Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

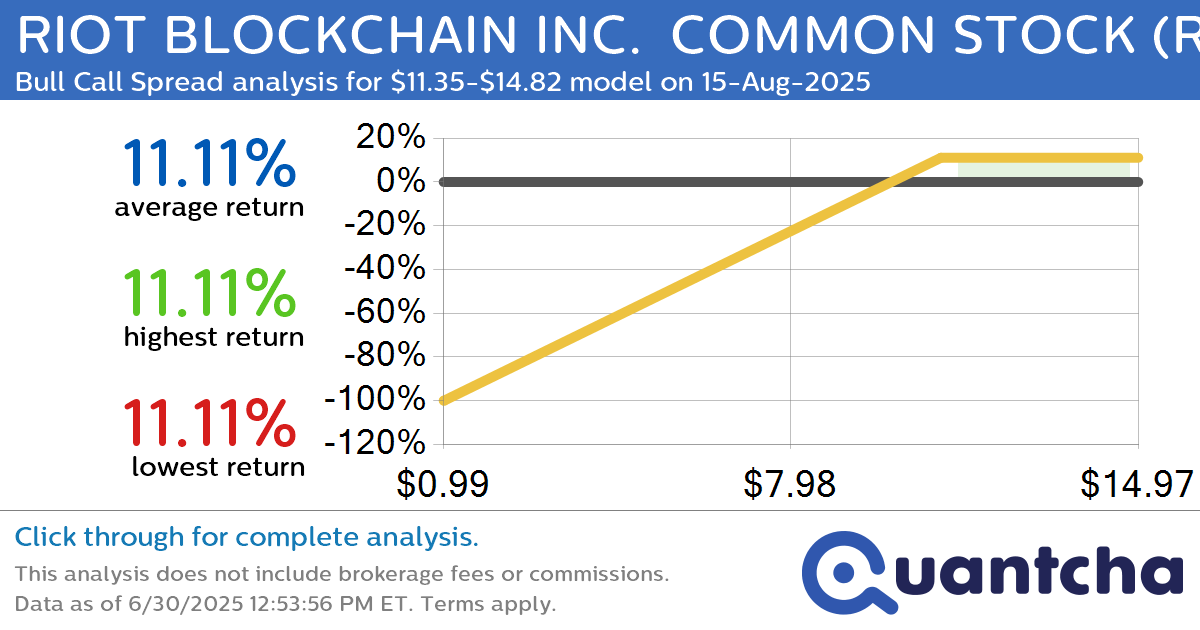

Big Gainer Alert: Trading today’s 7.0% move in RIOT BLOCKCHAIN INC. COMMON STOCK $RIOT

Quantchabot has detected a new Bull Call Spread trade opportunity for RIOT BLOCKCHAIN INC. COMMON STOCK (RIOT) for the 15-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RIOT was recently trading at $11.29 and has an implied volatility of 74.63% for this period. Based on an…

