Author: Quantcha Trade Ideas

-

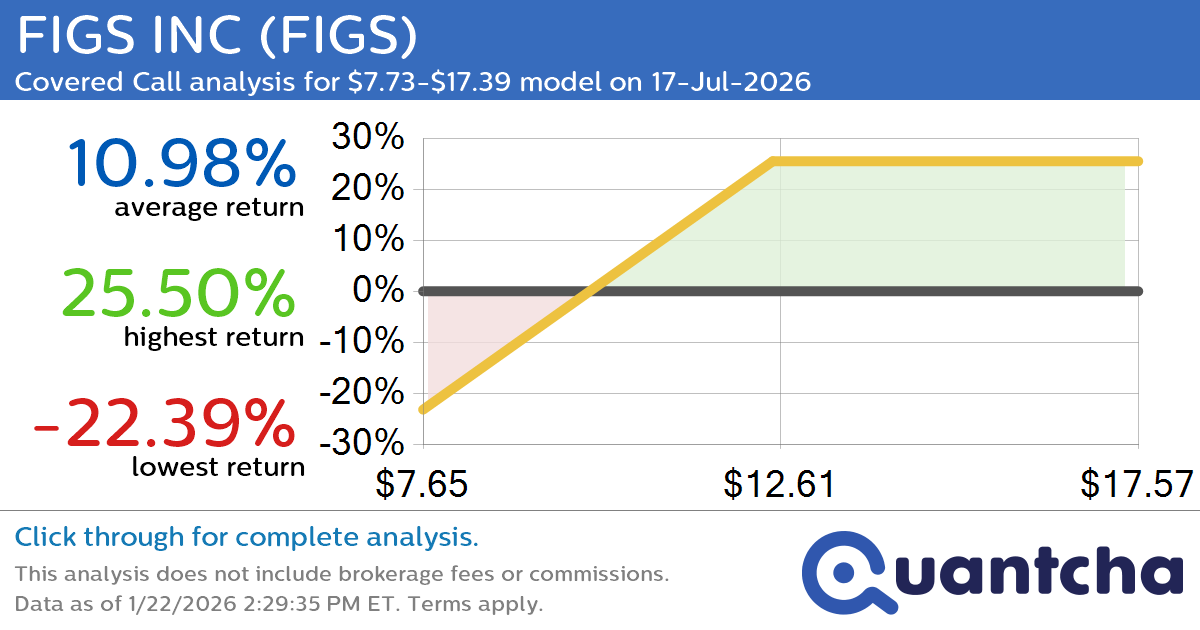

Covered Call Alert: FIGS INC $FIGS returning up to 25.13% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for FIGS INC (FIGS) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIGS was recently trading at $11.38 and has an implied volatility of 58.28% for this period. Based on an analysis of the options…

