Author: Quantcha Trade Ideas

-

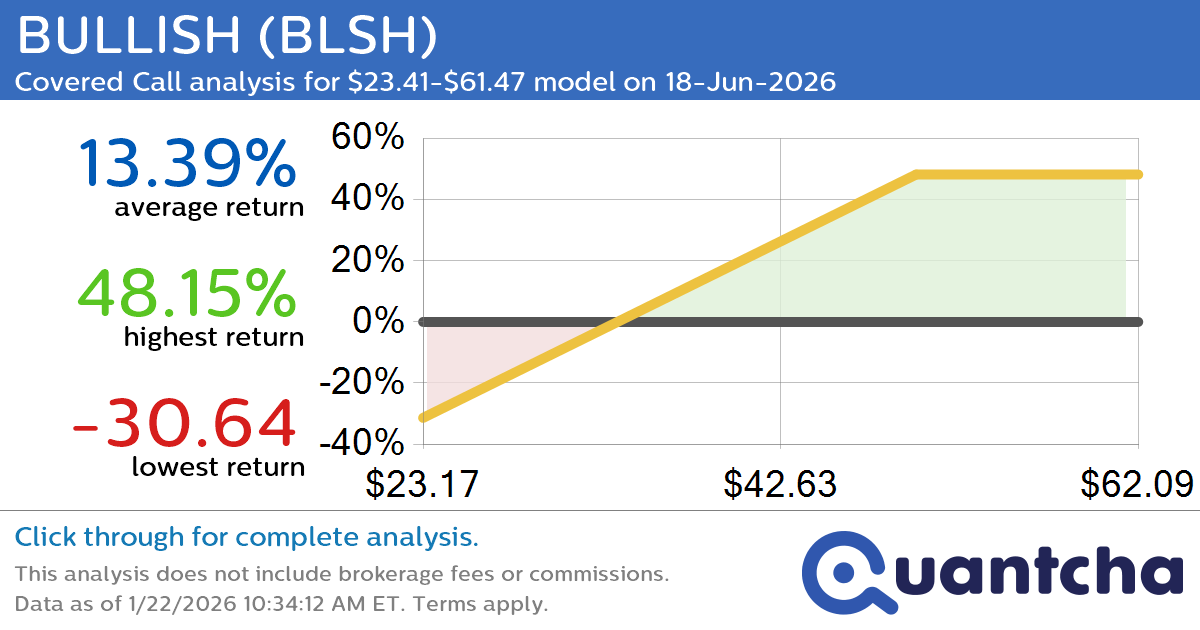

Covered Call Alert: BULLISH $BLSH returning up to 47.45% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for BULLISH (BLSH) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BLSH was recently trading at $37.36 and has an implied volatility of 75.86% for this period. Based on an analysis of the options available…

