Category: Trade Ideas

-

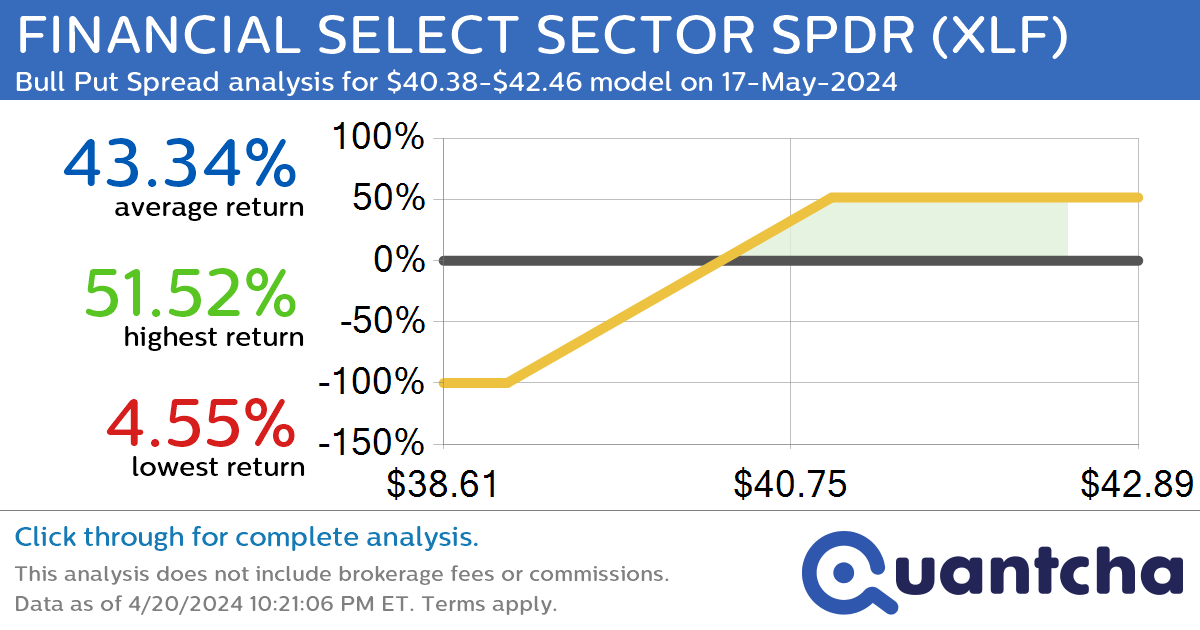

StockTwits Trending Alert: Trading recent interest in FINANCIAL SELECT SECTOR SPDR $XLF

Quantchabot has detected a new Bull Put Spread trade opportunity for FINANCIAL SELECT SECTOR SPDR (XLF) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XLF was recently trading at $40.38 and has an implied volatility of 16.82% for this period. Based on an analysis…

