Category: Trade Ideas

-

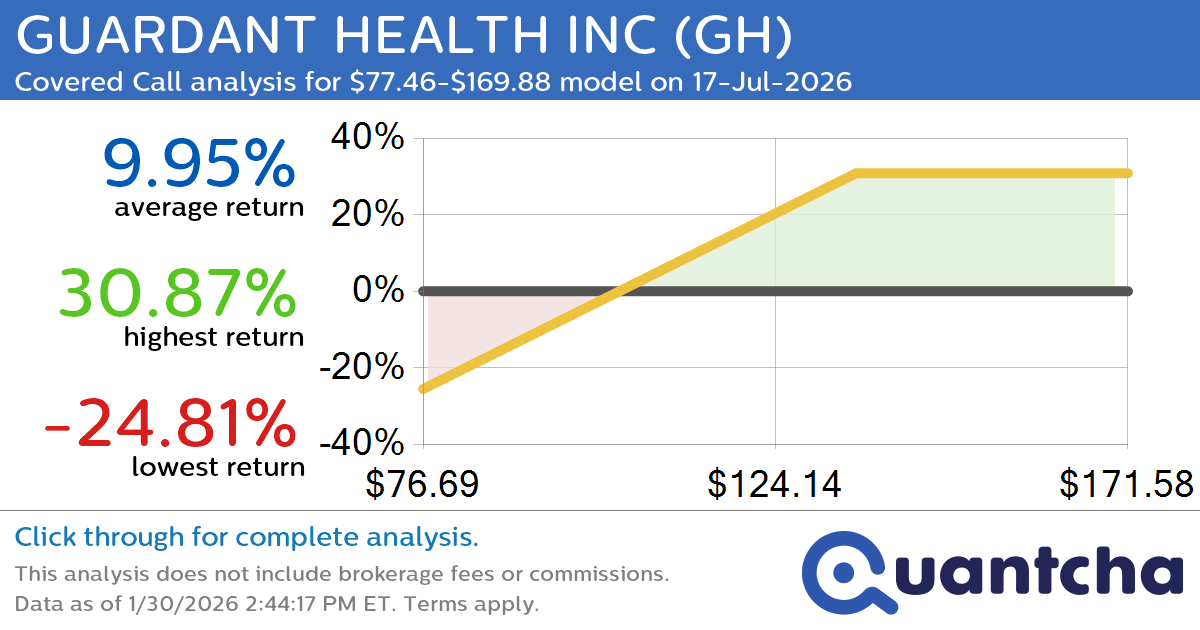

Covered Call Alert: GUARDANT HEALTH INC $GH returning up to 30.87% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for GUARDANT HEALTH INC (GH) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GH was recently trading at $113.00 and has an implied volatility of 57.78% for this period. Based on an analysis of the…

