Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

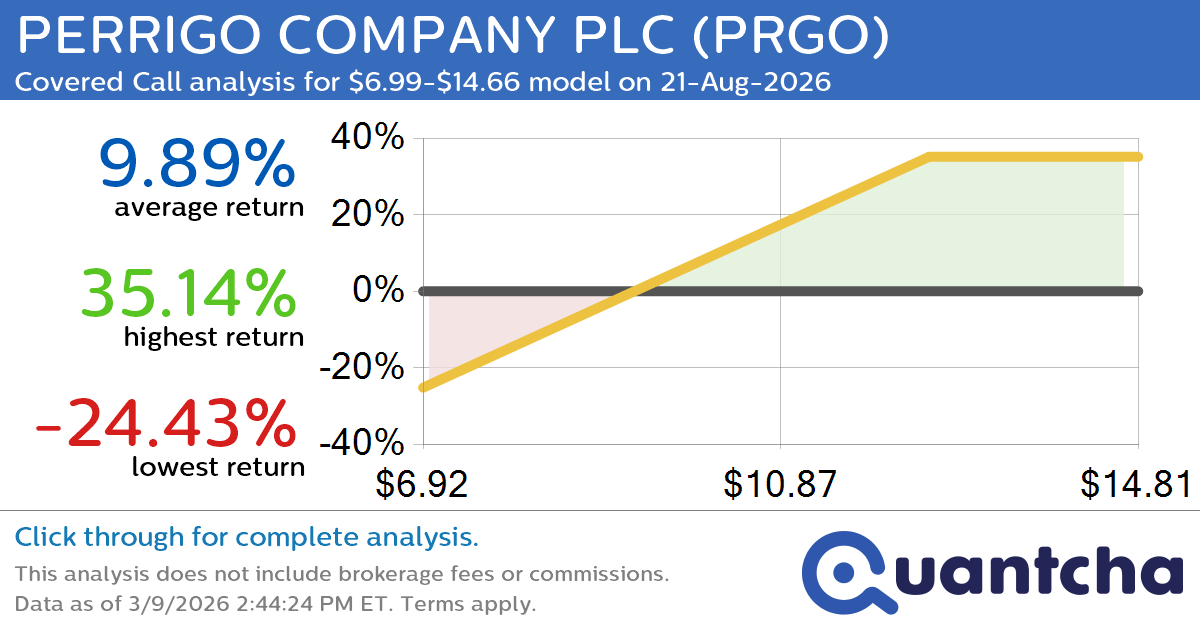

Covered Call Alert: PERRIGO COMPANY PLC $PRGO returning up to 35.14% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for PERRIGO COMPANY PLC (PRGO) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PRGO was recently trading at $9.95 and has an implied volatility of 54.99% for this period. Based on an analysis of the…