-

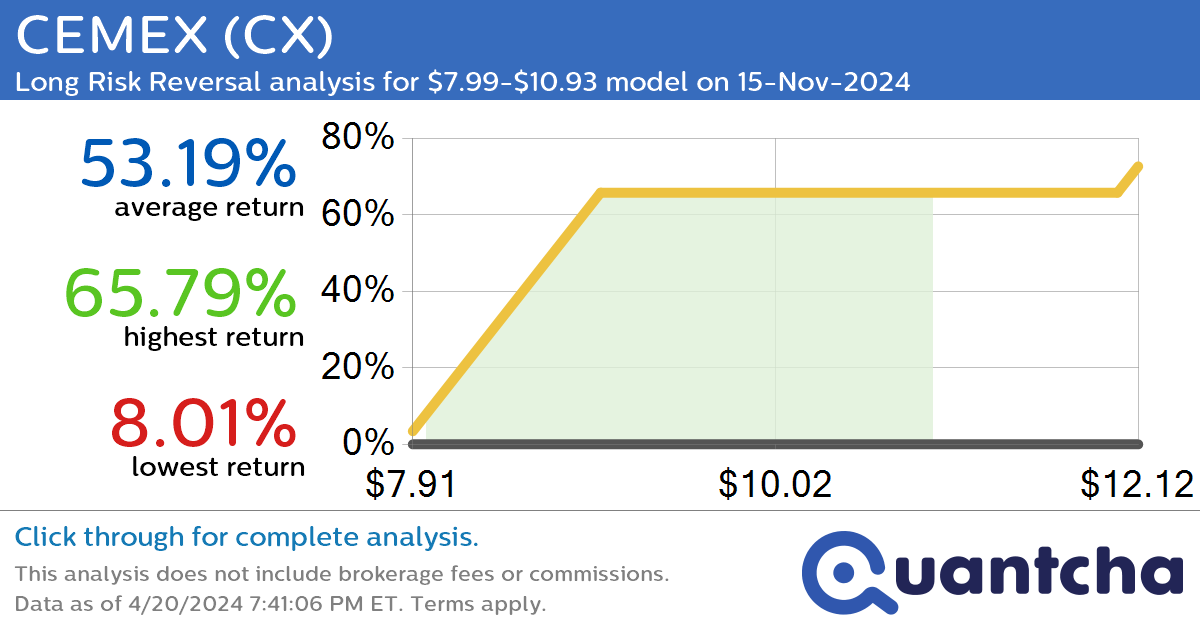

StockTwits Trending Alert: Trading recent interest in CEMEX $CX

Quantchabot has detected a new Long Risk Reversal trade opportunity for CEMEX (CX) for the 15-Nov-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CX was recently trading at $7.99 and has an implied volatility of 37.18% for this period. Based on an analysis of the options…

-

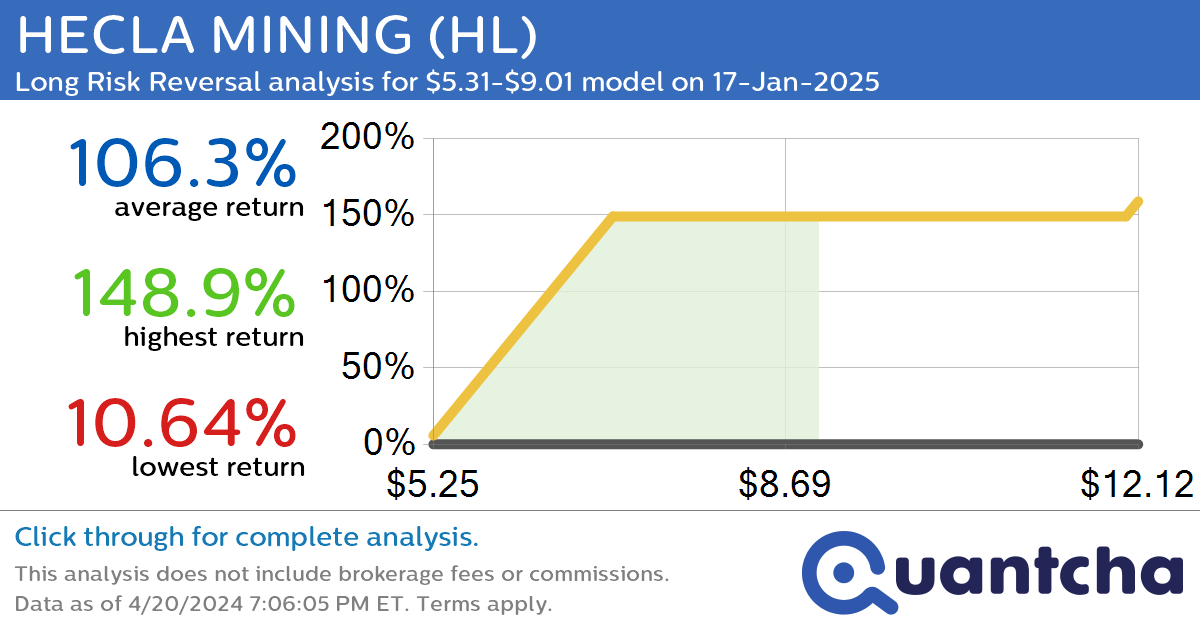

StockTwits Trending Alert: Trading recent interest in HECLA MINING $HL

Quantchabot has detected a new Long Risk Reversal trade opportunity for HECLA MINING (HL) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HL was recently trading at $5.31 and has an implied volatility of 56.49% for this period. Based on an analysis of the…

