Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

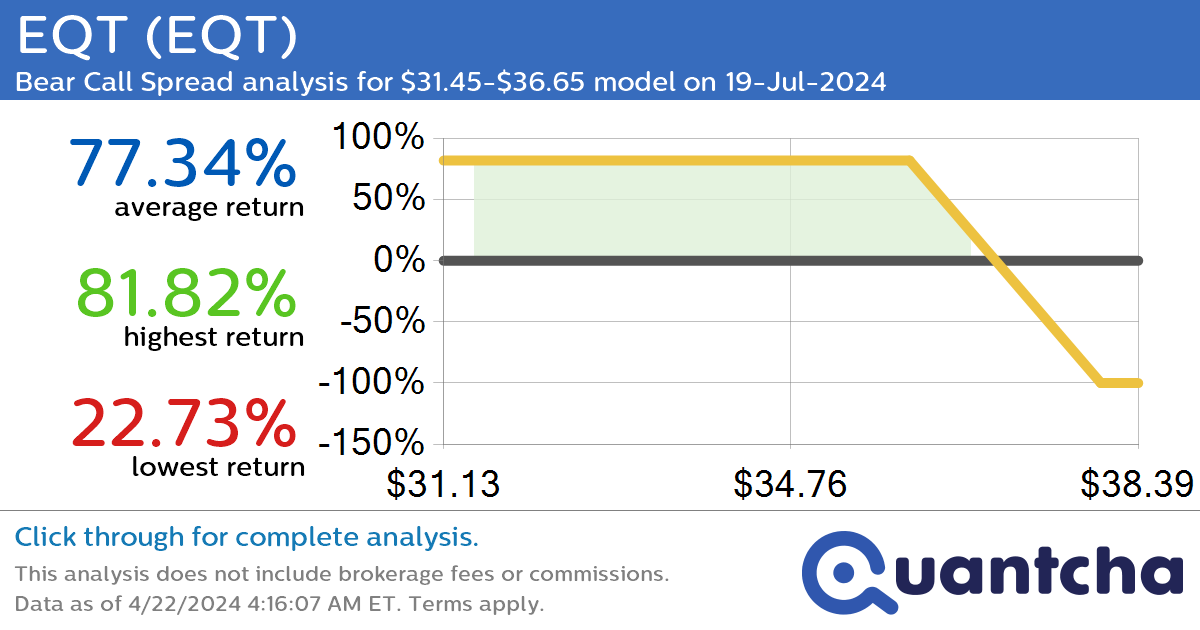

StockTwits Trending Alert: Trading recent interest in EQT $EQT

Quantchabot has detected a new Bear Call Spread trade opportunity for EQT (EQT) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EQT was recently trading at $36.65 and has an implied volatility of 32.87% for this period. Based on an analysis of the options…

