Author: Quantcha Trade Ideas

-

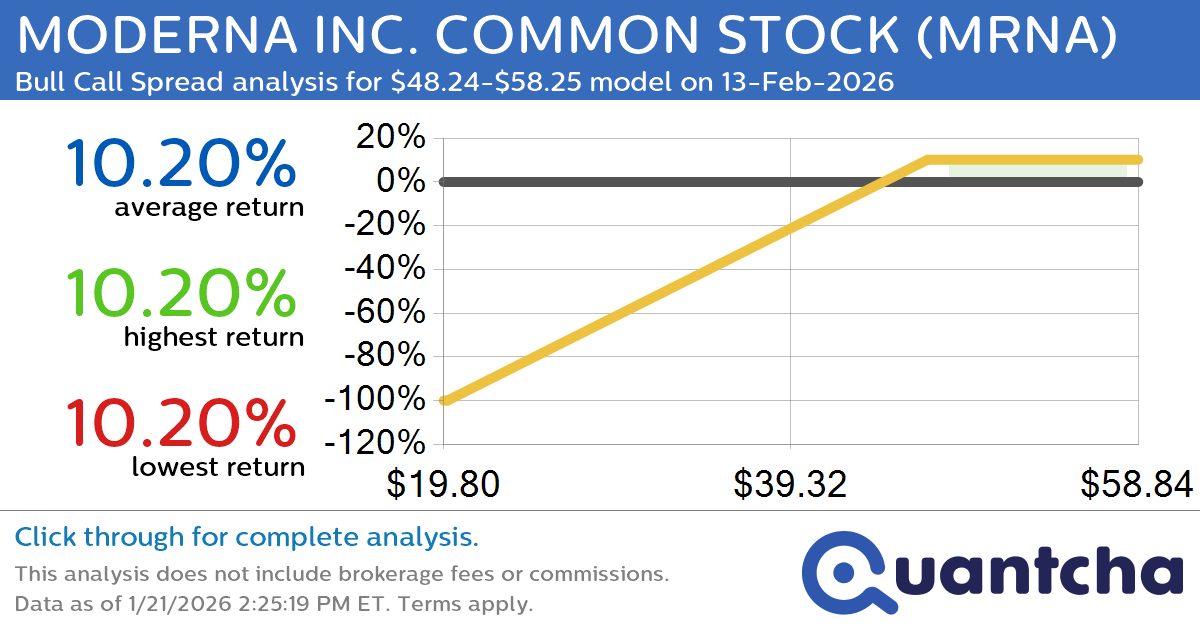

52-Week High Alert: Trading today’s movement in MODERNA INC. COMMON STOCK $MRNA

Quantchabot has detected a new Bull Call Spread trade opportunity for MODERNA INC. COMMON STOCK (MRNA) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MRNA was recently trading at $48.12 and has an implied volatility of 74.17% for this period. Based on an analysis…

