Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

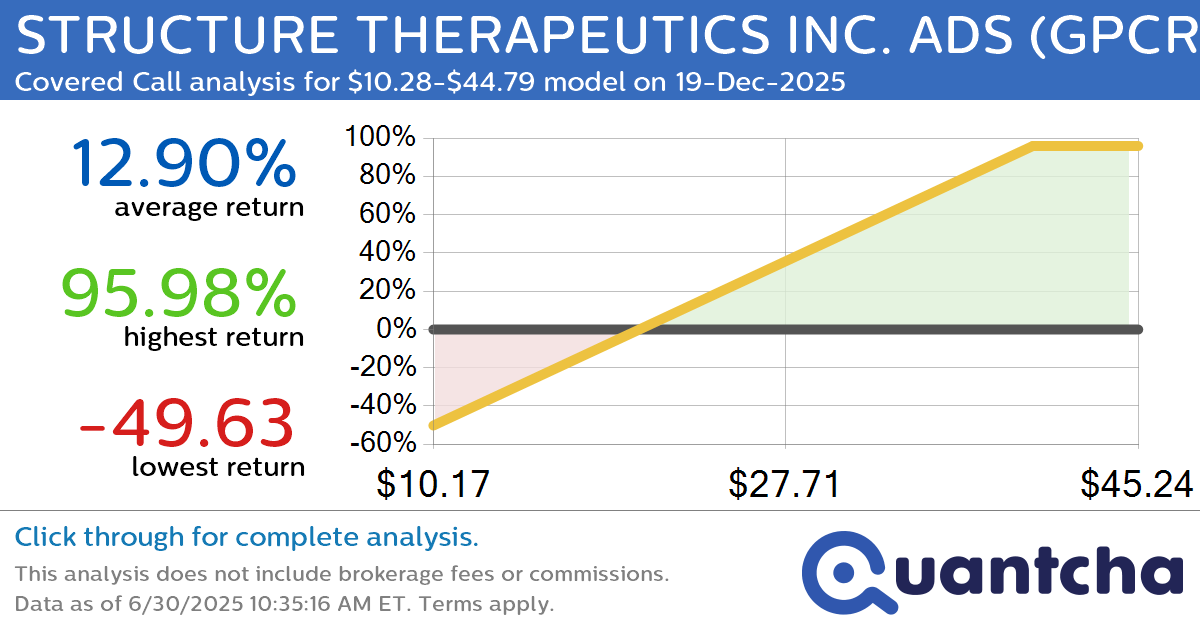

Covered Call Alert: STRUCTURE THERAPEUTICS INC. ADS $GPCR returning up to 95.98% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for STRUCTURE THERAPEUTICS INC. ADS (GPCR) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GPCR was recently trading at $21.01 and has an implied volatility of 106.94% for this period. Based on an analysis of…