-

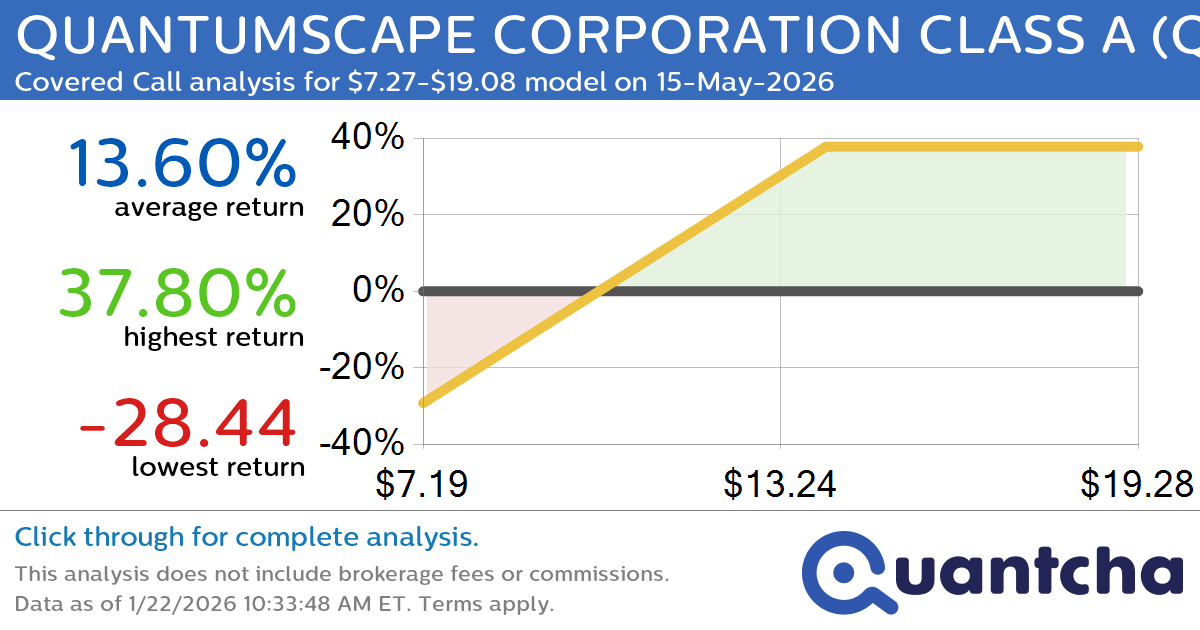

Covered Call Alert: QUANTUMSCAPE CORPORATION CLASS A $QS returning up to 38.34% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for QUANTUMSCAPE CORPORATION CLASS A (QS) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. QS was recently trading at $11.64 and has an implied volatility of 86.38% for this period. Based on an analysis of…

-

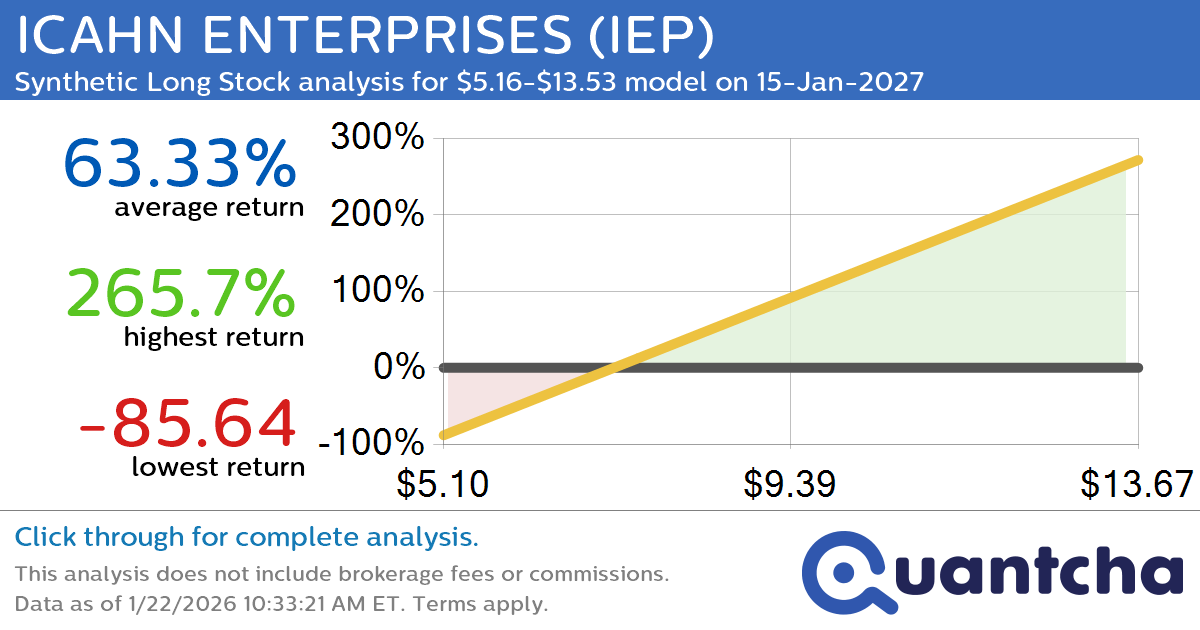

Synthetic Long Discount Alert: ICAHN ENTERPRISES $IEP trading at a 10.67% discount for the 15-Jan-2027 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ICAHN ENTERPRISES (IEP) for the 15-Jan-2027 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IEP was recently trading at $8.06 and has an implied volatility of 48.56% for this period. Based on an analysis of the…