-

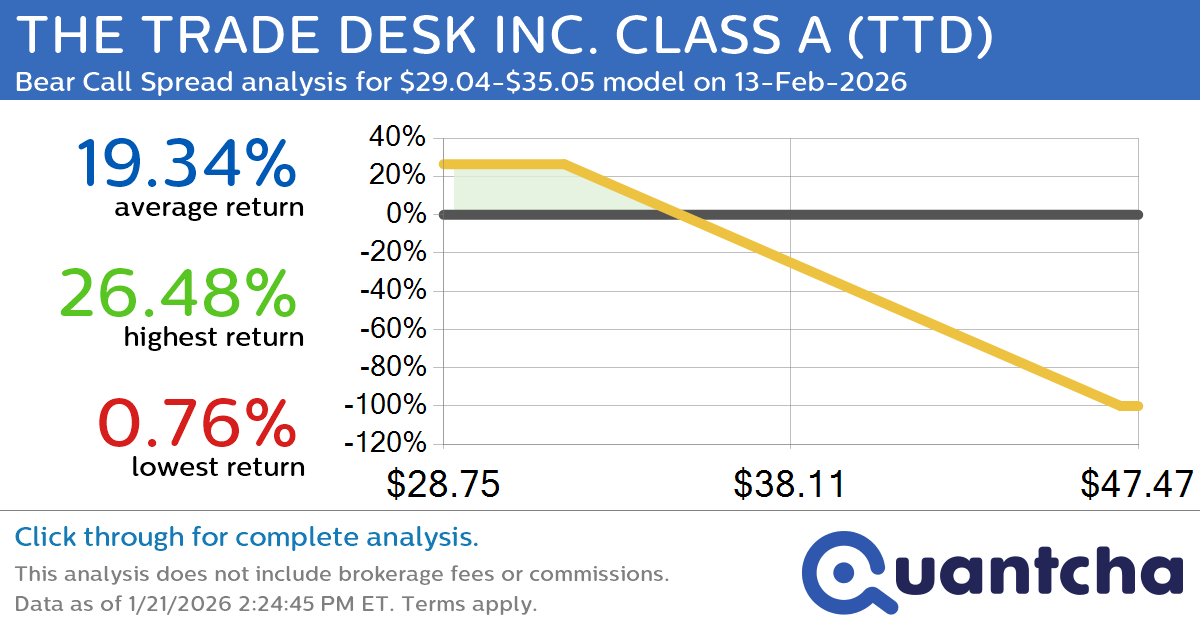

52-Week Low Alert: Trading today’s movement in THE TRADE DESK INC. CLASS A $TTD

Quantchabot has detected a new Bear Call Spread trade opportunity for THE TRADE DESK INC. CLASS A (TTD) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTD was recently trading at $34.96 and has an implied volatility of 73.88% for this period. Based on…

-

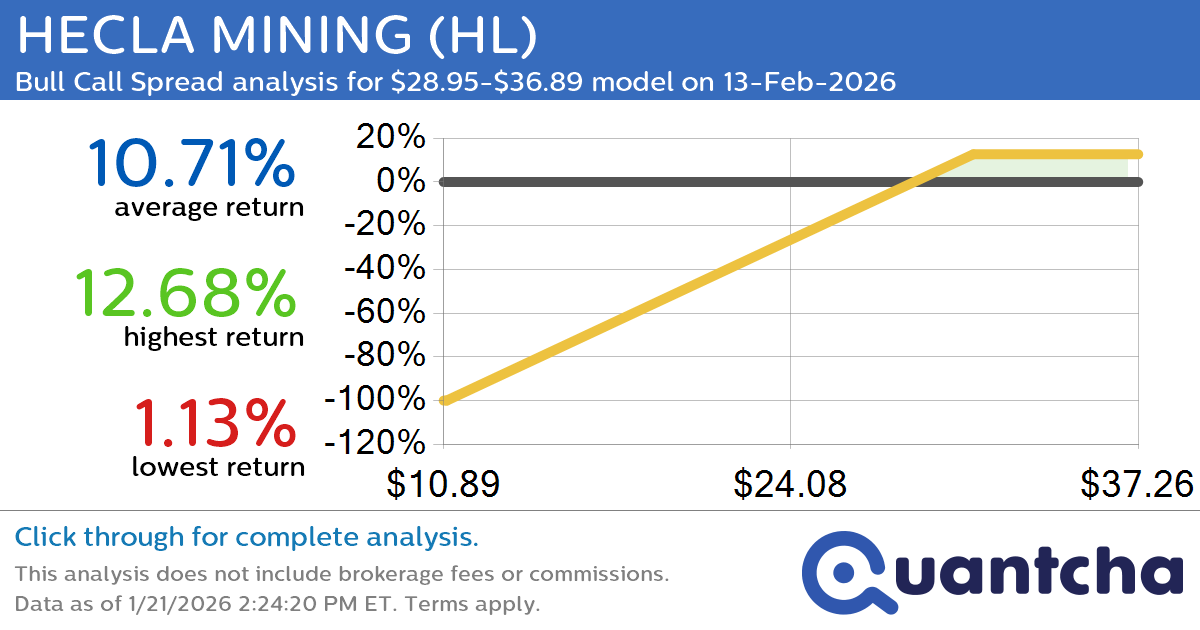

52-Week High Alert: Trading today’s movement in HECLA MINING $HL

Quantchabot has detected a new Bull Call Spread trade opportunity for HECLA MINING (HL) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HL was recently trading at $28.88 and has an implied volatility of 95.32% for this period. Based on an analysis of the…