-

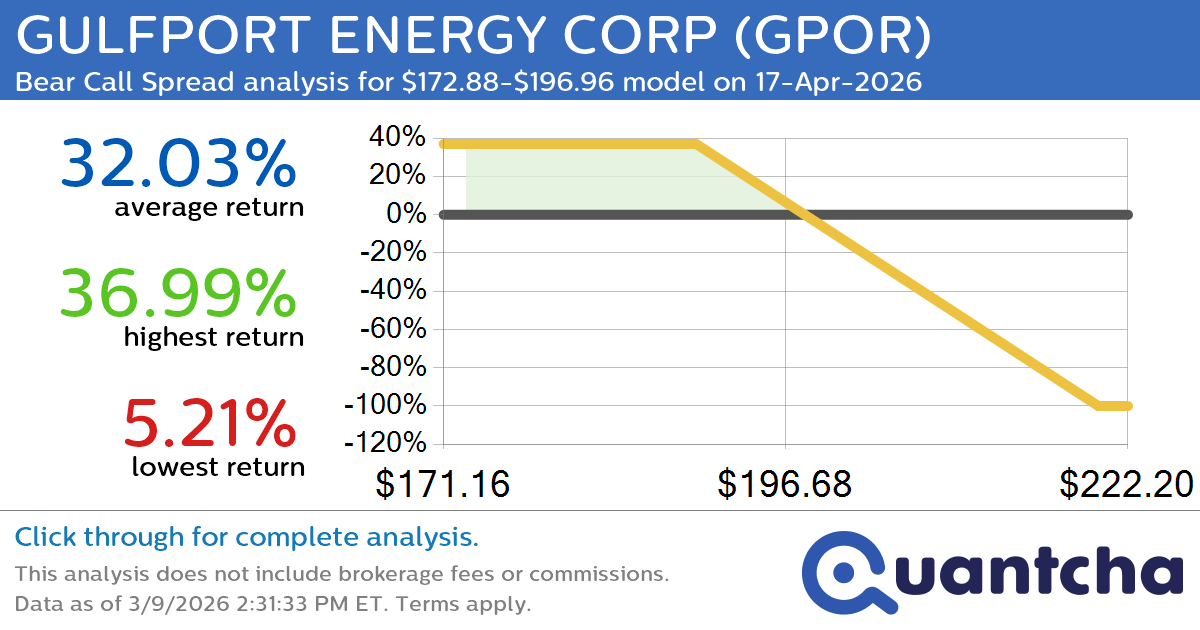

Big Loser Alert: Trading today’s -7.2% move in GULFPORT ENERGY CORP $GPOR

Quantchabot has detected a new Bear Call Spread trade opportunity for GULFPORT ENERGY CORP (GPOR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GPOR was recently trading at $196.15 and has an implied volatility of 39.62% for this period. Based on an analysis of…

-

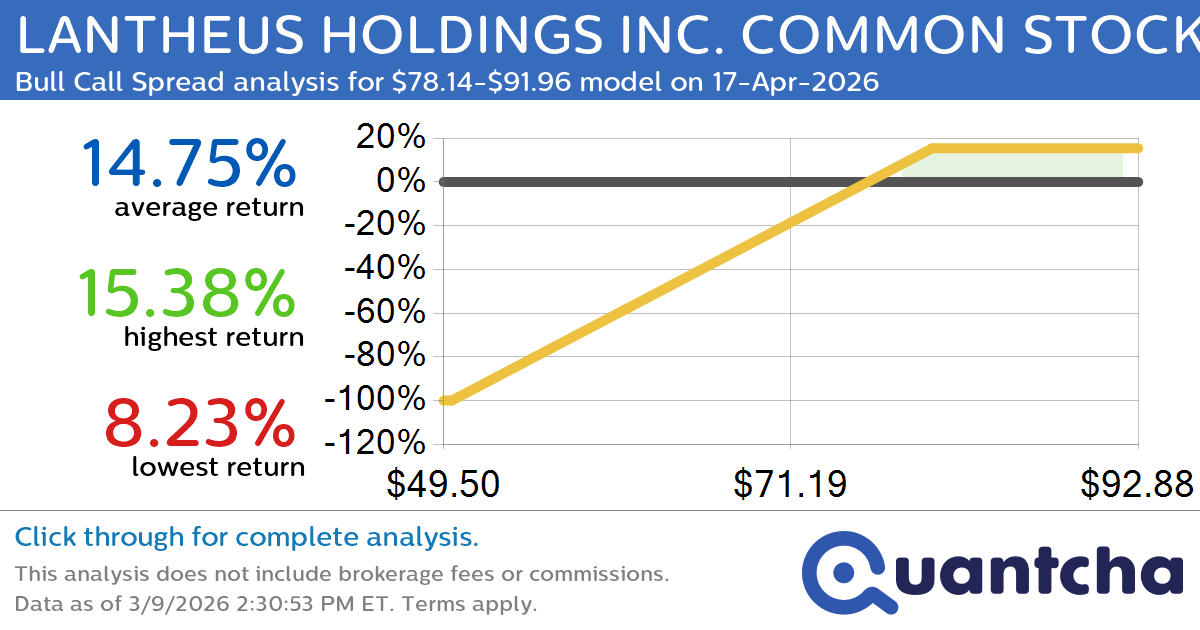

Big Gainer Alert: Trading today’s 7.2% move in LANTHEUS HOLDINGS INC. COMMON STOCK $LNTH