-

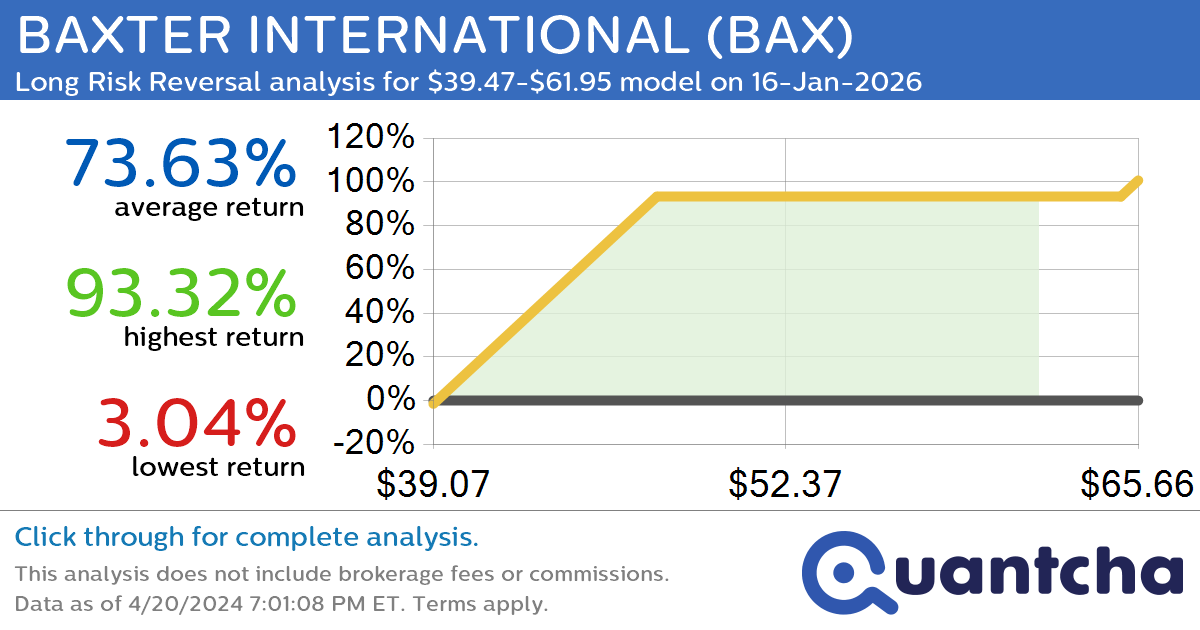

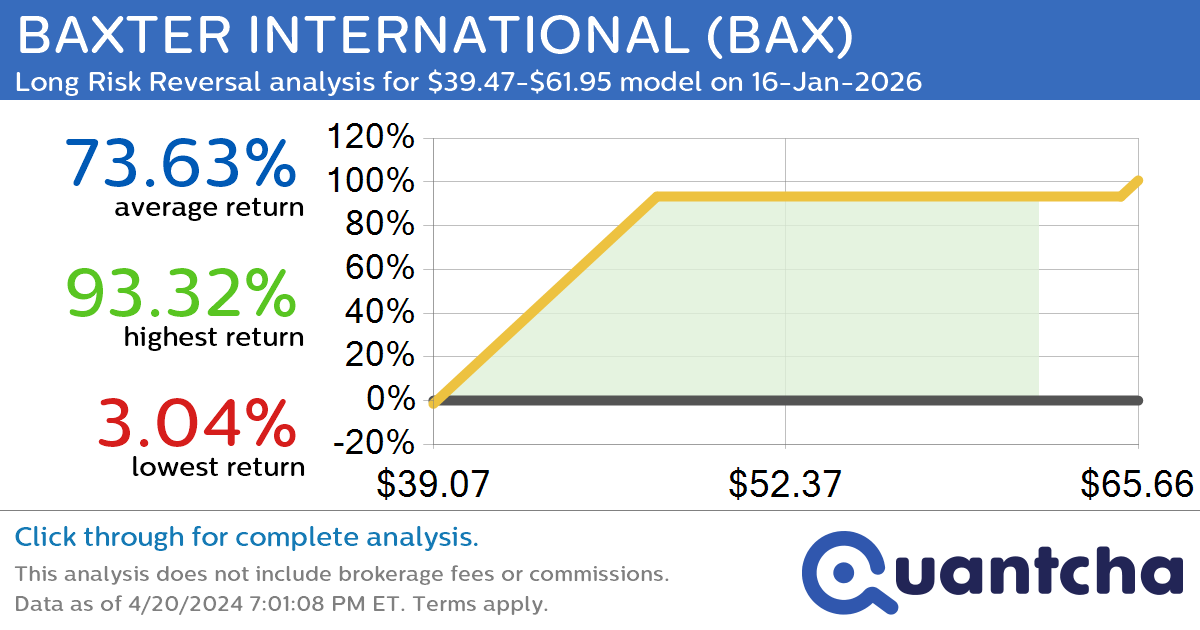

StockTwits Trending Alert: Trading recent interest in BAXTER INTERNATIONAL $BAX

Quantchabot has detected a new Long Risk Reversal trade opportunity for BAXTER INTERNATIONAL (BAX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BAX was recently trading at $39.47 and has an implied volatility of 27.13% for this period. Based on an analysis of the…

-

StockTwits Trending Alert: Trading recent interest in BAXTER INTERNATIONAL $BAX

Quantchabot has detected a new Long Risk Reversal trade opportunity for BAXTER INTERNATIONAL (BAX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BAX was recently trading at $39.47 and has an implied volatility of 27.13% for this period. Based on an analysis of the…