-

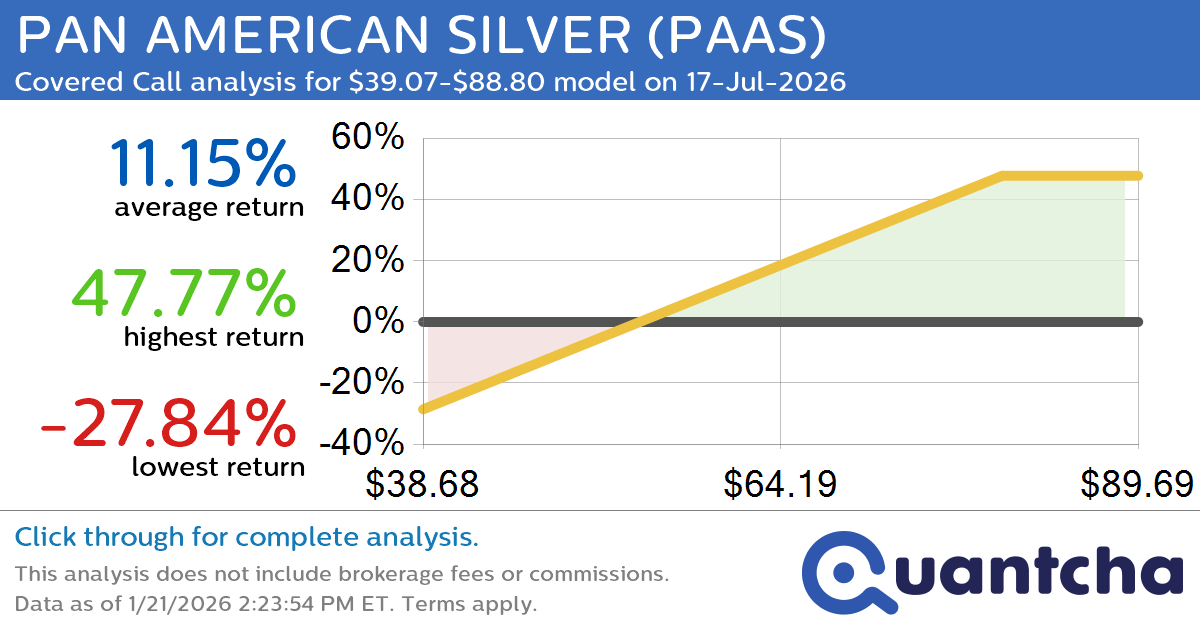

Covered Call Alert: PAN AMERICAN SILVER $PAAS returning up to 47.77% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for PAN AMERICAN SILVER (PAAS) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PAAS was recently trading at $57.83 and has an implied volatility of 58.85% for this period. Based on an analysis of the…