-

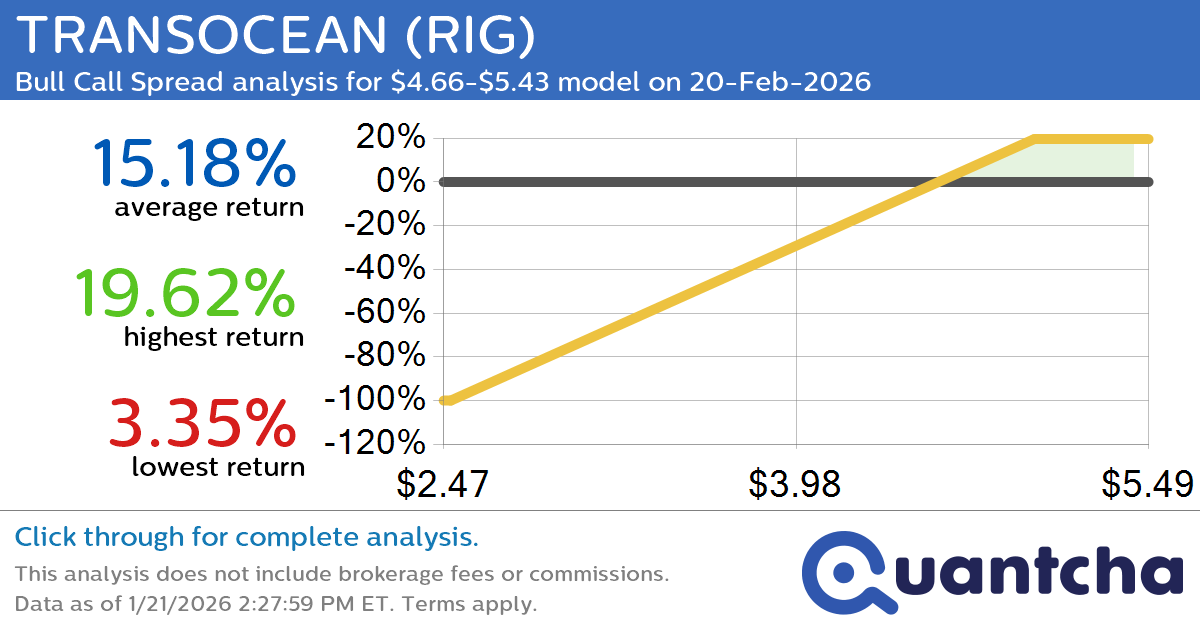

Big Gainer Alert: Trading today’s 7.9% move in TRANSOCEAN $RIG

Quantchabot has detected a new Bull Call Spread trade opportunity for TRANSOCEAN (RIG) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RIG was recently trading at $4.64 and has an implied volatility of 53.39% for this period. Based on an analysis of the options…

