Author: Quantcha Trade Ideas

-

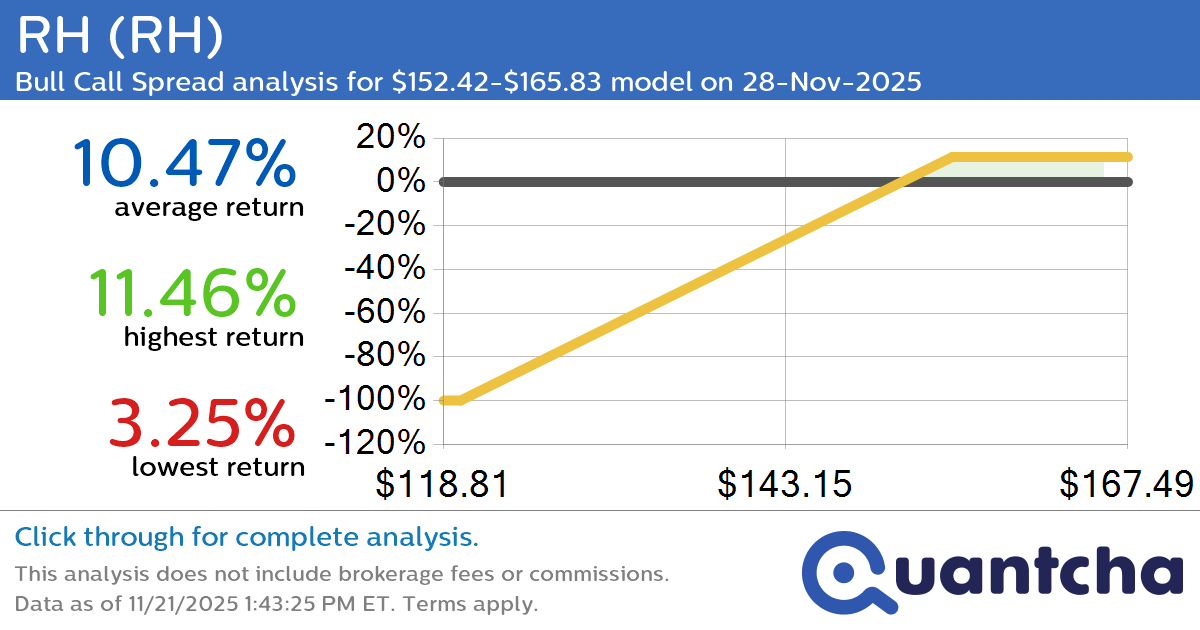

Big Gainer Alert: Trading today’s 9.1% move in RH $RH

Quantchabot has detected a new Bull Call Spread trade opportunity for RH (RH) for the 28-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RH was recently trading at $152.29 and has an implied volatility of 58.30% for this period. Based on an analysis of the options…

