Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

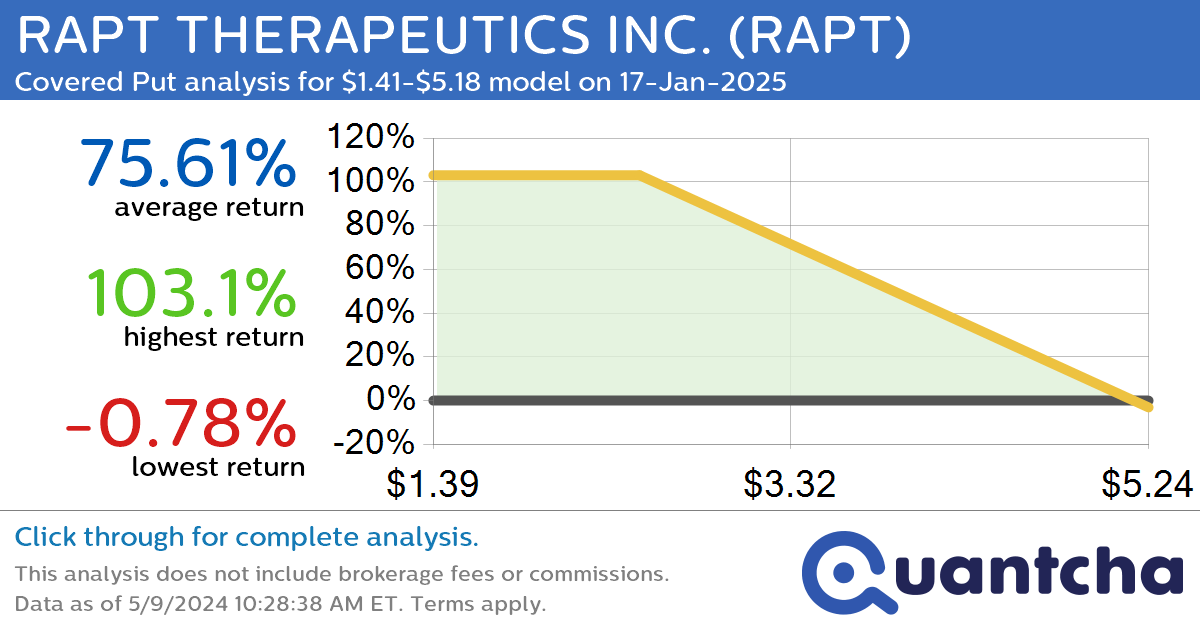

StockTwits Trending Alert: Trading recent interest in RAPT THERAPEUTICS INC. $RAPT

Quantchabot has detected a new Covered Put trade opportunity for RAPT THERAPEUTICS INC. (RAPT) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RAPT was recently trading at $5.16 and has an implied volatility of 160.61% for this period. Based on an analysis of the…