-

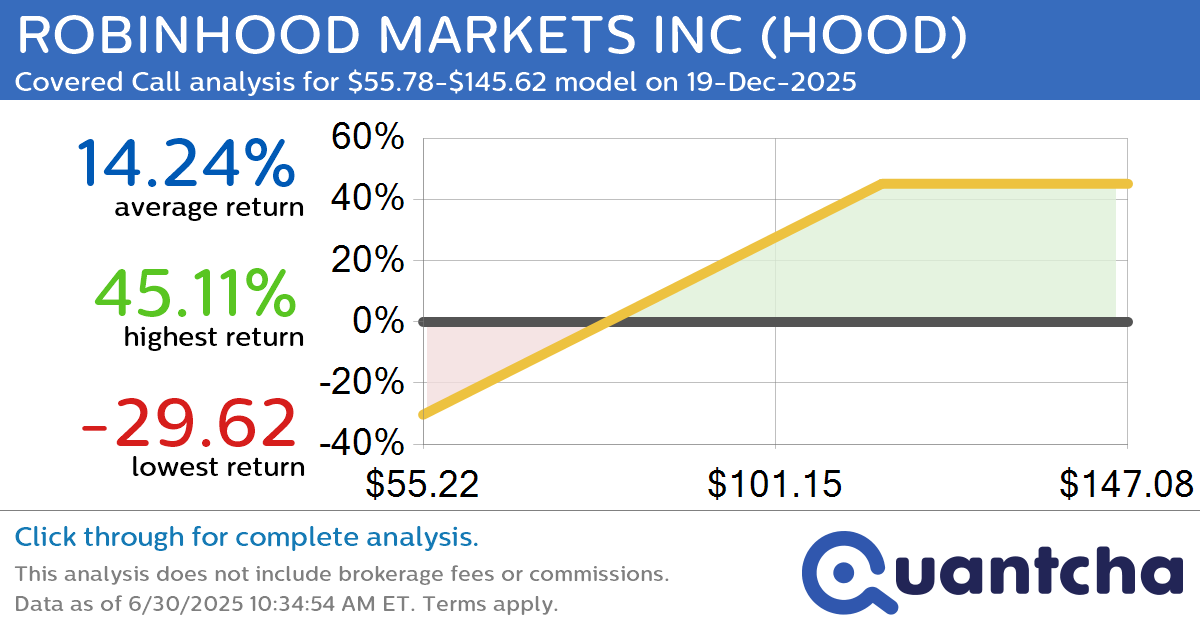

Covered Call Alert: ROBINHOOD MARKETS INC $HOOD returning up to 45.13% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for ROBINHOOD MARKETS INC (HOOD) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HOOD was recently trading at $88.23 and has an implied volatility of 69.74% for this period. Based on an analysis of the…

-

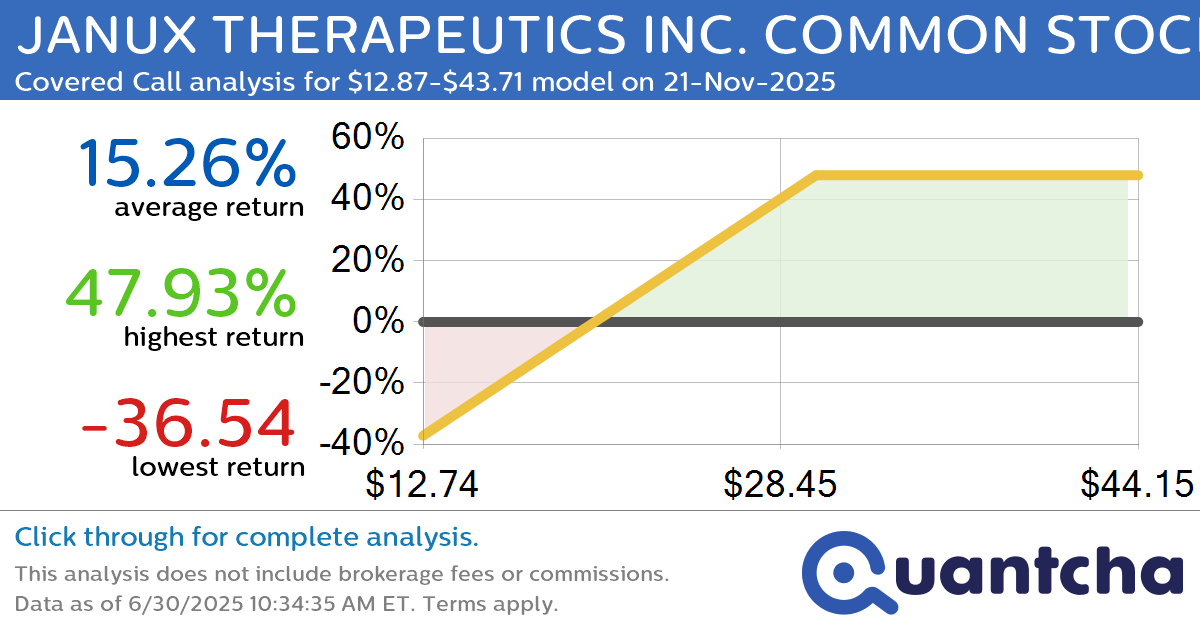

Covered Call Alert: JANUX THERAPEUTICS INC. COMMON STOCK $JANX returning up to 47.42% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for JANUX THERAPEUTICS INC. COMMON STOCK (JANX) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JANX was recently trading at $23.30 and has an implied volatility of 97.08% for this period. Based on an analysis…

