Author: Quantcha Trade Ideas

-

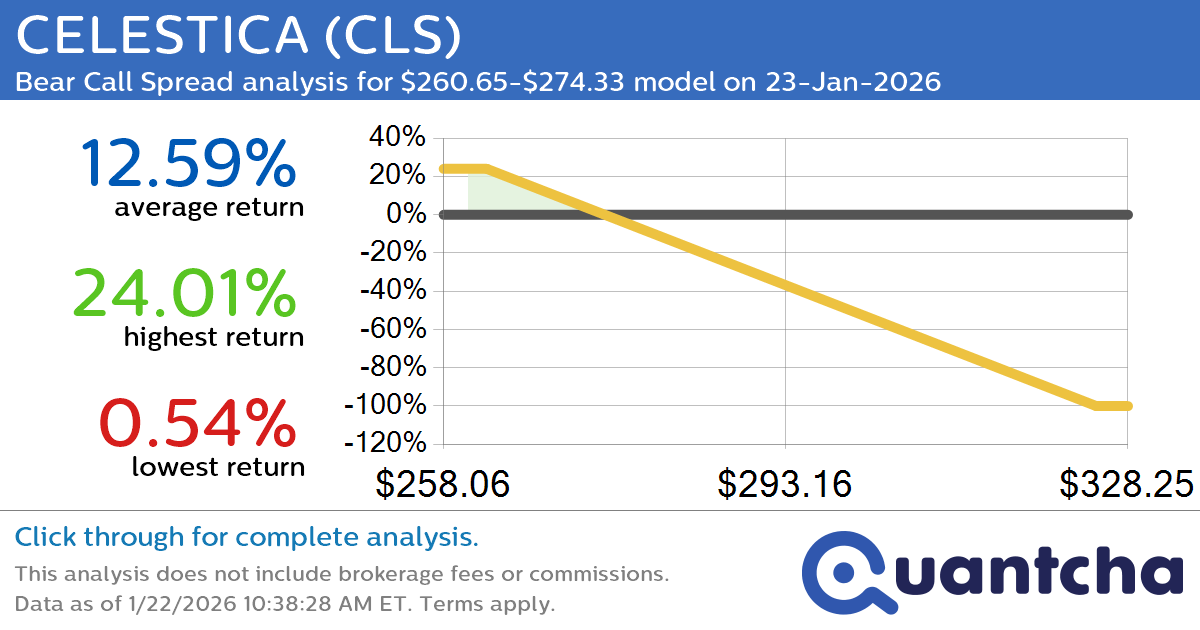

Big Loser Alert: Trading today’s -11.5% move in CELESTICA $CLS

Quantchabot has detected a new Bear Call Spread trade opportunity for CELESTICA (CLS) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CLS was recently trading at $274.28 and has an implied volatility of 73.45% for this period. Based on an analysis of the options…

