Category: Trade Ideas

-

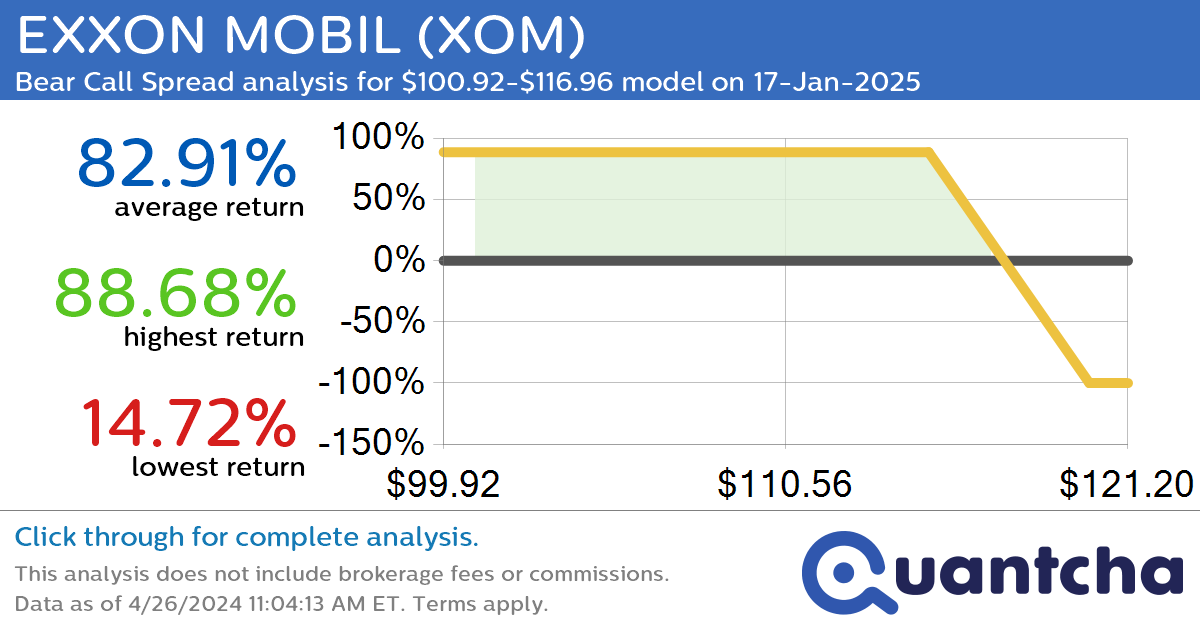

StockTwits Trending Alert: Trading recent interest in EXXON MOBIL $XOM

Quantchabot has detected a new Bear Call Spread trade opportunity for EXXON MOBIL (XOM) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XOM was recently trading at $116.98 and has an implied volatility of 22.04% for this period. Based on an analysis of the…

