Category: Trade Ideas

-

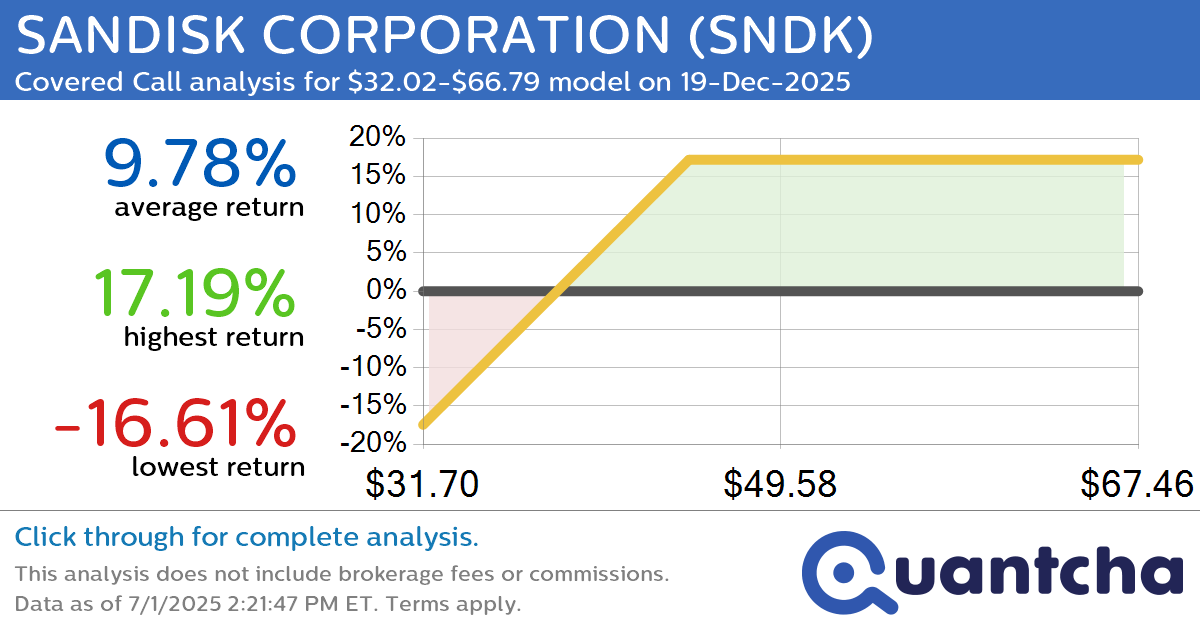

Covered Call Alert: SANDISK CORPORATION $SNDK returning up to 17.49% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for SANDISK CORPORATION (SNDK) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SNDK was recently trading at $45.27 and has an implied volatility of 53.61% for this period. Based on an analysis of the options…