-

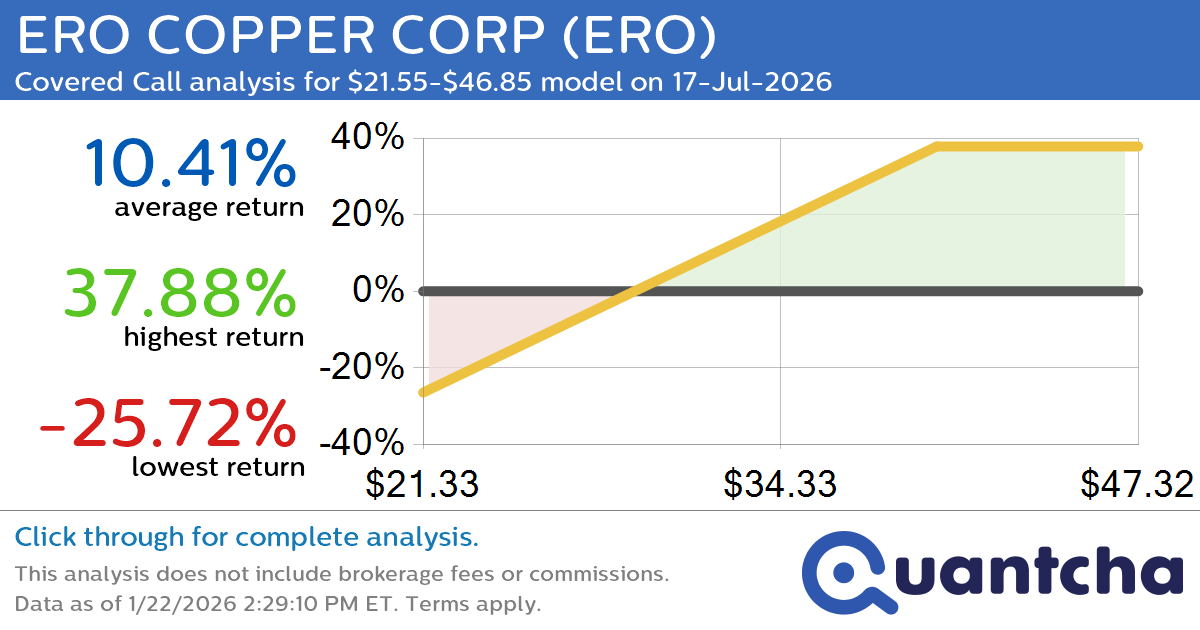

Covered Call Alert: ERO COPPER CORP $ERO returning up to 38.36% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for ERO COPPER CORP (ERO) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ERO was recently trading at $31.20 and has an implied volatility of 55.81% for this period. Based on an analysis of the…

-

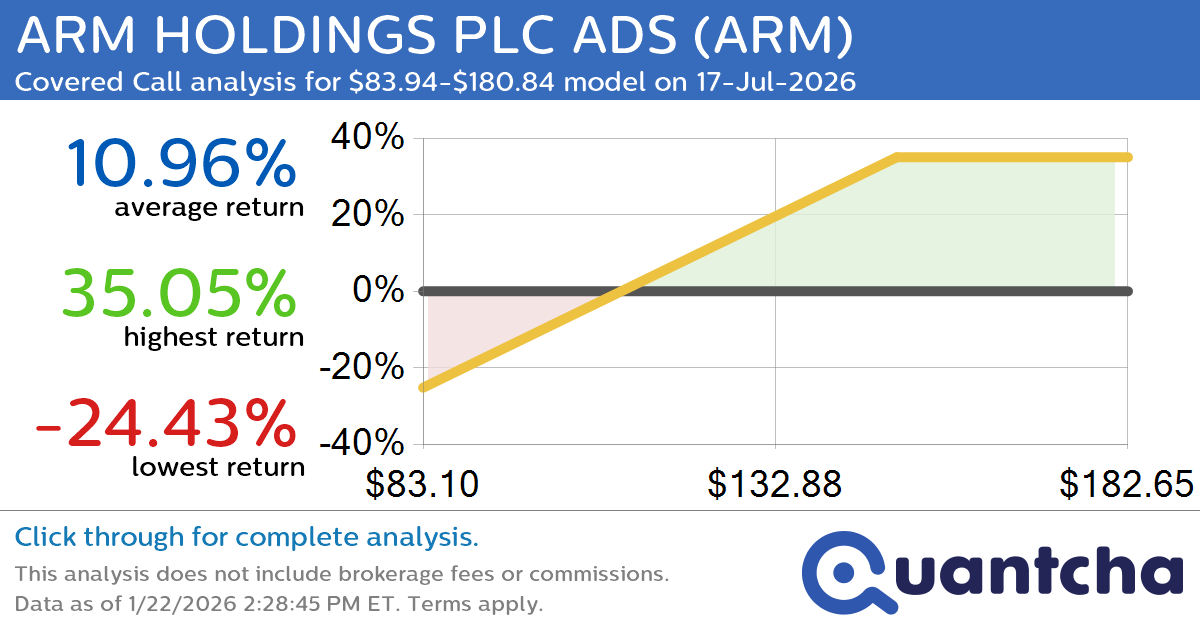

Covered Call Alert: ARM HOLDINGS PLC ADS $ARM returning up to 34.86% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for ARM HOLDINGS PLC ADS (ARM) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARM was recently trading at $120.98 and has an implied volatility of 55.17% for this period. Based on an analysis of…

