Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

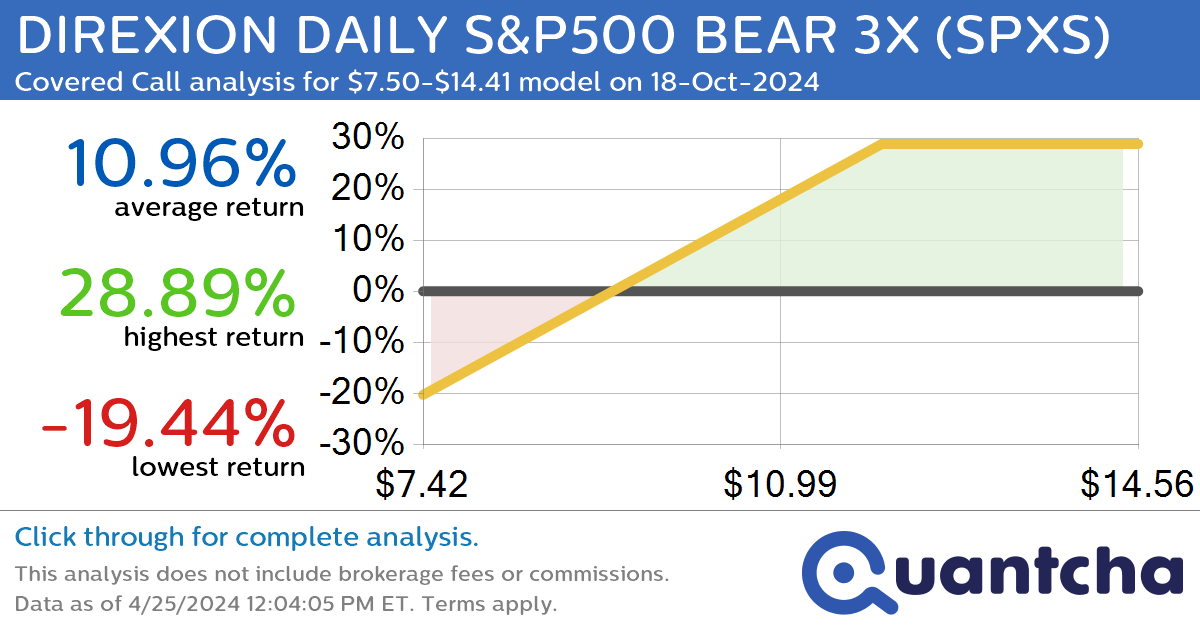

Covered Call Alert: DIREXION DAILY S&P500 BEAR 3X $SPXS returning up to 28.89% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for DIREXION DAILY S&P500 BEAR 3X (SPXS) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SPXS was recently trading at $10.12 and has an implied volatility of 46.96% for this period. Based on an analysis…

-

Big Loser Alert: Trading today’s -7.4% move in PHREESIA INC $PHR

Quantchabot has detected a new Bear Call Spread trade opportunity for PHREESIA INC (PHR) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PHR was recently trading at $20.32 and has an implied volatility of 52.07% for this period. Based on an analysis of the…