-

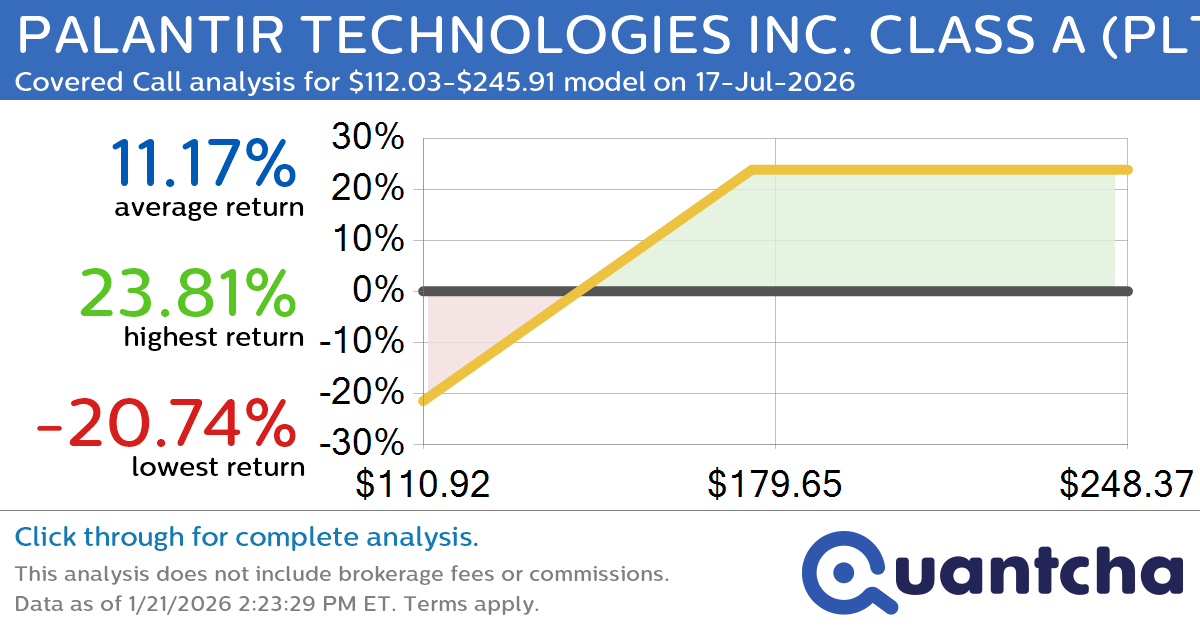

Covered Call Alert: PALANTIR TECHNOLOGIES INC. CLASS A $PLTR returning up to 23.81% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for PALANTIR TECHNOLOGIES INC. CLASS A (PLTR) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PLTR was recently trading at $162.97 and has an implied volatility of 56.35% for this period. Based on an analysis…