-

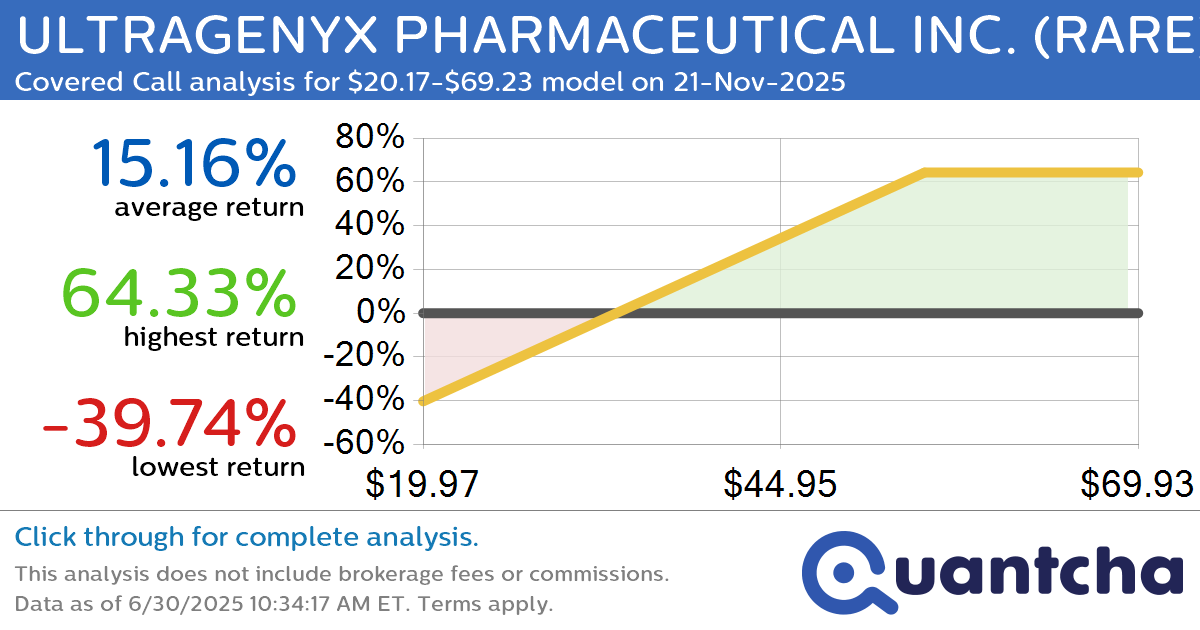

Covered Call Alert: ULTRAGENYX PHARMACEUTICAL INC. $RARE returning up to 65.26% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for ULTRAGENYX PHARMACEUTICAL INC. (RARE) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RARE was recently trading at $36.71 and has an implied volatility of 97.91% for this period. Based on an analysis of the…