-

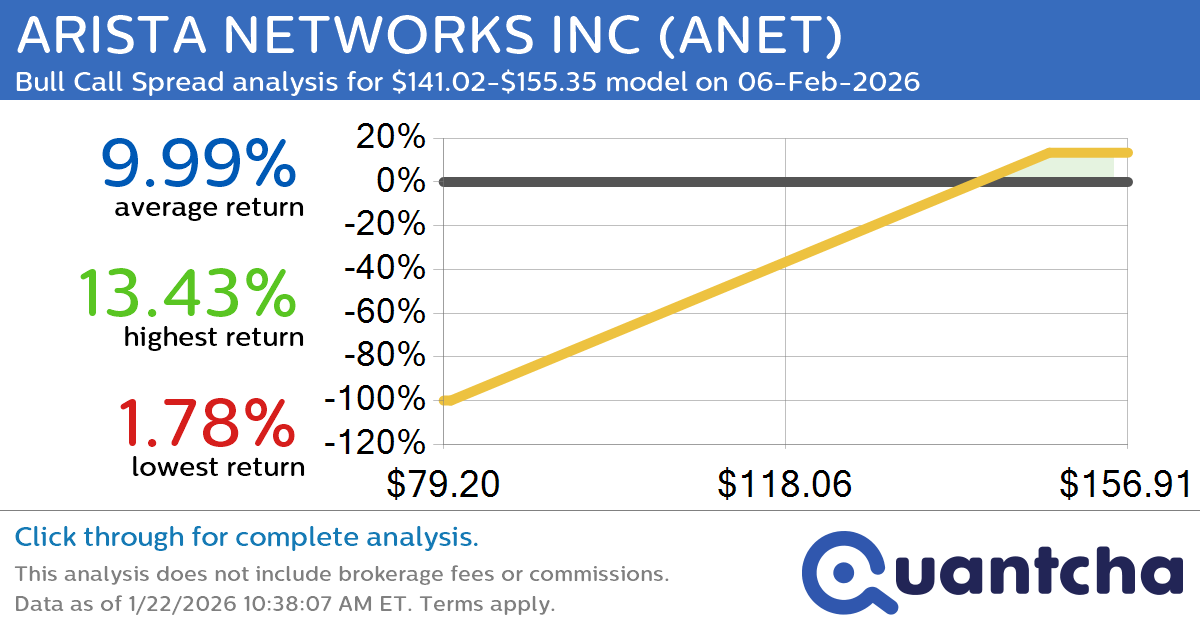

Big Gainer Alert: Trading today’s 10.6% move in ARISTA NETWORKS INC $ANET

Quantchabot has detected a new Bull Call Spread trade opportunity for ARISTA NETWORKS INC (ANET) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ANET was recently trading at $140.78 and has an implied volatility of 46.56% for this period. Based on an analysis of…

-

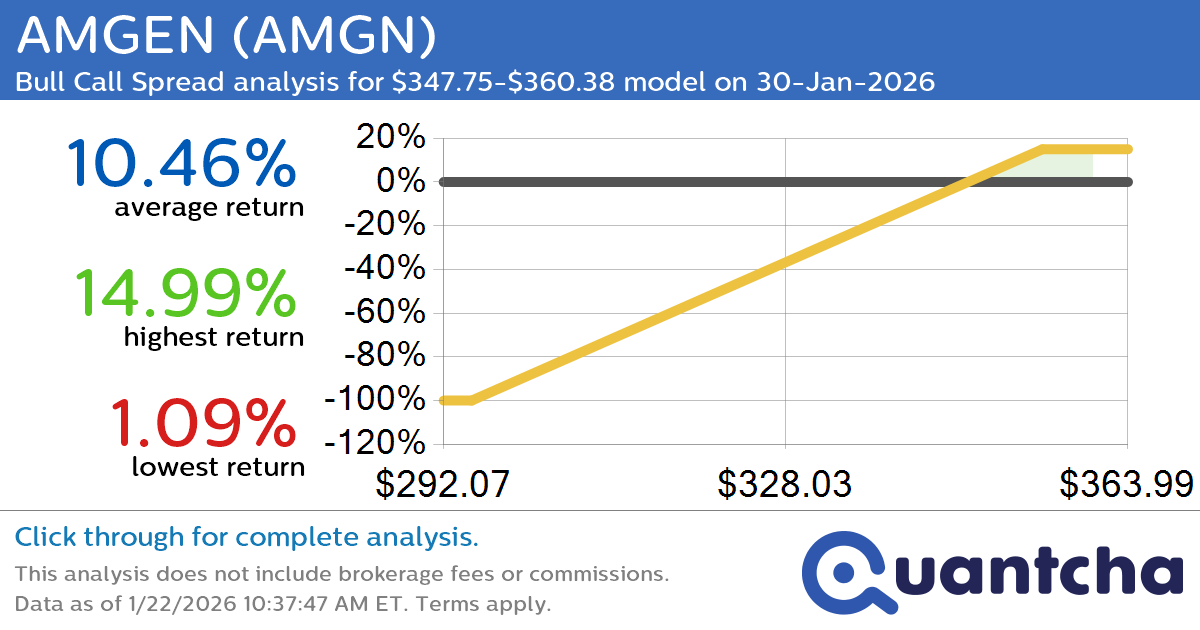

52-Week High Alert: Trading today’s movement in AMGEN $AMGN

Quantchabot has detected a new Bull Call Spread trade opportunity for AMGEN (AMGN) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMGN was recently trading at $347.44 and has an implied volatility of 23.02% for this period. Based on an analysis of the options…

