Author: Quantcha Trade Ideas

-

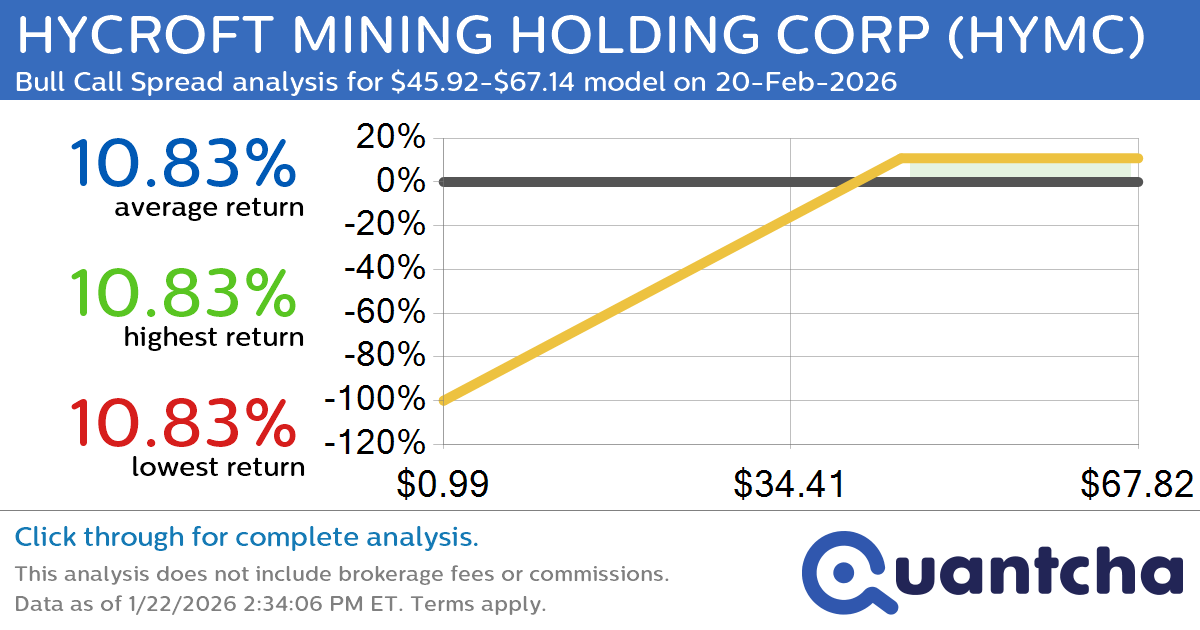

Big Gainer Alert: Trading today’s 15.7% move in HYCROFT MINING HOLDING CORP $HYMC

Quantchabot has detected a new Bull Call Spread trade opportunity for HYCROFT MINING HOLDING CORP (HYMC) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HYMC was recently trading at $45.78 and has an implied volatility of 133.39% for this period. Based on an analysis…

