Author: Quantcha Trade Ideas

-

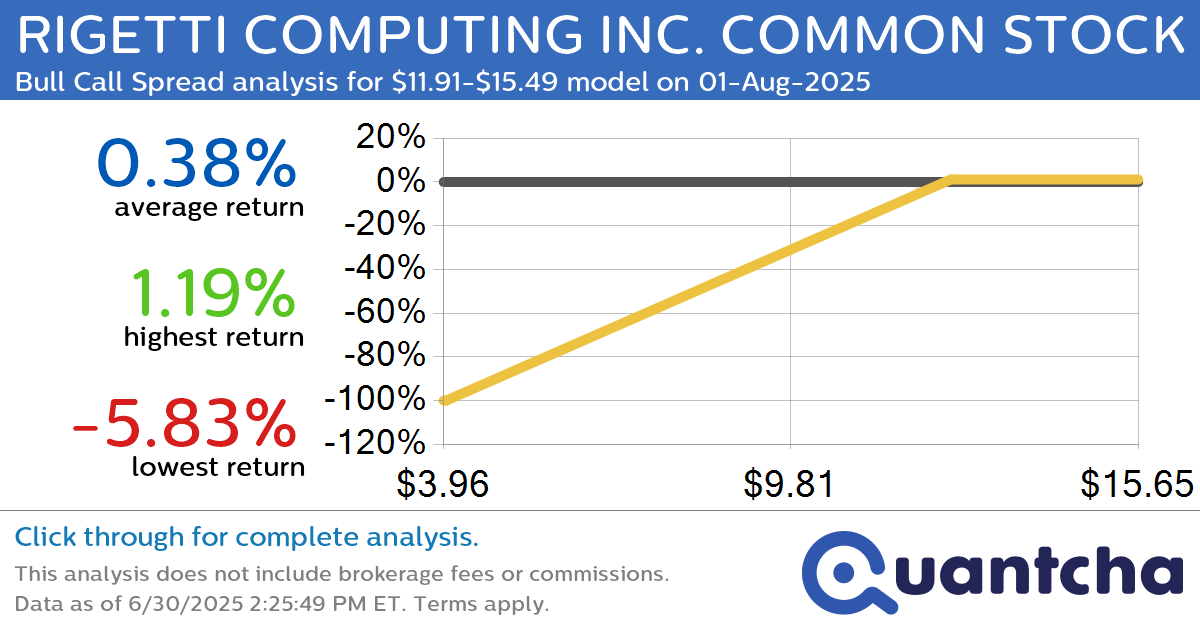

Big Gainer Alert: Trading today’s 7.2% move in RIGETTI COMPUTING INC. COMMON STOCK $RGTI

Quantchabot has detected a new Bull Call Spread trade opportunity for RIGETTI COMPUTING INC. COMMON STOCK (RGTI) for the 1-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGTI was recently trading at $11.87 and has an implied volatility of 88.08% for this period. Based on an…