-

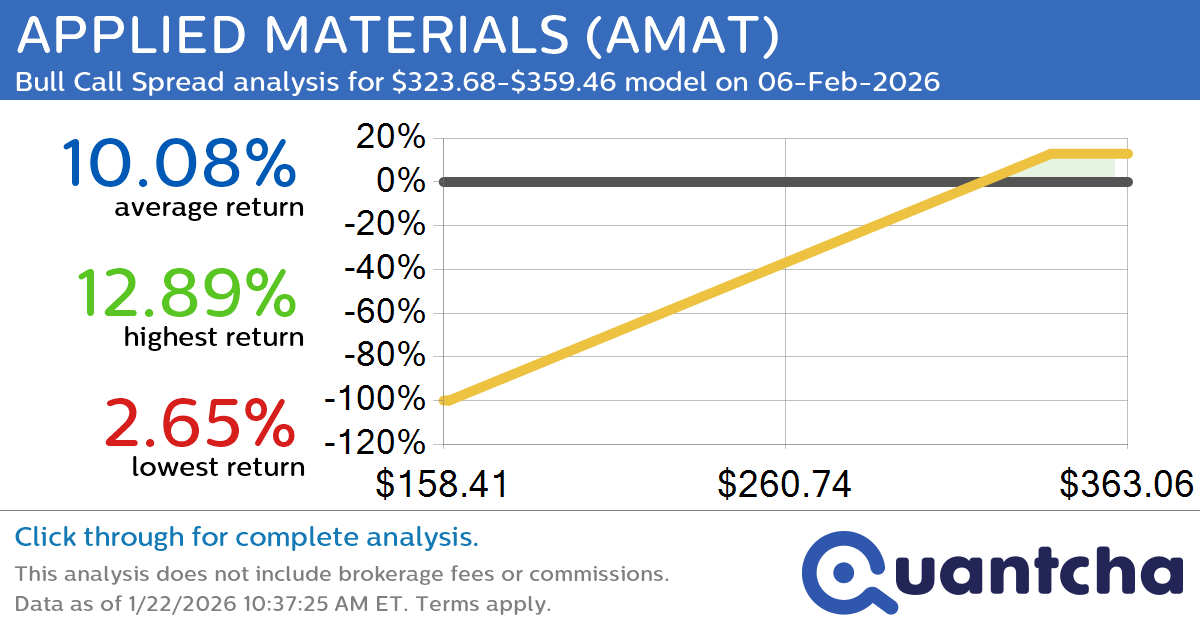

52-Week High Alert: Trading today’s movement in APPLIED MATERIALS $AMAT

Quantchabot has detected a new Bull Call Spread trade opportunity for APPLIED MATERIALS (AMAT) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMAT was recently trading at $323.15 and has an implied volatility of 50.44% for this period. Based on an analysis of the…