-

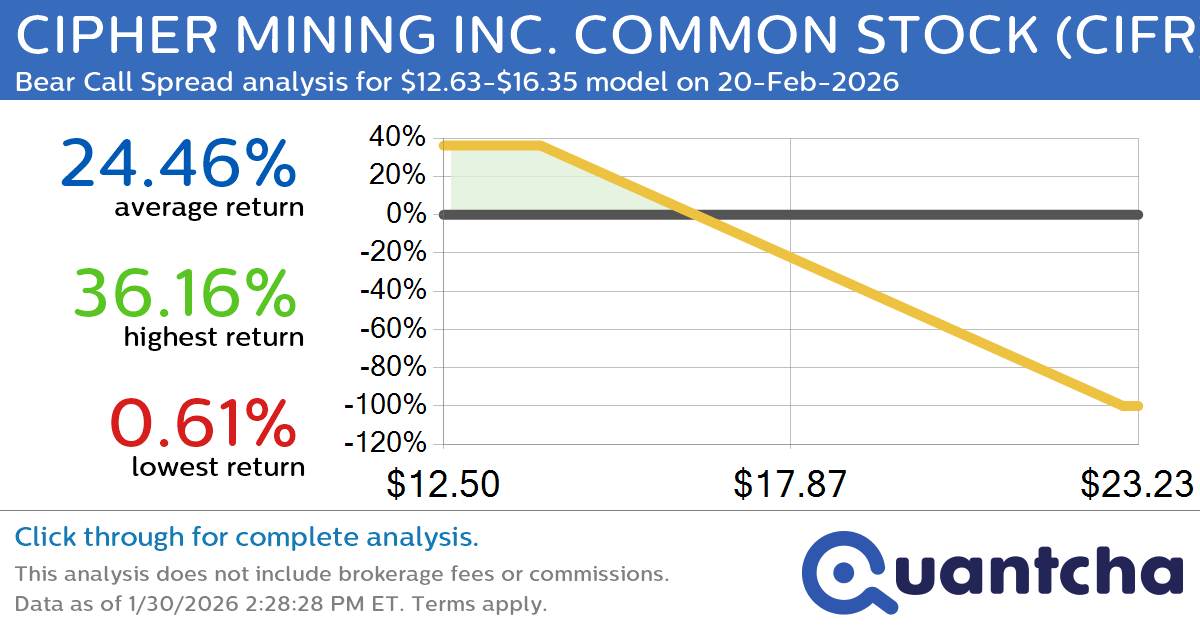

Big Loser Alert: Trading today’s -7.8% move in CIPHER MINING INC. COMMON STOCK $CIFR

Quantchabot has detected a new Bear Call Spread trade opportunity for CIPHER MINING INC. COMMON STOCK (CIFR) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CIFR was recently trading at $16.32 and has an implied volatility of 105.99% for this period. Based on an…

-

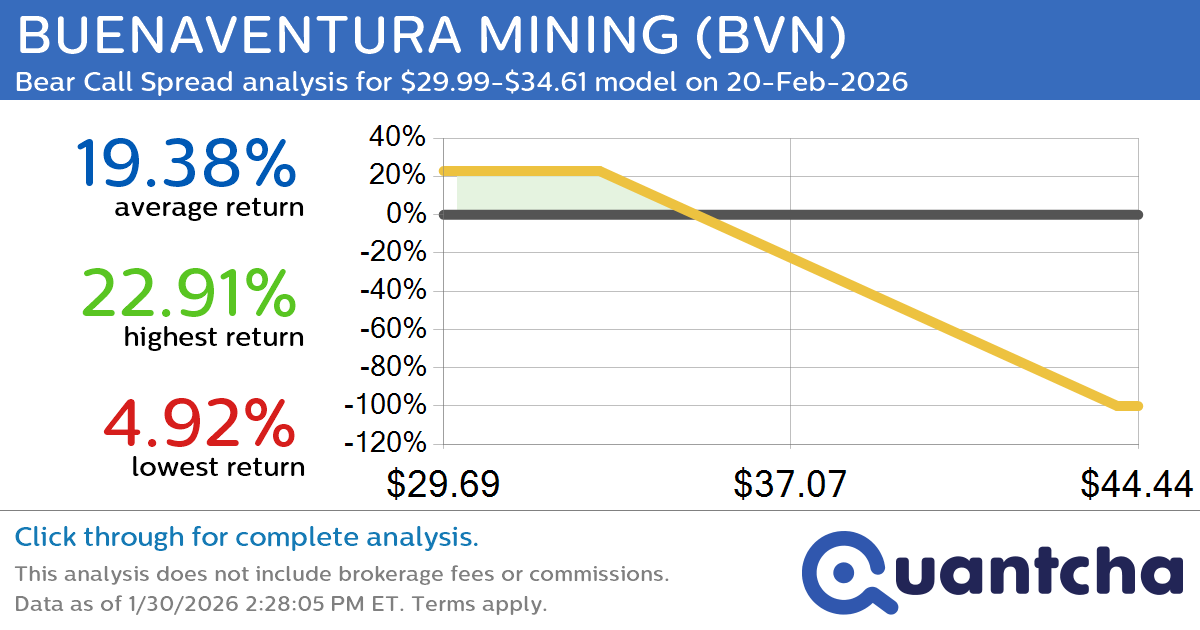

Big Loser Alert: Trading today’s -10.4% move in BUENAVENTURA MINING $BVN

Quantchabot has detected a new Bear Call Spread trade opportunity for BUENAVENTURA MINING (BVN) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BVN was recently trading at $34.53 and has an implied volatility of 58.90% for this period. Based on an analysis of the…