-

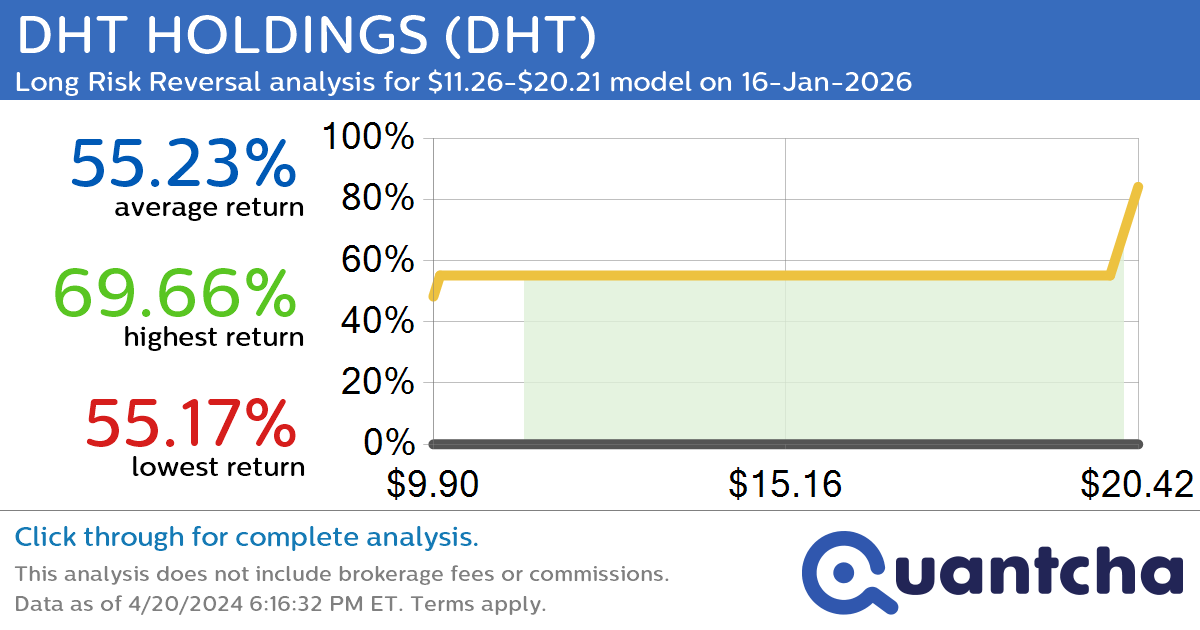

StockTwits Trending Alert: Trading recent interest in DHT HOLDINGS $DHT

Quantchabot has detected a new Long Risk Reversal trade opportunity for DHT HOLDINGS (DHT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DHT was recently trading at $11.26 and has an implied volatility of 37.28% for this period. Based on an analysis of the…

-

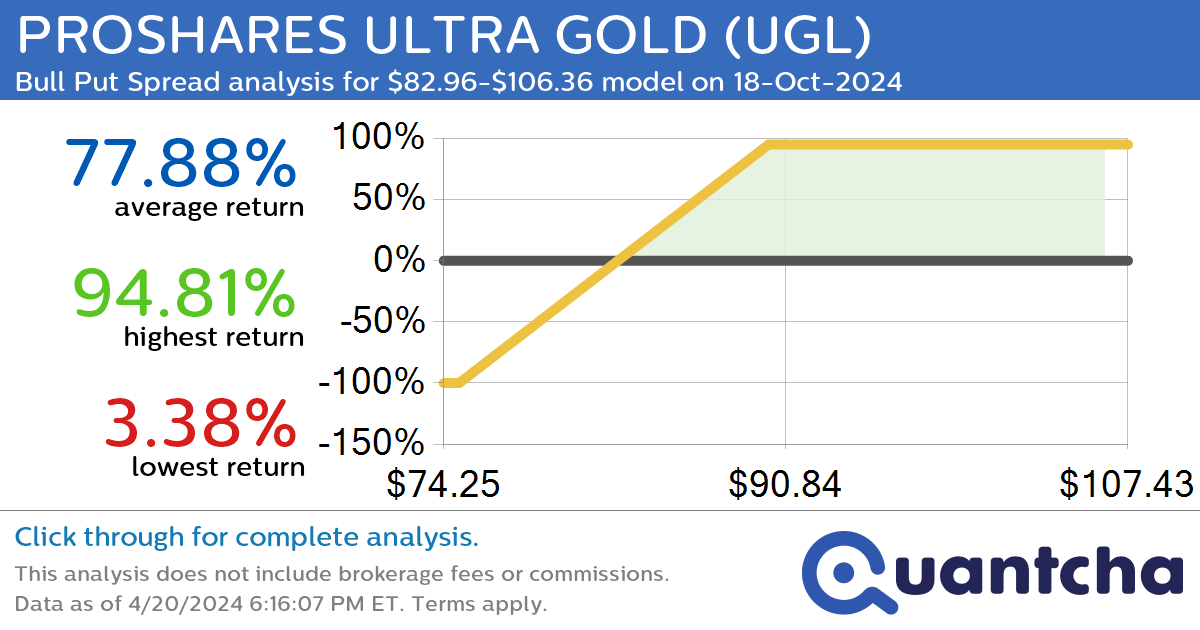

StockTwits Trending Alert: Trading recent interest in PROSHARES ULTRA GOLD $UGL

Quantchabot has detected a new Bull Put Spread trade opportunity for PROSHARES ULTRA GOLD (UGL) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UGL was recently trading at $82.96 and has an implied volatility of 31.34% for this period. Based on an analysis of…

