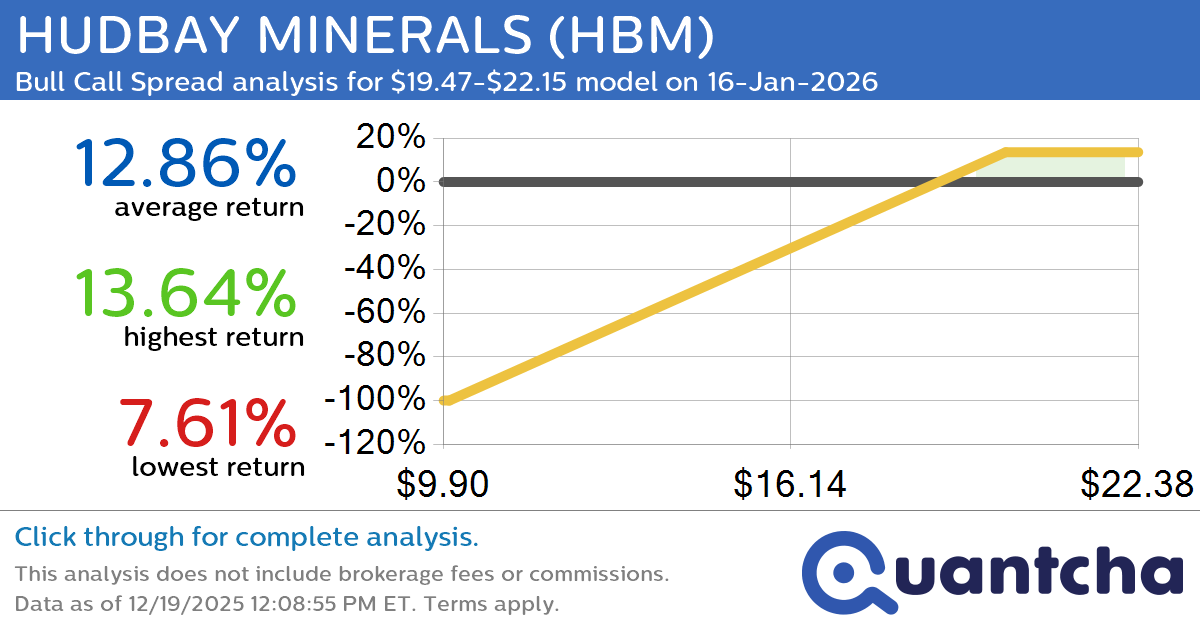

Quantchabot has detected a new Bull Call Spread trade opportunity for HUDBAY MINERALS (HBM) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine.

HBM was recently trading at $19.41 and has an implied volatility of 46.04% for this period. Based on an analysis of the options available for HBM expiring on 16-Jan-2026, there is a 34.22% likelihood that the underlying will close within the analyzed range of $19.47-$22.15 at expiration. In this scenario, the average linear return for the trade would be 12.87%.

52 week high: HUDBAY MINERALS recently reached a new 52-week high at $19.73. HBM had traded in the range $5.95-$19.30 over the past year.

Trade approach: Reaching a new 52-week high is a bullish indicator, so this trade is designed to be profitable if HBM maintains its current direction and does not revert back to pricing on the bearish side of $19.41 on 16-Jan-2026. If possible, the trade has been padded such that slight movement against the trade would still return a profit.

Upside potential: Using this bullish strategy, the trade would be profitable if HUDBAY MINERALS closes at or above $18.80 on 16-Jan-2026. Based on our risk-neutral analysis, there is a 60.69% likelihood of this return.

Downside risk: As with any options trade, there is a substantial downside risk where you may lose most or all of your investment.

To analyze this trade in depth, please visit the Quantcha Options Search Engine.

Leave a Reply

You must be logged in to post a comment.