Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

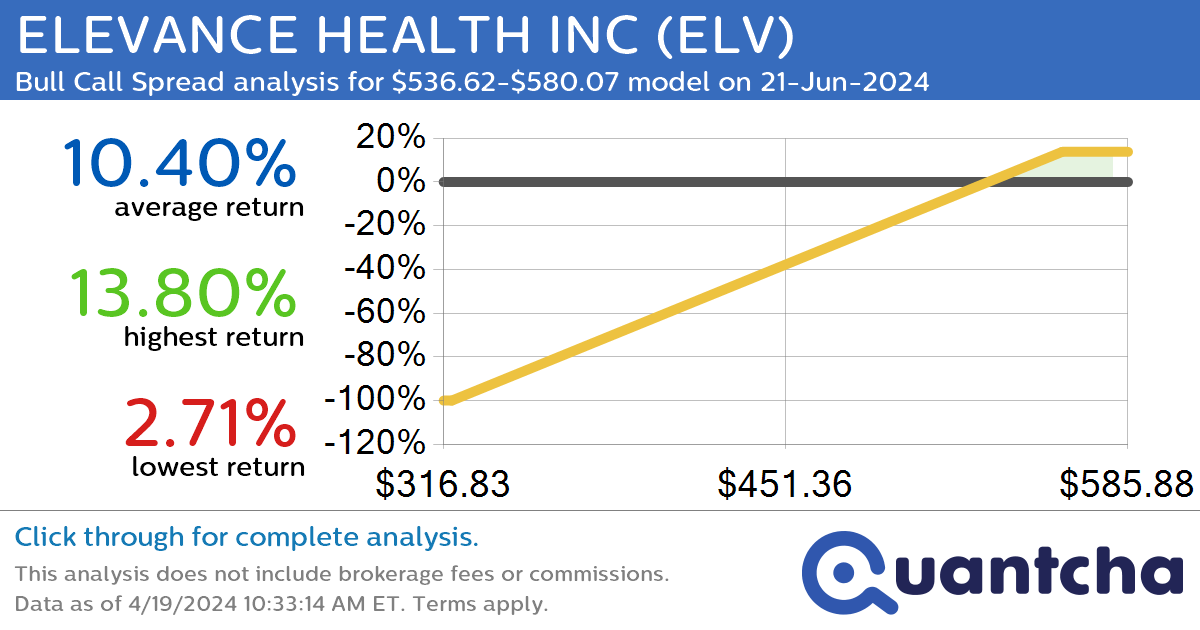

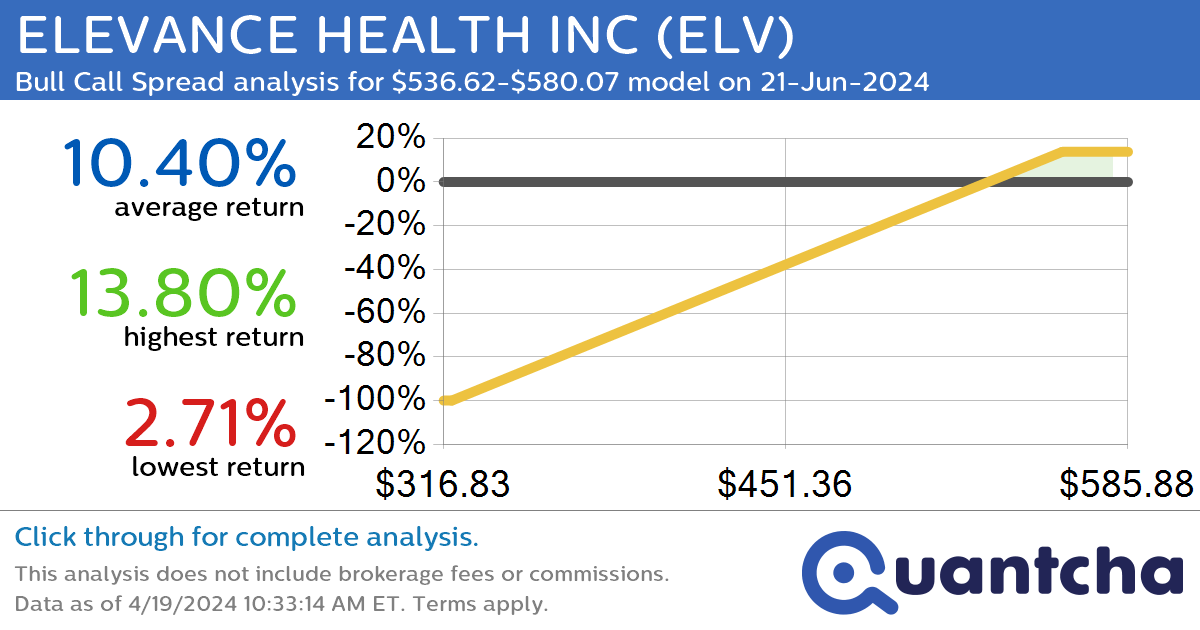

52-Week High Alert: Trading today’s movement in ELEVANCE HEALTH INC $ELV

Quantchabot has detected a new Bull Call Spread trade opportunity for ELEVANCE HEALTH INC (ELV) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ELV was recently trading at $531.36 and has an implied volatility of 18.64% for this period. Based on an analysis of…

-

Big Gainer Alert: Trading today’s 10.0% move in PARAMOUNT GLOBAL CLASS B COMMON STOCK $PARA

Quantchabot has detected a new Bull Call Spread trade opportunity for PARAMOUNT GLOBAL CLASS B COMMON STOCK (PARA) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PARA was recently trading at $12.07 and has an implied volatility of 71.90% for this period. Based on…

-

52-Week High Alert: Trading today’s movement in PROGRESSIVE $PGR

Quantchabot has detected a new Bull Call Spread trade opportunity for PROGRESSIVE (PGR) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PGR was recently trading at $212.75 and has an implied volatility of 23.14% for this period. Based on an analysis of the options…

