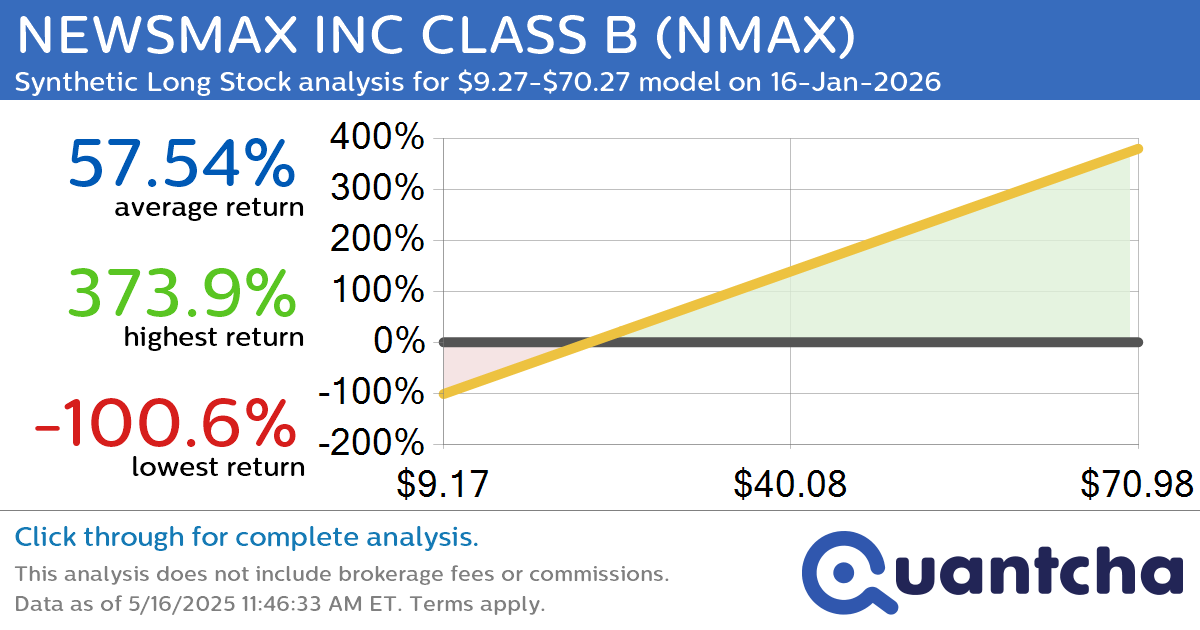

Quantchabot has detected a new Synthetic Long Stock trade opportunity for NEWSMAX INC CLASS B (NMAX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine.

NMAX was recently trading at $24.77 and has an implied volatility of 123.48% for this period. Based on an analysis of the options available for NMAX expiring on 16-Jan-2026, there is a 68.29% likelihood that the underlying will close within the analyzed range of $9.27-$70.27 at expiration. In this scenario, the average linear return for the trade would be 57.51%.

Upside potential: This synthetic long position offers the same potential benefits and liabilities as a long stock position, but at a discount due to the significant premium at-the-money puts are trading at over calls. In this case, the put position is opened at a strike of $25.00, which is already $0.23 in-the-money. However, its sale more than offsets this moneyness and the cost of the long call that the trade results in a net credit of of $2.80 per share. The final position can be considered as having a discount of $2.57 per share over the underlying price of $24.77 for a 10.39% total.

Downside risk: This discount is generally a sign of the stock facing considerable short pressure, and may indicate that the stock has become hard to borrow. However, if you have a long view of the underlying over this period, it could be a good opportunity to benefit from the upside at a major discount.

To analyze this trade in depth, please visit the Quantcha Options Search Engine.

Leave a Reply

You must be logged in to post a comment.