-

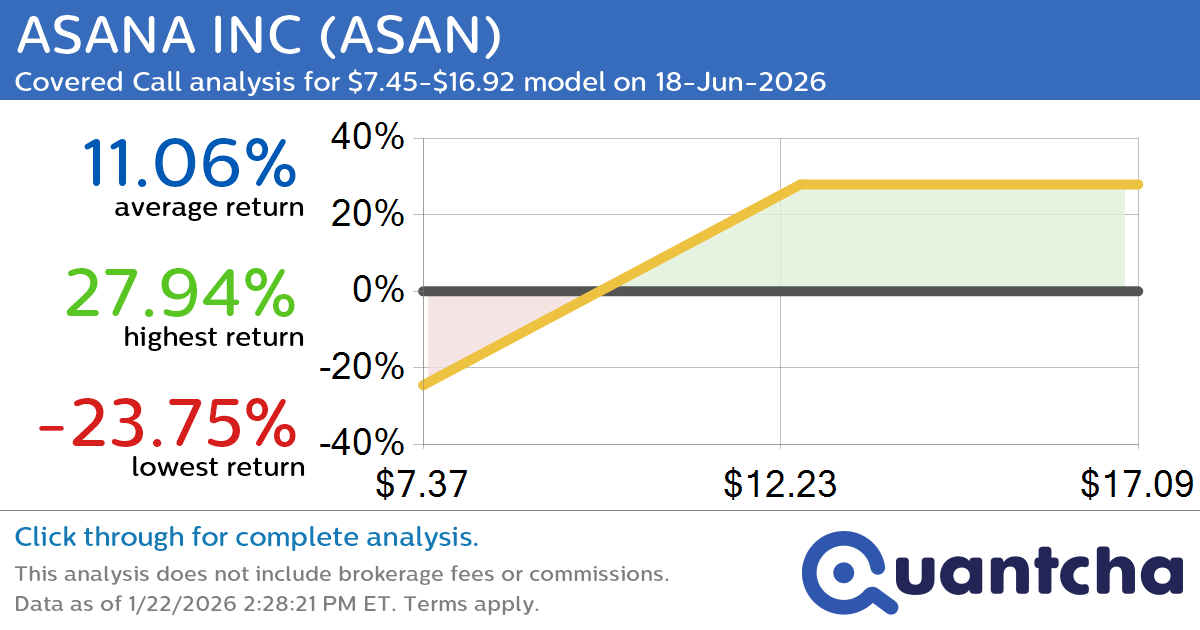

Covered Call Alert: ASANA INC $ASAN returning up to 27.94% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ASANA INC (ASAN) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ASAN was recently trading at $11.06 and has an implied volatility of 64.45% for this period. Based on an analysis of the options…

