Author: Quantcha Trade Ideas

-

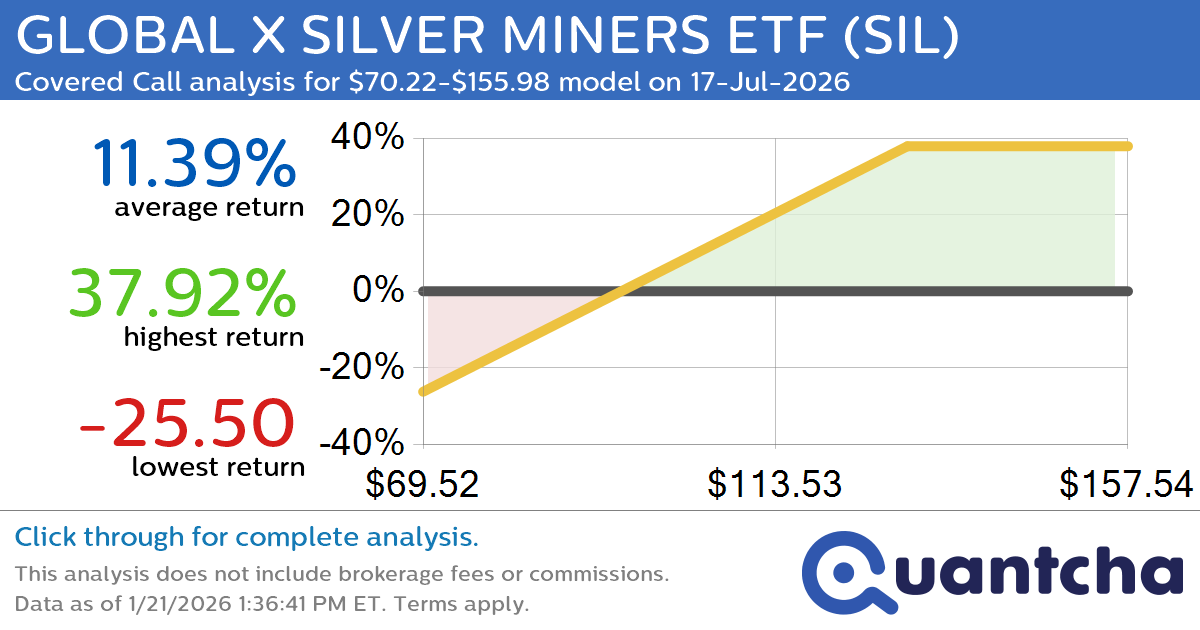

Covered Call Alert: GLOBAL X SILVER MINERS ETF $SIL returning up to 37.92% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for GLOBAL X SILVER MINERS ETF (SIL) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SIL was recently trading at $102.75 and has an implied volatility of 57.20% for this period. Based on an analysis…