-

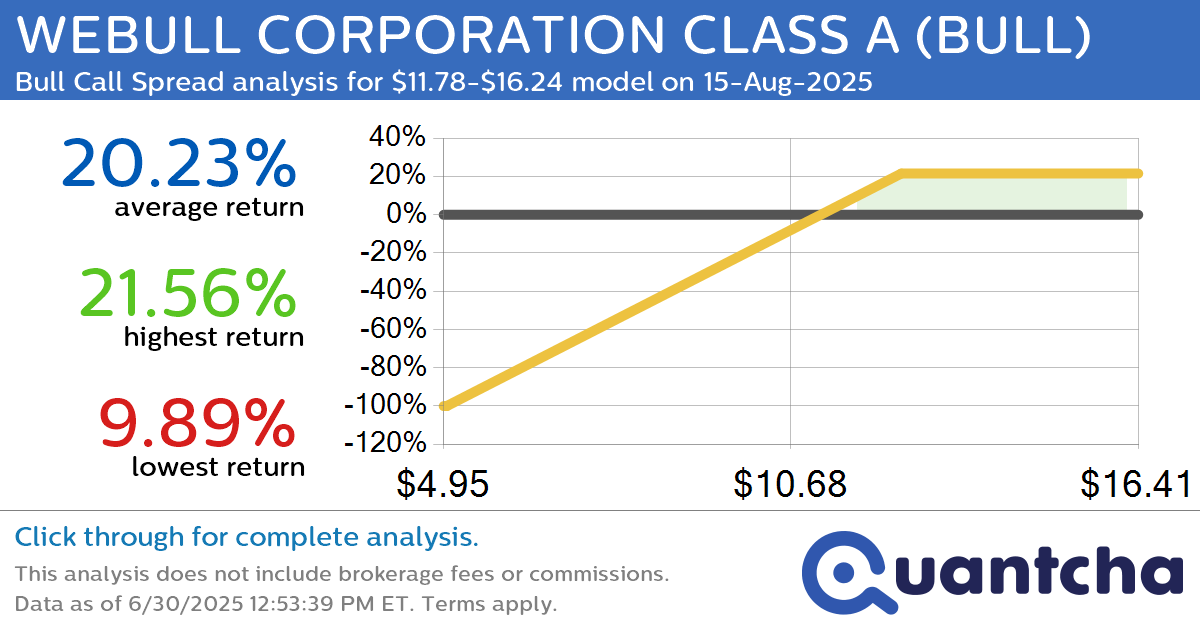

Big Gainer Alert: Trading today’s 8.2% move in WEBULL CORPORATION CLASS A $BULL

Quantchabot has detected a new Bull Call Spread trade opportunity for WEBULL CORPORATION CLASS A (BULL) for the 15-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BULL was recently trading at $11.72 and has an implied volatility of 89.76% for this period. Based on an analysis…

-

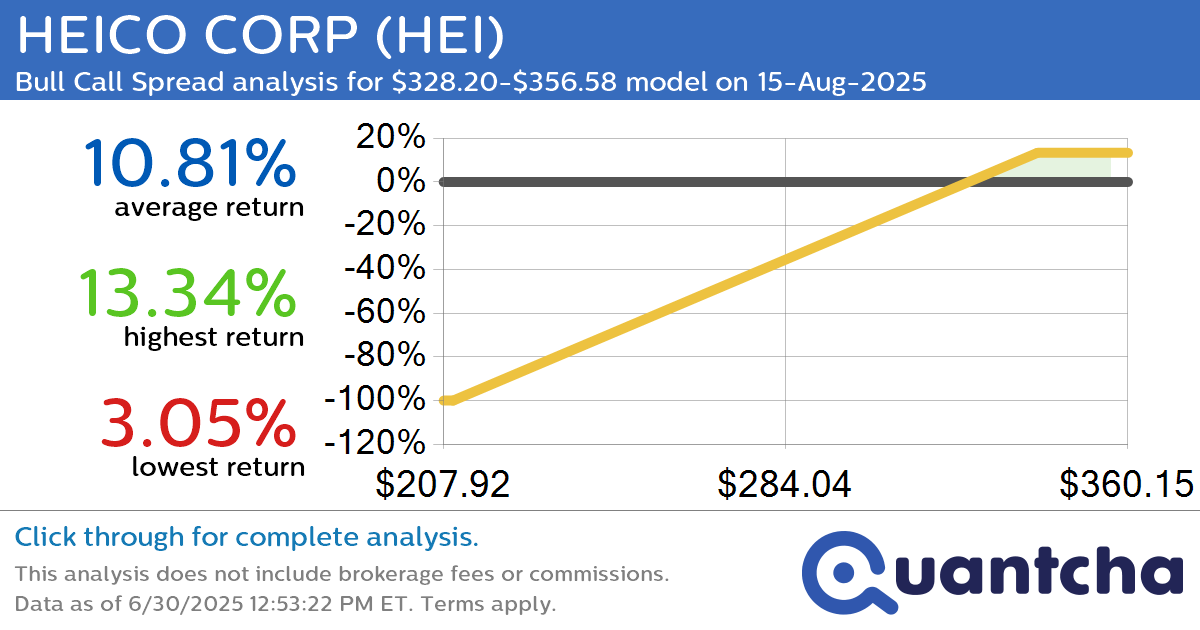

52-Week High Alert: Trading today’s movement in HEICO CORP $HEI

Quantchabot has detected a new Bull Call Spread trade opportunity for HEICO CORP (HEI) for the 15-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HEI was recently trading at $326.53 and has an implied volatility of 23.20% for this period. Based on an analysis of the…