-

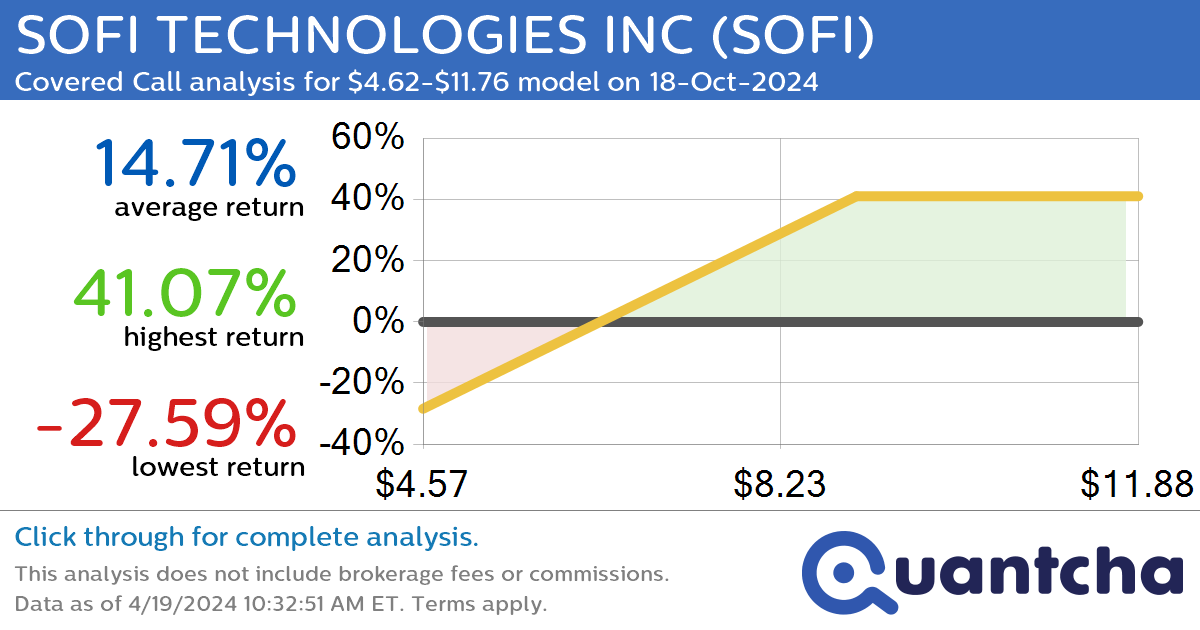

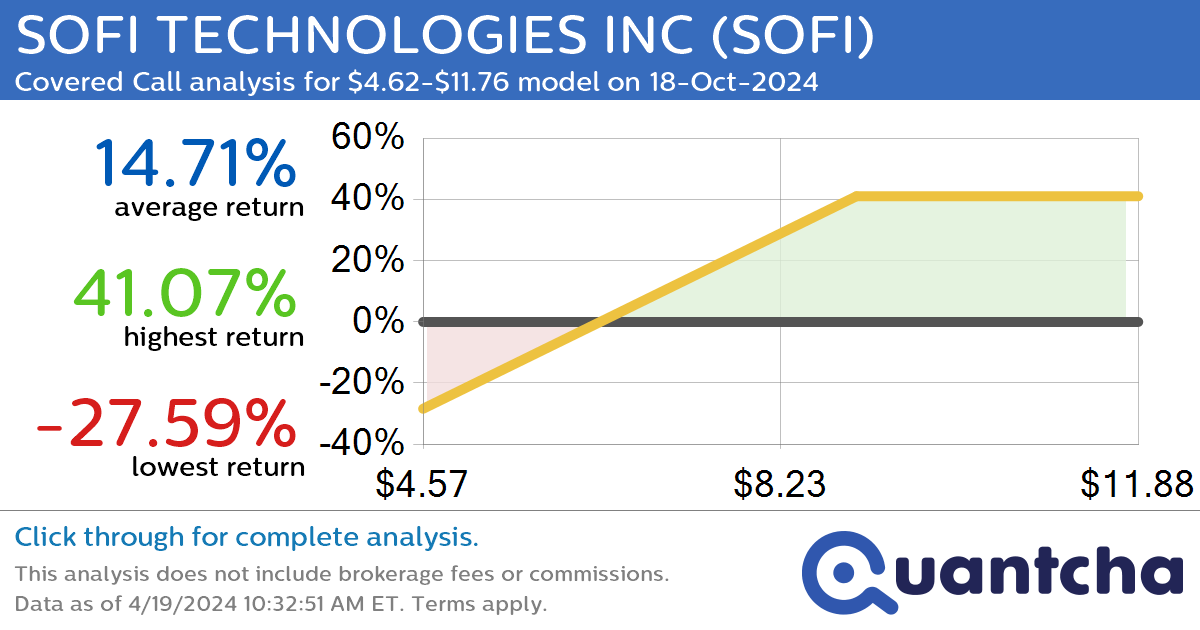

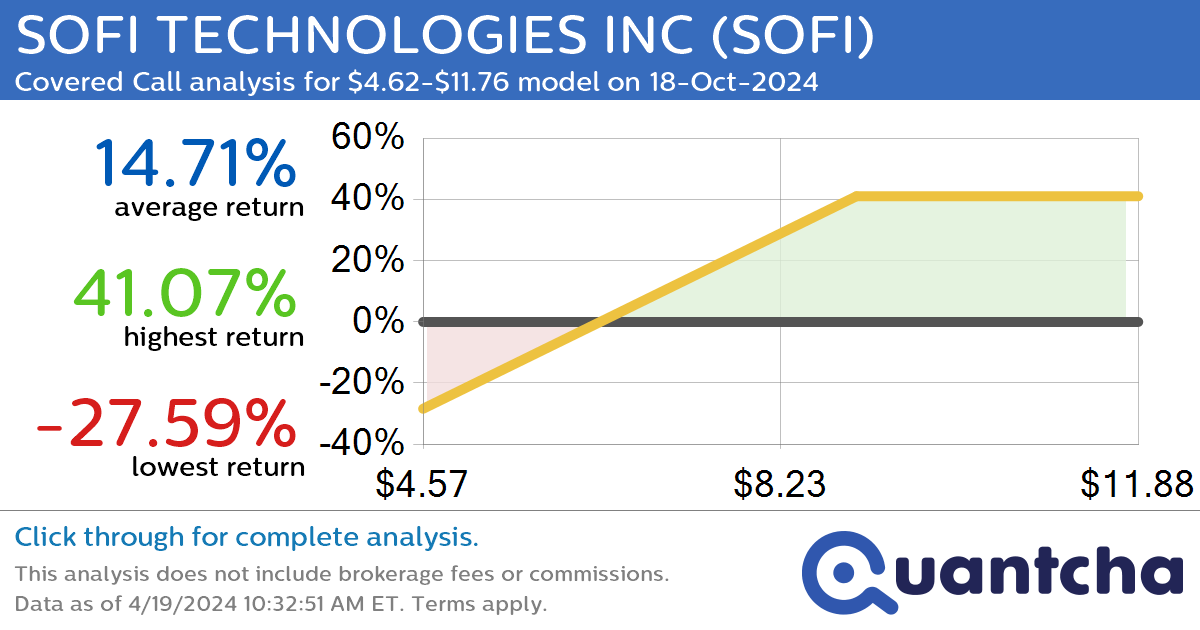

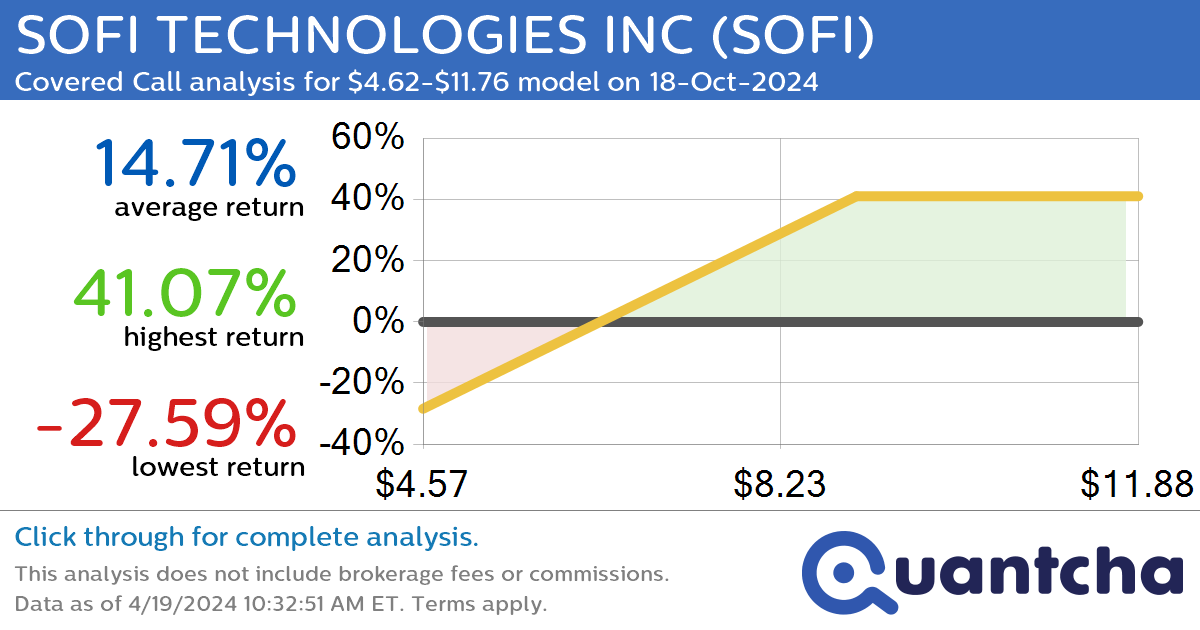

Covered Call Alert: SOFI TECHNOLOGIES INC $SOFI returning up to 41.07% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for SOFI TECHNOLOGIES INC (SOFI) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SOFI was recently trading at $7.17 and has an implied volatility of 66.05% for this period. Based on an analysis of the…