-

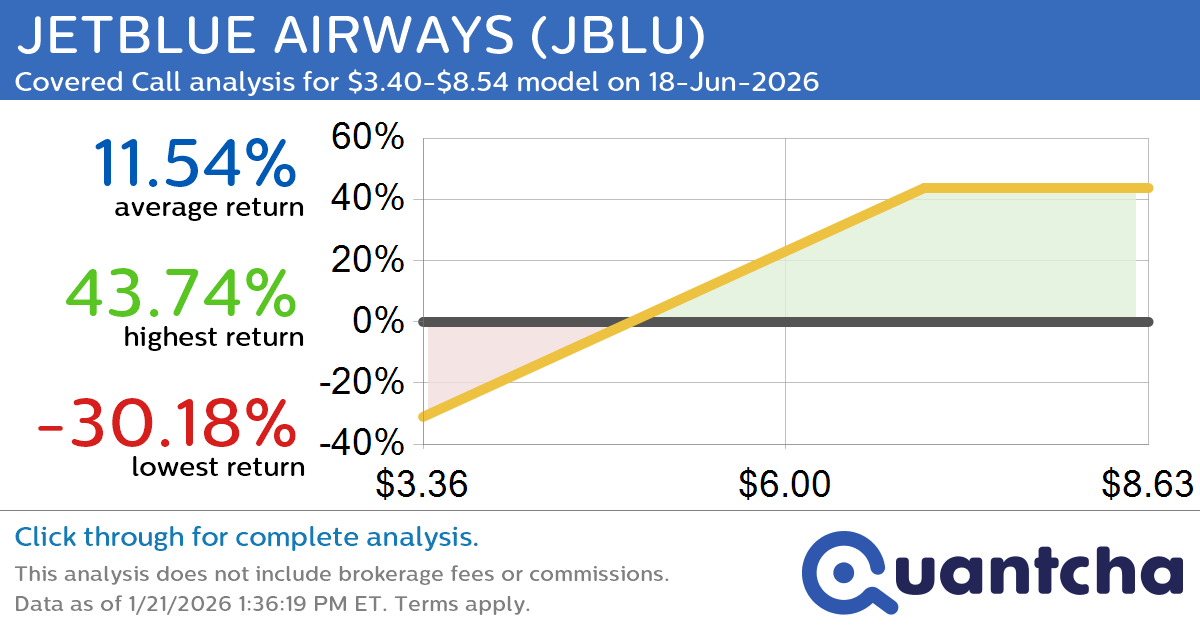

Covered Call Alert: JETBLUE AIRWAYS $JBLU returning up to 43.74% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for JETBLUE AIRWAYS (JBLU) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JBLU was recently trading at $5.30 and has an implied volatility of 72.16% for this period. Based on an analysis of the options…

-

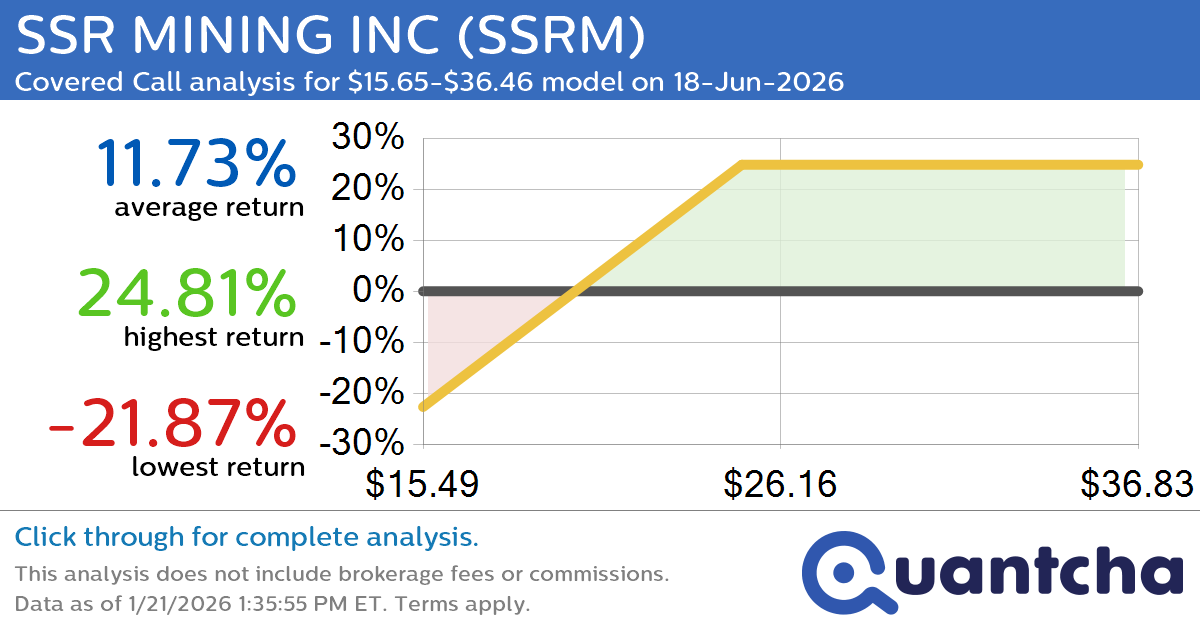

Covered Call Alert: SSR MINING INC $SSRM returning up to 24.81% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for SSR MINING INC (SSRM) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SSRM was recently trading at $23.52 and has an implied volatility of 66.27% for this period. Based on an analysis of the…