-

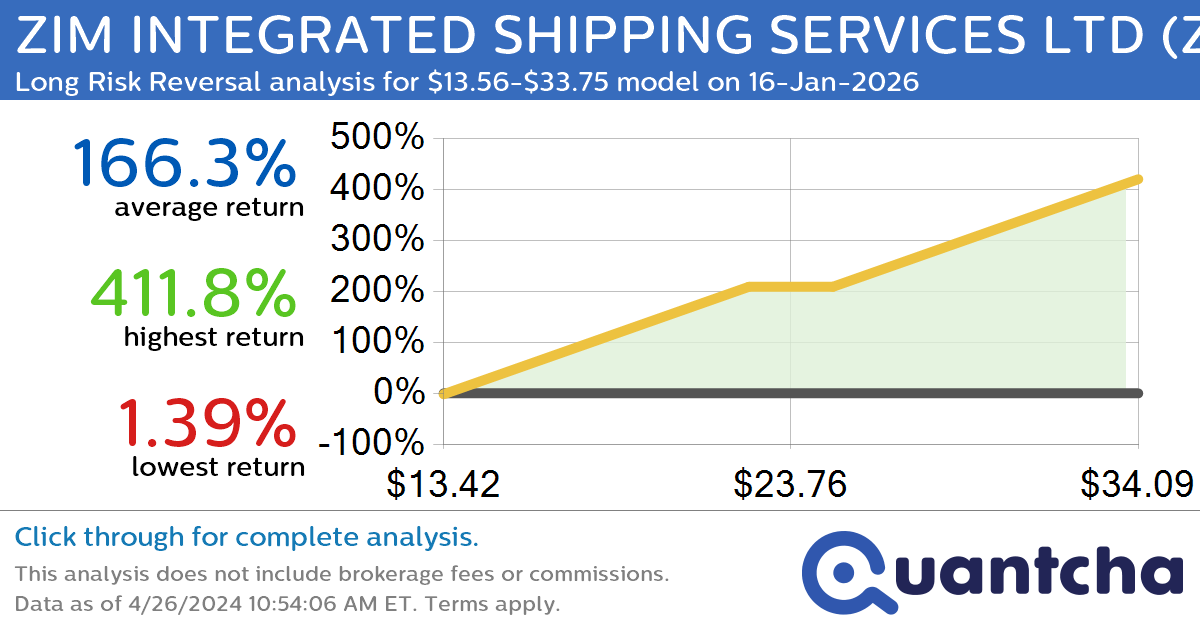

StockTwits Trending Alert: Trading recent interest in ZIM INTEGRATED SHIPPING SERVICES LTD $ZIM

Quantchabot has detected a new Long Risk Reversal trade opportunity for ZIM INTEGRATED SHIPPING SERVICES LTD (ZIM) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ZIM was recently trading at $13.55 and has an implied volatility of 62.39% for this period. Based on an…

-

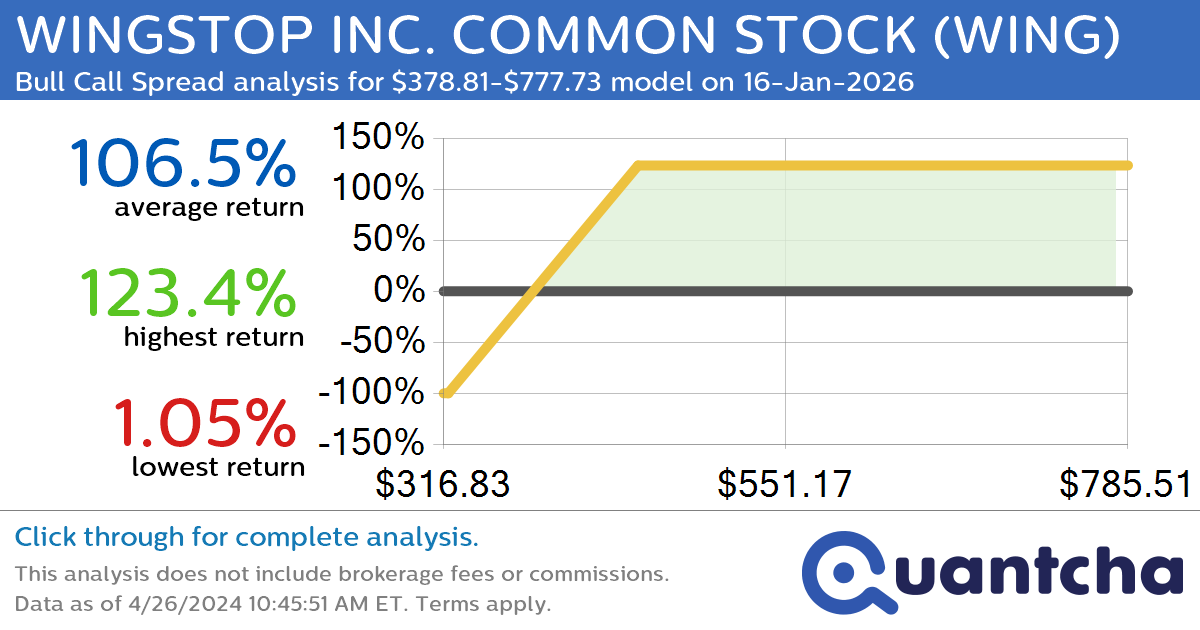

StockTwits Trending Alert: Trading recent interest in WINGSTOP INC. COMMON STOCK $WING