-

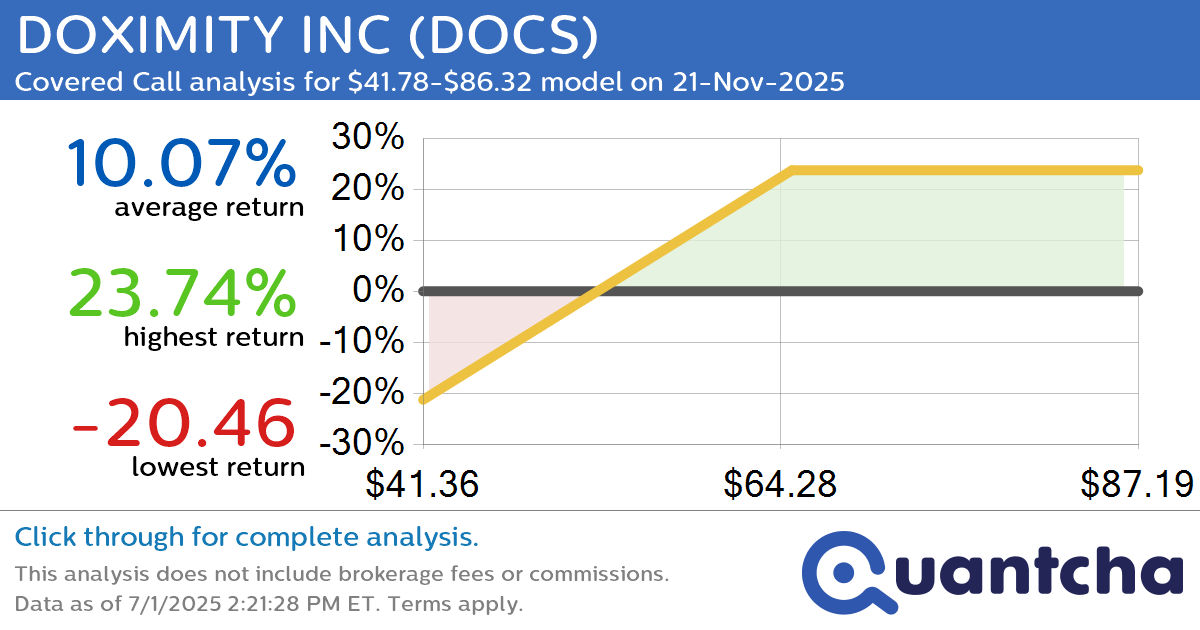

Covered Call Alert: DOXIMITY INC $DOCS returning up to 23.74% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for DOXIMITY INC (DOCS) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DOCS was recently trading at $59.00 and has an implied volatility of 57.85% for this period. Based on an analysis of the options…

-

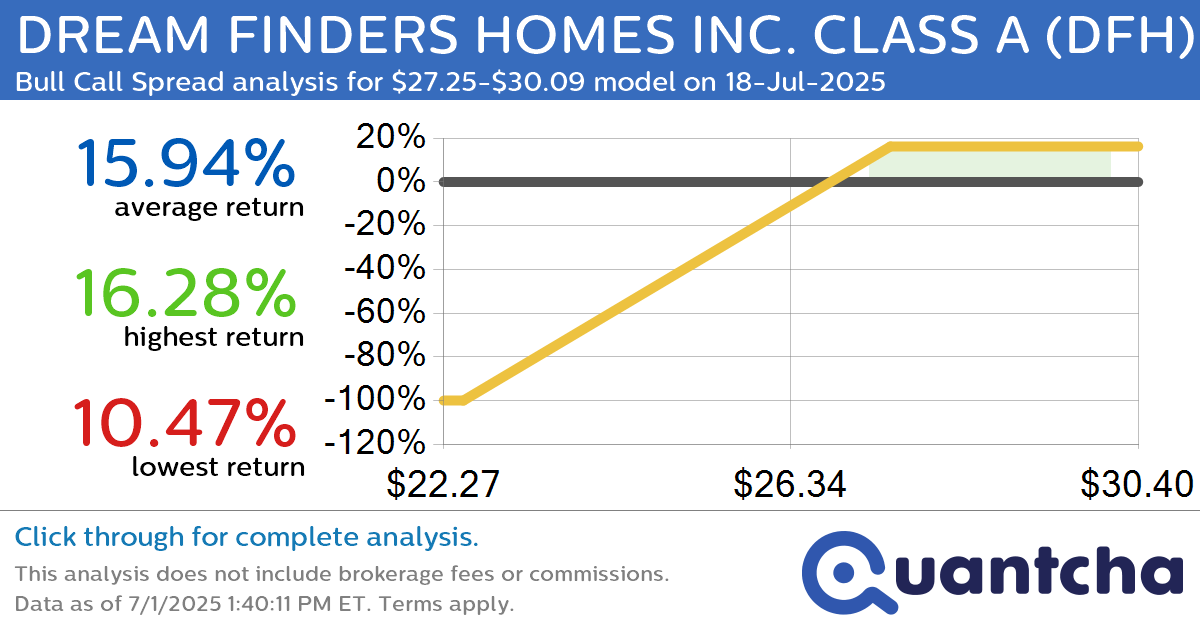

Big Gainer Alert: Trading today’s 8.2% move in DREAM FINDERS HOMES INC. CLASS A $DFH

Quantchabot has detected a new Bull Call Spread trade opportunity for DREAM FINDERS HOMES INC. CLASS A (DFH) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DFH was recently trading at $27.19 and has an implied volatility of 45.26% for this period. Based on…

