Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

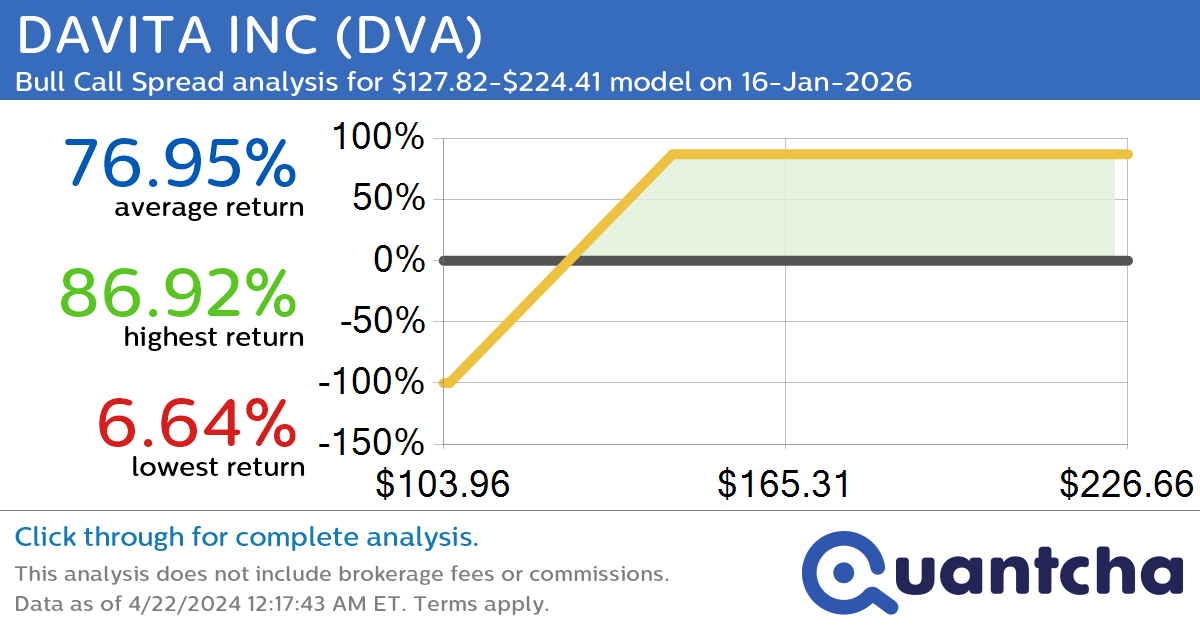

StockTwits Trending Alert: Trading recent interest in DAVITA INC $DVA

Quantchabot has detected a new Bull Call Spread trade opportunity for DAVITA INC (DVA) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DVA was recently trading at $127.82 and has an implied volatility of 35.67% for this period. Based on an analysis of the…