-

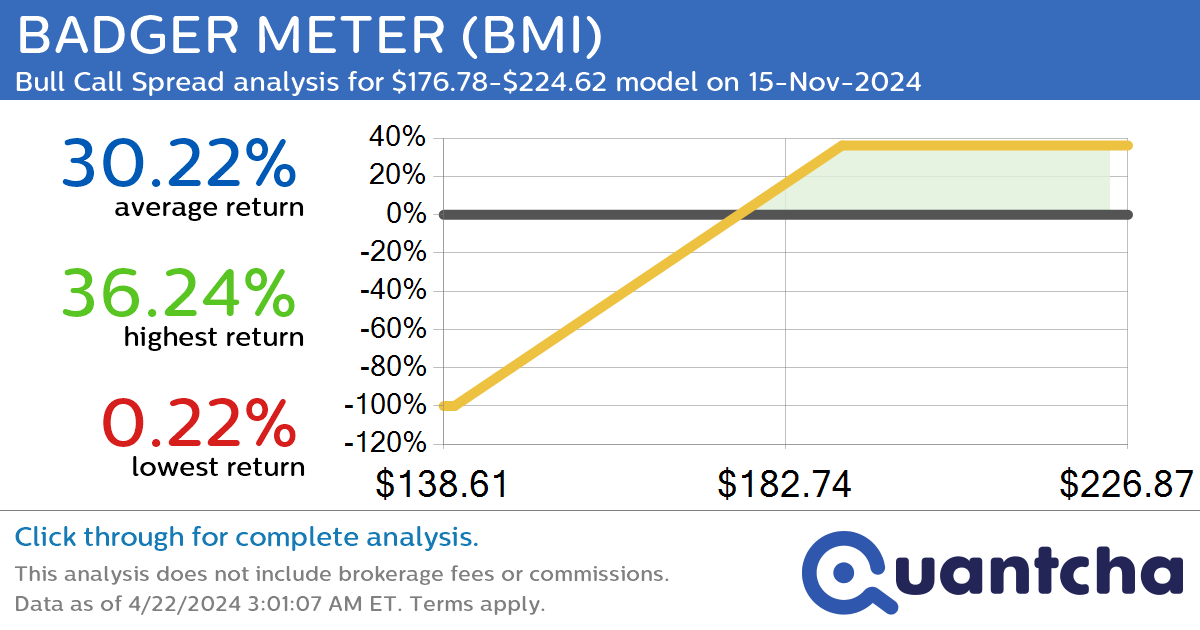

StockTwits Trending Alert: Trading recent interest in BADGER METER $BMI

Quantchabot has detected a new Bull Call Spread trade opportunity for BADGER METER (BMI) for the 15-Nov-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BMI was recently trading at $176.78 and has an implied volatility of 27.54% for this period. Based on an analysis of the…

-

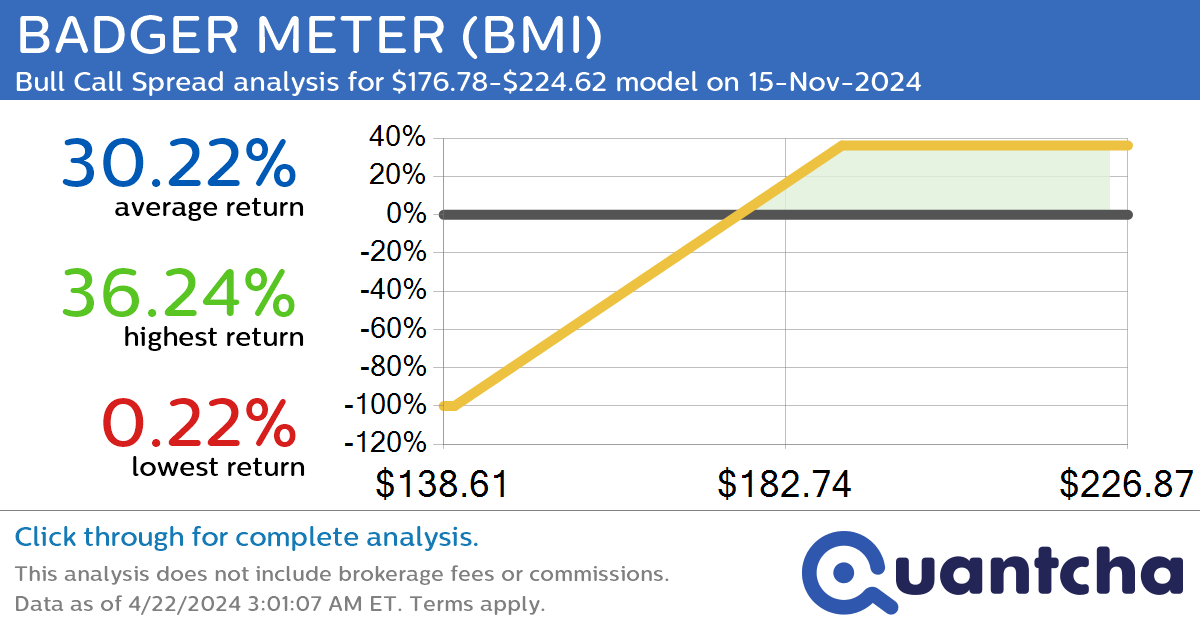

StockTwits Trending Alert: Trading recent interest in BADGER METER $BMI

Quantchabot has detected a new Bull Call Spread trade opportunity for BADGER METER (BMI) for the 15-Nov-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BMI was recently trading at $176.78 and has an implied volatility of 27.54% for this period. Based on an analysis of the…