-

Big Loser Alert: Trading today’s -8.1% move in TMC THE METALS COMPANY INC. $TMC

Quantchabot has detected a new Bear Call Spread trade opportunity for TMC THE METALS COMPANY INC. (TMC) for the 8-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TMC was recently trading at $6.07 and has an implied volatility of 121.72% for this period. Based on an…

-

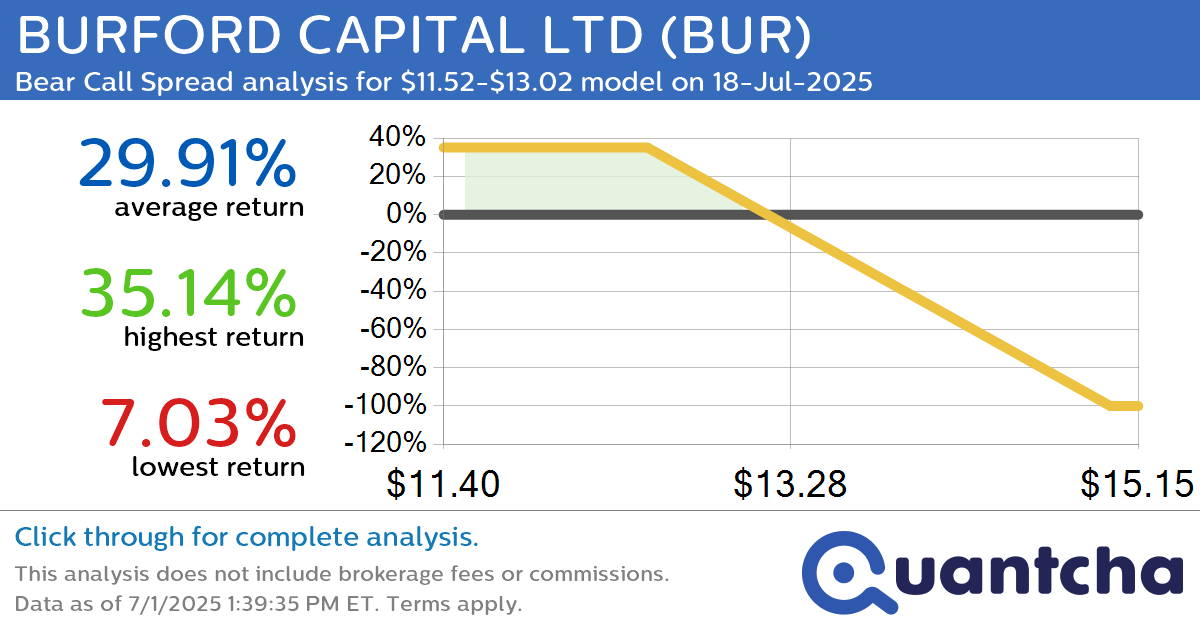

Big Loser Alert: Trading today’s -8.9% move in BURFORD CAPITAL LTD $BUR

Quantchabot has detected a new Bear Call Spread trade opportunity for BURFORD CAPITAL LTD (BUR) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BUR was recently trading at $12.99 and has an implied volatility of 55.71% for this period. Based on an analysis of…

