Author: Quantcha Trade Ideas

-

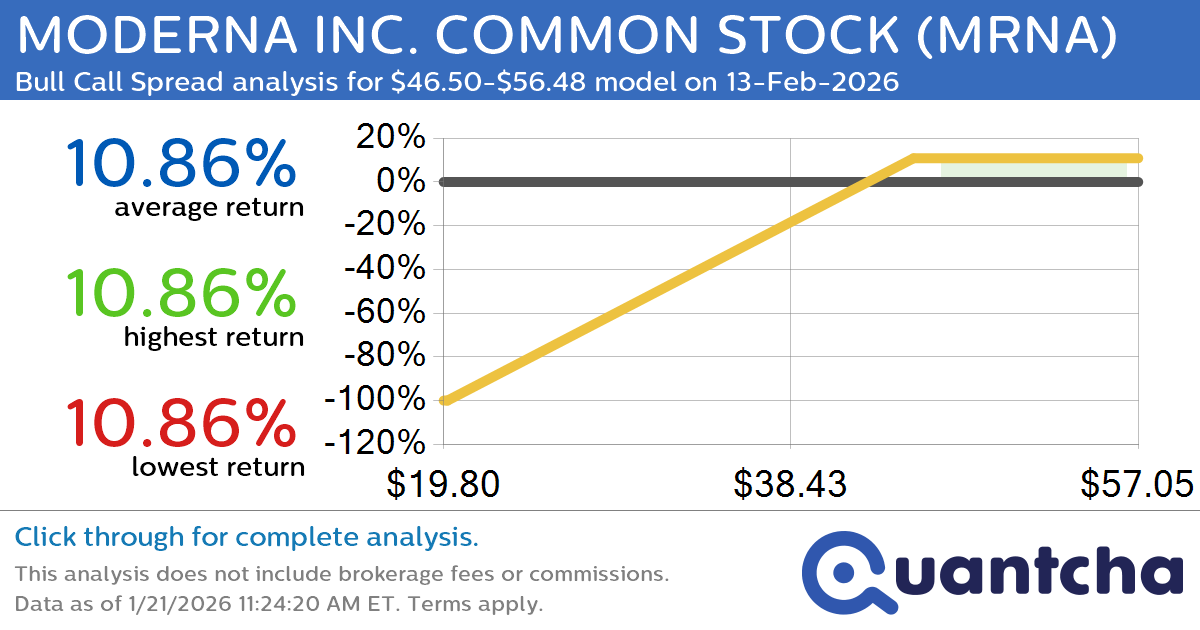

Big Gainer Alert: Trading today’s 7.9% move in MODERNA INC. COMMON STOCK $MRNA

Quantchabot has detected a new Bull Call Spread trade opportunity for MODERNA INC. COMMON STOCK (MRNA) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MRNA was recently trading at $46.38 and has an implied volatility of 76.31% for this period. Based on an analysis…