-

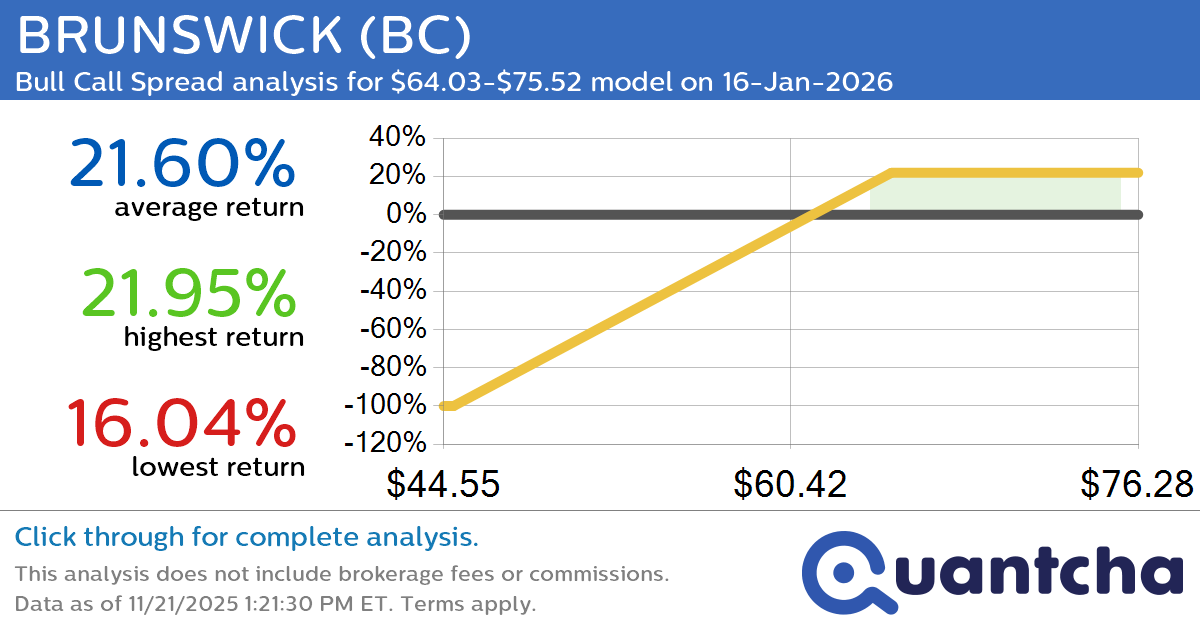

Big Gainer Alert: Trading today’s 7.9% move in BRUNSWICK $BC

Quantchabot has detected a new Bull Call Spread trade opportunity for BRUNSWICK (BC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BC was recently trading at $64.05 and has an implied volatility of 41.89% for this period. Based on an analysis of the options…

-

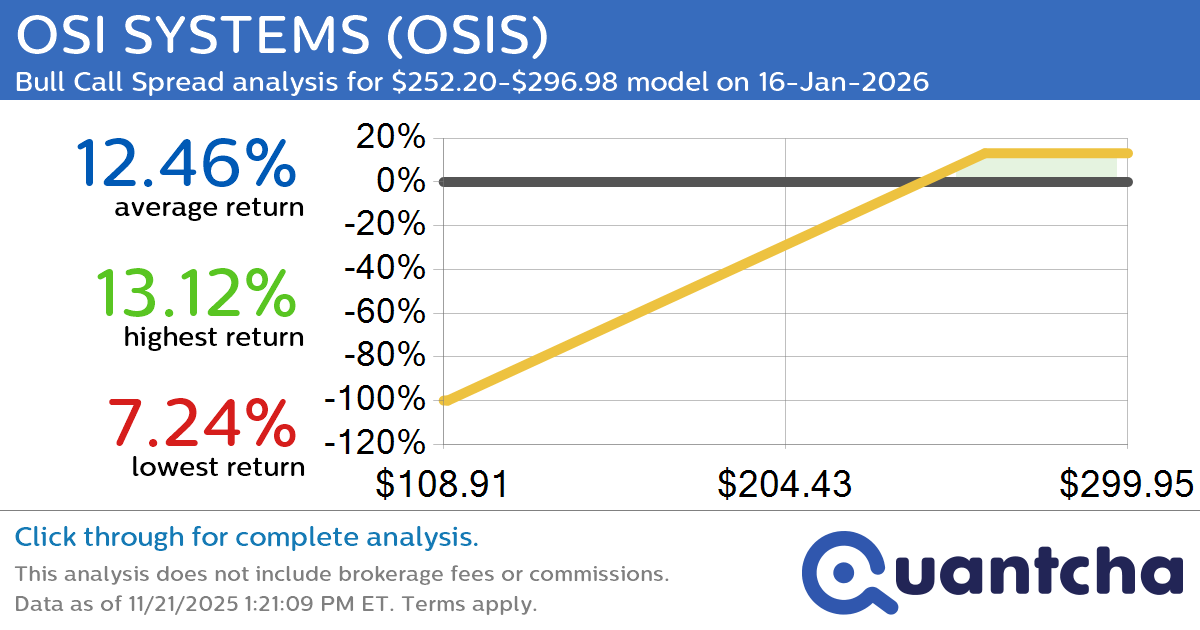

Big Gainer Alert: Trading today’s 7.1% move in OSI SYSTEMS $OSIS

Quantchabot has detected a new Bull Call Spread trade opportunity for OSI SYSTEMS (OSIS) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OSIS was recently trading at $250.59 and has an implied volatility of 41.49% for this period. Based on an analysis of the…