-

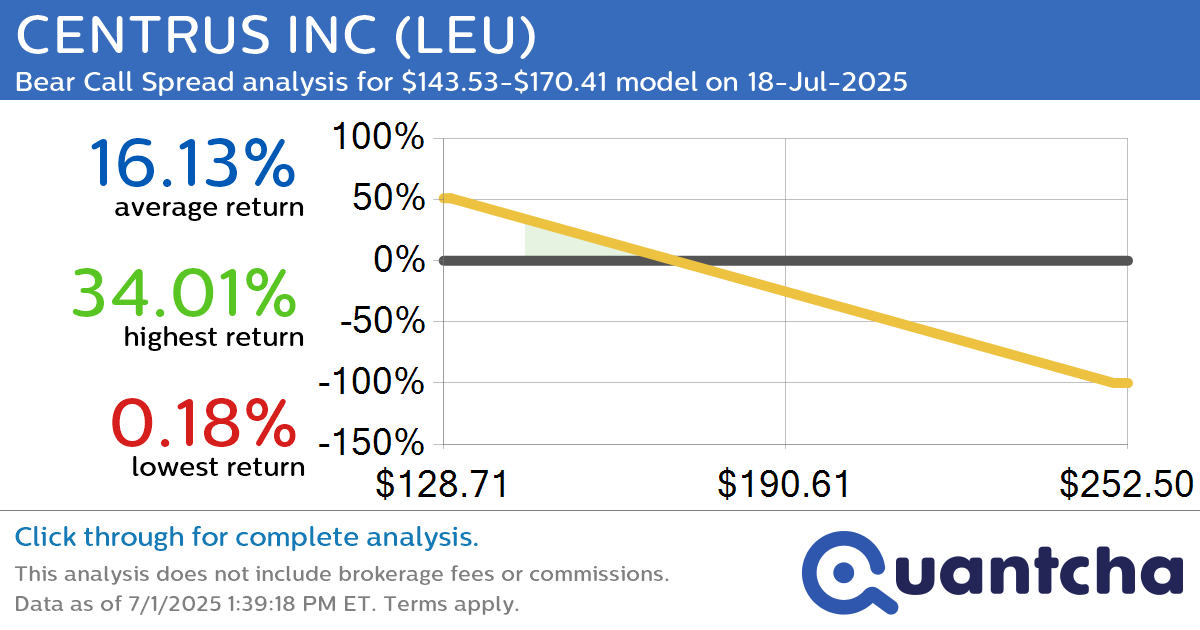

Big Loser Alert: Trading today’s -7.2% move in CENTRUS INC $LEU

Quantchabot has detected a new Bear Call Spread trade opportunity for CENTRUS INC (LEU) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LEU was recently trading at $170.05 and has an implied volatility of 78.18% for this period. Based on an analysis of the…

-

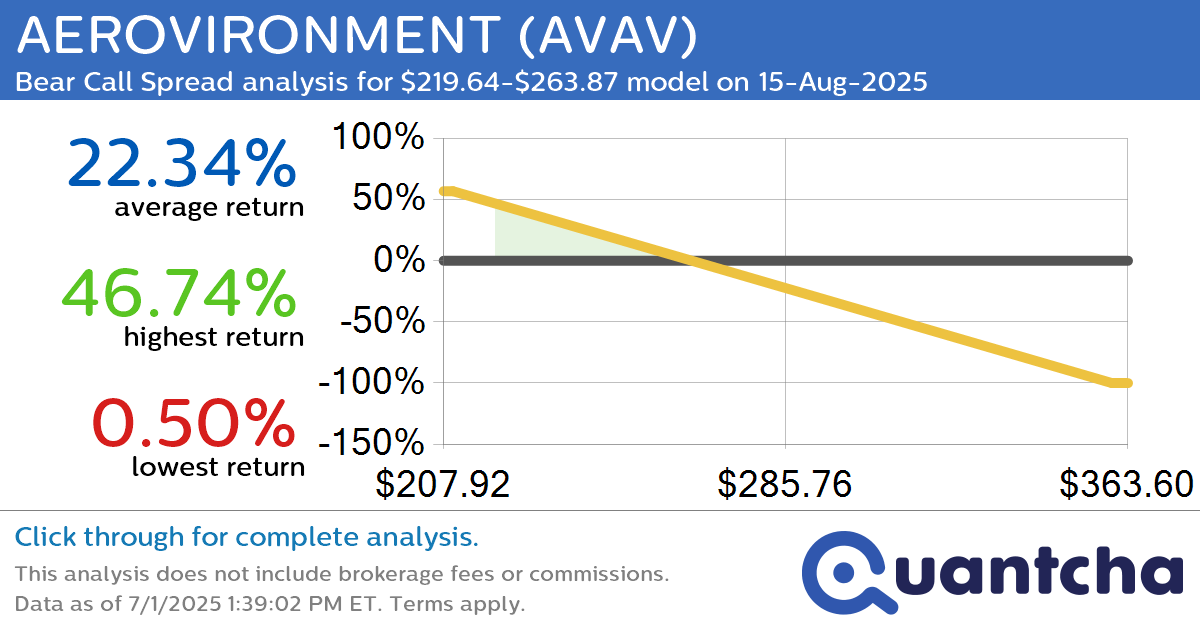

Big Loser Alert: Trading today’s -7.9% move in AEROVIRONMENT $AVAV

Quantchabot has detected a new Bear Call Spread trade opportunity for AEROVIRONMENT (AVAV) for the 15-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AVAV was recently trading at $262.43 and has an implied volatility of 51.90% for this period. Based on an analysis of the options…