-

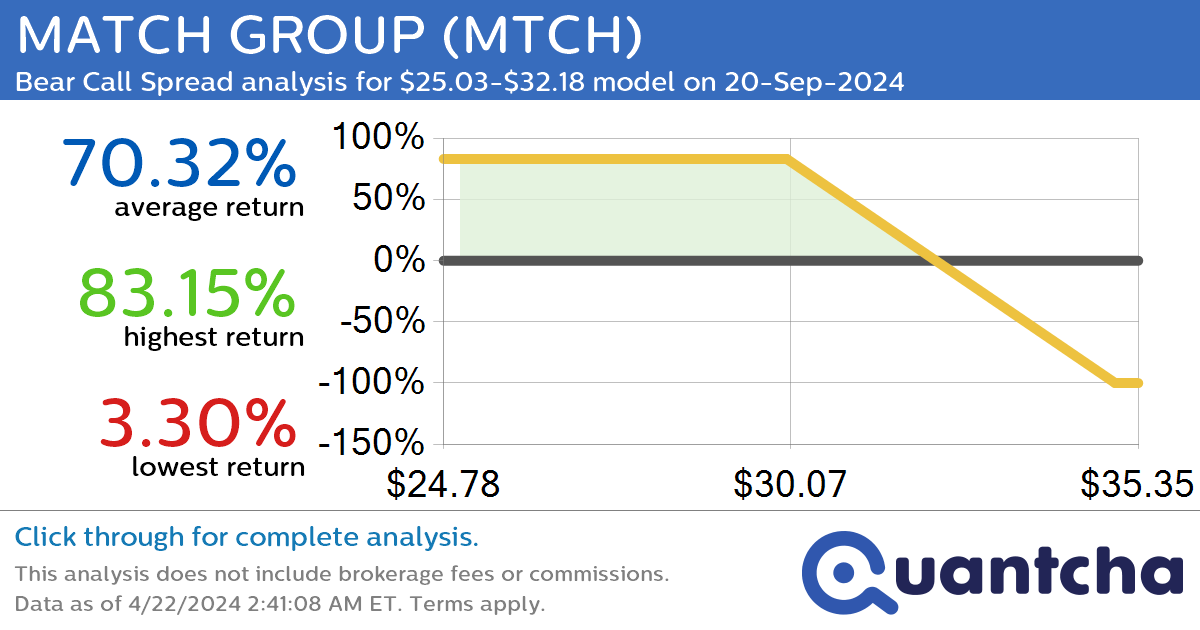

StockTwits Trending Alert: Trading recent interest in MATCH GROUP $MTCH

Quantchabot has detected a new Bear Call Spread trade opportunity for MATCH GROUP (MTCH) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MTCH was recently trading at $32.18 and has an implied volatility of 42.56% for this period. Based on an analysis of the…