-

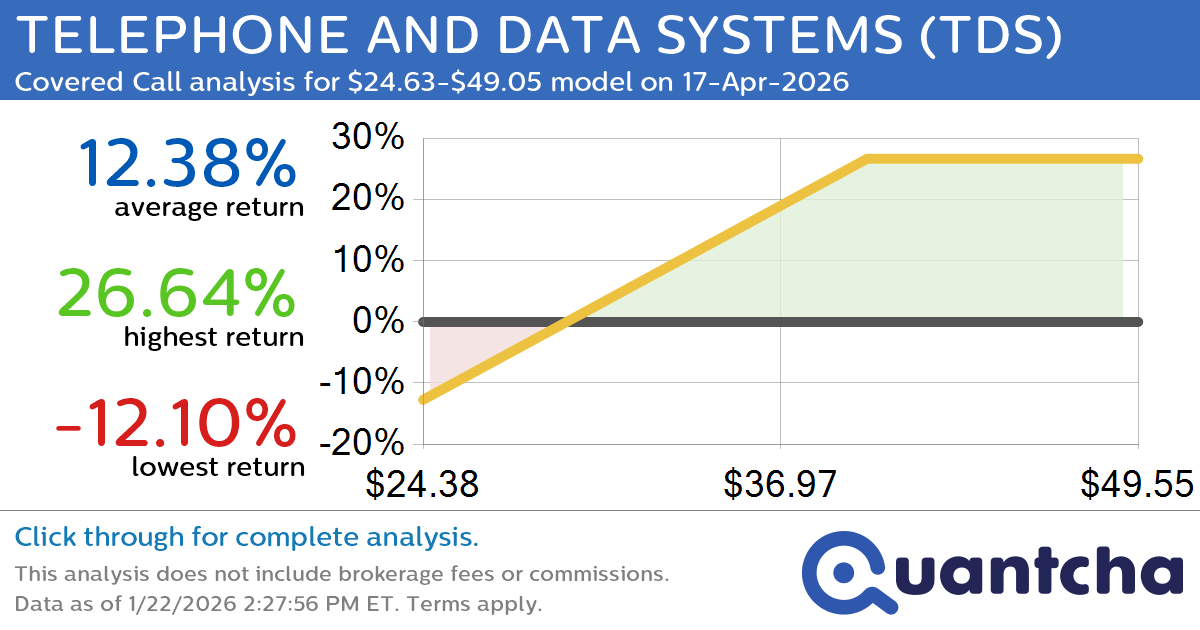

Covered Call Alert: TELEPHONE AND DATA SYSTEMS $TDS returning up to 27.09% through 17-Apr-2026

Quantchabot has detected a new Covered Call trade opportunity for TELEPHONE AND DATA SYSTEMS (TDS) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TDS was recently trading at $44.70 and has an implied volatility of 71.10% for this period. Based on an analysis of…

-

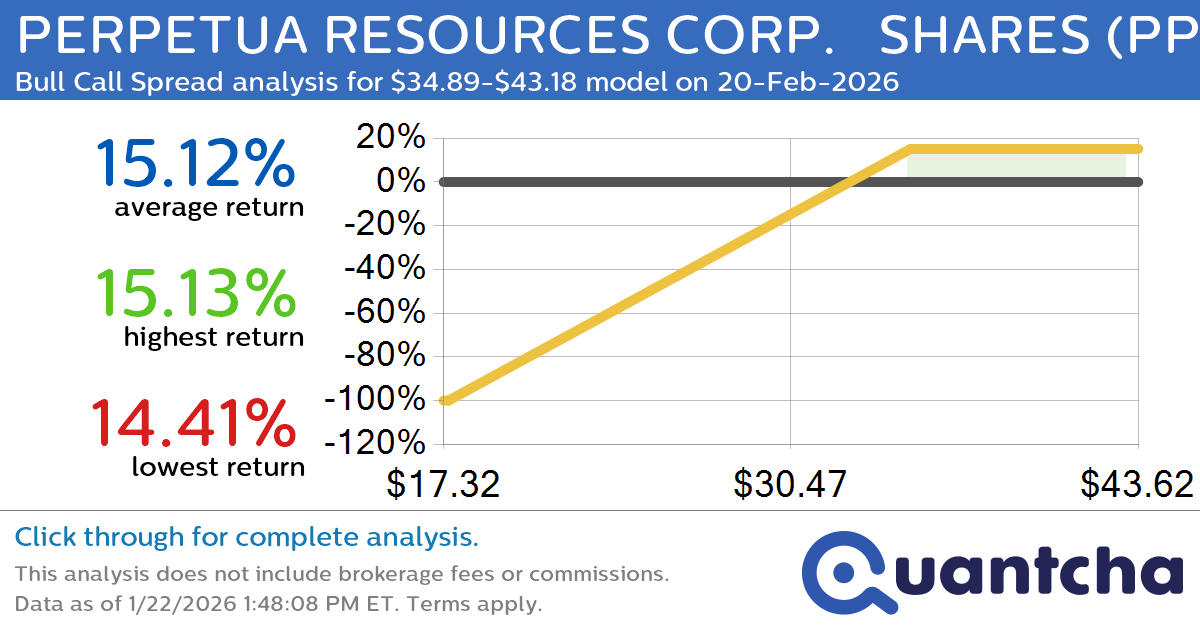

Big Gainer Alert: Trading today’s 10.5% move in PERPETUA RESOURCES CORP. SHARES $PPTA