-

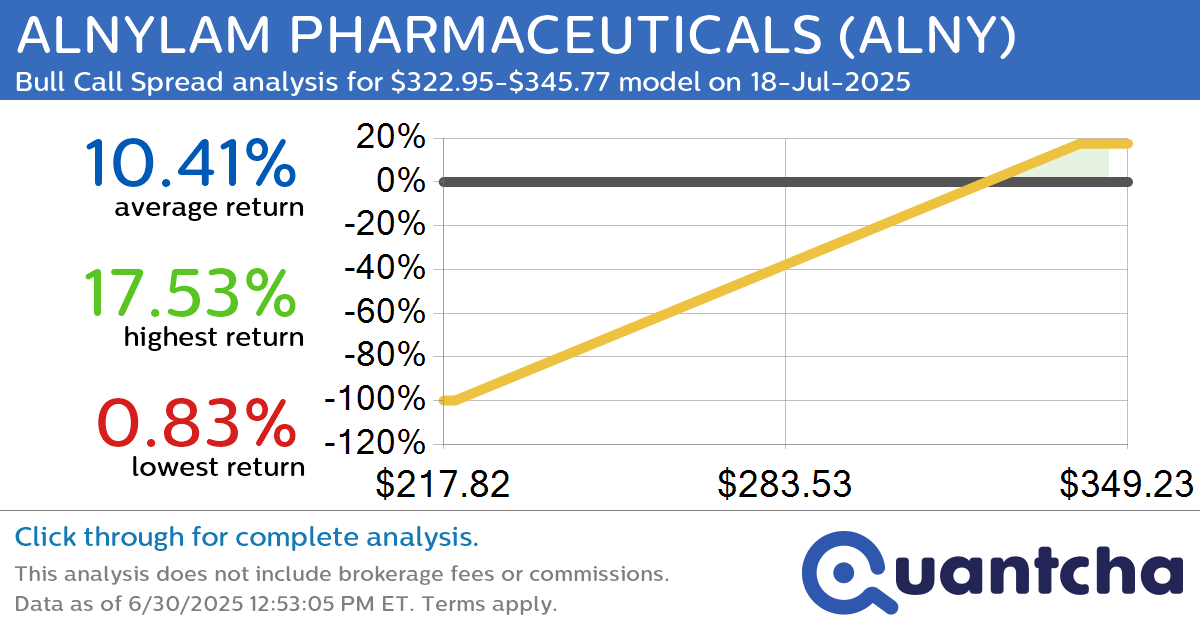

52-Week High Alert: Trading today’s movement in ALNYLAM PHARMACEUTICALS $ALNY

Quantchabot has detected a new Bull Call Spread trade opportunity for ALNYLAM PHARMACEUTICALS (ALNY) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ALNY was recently trading at $322.25 and has an implied volatility of 30.22% for this period. Based on an analysis of the…