-

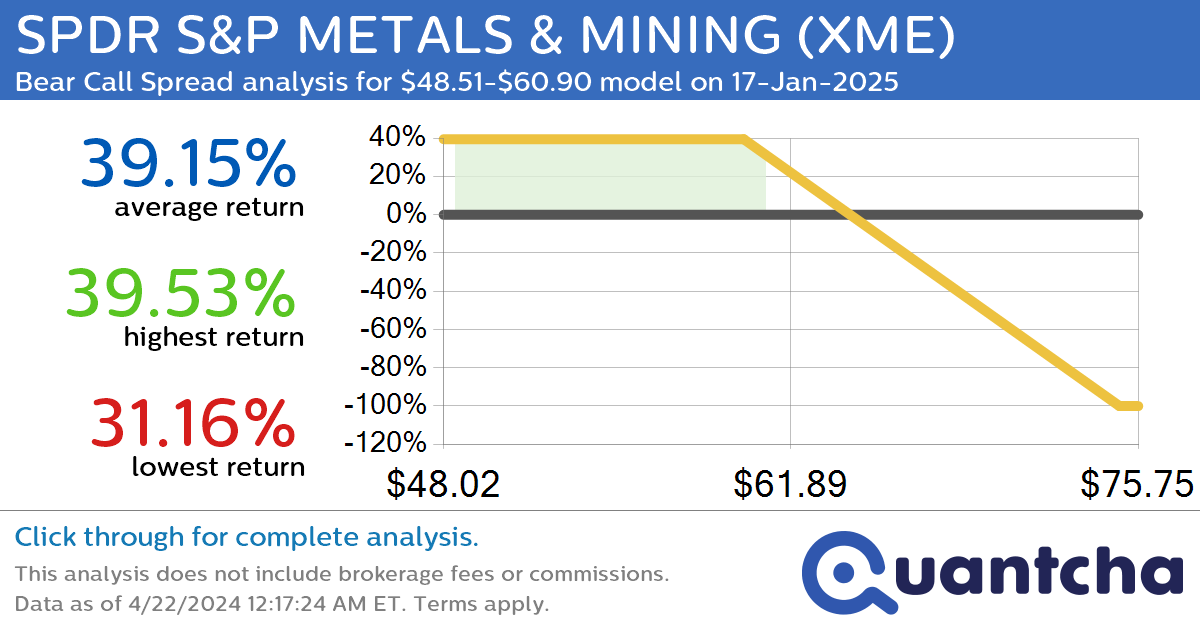

StockTwits Trending Alert: Trading recent interest in SPDR S&P METALS & MINING $XME

Quantchabot has detected a new Bear Call Spread trade opportunity for SPDR S&P METALS & MINING (XME) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XME was recently trading at $60.90 and has an implied volatility of 30.21% for this period. Based on an…

-

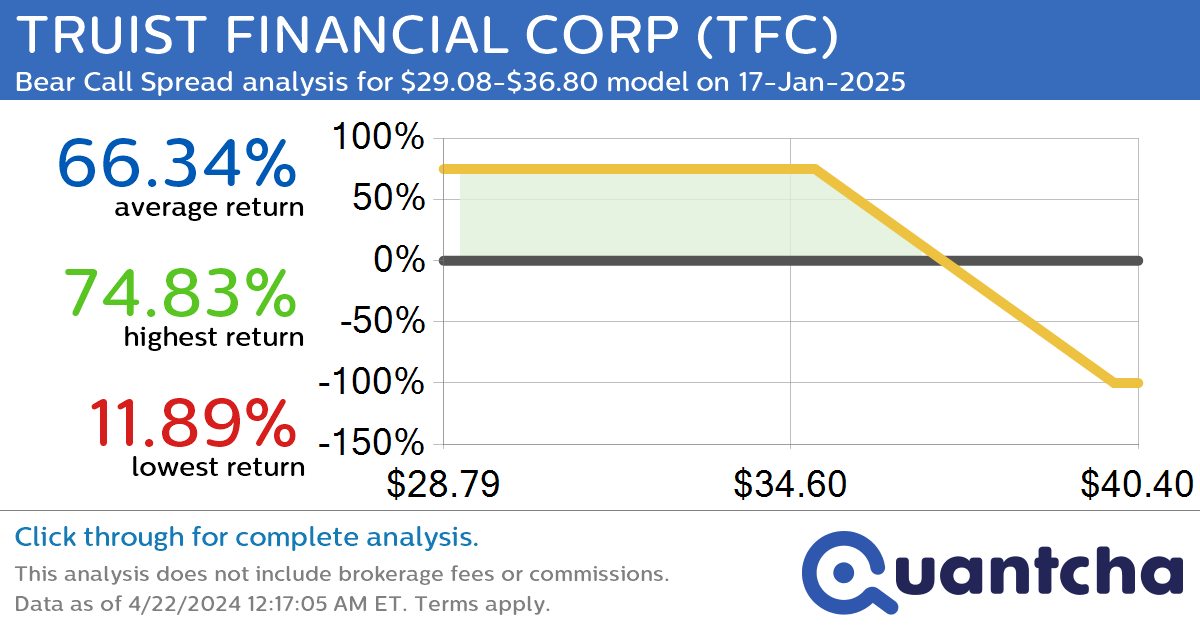

StockTwits Trending Alert: Trading recent interest in TRUIST FINANCIAL CORP $TFC

Quantchabot has detected a new Bear Call Spread trade opportunity for TRUIST FINANCIAL CORP (TFC) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TFC was recently trading at $36.80 and has an implied volatility of 32.07% for this period. Based on an analysis of…