-

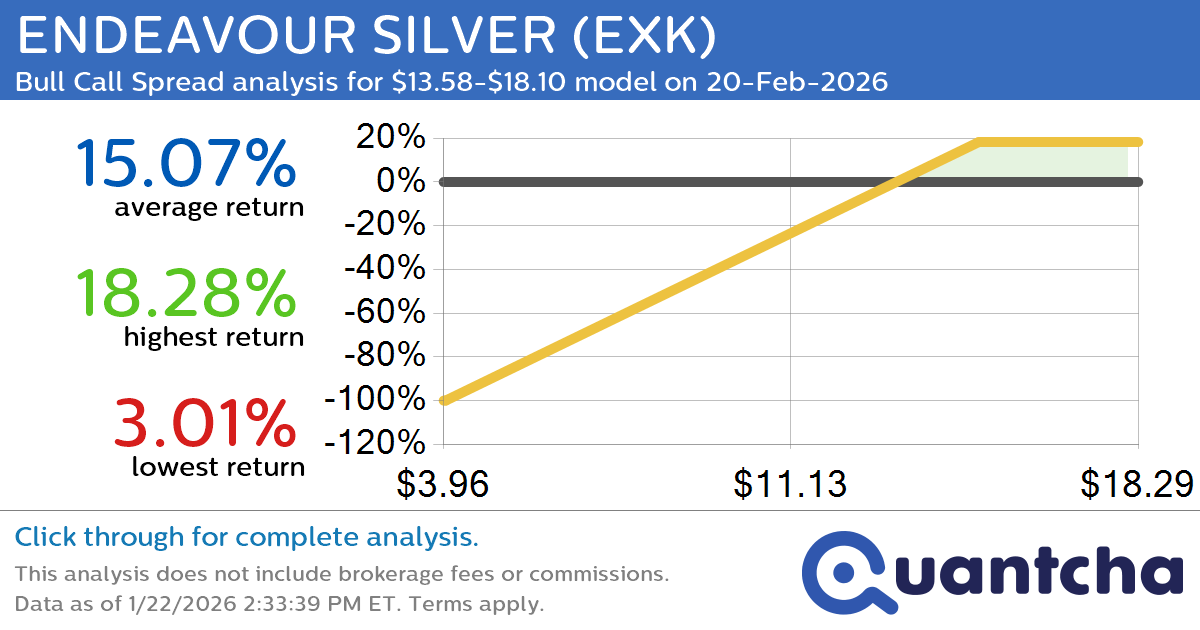

Big Gainer Alert: Trading today’s 10.4% move in ENDEAVOUR SILVER $EXK

Quantchabot has detected a new Bull Call Spread trade opportunity for ENDEAVOUR SILVER (EXK) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EXK was recently trading at $13.54 and has an implied volatility of 100.96% for this period. Based on an analysis of the…

-

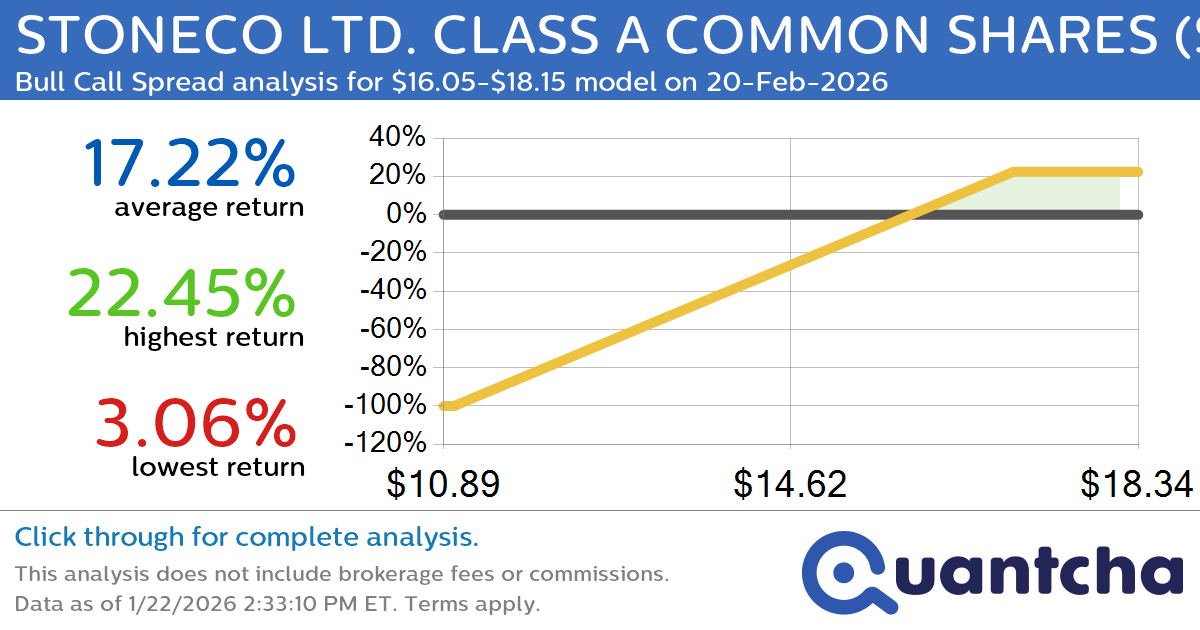

Big Gainer Alert: Trading today’s 7.3% move in STONECO LTD. CLASS A COMMON SHARES $STNE