-

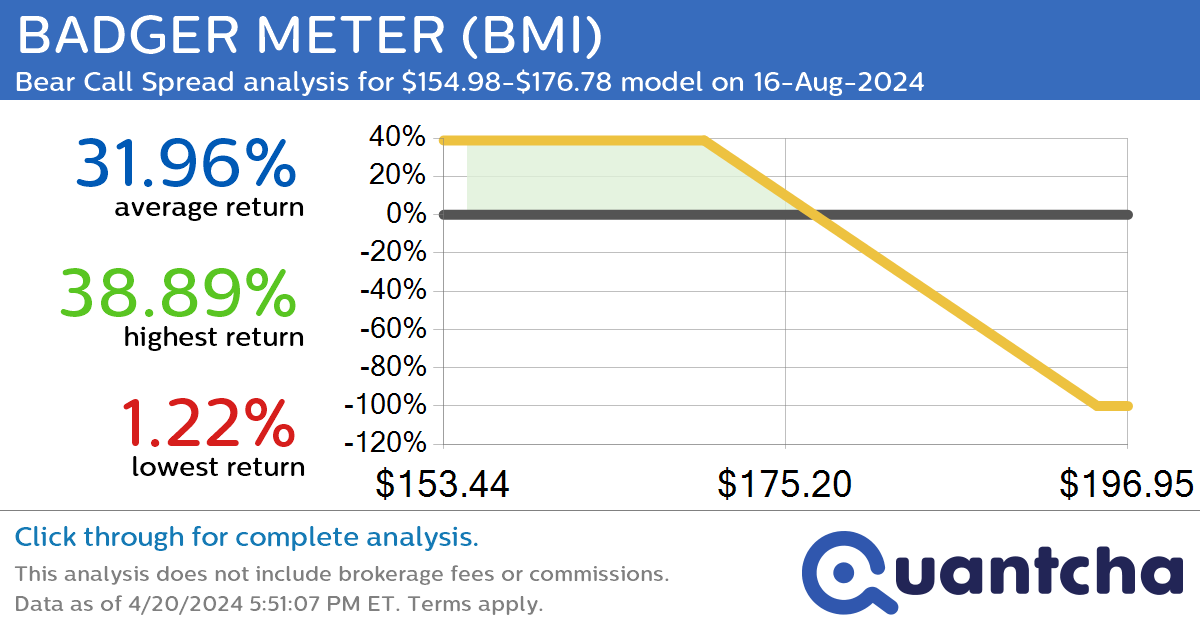

StockTwits Trending Alert: Trading recent interest in BADGER METER $BMI

Quantchabot has detected a new Bear Call Spread trade opportunity for BADGER METER (BMI) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BMI was recently trading at $176.78 and has an implied volatility of 26.30% for this period. Based on an analysis of the…

