Author: Quantcha Trade Ideas

-

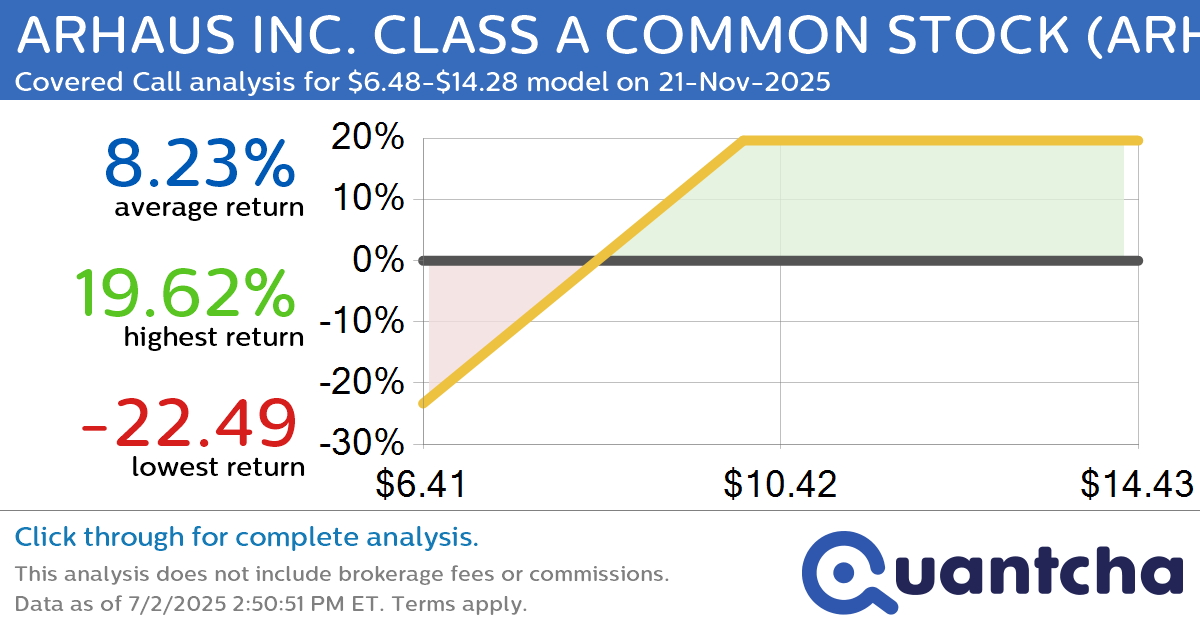

Covered Call Alert: ARHAUS INC. CLASS A COMMON STOCK $ARHS returning up to 21.80% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for ARHAUS INC. CLASS A COMMON STOCK (ARHS) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARHS was recently trading at $9.45 and has an implied volatility of 63.20% for this period. Based on an…