-

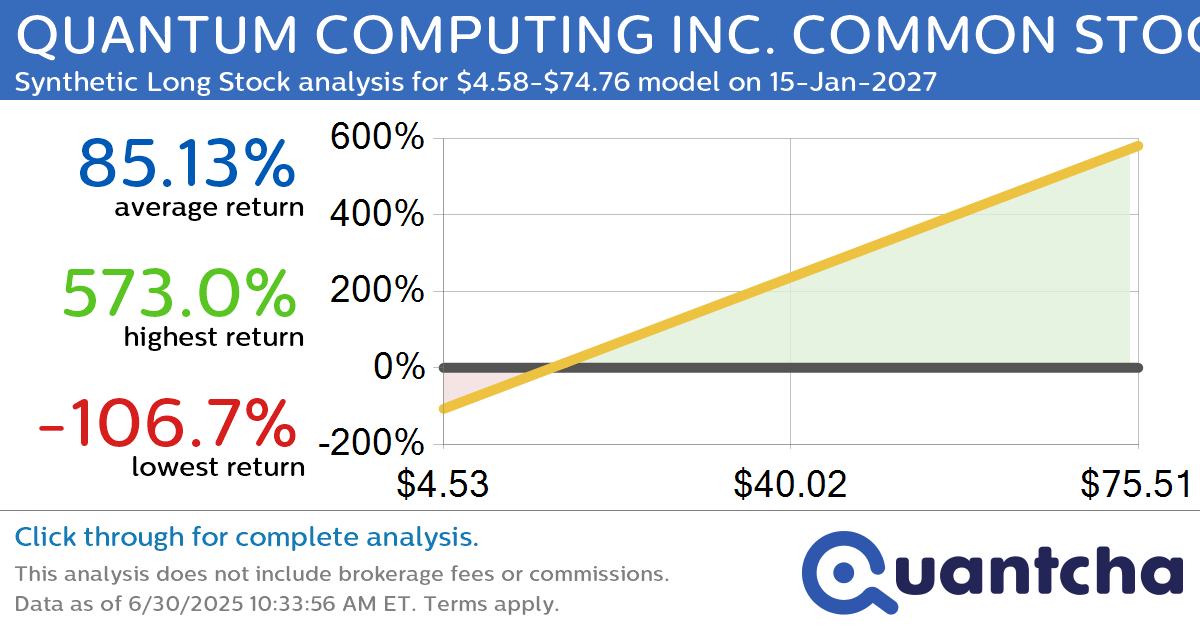

Synthetic Long Discount Alert: QUANTUM COMPUTING INC. COMMON STOCK $QUBT trading at a 10.29% discount for the 15-Jan-2027 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for QUANTUM COMPUTING INC. COMMON STOCK (QUBT) for the 15-Jan-2027 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. QUBT was recently trading at $17.39 and has an implied volatility of 112.21% for this period. Based on an…

-

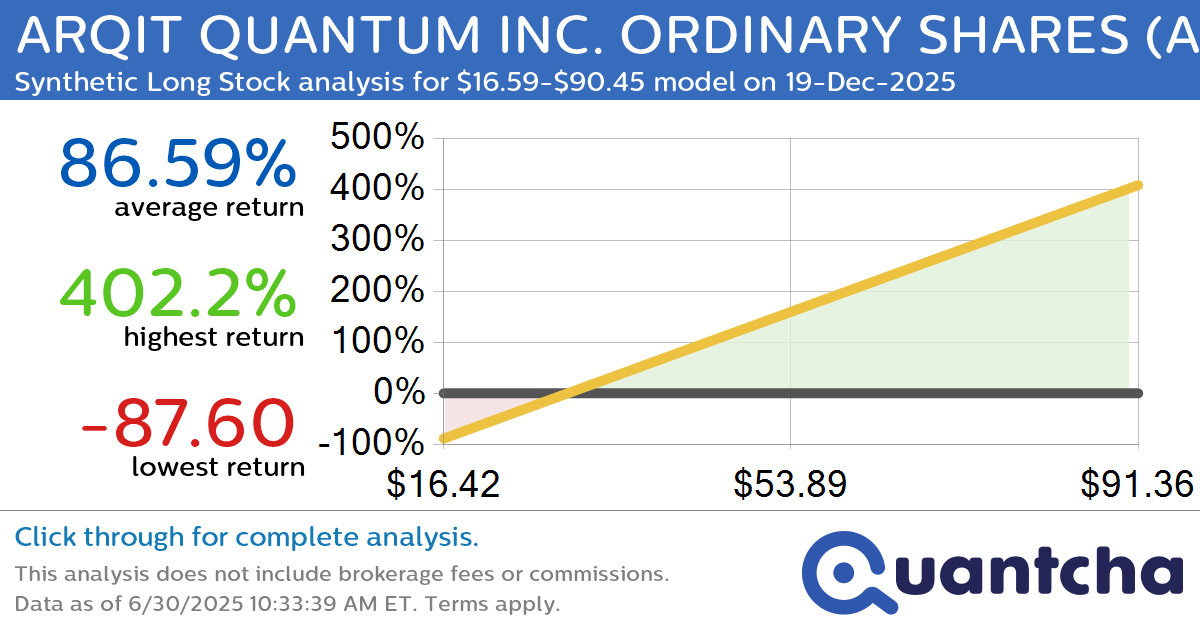

Synthetic Long Discount Alert: ARQIT QUANTUM INC. ORDINARY SHARES $ARQQ trading at a 21.41% discount for the 19-Dec-2025 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ARQIT QUANTUM INC. ORDINARY SHARES (ARQQ) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARQQ was recently trading at $37.92 and has an implied volatility of 123.29% for this period. Based on an…

