Author: Quantcha Trade Ideas

-

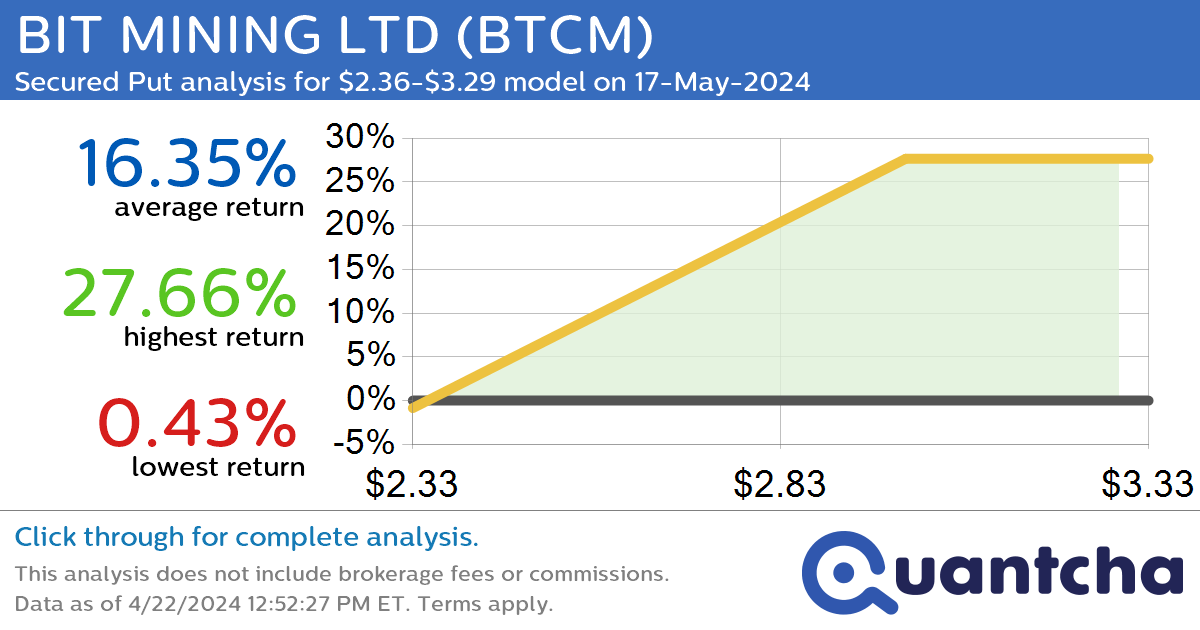

Big Gainer Alert: Trading today’s 18.1% move in BIT MINING LTD $BTCM

Quantchabot has detected a new Secured Put trade opportunity for BIT MINING LTD (BTCM) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BTCM was recently trading at $2.35 and has an implied volatility of 125.22% for this period. Based on an analysis of the…