-

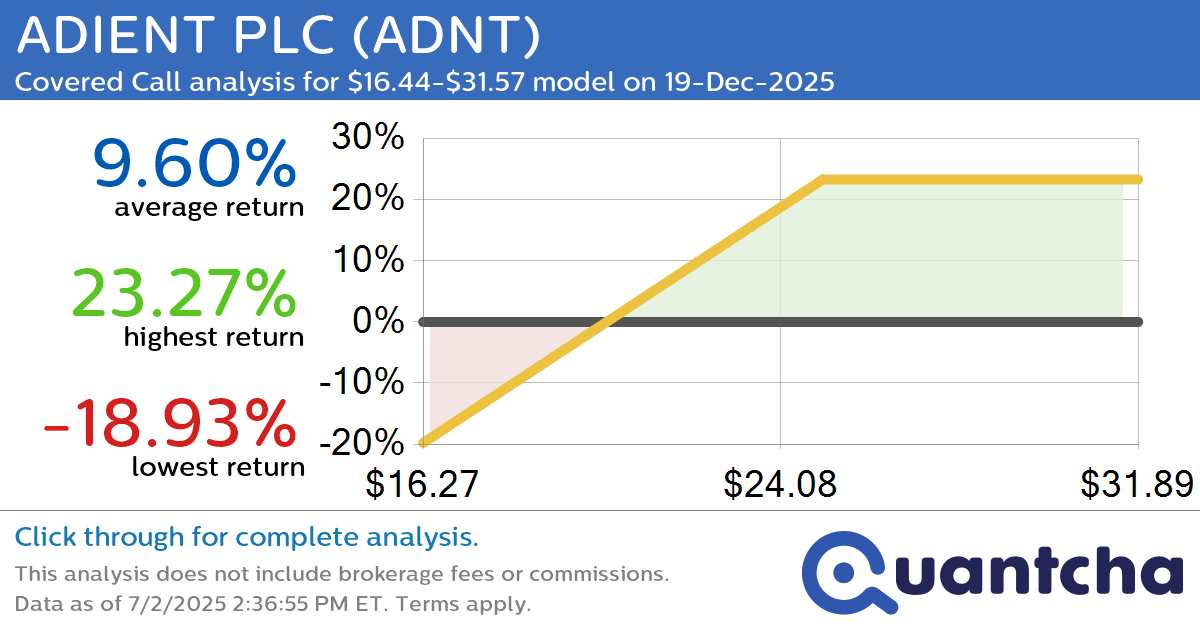

Covered Call Alert: ADIENT PLC $ADNT returning up to 23.89% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for ADIENT PLC (ADNT) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ADNT was recently trading at $22.31 and has an implied volatility of 47.73% for this period. Based on an analysis of the options…

