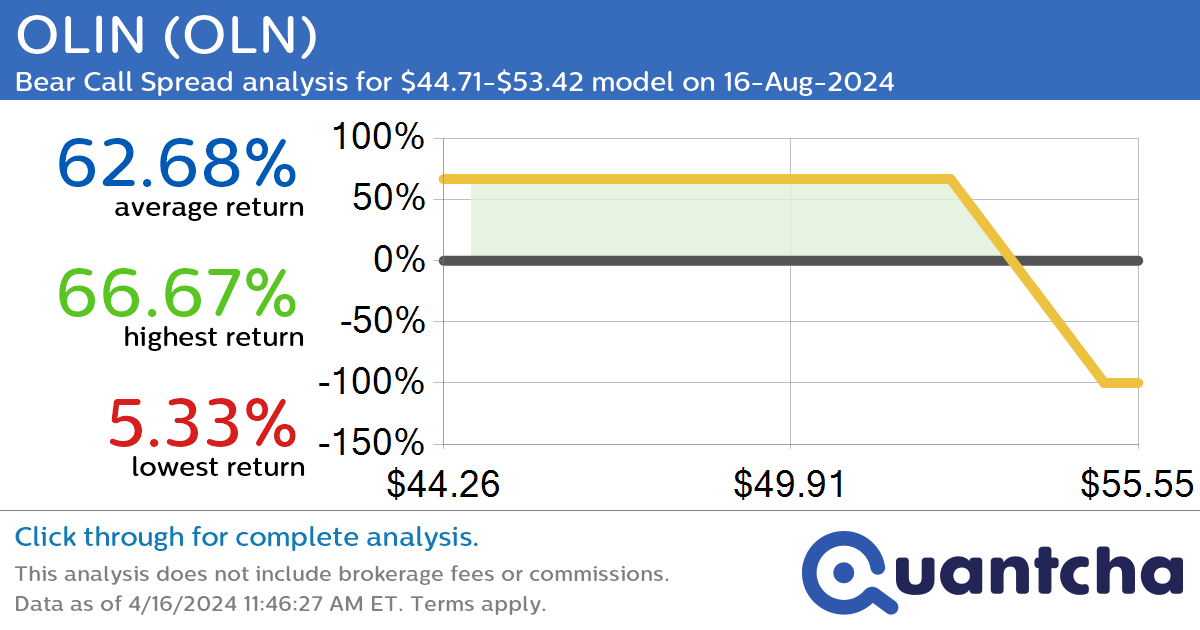

StockTwits Trending Alert: Trading recent interest in OLIN $OLN

Quantchabot has detected a new Bear Call Spread trade opportunity for OLIN (OLN) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OLN was recently trading at $53.38 and has an implied volatility of 33.84% for this period. Based on an analysis of the options…

