Author: Quantcha Trade Ideas

-

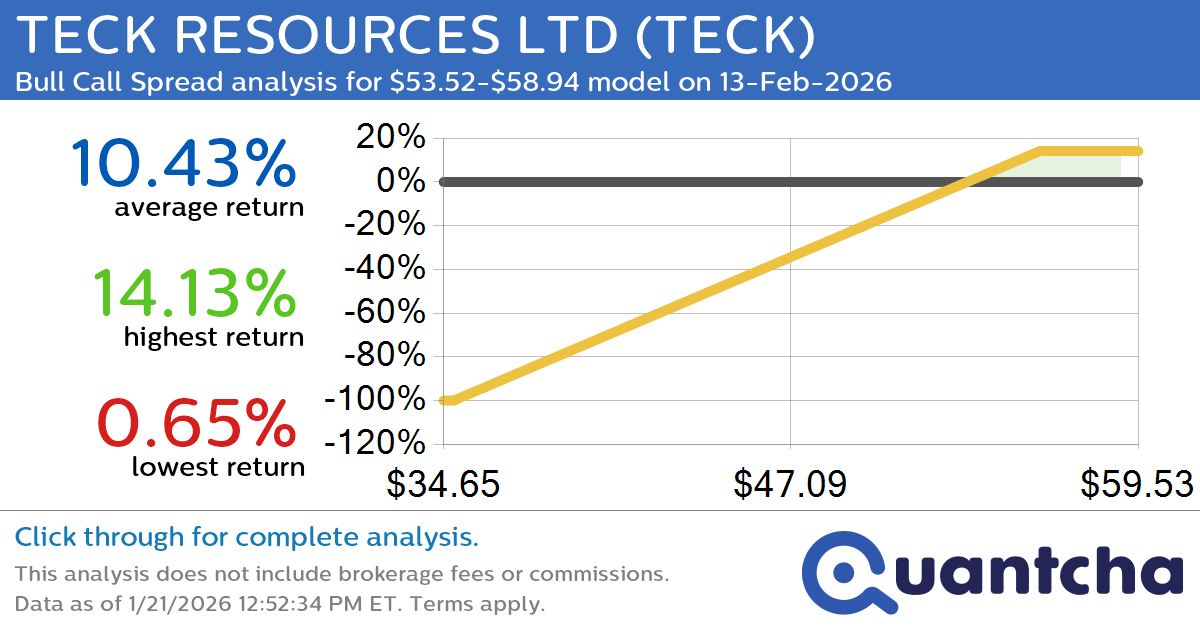

52-Week High Alert: Trading today’s movement in TECK RESOURCES LTD $TECK

Quantchabot has detected a new Bull Call Spread trade opportunity for TECK RESOURCES LTD (TECK) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TECK was recently trading at $53.39 and has an implied volatility of 37.89% for this period. Based on an analysis of…