-

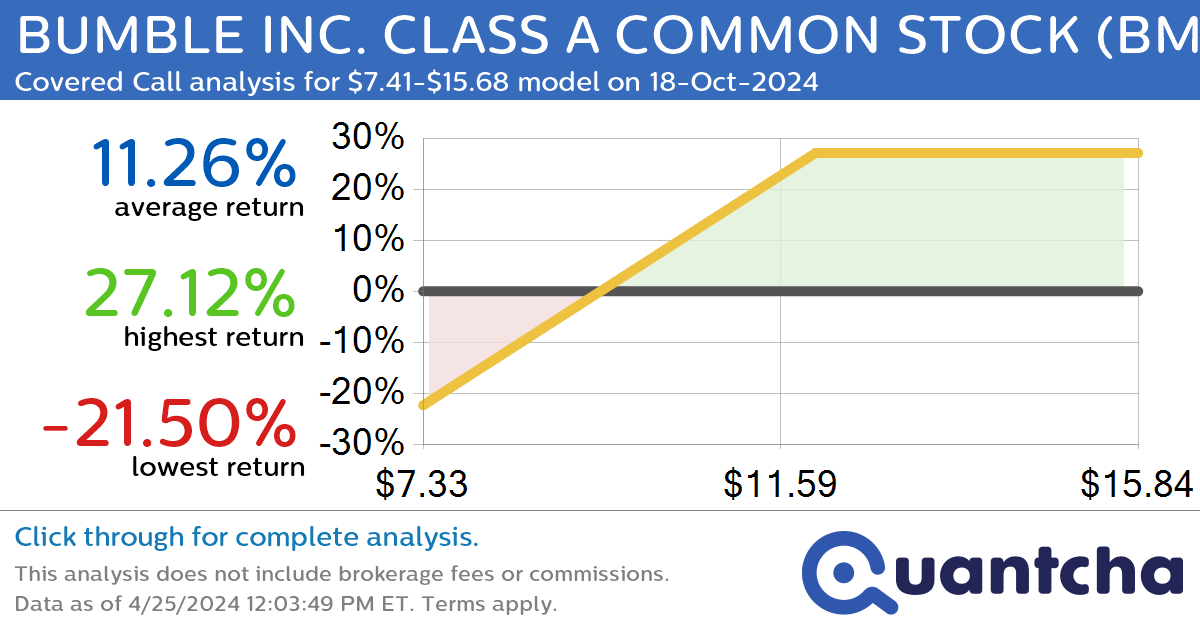

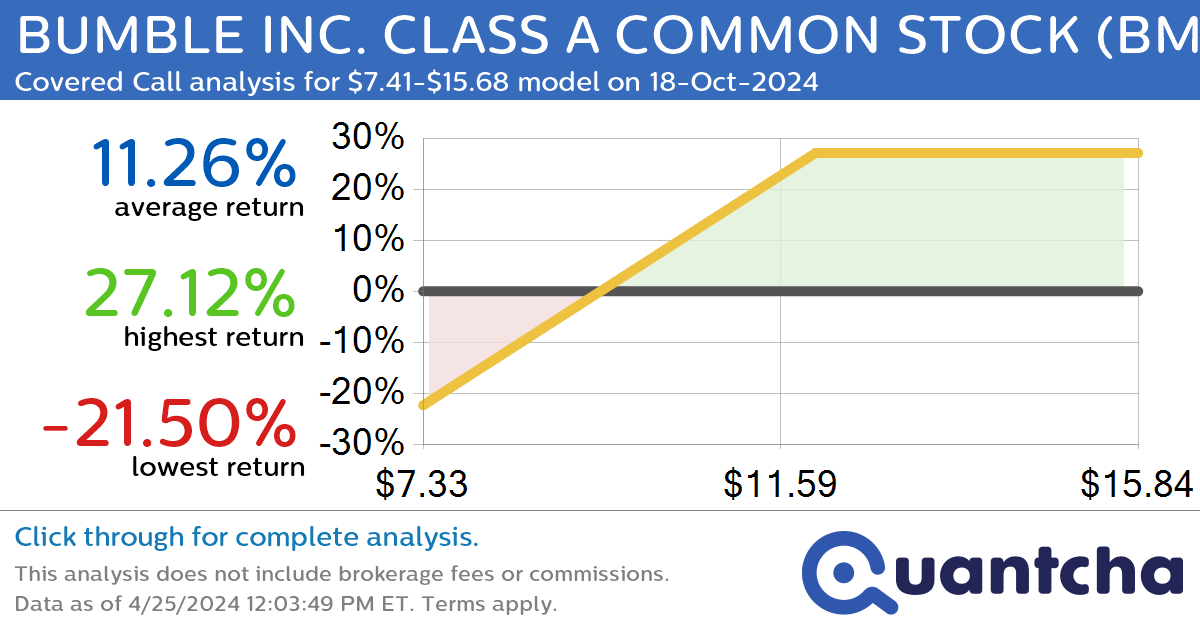

Covered Call Alert: BUMBLE INC. CLASS A COMMON STOCK $BMBL returning up to 27.12% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for BUMBLE INC. CLASS A COMMON STOCK (BMBL) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BMBL was recently trading at $10.49 and has an implied volatility of 53.86% for this period. Based on an…