-

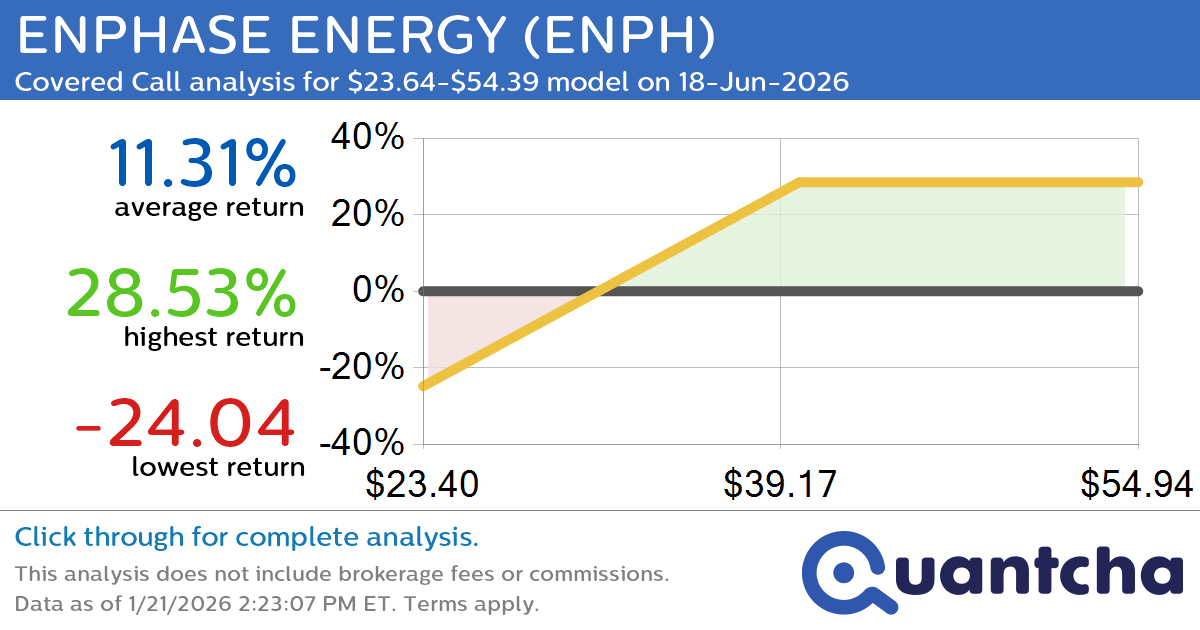

Covered Call Alert: ENPHASE ENERGY $ENPH returning up to 28.53% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ENPHASE ENERGY (ENPH) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ENPH was recently trading at $35.31 and has an implied volatility of 65.31% for this period. Based on an analysis of the options…

-

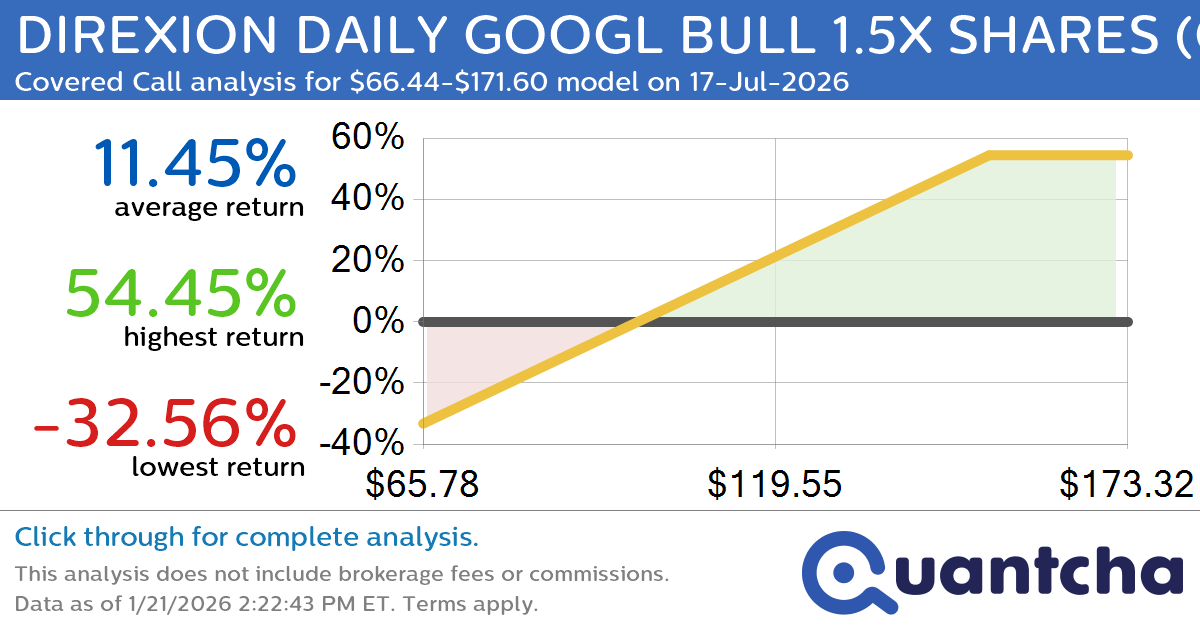

Covered Call Alert: DIREXION DAILY GOOGL BULL 1.5X SHARES $GGLL returning up to 54.45% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for DIREXION DAILY GOOGL BULL 1.5X SHARES (GGLL) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GGLL was recently trading at $104.83 and has an implied volatility of 68.02% for this period. Based on an…

