Category: Trade Ideas

-

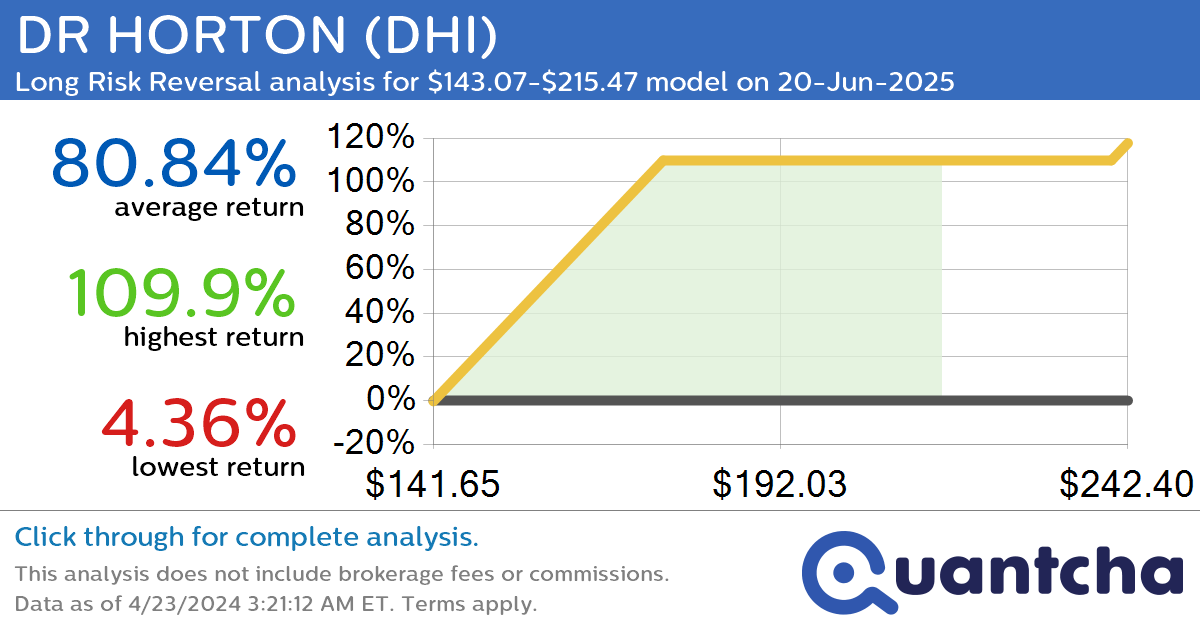

StockTwits Trending Alert: Trading recent interest in DR HORTON $DHI

Quantchabot has detected a new Long Risk Reversal trade opportunity for DR HORTON (DHI) for the 20-Jun-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DHI was recently trading at $143.07 and has an implied volatility of 33.26% for this period. Based on an analysis of the…