-

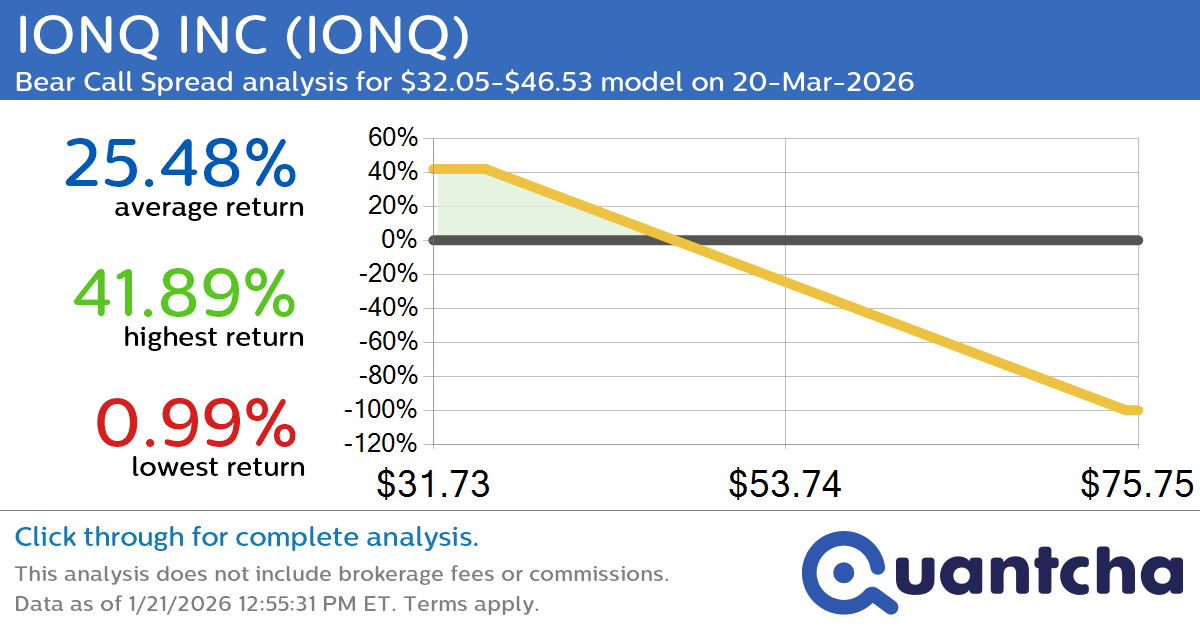

Big Loser Alert: Trading today’s -8.7% move in IONQ INC $IONQ

Quantchabot has detected a new Bear Call Spread trade opportunity for IONQ INC (IONQ) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IONQ was recently trading at $46.25 and has an implied volatility of 93.00% for this period. Based on an analysis of the…