Quantchabot has detected a new Bull Call Spread trade opportunity for PERPETUA RESOURCES CORP. SHARES (PPTA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PPTA was recently trading at $34.78 and has an implied volatility of 74.80% for this period. Based on an analysis…

-

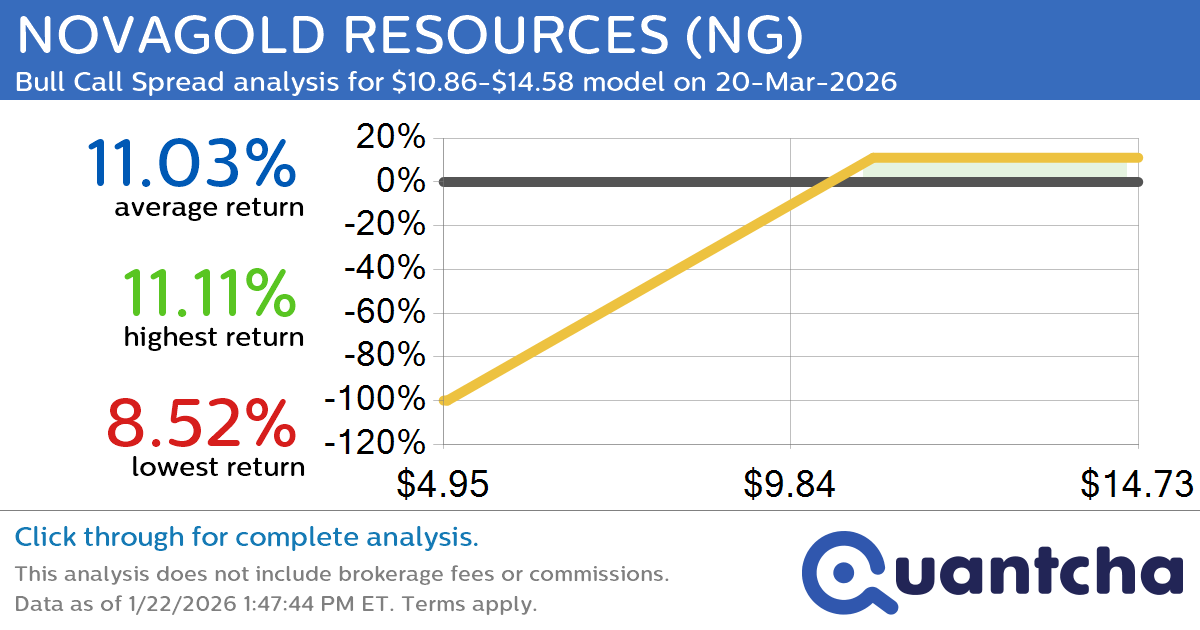

Big Gainer Alert: Trading today’s 8.1% move in NOVAGOLD RESOURCES $NG

Quantchabot has detected a new Bull Call Spread trade opportunity for NOVAGOLD RESOURCES (NG) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NG was recently trading at $10.79 and has an implied volatility of 74.11% for this period. Based on an analysis of the…