-

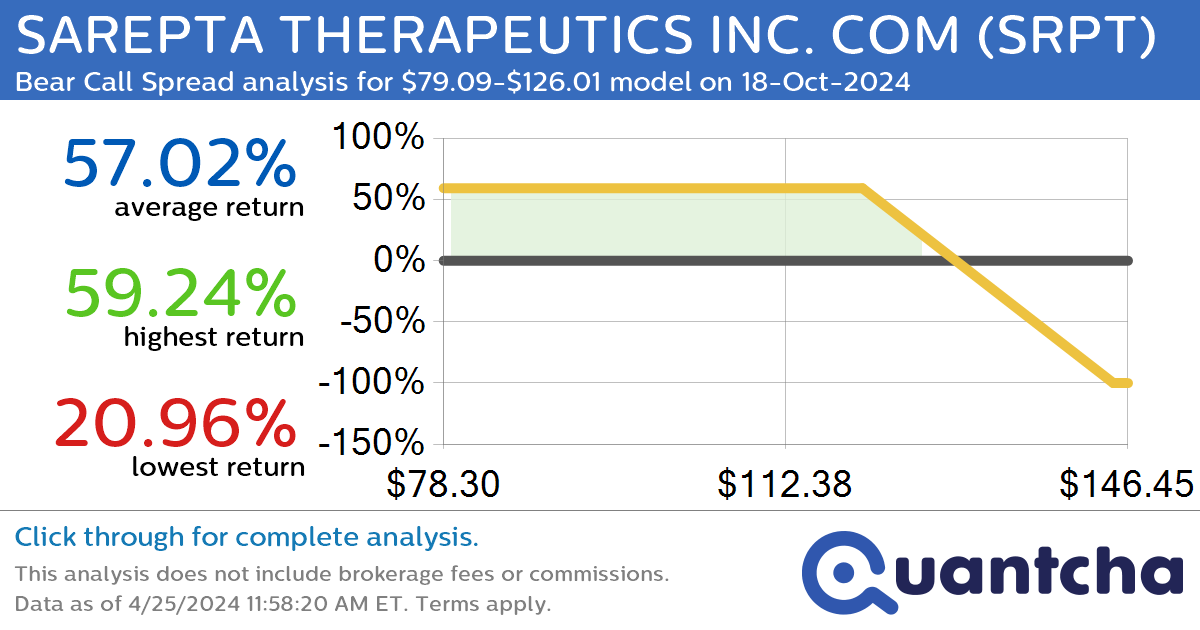

StockTwits Trending Alert: Trading recent interest in SAREPTA THERAPEUTICS INC. COM $SRPT

Quantchabot has detected a new Bear Call Spread trade opportunity for SAREPTA THERAPEUTICS INC. COM (SRPT) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SRPT was recently trading at $126.00 and has an implied volatility of 70.85% for this period. Based on an analysis…

