Author: Quantcha Trade Ideas

-

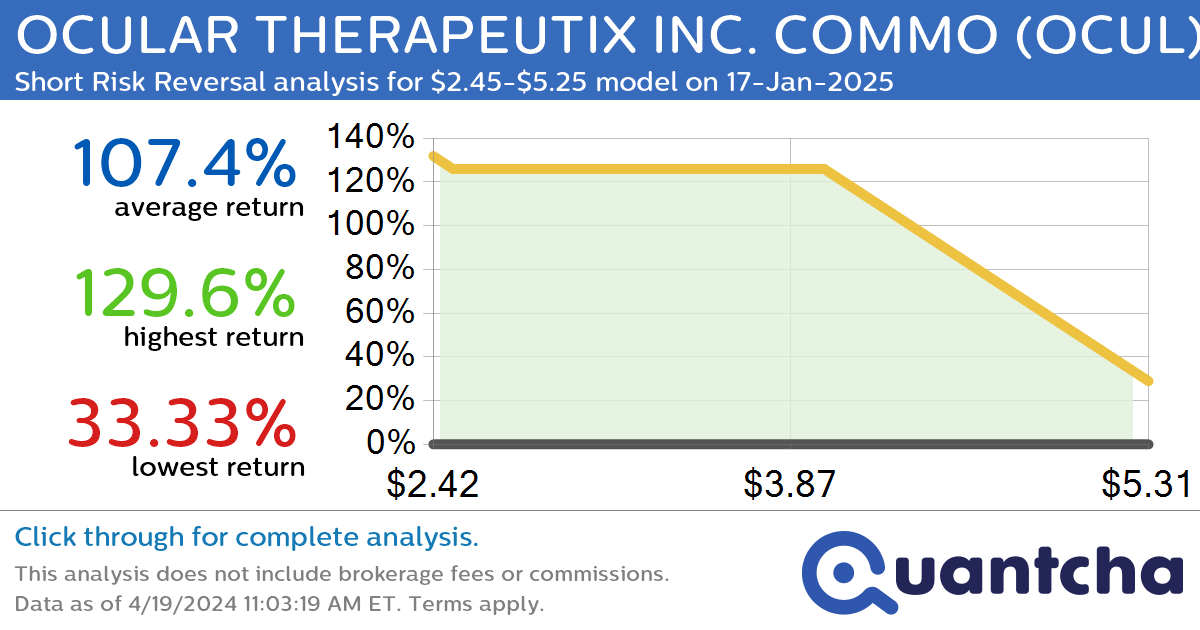

StockTwits Trending Alert: Trading recent interest in OCULAR THERAPEUTIX INC. COMMO $OCUL

Quantchabot has detected a new Short Risk Reversal trade opportunity for OCULAR THERAPEUTIX INC. COMMO (OCUL) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OCUL was recently trading at $5.25 and has an implied volatility of 92.79% for this period. Based on an analysis…