-

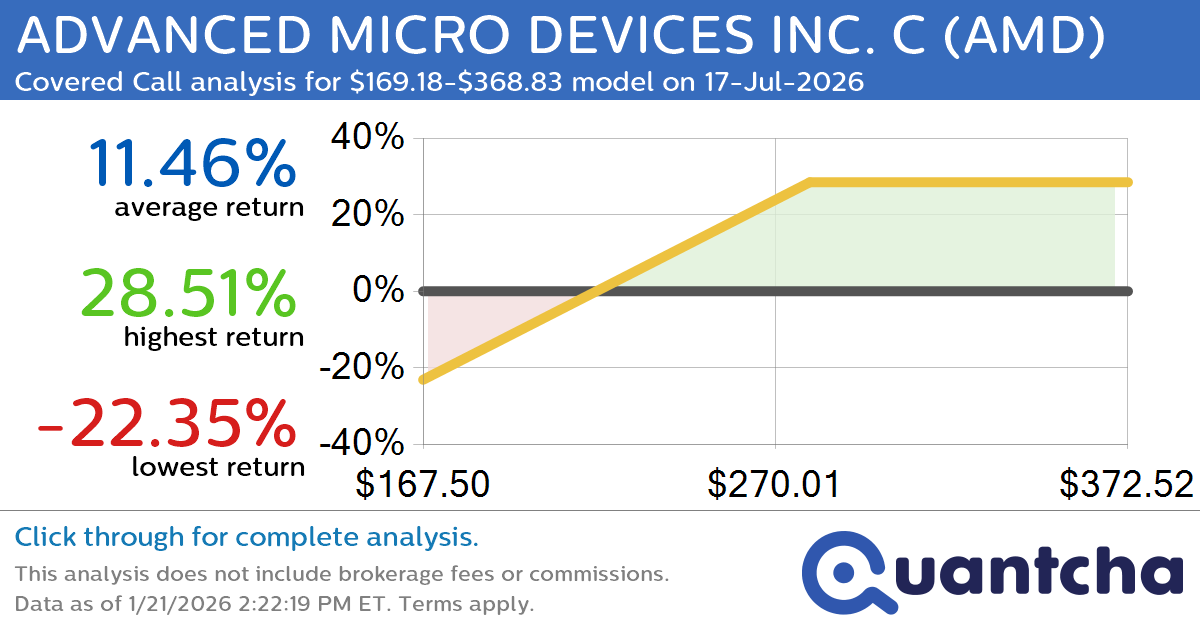

Covered Call Alert: ADVANCED MICRO DEVICES INC. C $AMD returning up to 28.51% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for ADVANCED MICRO DEVICES INC. C (AMD) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMD was recently trading at $245.26 and has an implied volatility of 55.86% for this period. Based on an analysis…