-

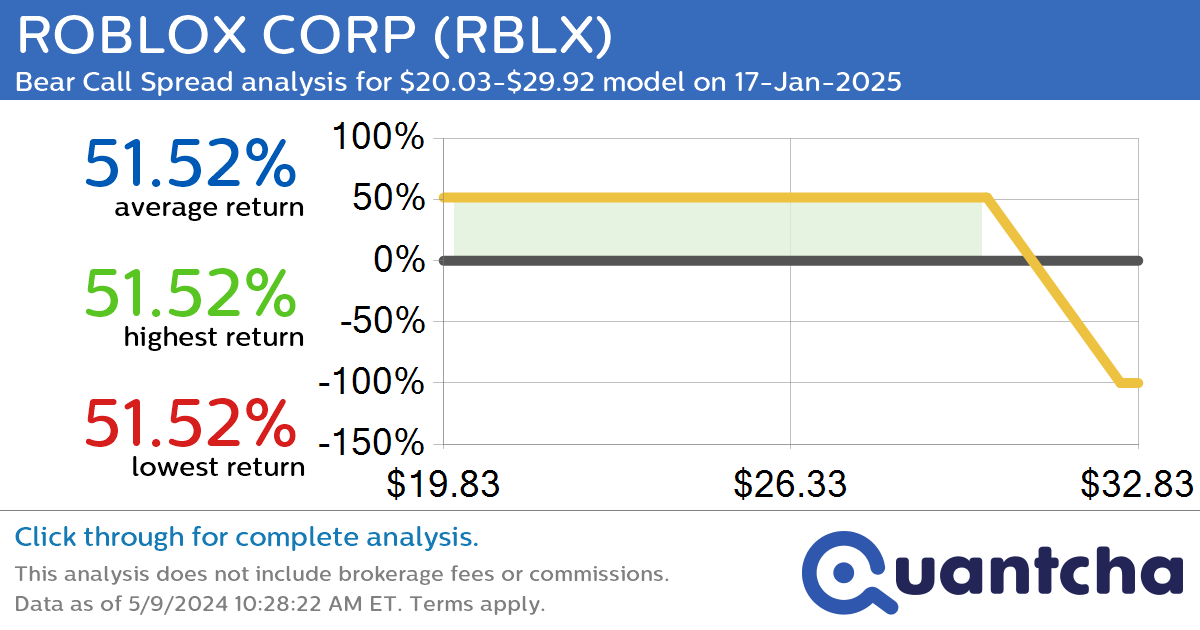

StockTwits Trending Alert: Trading recent interest in ROBLOX CORP $RBLX

Quantchabot has detected a new Bear Call Spread trade opportunity for ROBLOX CORP (RBLX) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RBLX was recently trading at $29.92 and has an implied volatility of 52.77% for this period. Based on an analysis of the…

-

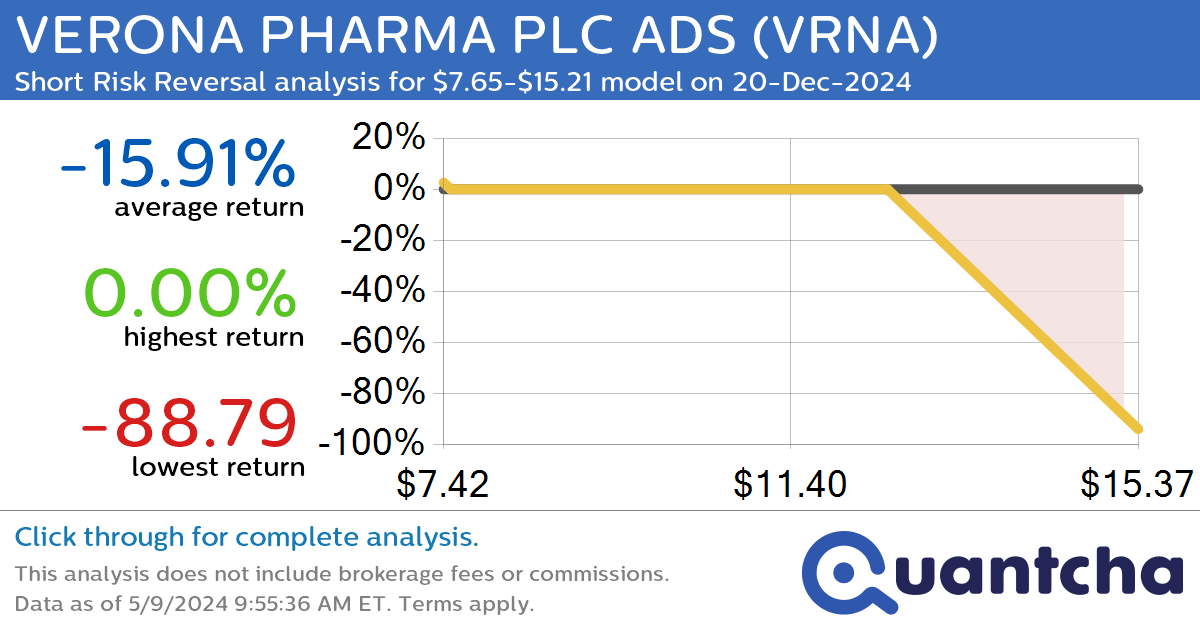

StockTwits Trending Alert: Trading recent interest in VERONA PHARMA PLC ADS $VRNA