-

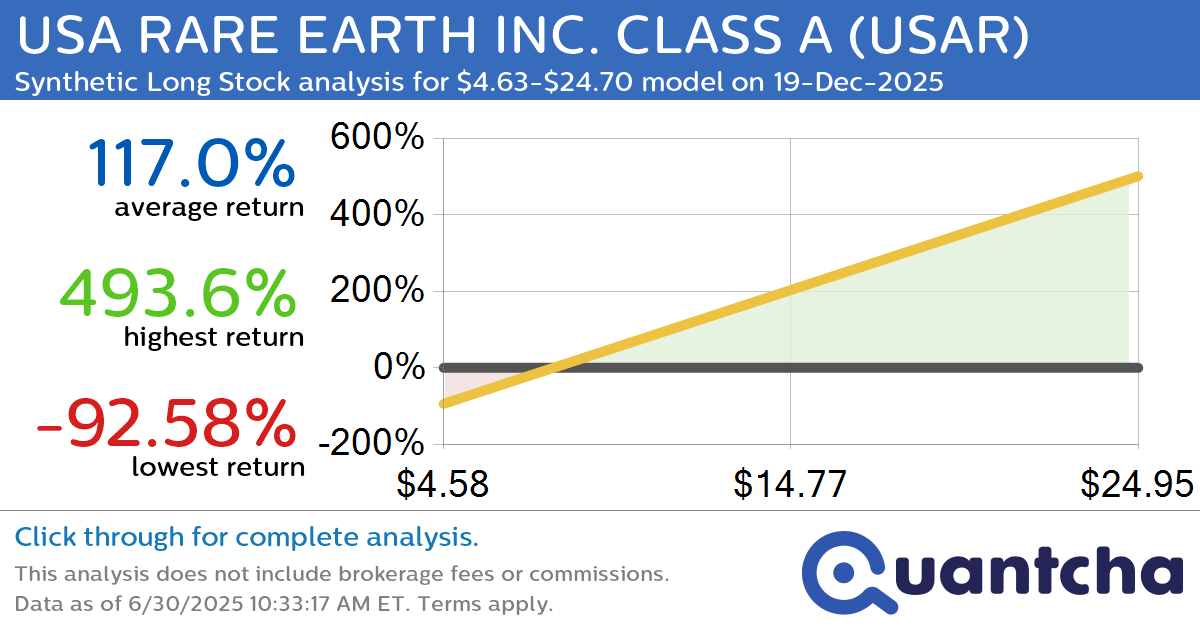

Synthetic Long Discount Alert: USA RARE EARTH INC. CLASS A $USAR trading at a 25.50% discount for the 19-Dec-2025 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for USA RARE EARTH INC. CLASS A (USAR) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. USAR was recently trading at $10.47 and has an implied volatility of 121.67% for this period. Based on…

