Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

Big Loser Alert: Trading today’s -9.6% move in APPLIED OPTOELECTRONICS INC. $AAOI

Quantchabot has detected a new Bear Call Spread trade opportunity for APPLIED OPTOELECTRONICS INC. (AAOI) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AAOI was recently trading at $10.96 and has an implied volatility of 85.50% for this period. Based on an analysis of…

-

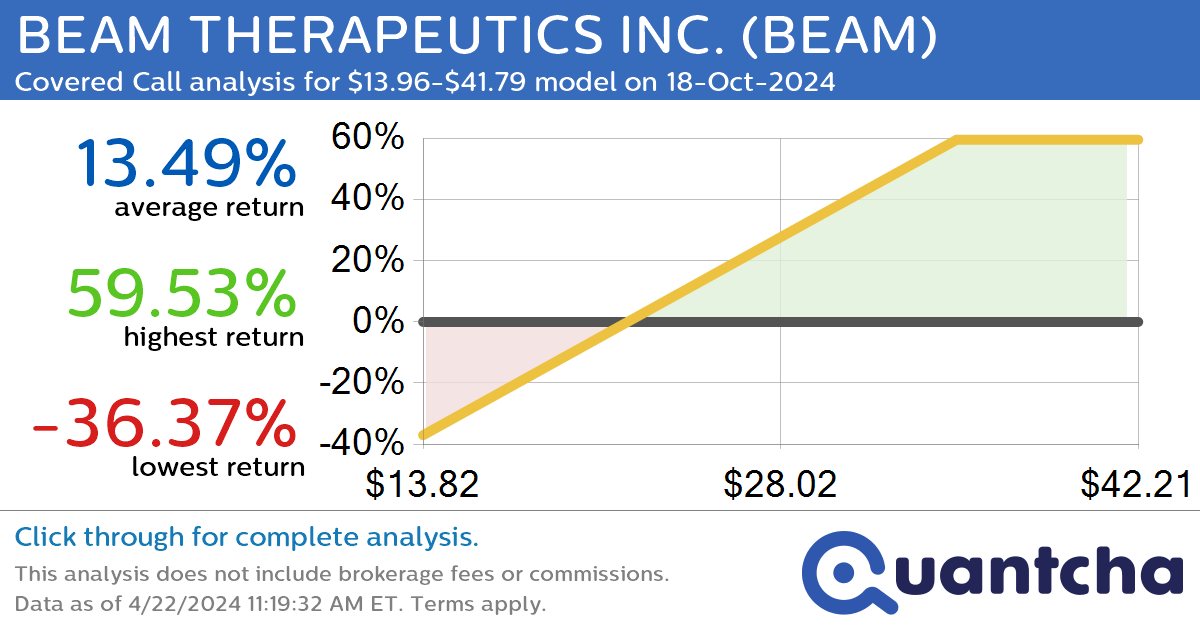

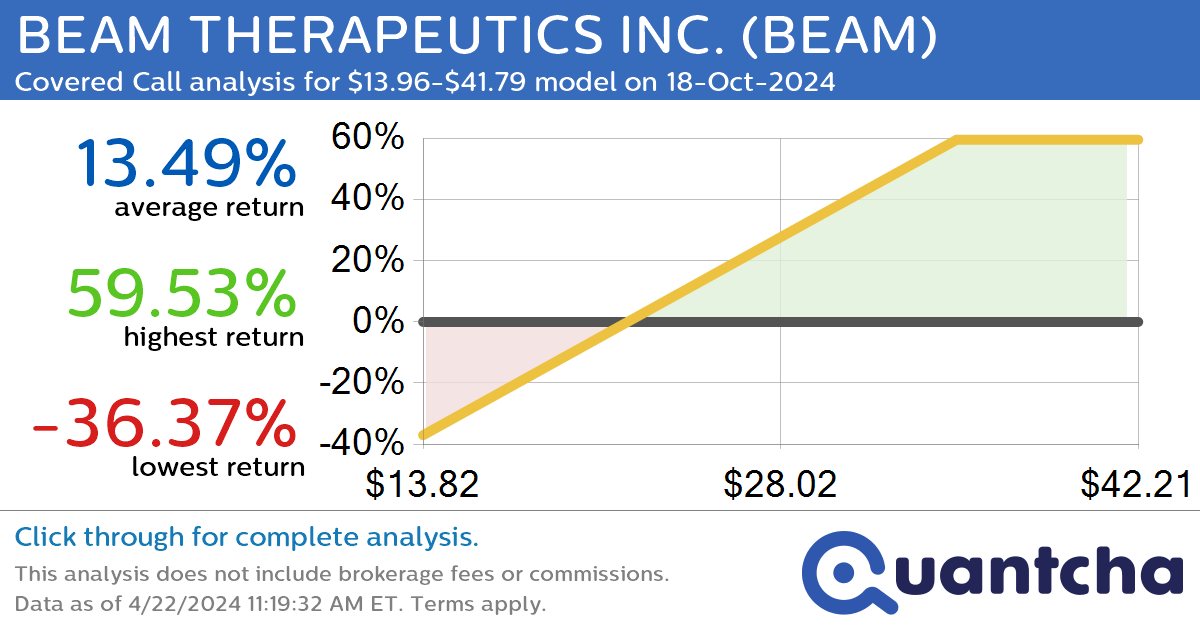

Covered Call Alert: BEAM THERAPEUTICS INC. $BEAM returning up to 59.89% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for BEAM THERAPEUTICS INC. (BEAM) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BEAM was recently trading at $23.50 and has an implied volatility of 78.11% for this period. Based on an analysis of the…

-

52-Week Low Alert: Trading today’s movement in ASANA INC $ASAN

Quantchabot has detected a new Bear Call Spread trade opportunity for ASANA INC (ASAN) for the 24-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ASAN was recently trading at $13.43 and has an implied volatility of 50.10% for this period. Based on an analysis of the…

-

Covered Call Alert: SAREPTA THERAPEUTICS INC. COM $SRPT returning up to 47.77% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for SAREPTA THERAPEUTICS INC. COM (SRPT) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SRPT was recently trading at $115.24 and has an implied volatility of 74.75% for this period. Based on an analysis of…