-

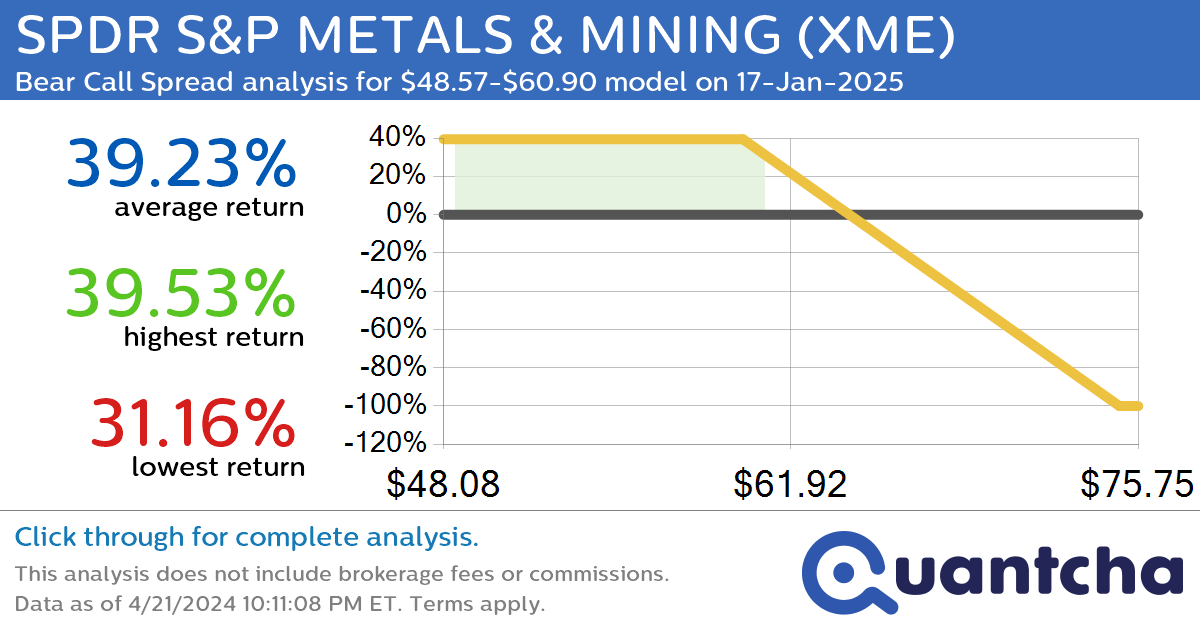

StockTwits Trending Alert: Trading recent interest in SPDR S&P METALS & MINING $XME

Quantchabot has detected a new Bear Call Spread trade opportunity for SPDR S&P METALS & MINING (XME) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XME was recently trading at $60.90 and has an implied volatility of 30.05% for this period. Based on an…