-

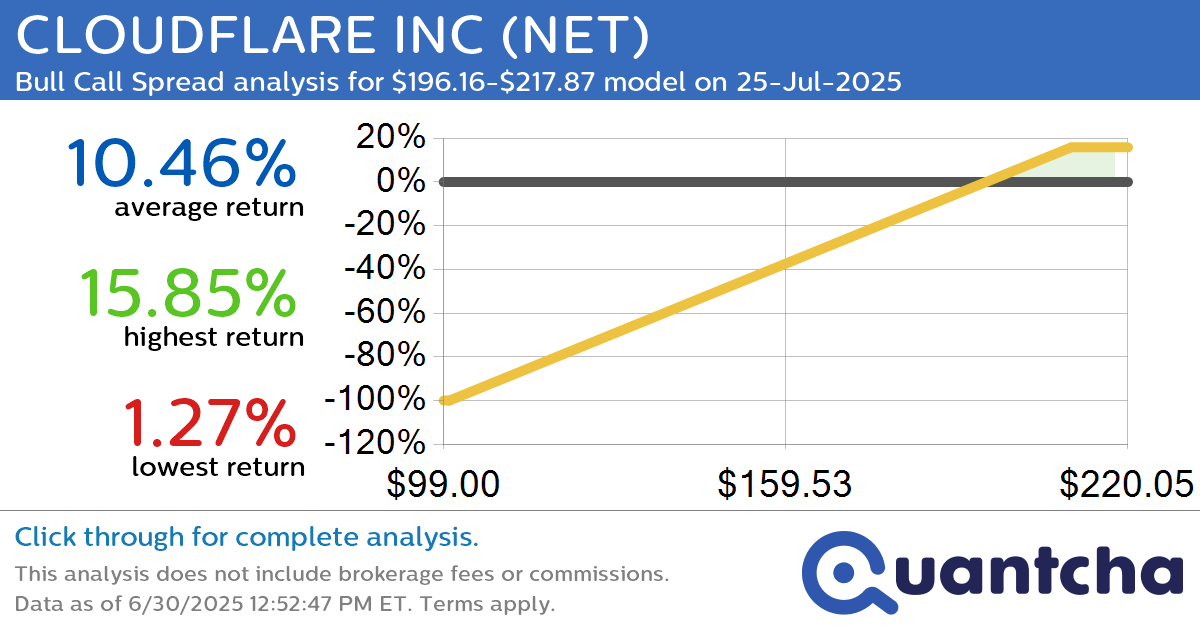

52-Week High Alert: Trading today’s movement in CLOUDFLARE INC $NET

Quantchabot has detected a new Bull Call Spread trade opportunity for CLOUDFLARE INC (NET) for the 25-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NET was recently trading at $195.57 and has an implied volatility of 39.61% for this period. Based on an analysis of the…