Quantchabot has detected a new Bull Call Spread trade opportunity for LANTHEUS HOLDINGS INC. COMMON STOCK (LNTH) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LNTH was recently trading at $77.82 and has an implied volatility of 49.44% for this period. Based on an…

-

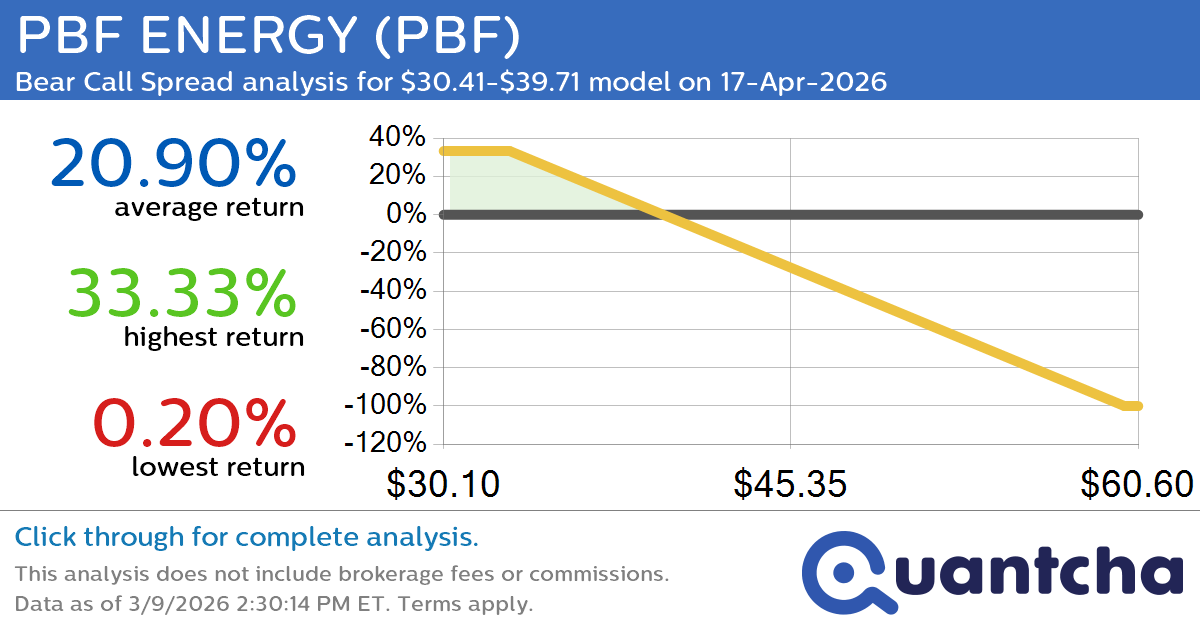

Big Loser Alert: Trading today’s -8.6% move in PBF ENERGY $PBF

Quantchabot has detected a new Bear Call Spread trade opportunity for PBF ENERGY (PBF) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PBF was recently trading at $39.55 and has an implied volatility of 81.12% for this period. Based on an analysis of the…