-

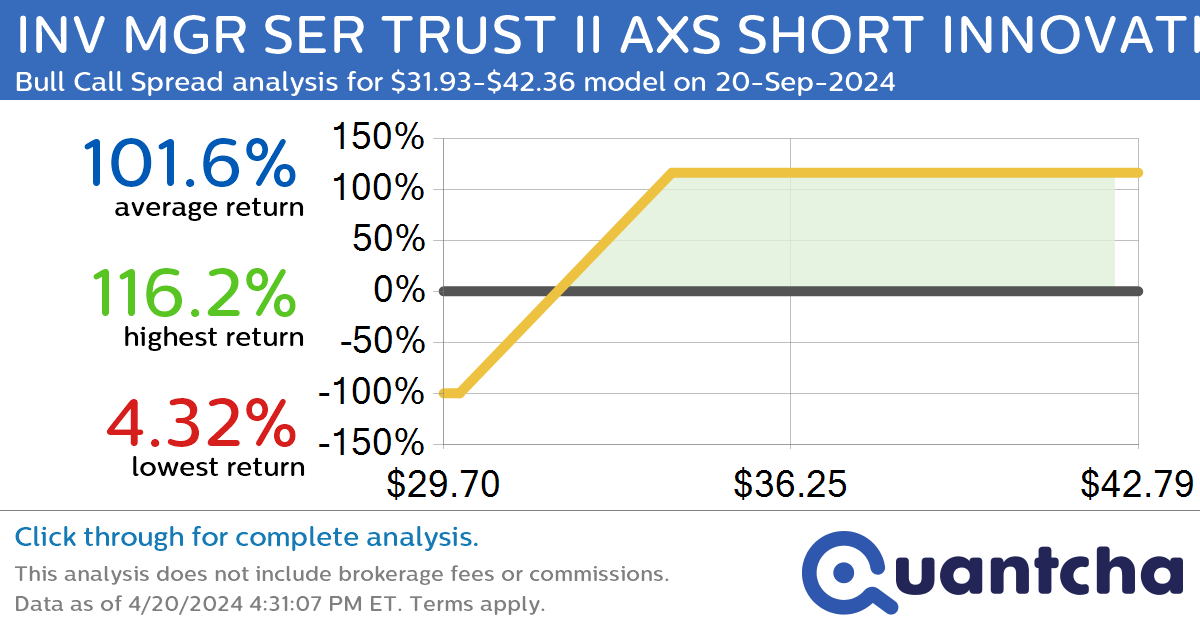

StockTwits Trending Alert: Trading recent interest in INV MGR SER TRUST II AXS SHORT INNOVATION $SARK

Quantchabot has detected a new Bull Call Spread trade opportunity for INV MGR SER TRUST II AXS SHORT INNOVATION (SARK) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SARK was recently trading at $31.93 and has an implied volatility of 39.96% for this period.…