-

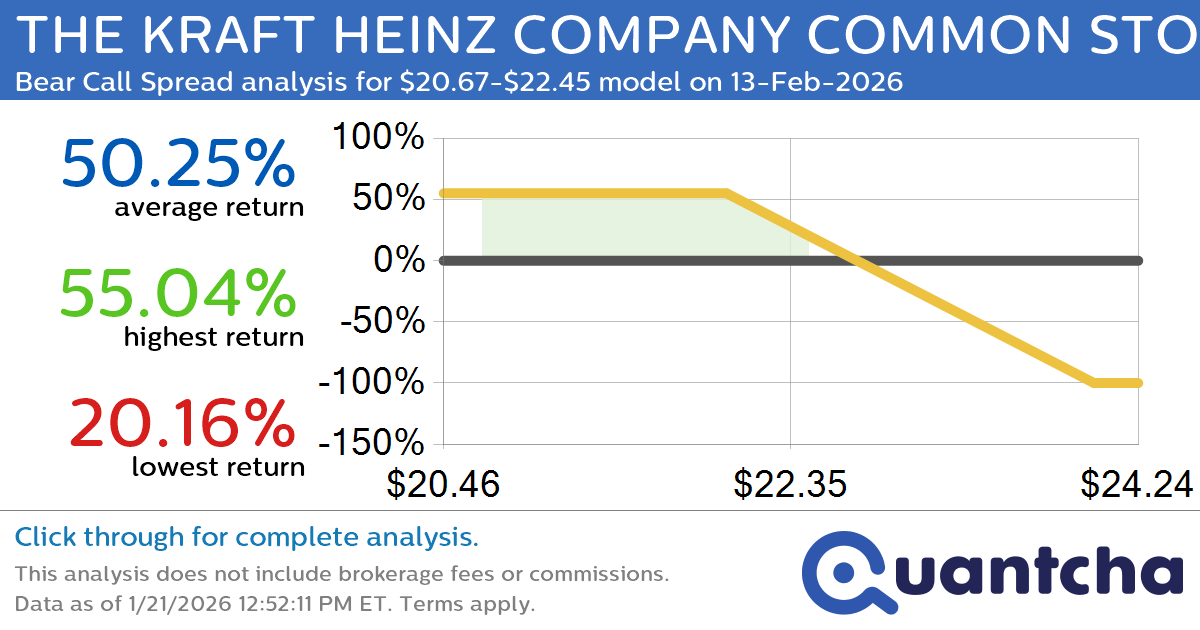

52-Week Low Alert: Trading today’s movement in THE KRAFT HEINZ COMPANY COMMON STOCK $KHC

Quantchabot has detected a new Bear Call Spread trade opportunity for THE KRAFT HEINZ COMPANY COMMON STOCK (KHC) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KHC was recently trading at $22.39 and has an implied volatility of 32.36% for this period. Based on…

-

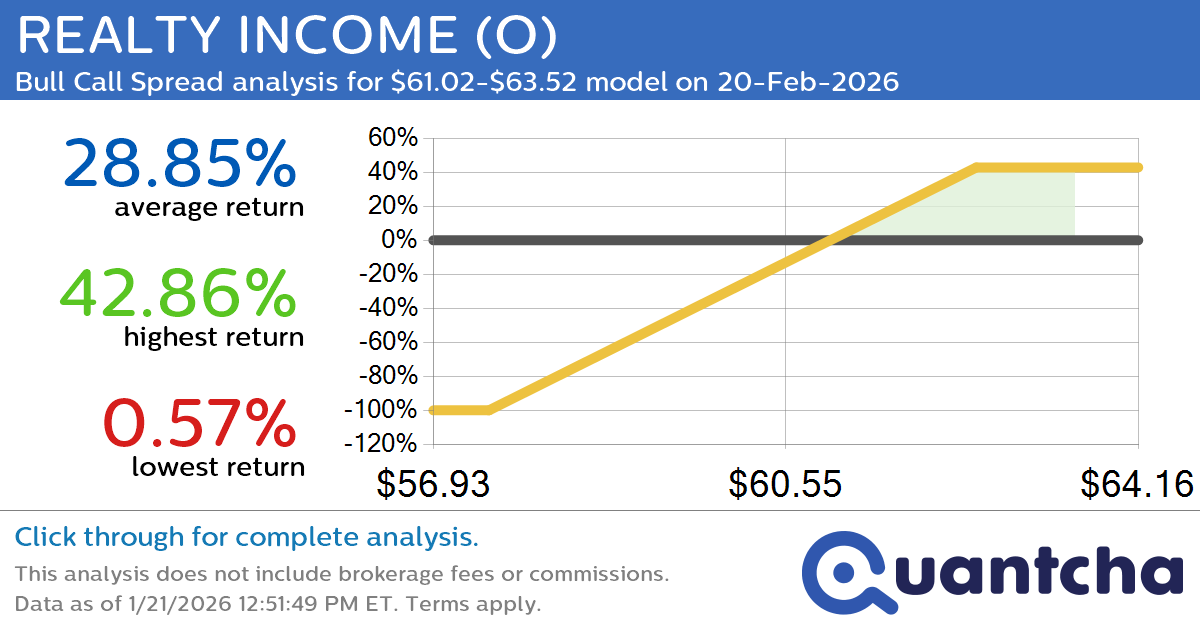

52-Week High Alert: Trading today’s movement in REALTY INCOME $O

Quantchabot has detected a new Bull Call Spread trade opportunity for REALTY INCOME (O) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. O was recently trading at $61.09 and has an implied volatility of 13.82% for this period. Based on an analysis of the…