-

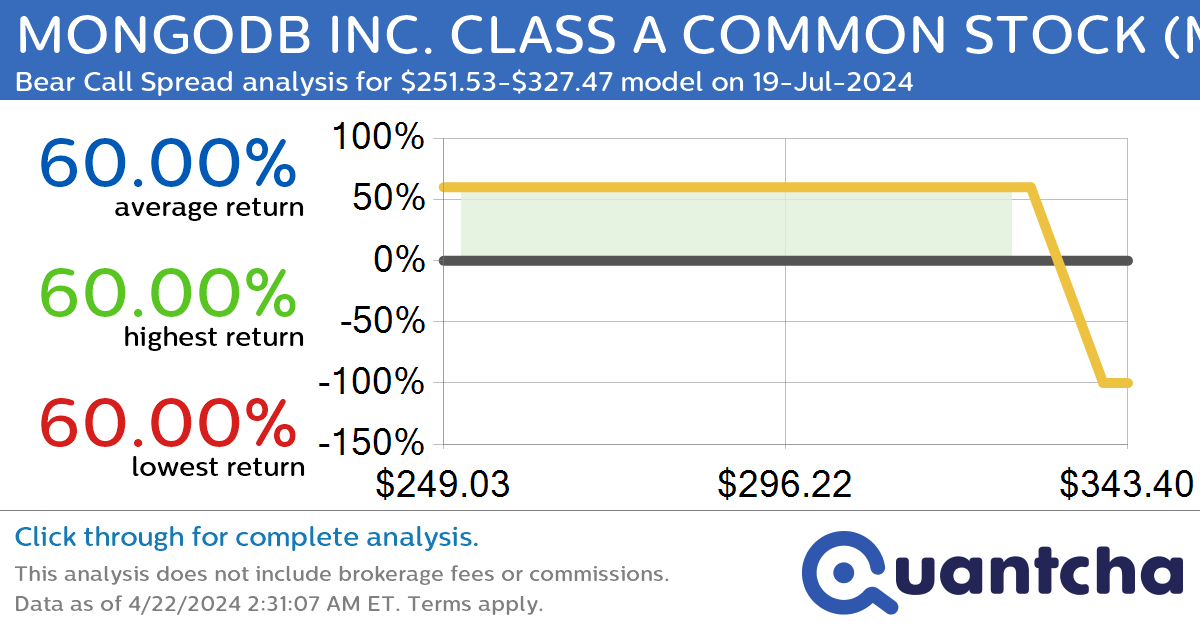

StockTwits Trending Alert: Trading recent interest in MONGODB INC. CLASS A COMMON STOCK $MDB

Quantchabot has detected a new Bear Call Spread trade opportunity for MONGODB INC. CLASS A COMMON STOCK (MDB) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MDB was recently trading at $327.47 and has an implied volatility of 56.20% for this period. Based on…