-

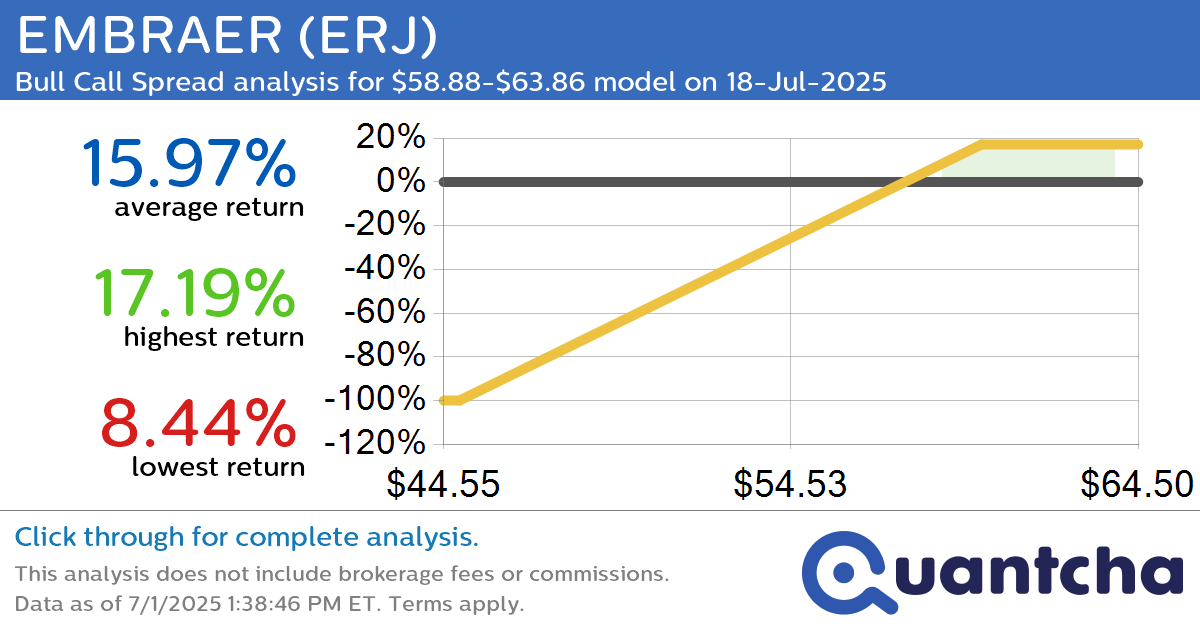

52-Week High Alert: Trading today’s movement in EMBRAER $ERJ

Quantchabot has detected a new Bull Call Spread trade opportunity for EMBRAER (ERJ) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ERJ was recently trading at $58.76 and has an implied volatility of 36.97% for this period. Based on an analysis of the options…