-

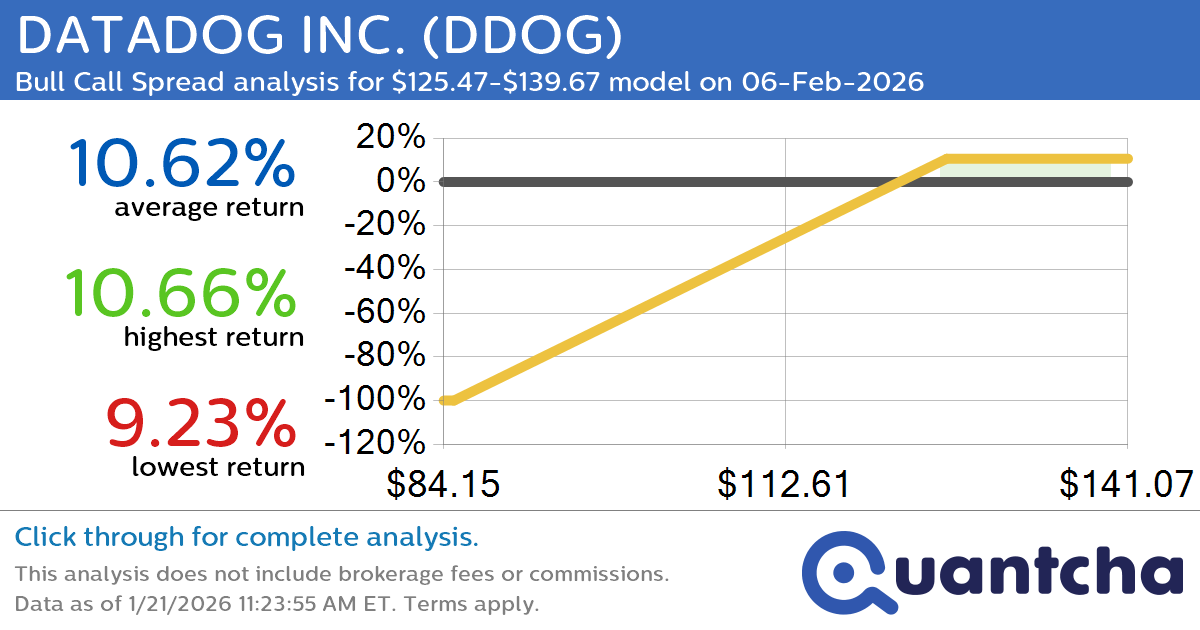

Big Gainer Alert: Trading today’s 7.1% move in DATADOG INC. $DDOG

Quantchabot has detected a new Bull Call Spread trade opportunity for DATADOG INC. (DDOG) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DDOG was recently trading at $125.25 and has an implied volatility of 50.08% for this period. Based on an analysis of the…

-

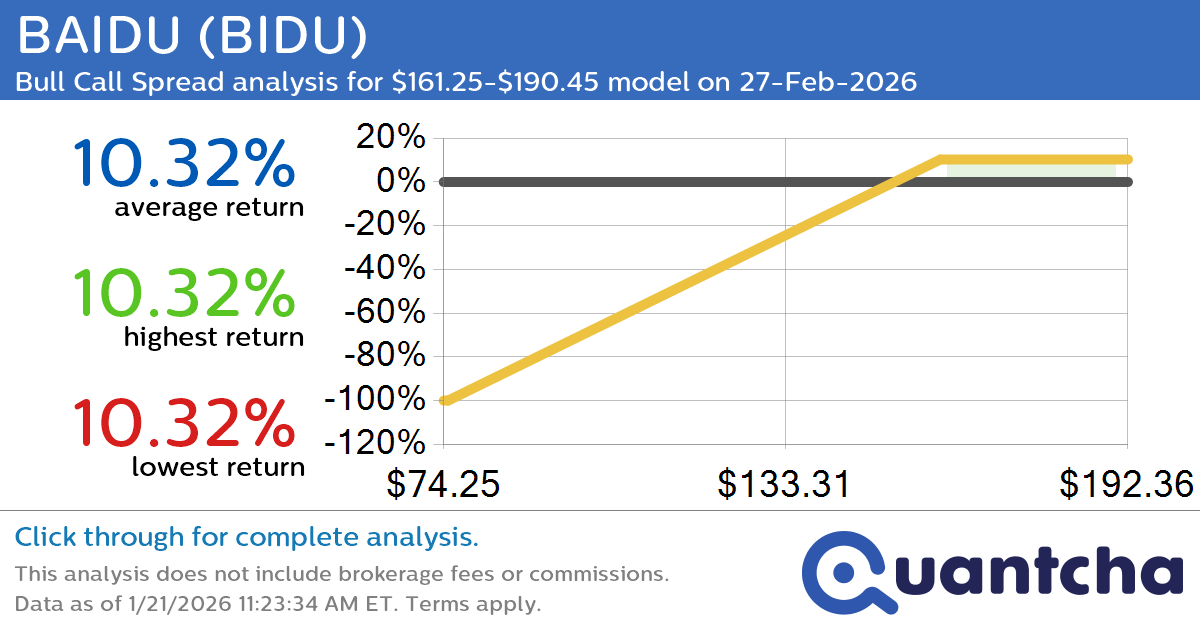

Big Gainer Alert: Trading today’s 7.1% move in BAIDU $BIDU

Quantchabot has detected a new Bull Call Spread trade opportunity for BAIDU (BIDU) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BIDU was recently trading at $160.62 and has an implied volatility of 51.75% for this period. Based on an analysis of the options…