-

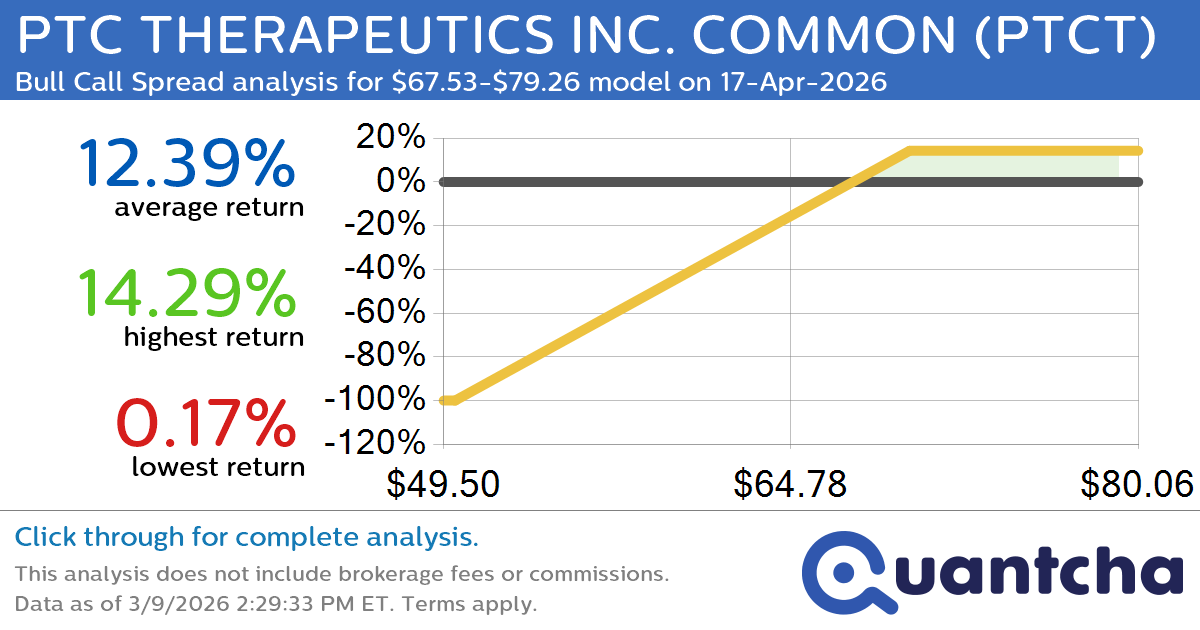

Big Gainer Alert: Trading today’s 7.1% move in PTC THERAPEUTICS INC. COMMON $PTCT

Quantchabot has detected a new Bull Call Spread trade opportunity for PTC THERAPEUTICS INC. COMMON (PTCT) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PTCT was recently trading at $67.25 and has an implied volatility of 48.66% for this period. Based on an analysis…