-

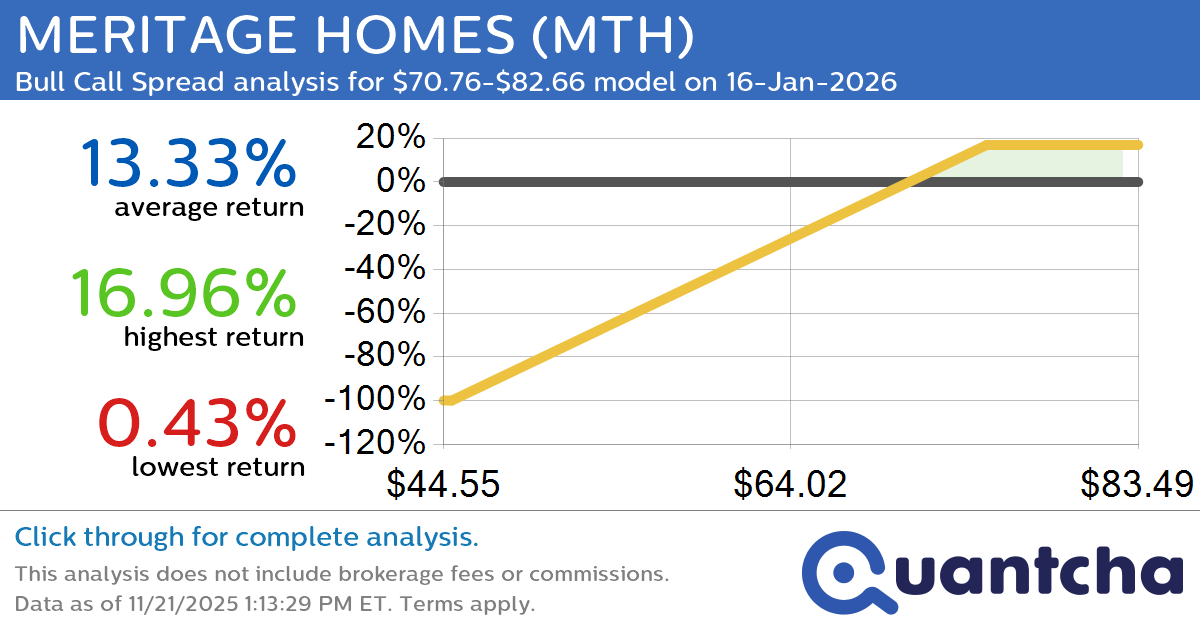

Big Gainer Alert: Trading today’s 7.7% move in MERITAGE HOMES $MTH

Quantchabot has detected a new Bull Call Spread trade opportunity for MERITAGE HOMES (MTH) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MTH was recently trading at $70.74 and has an implied volatility of 39.45% for this period. Based on an analysis of the…