-

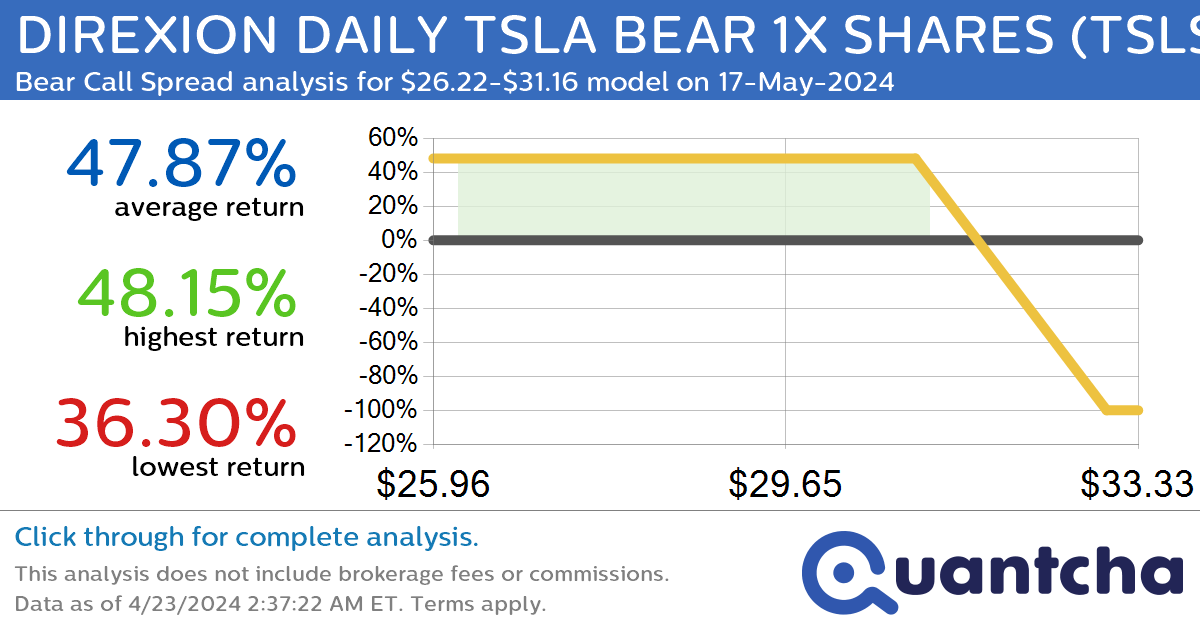

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY TSLA BEAR 1X SHARES $TSLS

Quantchabot has detected a new Bear Call Spread trade opportunity for DIREXION DAILY TSLA BEAR 1X SHARES (TSLS) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TSLS was recently trading at $31.16 and has an implied volatility of 67.34% for this period. Based on…

-

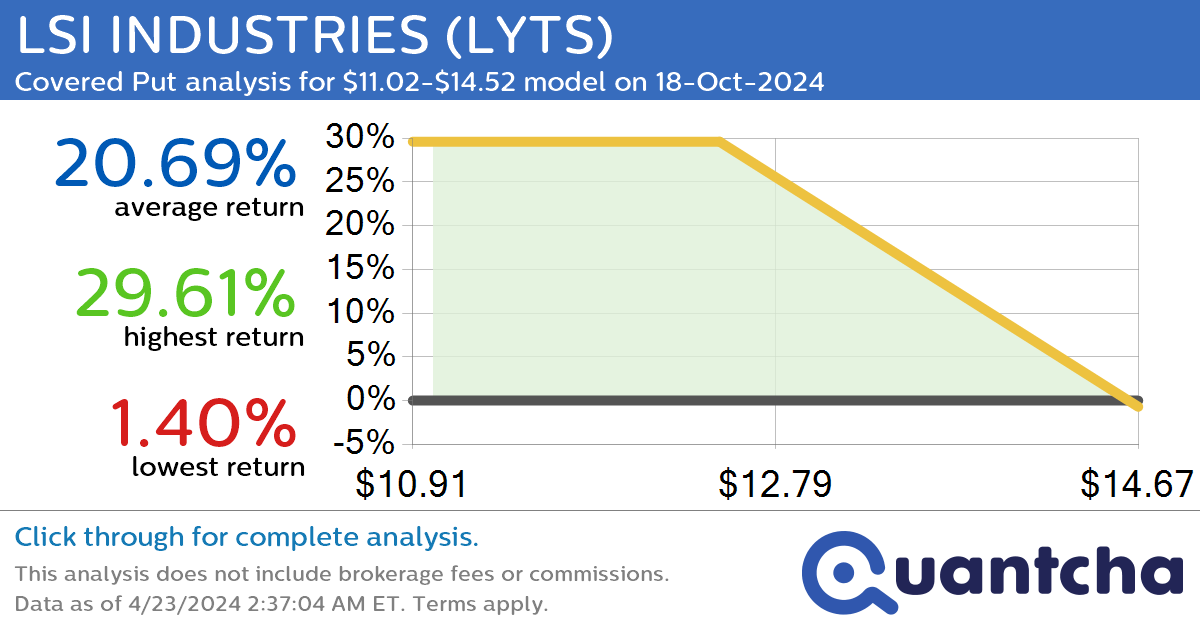

StockTwits Trending Alert: Trading recent interest in LSI INDUSTRIES $LYTS

Quantchabot has detected a new Covered Put trade opportunity for LSI INDUSTRIES (LYTS) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LYTS was recently trading at $14.52 and has an implied volatility of 43.33% for this period. Based on an analysis of the options…