Quantchabot has detected a new Short Risk Reversal trade opportunity for VERONA PHARMA PLC ADS (VRNA) for the 20-Dec-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VRNA was recently trading at $15.26 and has an implied volatility of 92.24% for this period. Based on an analysis…

-

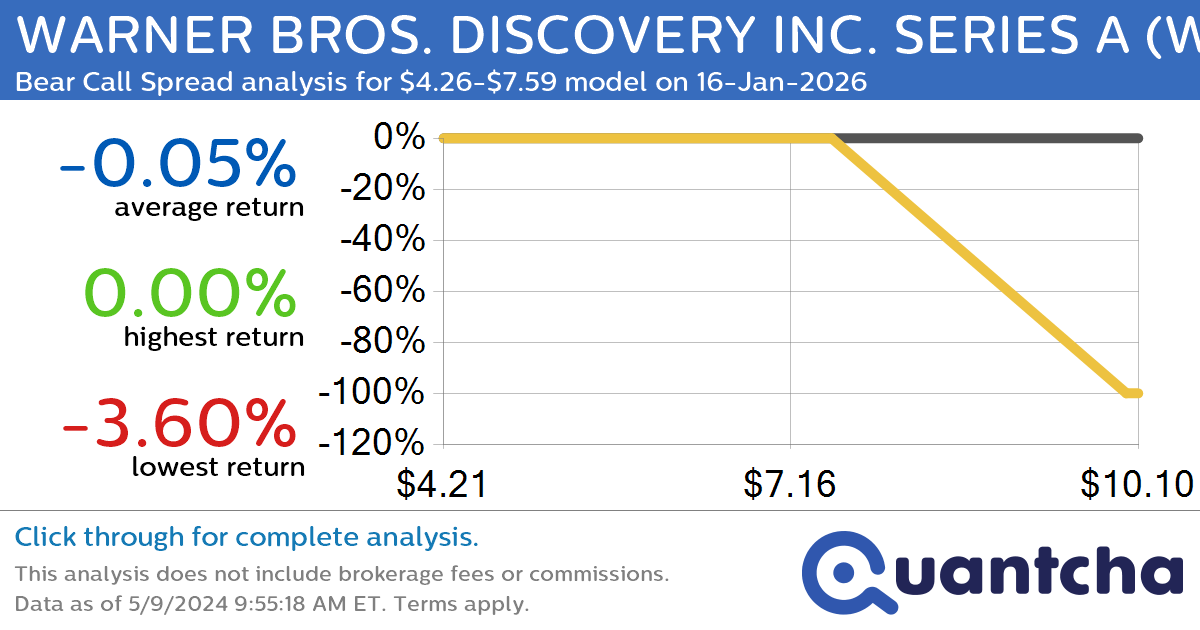

StockTwits Trending Alert: Trading recent interest in WARNER BROS. DISCOVERY INC. SERIES A $WBD

Quantchabot has detected a new Bear Call Spread trade opportunity for WARNER BROS. DISCOVERY INC. SERIES A (WBD) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WBD was recently trading at $7.59 and has an implied volatility of 51.25% for this period. Based on…