-

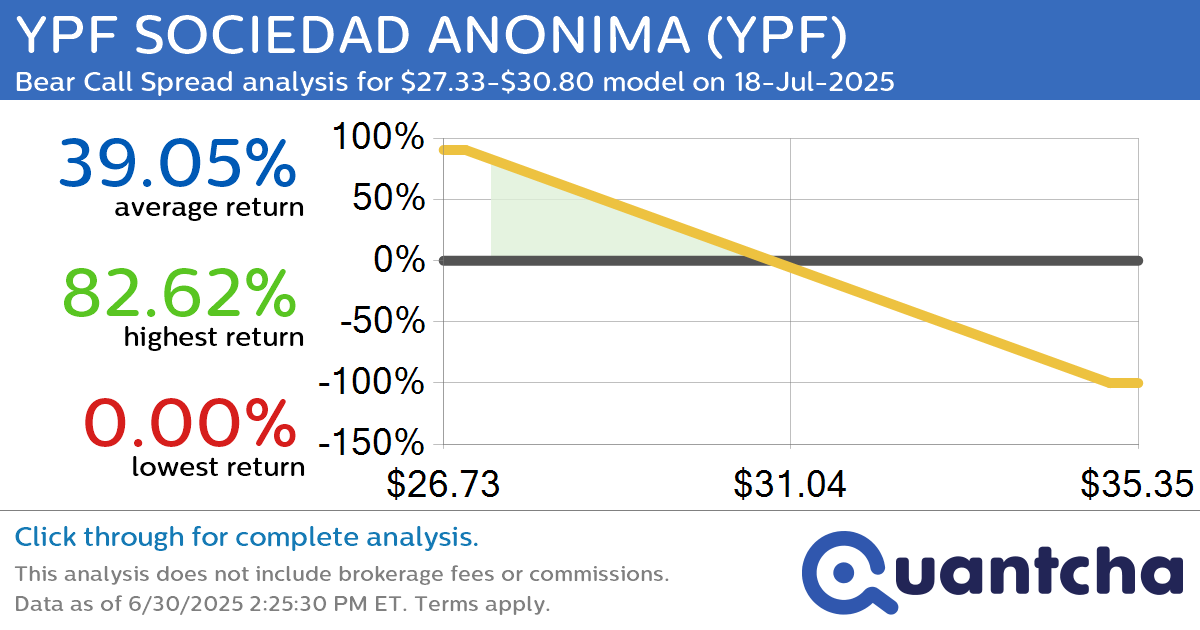

Big Loser Alert: Trading today’s -7.8% move in YPF SOCIEDAD ANONIMA $YPF

Quantchabot has detected a new Bear Call Spread trade opportunity for YPF SOCIEDAD ANONIMA (YPF) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. YPF was recently trading at $30.73 and has an implied volatility of 52.89% for this period. Based on an analysis of…

-

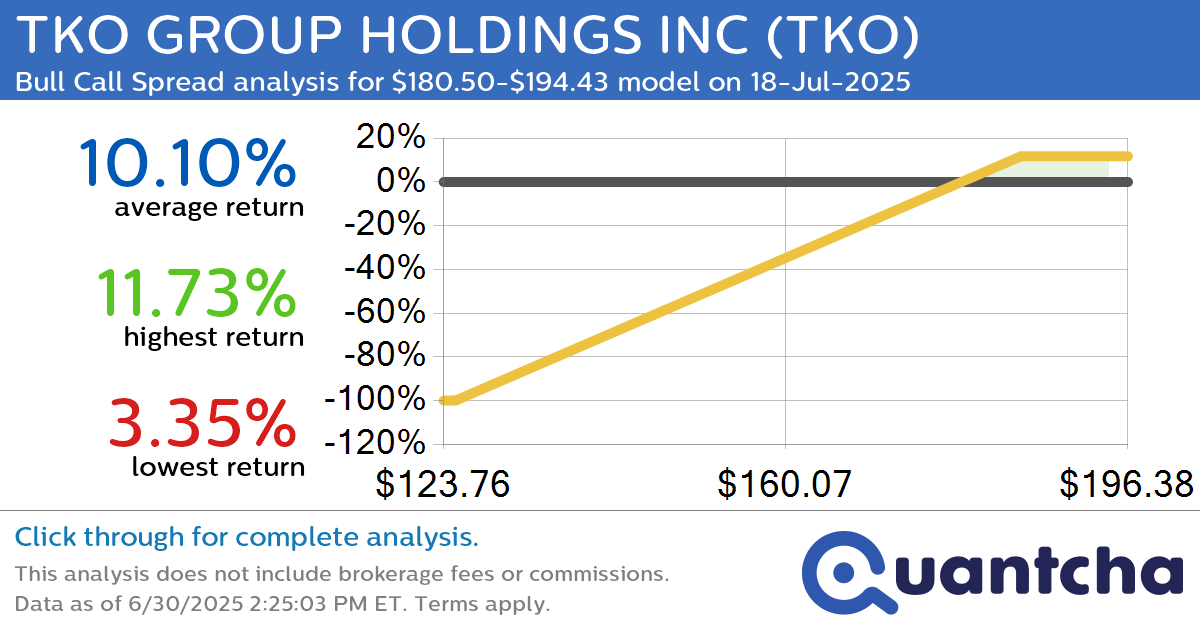

52-Week High Alert: Trading today’s movement in TKO GROUP HOLDINGS INC $TKO

Quantchabot has detected a new Bull Call Spread trade opportunity for TKO GROUP HOLDINGS INC (TKO) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TKO was recently trading at $180.11 and has an implied volatility of 32.95% for this period. Based on an analysis…