-

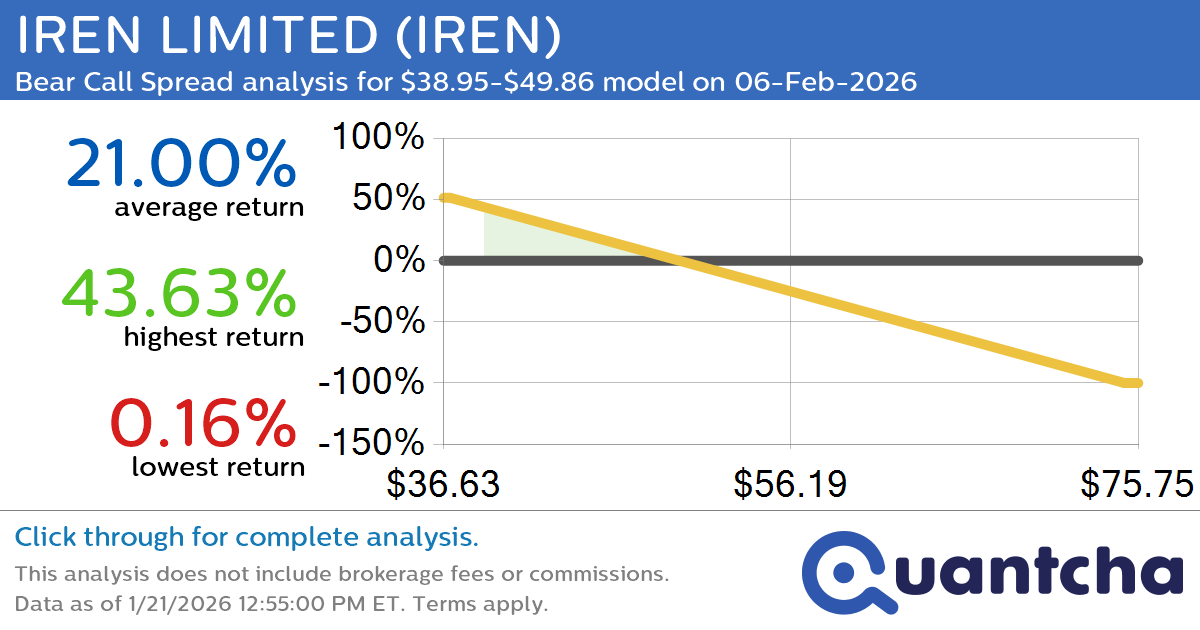

Big Loser Alert: Trading today’s -8.3% move in IREN LIMITED $IREN

Quantchabot has detected a new Bear Call Spread trade opportunity for IREN LIMITED (IREN) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IREN was recently trading at $49.77 and has an implied volatility of 115.59% for this period. Based on an analysis of the…