-

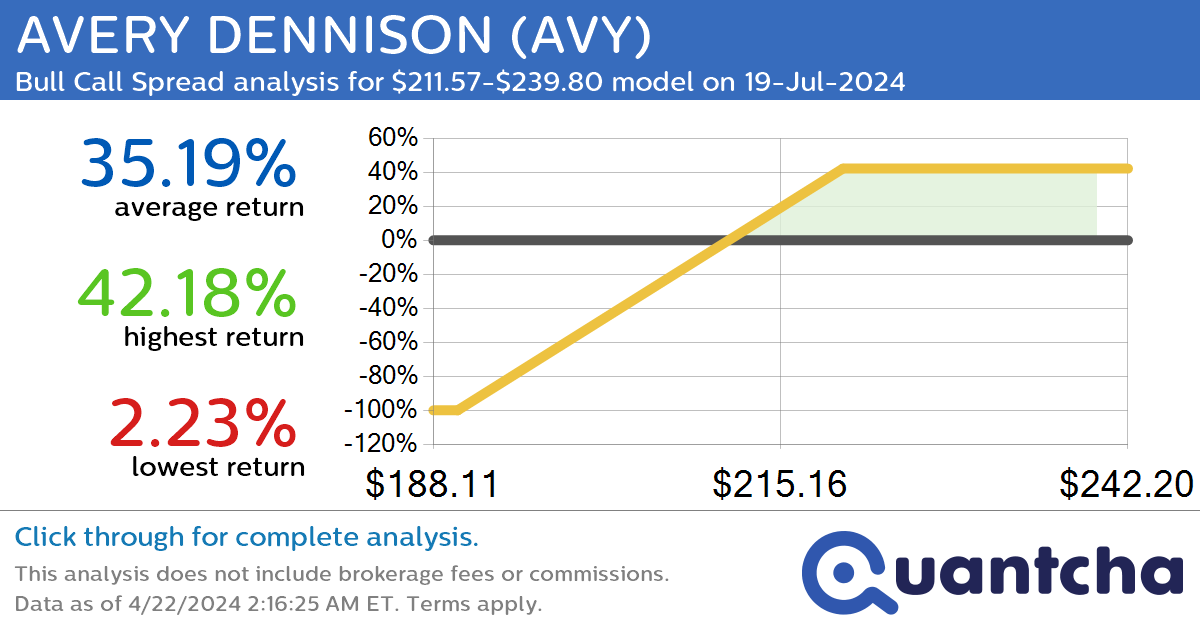

StockTwits Trending Alert: Trading recent interest in AVERY DENNISON $AVY

Quantchabot has detected a new Bull Call Spread trade opportunity for AVERY DENNISON (AVY) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AVY was recently trading at $211.57 and has an implied volatility of 22.57% for this period. Based on an analysis of the…

-

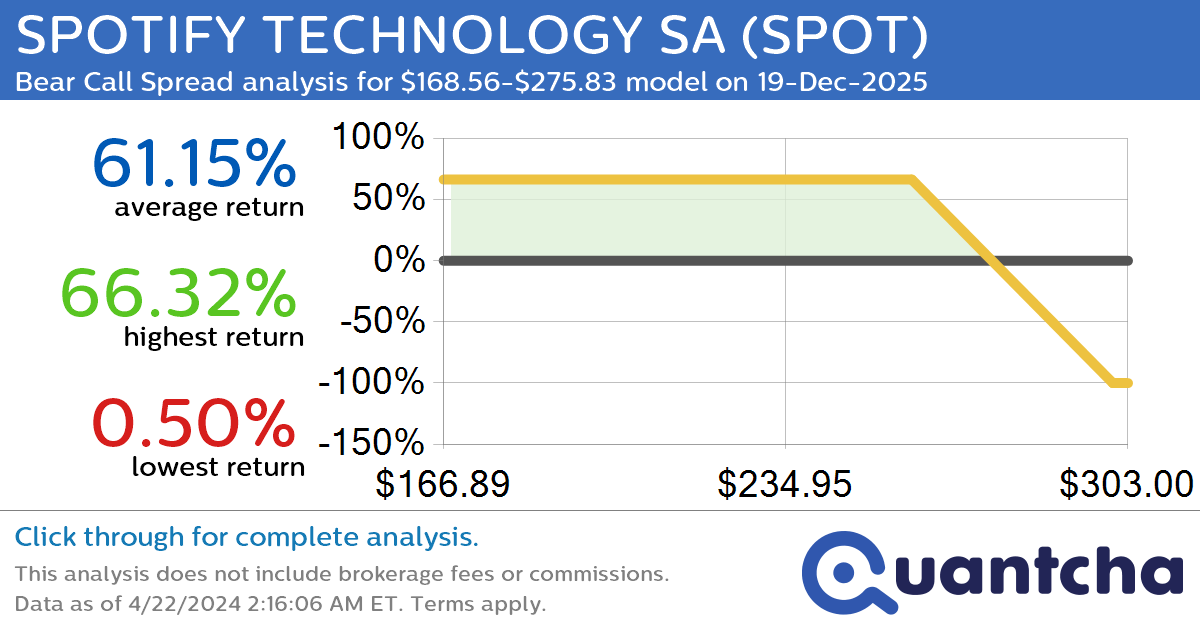

StockTwits Trending Alert: Trading recent interest in SPOTIFY TECHNOLOGY SA $SPOT

Quantchabot has detected a new Bear Call Spread trade opportunity for SPOTIFY TECHNOLOGY SA (SPOT) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SPOT was recently trading at $275.83 and has an implied volatility of 45.03% for this period. Based on an analysis of…

