Category: Trade Ideas

-

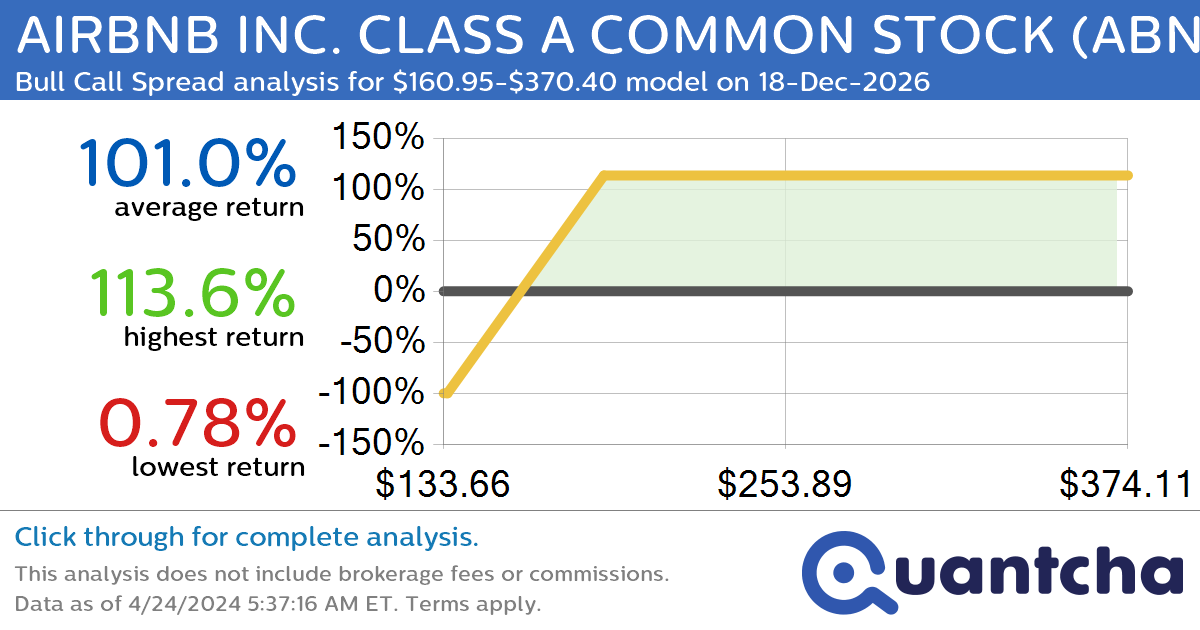

StockTwits Trending Alert: Trading recent interest in AIRBNB INC. CLASS A COMMON STOCK $ABNB

Quantchabot has detected a new Bull Call Spread trade opportunity for AIRBNB INC. CLASS A COMMON STOCK (ABNB) for the 18-Dec-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABNB was recently trading at $160.95 and has an implied volatility of 42.56% for this period. Based on…