-

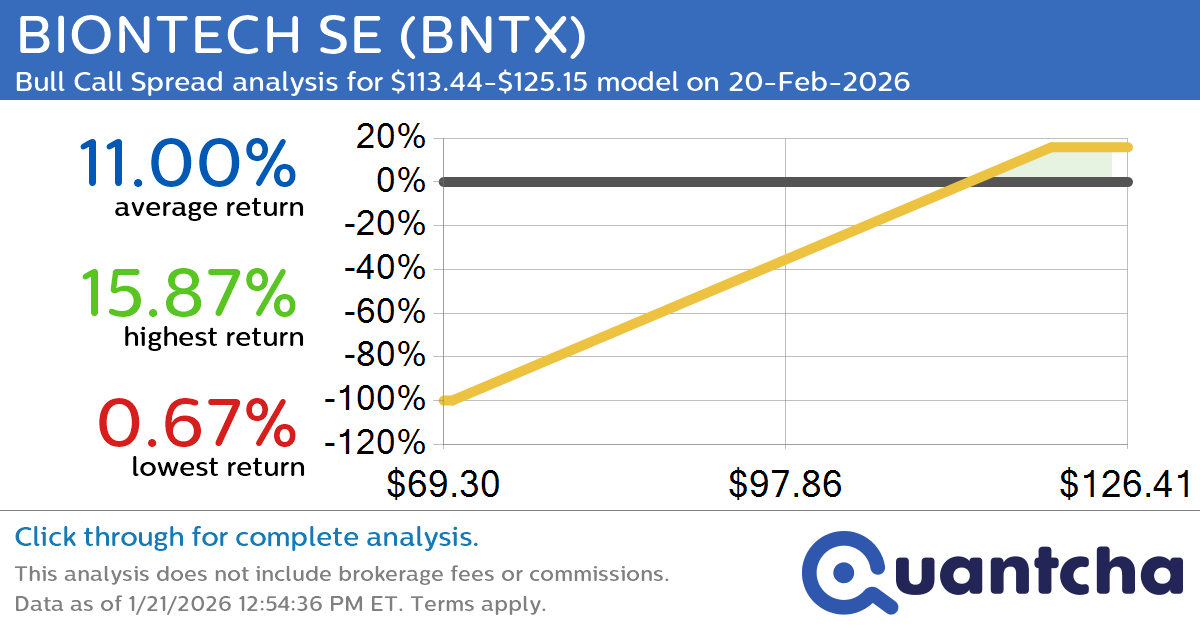

Big Gainer Alert: Trading today’s 7.1% move in BIONTECH SE $BNTX

Quantchabot has detected a new Bull Call Spread trade opportunity for BIONTECH SE (BNTX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BNTX was recently trading at $113.08 and has an implied volatility of 33.89% for this period. Based on an analysis of the…

-

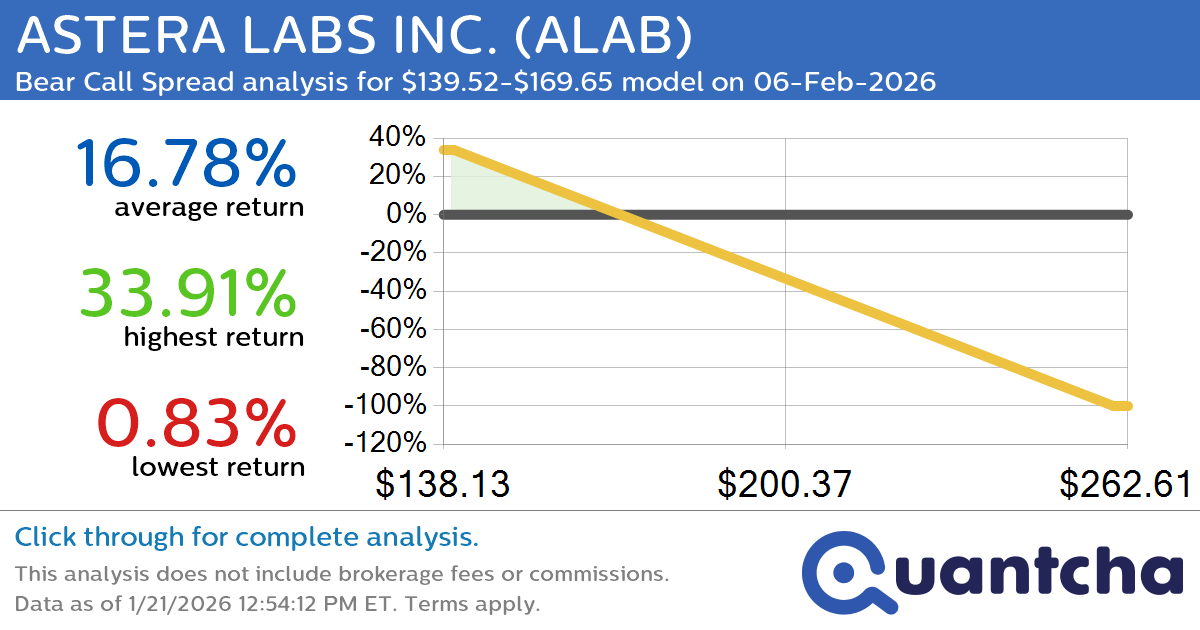

Big Loser Alert: Trading today’s -7.8% move in ASTERA LABS INC. $ALAB

Quantchabot has detected a new Bear Call Spread trade opportunity for ASTERA LABS INC. (ALAB) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ALAB was recently trading at $169.36 and has an implied volatility of 91.47% for this period. Based on an analysis of…