-

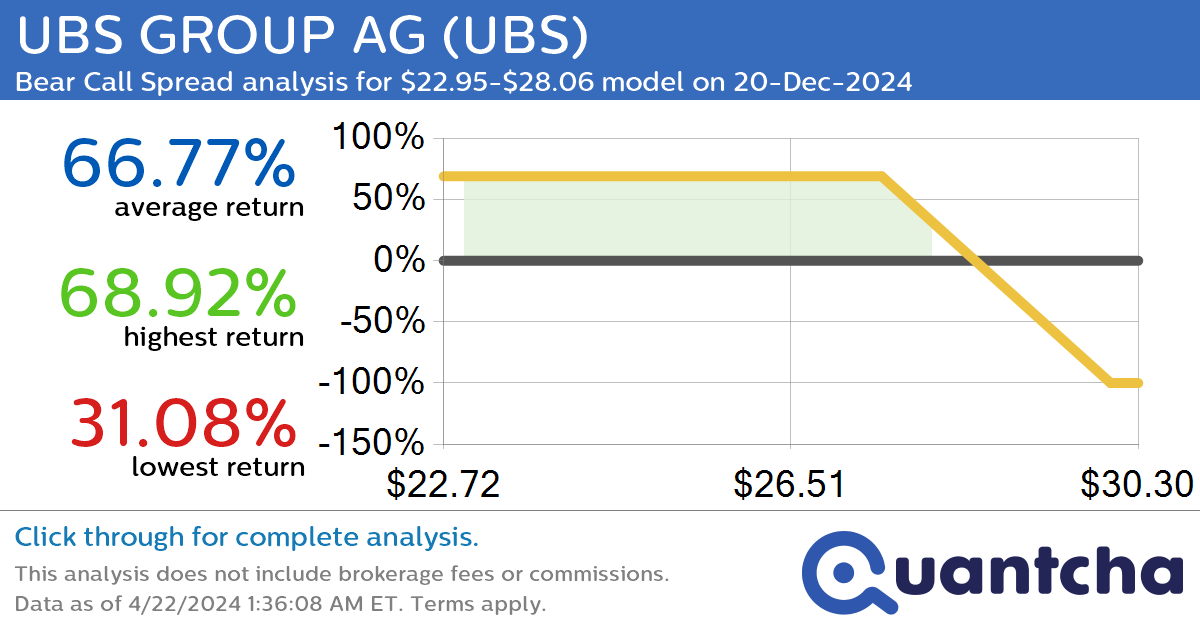

StockTwits Trending Alert: Trading recent interest in UBS GROUP AG $UBS

Quantchabot has detected a new Bear Call Spread trade opportunity for UBS GROUP AG (UBS) for the 20-Dec-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UBS was recently trading at $28.06 and has an implied volatility of 28.14% for this period. Based on an analysis of…