-

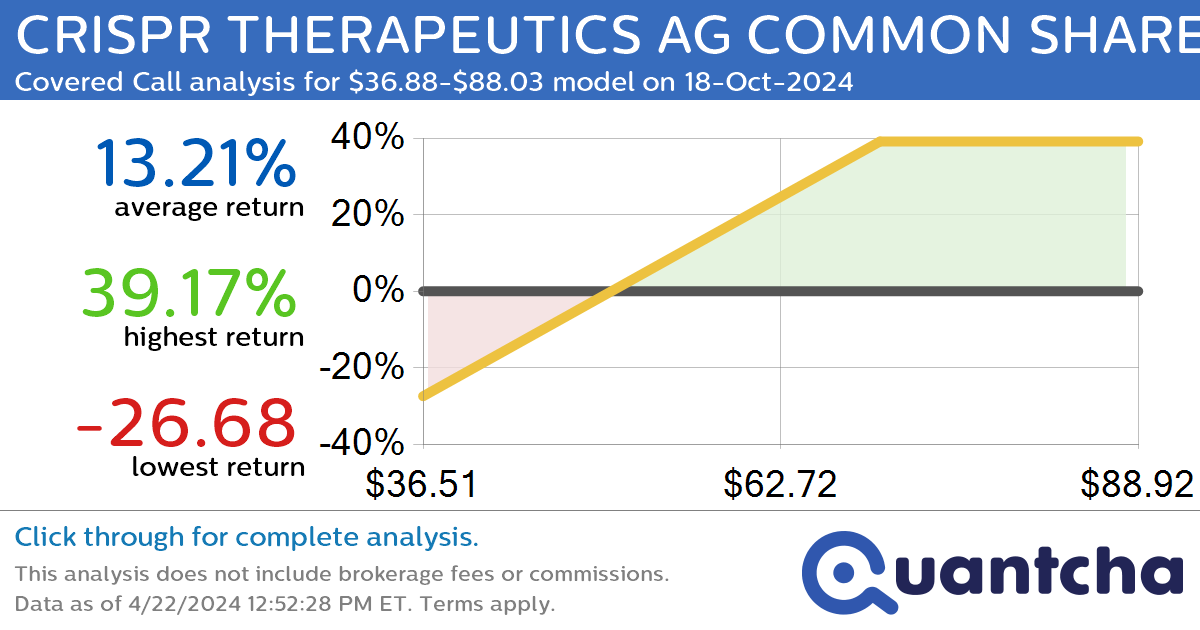

Covered Call Alert: CRISPR THERAPEUTICS AG COMMON SHARES $CRSP returning up to 38.86% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for CRISPR THERAPEUTICS AG COMMON SHARES (CRSP) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRSP was recently trading at $55.43 and has an implied volatility of 62.00% for this period. Based on an analysis…

-

52-Week High Alert: Trading today’s movement in LANDS END INC. COMMON STOCK $LE

Quantchabot has detected a new Bull Call Spread trade opportunity for LANDS END INC. COMMON STOCK (LE) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LE was recently trading at $13.23 and has an implied volatility of 52.95% for this period. Based on an…

-

Covered Call Alert: ALNYLAM PHARMACEUTICALS $ALNY returning up to 24.39% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for ALNYLAM PHARMACEUTICALS (ALNY) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ALNY was recently trading at $146.50 and has an implied volatility of 72.79% for this period. Based on an analysis of the options…

-

Big Gainer Alert: Trading today’s 7.4% move in TERAWULF INC. COMMON STOCK $WULF

Quantchabot has detected a new Bull Call Spread trade opportunity for TERAWULF INC. COMMON STOCK (WULF) for the 10-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WULF was recently trading at $2.46 and has an implied volatility of 133.20% for this period. Based on an analysis…