-

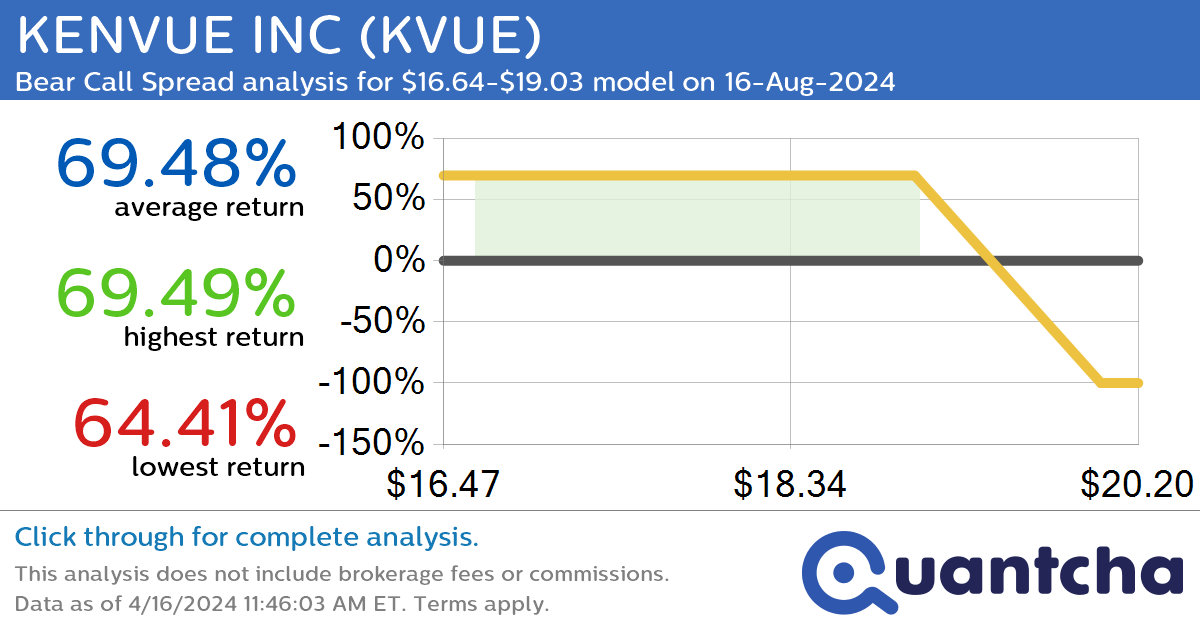

StockTwits Trending Alert: Trading recent interest in KENVUE INC $KVUE

Quantchabot has detected a new Bear Call Spread trade opportunity for KENVUE INC (KVUE) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KVUE was recently trading at $19.02 and has an implied volatility of 26.35% for this period. Based on an analysis of the…

-

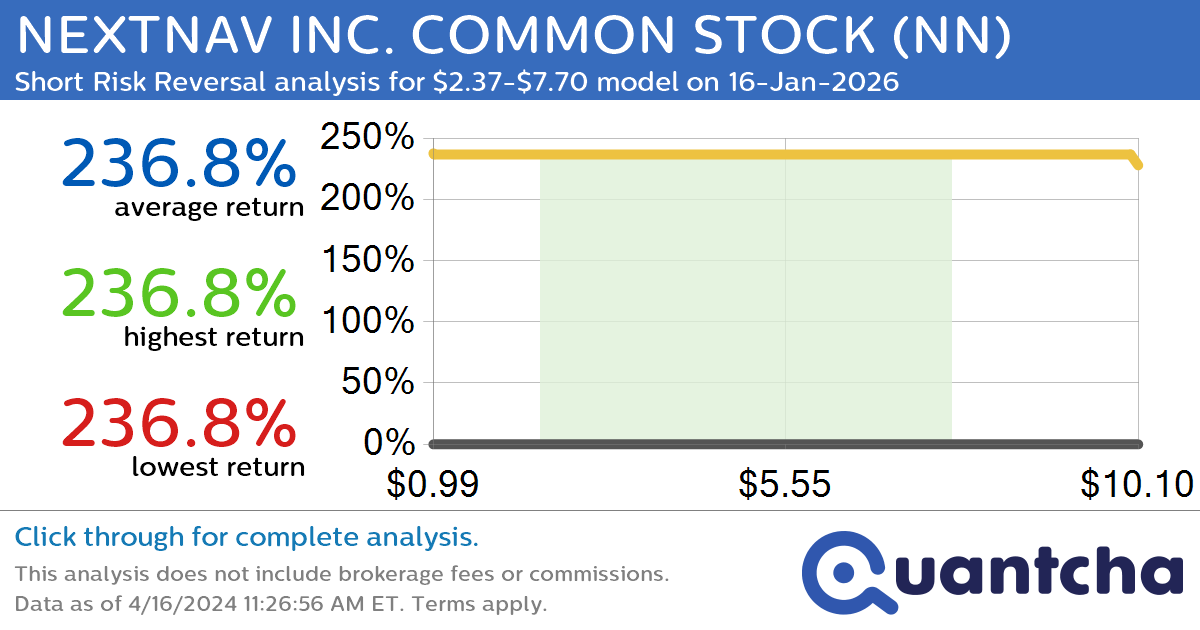

StockTwits Trending Alert: Trading recent interest in NEXTNAV INC. COMMON STOCK $NN

Quantchabot has detected a new Short Risk Reversal trade opportunity for NEXTNAV INC. COMMON STOCK (NN) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NN was recently trading at $7.69 and has an implied volatility of 95.76% for this period. Based on an analysis…