-

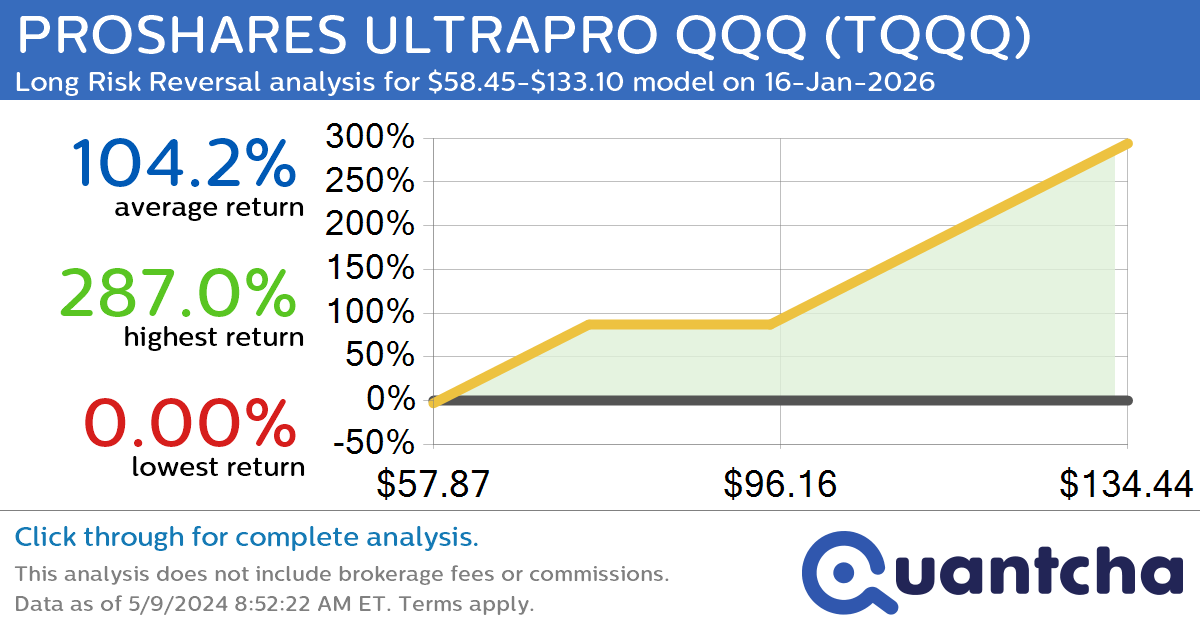

StockTwits Trending Alert: Trading recent interest in PROSHARES ULTRAPRO QQQ $TQQQ

Quantchabot has detected a new Long Risk Reversal trade opportunity for PROSHARES ULTRAPRO QQQ (TQQQ) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TQQQ was recently trading at $58.45 and has an implied volatility of 56.40% for this period. Based on an analysis of…

-

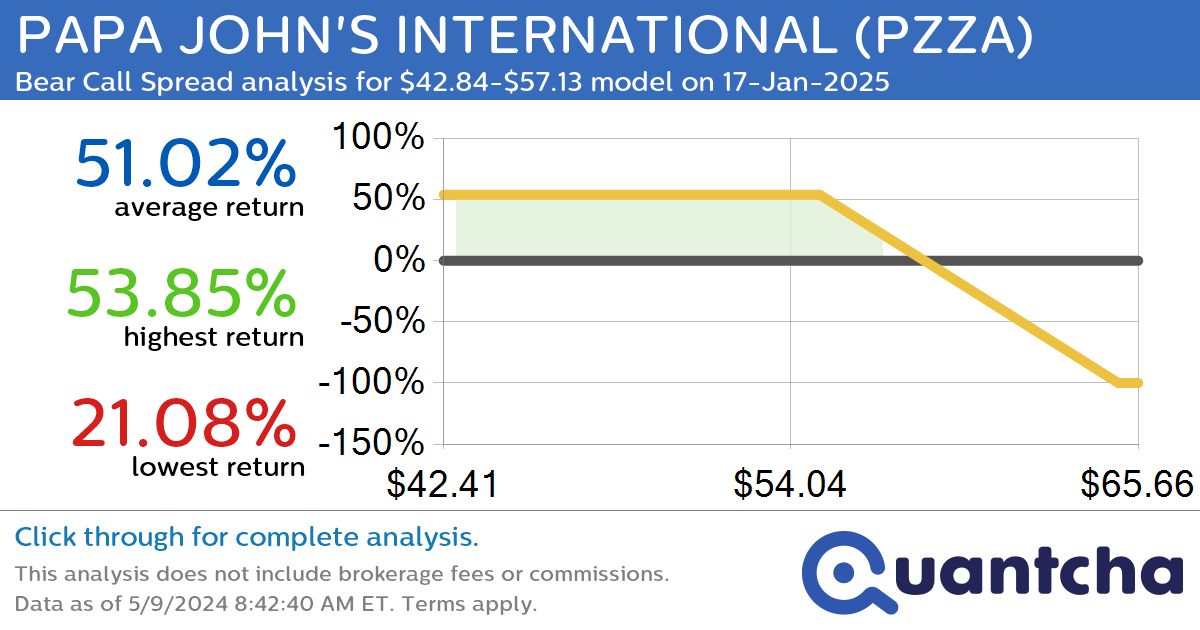

StockTwits Trending Alert: Trading recent interest in PAPA JOHN’S INTERNATIONAL $PZZA