Quantchabot has detected a new Bull Call Spread trade opportunity for WINGSTOP INC. COMMON STOCK (WING) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WING was recently trading at $378.80 and has an implied volatility of 47.69% for this period. Based on an analysis…

-

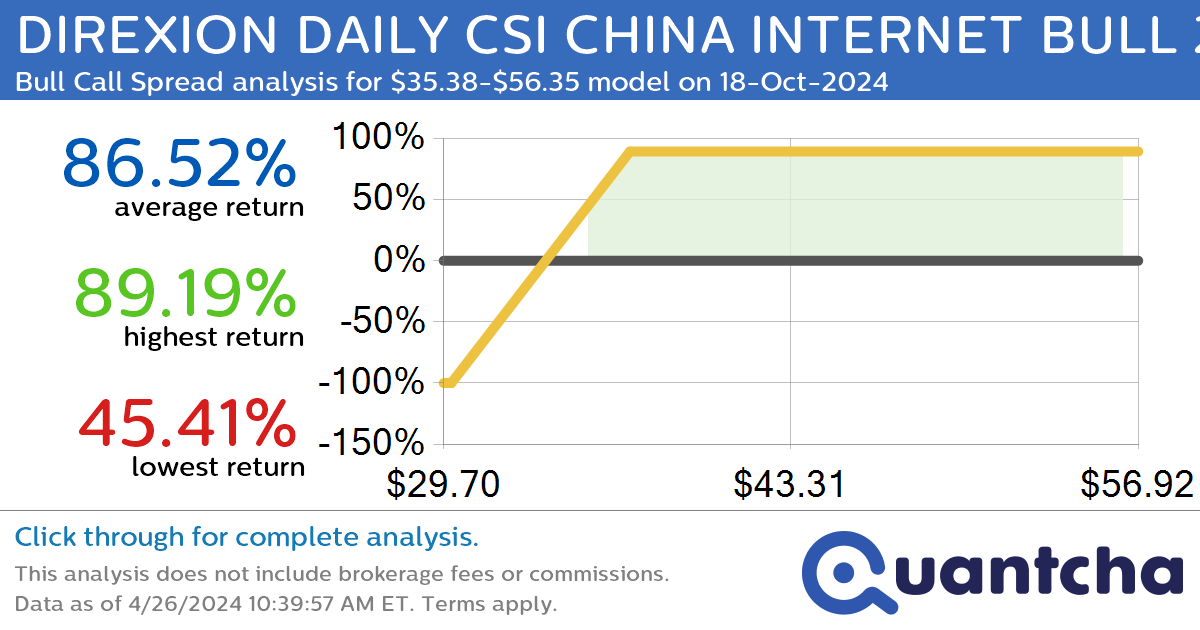

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY CSI CHINA INTERNET BULL 2X SHARES $CWEB

Quantchabot has detected a new Bull Call Spread trade opportunity for DIREXION DAILY CSI CHINA INTERNET BULL 2X SHARES (CWEB) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CWEB was recently trading at $35.38 and has an implied volatility of 63.18% for this period.…