-

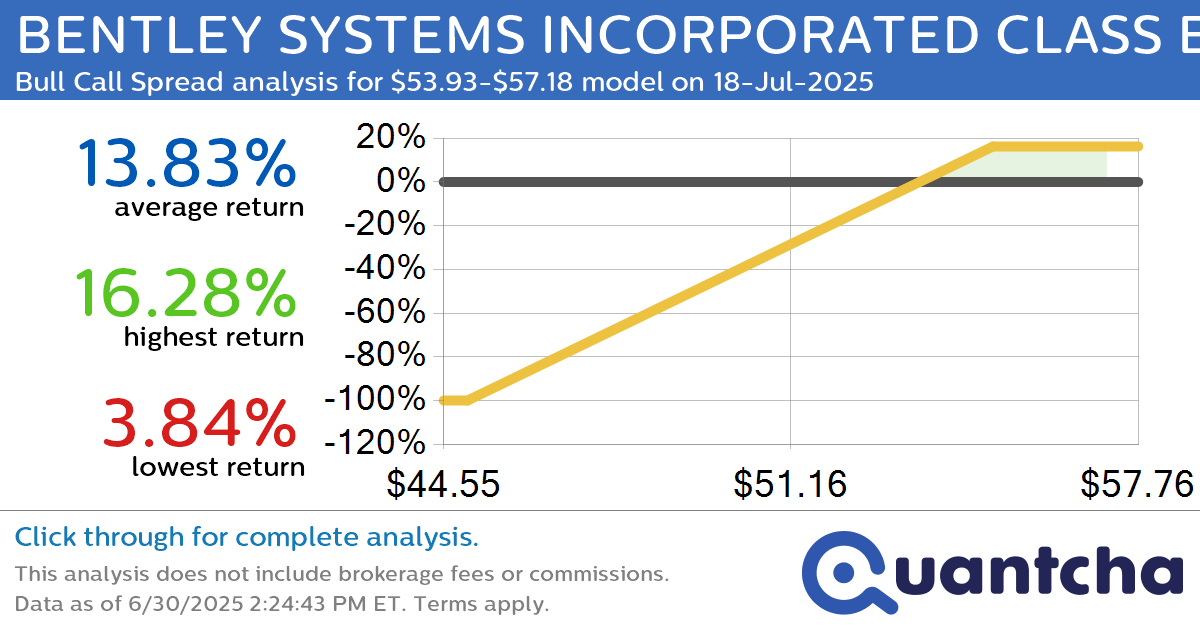

52-Week High Alert: Trading today’s movement in BENTLEY SYSTEMS INCORPORATED CLASS B $BSY

Quantchabot has detected a new Bull Call Spread trade opportunity for BENTLEY SYSTEMS INCORPORATED CLASS B (BSY) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BSY was recently trading at $53.81 and has an implied volatility of 25.97% for this period. Based on an…