-

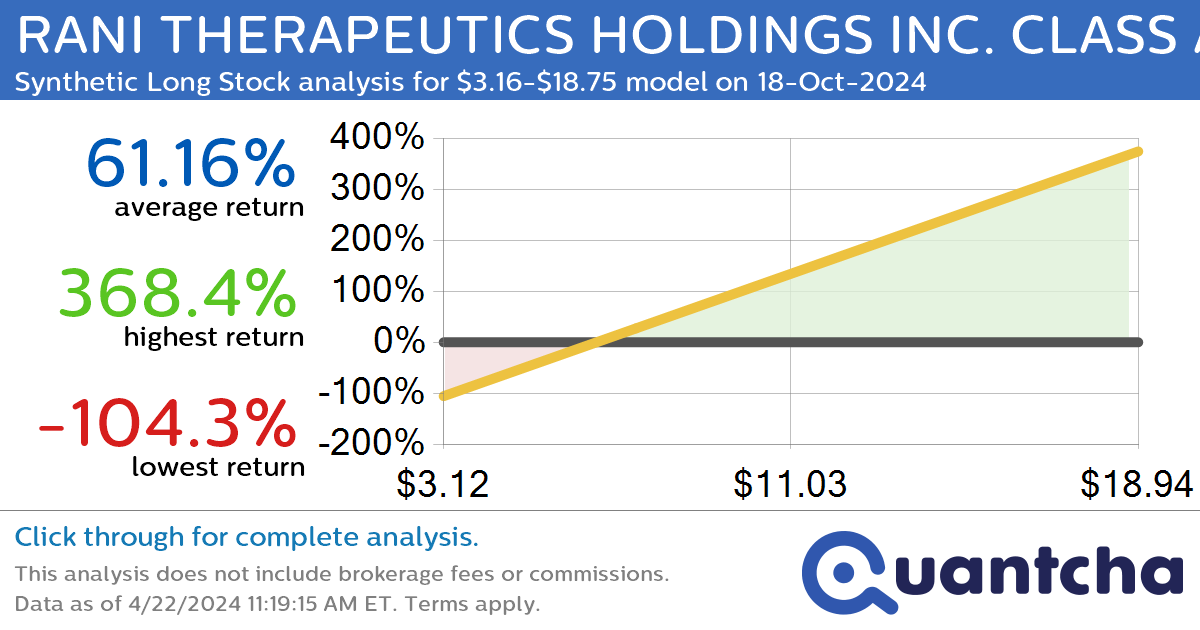

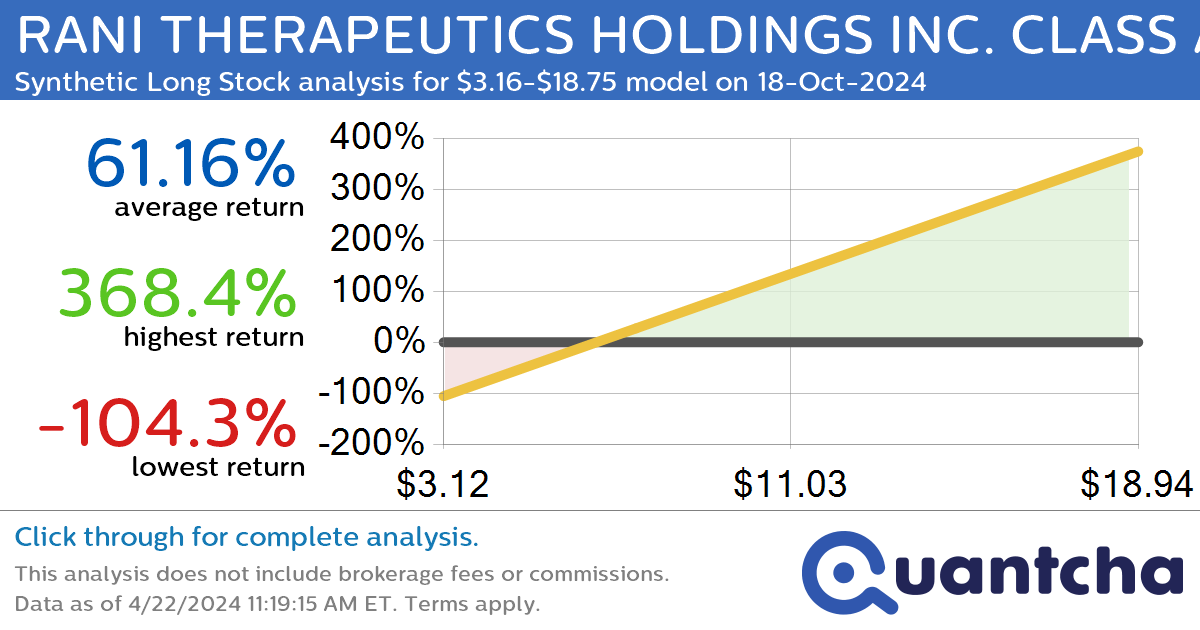

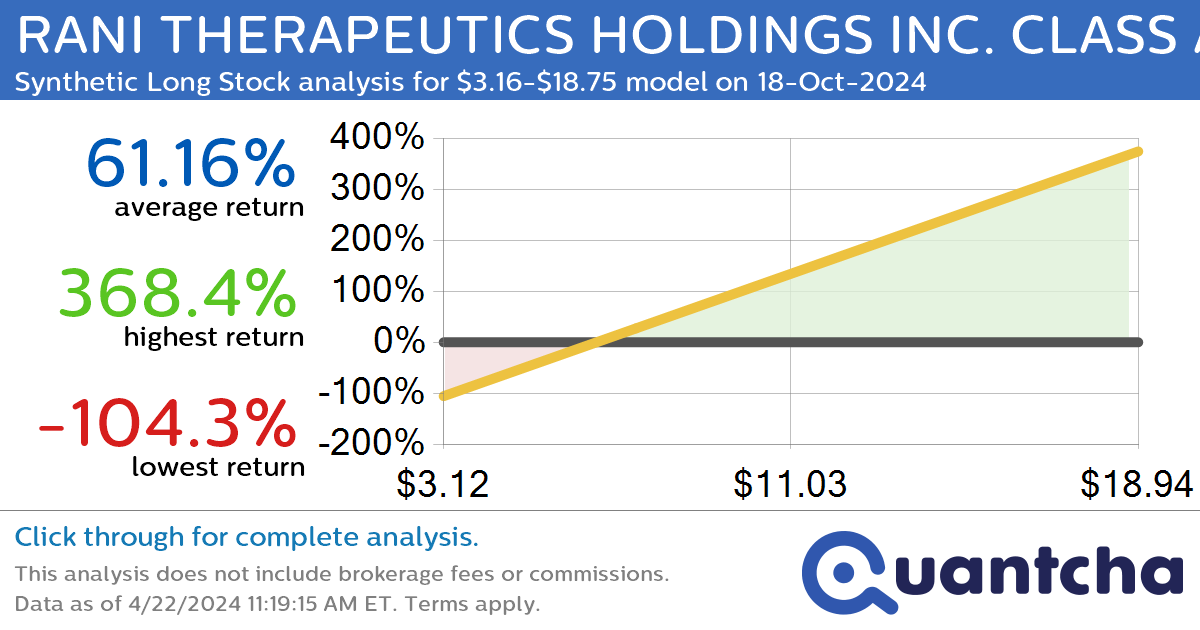

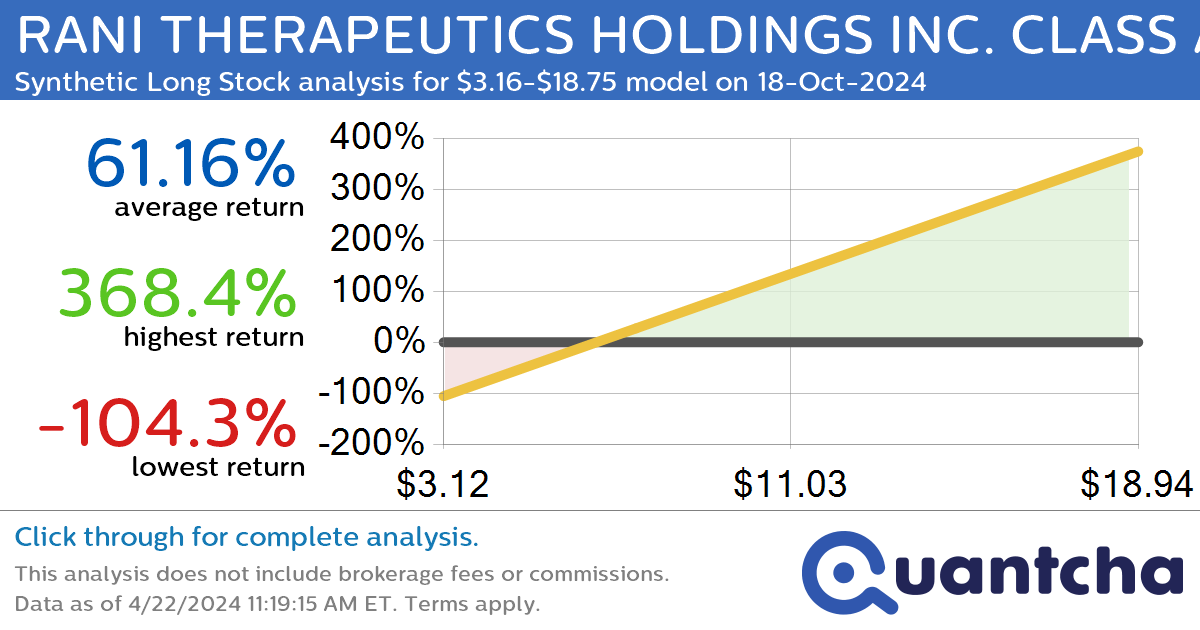

Synthetic Long Discount Alert: RANI THERAPEUTICS HOLDINGS INC. CLASS A $RANI trading at a 11.88% discount for the 18-Oct-2024 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for RANI THERAPEUTICS HOLDINGS INC. CLASS A (RANI) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RANI was recently trading at $7.49 and has an implied volatility of 126.84% for this period. Based on…