-

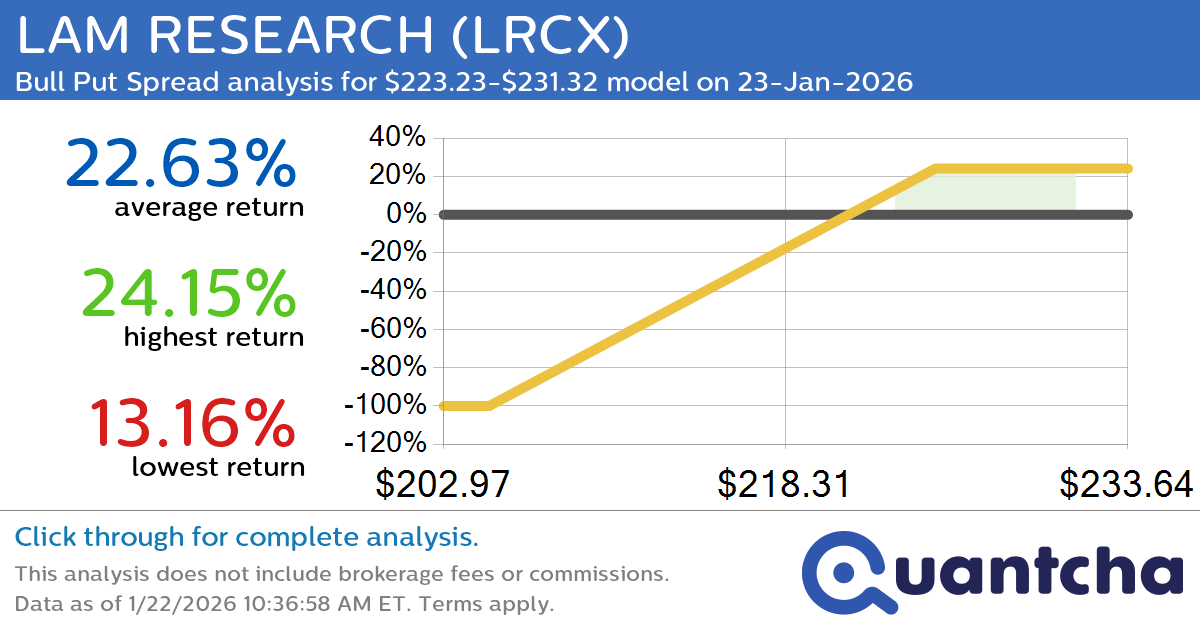

52-Week High Alert: Trading today’s movement in LAM RESEARCH $LRCX

Quantchabot has detected a new Bull Put Spread trade opportunity for LAM RESEARCH (LRCX) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LRCX was recently trading at $223.19 and has an implied volatility of 51.15% for this period. Based on an analysis of the…