-

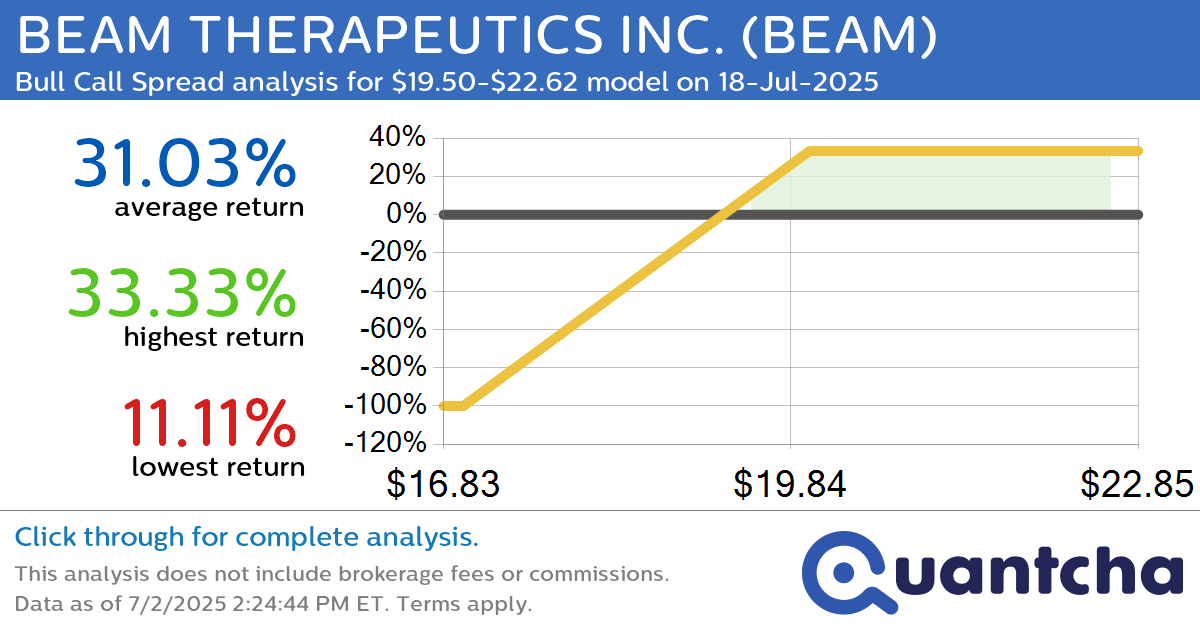

Big Gainer Alert: Trading today’s 11.0% move in BEAM THERAPEUTICS INC. $BEAM

Quantchabot has detected a new Bull Call Spread trade opportunity for BEAM THERAPEUTICS INC. (BEAM) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BEAM was recently trading at $19.46 and has an implied volatility of 69.70% for this period. Based on an analysis of…

-

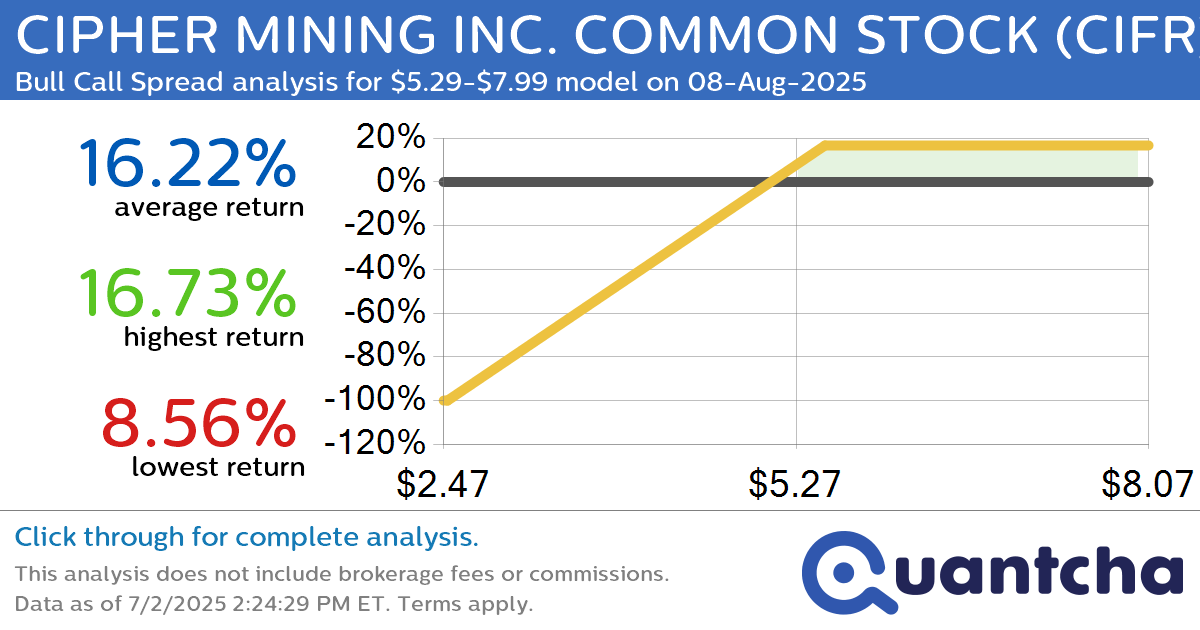

Big Gainer Alert: Trading today’s 7.4% move in CIPHER MINING INC. COMMON STOCK $CIFR

Quantchabot has detected a new Bull Call Spread trade opportunity for CIPHER MINING INC. COMMON STOCK (CIFR) for the 8-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CIFR was recently trading at $5.26 and has an implied volatility of 128.41% for this period. Based on an…

-

Big Gainer Alert: Trading today’s 7.6% move in VNET GROUP INC $VNET

Quantchabot has detected a new Bull Call Spread trade opportunity for VNET GROUP INC (VNET) for the 15-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VNET was recently trading at $7.11 and has an implied volatility of 88.00% for this period. Based on an analysis of…