-

Big Gainer Alert: Trading today’s 7.1% move in IRIS ENERGY LIMITED ORDINARY SHARES $IREN

Quantchabot has detected a new Bull Call Spread trade opportunity for IRIS ENERGY LIMITED ORDINARY SHARES (IREN) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IREN was recently trading at $5.30 and has an implied volatility of 125.55% for this period. Based on an…

-

Covered Call Alert: ROKU INC. CLASS A COMMON STOCK $ROKU returning up to 32.76% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for ROKU INC. CLASS A COMMON STOCK (ROKU) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ROKU was recently trading at $56.26 and has an implied volatility of 64.72% for this period. Based on an…

-

52-Week High Alert: Trading today’s movement in CHARLES SCHWAB $SCHW

Quantchabot has detected a new Bull Call Spread trade opportunity for CHARLES SCHWAB (SCHW) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SCHW was recently trading at $74.28 and has an implied volatility of 24.27% for this period. Based on an analysis of the…

-

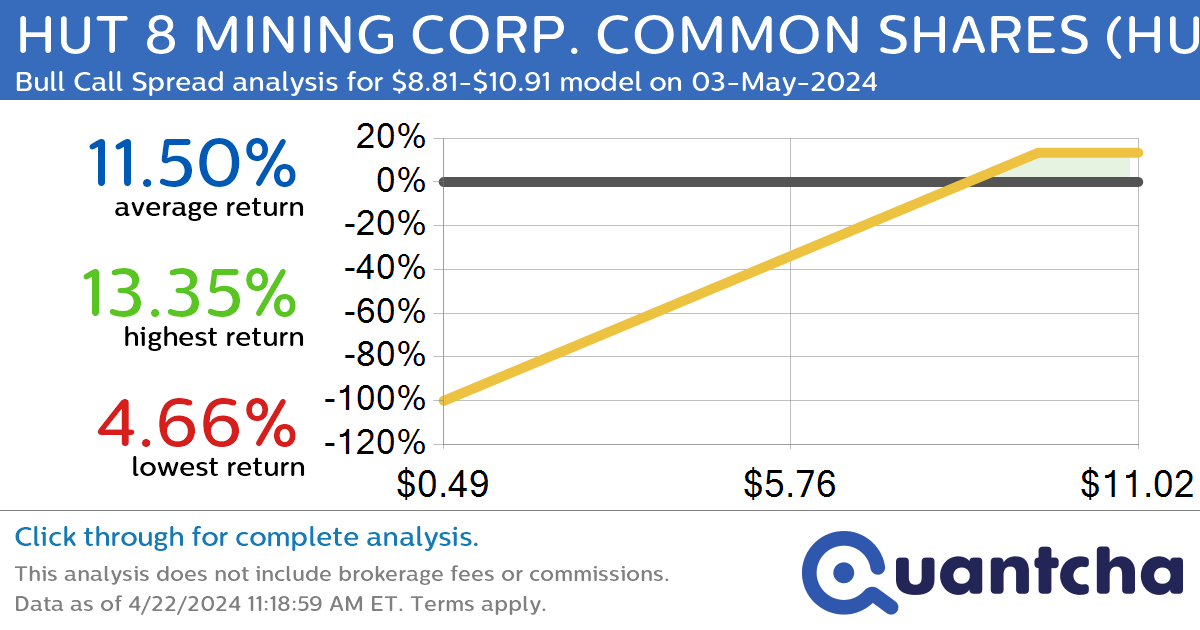

Big Gainer Alert: Trading today’s 9.3% move in HUT 8 MINING CORP. COMMON SHARES $HUT