-

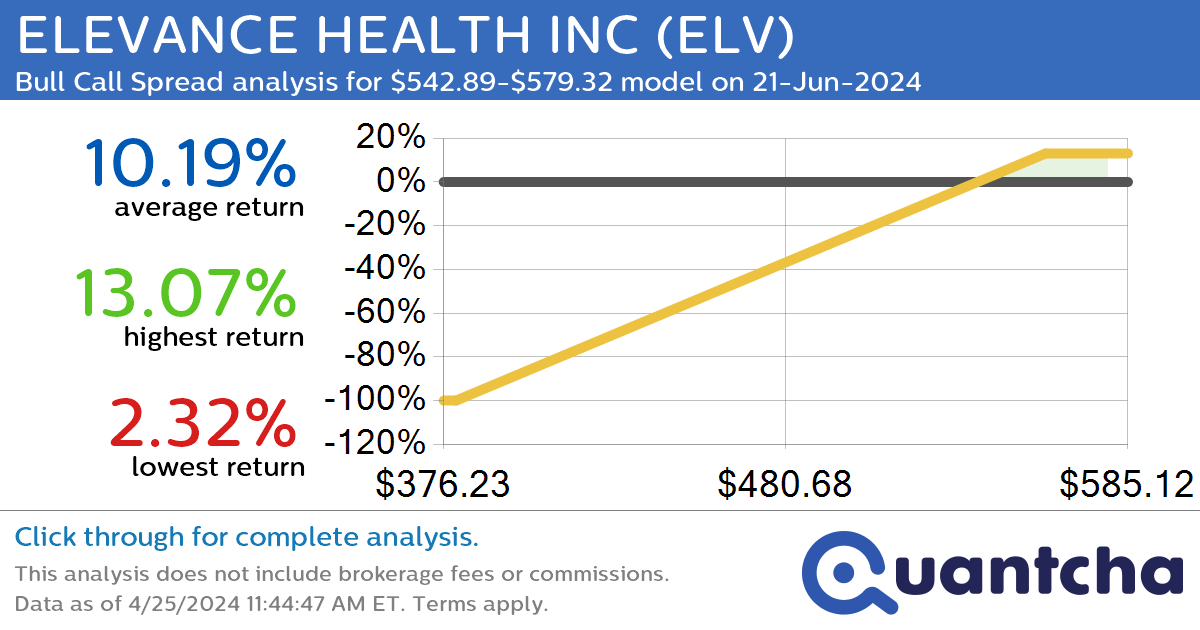

52-Week High Alert: Trading today’s movement in ELEVANCE HEALTH INC $ELV

Quantchabot has detected a new Bull Call Spread trade opportunity for ELEVANCE HEALTH INC (ELV) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ELV was recently trading at $539.70 and has an implied volatility of 16.34% for this period. Based on an analysis of…

