Category: Trade Ideas

-

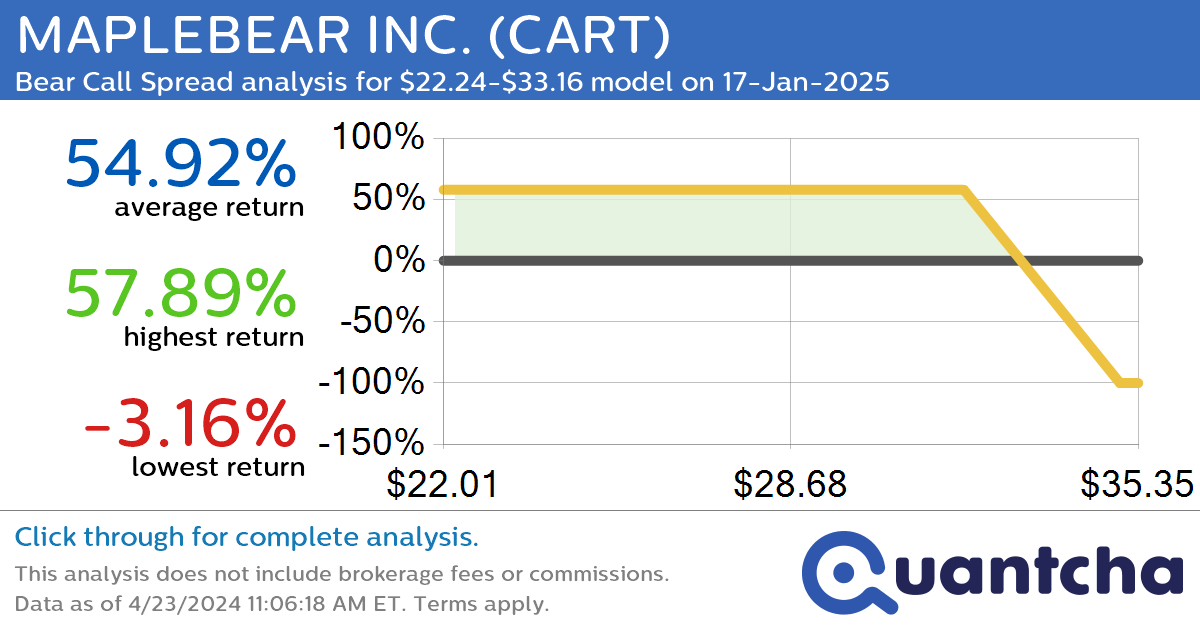

StockTwits Trending Alert: Trading recent interest in MAPLEBEAR INC. $CART

Quantchabot has detected a new Bear Call Spread trade opportunity for MAPLEBEAR INC. (CART) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CART was recently trading at $33.16 and has an implied volatility of 51.24% for this period. Based on an analysis of the…