-

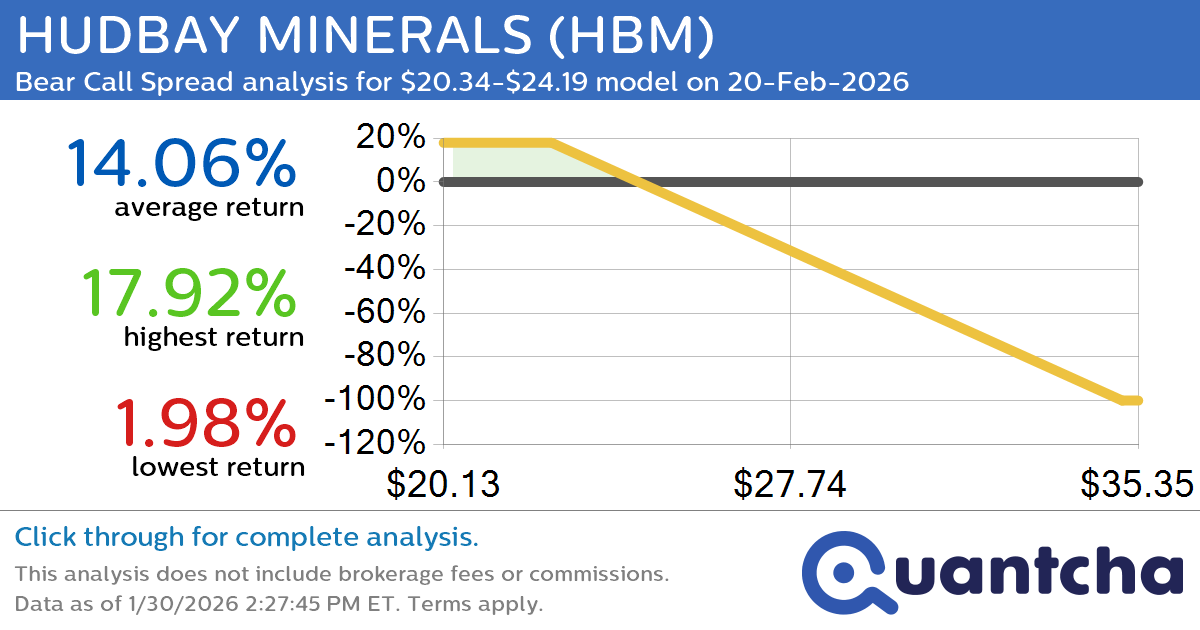

Big Loser Alert: Trading today’s -10.3% move in HUDBAY MINERALS $HBM

Quantchabot has detected a new Bear Call Spread trade opportunity for HUDBAY MINERALS (HBM) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HBM was recently trading at $24.14 and has an implied volatility of 71.24% for this period. Based on an analysis of the…