-

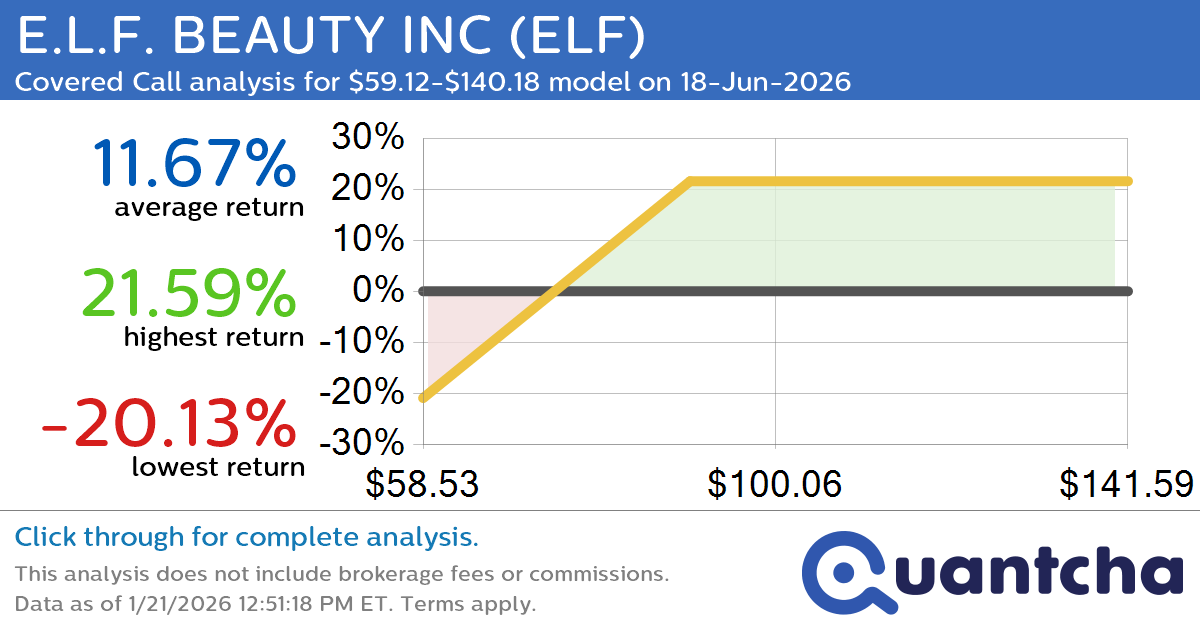

Covered Call Alert: E.L.F. BEAUTY INC $ELF returning up to 21.70% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for E.L.F. BEAUTY INC (ELF) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ELF was recently trading at $89.65 and has an implied volatility of 67.63% for this period. Based on an analysis of the…