-

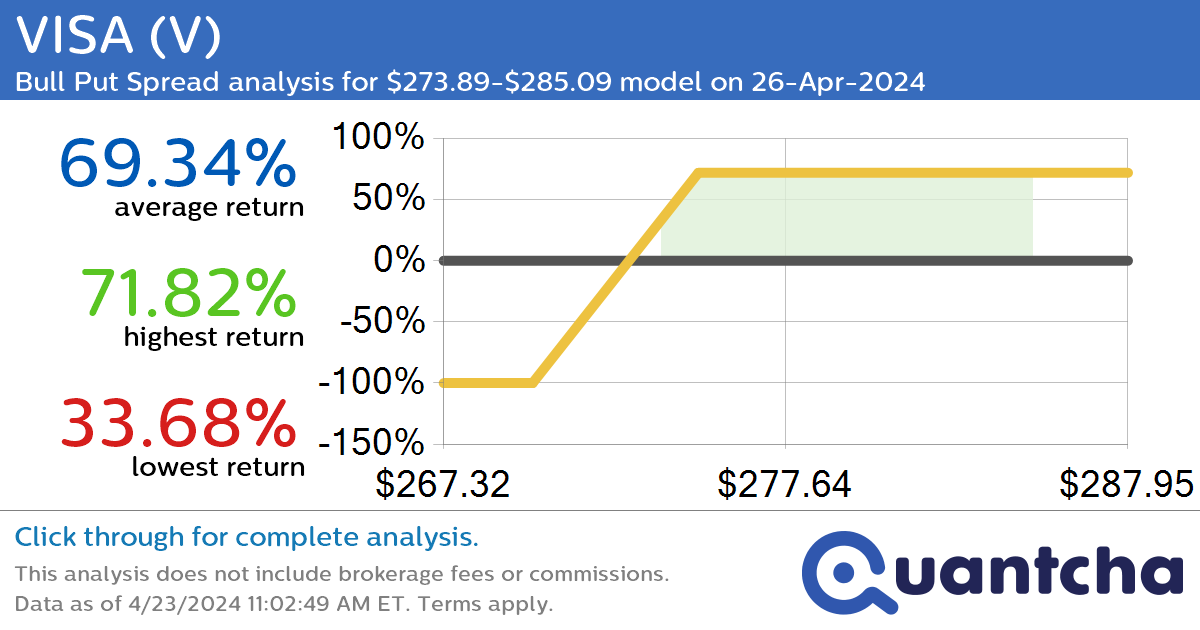

StockTwits Trending Alert: Trading recent interest in VISA $V

Quantchabot has detected a new Bull Put Spread trade opportunity for VISA (V) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. V was recently trading at $273.87 and has an implied volatility of 39.26% for this period. Based on an analysis of the options…

-

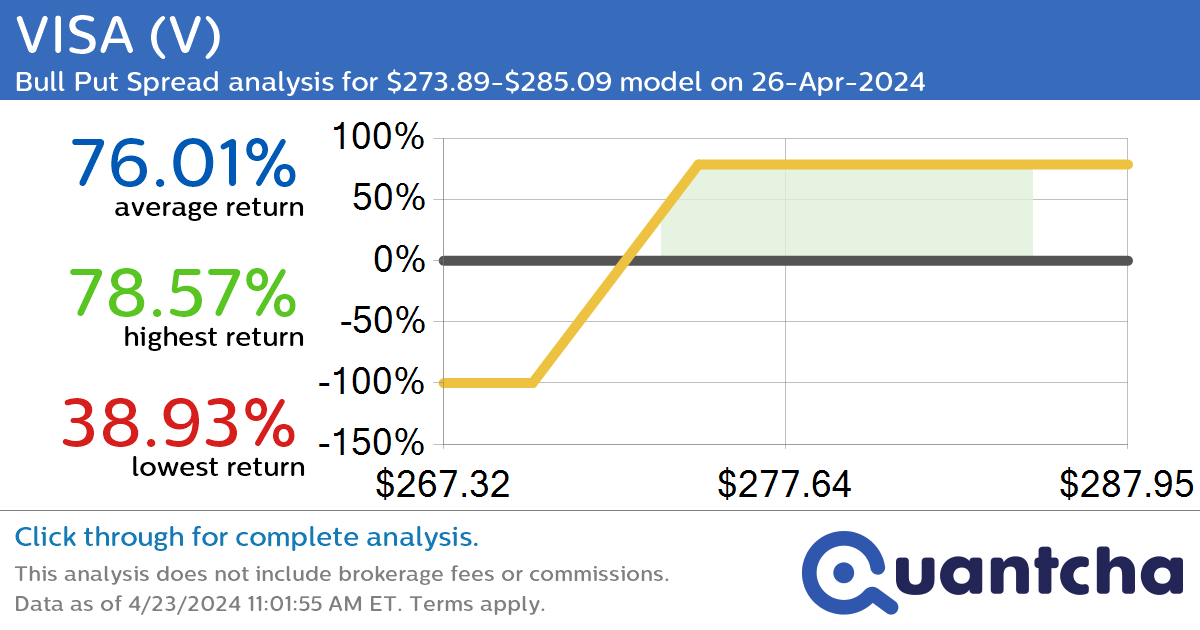

StockTwits Trending Alert: Trading recent interest in VISA $V

Quantchabot has detected a new Bull Put Spread trade opportunity for VISA (V) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. V was recently trading at $273.87 and has an implied volatility of 39.26% for this period. Based on an analysis of the options…