-

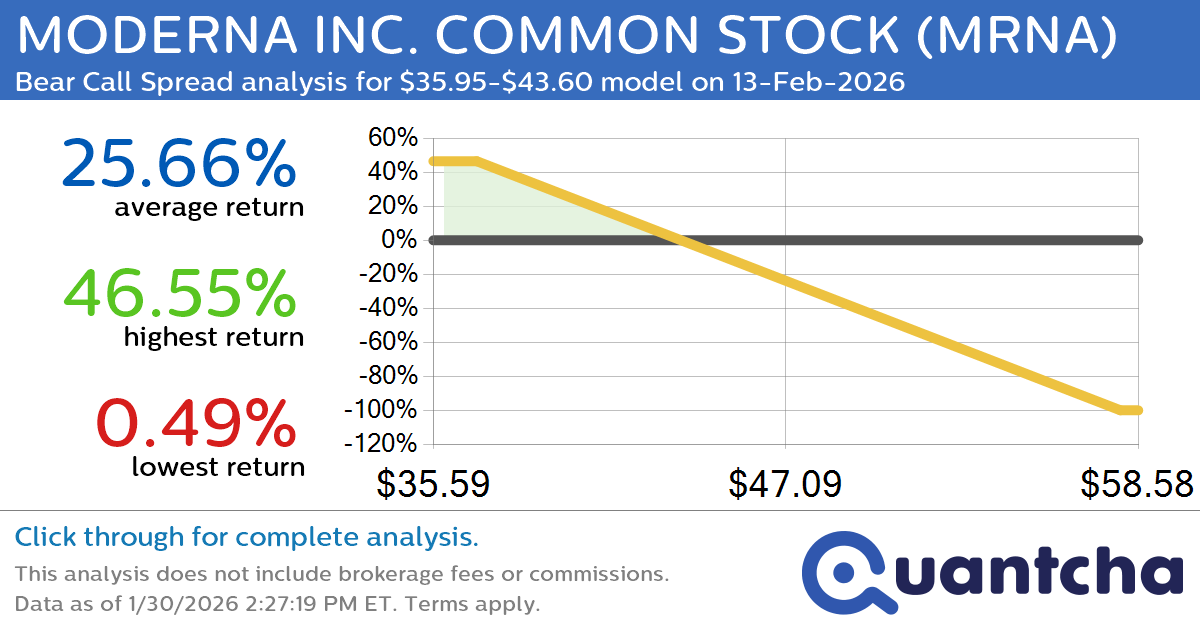

Big Loser Alert: Trading today’s -7.1% move in MODERNA INC. COMMON STOCK $MRNA

Quantchabot has detected a new Bear Call Spread trade opportunity for MODERNA INC. COMMON STOCK (MRNA) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MRNA was recently trading at $43.53 and has an implied volatility of 96.44% for this period. Based on an analysis…