Quantchabot has detected a new Bull Call Spread trade opportunity for HUT 8 MINING CORP. COMMON SHARES (HUT) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HUT was recently trading at $8.79 and has an implied volatility of 119.14% for this period. Based on…

-

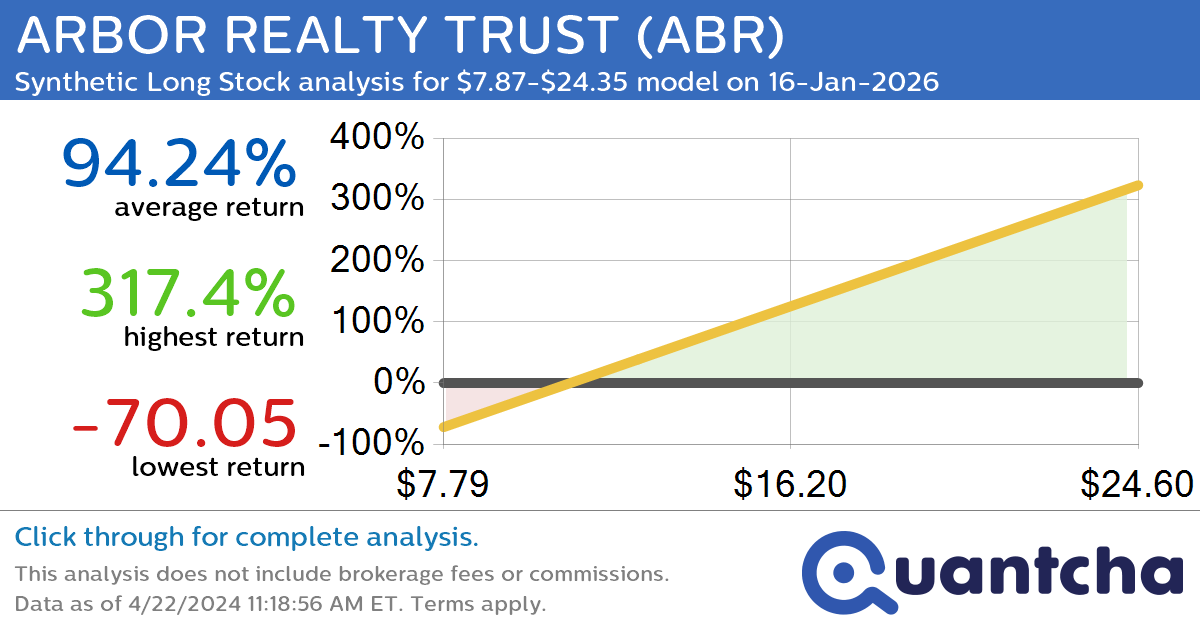

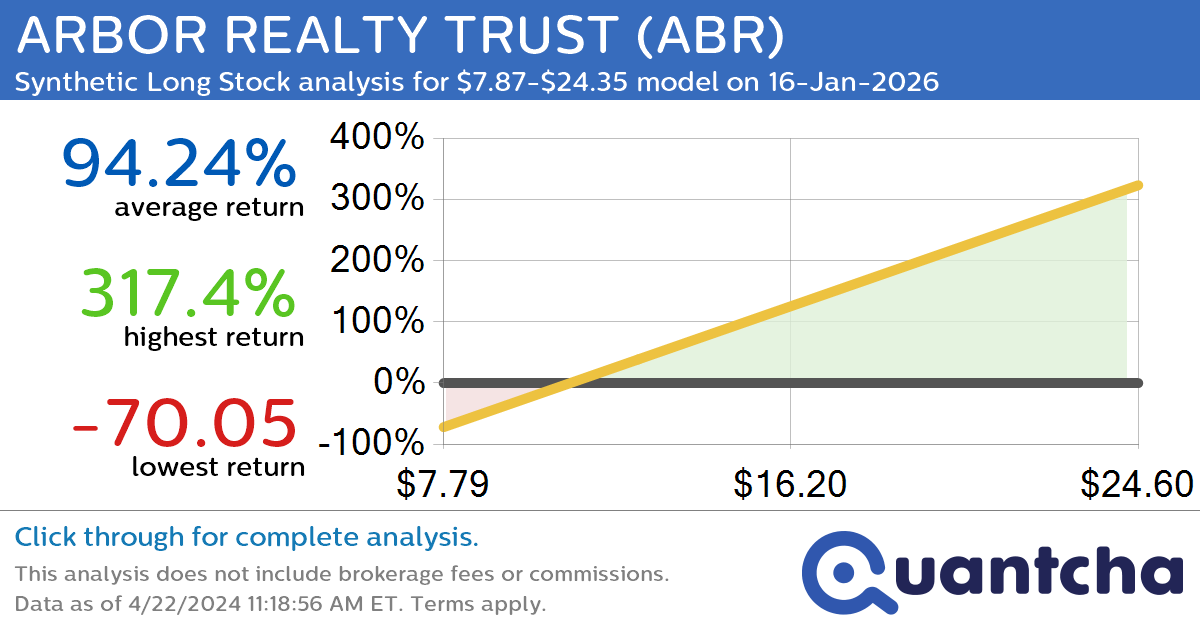