Quantchabot has detected a new Bear Call Spread trade opportunity for PAPA JOHN’S INTERNATIONAL (PZZA) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PZZA was recently trading at $57.13 and has an implied volatility of 36.22% for this period. Based on an analysis of…

-

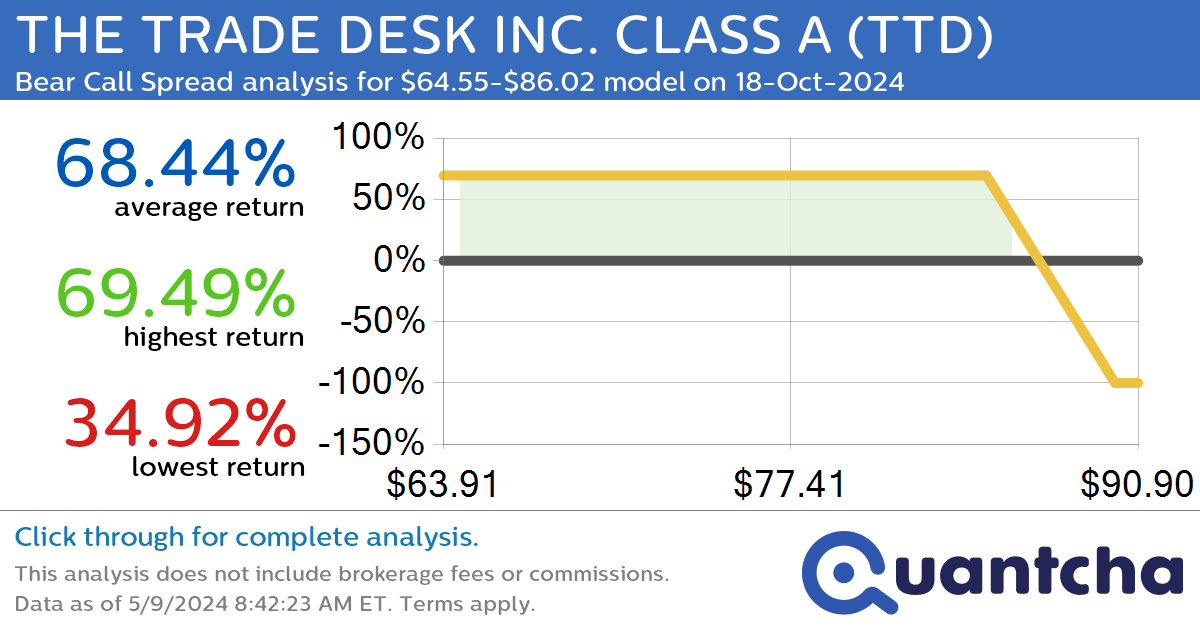

StockTwits Trending Alert: Trading recent interest in THE TRADE DESK INC. CLASS A $TTD

Quantchabot has detected a new Bear Call Spread trade opportunity for THE TRADE DESK INC. CLASS A (TTD) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTD was recently trading at $86.02 and has an implied volatility of 46.73% for this period. Based on…