-

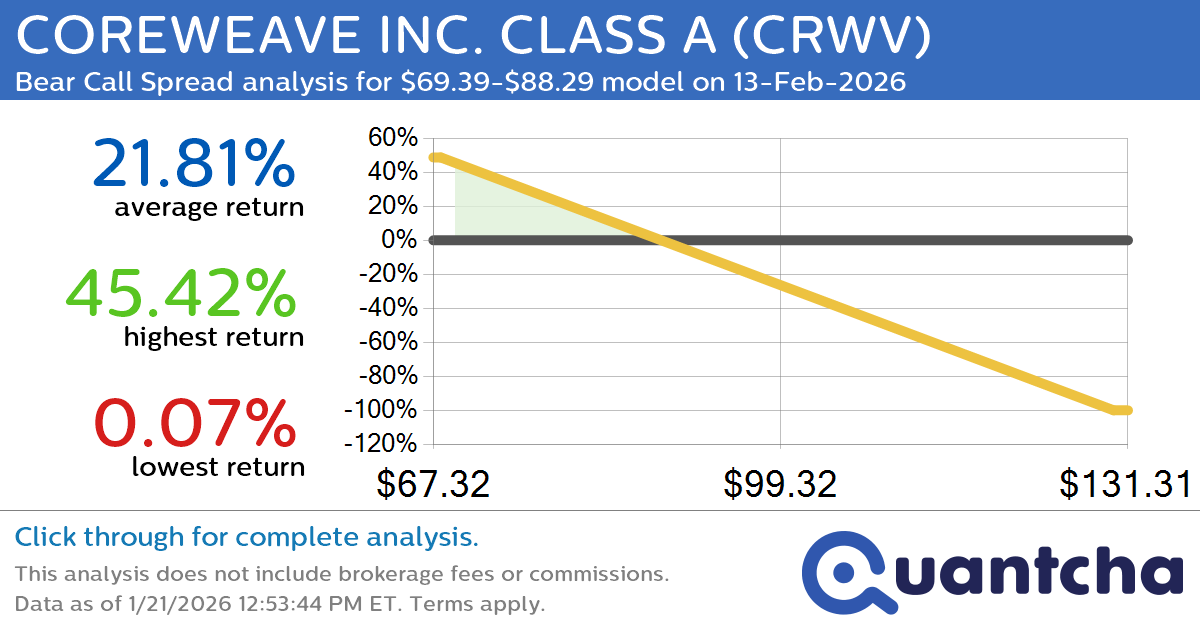

Big Loser Alert: Trading today’s -7.5% move in COREWEAVE INC. CLASS A $CRWV

Quantchabot has detected a new Bear Call Spread trade opportunity for COREWEAVE INC. CLASS A (CRWV) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRWV was recently trading at $88.07 and has an implied volatility of 94.60% for this period. Based on an analysis…