-

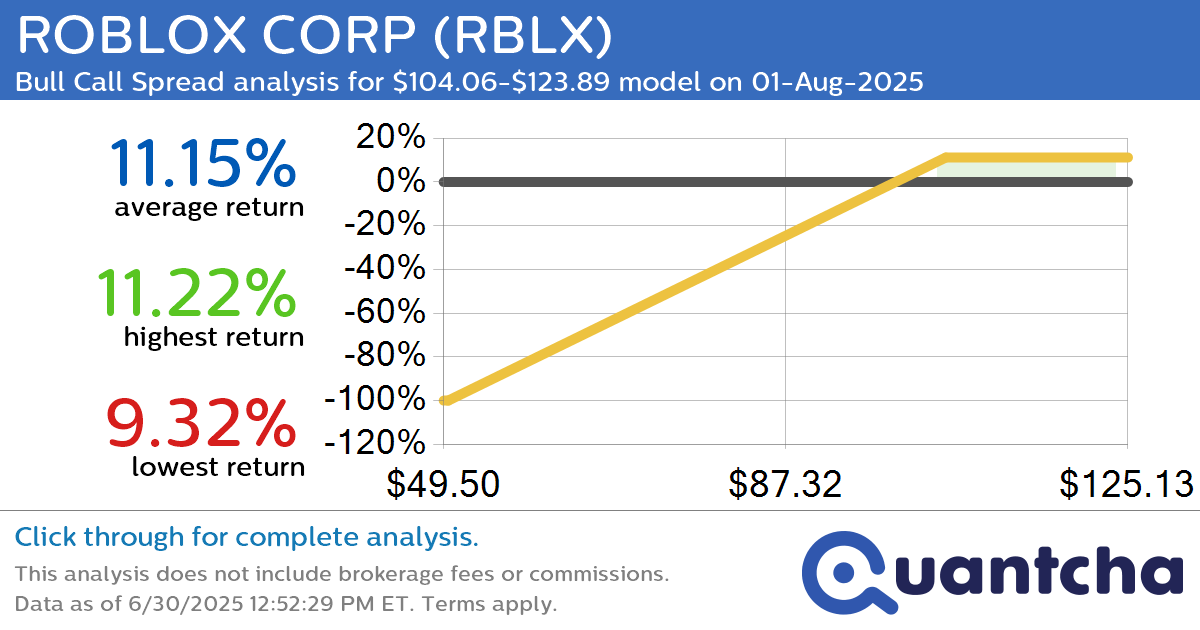

52-Week High Alert: Trading today’s movement in ROBLOX CORP $RBLX

Quantchabot has detected a new Bull Call Spread trade opportunity for ROBLOX CORP (RBLX) for the 1-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RBLX was recently trading at $103.66 and has an implied volatility of 58.35% for this period. Based on an analysis of the…

-

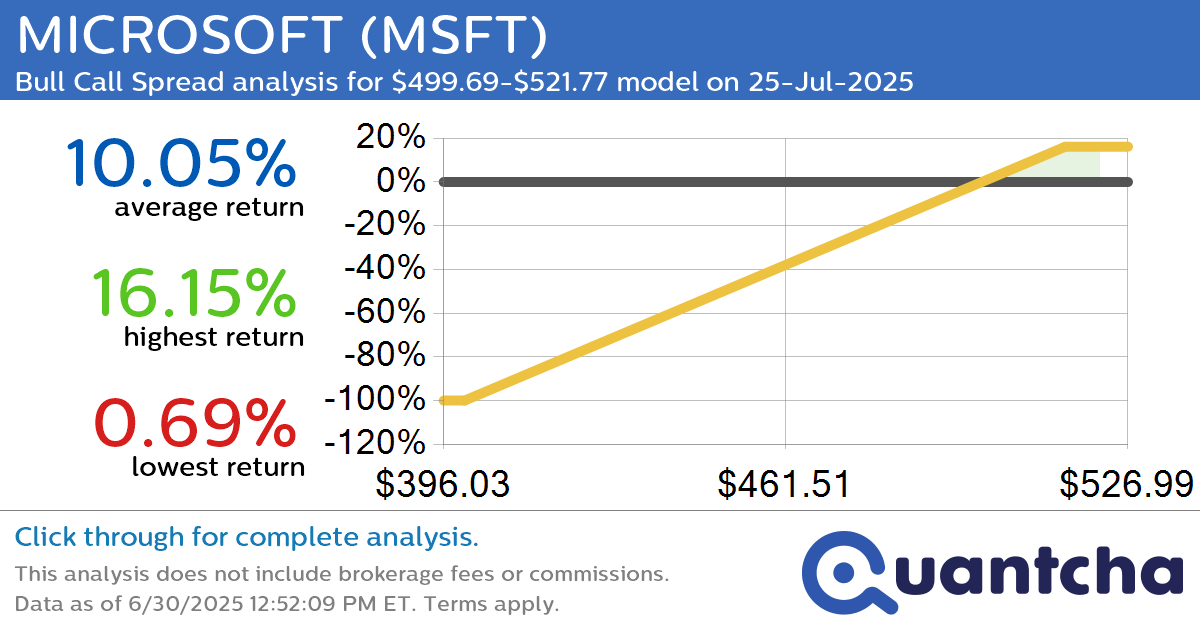

52-Week High Alert: Trading today’s movement in MICROSOFT $MSFT

Quantchabot has detected a new Bull Call Spread trade opportunity for MICROSOFT (MSFT) for the 25-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MSFT was recently trading at $498.19 and has an implied volatility of 16.31% for this period. Based on an analysis of the options…