-

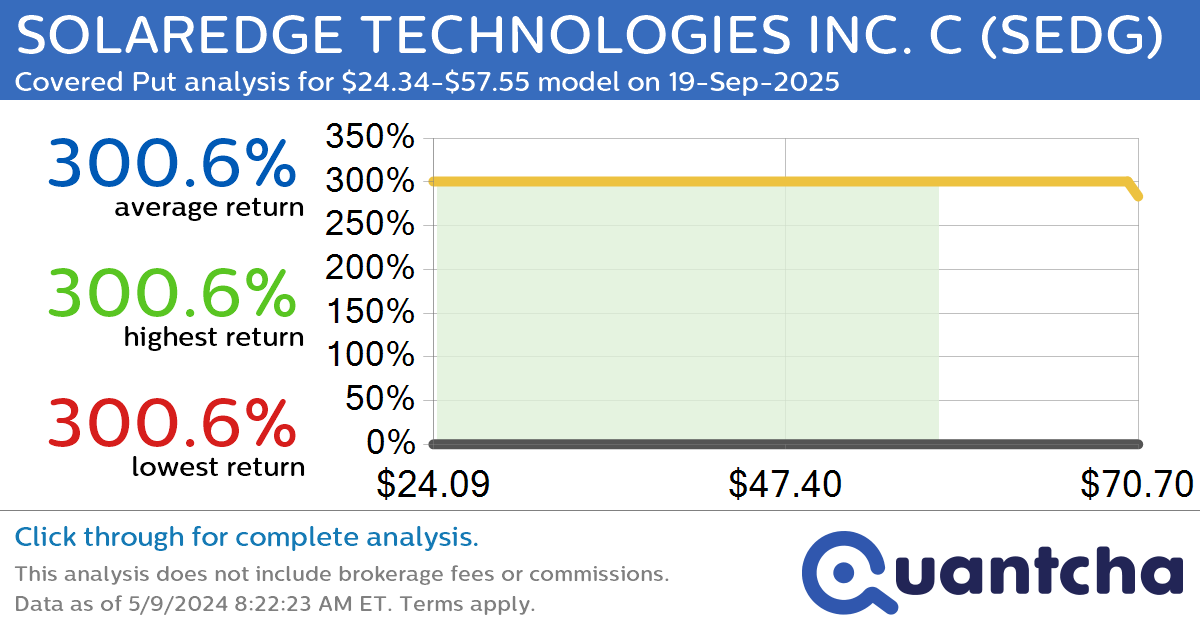

StockTwits Trending Alert: Trading recent interest in SOLAREDGE TECHNOLOGIES INC. C $SEDG

Quantchabot has detected a new Covered Put trade opportunity for SOLAREDGE TECHNOLOGIES INC. C (SEDG) for the 19-Sep-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SEDG was recently trading at $57.55 and has an implied volatility of 79.77% for this period. Based on an analysis of…