-

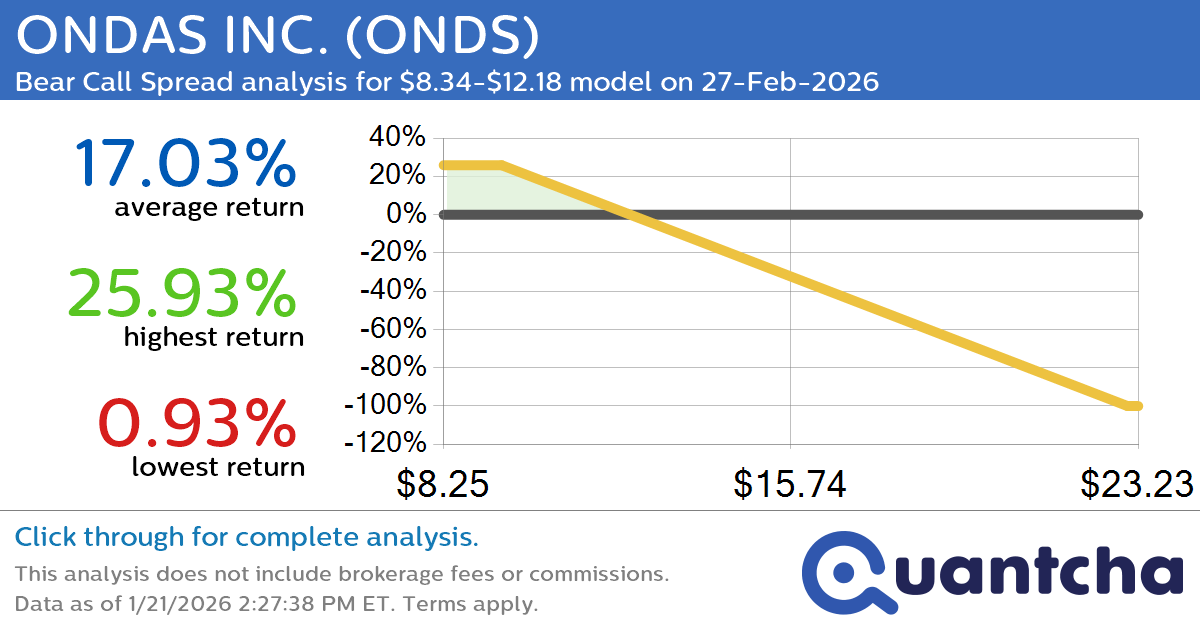

Big Loser Alert: Trading today’s -7.6% move in ONDAS INC. $ONDS

Quantchabot has detected a new Bear Call Spread trade opportunity for ONDAS INC. (ONDS) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ONDS was recently trading at $12.14 and has an implied volatility of 118.11% for this period. Based on an analysis of the…

