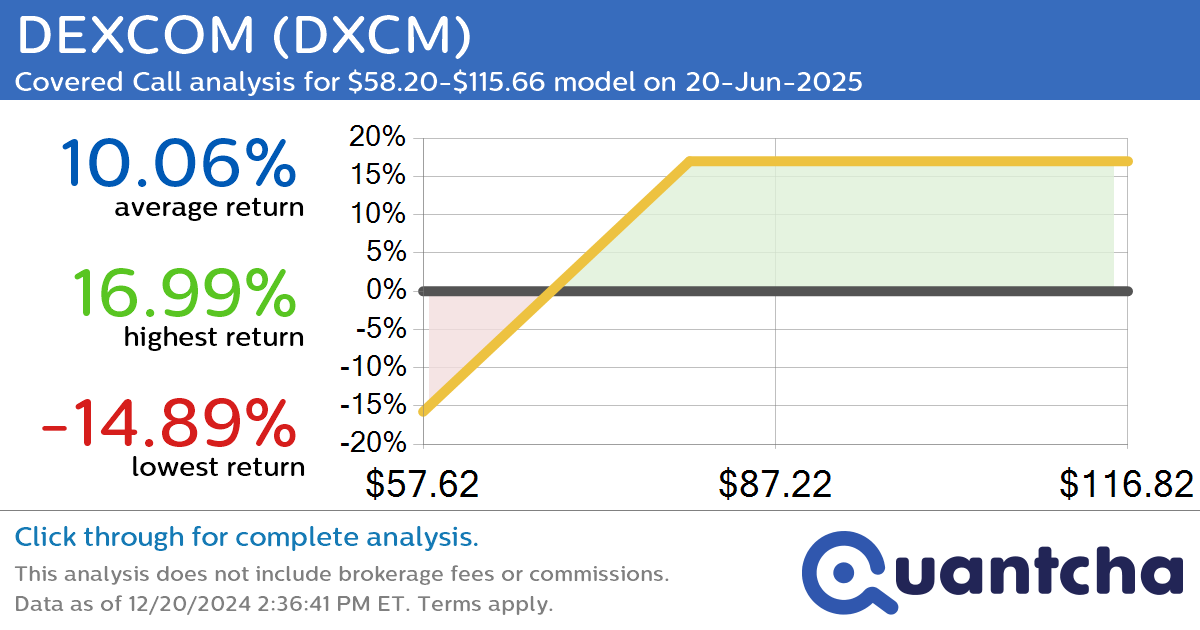

Quantchabot has detected a new Covered Call trade opportunity for DEXCOM (DXCM) for the 20-Jun-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine.

DXCM was recently trading at $80.27 and has an implied volatility of 48.56% for this period. Based on an analysis of the options available for DXCM expiring on 20-Jun-2025, there is a 68.30% likelihood that the underlying will close within the analyzed range of $58.20-$115.66 at expiration. In this scenario, the average linear return for the trade would be 10.05%.

Moneyness: These options are currently 0.33% in the money and there is a 52.90% likelihood that these options will be exercised before or at expiration.

Most upside: If DEXCOM closes at or above $80.00, this trade could return up to 16.99%. Based on our analysis, there is a 52.93% likelihood of this return.

The downside: As with any covered call, the risk is substantial as it is vulnerable to a downturn in the underlying itself. There is a 29.78% chance the underlying will close at or below its breakeven price of $68.38, resulting in a net loss on the trade.

To find the best covered calls on the market, be sure to check out Quantcha’s covered call screener.

To analyze this trade in depth, please visit the Quantcha Options Search Engine.

Leave a Reply

You must be logged in to post a comment.