-

Synthetic Long Discount Alert: BEYOND MEAT INC. COMMON STOCK $BYND trading at a 28.12% discount for the 19-Dec-2025 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for BEYOND MEAT INC. COMMON STOCK (BYND) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BYND was recently trading at $6.33 and has an implied volatility of 114.57% for this period. Based on an…

-

Big Loser Alert: Trading today’s -12.3% move in SUPER MICRO COMPUTER $SMCI

Quantchabot has detected a new Bear Call Spread trade opportunity for SUPER MICRO COMPUTER (SMCI) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMCI was recently trading at $814.00 and has an implied volatility of 80.00% for this period. Based on an analysis of…

-

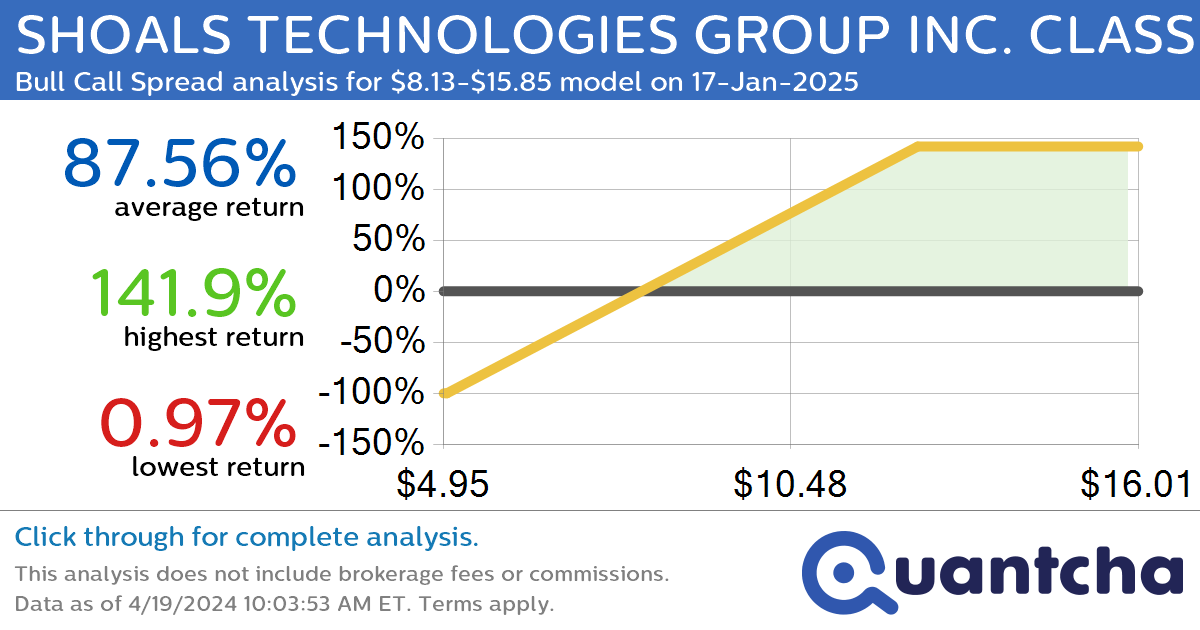

StockTwits Trending Alert: Trading recent interest in SHOALS TECHNOLOGIES GROUP INC. CLASS A $SHLS

Quantchabot has detected a new Bull Call Spread trade opportunity for SHOALS TECHNOLOGIES GROUP INC. CLASS A (SHLS) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SHLS was recently trading at $8.13 and has an implied volatility of 72.30% for this period. Based on…