-

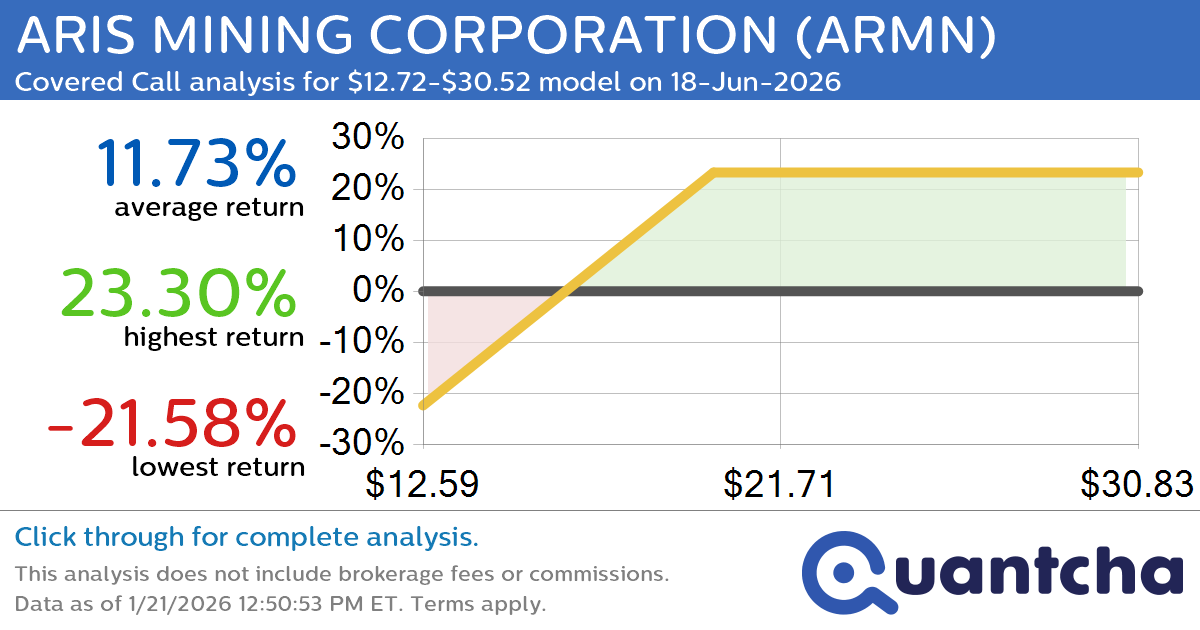

Covered Call Alert: ARIS MINING CORPORATION $ARMN returning up to 23.30% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ARIS MINING CORPORATION (ARMN) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARMN was recently trading at $19.41 and has an implied volatility of 68.54% for this period. Based on an analysis of the…