-

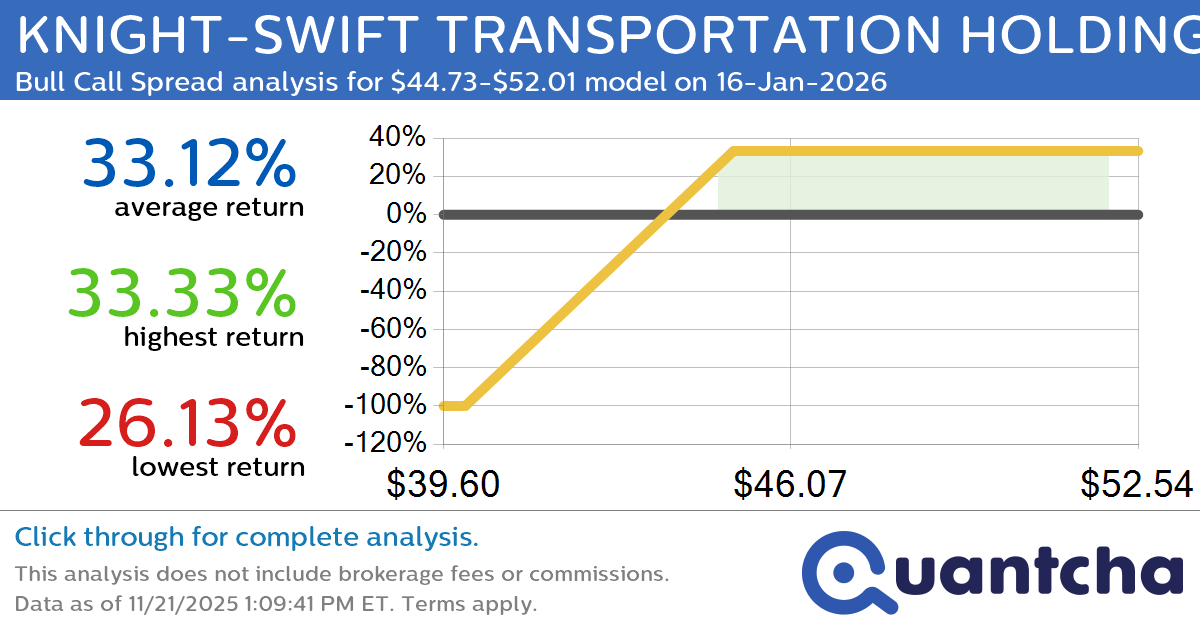

Big Gainer Alert: Trading today’s 7.1% move in KNIGHT-SWIFT TRANSPORTATION HOLDINGS INC $KNX

Quantchabot has detected a new Bull Call Spread trade opportunity for KNIGHT-SWIFT TRANSPORTATION HOLDINGS INC (KNX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KNX was recently trading at $44.62 and has an implied volatility of 38.29% for this period. Based on an analysis…