-

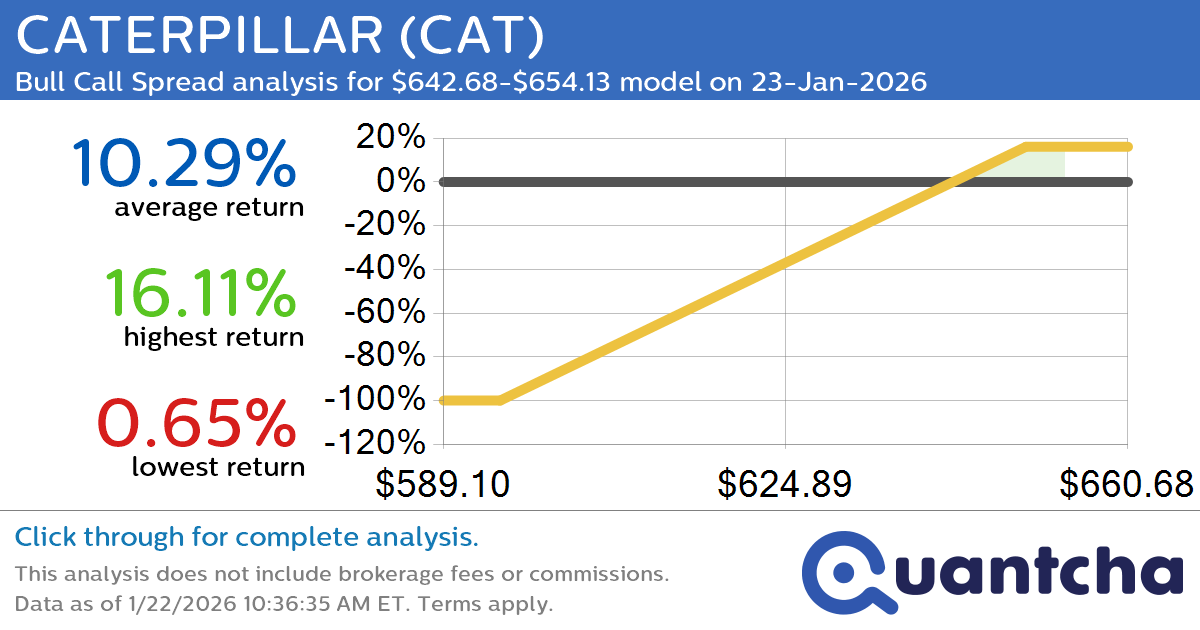

52-Week High Alert: Trading today’s movement in CATERPILLAR $CAT

Quantchabot has detected a new Bull Call Spread trade opportunity for CATERPILLAR (CAT) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAT was recently trading at $642.56 and has an implied volatility of 25.36% for this period. Based on an analysis of the options…

-

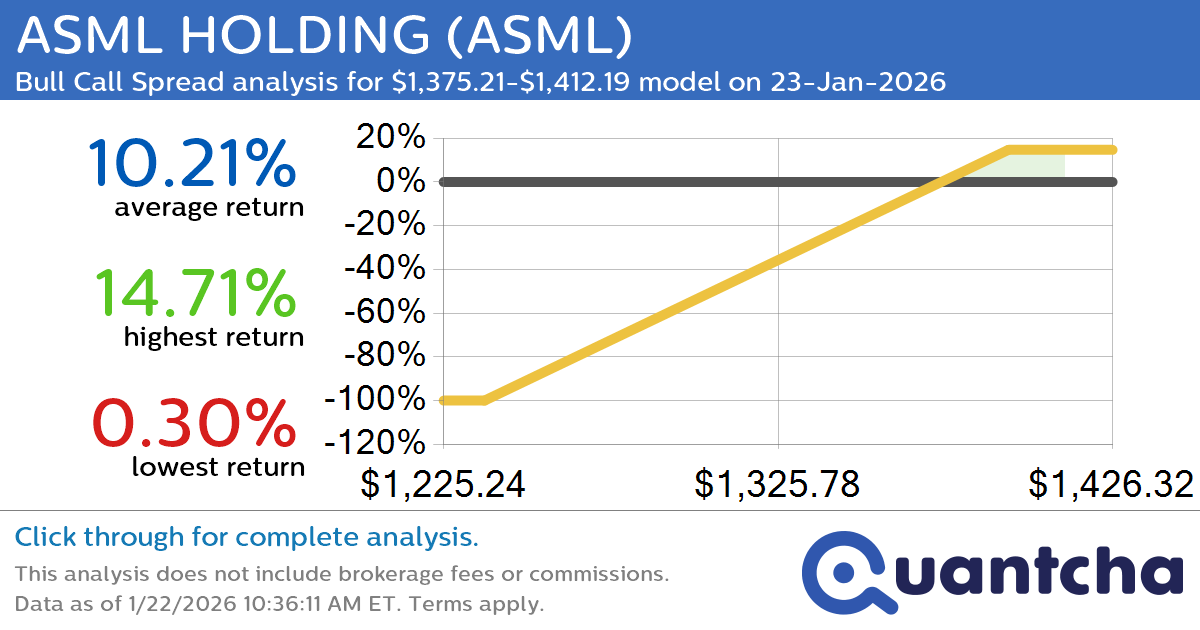

52-Week High Alert: Trading today’s movement in ASML HOLDING $ASML

Quantchabot has detected a new Bull Call Spread trade opportunity for ASML HOLDING (ASML) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ASML was recently trading at $1,374.96 and has an implied volatility of 38.10% for this period. Based on an analysis of the…