-

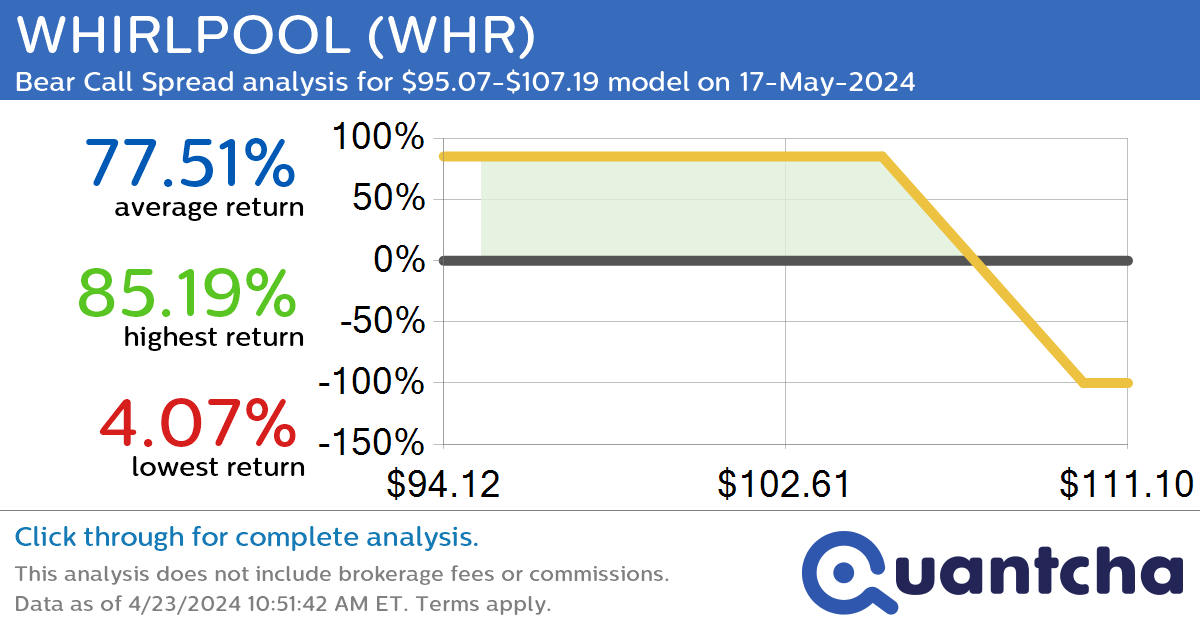

StockTwits Trending Alert: Trading recent interest in WHIRLPOOL $WHR

Quantchabot has detected a new Bear Call Spread trade opportunity for WHIRLPOOL (WHR) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WHR was recently trading at $107.21 and has an implied volatility of 41.34% for this period. Based on an analysis of the options…

-

Covered Call Alert: TELEPHONE AND DATA SYSTEMS $TDS returning up to 27.37% through 16-Aug-2024

Quantchabot has detected a new Covered Call trade opportunity for TELEPHONE AND DATA SYSTEMS (TDS) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TDS was recently trading at $16.03 and has an implied volatility of 82.49% for this period. Based on an analysis of…

-

52-Week High Alert: Trading today’s movement in DESCARTES SYSTEMS GROUP $DSGX

Quantchabot has detected a new Bull Call Spread trade opportunity for DESCARTES SYSTEMS GROUP (DSGX) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DSGX was recently trading at $95.40 and has an implied volatility of 22.91% for this period. Based on an analysis of…