-

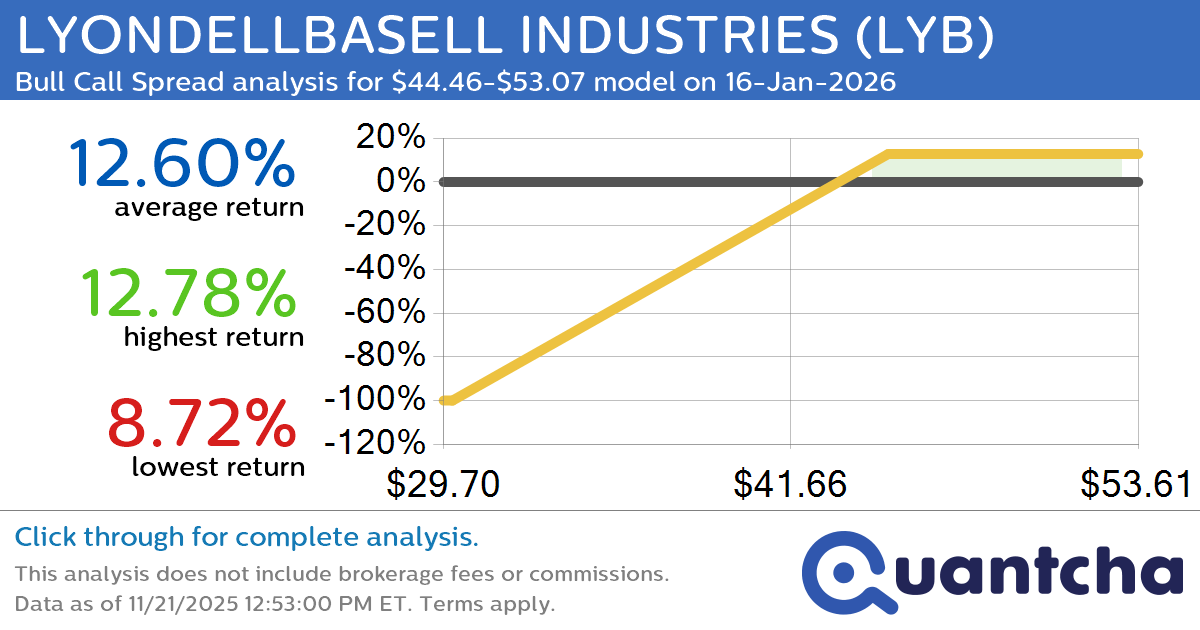

Big Gainer Alert: Trading today’s 7.0% move in LYONDELLBASELL INDUSTRIES $LYB

Quantchabot has detected a new Bull Call Spread trade opportunity for LYONDELLBASELL INDUSTRIES (LYB) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LYB was recently trading at $45.55 and has an implied volatility of 44.95% for this period. Based on an analysis of the…

-

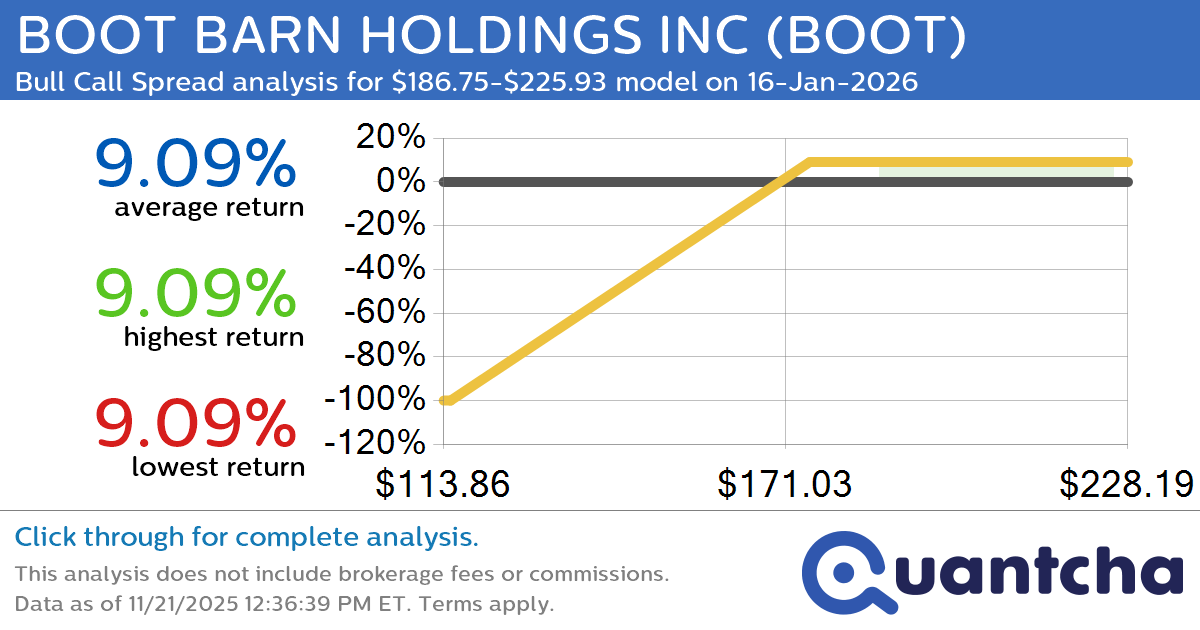

Big Gainer Alert: Trading today’s 7.2% move in BOOT BARN HOLDINGS INC $BOOT

Quantchabot has detected a new Bull Call Spread trade opportunity for BOOT BARN HOLDINGS INC (BOOT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BOOT was recently trading at $185.56 and has an implied volatility of 48.32% for this period. Based on an analysis…