-

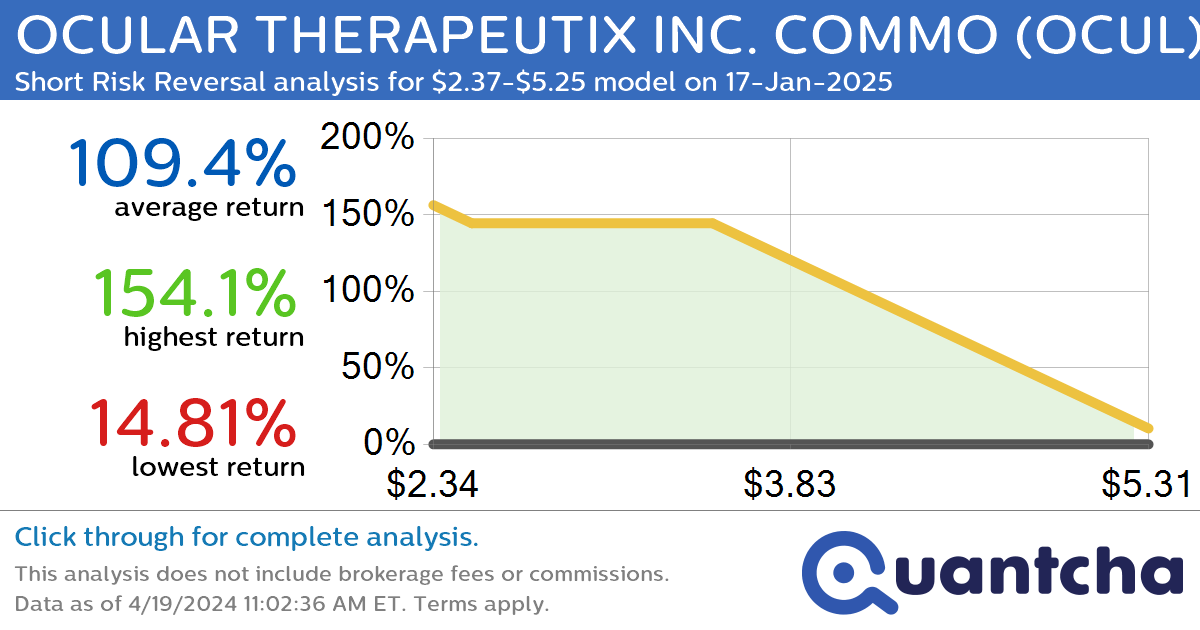

StockTwits Trending Alert: Trading recent interest in OCULAR THERAPEUTIX INC. COMMO $OCUL

Quantchabot has detected a new Short Risk Reversal trade opportunity for OCULAR THERAPEUTIX INC. COMMO (OCUL) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OCUL was recently trading at $5.25 and has an implied volatility of 96.44% for this period. Based on an analysis…

-

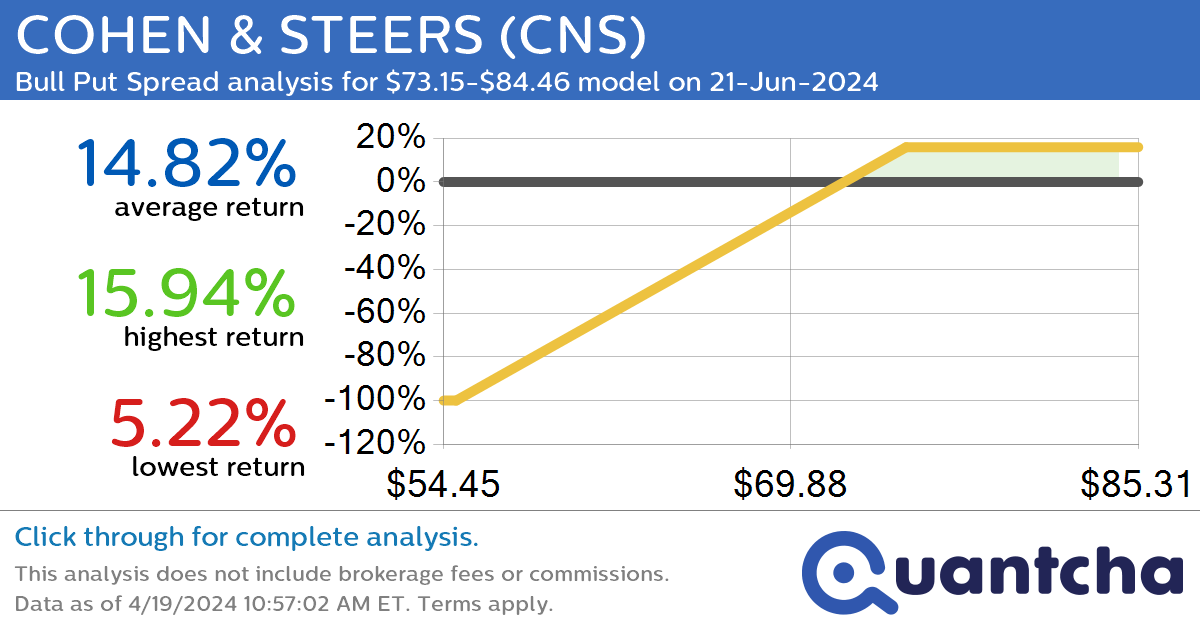

Big Gainer Alert: Trading today’s 9.6% move in COHEN & STEERS $CNS

Quantchabot has detected a new Bull Put Spread trade opportunity for COHEN & STEERS (CNS) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CNS was recently trading at $72.43 and has an implied volatility of 34.42% for this period. Based on an analysis of…