-

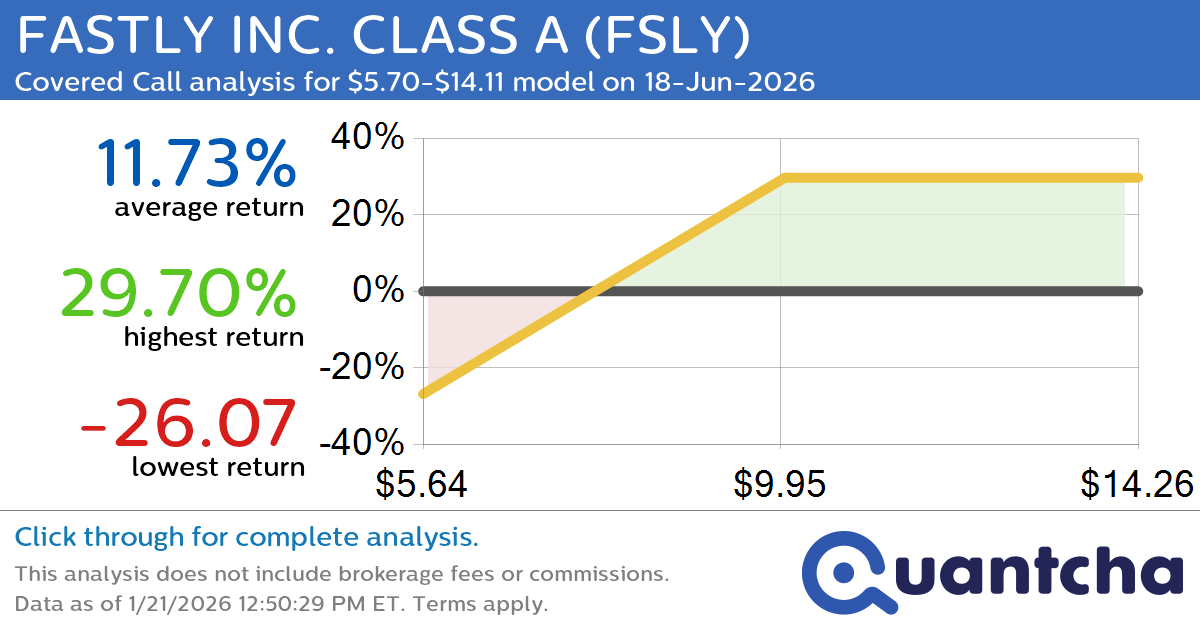

Covered Call Alert: FASTLY INC. CLASS A $FSLY returning up to 30.21% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for FASTLY INC. CLASS A (FSLY) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FSLY was recently trading at $8.83 and has an implied volatility of 71.08% for this period. Based on an analysis of…

-

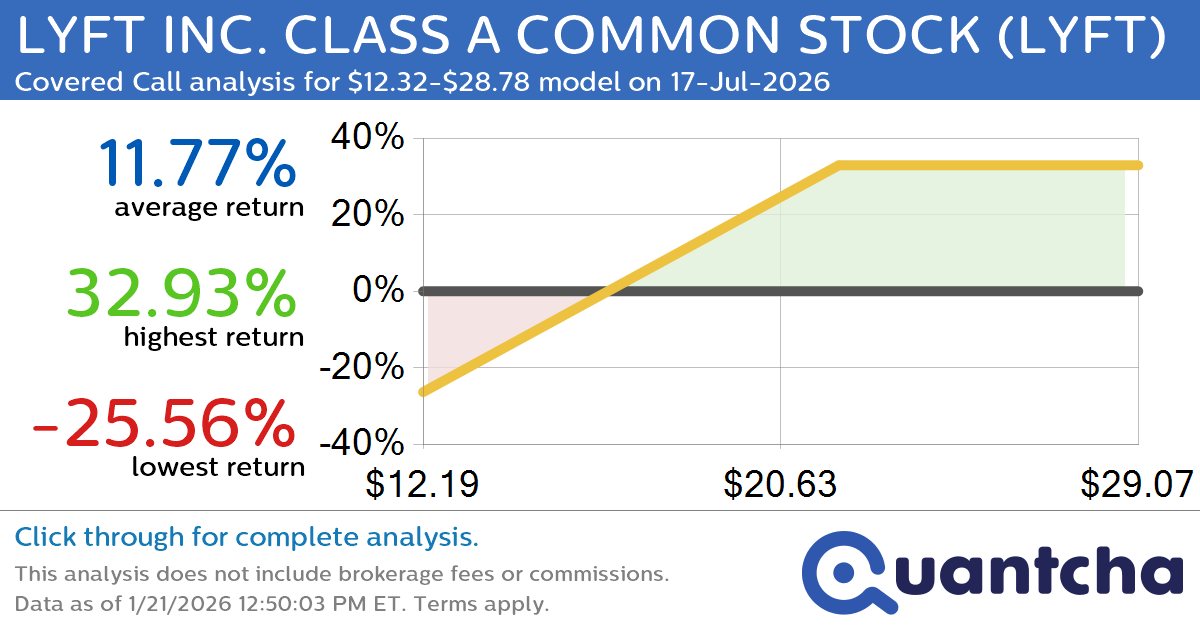

Covered Call Alert: LYFT INC. CLASS A COMMON STOCK $LYFT returning up to 33.25% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for LYFT INC. CLASS A COMMON STOCK (LYFT) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LYFT was recently trading at $18.48 and has an implied volatility of 60.82% for this period. Based on an…