-

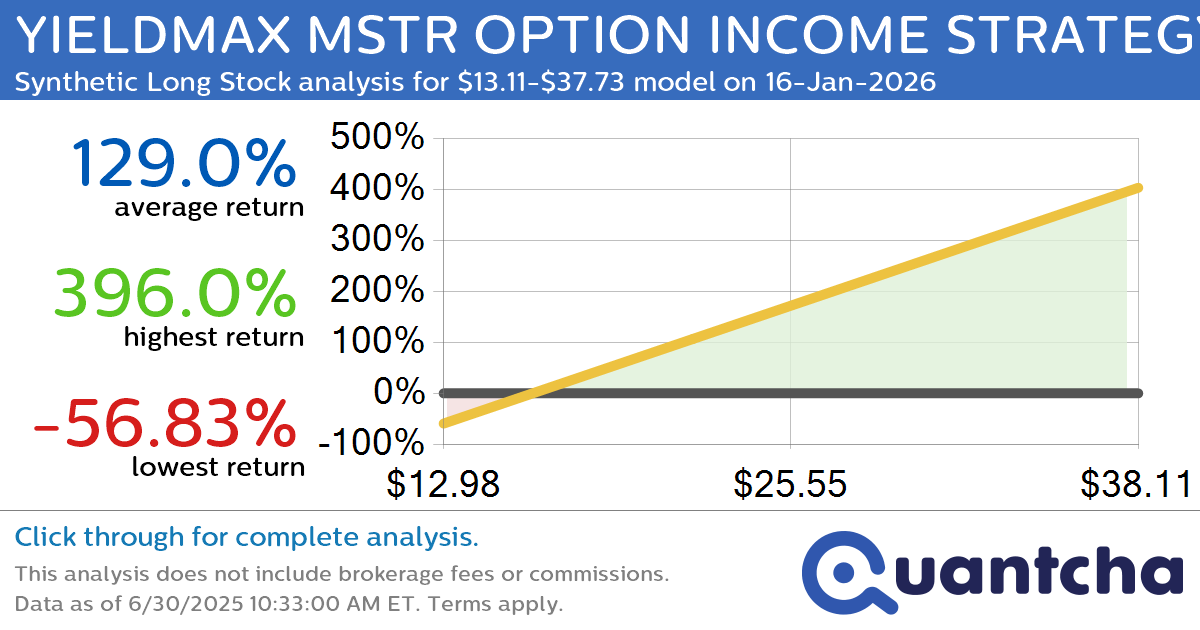

Synthetic Long Discount Alert: YIELDMAX MSTR OPTION INCOME STRATEGY ETF $MSTY trading at a 25.38% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for YIELDMAX MSTR OPTION INCOME STRATEGY ETF (MSTY) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MSTY was recently trading at $21.71 and has an implied volatility of 71.29% for this period. Based on…

-

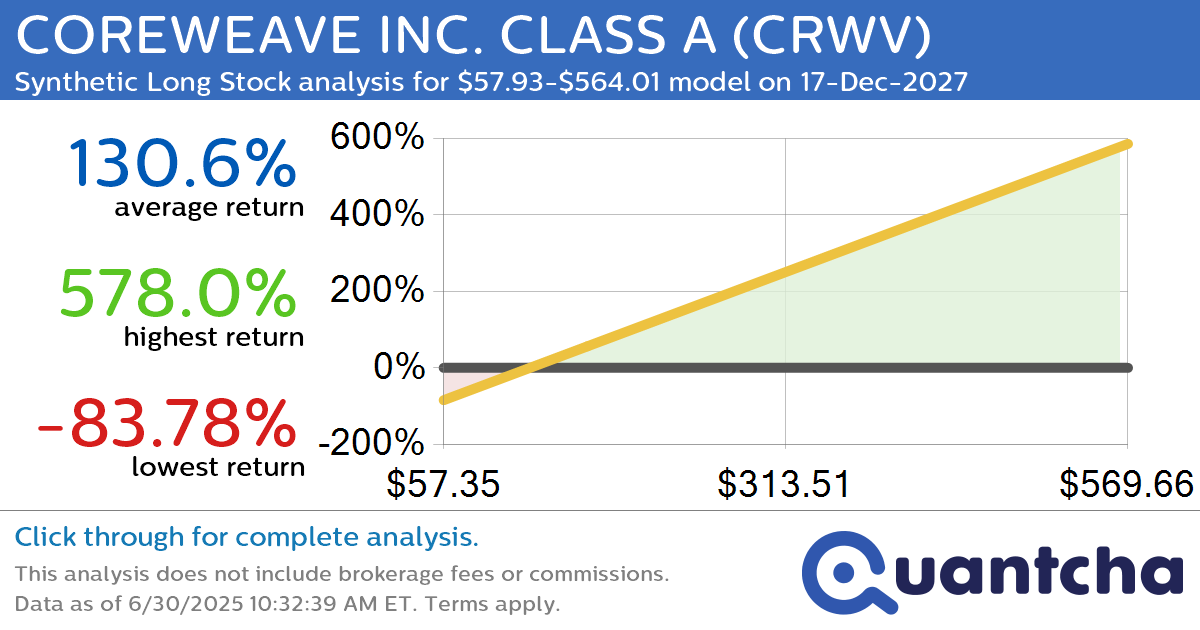

Synthetic Long Discount Alert: COREWEAVE INC. CLASS A $CRWV trading at a 25.41% discount for the 17-Dec-2027 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for COREWEAVE INC. CLASS A (CRWV) for the 17-Dec-2027 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRWV was recently trading at $163.56 and has an implied volatility of 72.44% for this period. Based on an analysis…