Quantchabot has detected a new Bull Call Spread trade opportunity for STONECO LTD. CLASS A COMMON SHARES (STNE) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. STNE was recently trading at $16.00 and has an implied volatility of 43.11% for this period. Based on…

-

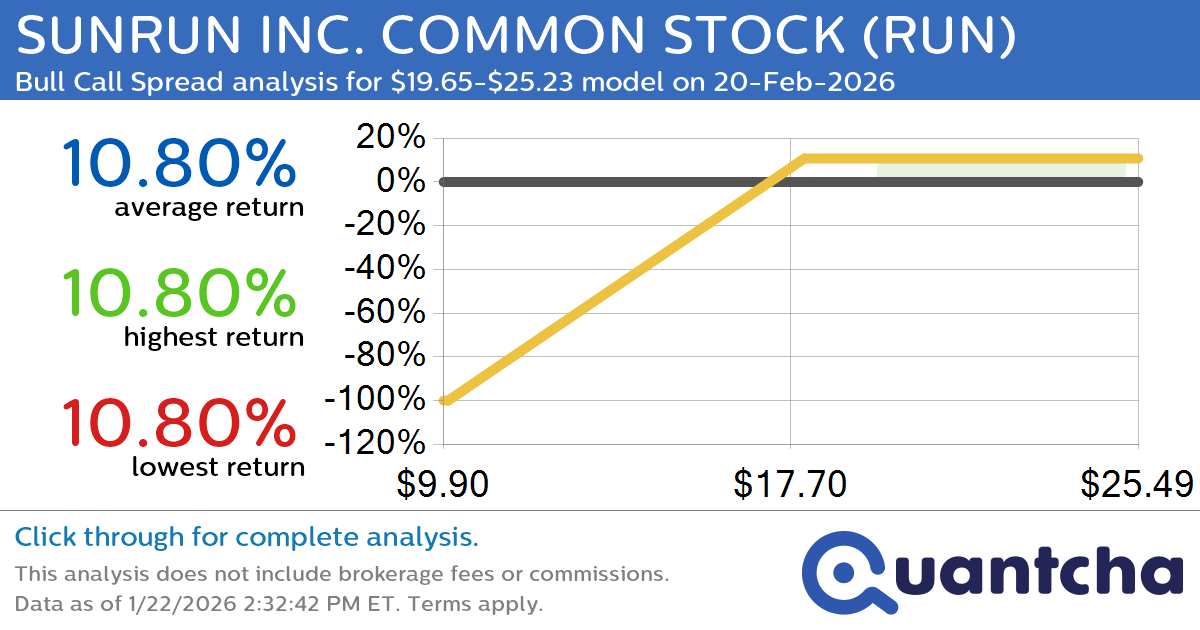

Big Gainer Alert: Trading today’s 9.9% move in SUNRUN INC. COMMON STOCK $RUN

Quantchabot has detected a new Bull Call Spread trade opportunity for SUNRUN INC. COMMON STOCK (RUN) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RUN was recently trading at $19.59 and has an implied volatility of 87.70% for this period. Based on an analysis…