-

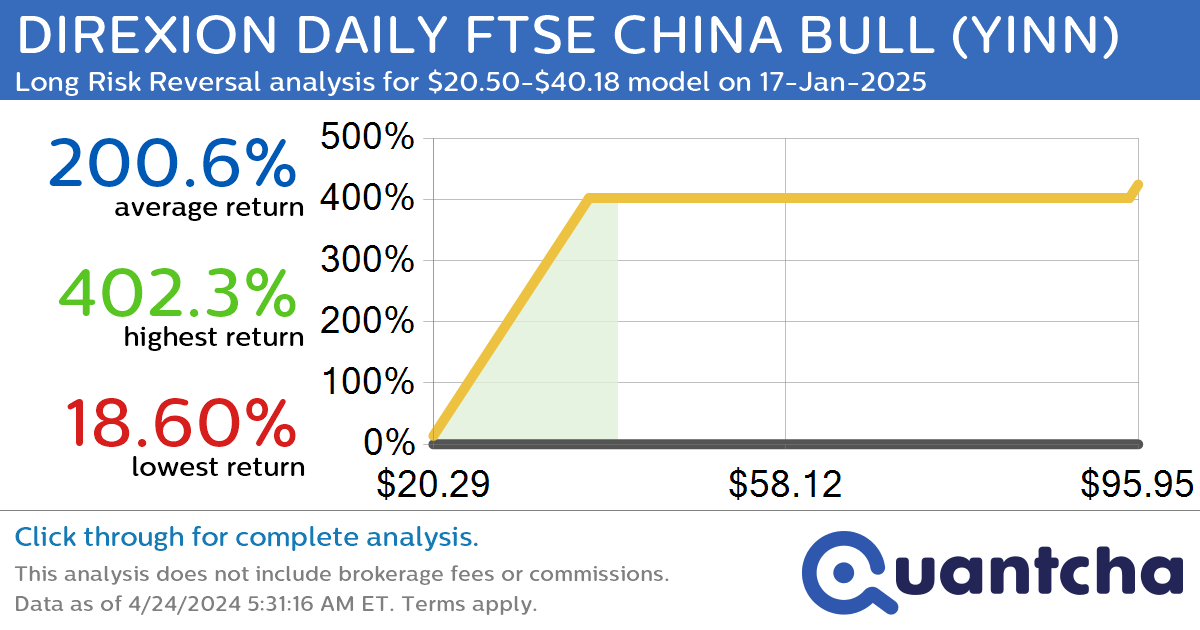

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY FTSE CHINA BULL $YINN

Quantchabot has detected a new Long Risk Reversal trade opportunity for DIREXION DAILY FTSE CHINA BULL (YINN) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. YINN was recently trading at $20.50 and has an implied volatility of 73.65% for this period. Based on an…

-

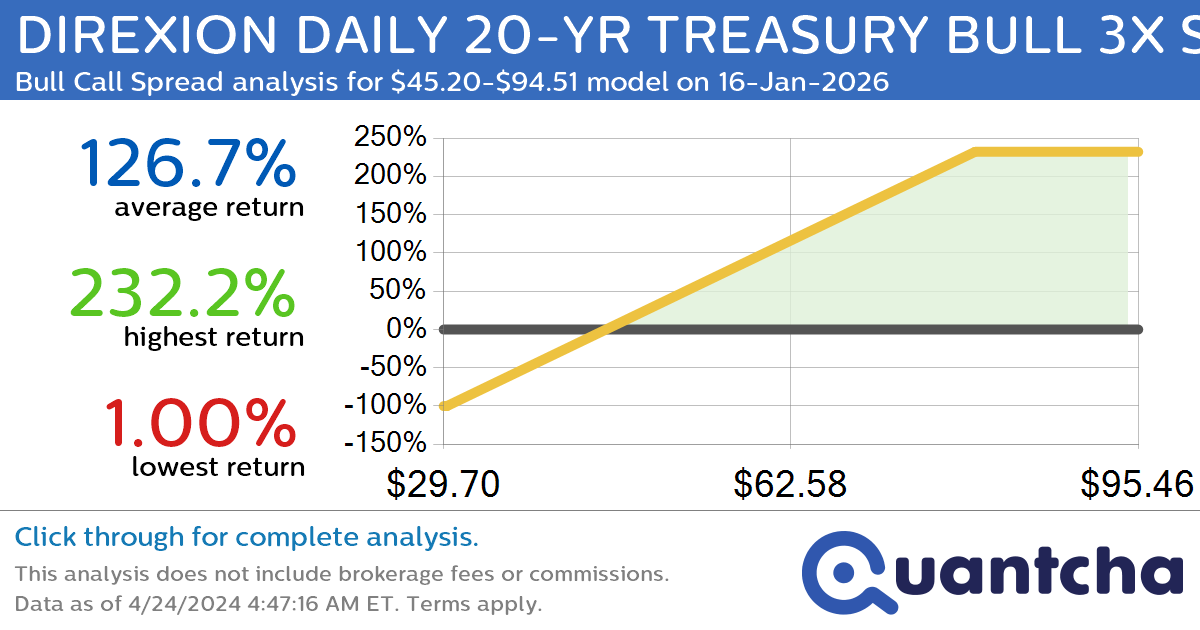

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY 20-YR TREASURY BULL 3X SHRS $TMF