-

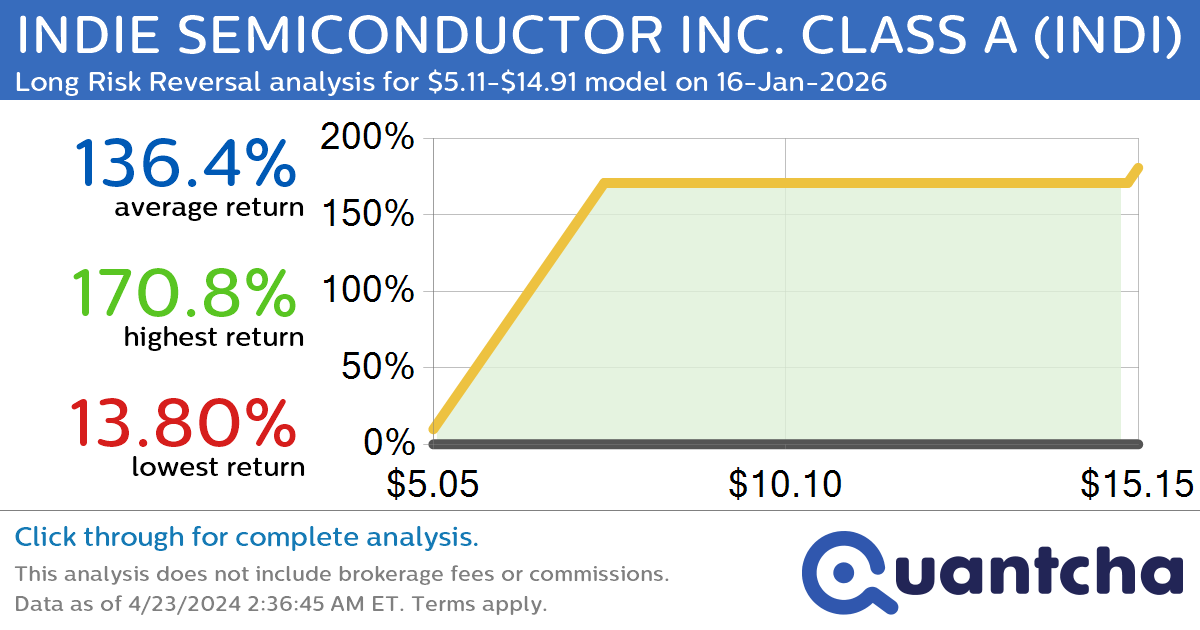

StockTwits Trending Alert: Trading recent interest in INDIE SEMICONDUCTOR INC. CLASS A $INDI

Quantchabot has detected a new Long Risk Reversal trade opportunity for INDIE SEMICONDUCTOR INC. CLASS A (INDI) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INDI was recently trading at $5.11 and has an implied volatility of 74.29% for this period. Based on an…