-

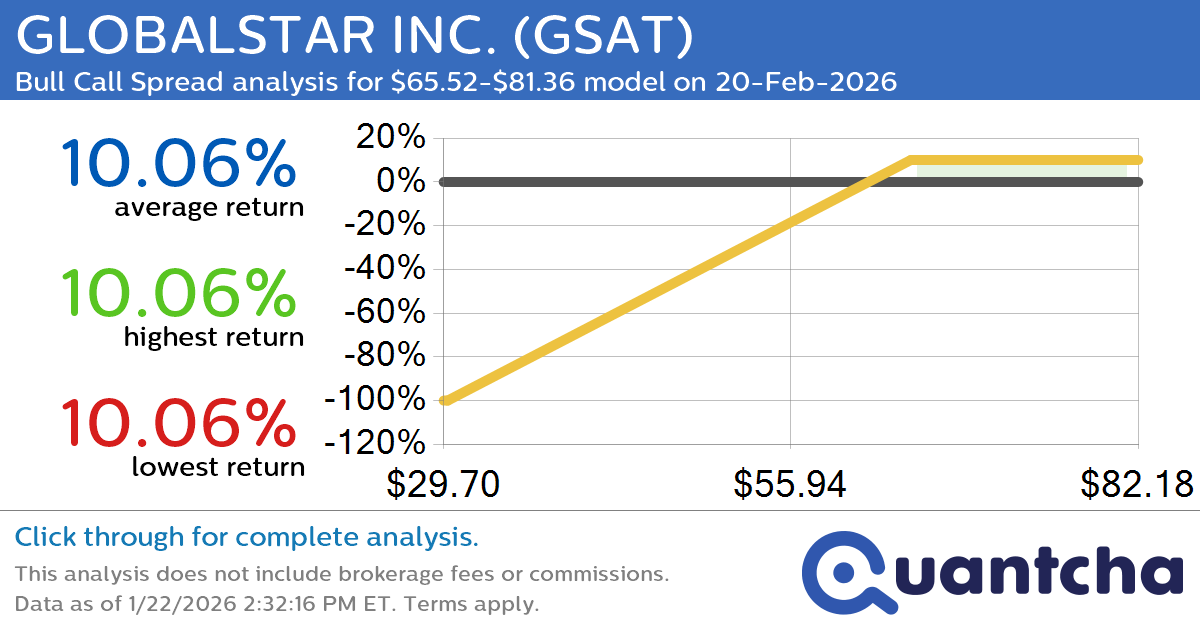

Big Gainer Alert: Trading today’s 7.4% move in GLOBALSTAR INC. $GSAT

Quantchabot has detected a new Bull Call Spread trade opportunity for GLOBALSTAR INC. (GSAT) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GSAT was recently trading at $65.32 and has an implied volatility of 75.99% for this period. Based on an analysis of the…