-

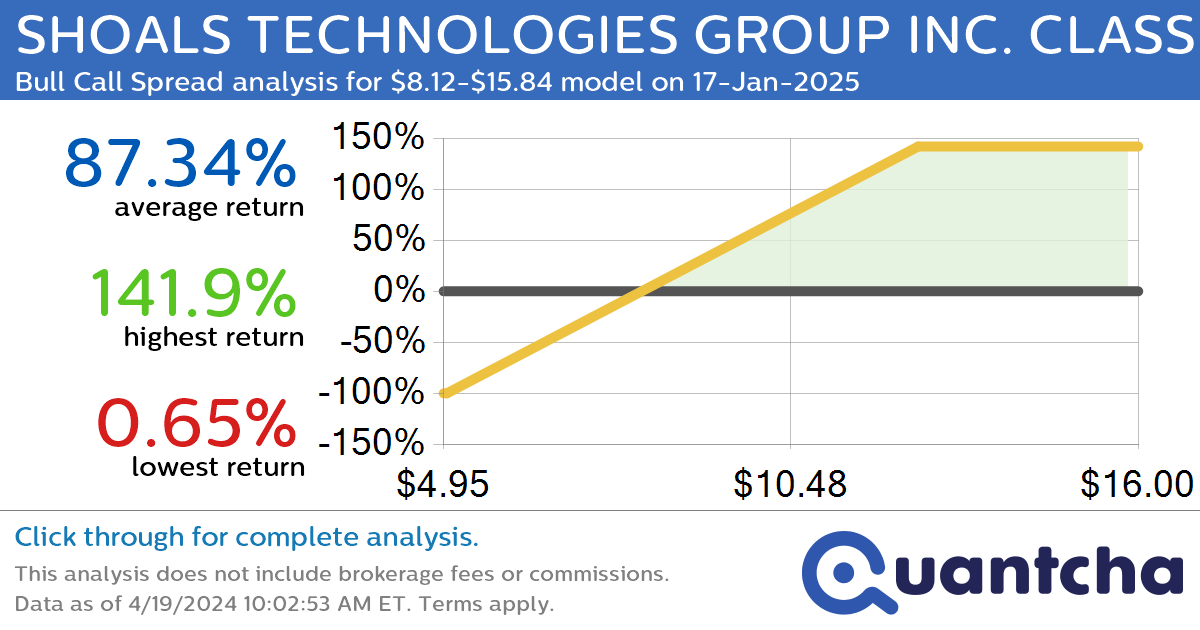

StockTwits Trending Alert: Trading recent interest in SHOALS TECHNOLOGIES GROUP INC. CLASS A $SHLS

Quantchabot has detected a new Bull Call Spread trade opportunity for SHOALS TECHNOLOGIES GROUP INC. CLASS A (SHLS) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SHLS was recently trading at $8.12 and has an implied volatility of 72.33% for this period. Based on…