-

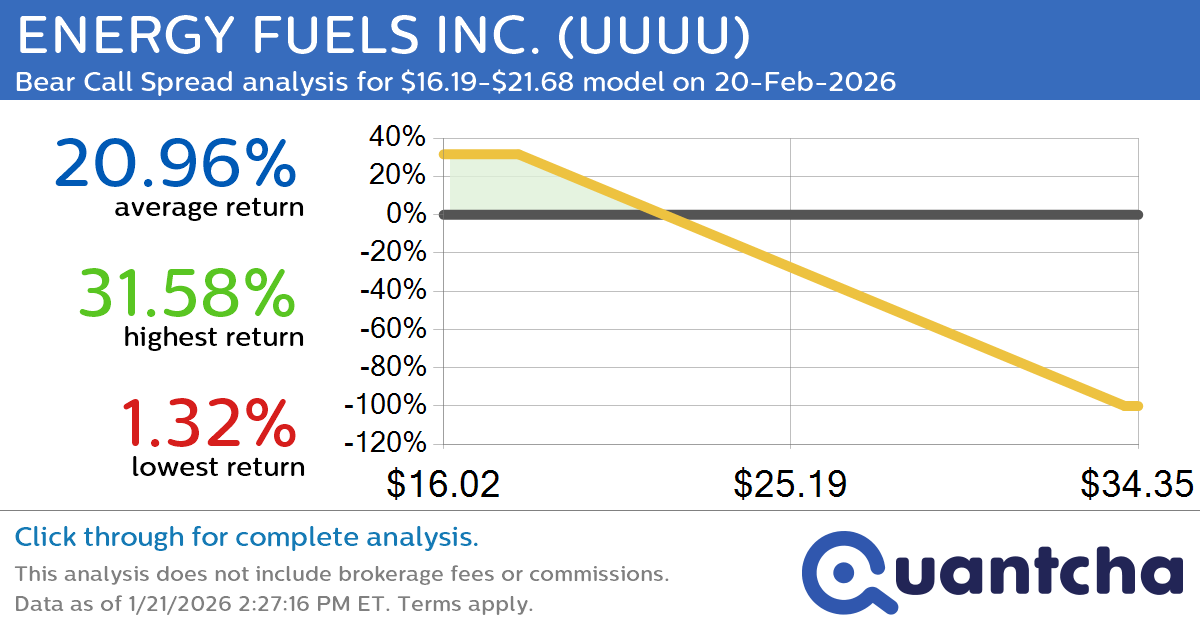

Big Loser Alert: Trading today’s -8.1% move in ENERGY FUELS INC. $UUUU

Quantchabot has detected a new Bear Call Spread trade opportunity for ENERGY FUELS INC. (UUUU) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UUUU was recently trading at $21.61 and has an implied volatility of 100.88% for this period. Based on an analysis of…

-

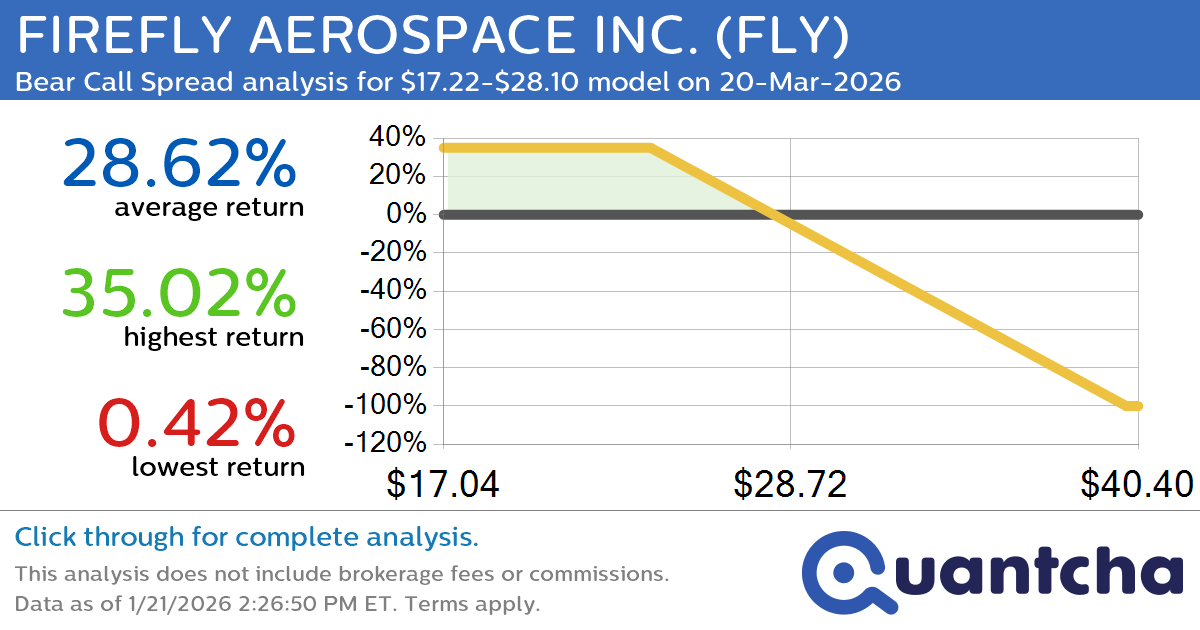

Big Loser Alert: Trading today’s -8.0% move in FIREFLY AEROSPACE INC. $FLY

Quantchabot has detected a new Bear Call Spread trade opportunity for FIREFLY AEROSPACE INC. (FLY) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FLY was recently trading at $27.93 and has an implied volatility of 122.17% for this period. Based on an analysis of…