-

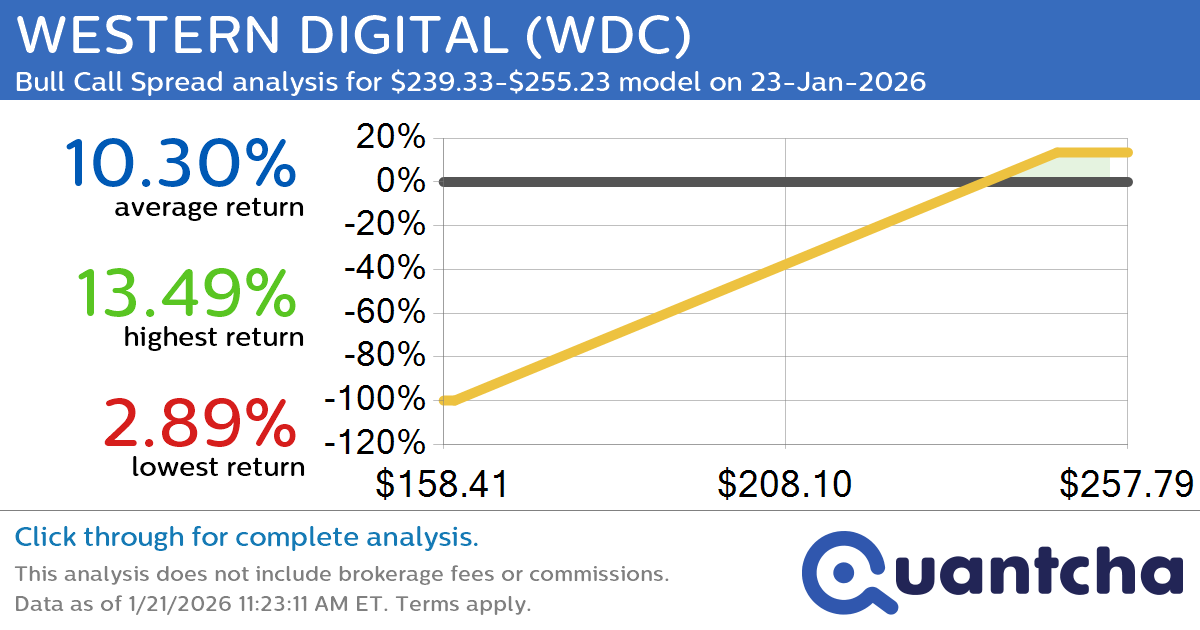

Big Gainer Alert: Trading today’s 7.3% move in WESTERN DIGITAL $WDC

Quantchabot has detected a new Bull Call Spread trade opportunity for WESTERN DIGITAL (WDC) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WDC was recently trading at $239.26 and has an implied volatility of 74.27% for this period. Based on an analysis of the…