-

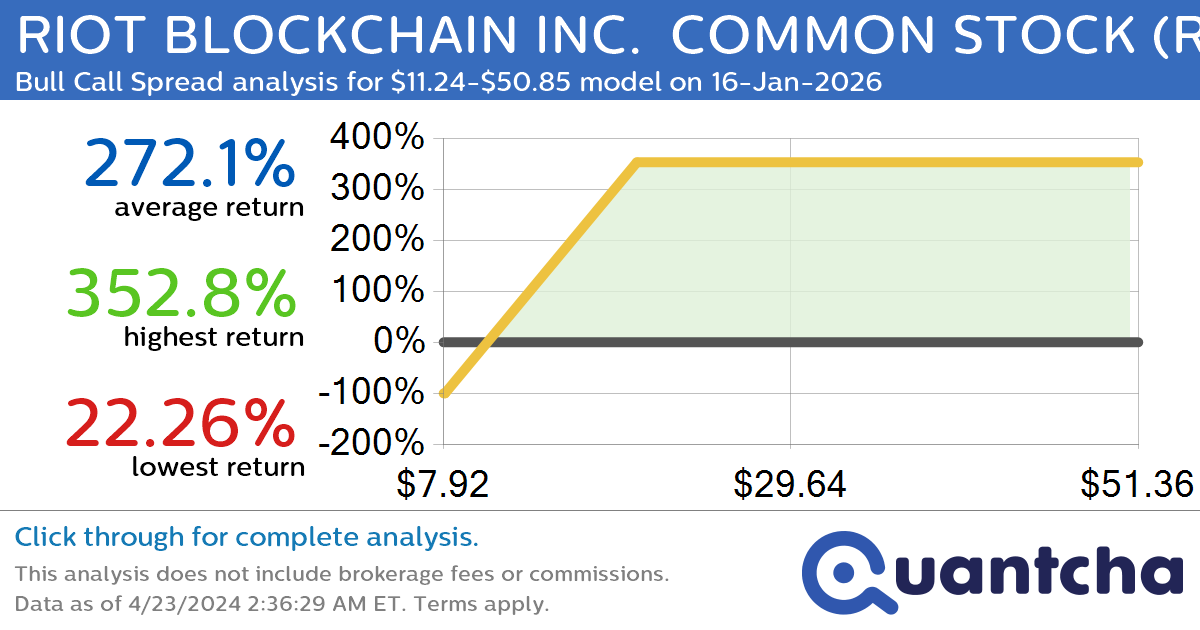

StockTwits Trending Alert: Trading recent interest in RIOT BLOCKCHAIN INC. COMMON STOCK $RIOT

Quantchabot has detected a new Bull Call Spread trade opportunity for RIOT BLOCKCHAIN INC. COMMON STOCK (RIOT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RIOT was recently trading at $11.24 and has an implied volatility of 107.54% for this period. Based on an…

-

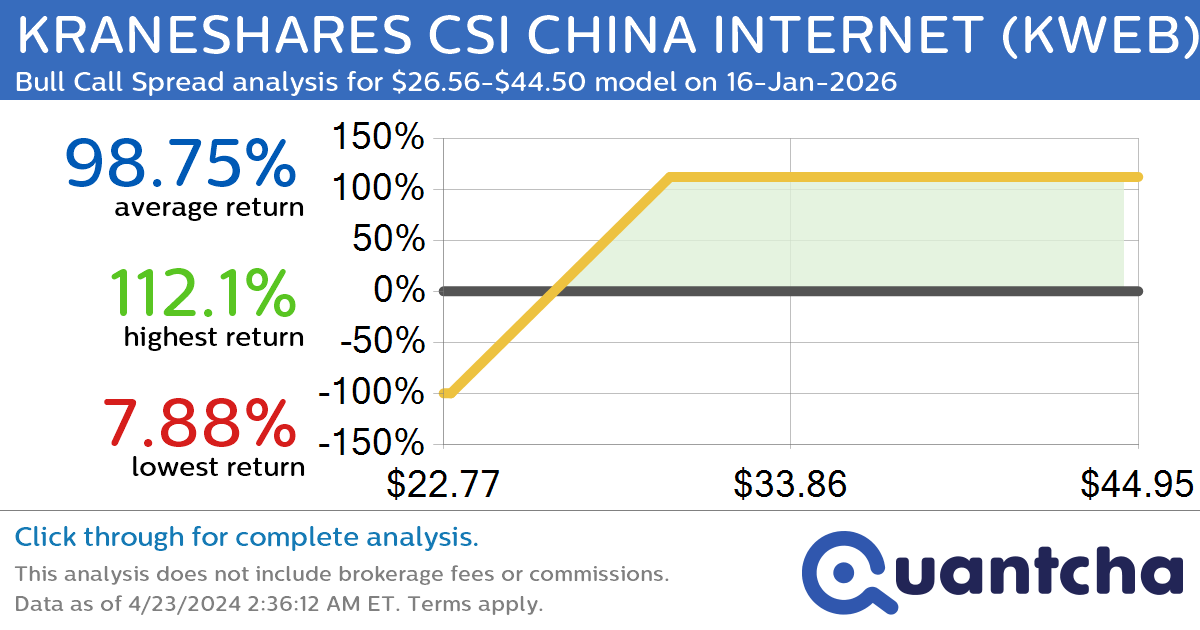

StockTwits Trending Alert: Trading recent interest in KRANESHARES CSI CHINA INTERNET $KWEB