-

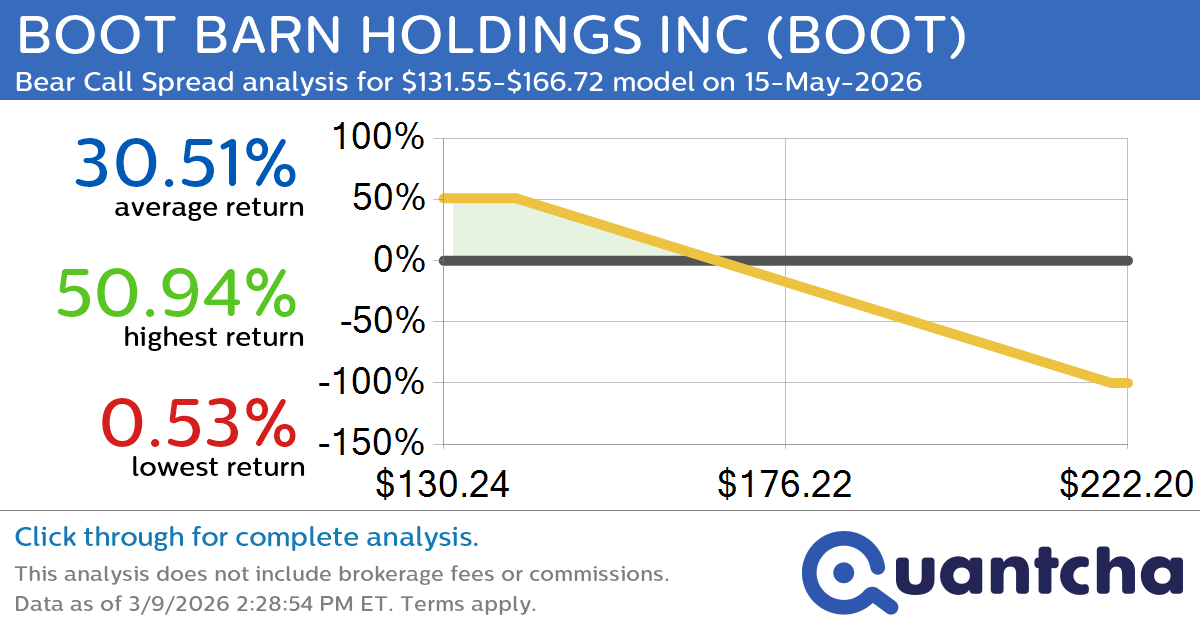

Big Loser Alert: Trading today’s -7.1% move in BOOT BARN HOLDINGS INC $BOOT

Quantchabot has detected a new Bear Call Spread trade opportunity for BOOT BARN HOLDINGS INC (BOOT) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BOOT was recently trading at $165.54 and has an implied volatility of 55.06% for this period. Based on an analysis…

-

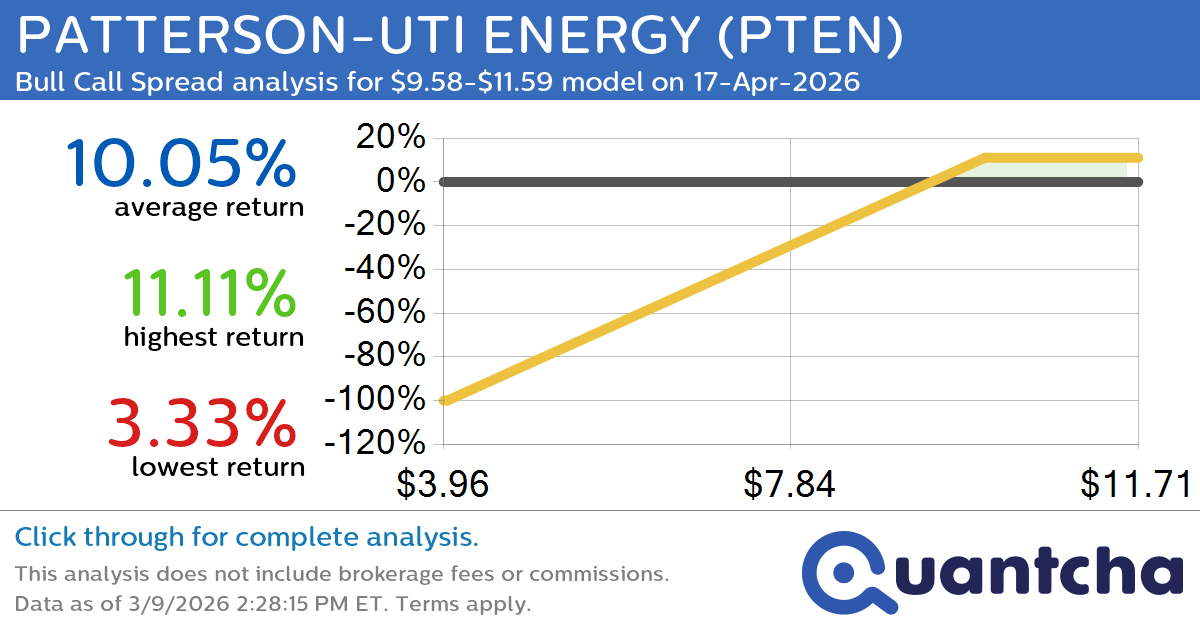

52-Week High Alert: Trading today’s movement in PATTERSON-UTI ENERGY $PTEN

Quantchabot has detected a new Bull Call Spread trade opportunity for PATTERSON-UTI ENERGY (PTEN) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PTEN was recently trading at $9.54 and has an implied volatility of 57.57% for this period. Based on an analysis of the…