-

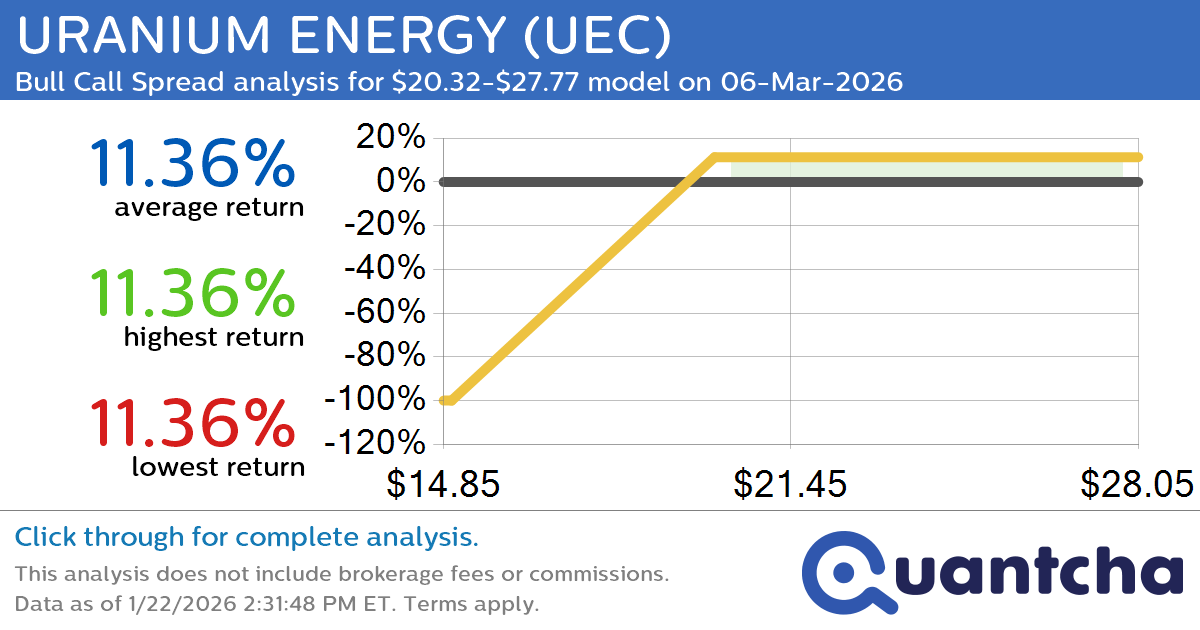

52-Week High Alert: Trading today’s movement in URANIUM ENERGY $UEC

Quantchabot has detected a new Bull Call Spread trade opportunity for URANIUM ENERGY (UEC) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UEC was recently trading at $20.23 and has an implied volatility of 90.31% for this period. Based on an analysis of the…

-

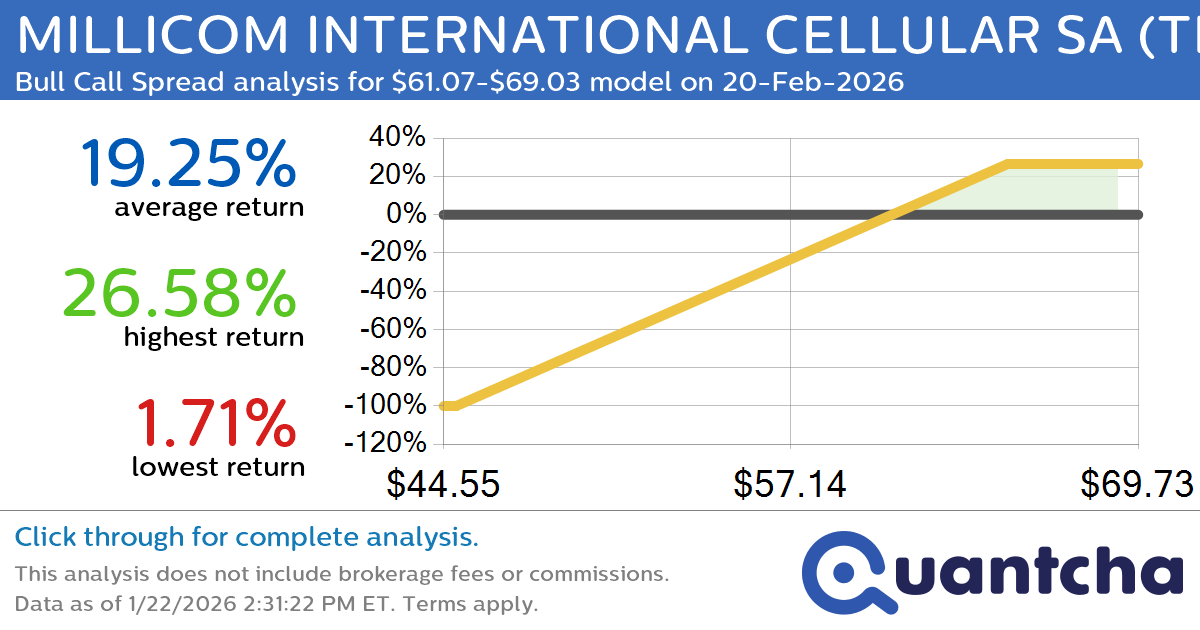

52-Week High Alert: Trading today’s movement in MILLICOM INTERNATIONAL CELLULAR SA $TIGO

Quantchabot has detected a new Bull Call Spread trade opportunity for MILLICOM INTERNATIONAL CELLULAR SA (TIGO) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TIGO was recently trading at $60.88 and has an implied volatility of 42.99% for this period. Based on an analysis…