-

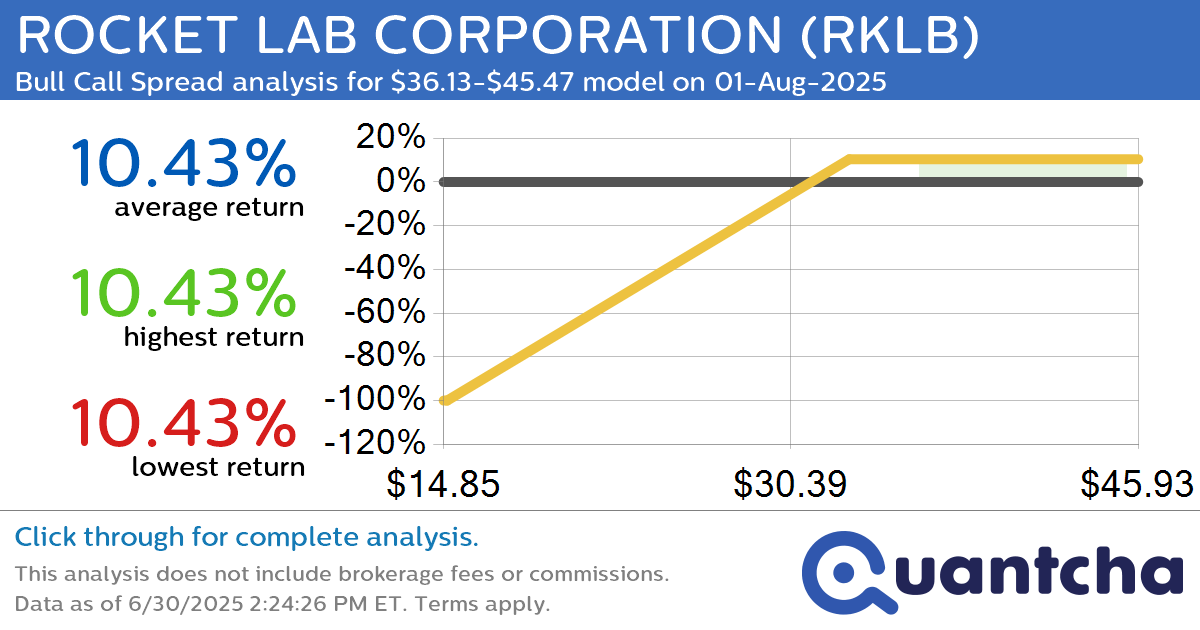

52-Week High Alert: Trading today’s movement in ROCKET LAB CORPORATION $RKLB

Quantchabot has detected a new Bull Call Spread trade opportunity for ROCKET LAB CORPORATION (RKLB) for the 1-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RKLB was recently trading at $35.99 and has an implied volatility of 76.96% for this period. Based on an analysis of…