Quantchabot has detected a new Bull Call Spread trade opportunity for DIREXION DAILY 20-YR TREASURY BULL 3X SHRS (TMF) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TMF was recently trading at $45.20 and has an implied volatility of 49.07% for this period. Based…

-

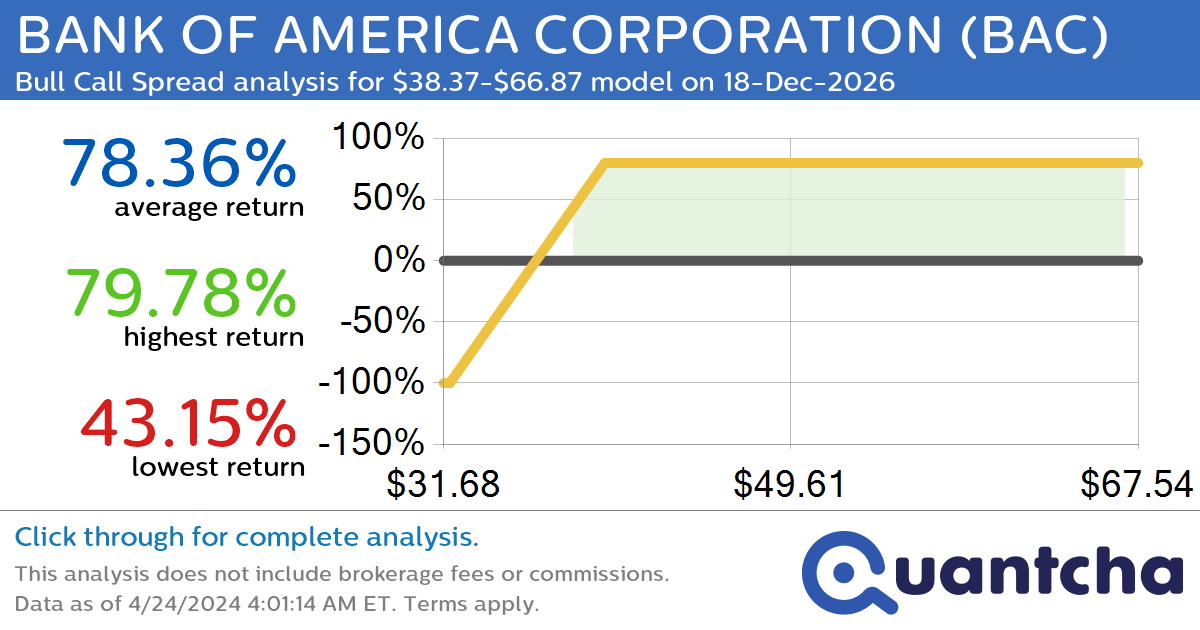

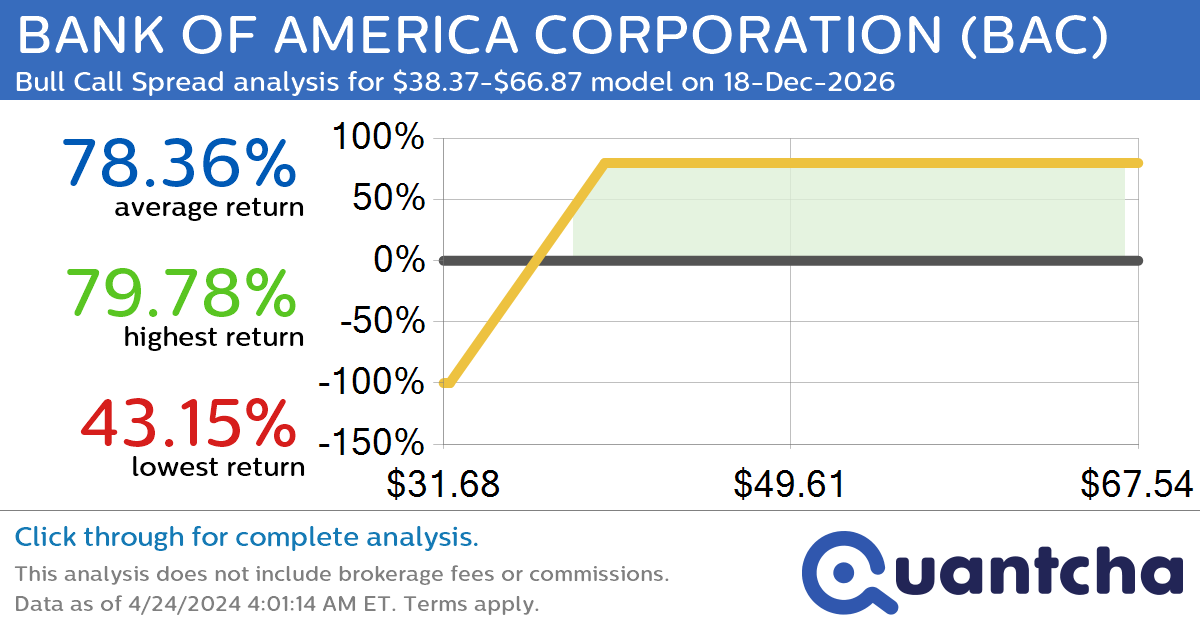

StockTwits Trending Alert: Trading recent interest in BANK OF AMERICA CORPORATION $BAC

Quantchabot has detected a new Bull Call Spread trade opportunity for BANK OF AMERICA CORPORATION (BAC) for the 18-Dec-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BAC was recently trading at $38.37 and has an implied volatility of 25.50% for this period. Based on an analysis…

-

StockTwits Trending Alert: Trading recent interest in BANK OF AMERICA CORPORATION $BAC

Quantchabot has detected a new Bull Call Spread trade opportunity for BANK OF AMERICA CORPORATION (BAC) for the 18-Dec-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BAC was recently trading at $38.37 and has an implied volatility of 25.50% for this period. Based on an analysis…