-

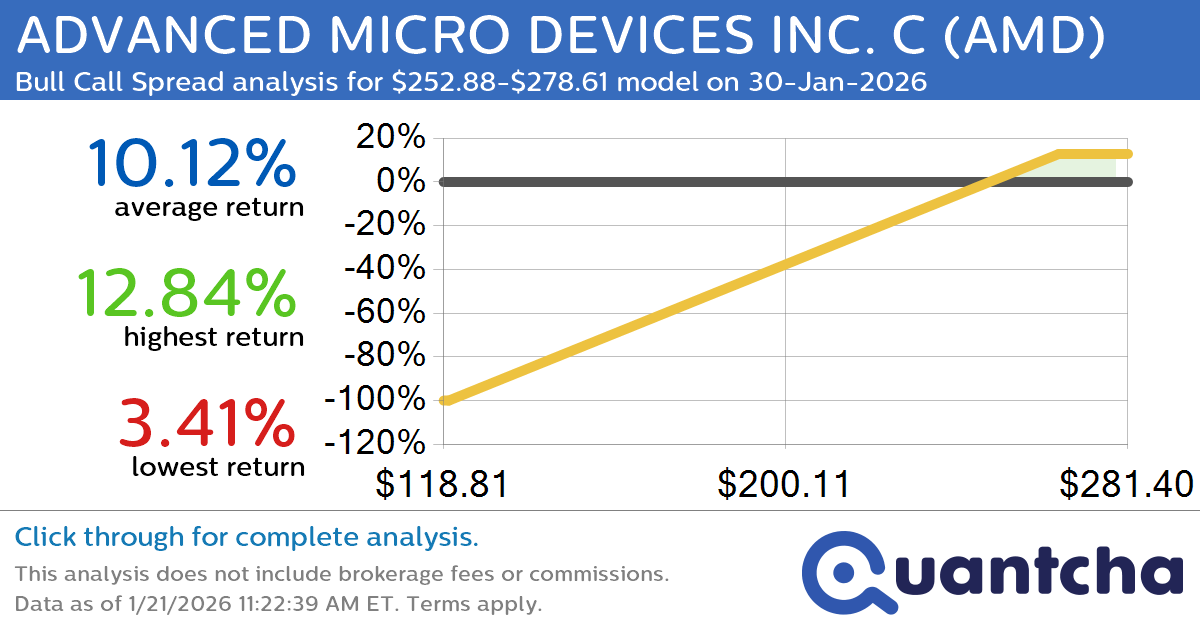

Big Gainer Alert: Trading today’s 8.9% move in ADVANCED MICRO DEVICES INC. C $AMD

Quantchabot has detected a new Bull Call Spread trade opportunity for ADVANCED MICRO DEVICES INC. C (AMD) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMD was recently trading at $252.62 and has an implied volatility of 59.34% for this period. Based on an…