-

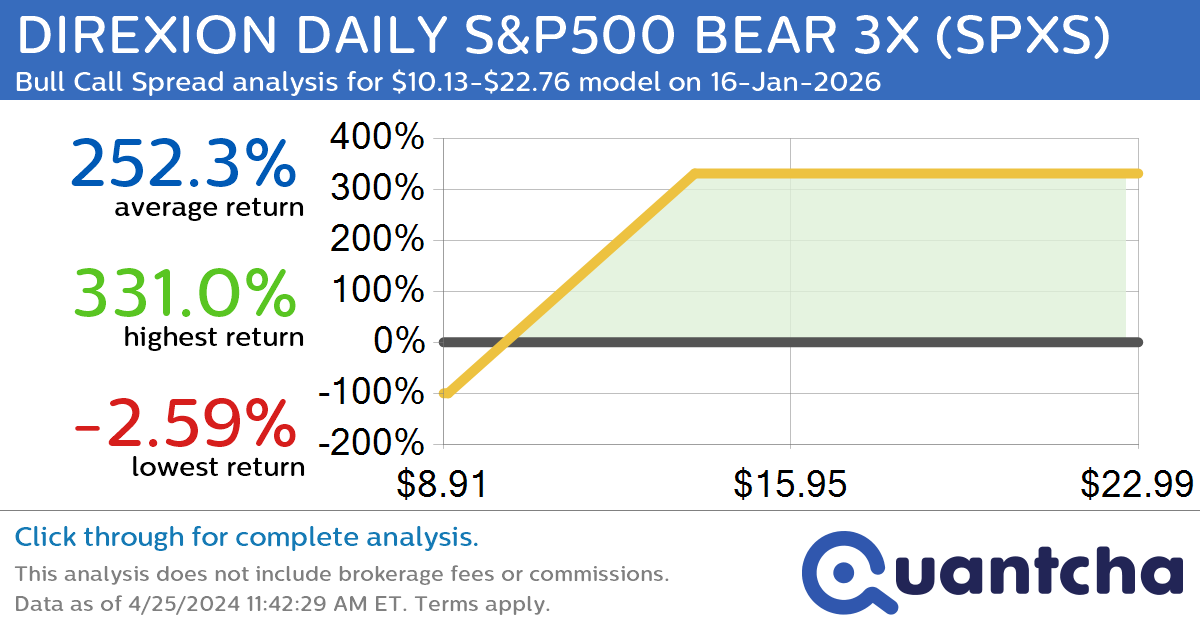

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY S&P500 BEAR 3X $SPXS

Quantchabot has detected a new Bull Call Spread trade opportunity for DIREXION DAILY S&P500 BEAR 3X (SPXS) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SPXS was recently trading at $10.13 and has an implied volatility of 54.55% for this period. Based on an…

-

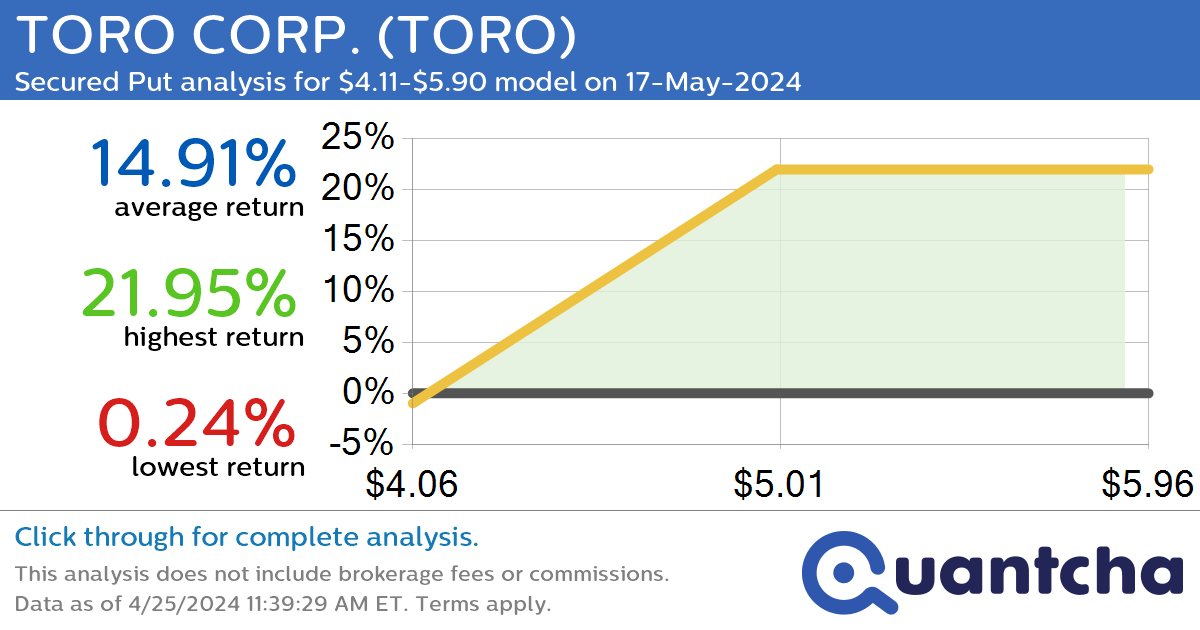

Big Gainer Alert: Trading today’s 8.8% move in TORO CORP. $TORO

Quantchabot has detected a new Secured Put trade opportunity for TORO CORP. (TORO) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TORO was recently trading at $4.10 and has an implied volatility of 144.81% for this period. Based on an analysis of the options…