-

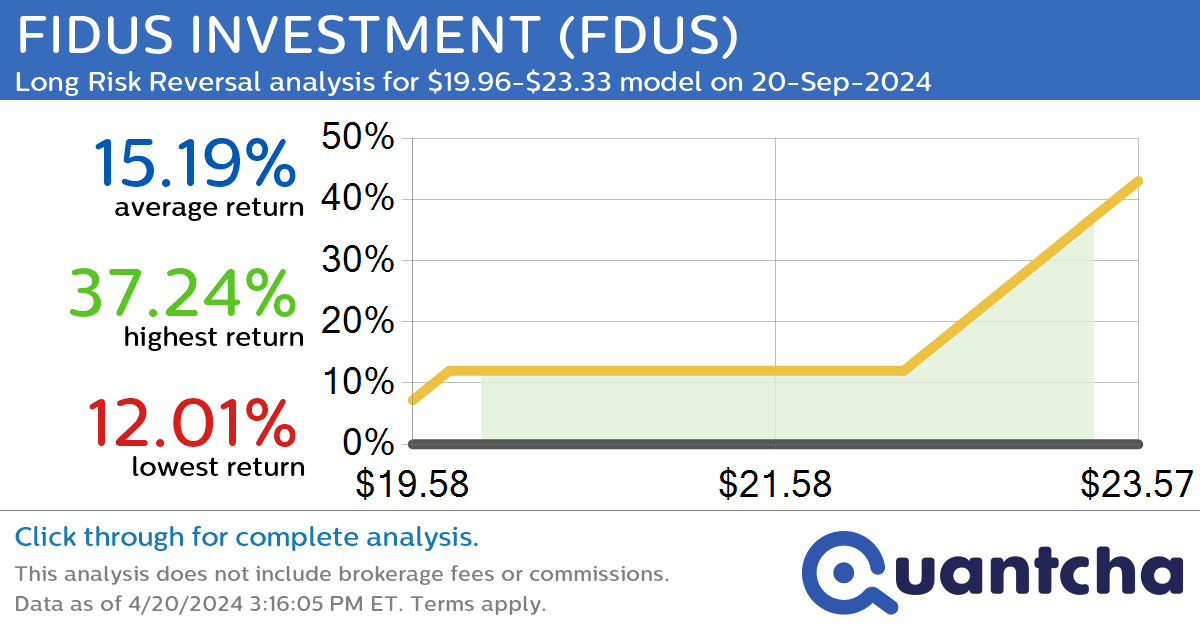

StockTwits Trending Alert: Trading recent interest in FIDUS INVESTMENT $FDUS

Quantchabot has detected a new Long Risk Reversal trade opportunity for FIDUS INVESTMENT (FDUS) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FDUS was recently trading at $19.96 and has an implied volatility of 20.39% for this period. Based on an analysis of the…