-

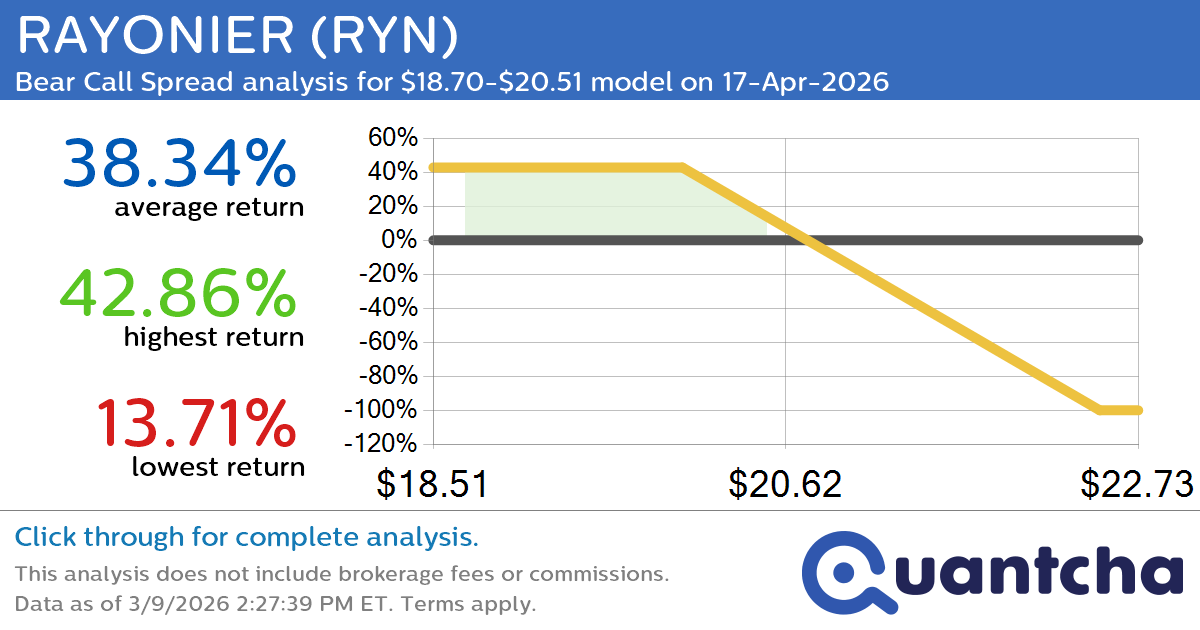

52-Week Low Alert: Trading today’s movement in RAYONIER $RYN

Quantchabot has detected a new Bear Call Spread trade opportunity for RAYONIER (RYN) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RYN was recently trading at $20.69 and has an implied volatility of 28.09% for this period. Based on an analysis of the options…