-

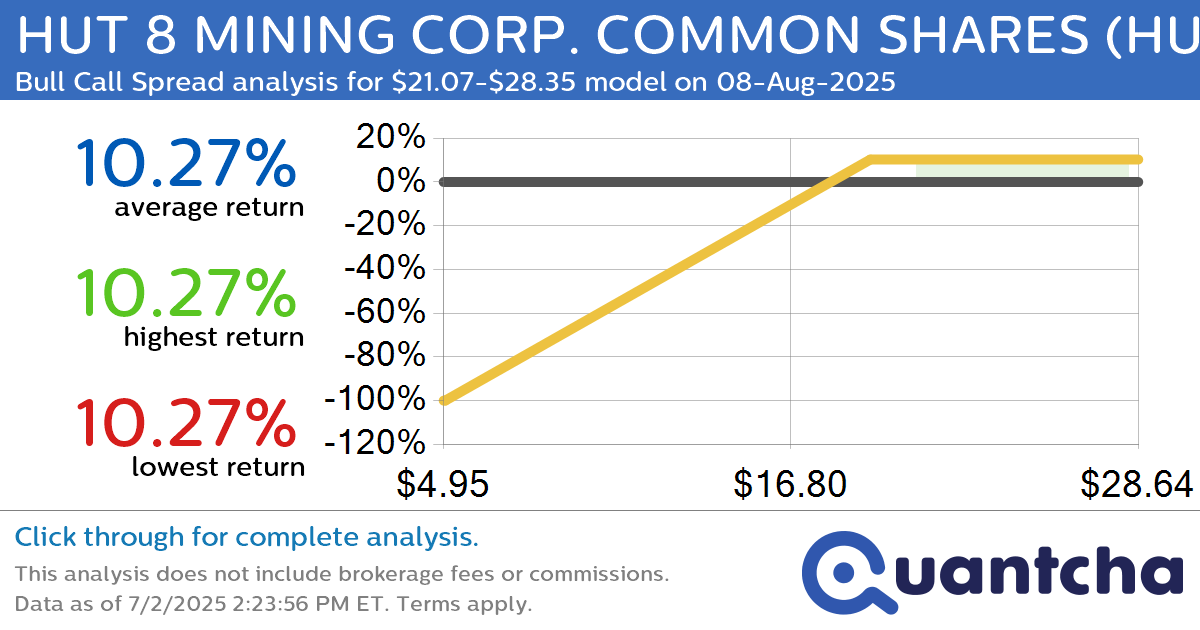

Big Gainer Alert: Trading today’s 13.5% move in HUT 8 MINING CORP. COMMON SHARES $HUT

Quantchabot has detected a new Bull Call Spread trade opportunity for HUT 8 MINING CORP. COMMON SHARES (HUT) for the 8-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HUT was recently trading at $20.97 and has an implied volatility of 92.59% for this period. Based on…