-

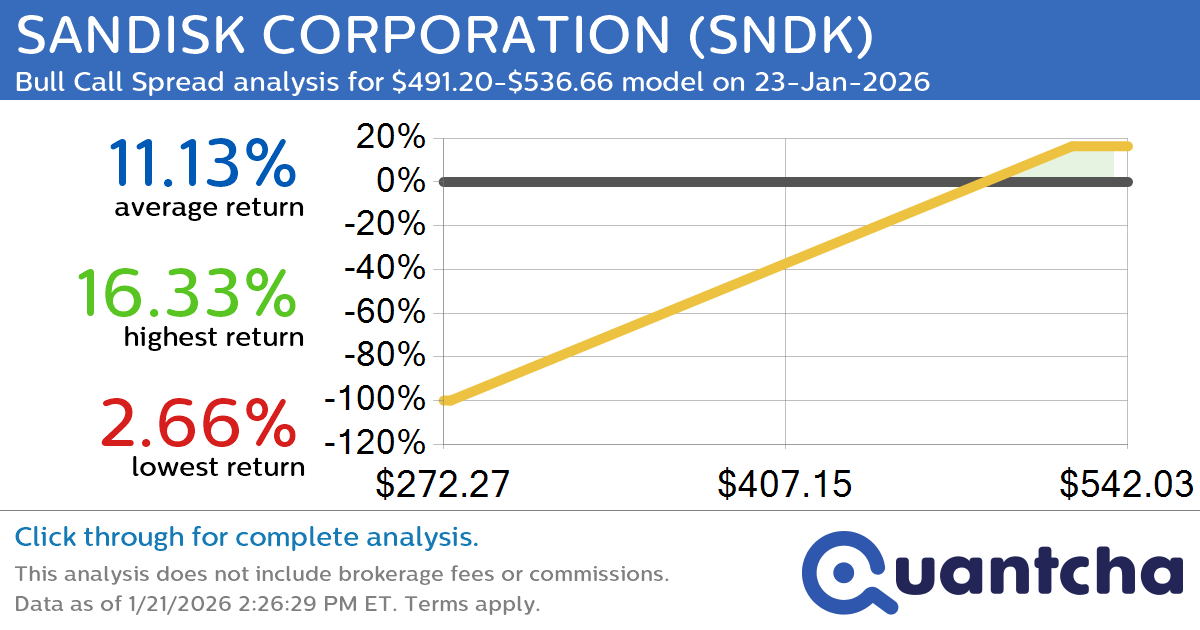

Big Gainer Alert: Trading today’s 8.4% move in SANDISK CORPORATION $SNDK

Quantchabot has detected a new Bull Call Spread trade opportunity for SANDISK CORPORATION (SNDK) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SNDK was recently trading at $491.07 and has an implied volatility of 104.65% for this period. Based on an analysis of the…