-

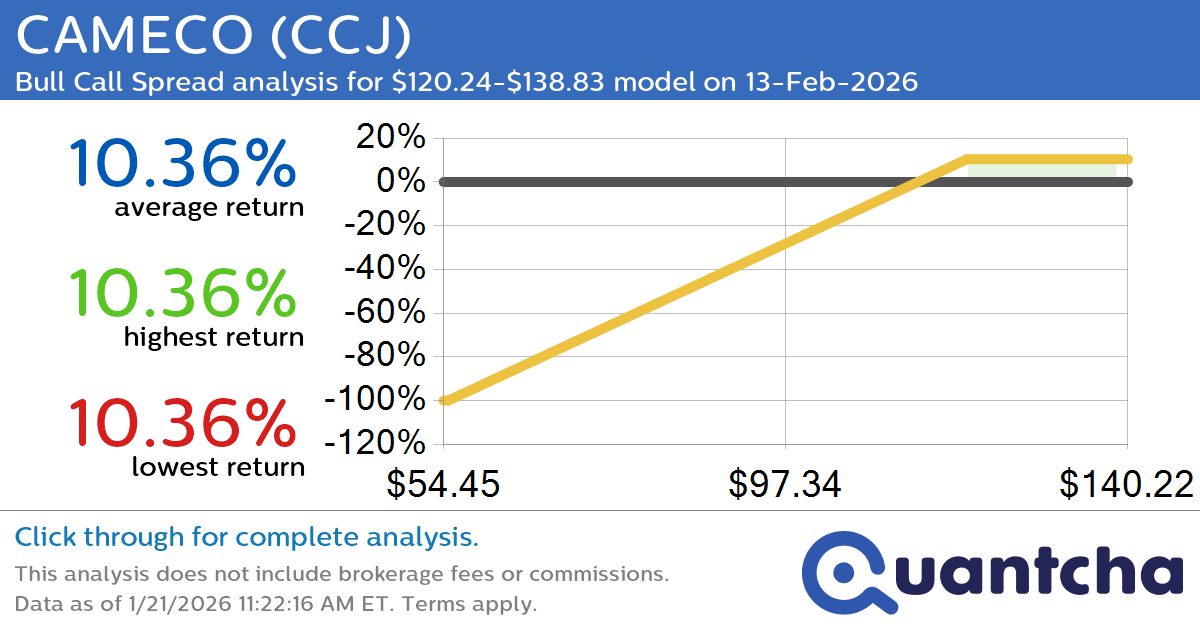

52-Week High Alert: Trading today’s movement in CAMECO $CCJ

Quantchabot has detected a new Bull Call Spread trade opportunity for CAMECO (CCJ) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CCJ was recently trading at $119.94 and has an implied volatility of 56.36% for this period. Based on an analysis of the options…

-

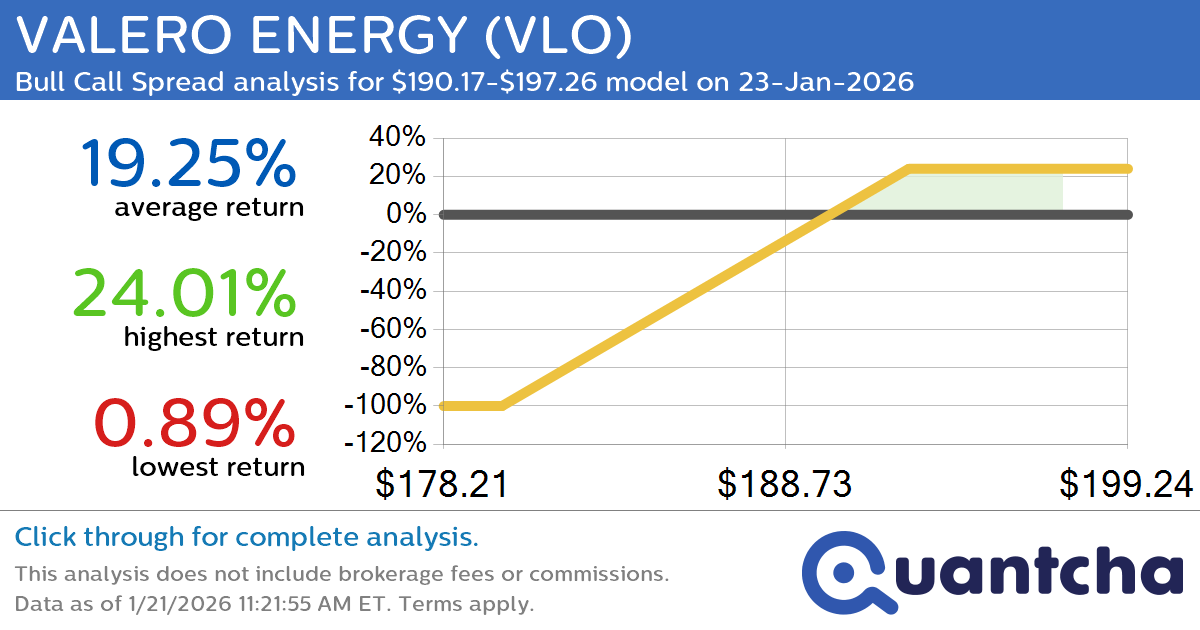

52-Week High Alert: Trading today’s movement in VALERO ENERGY $VLO

Quantchabot has detected a new Bull Call Spread trade opportunity for VALERO ENERGY (VLO) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VLO was recently trading at $190.12 and has an implied volatility of 42.29% for this period. Based on an analysis of the…