-

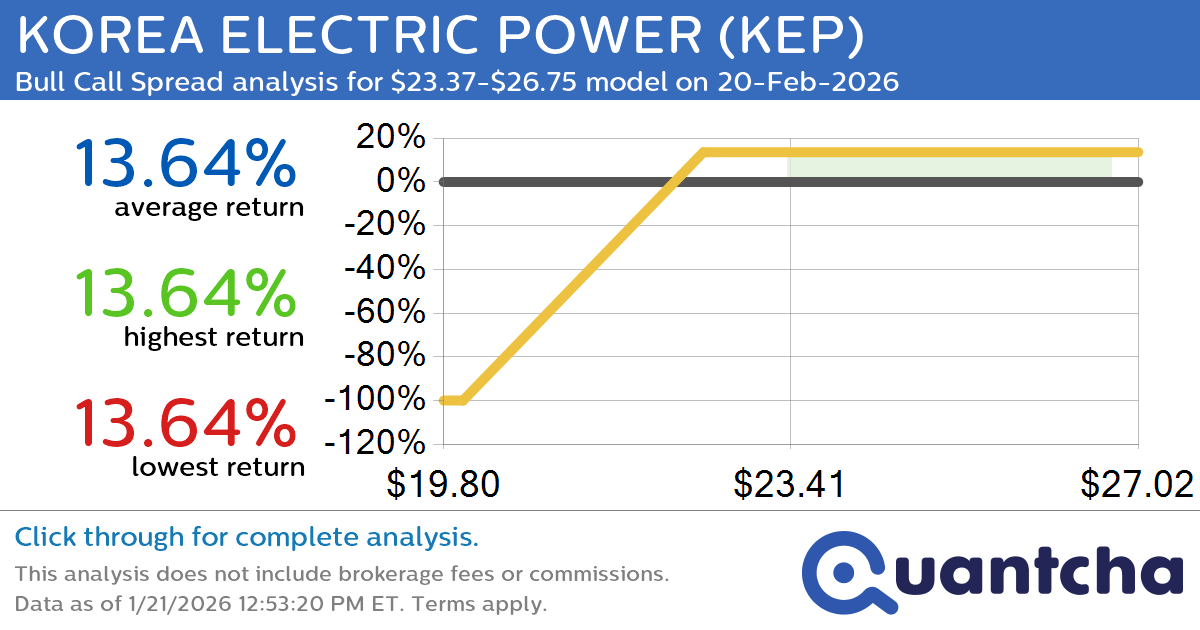

52-Week High Alert: Trading today’s movement in KOREA ELECTRIC POWER $KEP

Quantchabot has detected a new Bull Call Spread trade opportunity for KOREA ELECTRIC POWER (KEP) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KEP was recently trading at $23.30 and has an implied volatility of 46.59% for this period. Based on an analysis of…

-

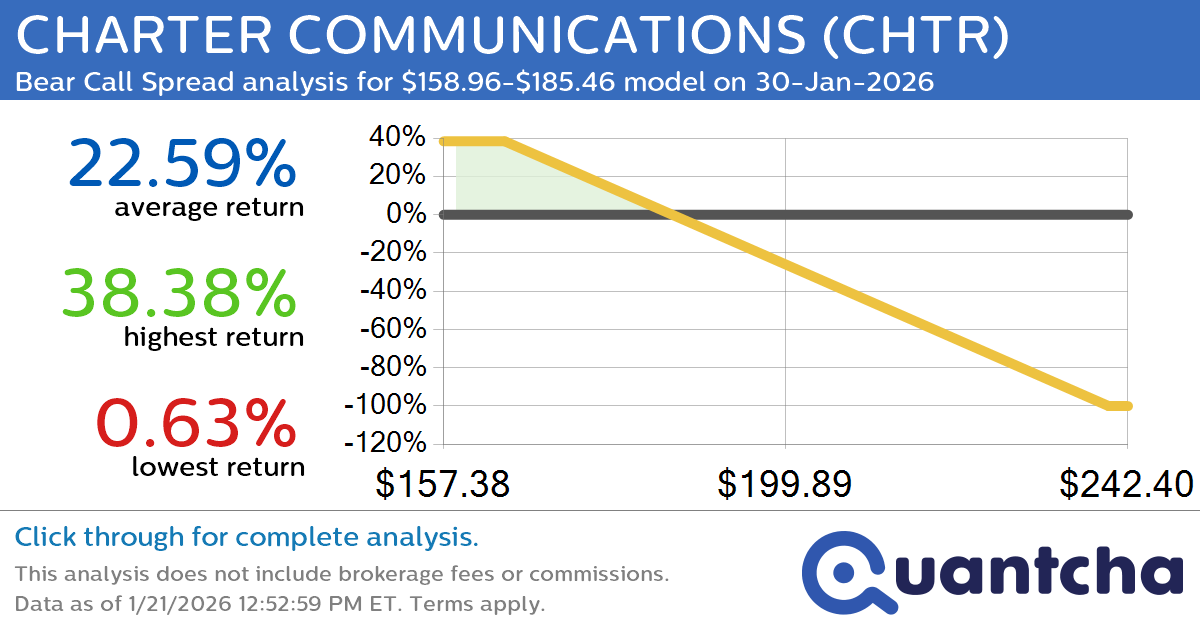

52-Week Low Alert: Trading today’s movement in CHARTER COMMUNICATIONS $CHTR

Quantchabot has detected a new Bear Call Spread trade opportunity for CHARTER COMMUNICATIONS (CHTR) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CHTR was recently trading at $185.27 and has an implied volatility of 94.68% for this period. Based on an analysis of the…