Quantchabot has detected a new Bull Call Spread trade opportunity for KRANESHARES CSI CHINA INTERNET (KWEB) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KWEB was recently trading at $26.56 and has an implied volatility of 32.18% for this period. Based on an analysis…

-

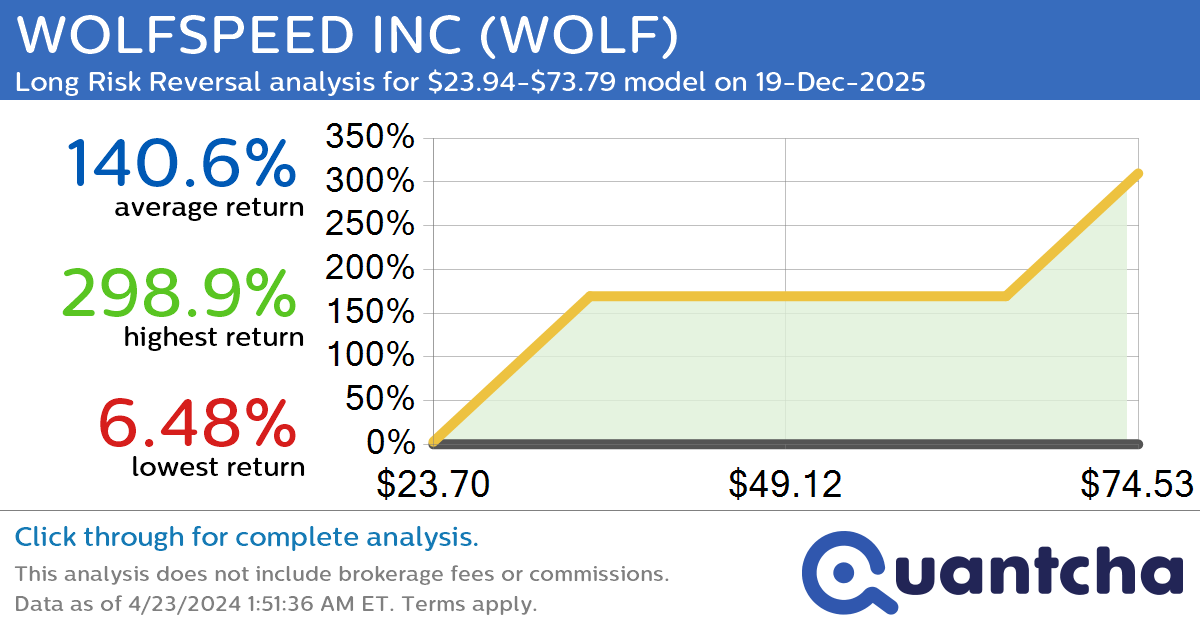

StockTwits Trending Alert: Trading recent interest in WOLFSPEED INC $WOLF

Quantchabot has detected a new Long Risk Reversal trade opportunity for WOLFSPEED INC (WOLF) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WOLF was recently trading at $23.94 and has an implied volatility of 80.53% for this period. Based on an analysis of the…