-

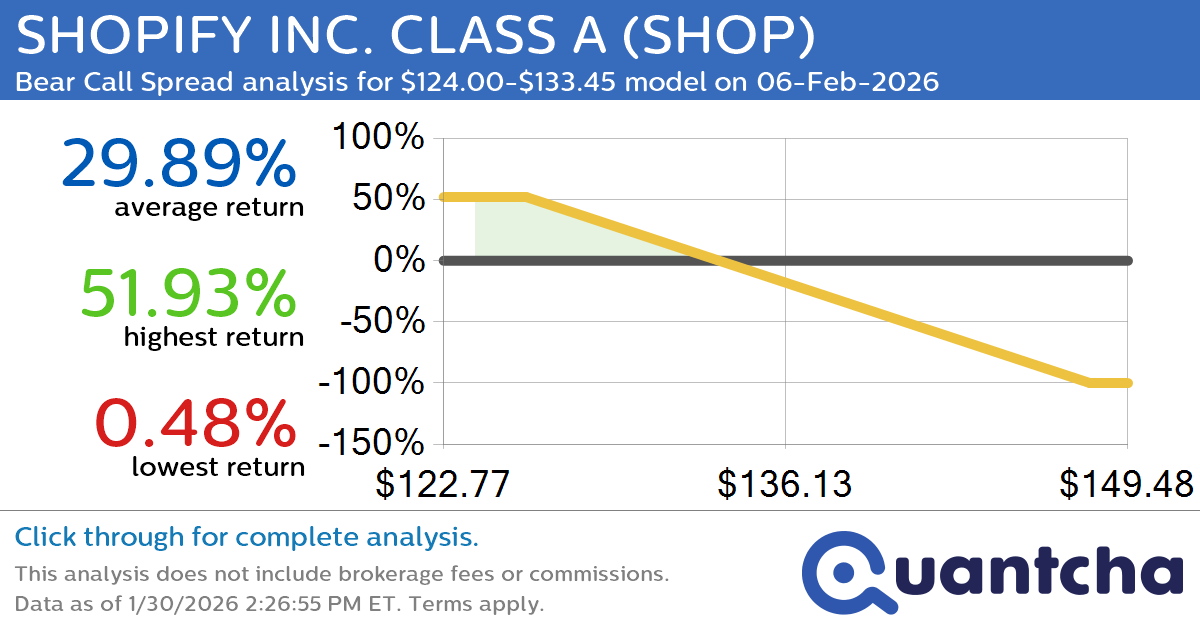

Big Loser Alert: Trading today’s -7.2% move in SHOPIFY INC. CLASS A $SHOP

Quantchabot has detected a new Bear Call Spread trade opportunity for SHOPIFY INC. CLASS A (SHOP) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SHOP was recently trading at $133.34 and has an implied volatility of 50.85% for this period. Based on an analysis…

-

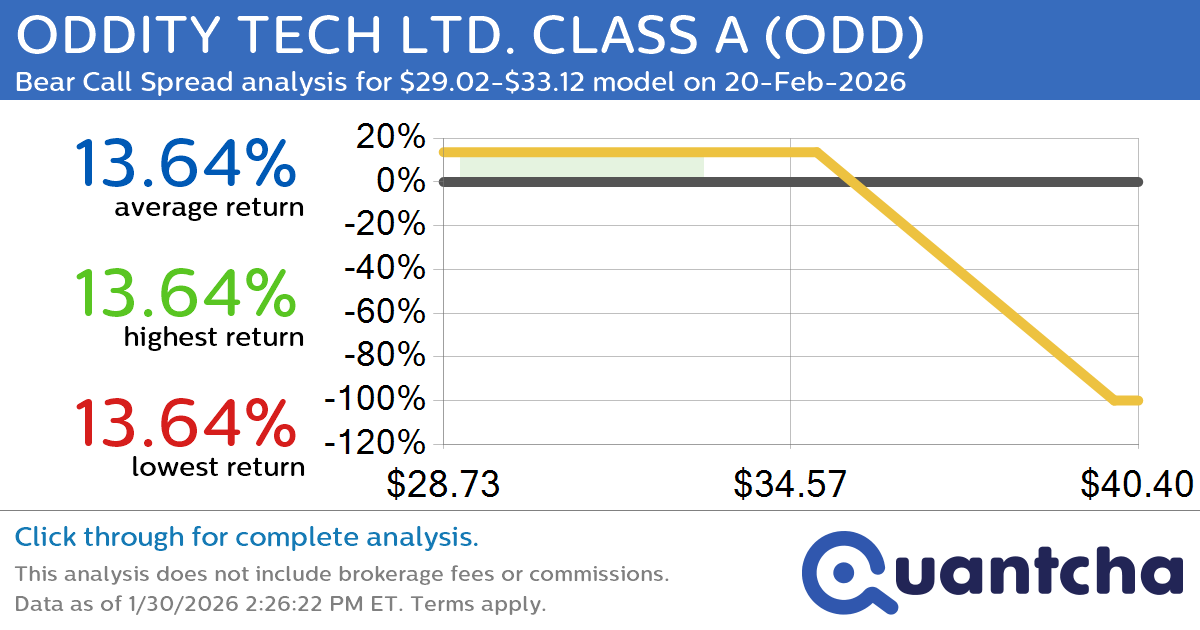

52-Week Low Alert: Trading today’s movement in ODDITY TECH LTD. CLASS A $ODD

Quantchabot has detected a new Bear Call Spread trade opportunity for ODDITY TECH LTD. CLASS A (ODD) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ODD was recently trading at $33.05 and has an implied volatility of 54.38% for this period. Based on an…