-

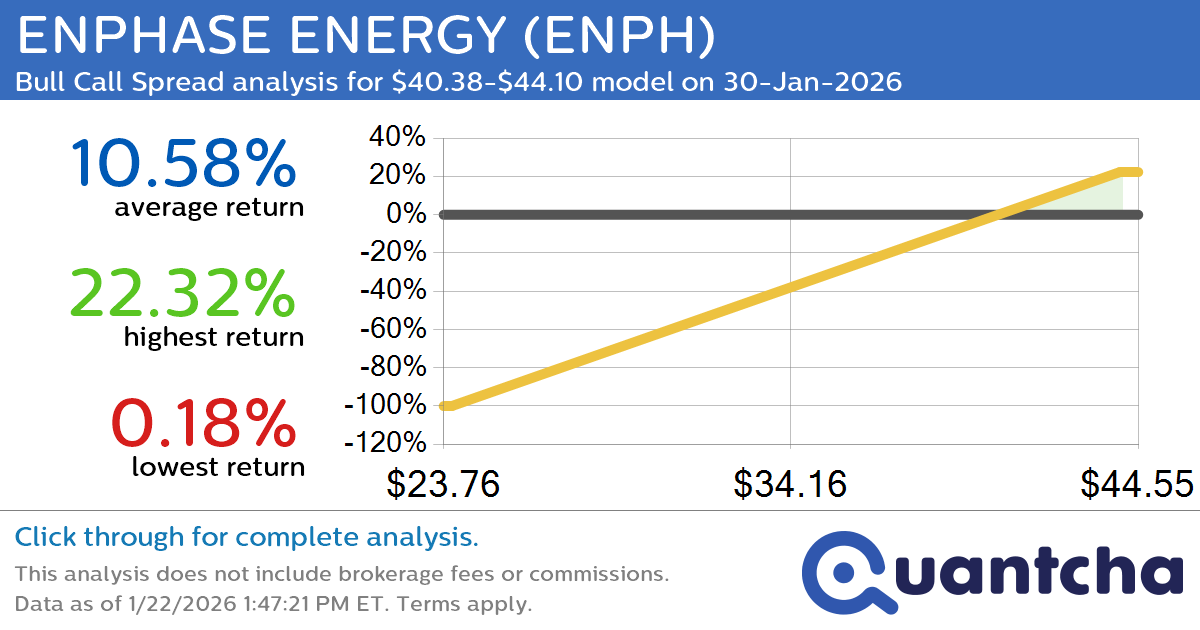

Big Gainer Alert: Trading today’s 12.1% move in ENPHASE ENERGY $ENPH

Quantchabot has detected a new Bull Call Spread trade opportunity for ENPHASE ENERGY (ENPH) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ENPH was recently trading at $40.34 and has an implied volatility of 57.28% for this period. Based on an analysis of the…