-

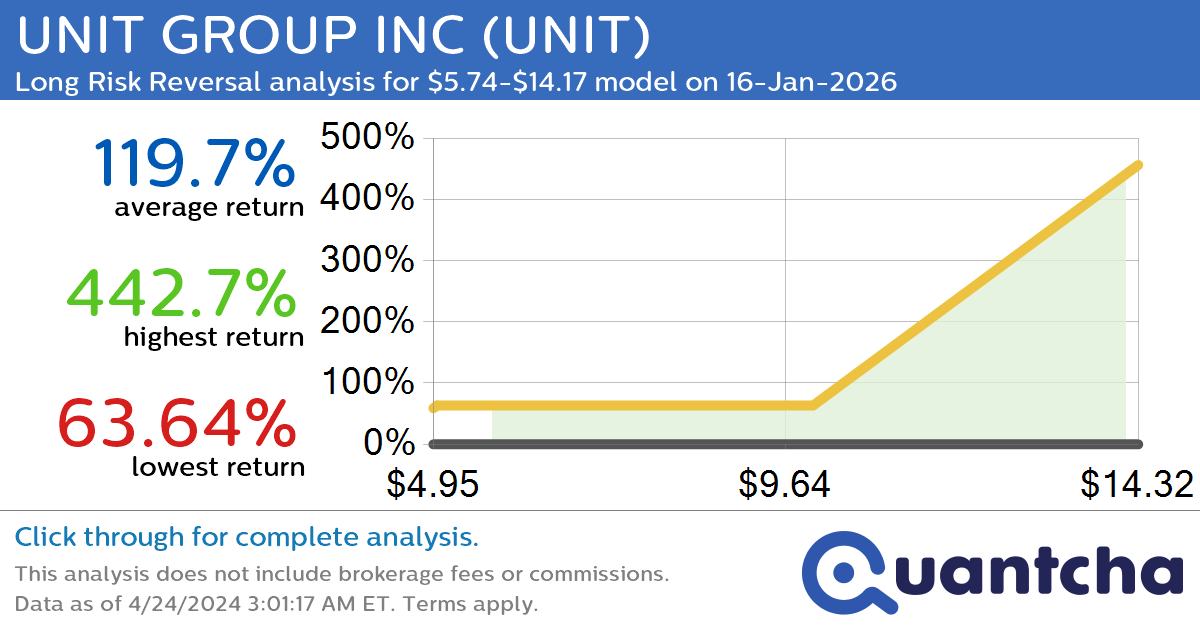

StockTwits Trending Alert: Trading recent interest in UNIT GROUP INC $UNIT

Quantchabot has detected a new Long Risk Reversal trade opportunity for UNIT GROUP INC (UNIT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UNIT was recently trading at $5.74 and has an implied volatility of 61.66% for this period. Based on an analysis of…

-

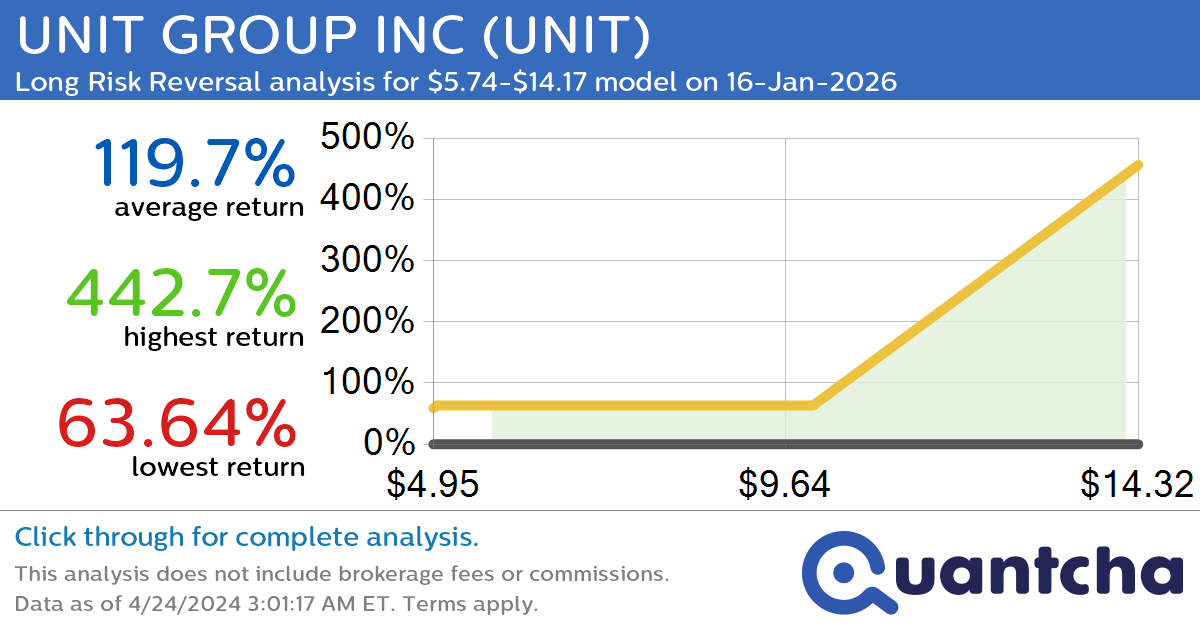

StockTwits Trending Alert: Trading recent interest in UNIT GROUP INC $UNIT

Quantchabot has detected a new Long Risk Reversal trade opportunity for UNIT GROUP INC (UNIT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UNIT was recently trading at $5.74 and has an implied volatility of 61.66% for this period. Based on an analysis of…