-

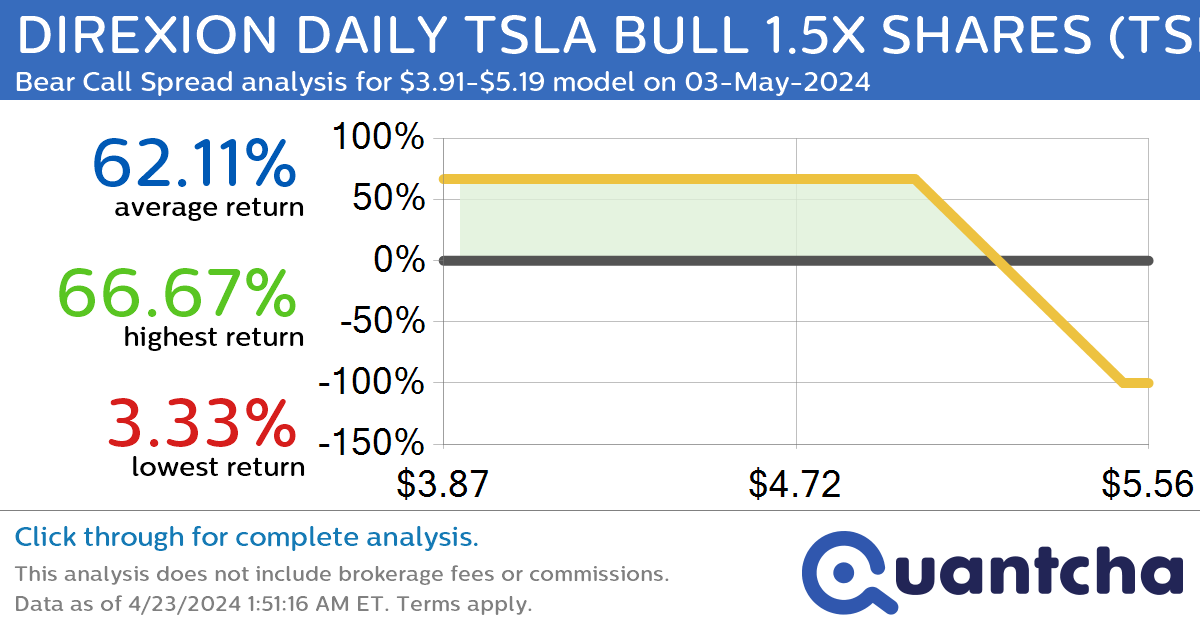

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY TSLA BULL 1.5X SHARES $TSLL

Quantchabot has detected a new Bear Call Spread trade opportunity for DIREXION DAILY TSLA BULL 1.5X SHARES (TSLL) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TSLL was recently trading at $5.19 and has an implied volatility of 162.78% for this period. Based on…