-

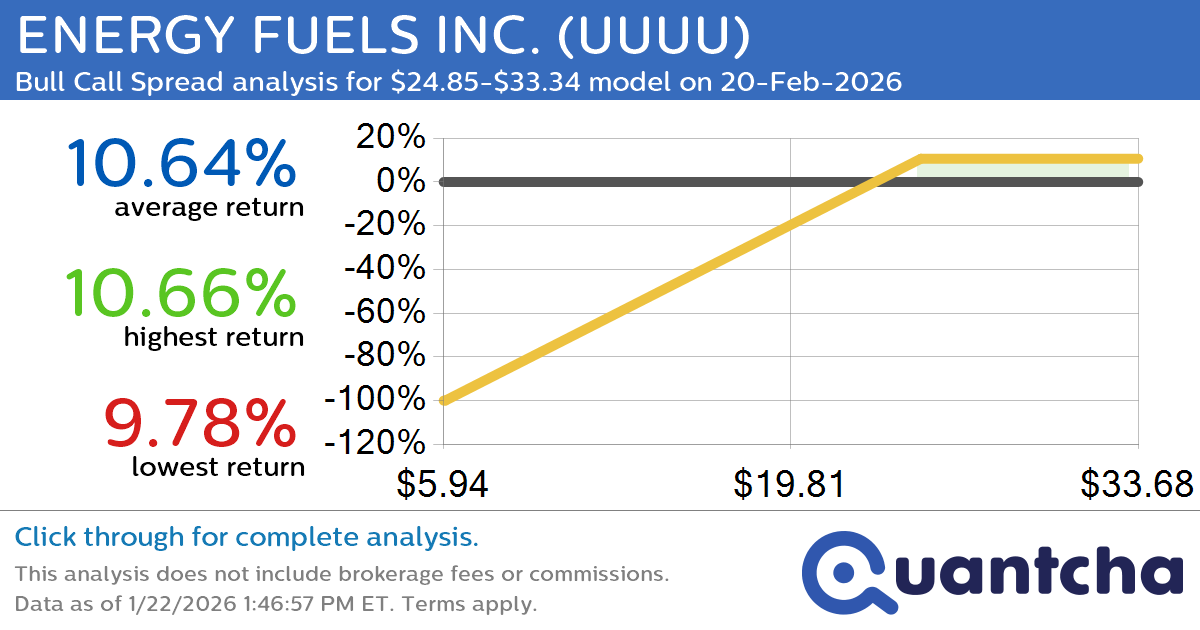

Big Gainer Alert: Trading today’s 10.0% move in ENERGY FUELS INC. $UUUU

Quantchabot has detected a new Bull Call Spread trade opportunity for ENERGY FUELS INC. (UUUU) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UUUU was recently trading at $24.77 and has an implied volatility of 103.18% for this period. Based on an analysis of…

-

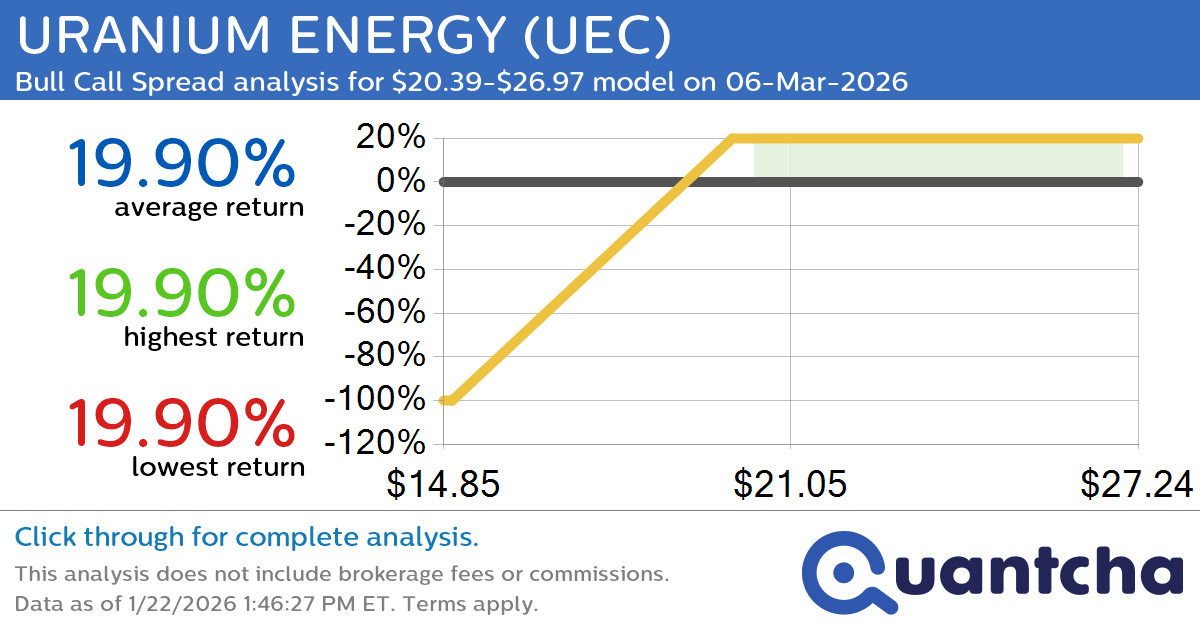

Big Gainer Alert: Trading today’s 7.9% move in URANIUM ENERGY $UEC

Quantchabot has detected a new Bull Call Spread trade opportunity for URANIUM ENERGY (UEC) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UEC was recently trading at $20.30 and has an implied volatility of 80.84% for this period. Based on an analysis of the…