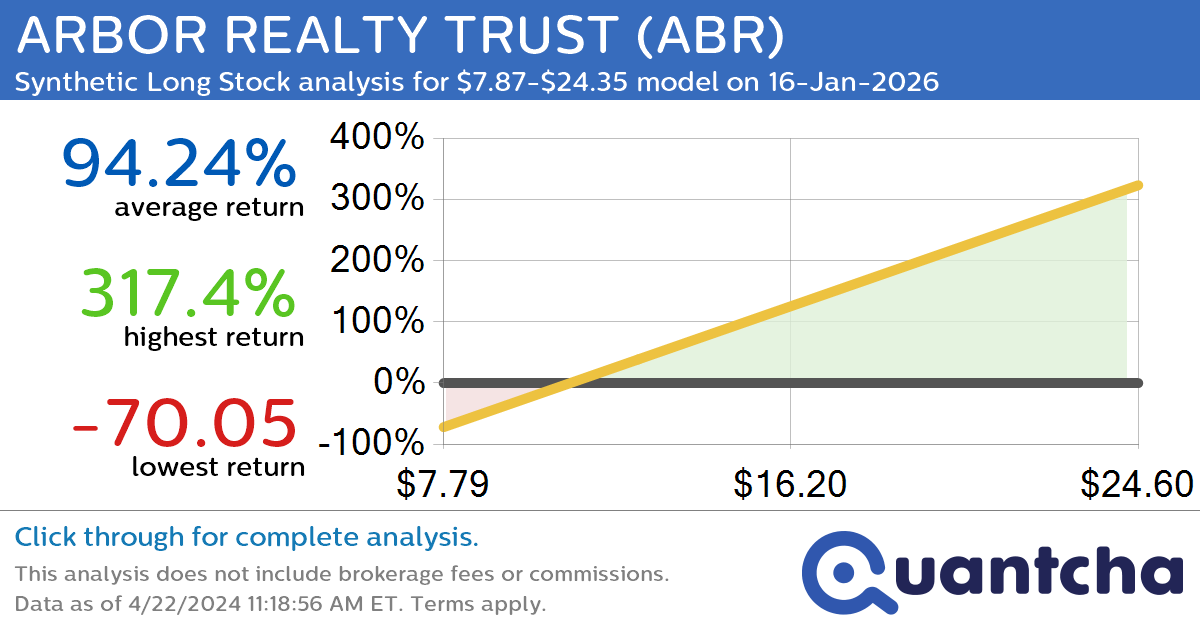

Synthetic Long Discount Alert: ARBOR REALTY TRUST $ABR trading at a 13.23% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ARBOR REALTY TRUST (ABR) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABR was recently trading at $12.62 and has an implied volatility of 42.84% for this period. Based on an analysis of…