-

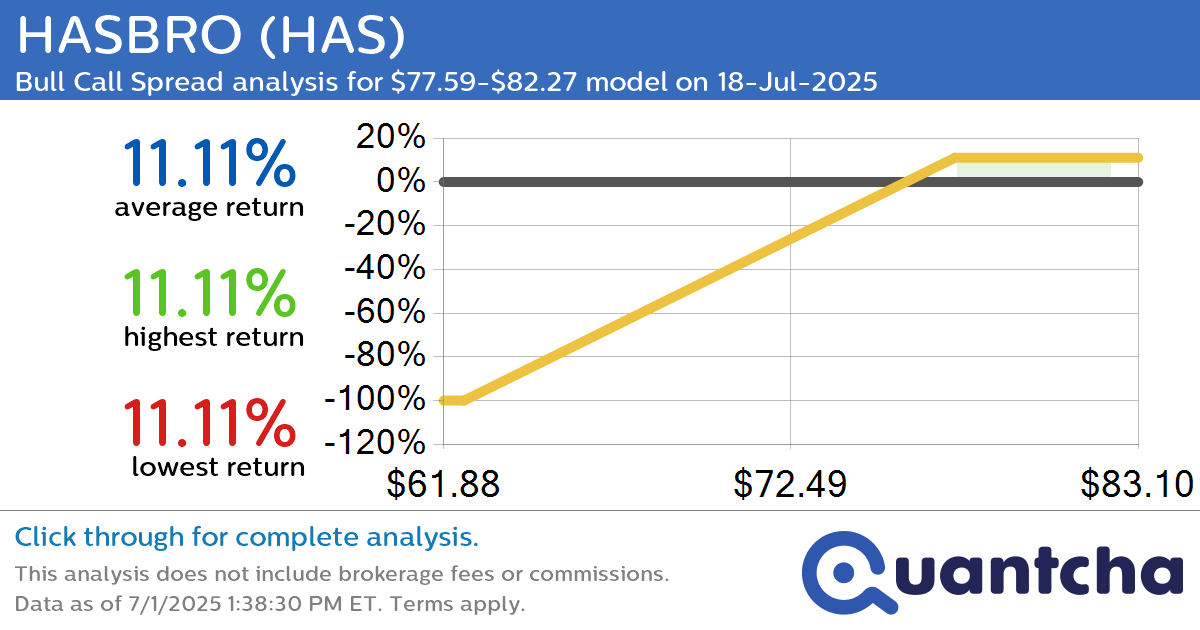

52-Week High Alert: Trading today’s movement in HASBRO $HAS

Quantchabot has detected a new Bull Call Spread trade opportunity for HASBRO (HAS) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HAS was recently trading at $77.43 and has an implied volatility of 26.63% for this period. Based on an analysis of the options…

-

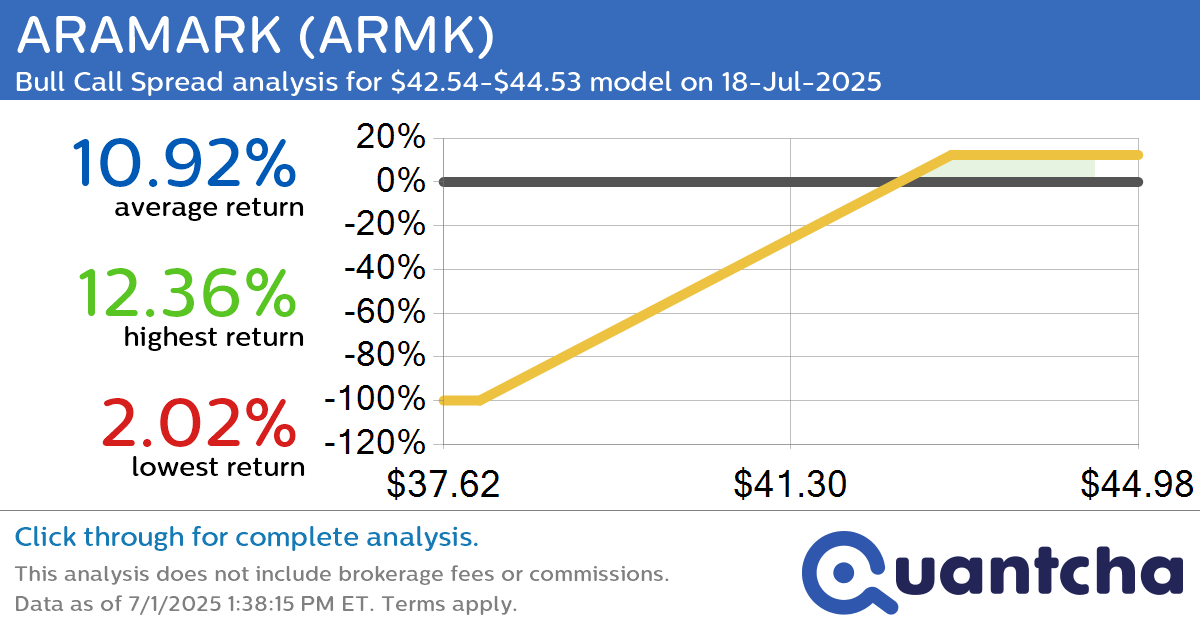

52-Week High Alert: Trading today’s movement in ARAMARK $ARMK

Quantchabot has detected a new Bull Call Spread trade opportunity for ARAMARK (ARMK) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARMK was recently trading at $42.45 and has an implied volatility of 20.84% for this period. Based on an analysis of the options…