-

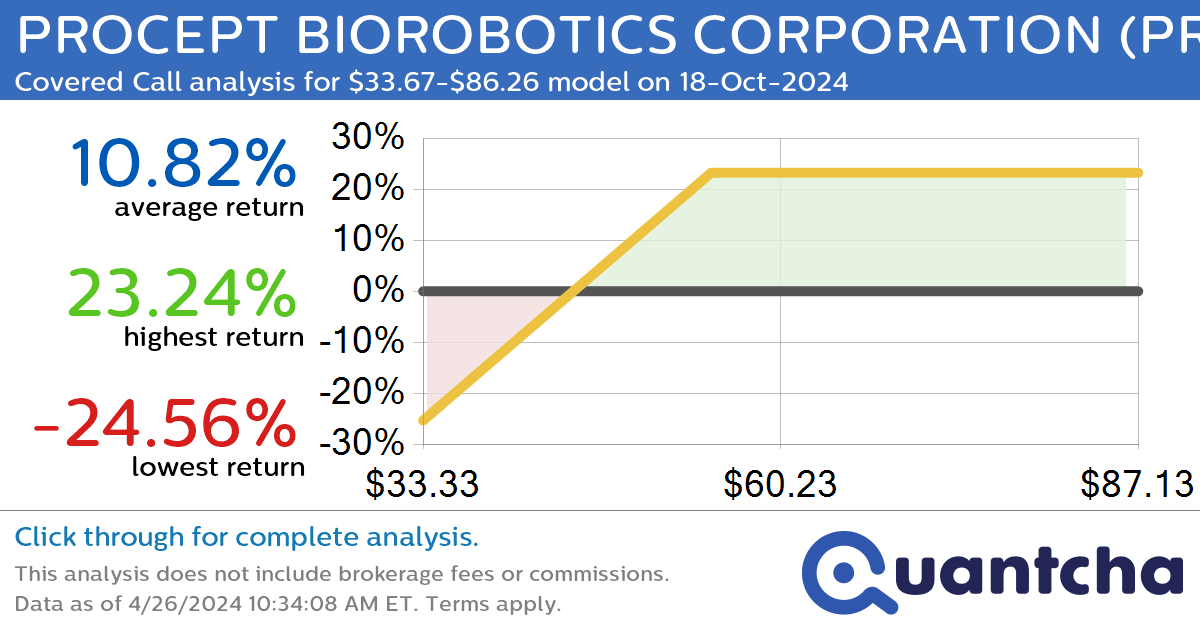

Covered Call Alert: PROCEPT BIOROBOTICS CORPORATION $PRCT returning up to 22.93% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for PROCEPT BIOROBOTICS CORPORATION (PRCT) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PRCT was recently trading at $52.45 and has an implied volatility of 67.79% for this period. Based on an analysis of the…