-

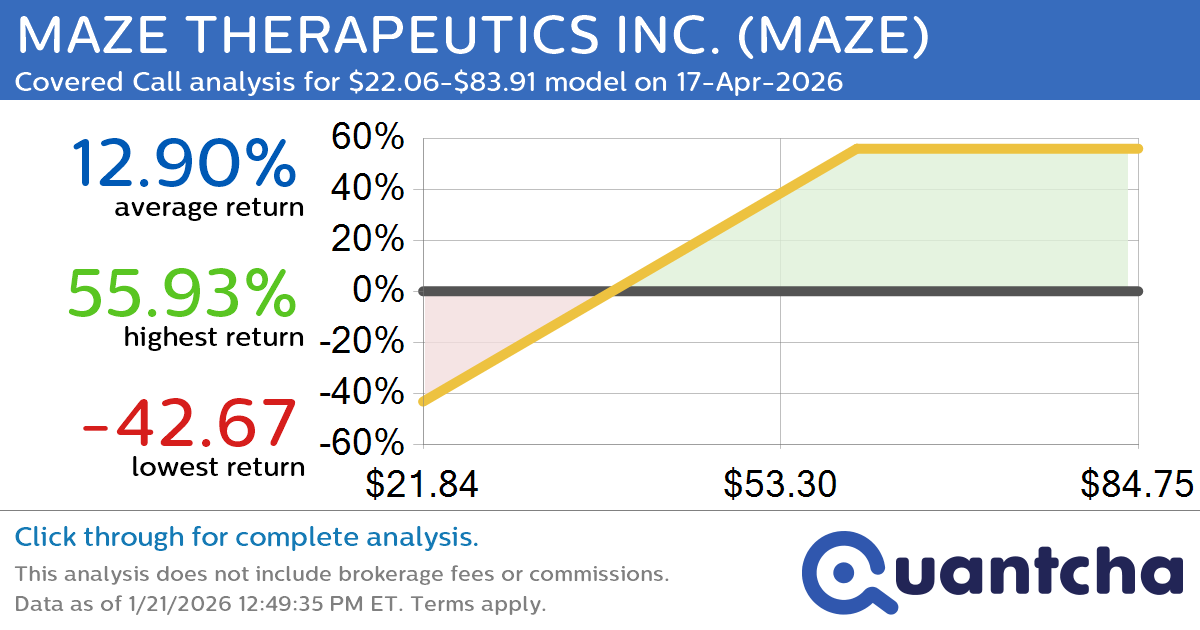

Covered Call Alert: MAZE THERAPEUTICS INC. $MAZE returning up to 54.96% through 17-Apr-2026

Quantchabot has detected a new Covered Call trade opportunity for MAZE THERAPEUTICS INC. (MAZE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MAZE was recently trading at $42.63 and has an implied volatility of 137.08% for this period. Based on an analysis of the…