-

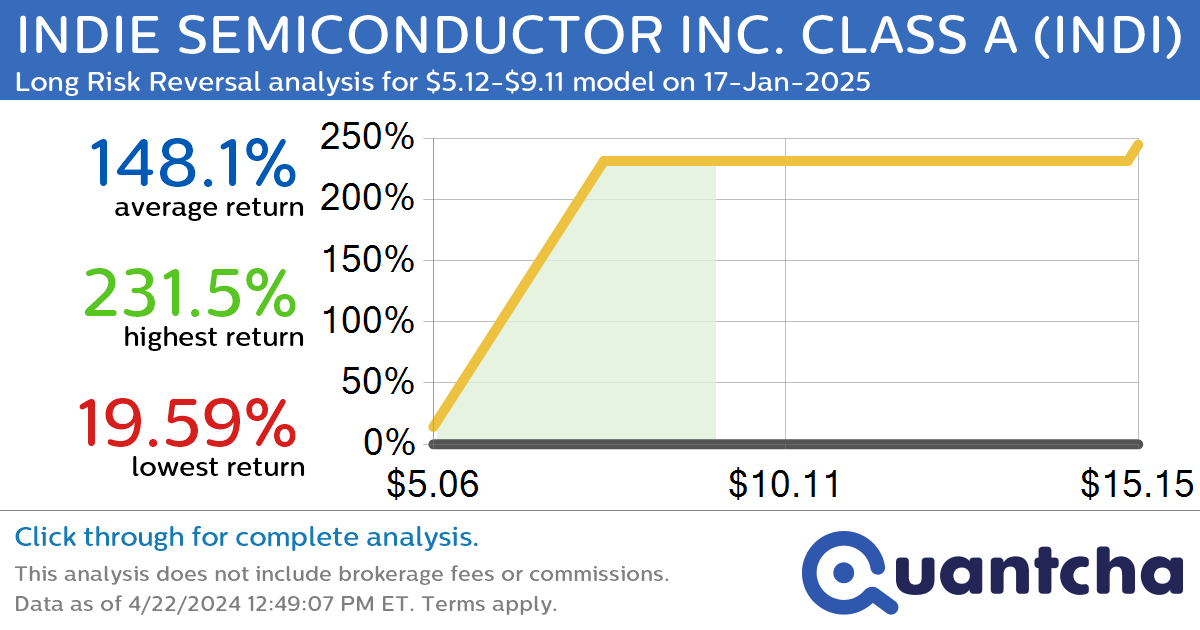

StockTwits Trending Alert: Trading recent interest in INDIE SEMICONDUCTOR INC. CLASS A $INDI

Quantchabot has detected a new Long Risk Reversal trade opportunity for INDIE SEMICONDUCTOR INC. CLASS A (INDI) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INDI was recently trading at $5.12 and has an implied volatility of 62.30% for this period. Based on an…

-

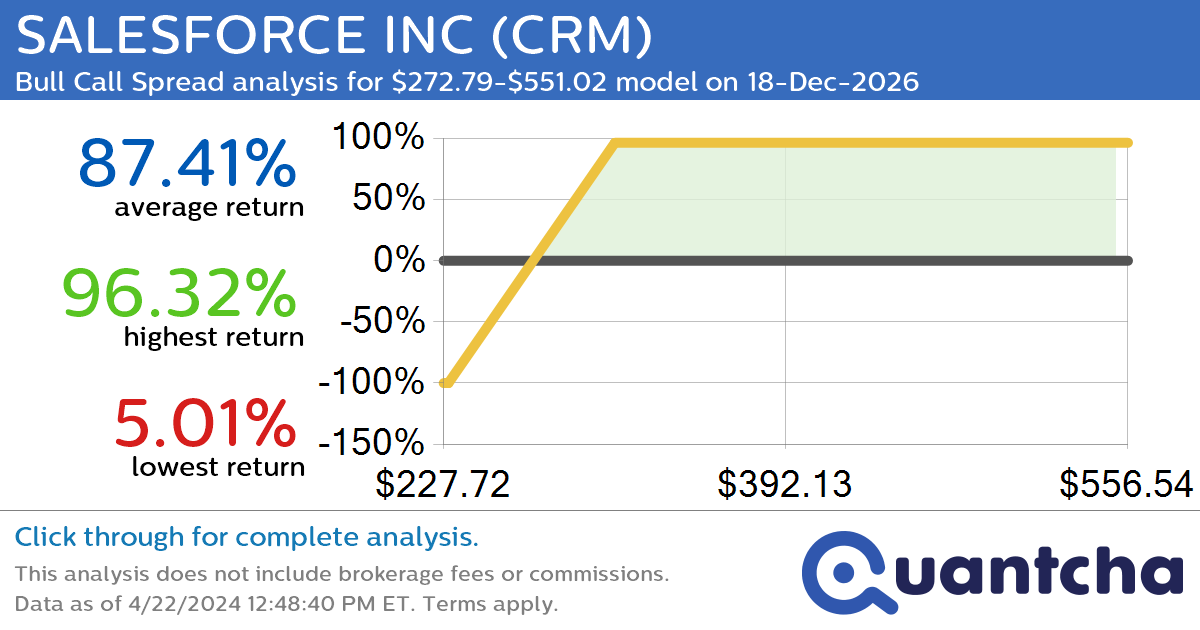

StockTwits Trending Alert: Trading recent interest in SALESFORCE INC $CRM

Quantchabot has detected a new Bull Call Spread trade opportunity for SALESFORCE INC (CRM) for the 18-Dec-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRM was recently trading at $272.77 and has an implied volatility of 34.46% for this period. Based on an analysis of the…