-

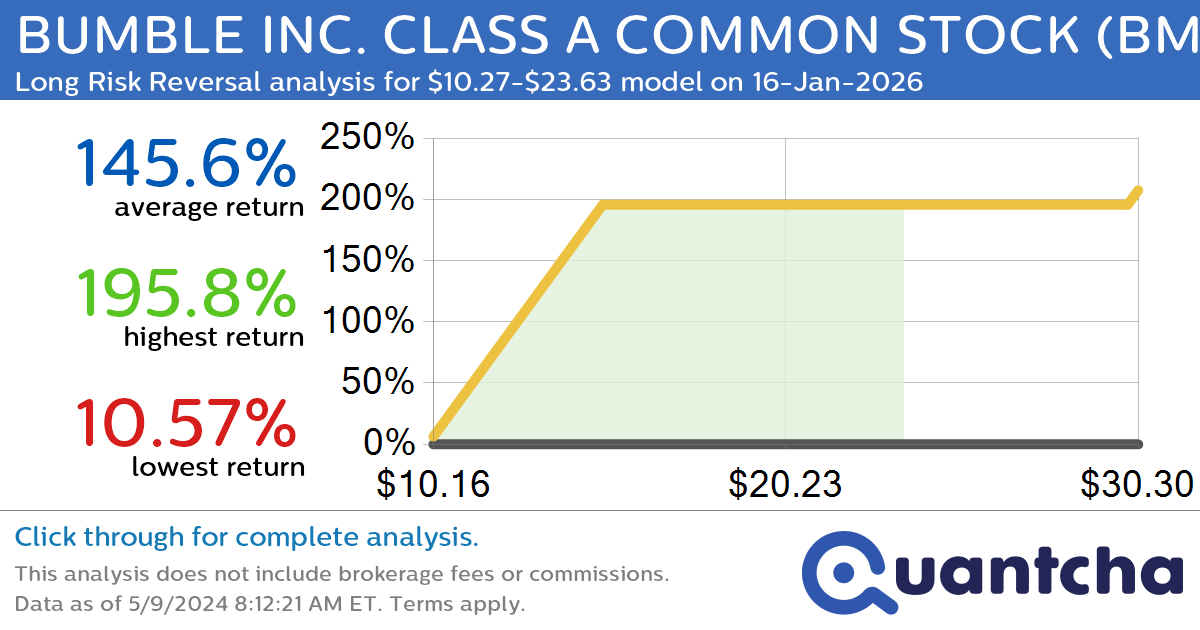

StockTwits Trending Alert: Trading recent interest in BUMBLE INC. CLASS A COMMON STOCK $BMBL

Quantchabot has detected a new Long Risk Reversal trade opportunity for BUMBLE INC. CLASS A COMMON STOCK (BMBL) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BMBL was recently trading at $10.27 and has an implied volatility of 57.19% for this period. Based on…

-

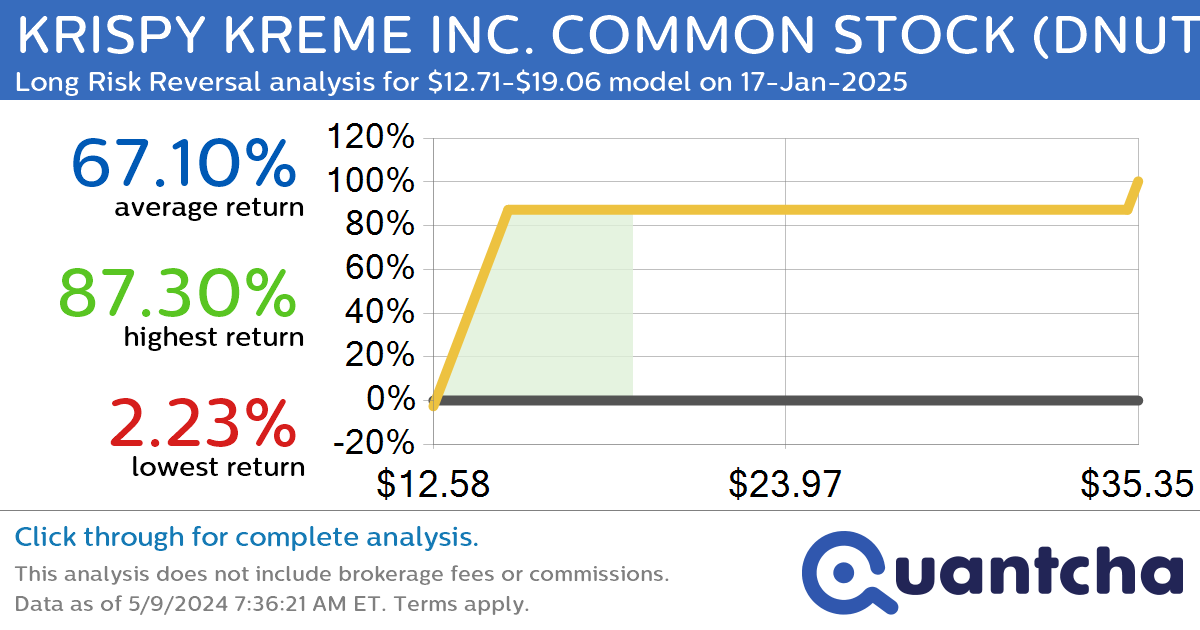

StockTwits Trending Alert: Trading recent interest in KRISPY KREME INC. COMMON STOCK $DNUT

Quantchabot has detected a new Long Risk Reversal trade opportunity for KRISPY KREME INC. COMMON STOCK (DNUT) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DNUT was recently trading at $12.71 and has an implied volatility of 44.72% for this period. Based on an…