-

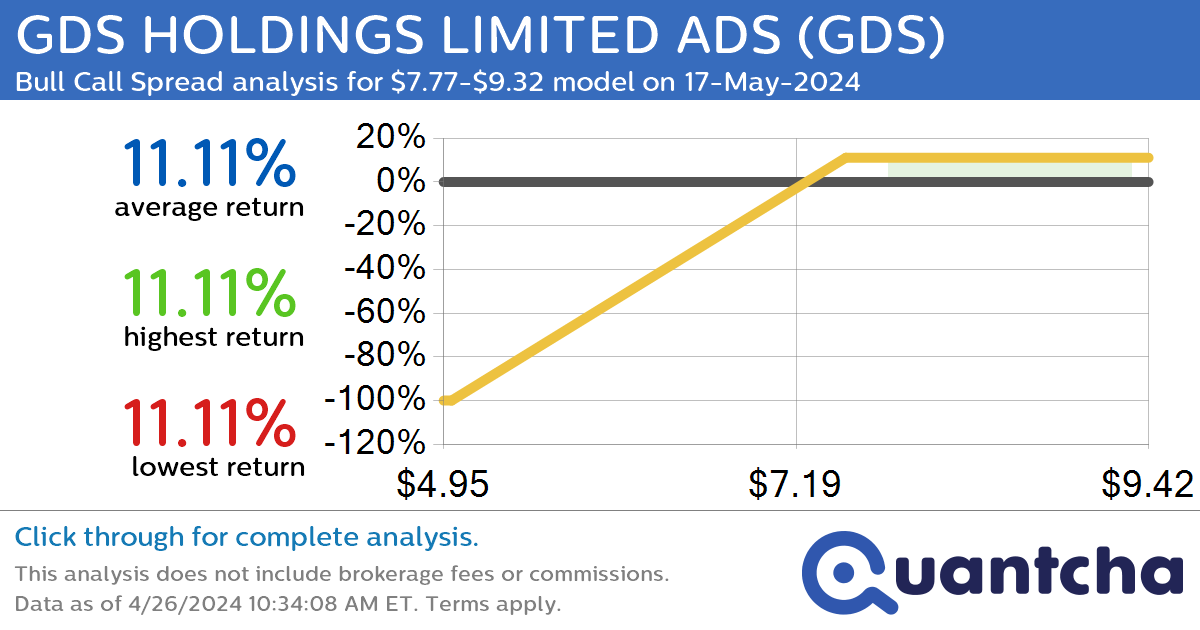

Big Gainer Alert: Trading today’s 7.6% move in GDS HOLDINGS LIMITED ADS $GDS

Quantchabot has detected a new Bull Call Spread trade opportunity for GDS HOLDINGS LIMITED ADS (GDS) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GDS was recently trading at $7.75 and has an implied volatility of 74.11% for this period. Based on an analysis…

-

52-Week Low Alert: Trading today’s movement in WALGREEN BOOTS ALLIANCE INC. $WBA

Quantchabot has detected a new Bear Call Spread trade opportunity for WALGREEN BOOTS ALLIANCE INC. (WBA) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WBA was recently trading at $17.89 and has an implied volatility of 34.50% for this period. Based on an analysis…