-

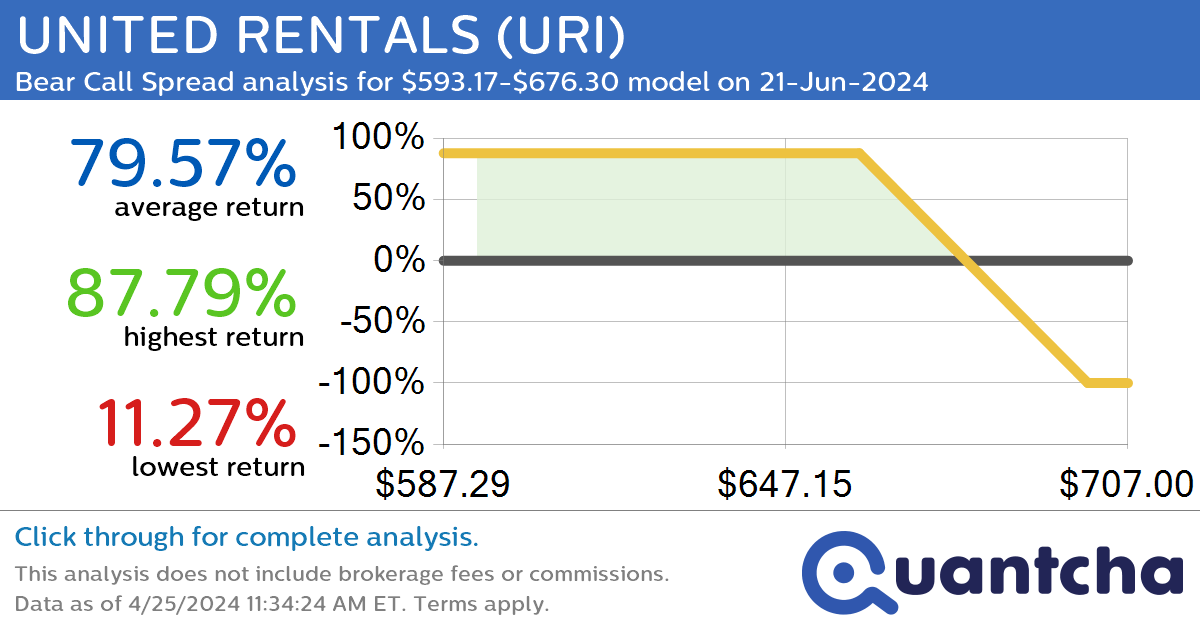

StockTwits Trending Alert: Trading recent interest in UNITED RENTALS $URI

Quantchabot has detected a new Bear Call Spread trade opportunity for UNITED RENTALS (URI) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. URI was recently trading at $676.37 and has an implied volatility of 34.66% for this period. Based on an analysis of the…