-

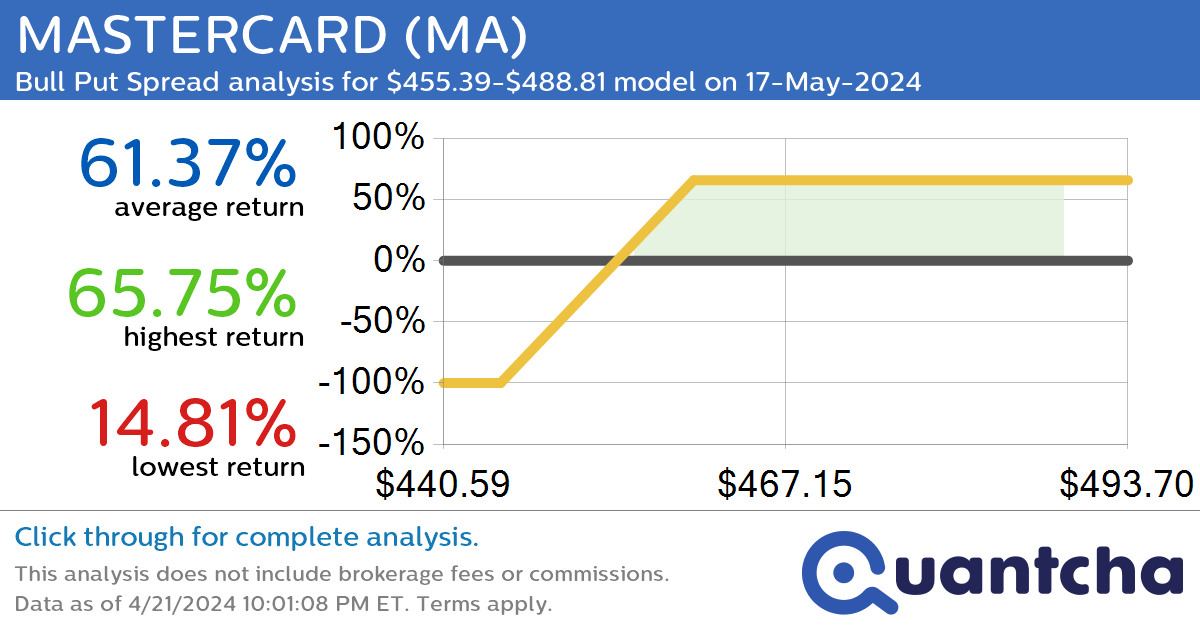

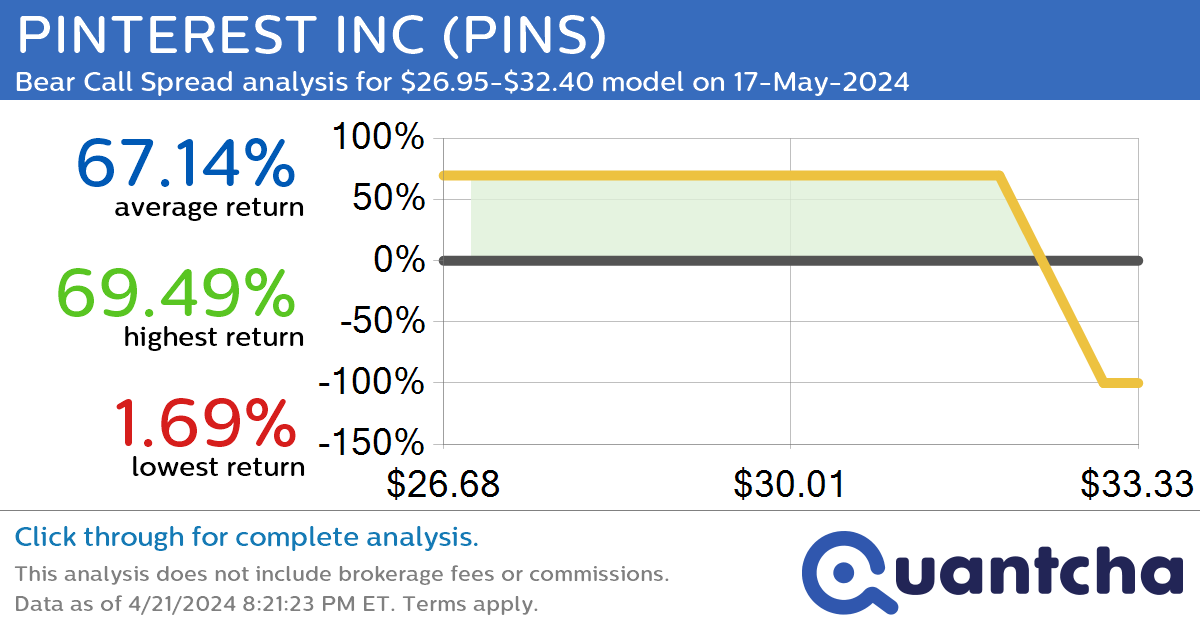

StockTwits Trending Alert: Trading recent interest in MASTERCARD $MA

Quantchabot has detected a new Bull Put Spread trade opportunity for MASTERCARD (MA) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MA was recently trading at $455.39 and has an implied volatility of 24.89% for this period. Based on an analysis of the options…