-

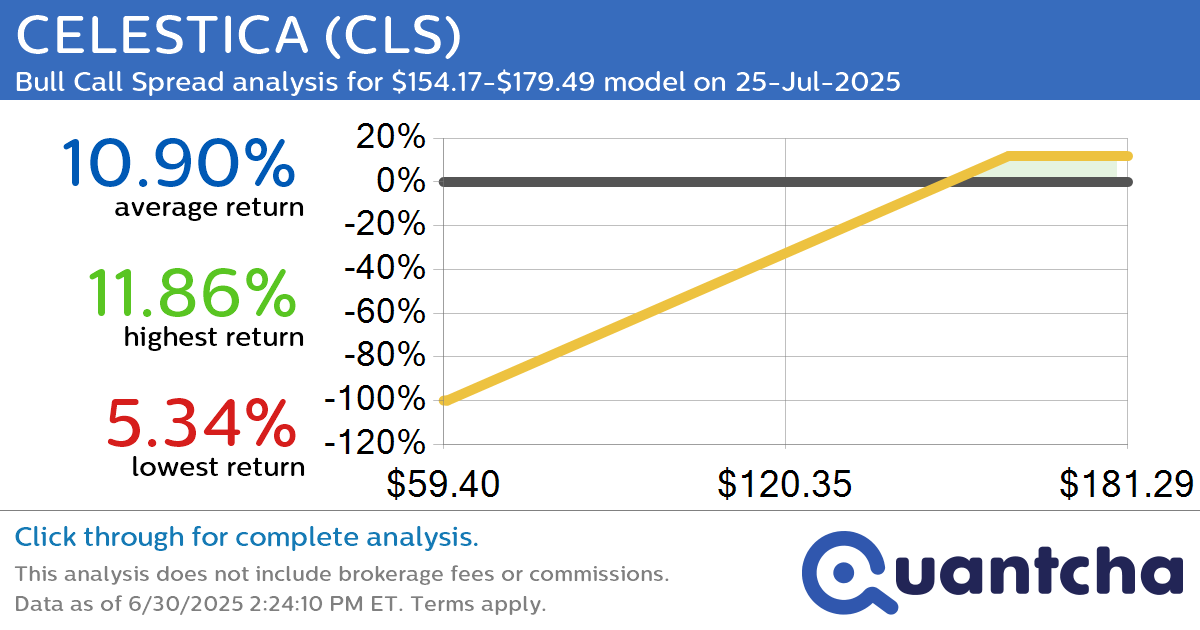

52-Week High Alert: Trading today’s movement in CELESTICA $CLS

Quantchabot has detected a new Bull Call Spread trade opportunity for CELESTICA (CLS) for the 25-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CLS was recently trading at $153.71 and has an implied volatility of 57.46% for this period. Based on an analysis of the options…

-

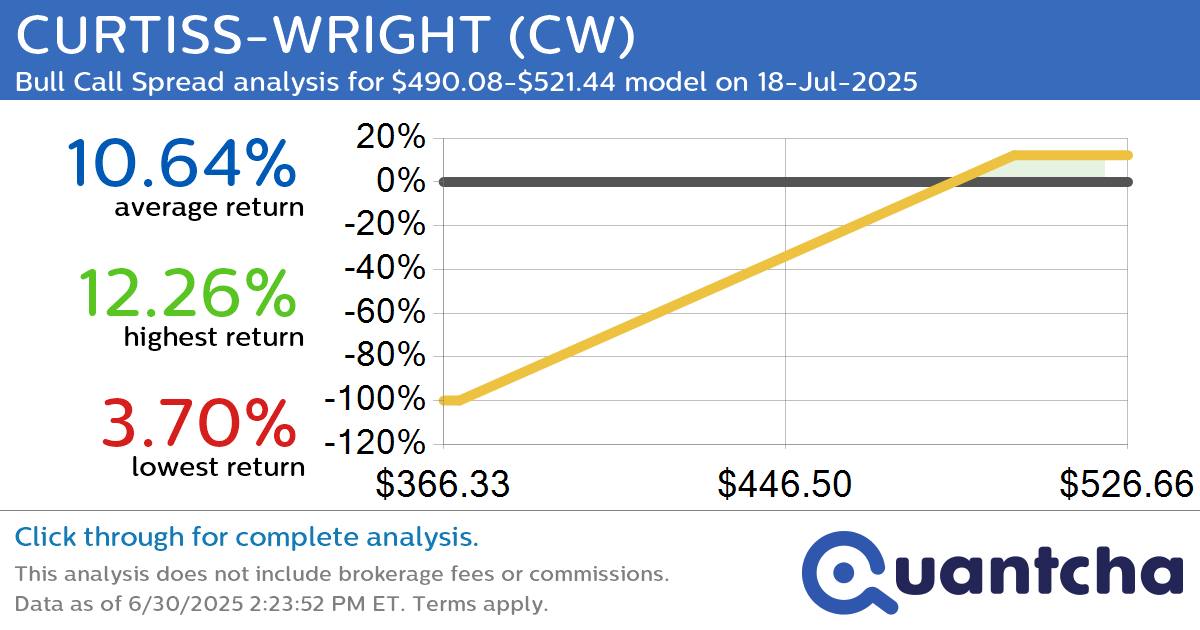

52-Week High Alert: Trading today’s movement in CURTISS-WRIGHT $CW

Quantchabot has detected a new Bull Call Spread trade opportunity for CURTISS-WRIGHT (CW) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CW was recently trading at $489.01 and has an implied volatility of 27.50% for this period. Based on an analysis of the options…