-

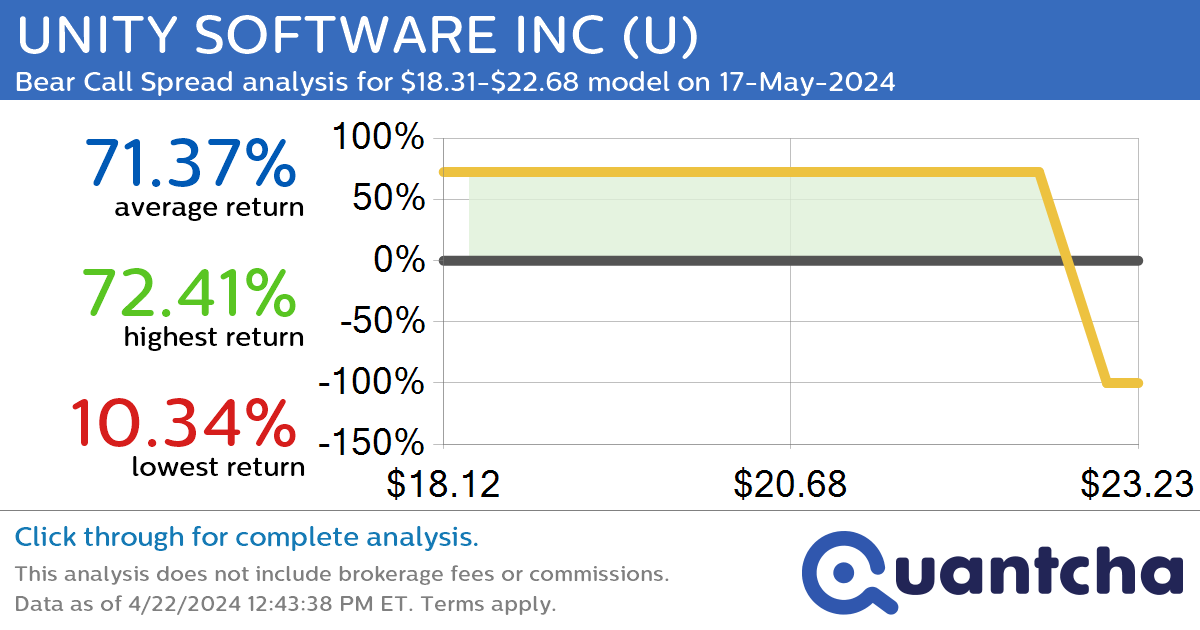

StockTwits Trending Alert: Trading recent interest in UNITY SOFTWARE INC $U

Quantchabot has detected a new Bear Call Spread trade opportunity for UNITY SOFTWARE INC (U) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. U was recently trading at $22.67 and has an implied volatility of 82.08% for this period. Based on an analysis of…