-

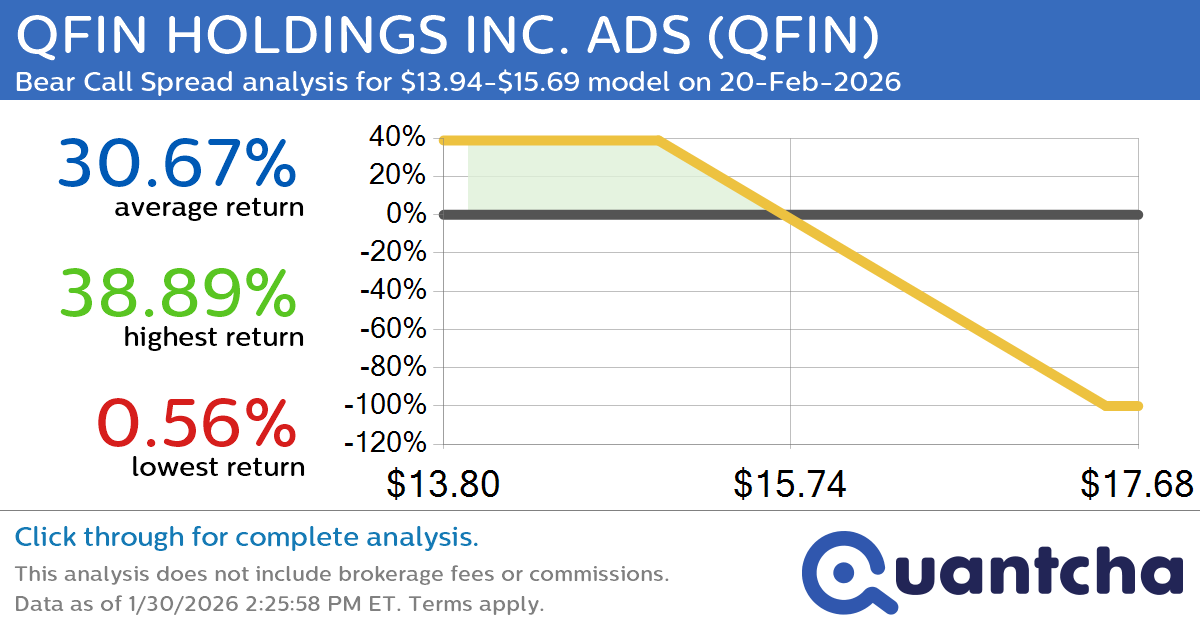

52-Week Low Alert: Trading today’s movement in QFIN HOLDINGS INC. ADS $QFIN

Quantchabot has detected a new Bear Call Spread trade opportunity for QFIN HOLDINGS INC. ADS (QFIN) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. QFIN was recently trading at $15.65 and has an implied volatility of 48.48% for this period. Based on an analysis…