-

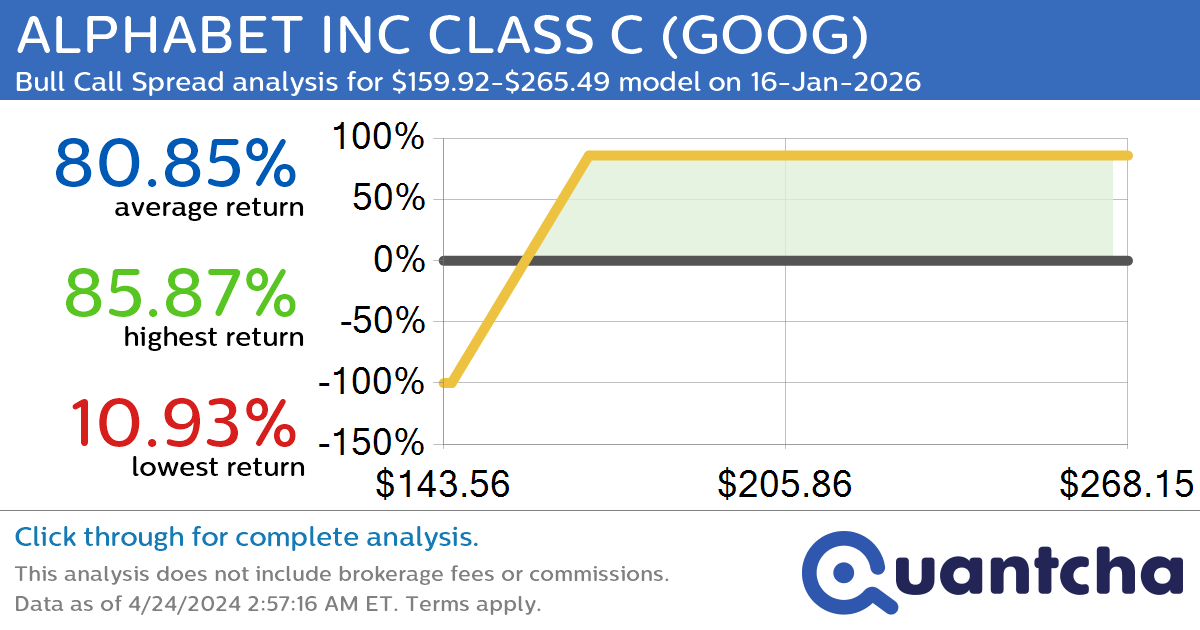

StockTwits Trending Alert: Trading recent interest in ALPHABET INC CLASS C $GOOG

Quantchabot has detected a new Bull Call Spread trade opportunity for ALPHABET INC CLASS C (GOOG) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GOOG was recently trading at $159.92 and has an implied volatility of 31.54% for this period. Based on an analysis…

