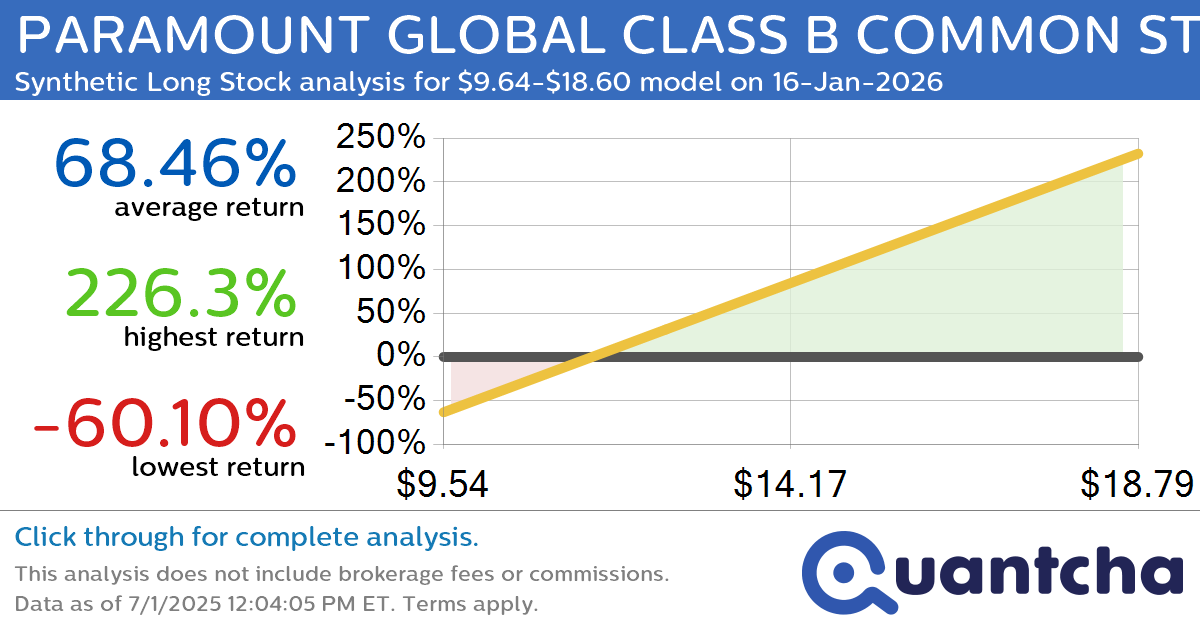

Quantchabot has detected a new Synthetic Long Stock trade opportunity for PARAMOUNT GLOBAL CLASS B COMMON STOCK (PARA) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine.

PARA was recently trading at $13.07 and has an implied volatility of 44.44% for this period. Based on an analysis of the options available for PARA expiring on 16-Jan-2026, there is a 68.29% likelihood that the underlying will close within the analyzed range of $9.64-$18.60 at expiration. In this scenario, the average linear return for the trade would be 69.40%.

Upside potential: This synthetic long position offers the same potential benefits and liabilities as a long stock position, but at a discount due to the significant premium at-the-money puts are trading at over calls. In this case, the long call position is opened at a strike of $12.50, which is already $0.57 in the money. An out-of-the-money put at the same strike is sold to finance the call, resulting in a net credit of $0.98 per share. The final position can be considered as having a discount of $1.55 per share over the underlying price of $13.07 for a 11.86% total.

Downside risk: This discount is generally a sign of the stock facing considerable short pressure, and may indicate that the stock has become hard to borrow. However, if you have a long view of the underlying over this period, it could be a good opportunity to benefit from the upside at a major discount.

To analyze this trade in depth, please visit the Quantcha Options Search Engine.

Leave a Reply

You must be logged in to post a comment.