-

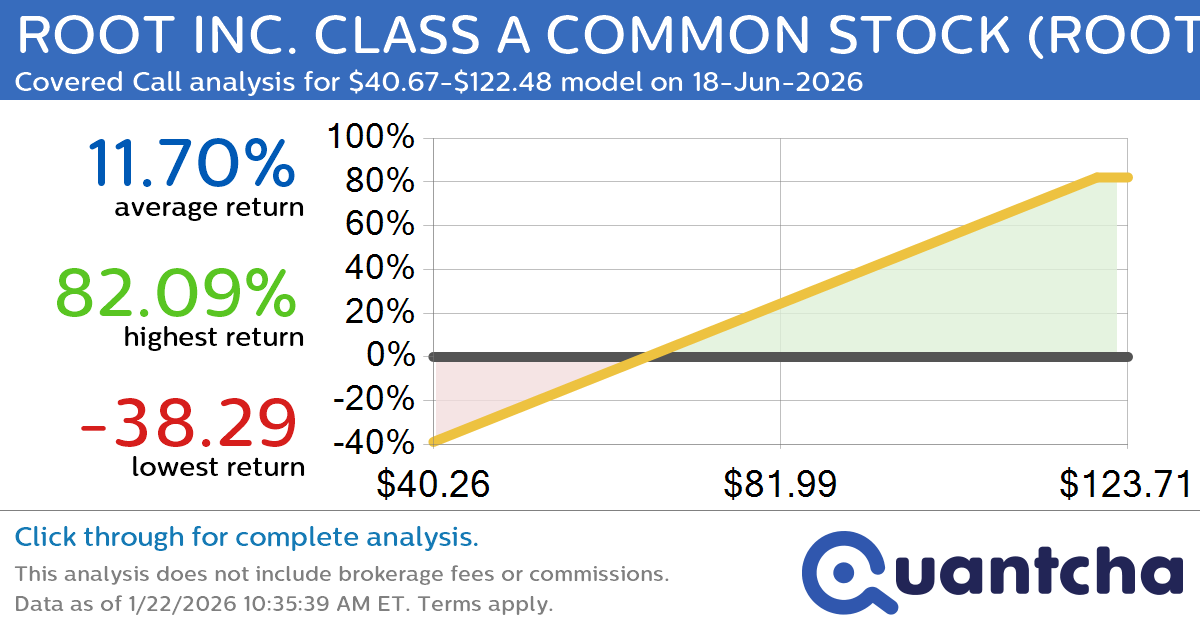

Covered Call Alert: ROOT INC. CLASS A COMMON STOCK $ROOT returning up to 81.00% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ROOT INC. CLASS A COMMON STOCK (ROOT) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ROOT was recently trading at $69.51 and has an implied volatility of 86.63% for this period. Based on an…