-

StockTwits Trending Alert: Trading recent interest in MASTERCARD $MA

Quantchabot has detected a new Bull Put Spread trade opportunity for MASTERCARD (MA) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MA was recently trading at $455.39 and has an implied volatility of 24.89% for this period. Based on an analysis of the options…

-

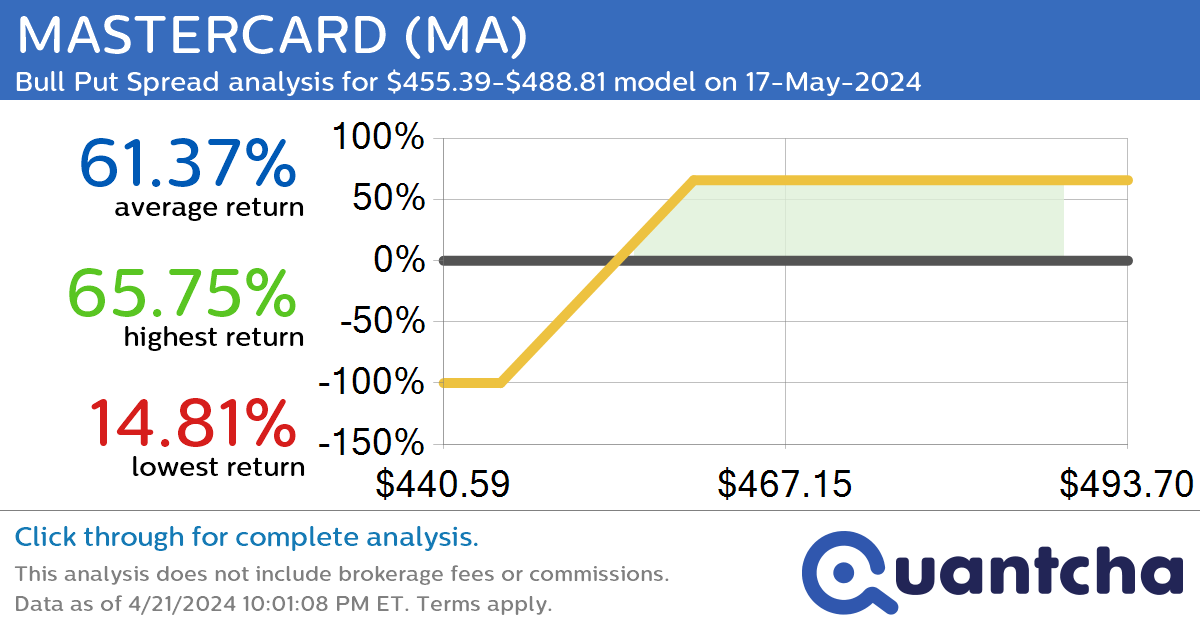

StockTwits Trending Alert: Trading recent interest in ENERGY FUELS INC. $UUUU

Quantchabot has detected a new Long Risk Reversal trade opportunity for ENERGY FUELS INC. (UUUU) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UUUU was recently trading at $5.84 and has an implied volatility of 68.71% for this period. Based on an analysis of…