-

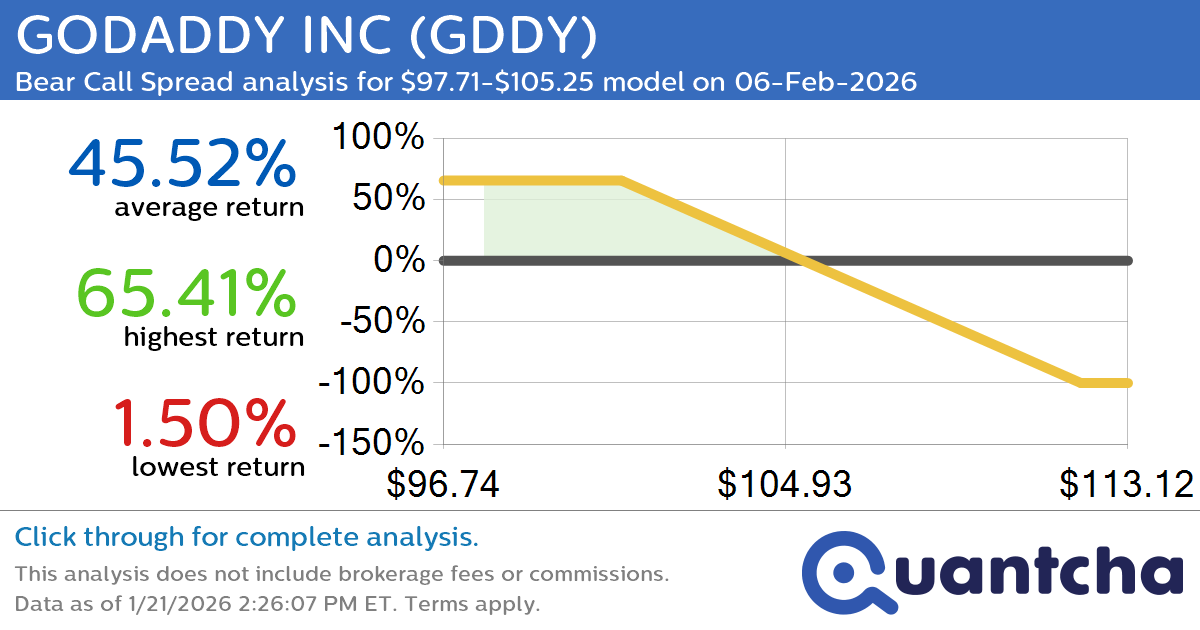

52-Week Low Alert: Trading today’s movement in GODADDY INC $GDDY

Quantchabot has detected a new Bear Call Spread trade opportunity for GODADDY INC (GDDY) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GDDY was recently trading at $105.07 and has an implied volatility of 34.87% for this period. Based on an analysis of the…

-

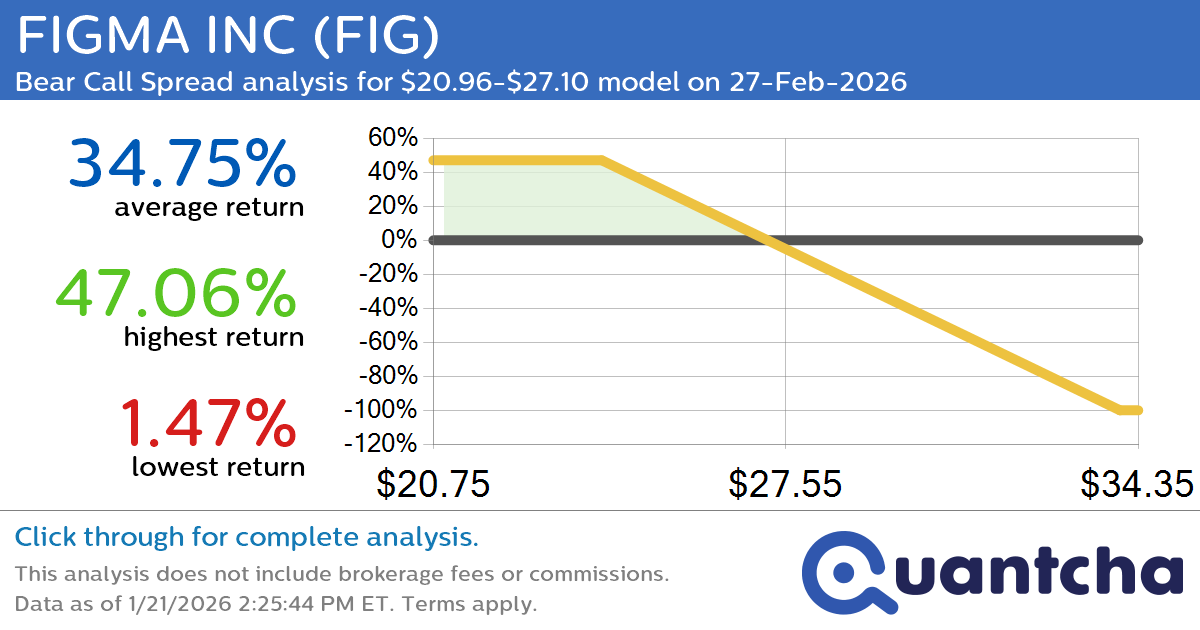

52-Week Low Alert: Trading today’s movement in FIGMA INC $FIG

Quantchabot has detected a new Bear Call Spread trade opportunity for FIGMA INC (FIG) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIG was recently trading at $27.00 and has an implied volatility of 80.02% for this period. Based on an analysis of the…