-

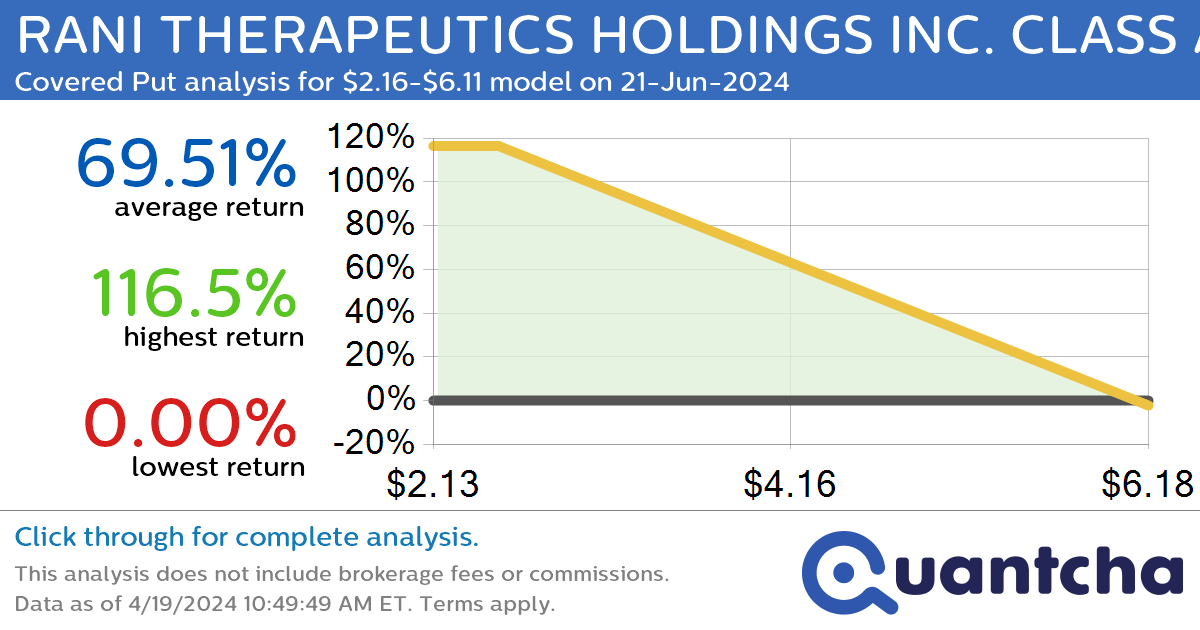

StockTwits Trending Alert: Trading recent interest in RANI THERAPEUTICS HOLDINGS INC. CLASS A $RANI

Quantchabot has detected a new Covered Put trade opportunity for RANI THERAPEUTICS HOLDINGS INC. CLASS A (RANI) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RANI was recently trading at $6.14 and has an implied volatility of 252.21% for this period. Based on an…