-

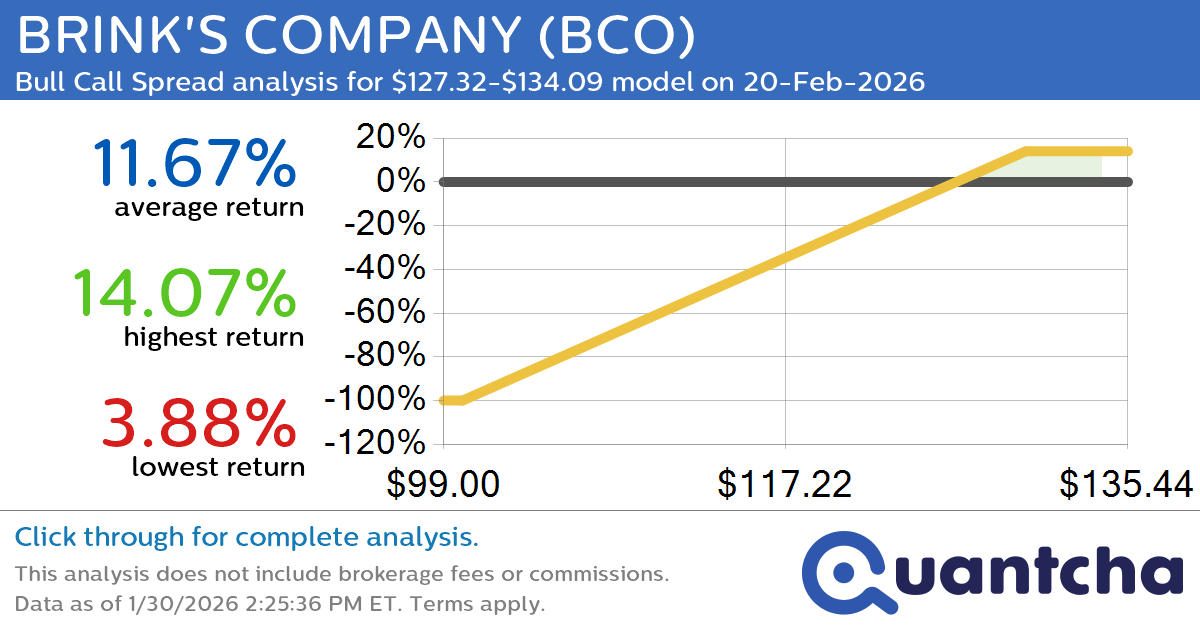

52-Week High Alert: Trading today’s movement in BRINK’S COMPANY $BCO

Quantchabot has detected a new Bull Call Spread trade opportunity for BRINK’S COMPANY (BCO) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BCO was recently trading at $127.29 and has an implied volatility of 21.31% for this period. Based on an analysis of the…

-

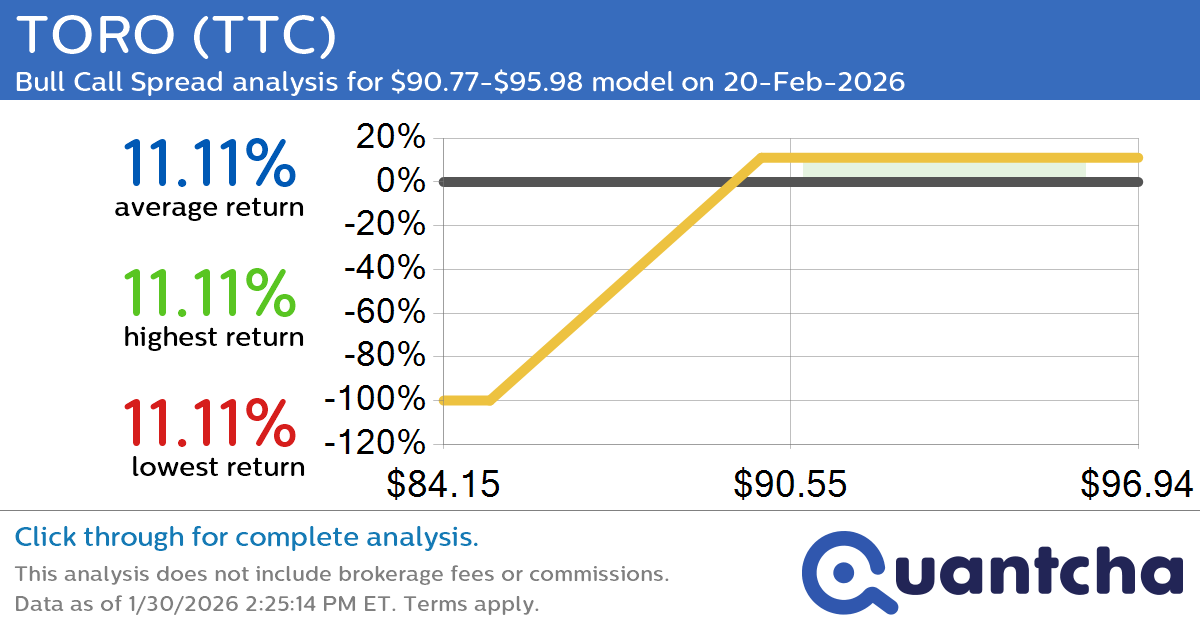

52-Week High Alert: Trading today’s movement in TORO $TTC

Quantchabot has detected a new Bull Call Spread trade opportunity for TORO (TTC) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTC was recently trading at $90.57 and has an implied volatility of 22.92% for this period. Based on an analysis of the options…