-

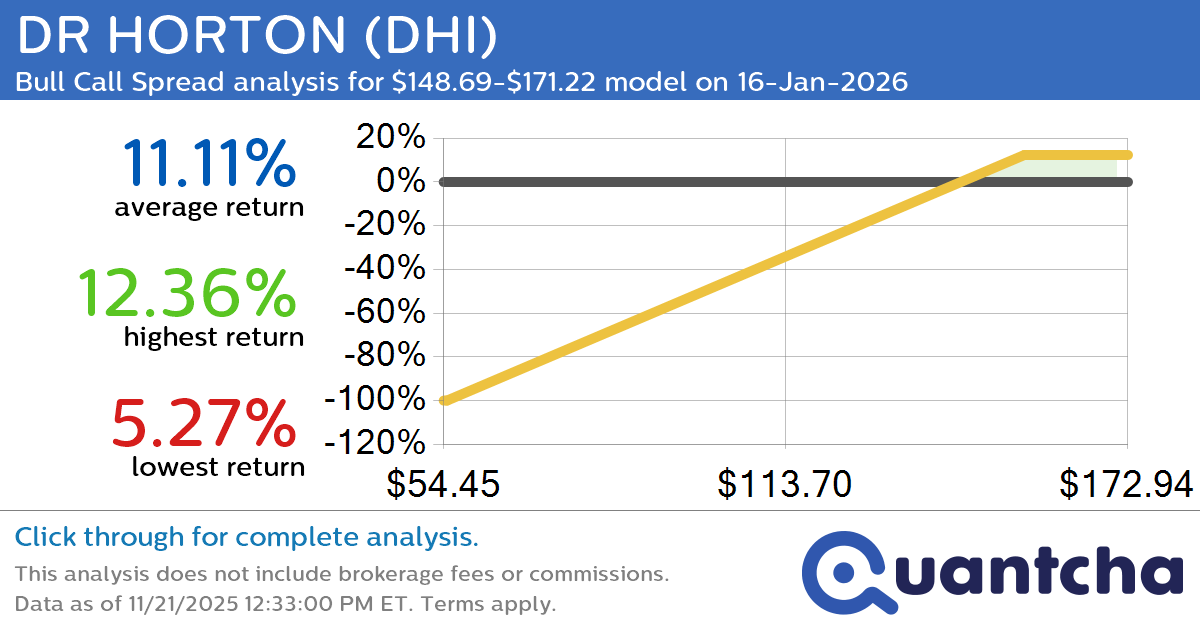

Big Gainer Alert: Trading today’s 7.6% move in DR HORTON $DHI

Quantchabot has detected a new Bull Call Spread trade opportunity for DR HORTON (DHI) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DHI was recently trading at $147.74 and has an implied volatility of 35.81% for this period. Based on an analysis of the…