-

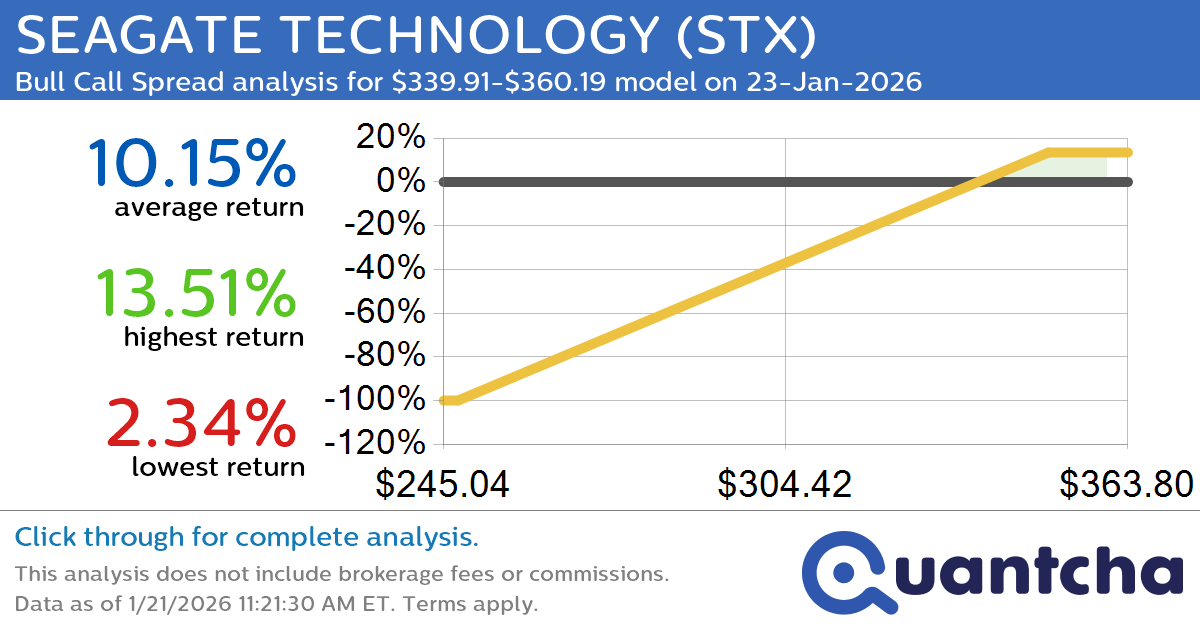

52-Week High Alert: Trading today’s movement in SEAGATE TECHNOLOGY $STX

Quantchabot has detected a new Bull Call Spread trade opportunity for SEAGATE TECHNOLOGY (STX) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. STX was recently trading at $339.81 and has an implied volatility of 66.89% for this period. Based on an analysis of the…