-

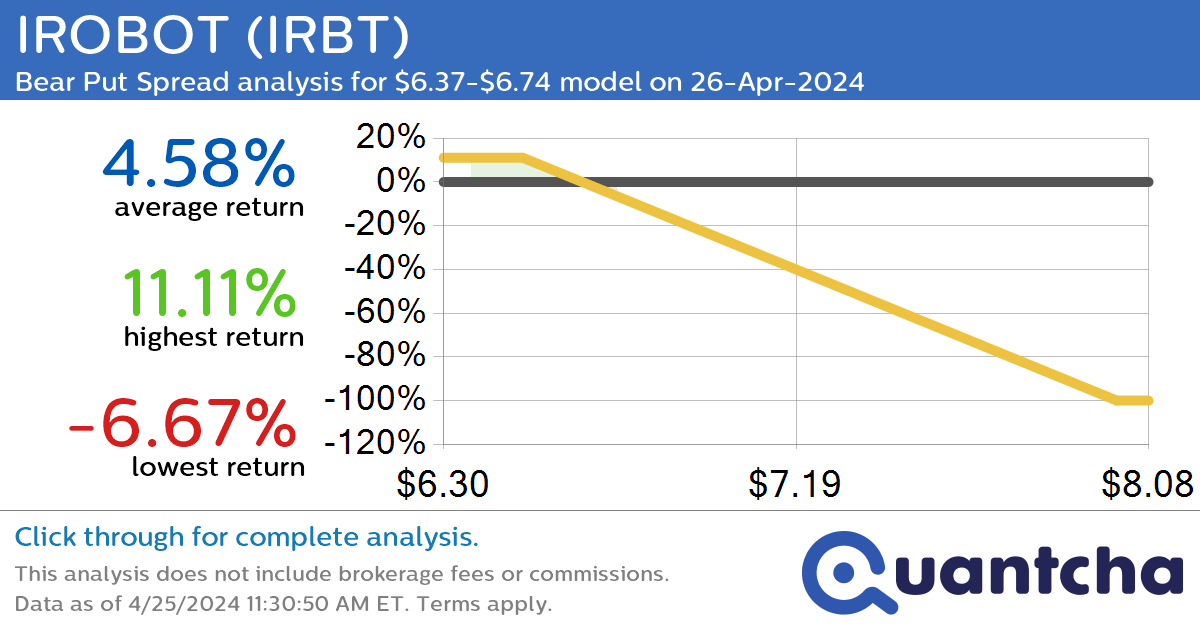

52-Week Low Alert: Trading today’s movement in IROBOT $IRBT

Quantchabot has detected a new Bear Put Spread trade opportunity for IROBOT (IRBT) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IRBT was recently trading at $6.74 and has an implied volatility of 82.72% for this period. Based on an analysis of the options…

-

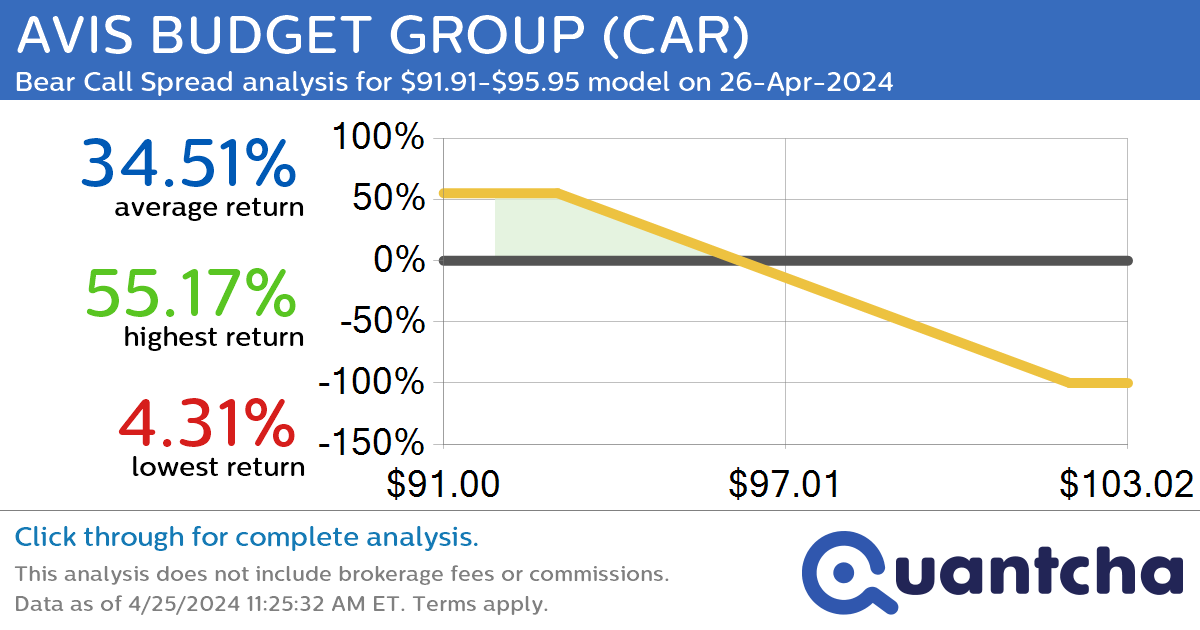

Big Loser Alert: Trading today’s -7.1% move in AVIS BUDGET GROUP $CAR

Quantchabot has detected a new Bear Call Spread trade opportunity for AVIS BUDGET GROUP (CAR) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAR was recently trading at $95.92 and has an implied volatility of 63.11% for this period. Based on an analysis of…