-

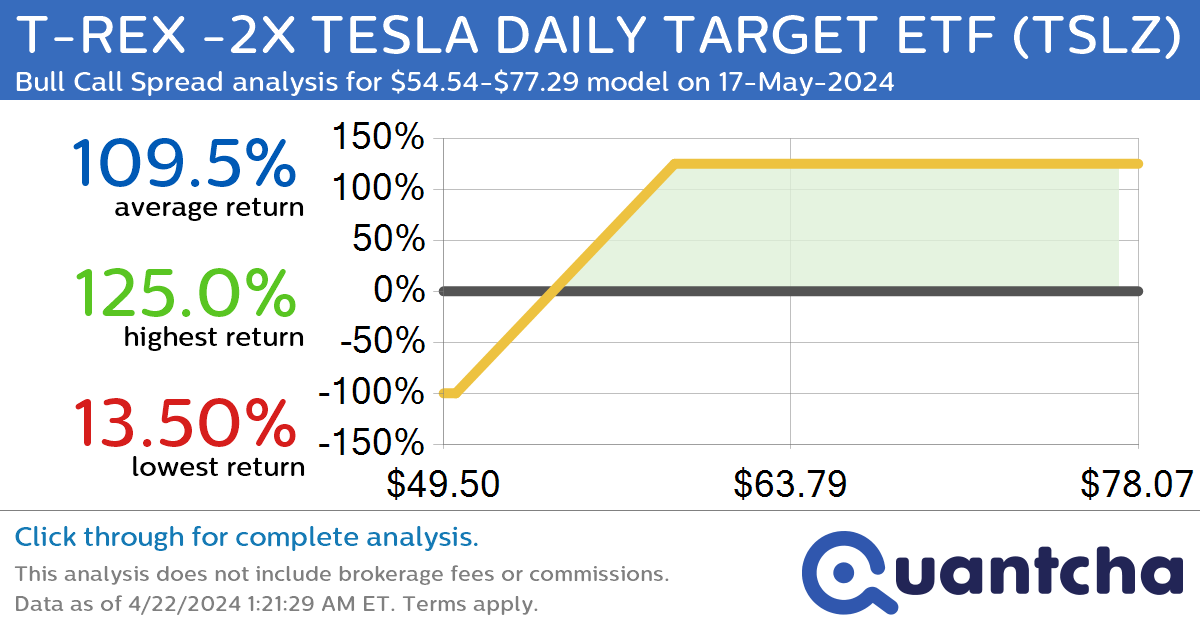

StockTwits Trending Alert: Trading recent interest in T-REX -2X TESLA DAILY TARGET ETF $TSLZ

Quantchabot has detected a new Bull Call Spread trade opportunity for T-REX -2X TESLA DAILY TARGET ETF (TSLZ) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TSLZ was recently trading at $54.54 and has an implied volatility of 128.83% for this period. Based on…

-

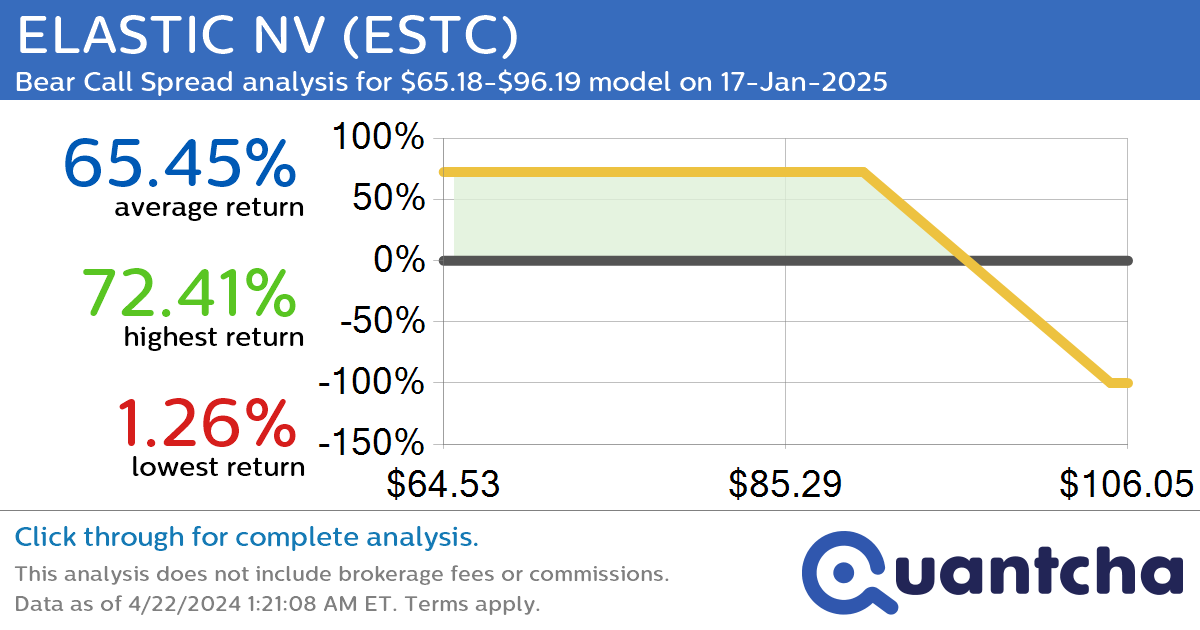

StockTwits Trending Alert: Trading recent interest in ELASTIC NV $ESTC

Quantchabot has detected a new Bear Call Spread trade opportunity for ELASTIC NV (ESTC) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ESTC was recently trading at $96.19 and has an implied volatility of 49.93% for this period. Based on an analysis of the…