Quantchabot has detected a new Bull Call Spread trade opportunity for OKLO INC (OKLO) for the 2-May-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine.

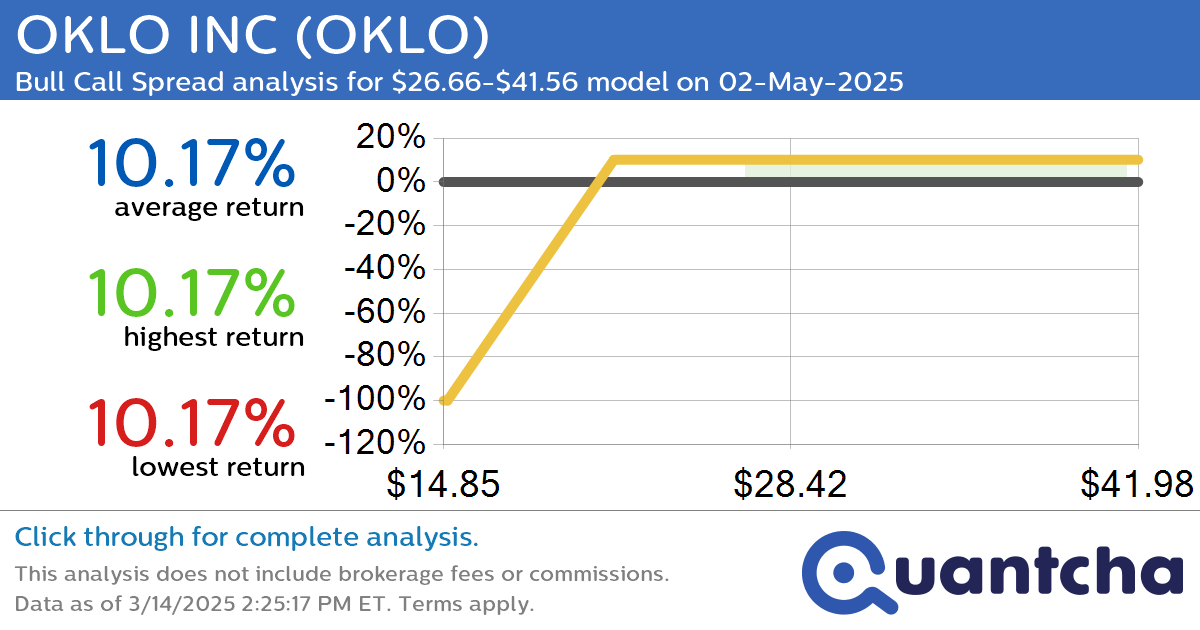

OKLO was recently trading at $26.50 and has an implied volatility of 120.50% for this period. Based on an analysis of the options available for OKLO expiring on 2-May-2025, there is a 34.18% likelihood that the underlying will close within the analyzed range of $26.66-$41.56 at expiration. In this scenario, the average linear return for the trade would be 10.17%.

Big 10.65% Change: After closing the last trading session at $23.95, OKLO INC opened today at $25.01 and has reached a high of $27.25.

Trade approach: A movement as big as 10.65% is a significantly bullish indicator, so this trade is designed to be profitable if OKLO maintains its current direction and does not revert back to pricing on the bearish side of $26.50 on 2-May-2025. If possible, the trade has been padded such that slight movement against the trade would still return a profit.

Upside potential: Using this bullish strategy, the trade would be profitable if OKLO INC closes at or above $20.90 on 2-May-2025. Based on our risk-neutral analysis, there is a 70.86% likelihood of this return.

Downside risk: As with any options trade, there is a substantial downside risk where you may lose most or all of your investment.

To analyze this trade in depth, please visit the Quantcha Options Search Engine.

Leave a Reply

You must be logged in to post a comment.