-

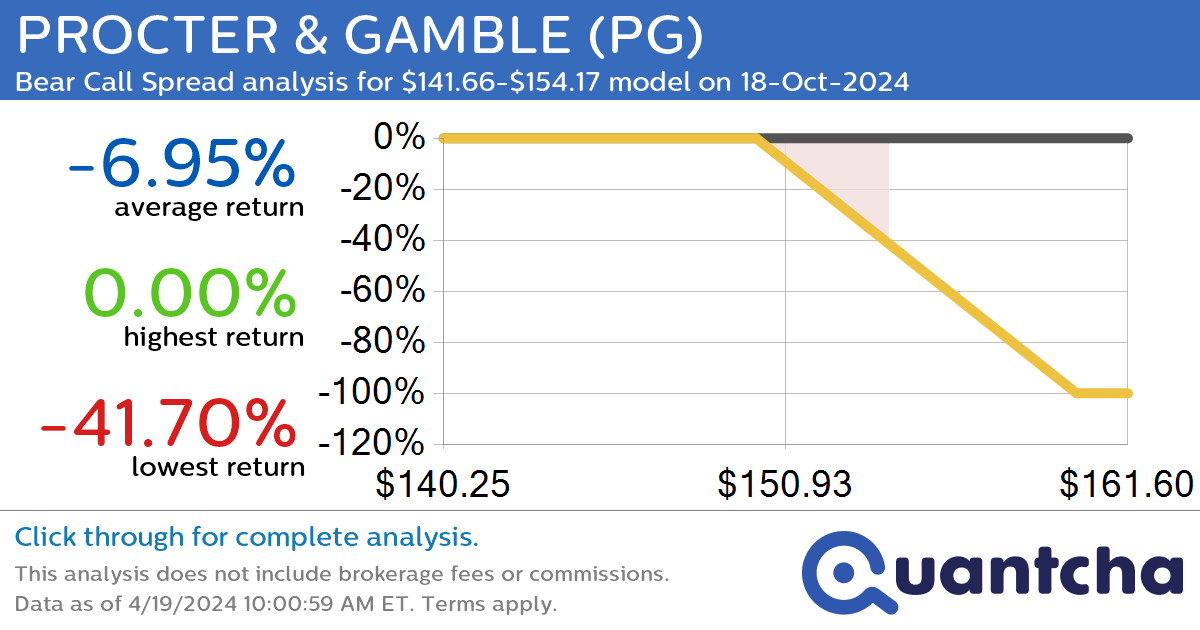

StockTwits Trending Alert: Trading recent interest in PROCTER & GAMBLE $PG

Quantchabot has detected a new Bear Call Spread trade opportunity for PROCTER & GAMBLE (PG) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PG was recently trading at $154.17 and has an implied volatility of 15.88% for this period. Based on an analysis of…

-

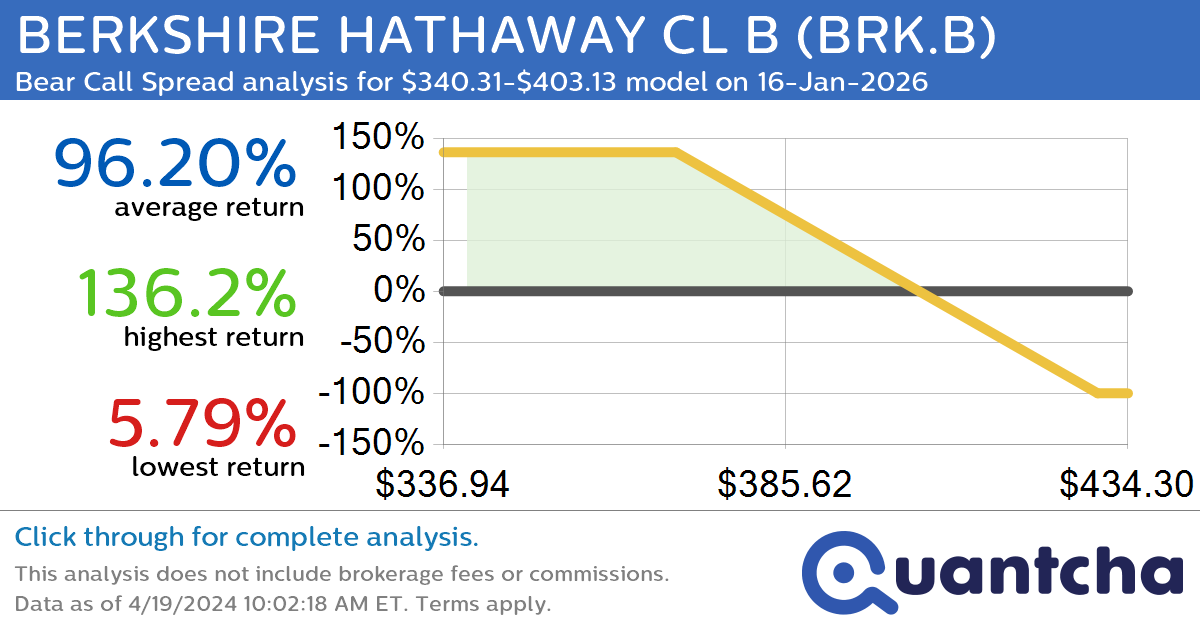

StockTwits Trending Alert: Trading recent interest in BERKSHIRE HATHAWAY CL B $BRK.B

Quantchabot has detected a new Bear Call Spread trade opportunity for BERKSHIRE HATHAWAY CL B (BRK.B) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BRK.B was recently trading at $403.25 and has an implied volatility of 19.87% for this period. Based on an analysis…