-

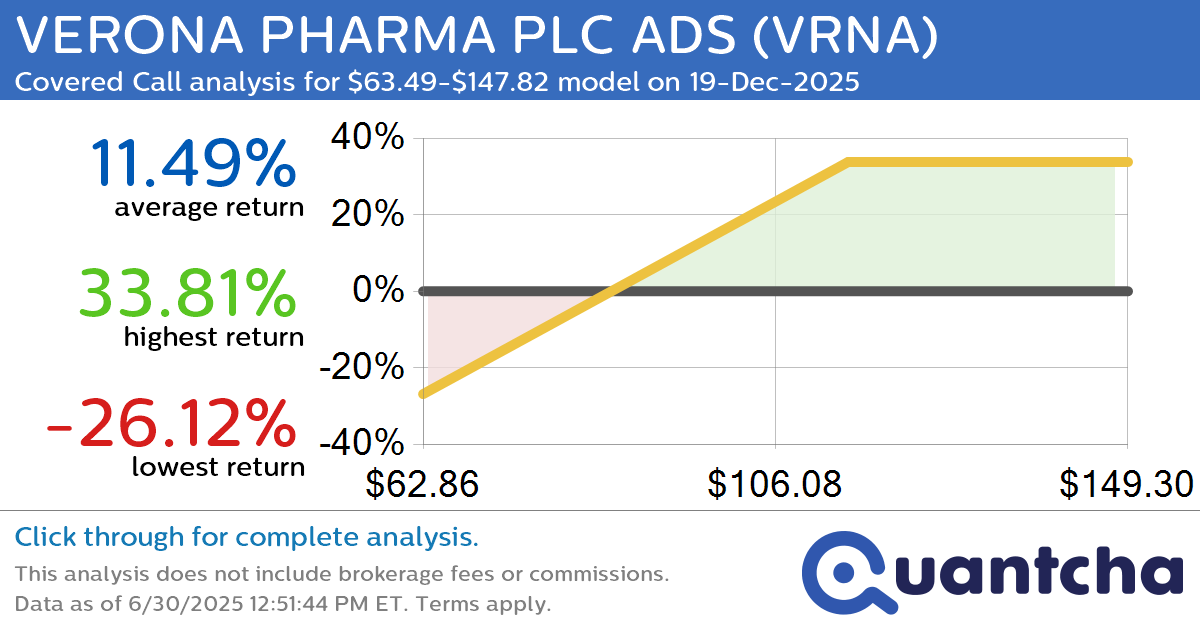

Covered Call Alert: VERONA PHARMA PLC ADS $VRNA returning up to 33.77% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for VERONA PHARMA PLC ADS (VRNA) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VRNA was recently trading at $94.84 and has an implied volatility of 61.45% for this period. Based on an analysis of…