-

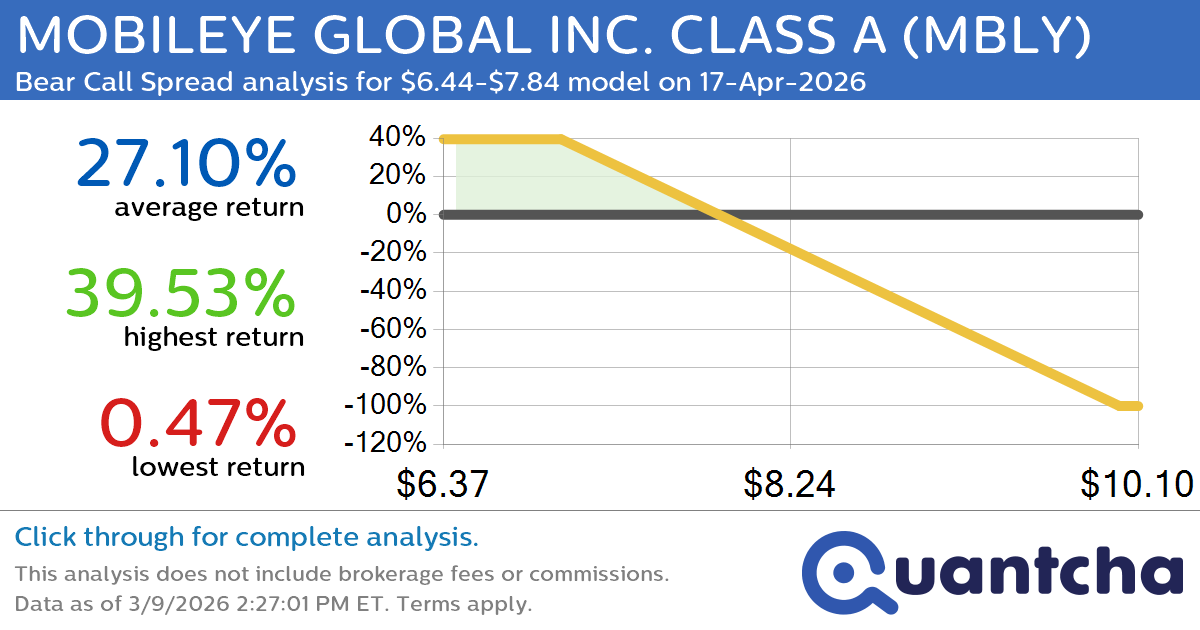

52-Week Low Alert: Trading today’s movement in MOBILEYE GLOBAL INC. CLASS A $MBLY

Quantchabot has detected a new Bear Call Spread trade opportunity for MOBILEYE GLOBAL INC. CLASS A (MBLY) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MBLY was recently trading at $7.80 and has an implied volatility of 59.59% for this period. Based on an…

-

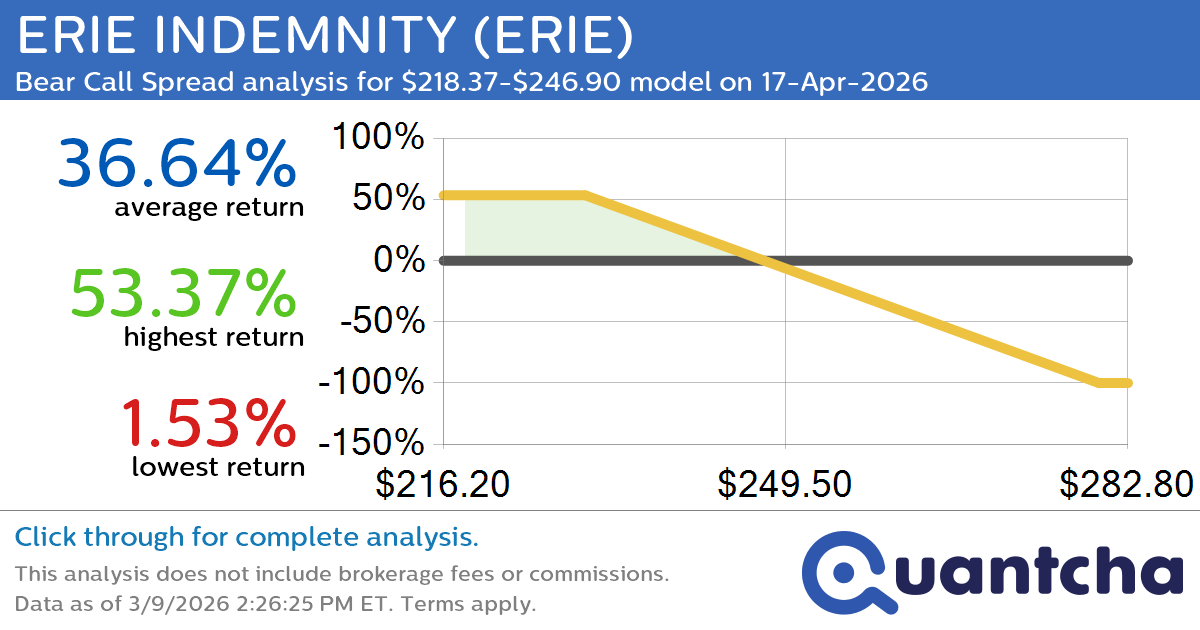

52-Week Low Alert: Trading today’s movement in ERIE INDEMNITY $ERIE

Quantchabot has detected a new Bear Call Spread trade opportunity for ERIE INDEMNITY (ERIE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ERIE was recently trading at $247.34 and has an implied volatility of 37.30% for this period. Based on an analysis of the…