-

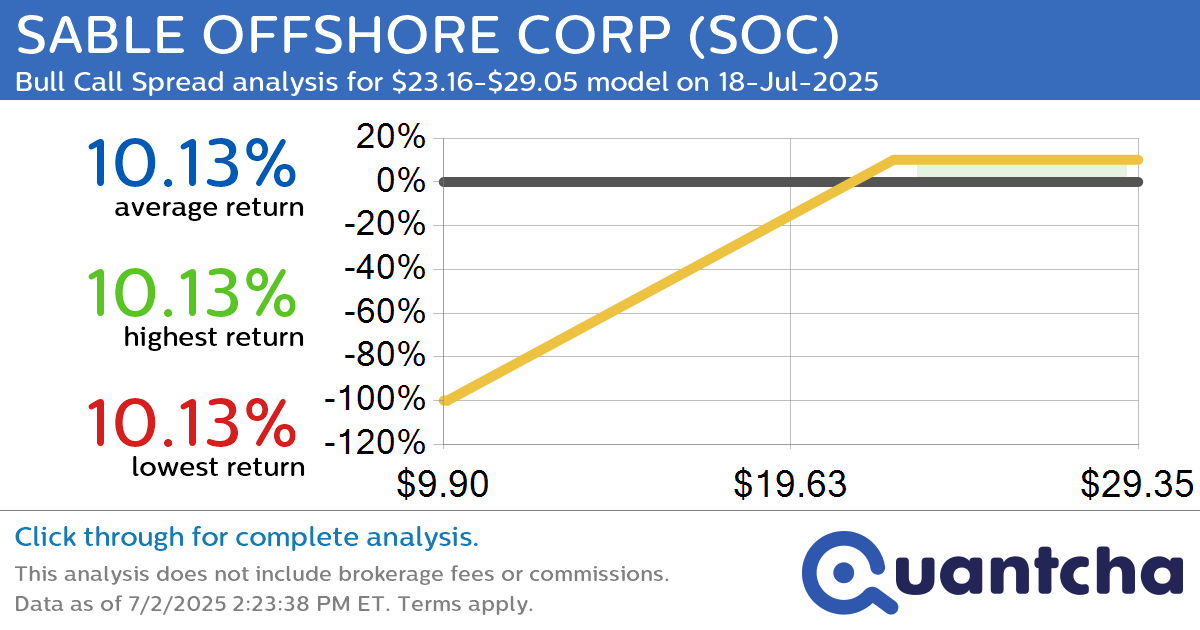

Big Gainer Alert: Trading today’s 7.5% move in SABLE OFFSHORE CORP $SOC

Quantchabot has detected a new Bull Call Spread trade opportunity for SABLE OFFSHORE CORP (SOC) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SOC was recently trading at $23.11 and has an implied volatility of 106.40% for this period. Based on an analysis of…

-

52-Week High Alert: Trading today’s movement in CHEESECAKE FACTORY $CAKE

Quantchabot has detected a new Bull Call Spread trade opportunity for CHEESECAKE FACTORY (CAKE) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAKE was recently trading at $65.02 and has an implied volatility of 29.93% for this period. Based on an analysis of the…