-

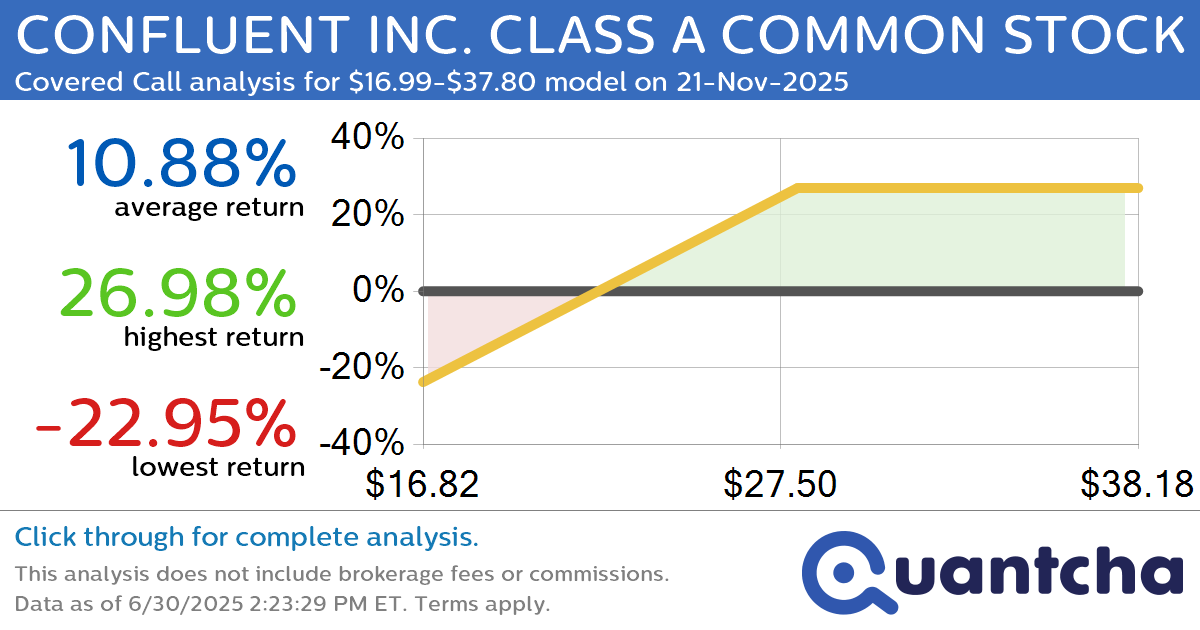

Covered Call Alert: CONFLUENT INC. CLASS A COMMON STOCK $CFLT returning up to 26.98% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for CONFLUENT INC. CLASS A COMMON STOCK (CFLT) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CFLT was recently trading at $24.89 and has an implied volatility of 63.52% for this period. Based on an…