-

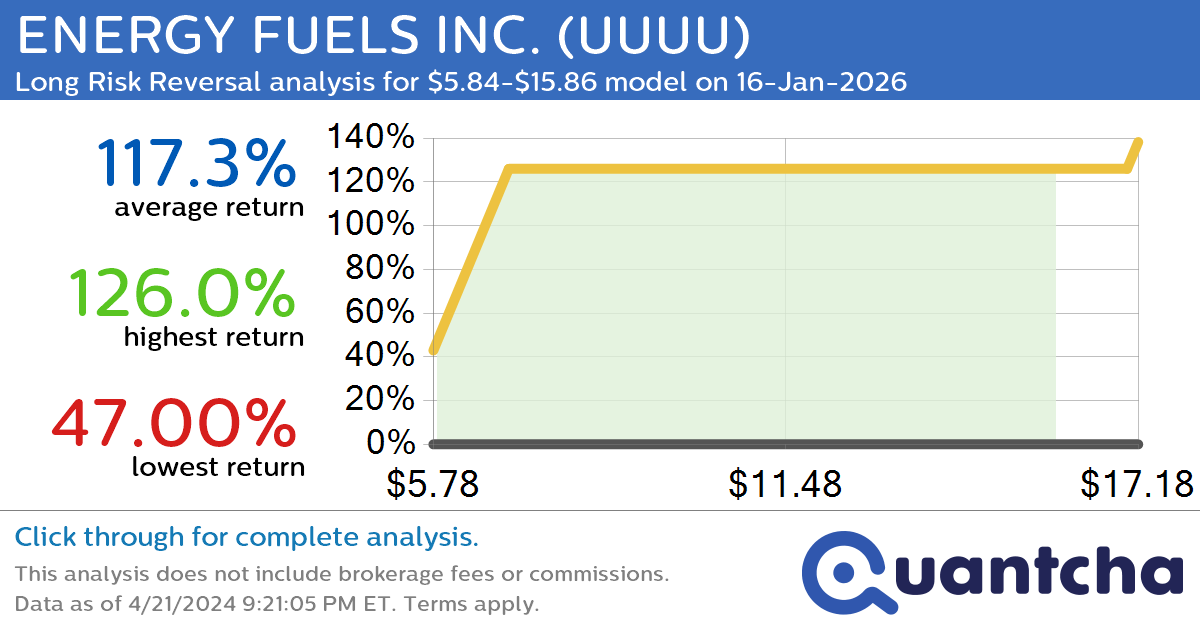

StockTwits Trending Alert: Trading recent interest in PINTEREST INC $PINS

Quantchabot has detected a new Bear Call Spread trade opportunity for PINTEREST INC (PINS) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PINS was recently trading at $32.40 and has an implied volatility of 70.13% for this period. Based on an analysis of the…