-

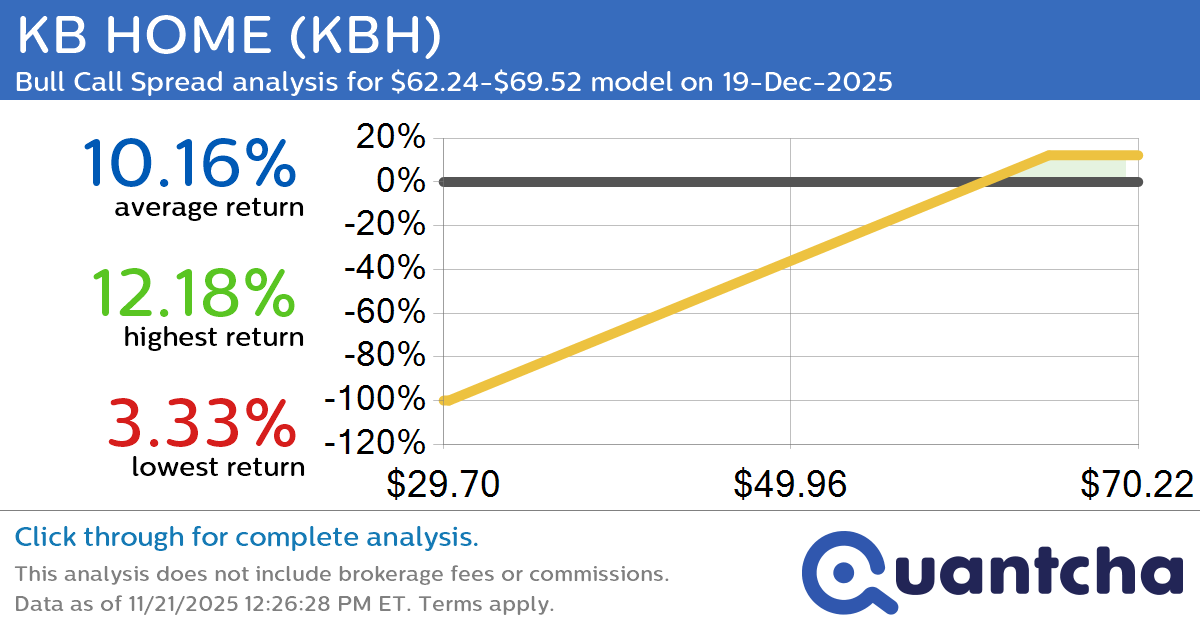

Big Gainer Alert: Trading today’s 7.2% move in KB HOME $KBH

Quantchabot has detected a new Bull Call Spread trade opportunity for KB HOME (KBH) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KBH was recently trading at $62.04 and has an implied volatility of 39.43% for this period. Based on an analysis of the…

-

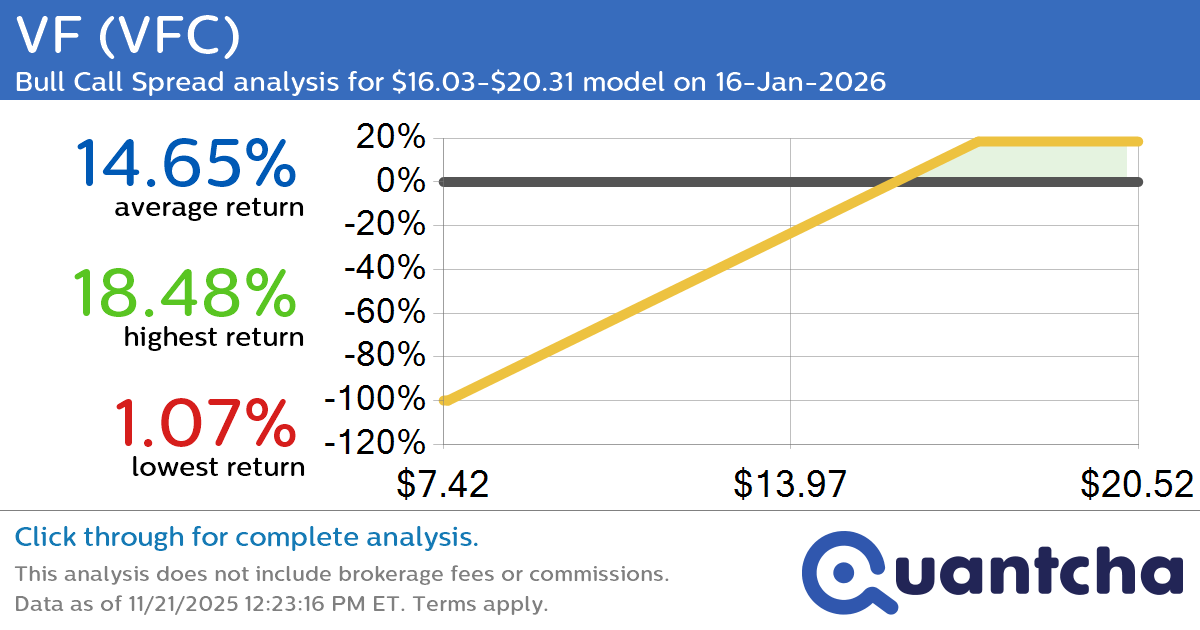

Big Gainer Alert: Trading today’s 9.5% move in VF $VFC

Quantchabot has detected a new Bull Call Spread trade opportunity for VF (VFC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VFC was recently trading at $16.02 and has an implied volatility of 60.07% for this period. Based on an analysis of the options…