-

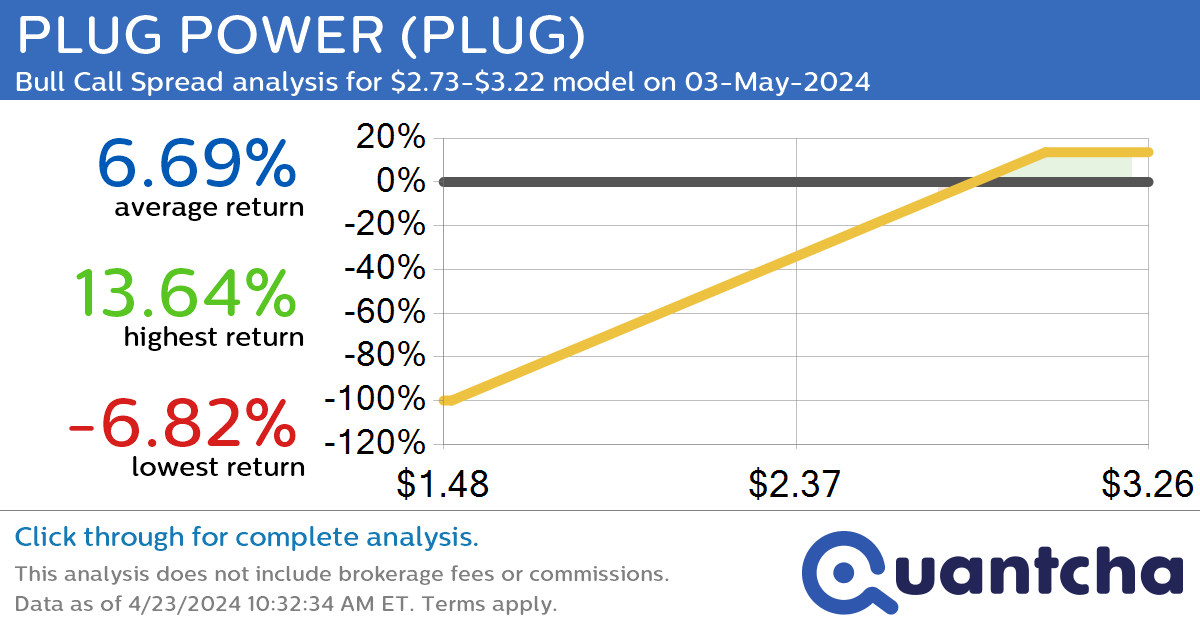

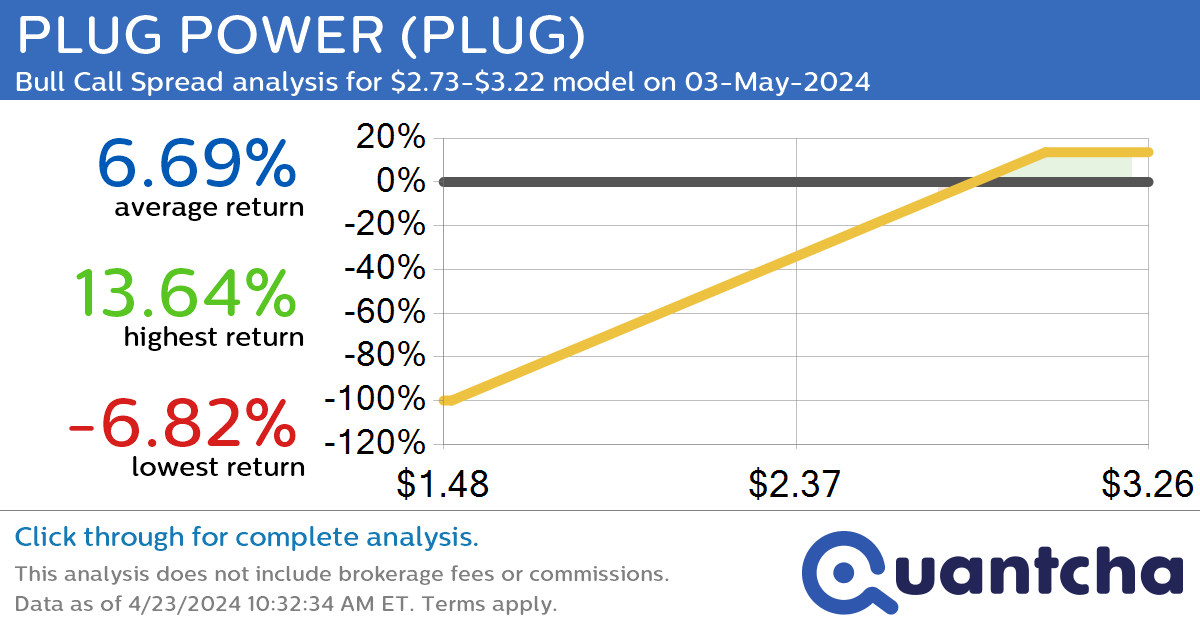

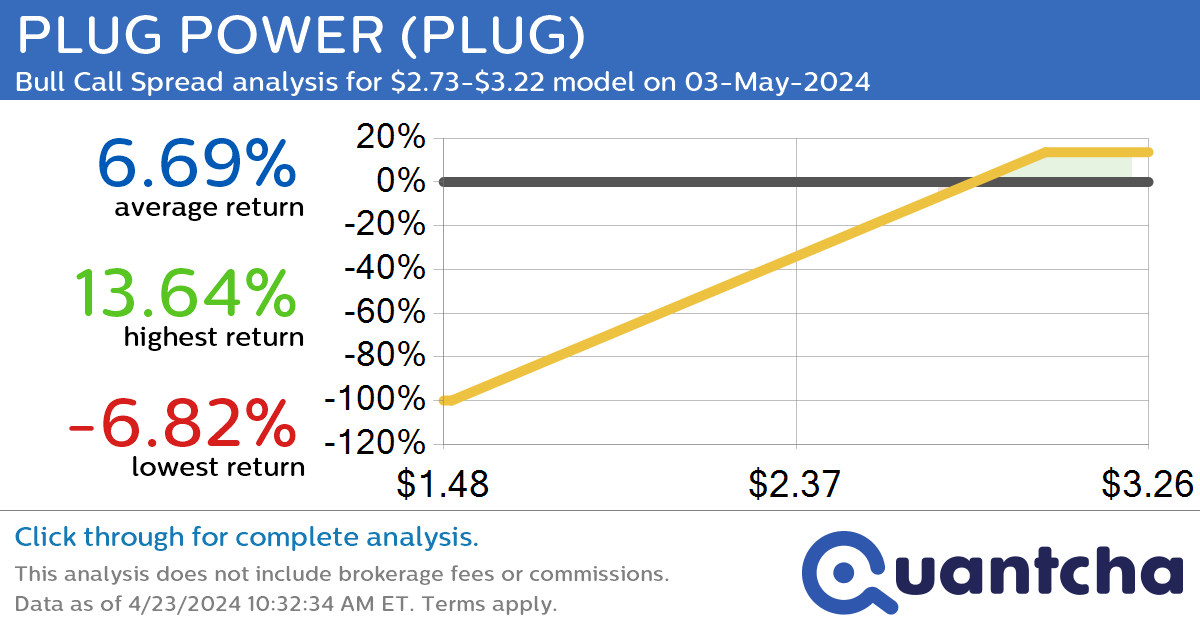

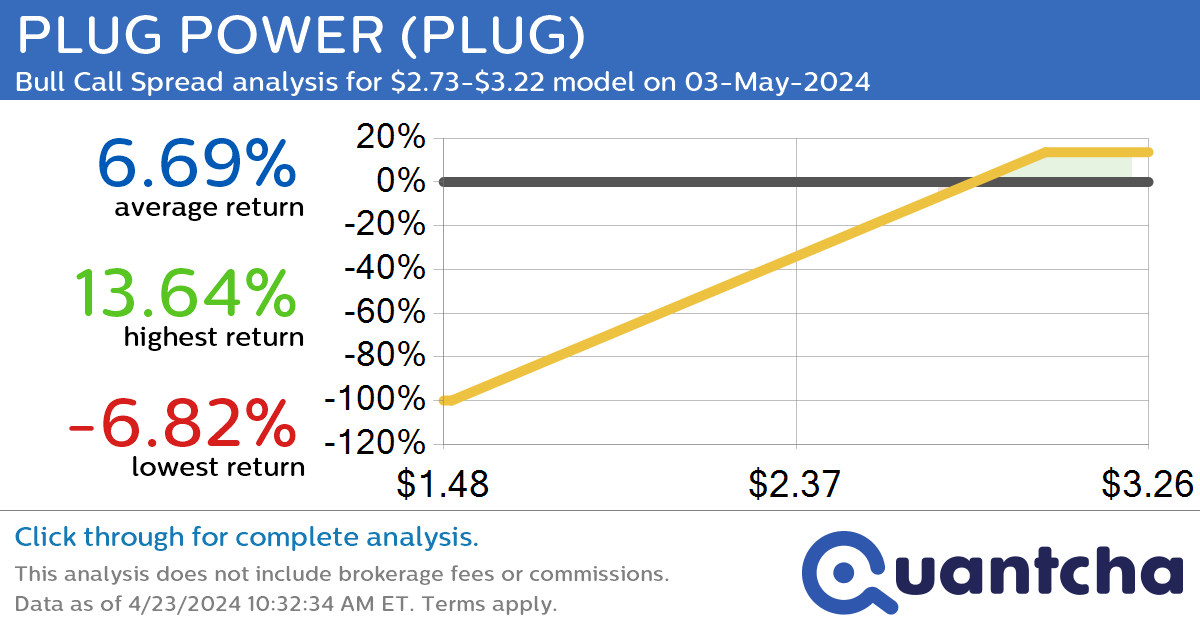

Big Gainer Alert: Trading today’s 9.3% move in PLUG POWER $PLUG

Quantchabot has detected a new Bull Call Spread trade opportunity for PLUG POWER (PLUG) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PLUG was recently trading at $2.72 and has an implied volatility of 96.62% for this period. Based on an analysis of the…

-

Synthetic Long Discount Alert: BLACKSTONE MORTGAGE TRUST INC $BXMT trading at a 10.04% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for BLACKSTONE MORTGAGE TRUST INC (BXMT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BXMT was recently trading at $19.07 and has an implied volatility of 35.05% for this period. Based on an analysis…

-

Covered Call Alert: BEYOND INC $BYON returning up to 24.56% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for BEYOND INC (BYON) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BYON was recently trading at $23.36 and has an implied volatility of 64.91% for this period. Based on an analysis of the options…