-

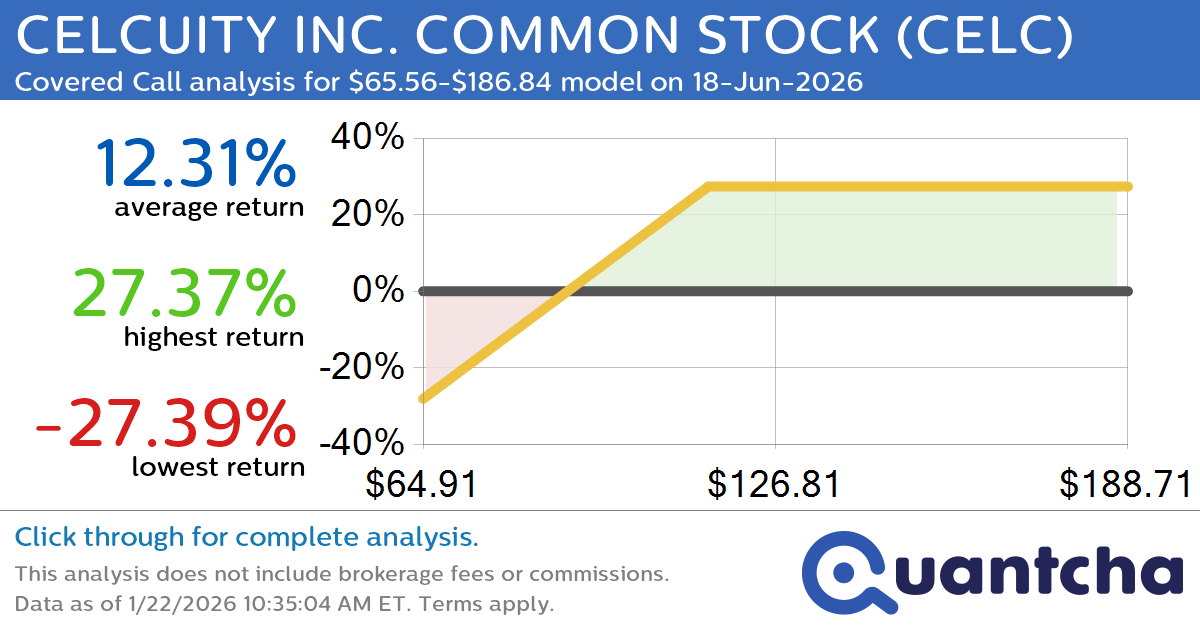

Covered Call Alert: CELCUITY INC. COMMON STOCK $CELC returning up to 27.35% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for CELCUITY INC. COMMON STOCK (CELC) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CELC was recently trading at $109.00 and has an implied volatility of 82.30% for this period. Based on an analysis of…

-

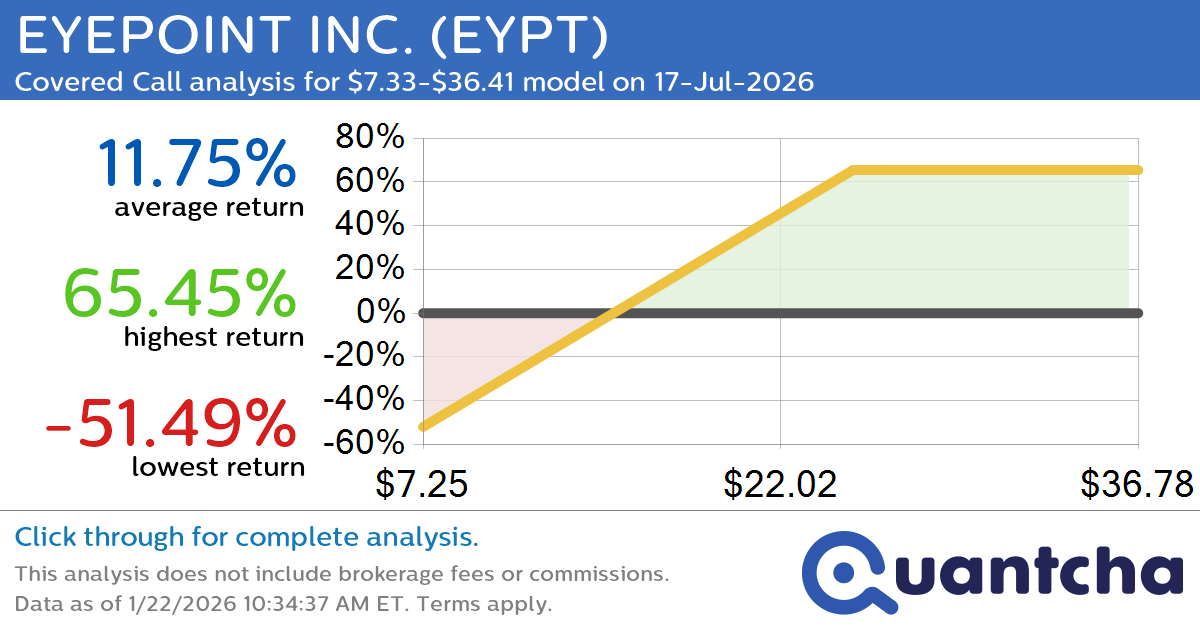

Covered Call Alert: EYEPOINT INC. $EYPT returning up to 66.11% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for EYEPOINT INC. (EYPT) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EYPT was recently trading at $16.04 and has an implied volatility of 115.16% for this period. Based on an analysis of the options…