-

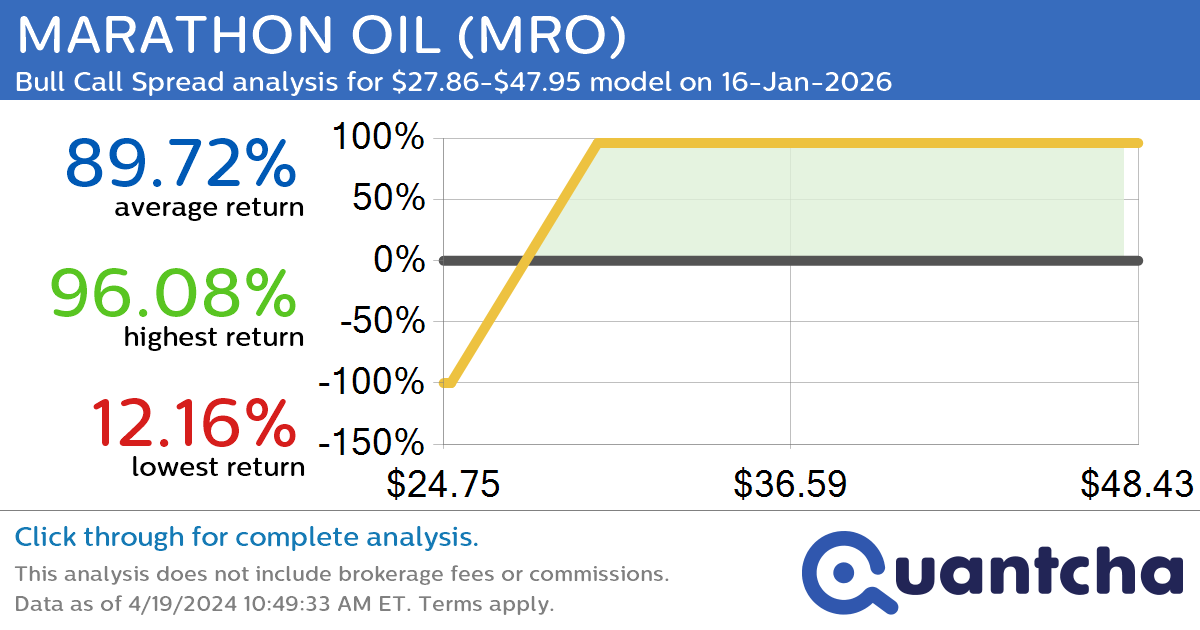

StockTwits Trending Alert: Trading recent interest in MARATHON OIL $MRO

Quantchabot has detected a new Bull Call Spread trade opportunity for MARATHON OIL (MRO) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MRO was recently trading at $27.86 and has an implied volatility of 34.04% for this period. Based on an analysis of the…