-

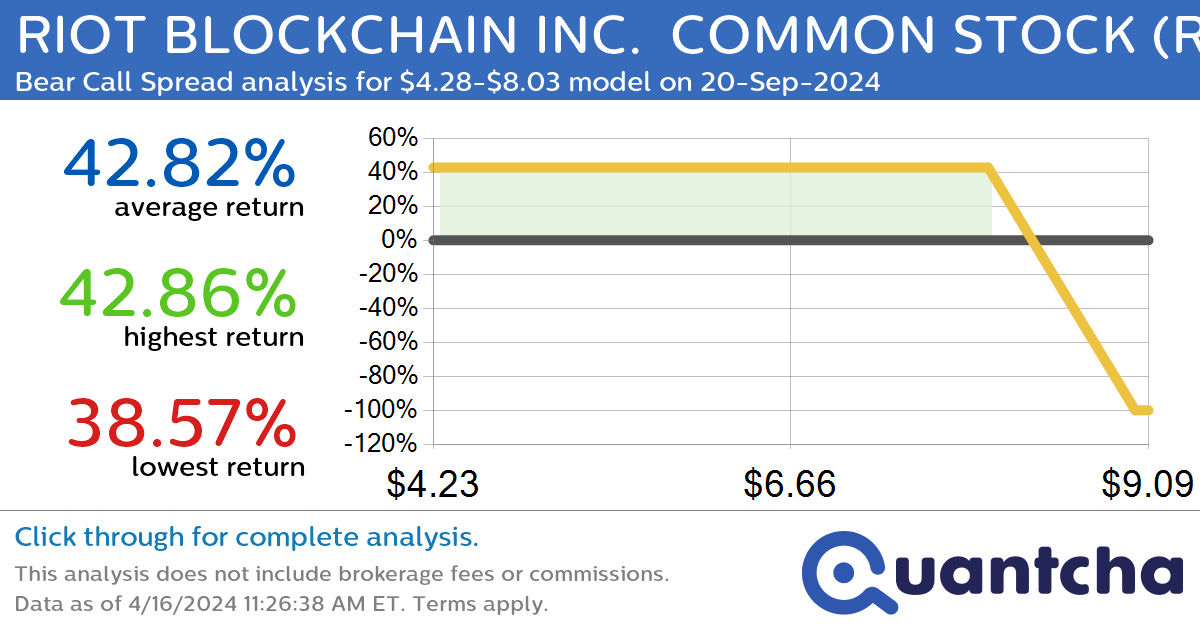

StockTwits Trending Alert: Trading recent interest in RIOT BLOCKCHAIN INC. COMMON STOCK $RIOT

Quantchabot has detected a new Bear Call Spread trade opportunity for RIOT BLOCKCHAIN INC. COMMON STOCK (RIOT) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RIOT was recently trading at $8.03 and has an implied volatility of 99.22% for this period. Based on an…

-

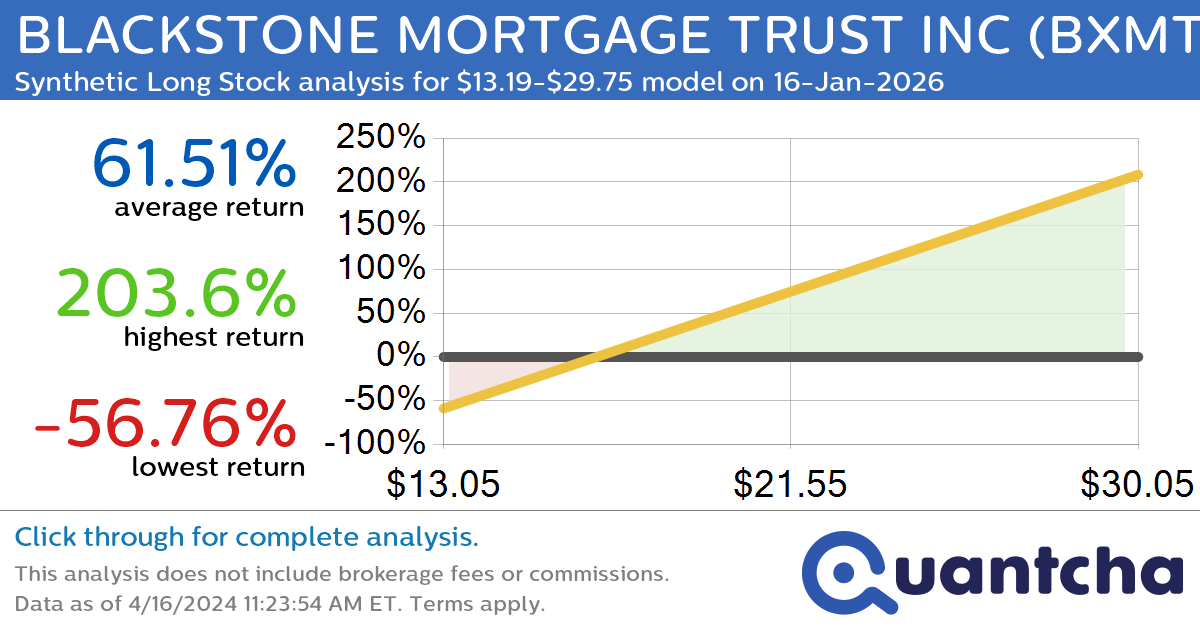

Synthetic Long Discount Alert: BLACKSTONE MORTGAGE TRUST INC $BXMT trading at a 11.36% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for BLACKSTONE MORTGAGE TRUST INC (BXMT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BXMT was recently trading at $18.05 and has an implied volatility of 30.71% for this period. Based on an analysis…