-

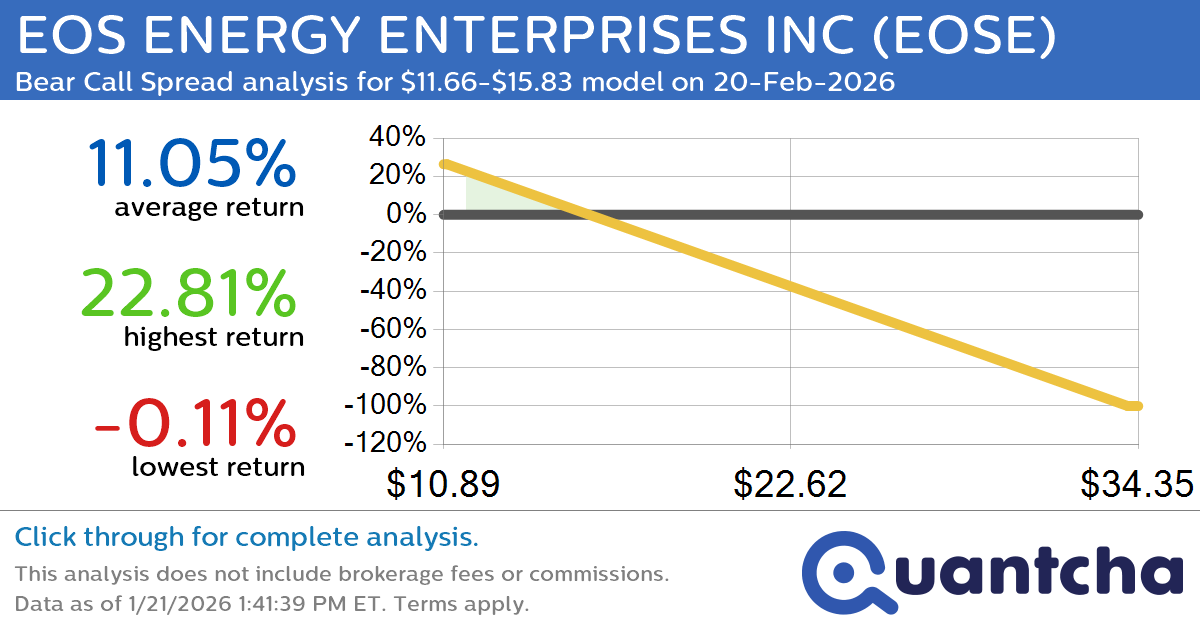

Big Loser Alert: Trading today’s -8.9% move in EOS ENERGY ENTERPRISES INC $EOSE

Quantchabot has detected a new Bear Call Spread trade opportunity for EOS ENERGY ENTERPRISES INC (EOSE) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EOSE was recently trading at $15.78 and has an implied volatility of 105.52% for this period. Based on an analysis…

-

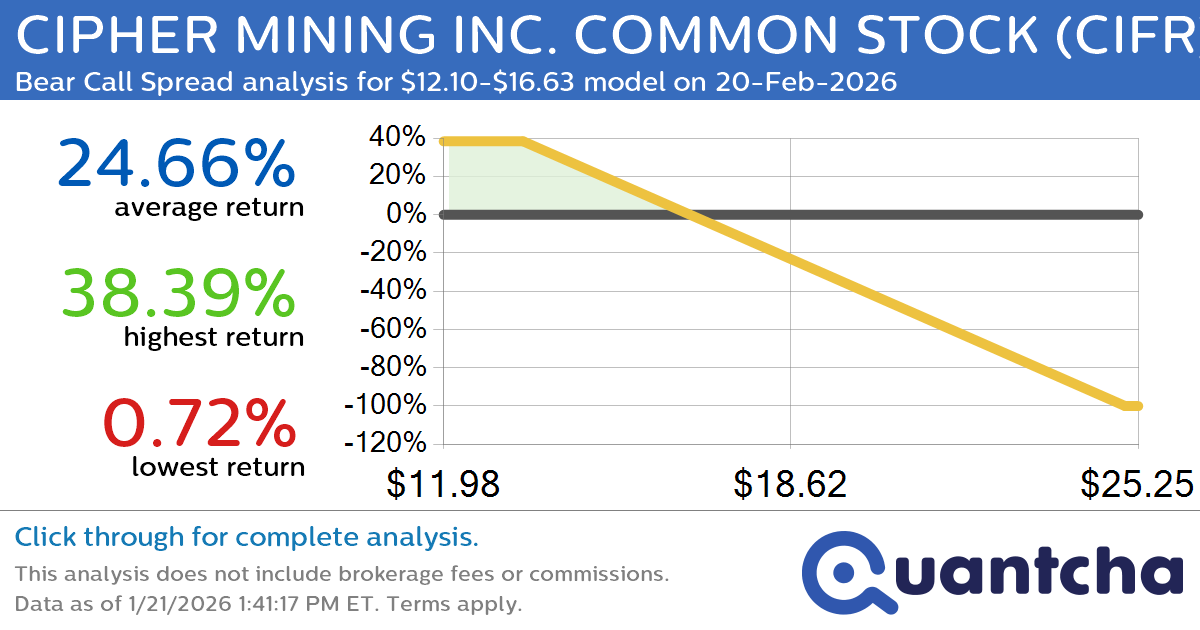

Big Loser Alert: Trading today’s -7.5% move in CIPHER MINING INC. COMMON STOCK $CIFR

Quantchabot has detected a new Bear Call Spread trade opportunity for CIPHER MINING INC. COMMON STOCK (CIFR) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CIFR was recently trading at $16.58 and has an implied volatility of 109.70% for this period. Based on an…