-

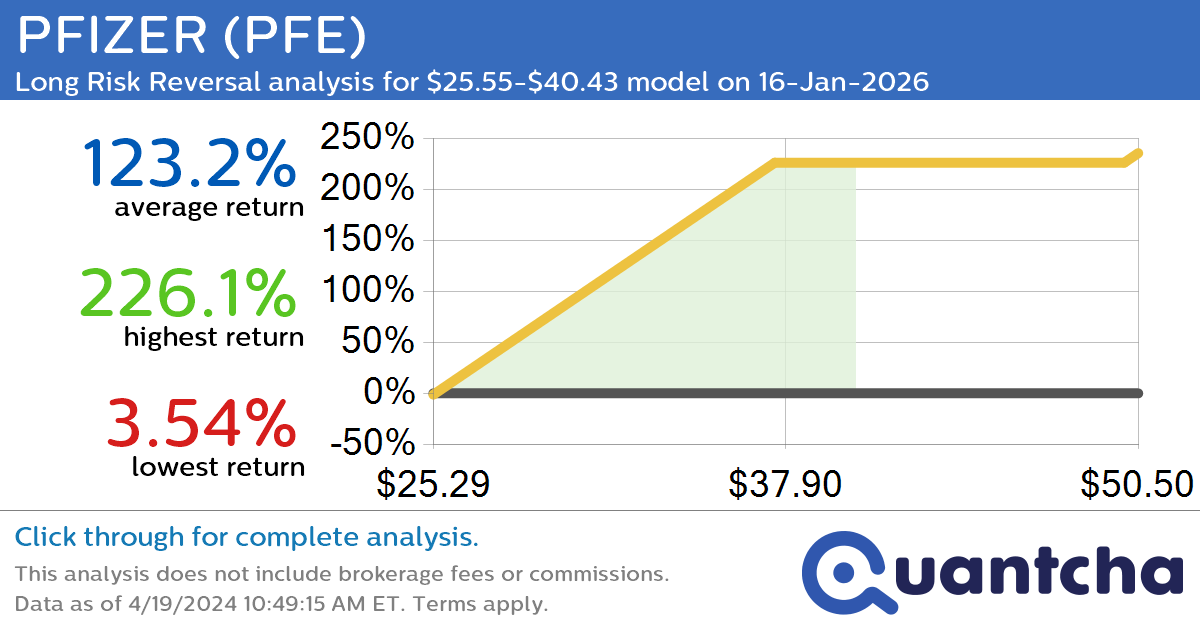

StockTwits Trending Alert: Trading recent interest in PFIZER $PFE

Quantchabot has detected a new Long Risk Reversal trade opportunity for PFIZER (PFE) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PFE was recently trading at $25.55 and has an implied volatility of 27.71% for this period. Based on an analysis of the options…

-

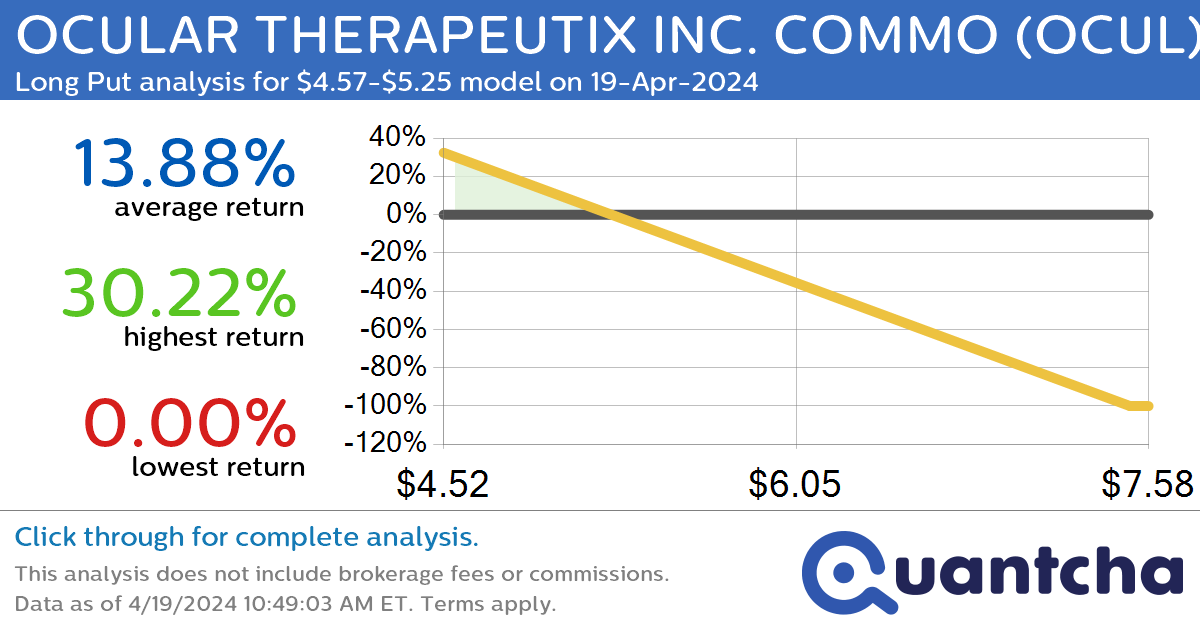

Big Loser Alert: Trading today’s -10.5% move in OCULAR THERAPEUTIX INC. COMMO $OCUL

Quantchabot has detected a new Long Put trade opportunity for OCULAR THERAPEUTIX INC. COMMO (OCUL) for the 19-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OCUL was recently trading at $5.25 and has an implied volatility of 312.69% for this period. Based on an analysis of…