-

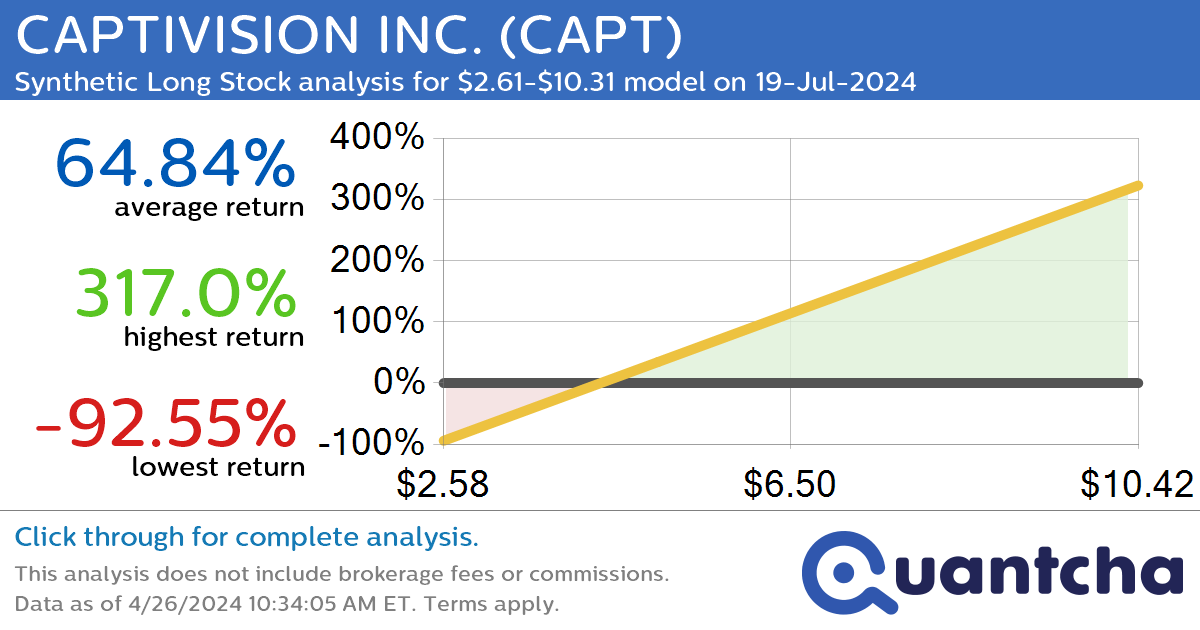

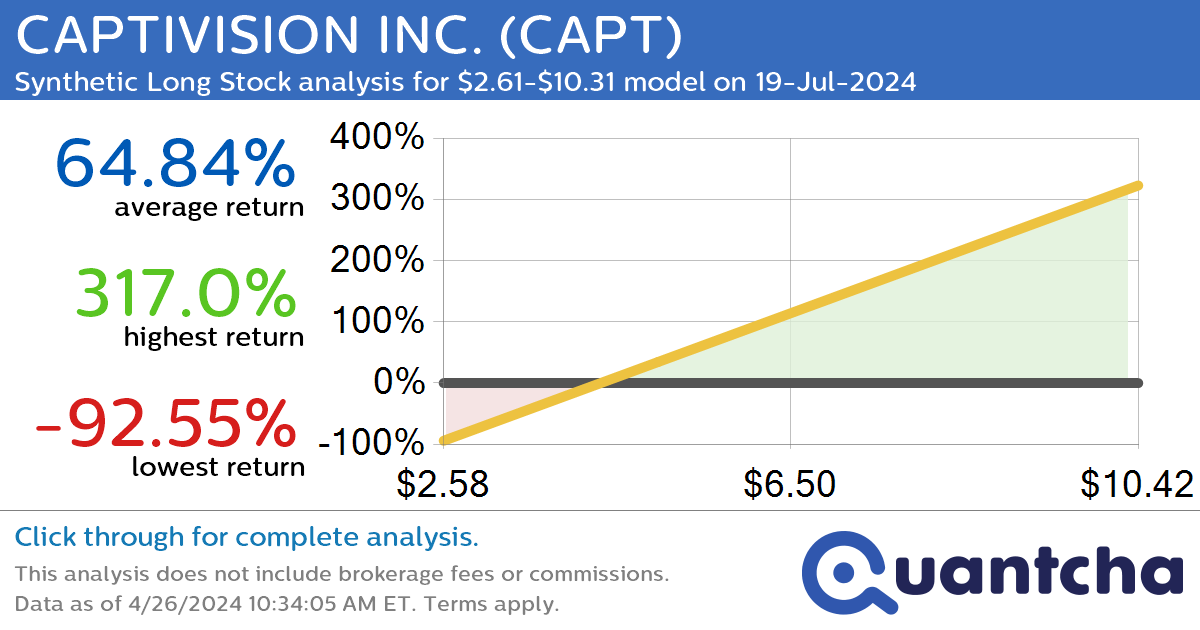

Synthetic Long Discount Alert: CAPTIVISION INC. $CAPT trading at a 15.04% discount for the 19-Jul-2024 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for CAPTIVISION INC. (CAPT) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAPT was recently trading at $5.12 and has an implied volatility of 142.64% for this period. Based on an analysis of the…