-

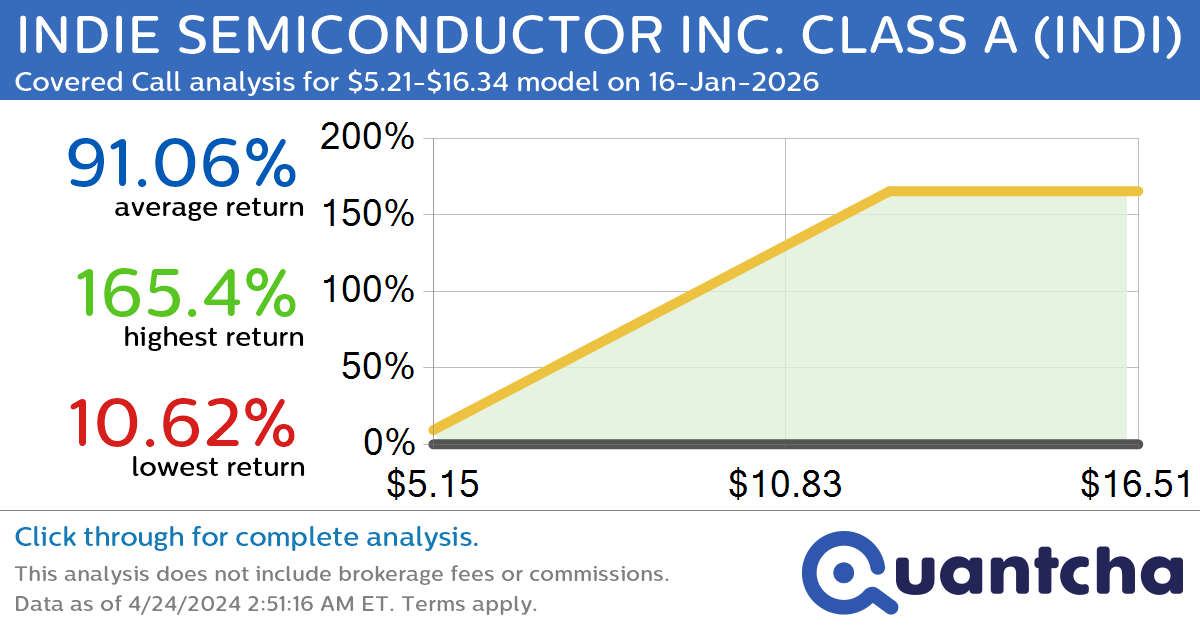

StockTwits Trending Alert: Trading recent interest in INDIE SEMICONDUCTOR INC. CLASS A $INDI

Quantchabot has detected a new Covered Call trade opportunity for INDIE SEMICONDUCTOR INC. CLASS A (INDI) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INDI was recently trading at $5.21 and has an implied volatility of 79.86% for this period. Based on an analysis…

-

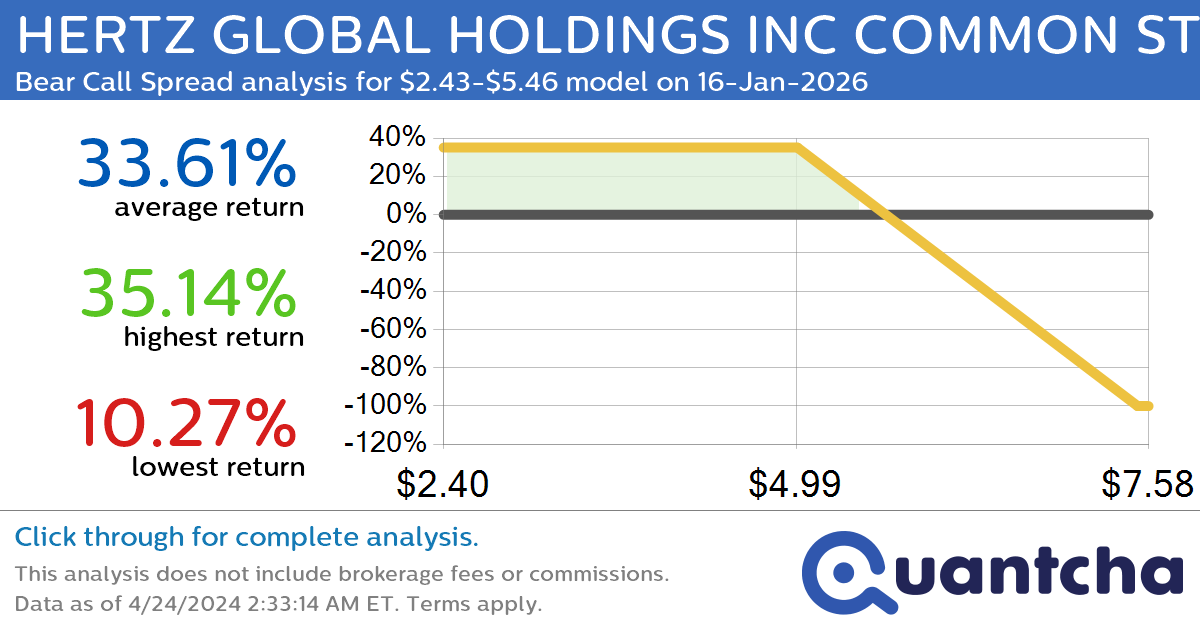

StockTwits Trending Alert: Trading recent interest in HERTZ GLOBAL HOLDINGS INC COMMON STOCK $HTZ

Quantchabot has detected a new Bear Call Spread trade opportunity for HERTZ GLOBAL HOLDINGS INC COMMON STOCK (HTZ) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HTZ was recently trading at $5.46 and has an implied volatility of 68.38% for this period. Based on…