-

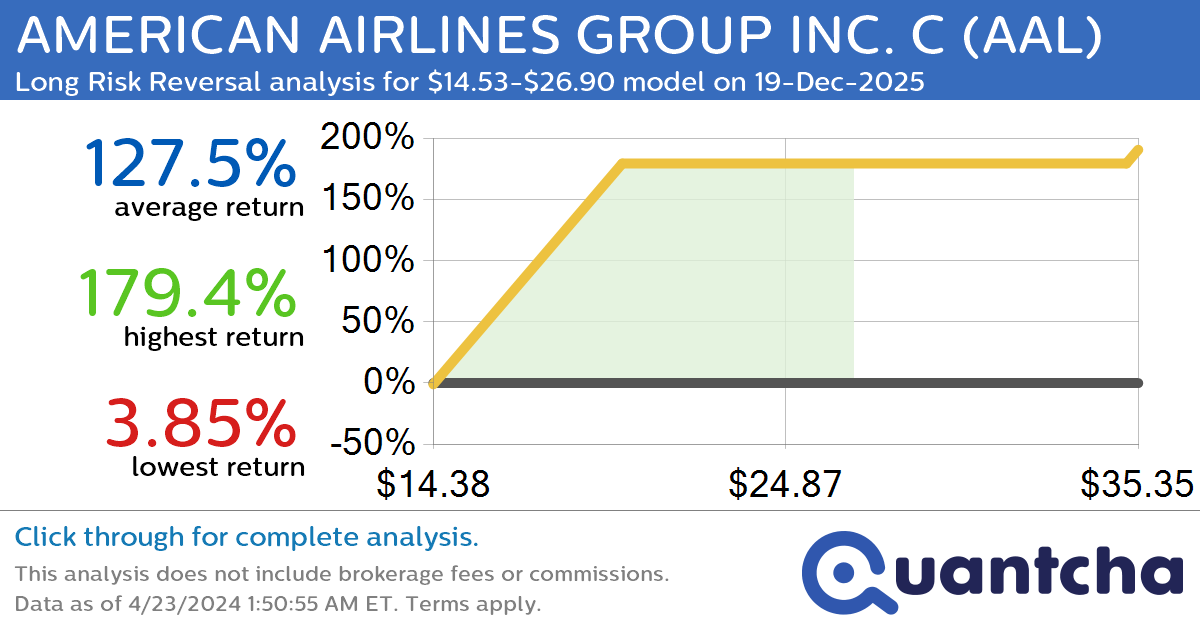

StockTwits Trending Alert: Trading recent interest in AMERICAN AIRLINES GROUP INC. C $AAL

Quantchabot has detected a new Long Risk Reversal trade opportunity for AMERICAN AIRLINES GROUP INC. C (AAL) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AAL was recently trading at $14.53 and has an implied volatility of 40.96% for this period. Based on an…

-

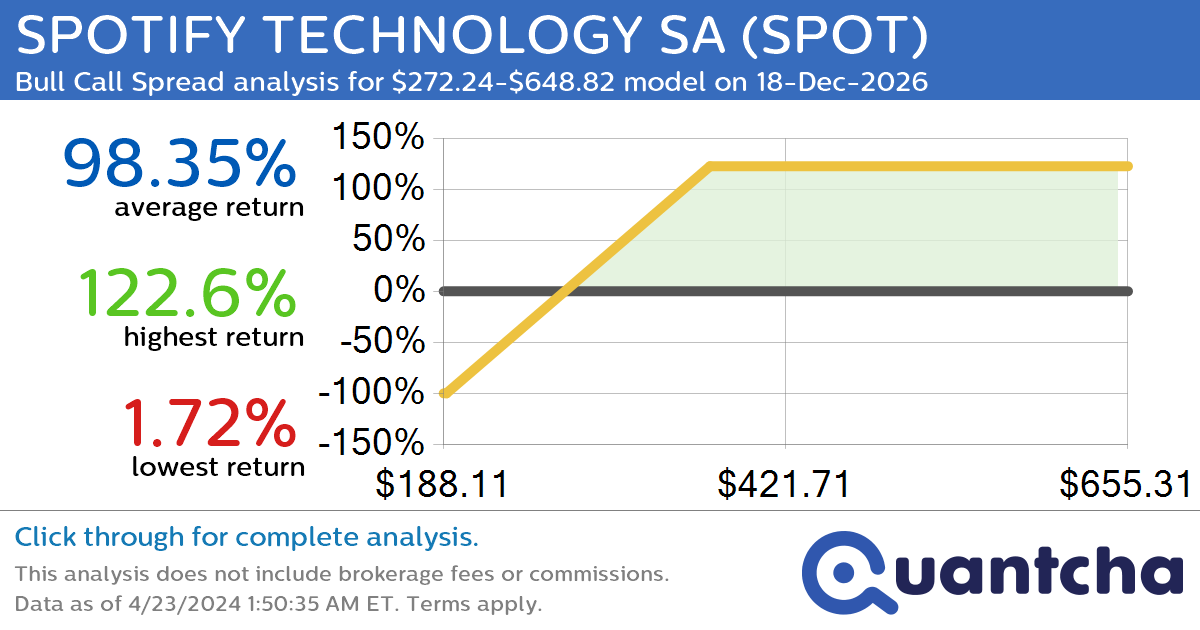

StockTwits Trending Alert: Trading recent interest in SPOTIFY TECHNOLOGY SA $SPOT

Quantchabot has detected a new Bull Call Spread trade opportunity for SPOTIFY TECHNOLOGY SA (SPOT) for the 18-Dec-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SPOT was recently trading at $272.24 and has an implied volatility of 44.64% for this period. Based on an analysis of…