-

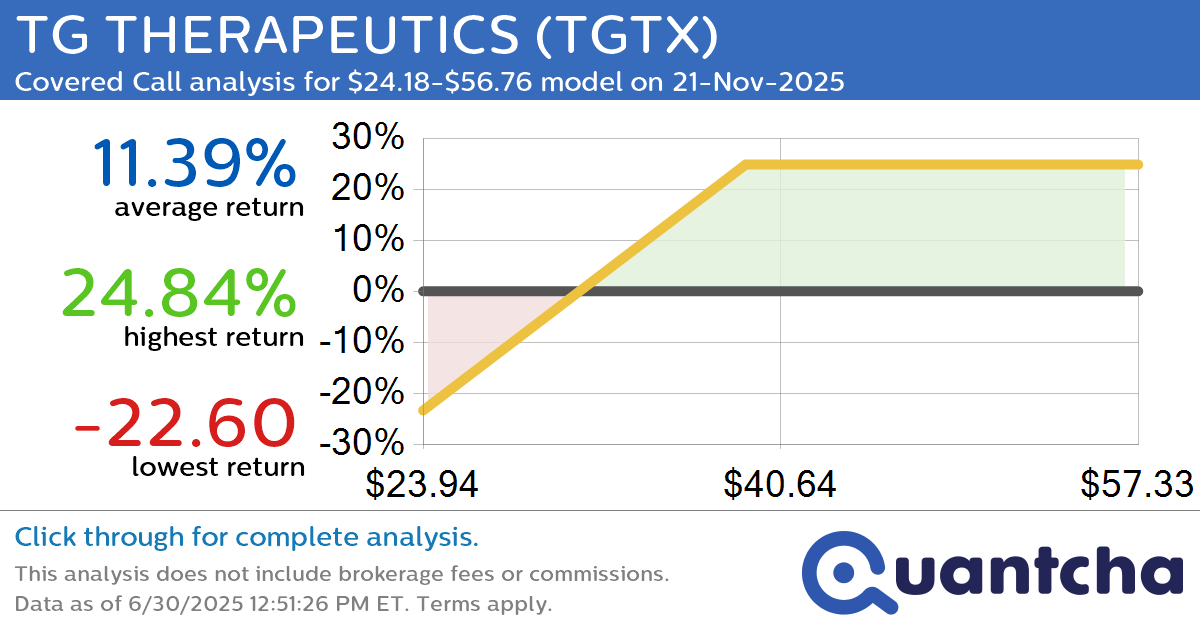

Covered Call Alert: TG THERAPEUTICS $TGTX returning up to 24.84% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for TG THERAPEUTICS (TGTX) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TGTX was recently trading at $36.40 and has an implied volatility of 67.77% for this period. Based on an analysis of the options…

-

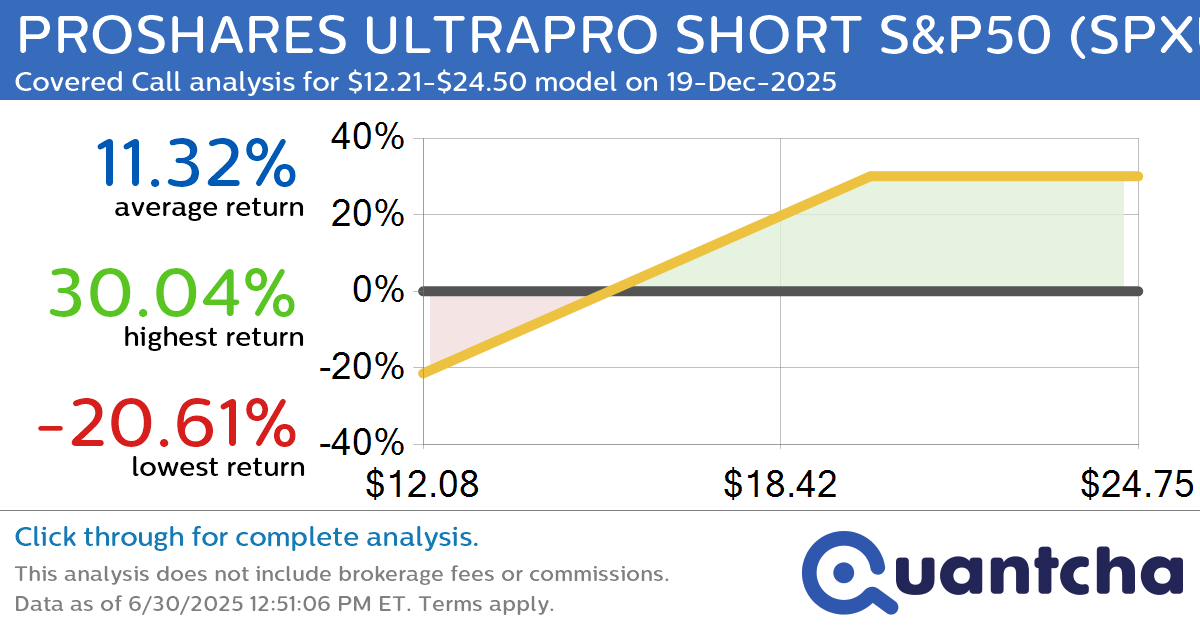

Covered Call Alert: PROSHARES ULTRAPRO SHORT S&P50 $SPXU returning up to 30.04% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for PROSHARES ULTRAPRO SHORT S&P50 (SPXU) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SPXU was recently trading at $16.93 and has an implied volatility of 50.64% for this period. Based on an analysis of…