-

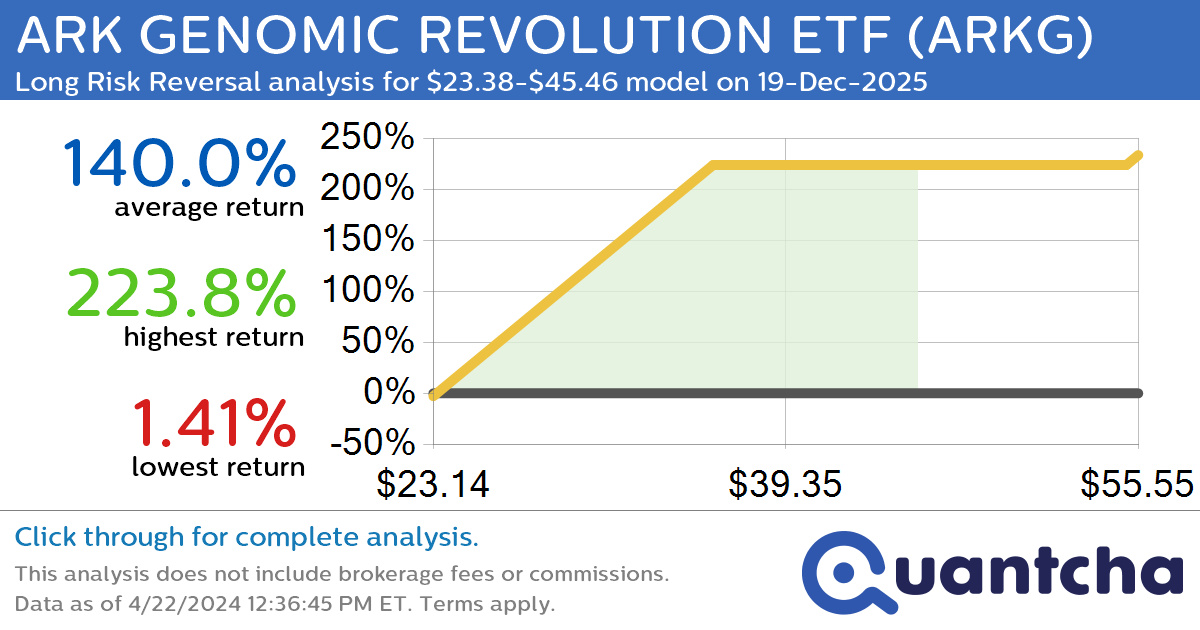

StockTwits Trending Alert: Trading recent interest in ARK GENOMIC REVOLUTION ETF $ARKG

Quantchabot has detected a new Long Risk Reversal trade opportunity for ARK GENOMIC REVOLUTION ETF (ARKG) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARKG was recently trading at $23.38 and has an implied volatility of 44.74% for this period. Based on an analysis…

-

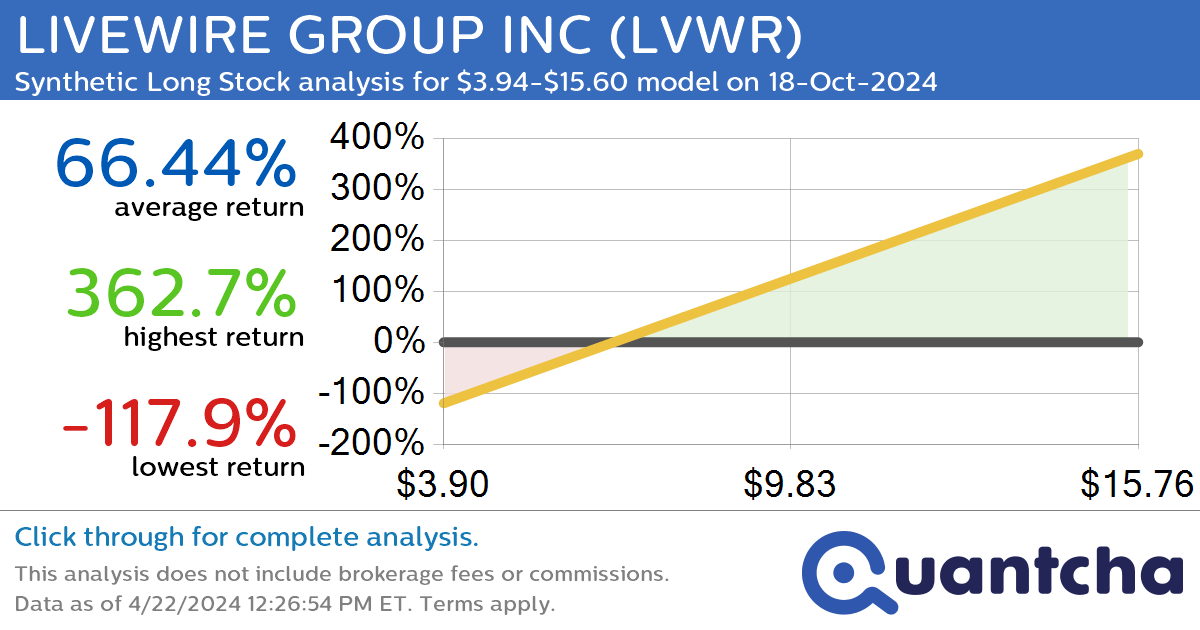

Synthetic Long Discount Alert: LIVEWIRE GROUP INC $LVWR trading at a 12.19% discount for the 18-Oct-2024 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for LIVEWIRE GROUP INC (LVWR) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LVWR was recently trading at $7.63 and has an implied volatility of 98.04% for this period. Based on an analysis of…