-

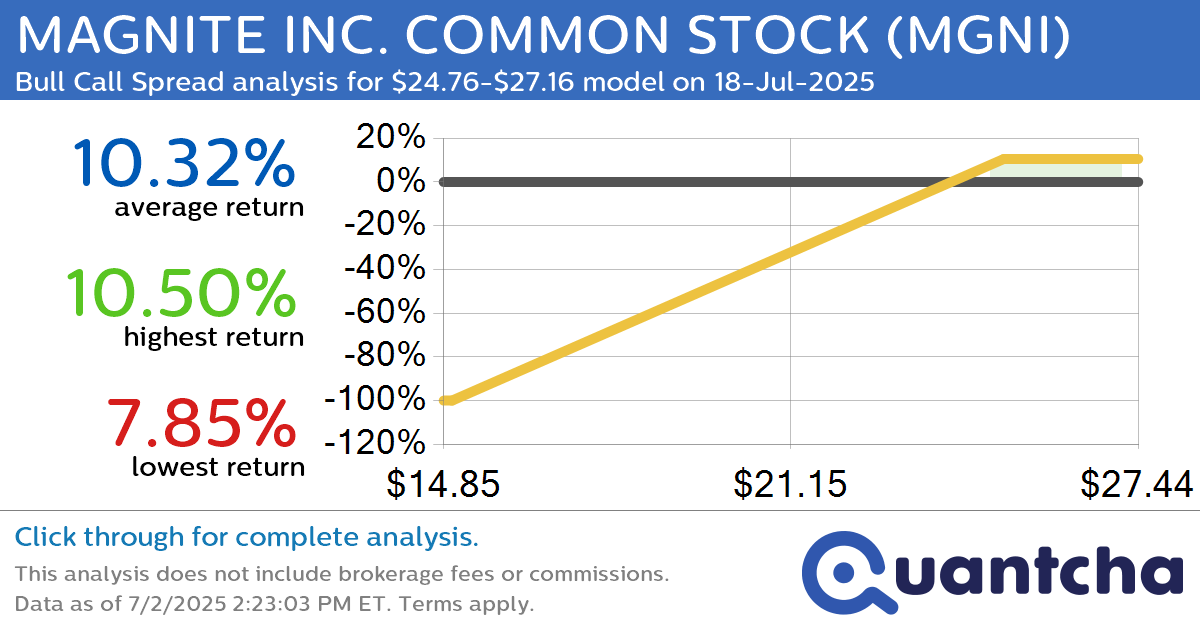

52-Week High Alert: Trading today’s movement in MAGNITE INC. COMMON STOCK $MGNI

Quantchabot has detected a new Bull Call Spread trade opportunity for MAGNITE INC. COMMON STOCK (MGNI) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MGNI was recently trading at $24.71 and has an implied volatility of 43.44% for this period. Based on an analysis…

-

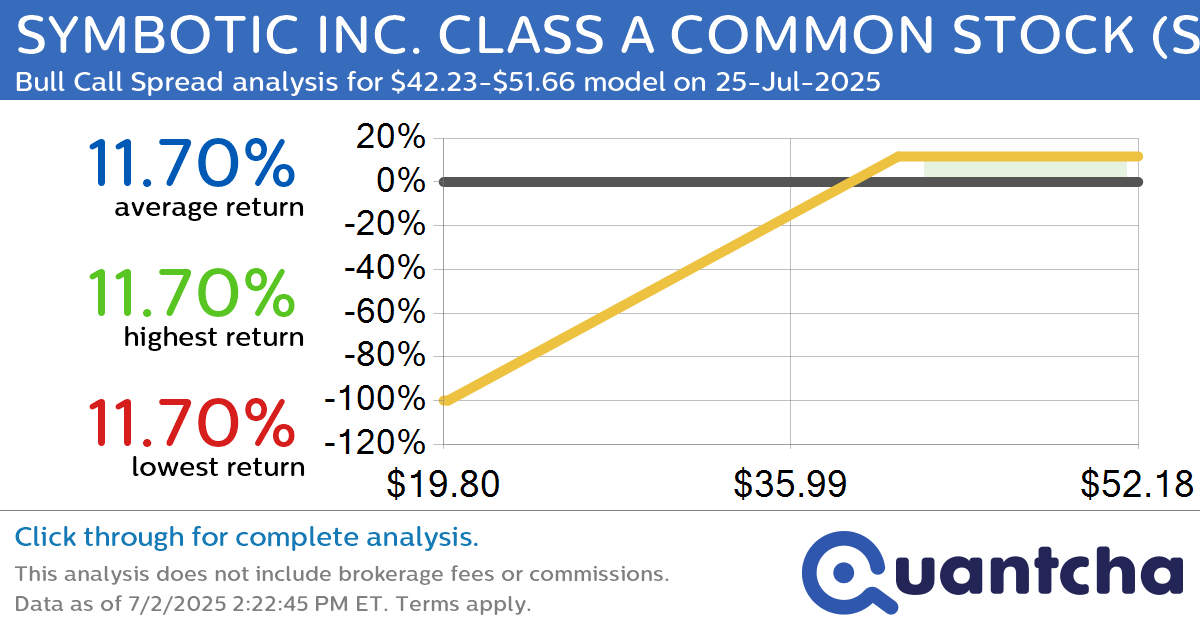

52-Week High Alert: Trading today’s movement in SYMBOTIC INC. CLASS A COMMON STOCK $SYM

Quantchabot has detected a new Bull Call Spread trade opportunity for SYMBOTIC INC. CLASS A COMMON STOCK (SYM) for the 25-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SYM was recently trading at $42.11 and has an implied volatility of 79.36% for this period. Based on…