-

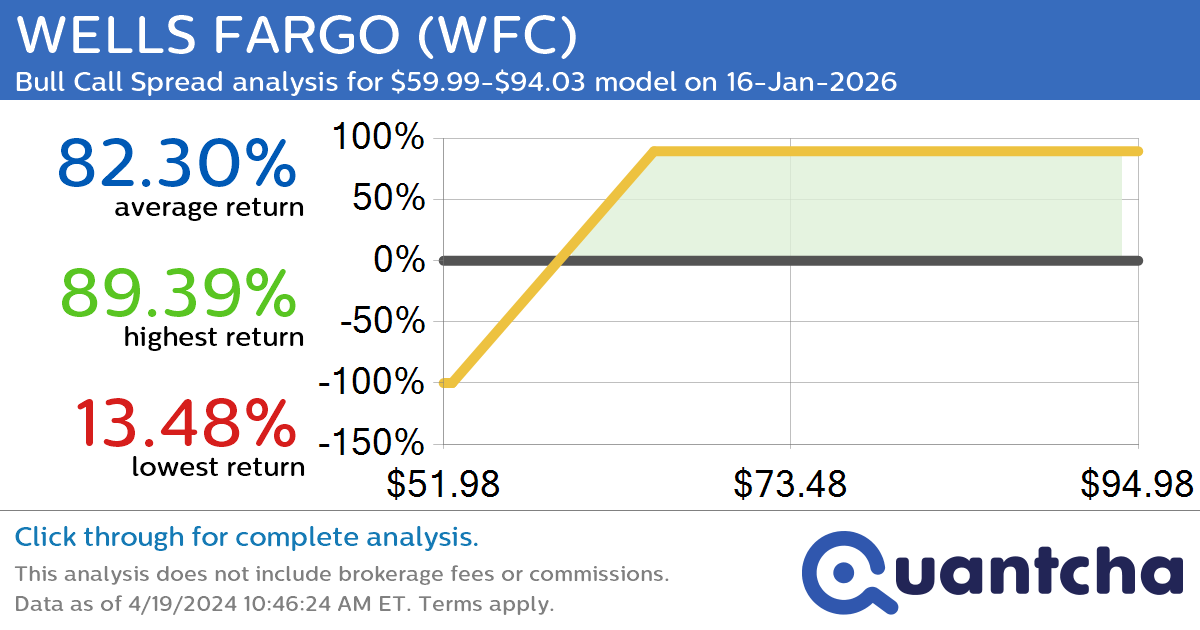

StockTwits Trending Alert: Trading recent interest in WELLS FARGO $WFC

Quantchabot has detected a new Bull Call Spread trade opportunity for WELLS FARGO (WFC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WFC was recently trading at $59.98 and has an implied volatility of 26.99% for this period. Based on an analysis of the…