-

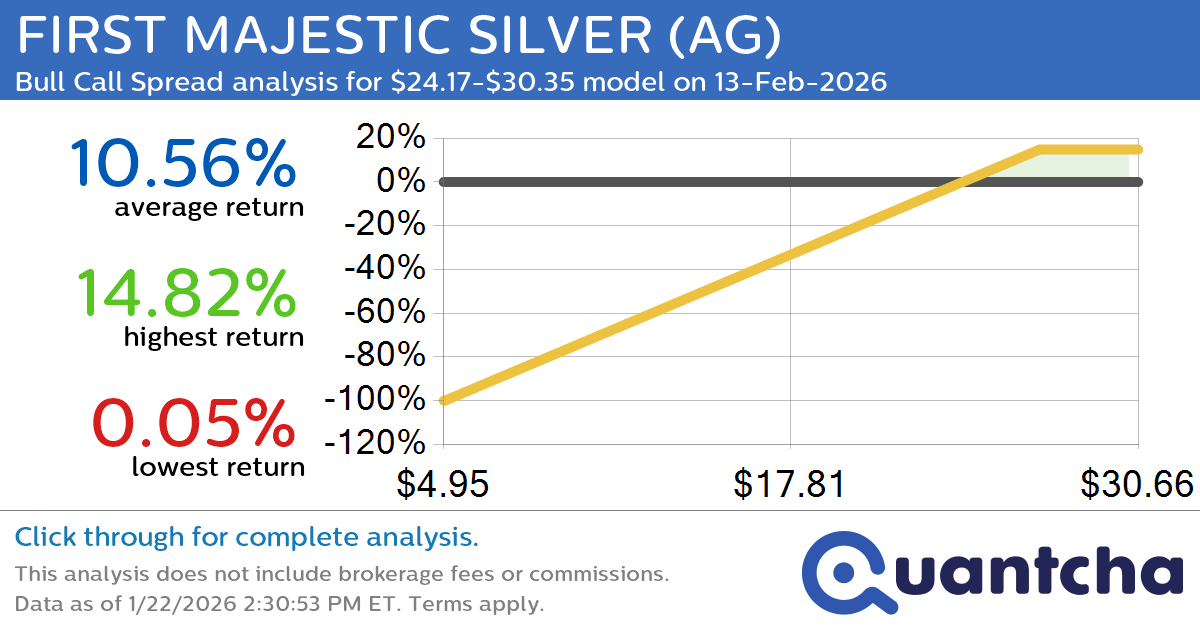

52-Week High Alert: Trading today’s movement in FIRST MAJESTIC SILVER $AG

Quantchabot has detected a new Bull Call Spread trade opportunity for FIRST MAJESTIC SILVER (AG) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AG was recently trading at $24.11 and has an implied volatility of 91.42% for this period. Based on an analysis of…