-

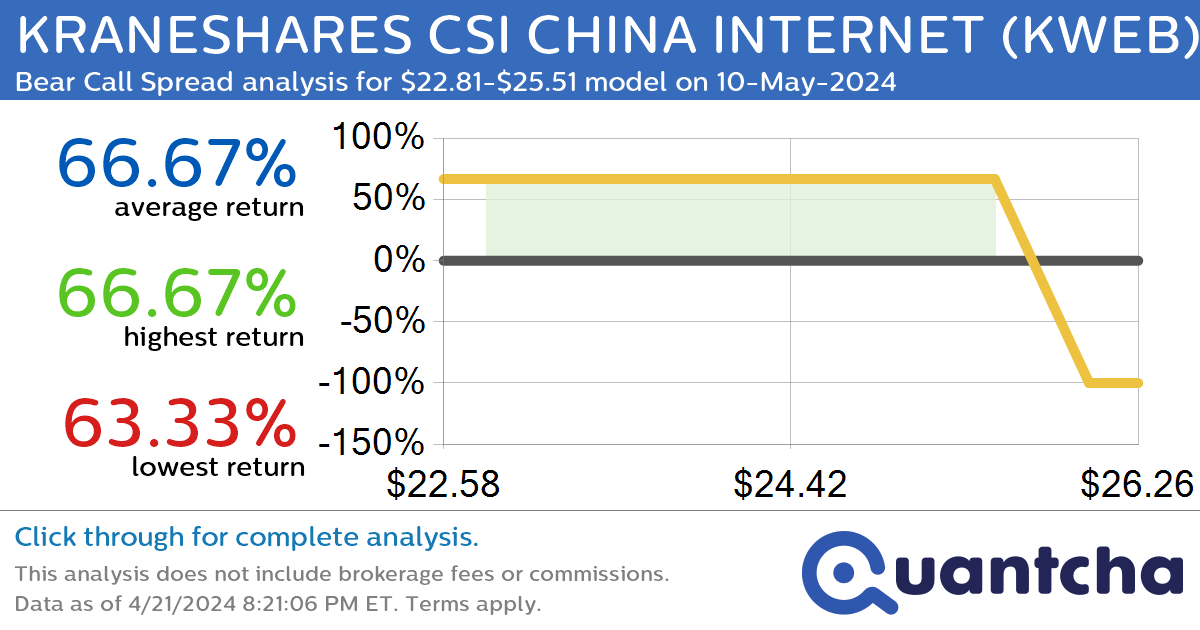

StockTwits Trending Alert: Trading recent interest in KRANESHARES CSI CHINA INTERNET $KWEB

Quantchabot has detected a new Bear Call Spread trade opportunity for KRANESHARES CSI CHINA INTERNET (KWEB) for the 10-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KWEB was recently trading at $25.51 and has an implied volatility of 49.85% for this period. Based on an analysis…

-

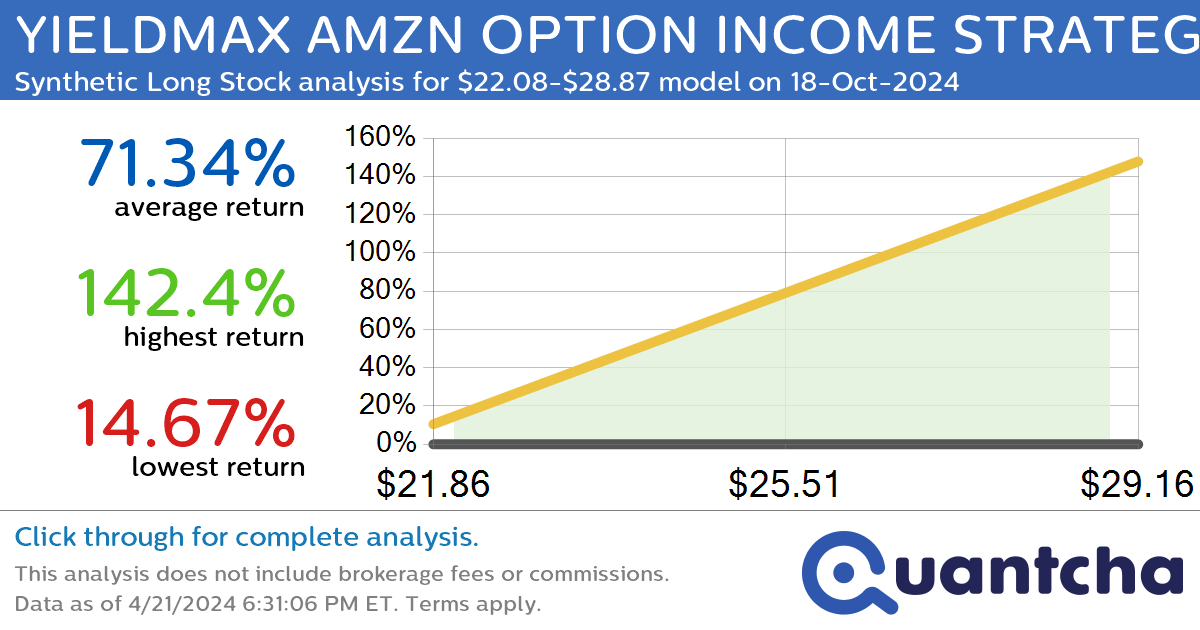

StockTwits Trending Alert: Trading recent interest in YIELDMAX AMZN OPTION INCOME STRATEGY ETF $AMZY

Quantchabot has detected a new Synthetic Long Stock trade opportunity for YIELDMAX AMZN OPTION INCOME STRATEGY ETF (AMZY) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMZY was recently trading at $22.08 and has an implied volatility of 34.23% for this period. Based on…