-

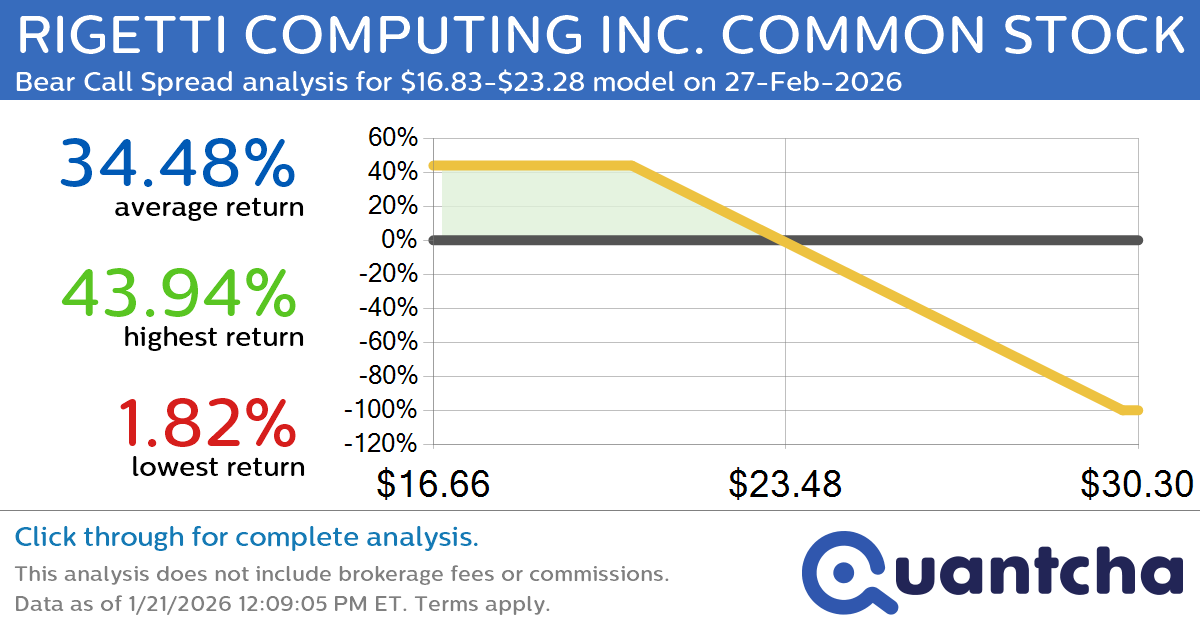

Big Loser Alert: Trading today’s -7.2% move in RIGETTI COMPUTING INC. COMMON STOCK $RGTI

Quantchabot has detected a new Bear Call Spread trade opportunity for RIGETTI COMPUTING INC. COMMON STOCK (RGTI) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGTI was recently trading at $23.19 and has an implied volatility of 100.97% for this period. Based on an…

-

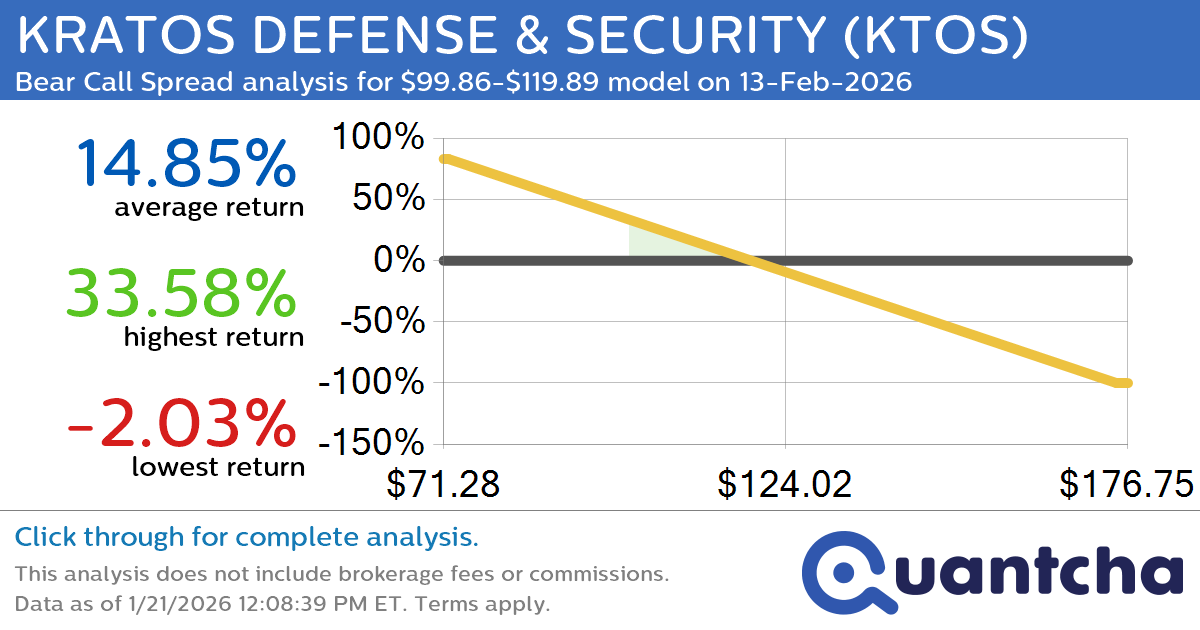

Big Loser Alert: Trading today’s -7.1% move in KRATOS DEFENSE & SECURITY $KTOS

Quantchabot has detected a new Bear Call Spread trade opportunity for KRATOS DEFENSE & SECURITY (KTOS) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KTOS was recently trading at $119.59 and has an implied volatility of 71.75% for this period. Based on an analysis…