-

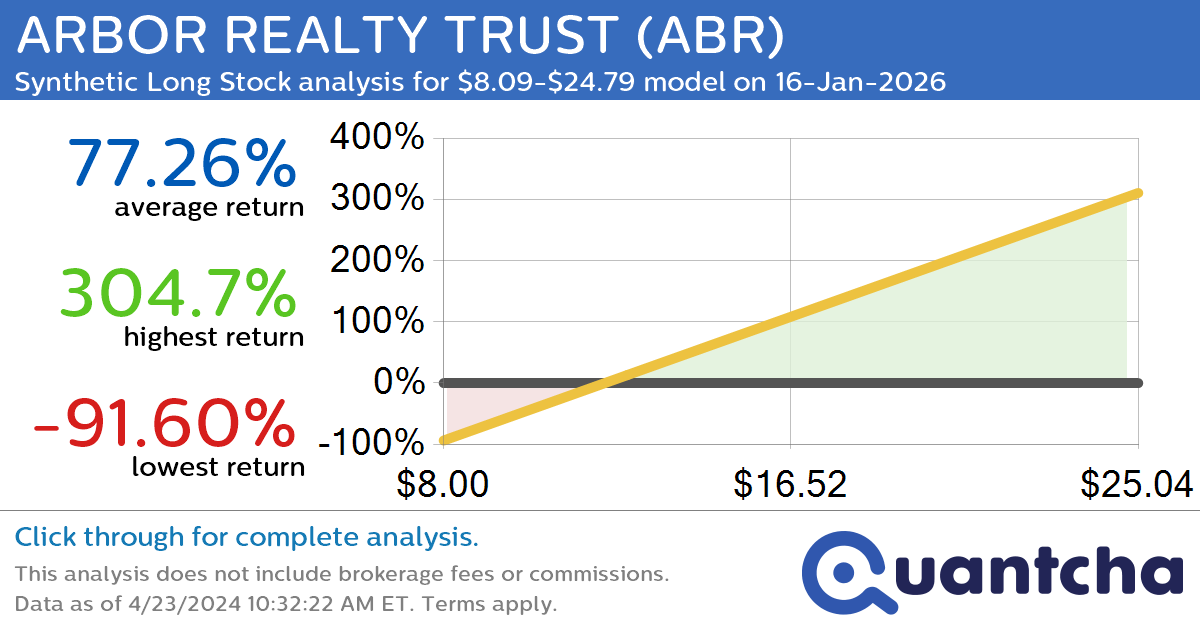

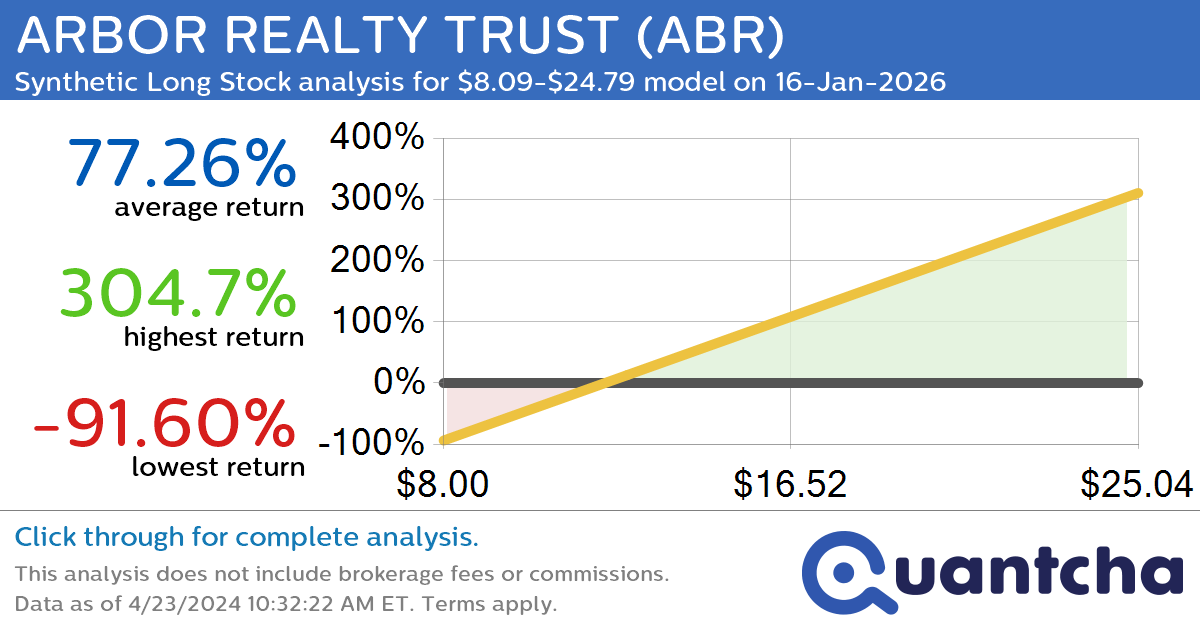

Synthetic Long Discount Alert: ARBOR REALTY TRUST $ABR trading at a 14.47% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ARBOR REALTY TRUST (ABR) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABR was recently trading at $12.92 and has an implied volatility of 42.47% for this period. Based on an analysis of…