-

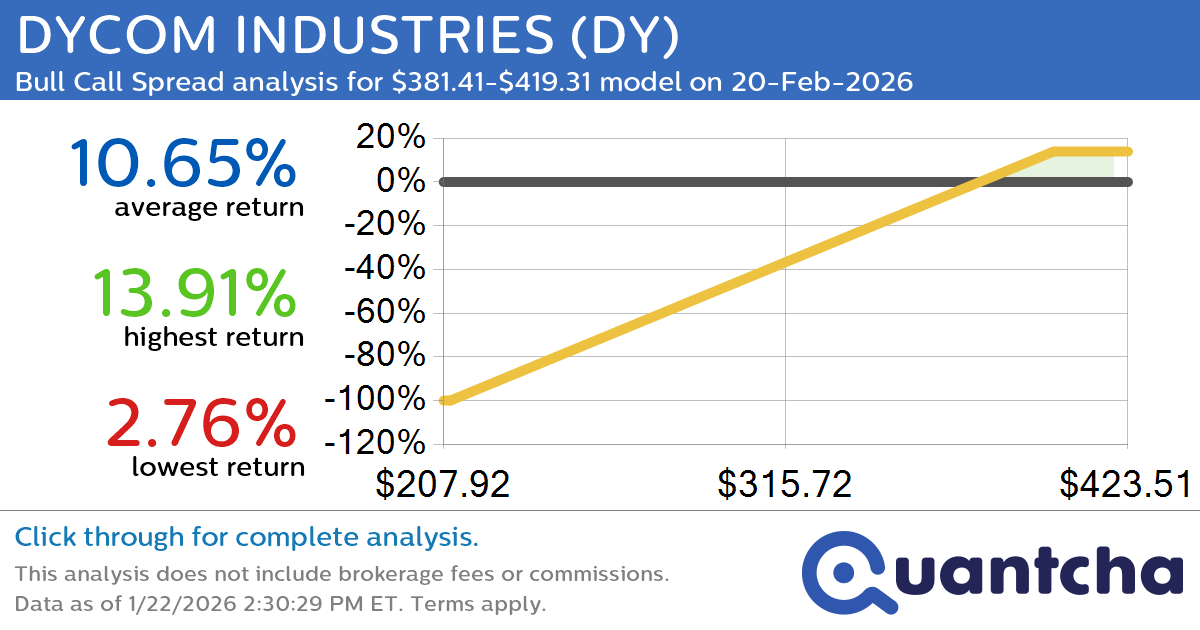

52-Week High Alert: Trading today’s movement in DYCOM INDUSTRIES $DY

Quantchabot has detected a new Bull Call Spread trade opportunity for DYCOM INDUSTRIES (DY) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DY was recently trading at $380.23 and has an implied volatility of 33.26% for this period. Based on an analysis of the…

-

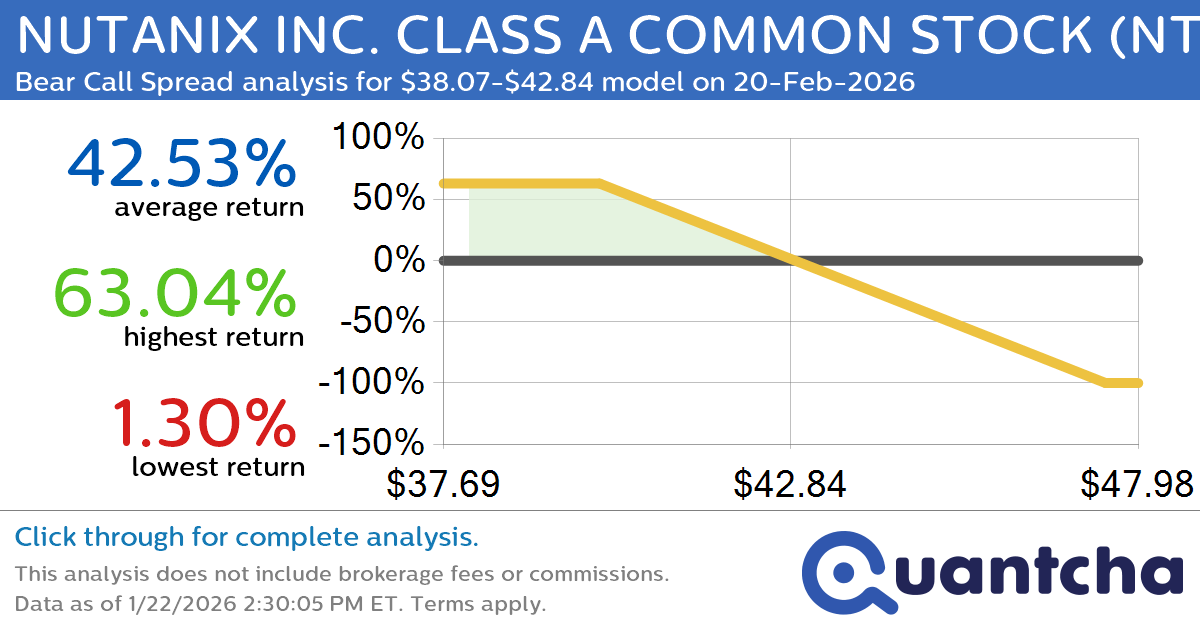

52-Week Low Alert: Trading today’s movement in NUTANIX INC. CLASS A COMMON STOCK $NTNX

Quantchabot has detected a new Bear Call Spread trade opportunity for NUTANIX INC. CLASS A COMMON STOCK (NTNX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NTNX was recently trading at $42.70 and has an implied volatility of 41.43% for this period. Based on…