-

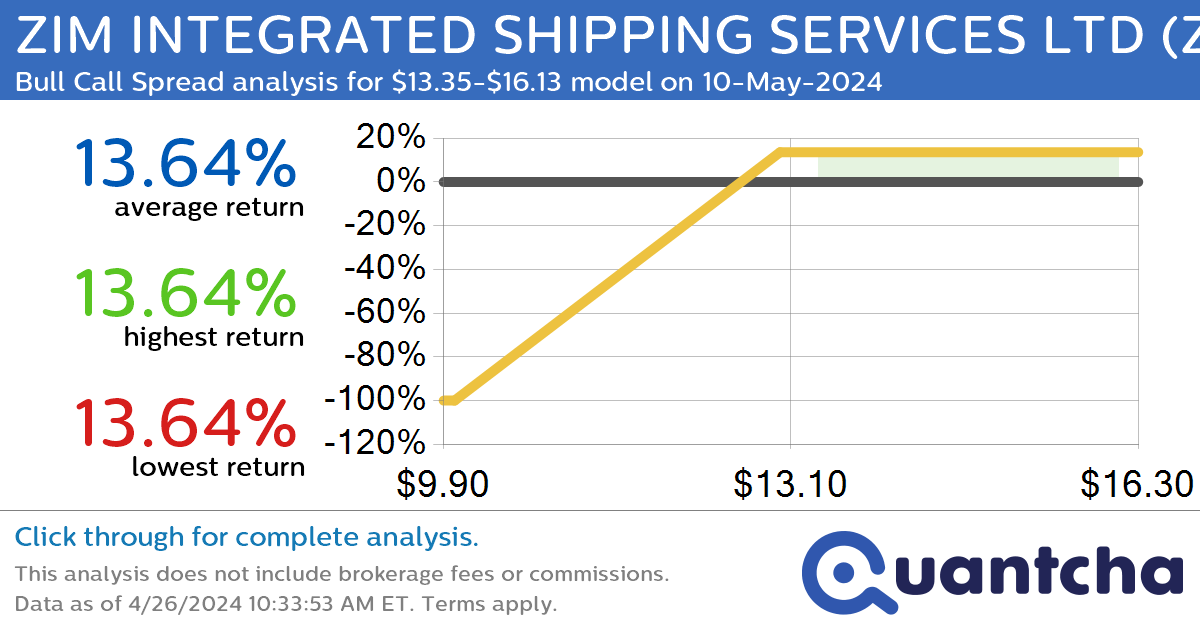

Big Gainer Alert: Trading today’s 16.9% move in ZIM INTEGRATED SHIPPING SERVICES LTD $ZIM

Quantchabot has detected a new Bull Call Spread trade opportunity for ZIM INTEGRATED SHIPPING SERVICES LTD (ZIM) for the 10-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ZIM was recently trading at $13.32 and has an implied volatility of 94.22% for this period. Based on an…

-

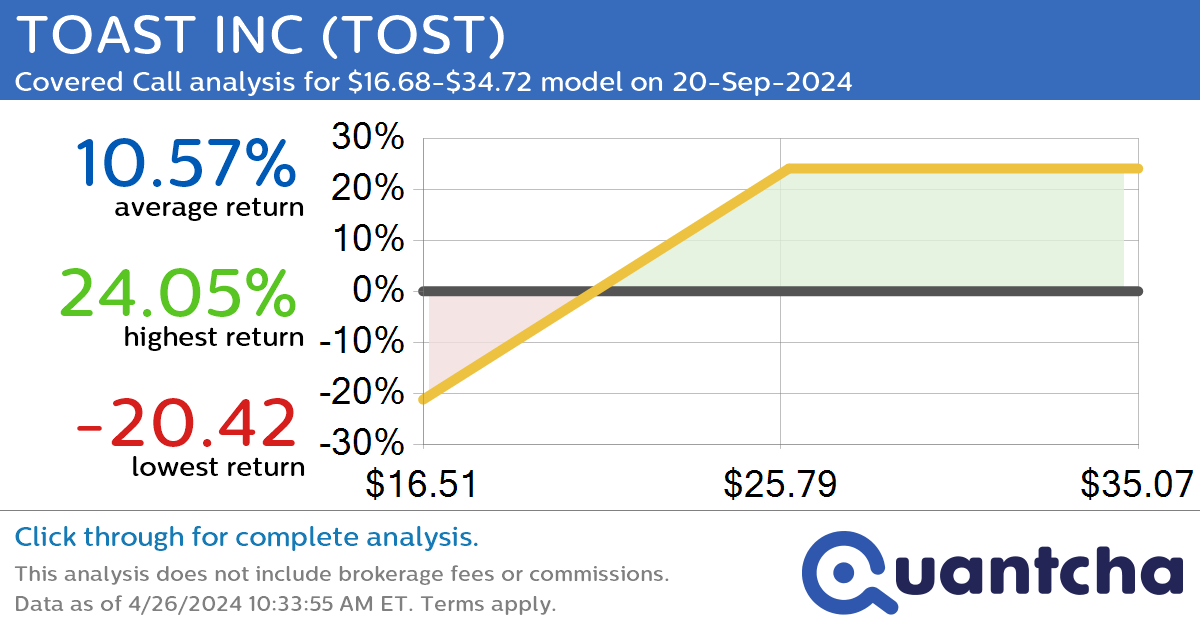

Covered Call Alert: TOAST INC $TOST returning up to 24.16% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for TOAST INC (TOST) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TOST was recently trading at $23.52 and has an implied volatility of 57.59% for this period. Based on an analysis of the options…