-

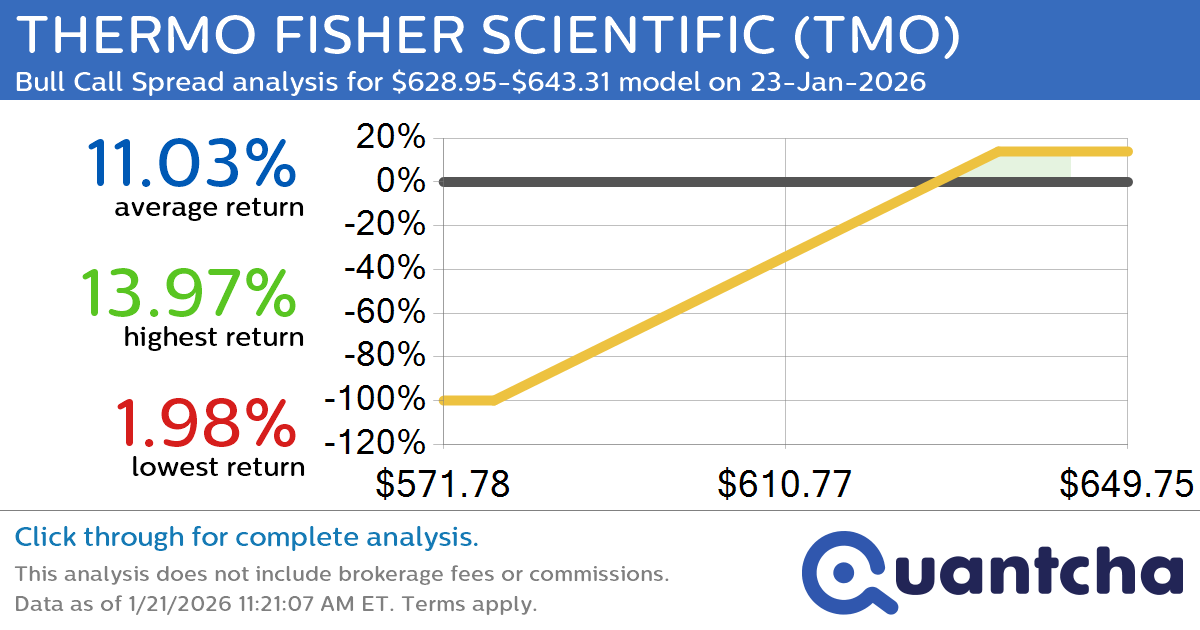

52-Week High Alert: Trading today’s movement in THERMO FISHER SCIENTIFIC $TMO

Quantchabot has detected a new Bull Call Spread trade opportunity for THERMO FISHER SCIENTIFIC (TMO) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TMO was recently trading at $628.77 and has an implied volatility of 26.07% for this period. Based on an analysis of…

-

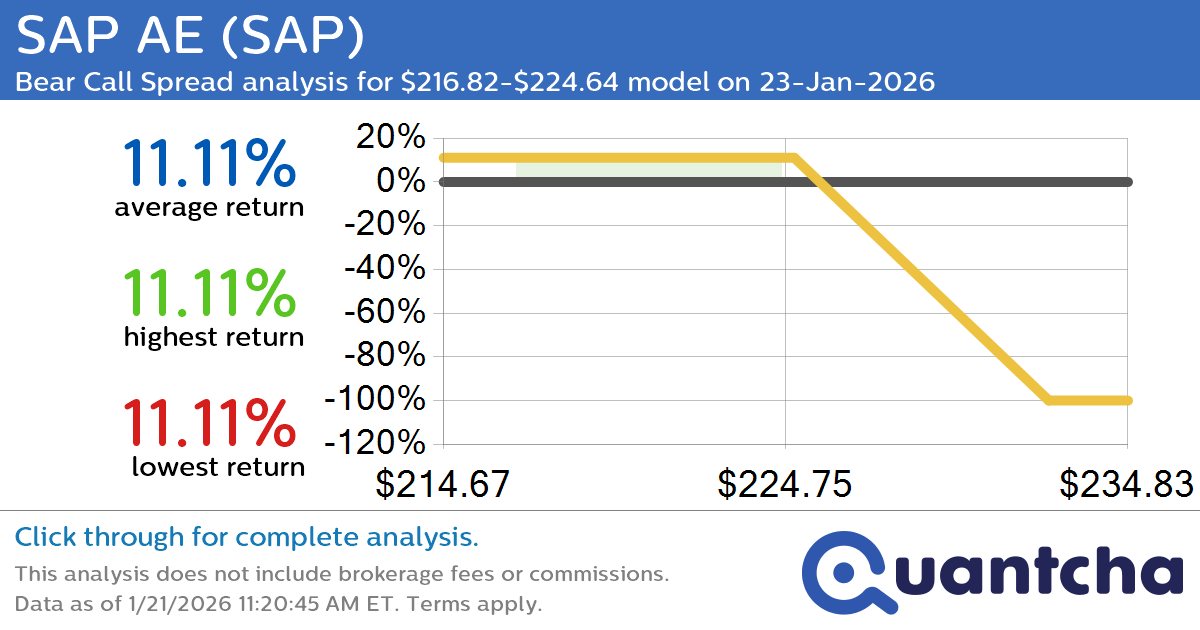

52-Week Low Alert: Trading today’s movement in SAP AE $SAP

Quantchabot has detected a new Bear Call Spread trade opportunity for SAP AE (SAP) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SAP was recently trading at $224.57 and has an implied volatility of 40.89% for this period. Based on an analysis of the…