-

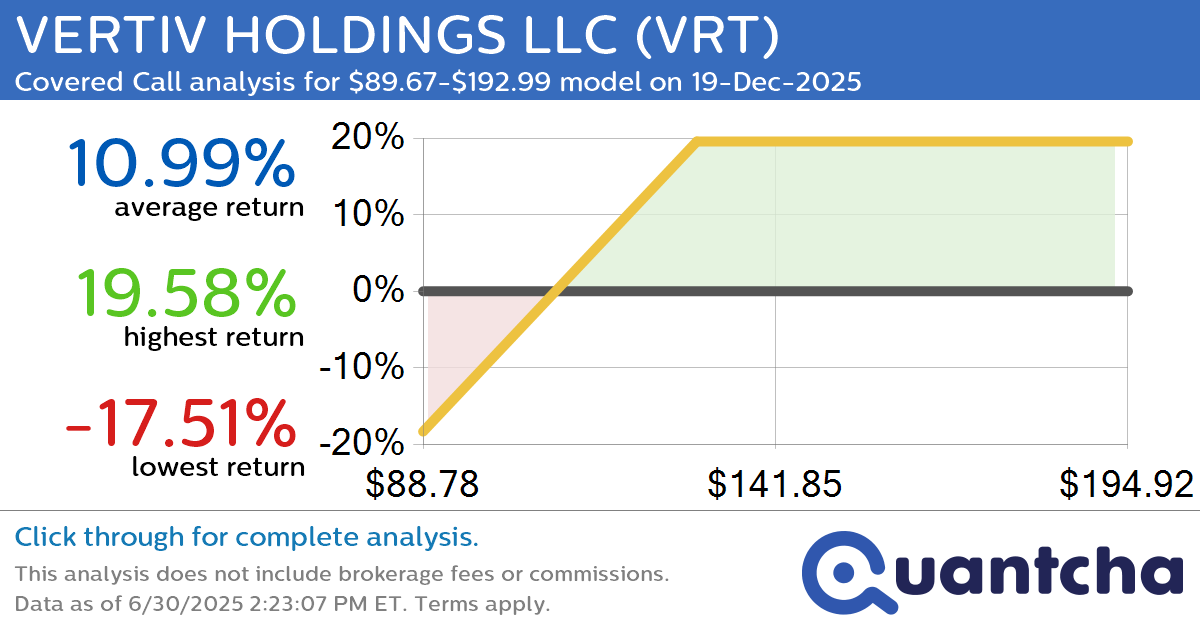

Covered Call Alert: VERTIV HOLDINGS LLC $VRT returning up to 19.58% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for VERTIV HOLDINGS LLC (VRT) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VRT was recently trading at $128.79 and has an implied volatility of 55.73% for this period. Based on an analysis of the…

-

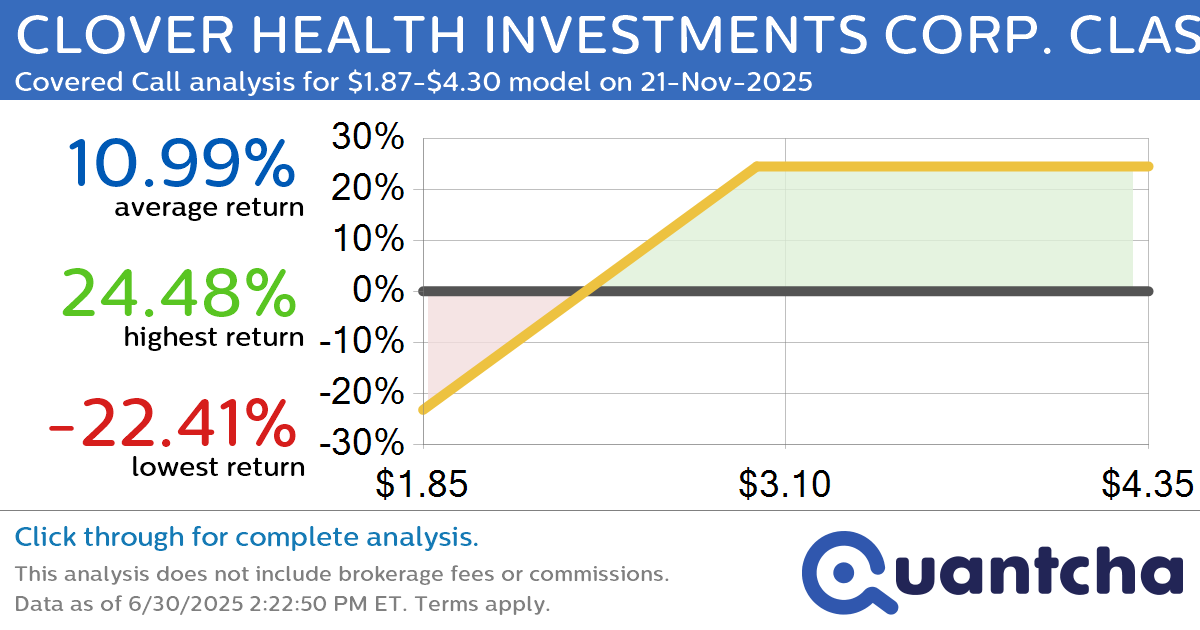

Covered Call Alert: CLOVER HEALTH INVESTMENTS CORP. CLASS A $CLOV returning up to 24.48% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for CLOVER HEALTH INVESTMENTS CORP. CLASS A (CLOV) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CLOV was recently trading at $2.79 and has an implied volatility of 66.35% for this period. Based on an…