-

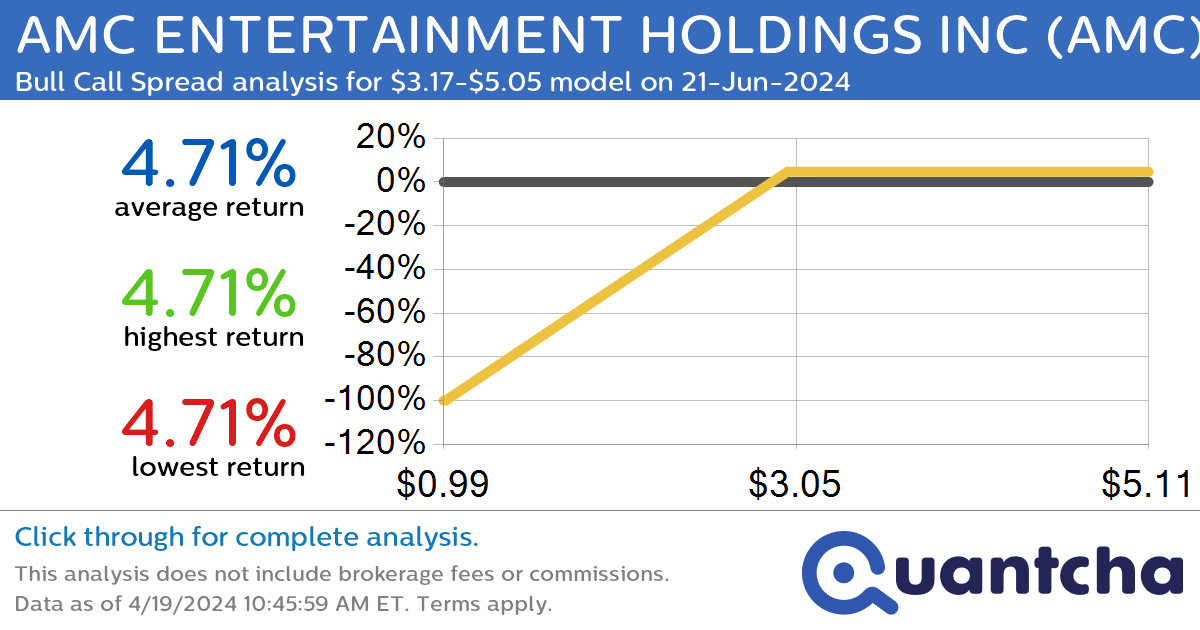

Big Gainer Alert: Trading today’s 7.5% move in AMC ENTERTAINMENT HOLDINGS INC $AMC

Quantchabot has detected a new Bull Call Spread trade opportunity for AMC ENTERTAINMENT HOLDINGS INC (AMC) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMC was recently trading at $3.14 and has an implied volatility of 111.50% for this period. Based on an analysis…

-

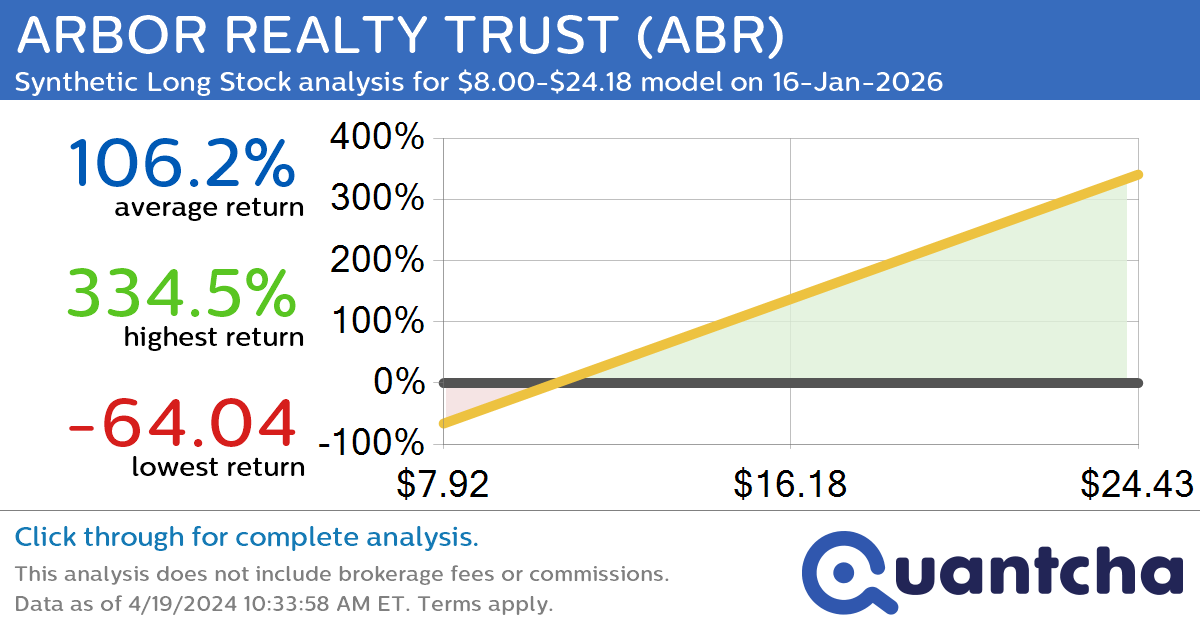

Synthetic Long Discount Alert: ARBOR REALTY TRUST $ABR trading at a 16.37% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ARBOR REALTY TRUST (ABR) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABR was recently trading at $12.68 and has an implied volatility of 41.85% for this period. Based on an analysis of…