Author: Quantcha Trade Ideas

-

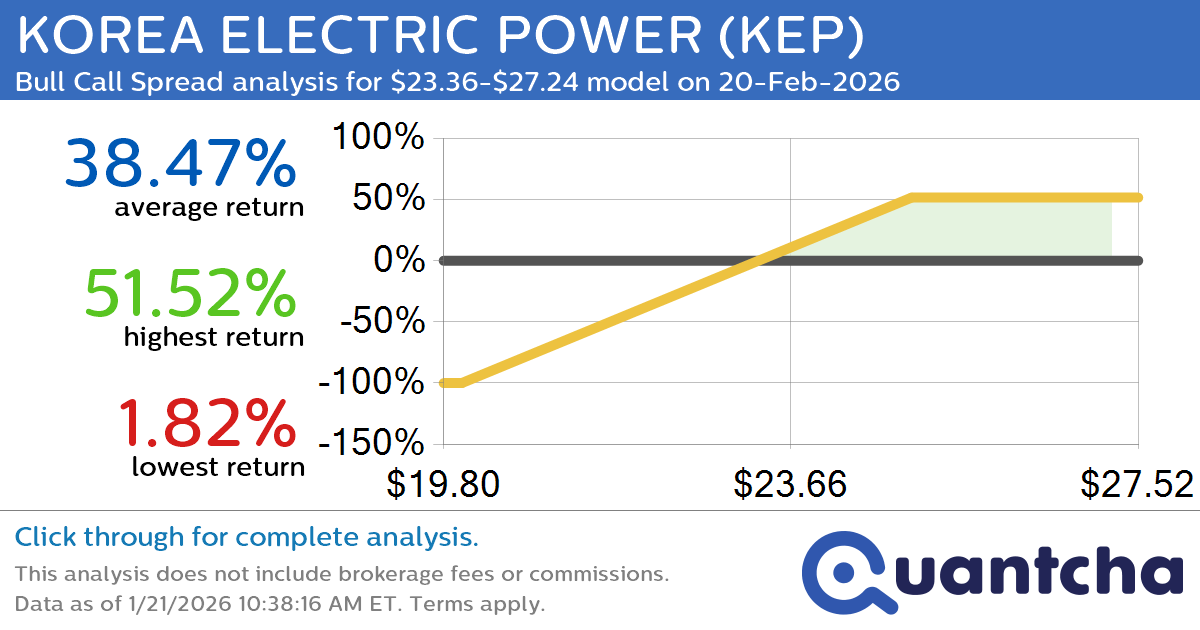

Big Gainer Alert: Trading today’s 8.6% move in KOREA ELECTRIC POWER $KEP

Quantchabot has detected a new Bull Call Spread trade opportunity for KOREA ELECTRIC POWER (KEP) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KEP was recently trading at $23.29 and has an implied volatility of 52.87% for this period. Based on an analysis of…

-

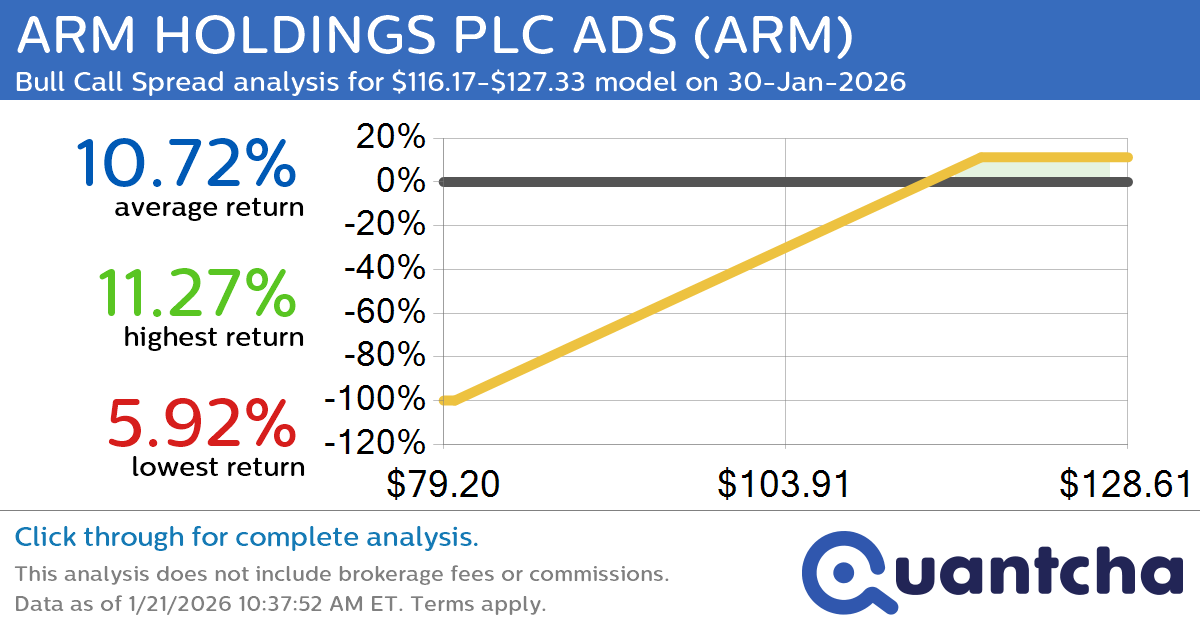

Big Gainer Alert: Trading today’s 8.3% move in ARM HOLDINGS PLC ADS $ARM

Quantchabot has detected a new Bull Call Spread trade opportunity for ARM HOLDINGS PLC ADS (ARM) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARM was recently trading at $116.05 and has an implied volatility of 56.04% for this period. Based on an analysis…

-

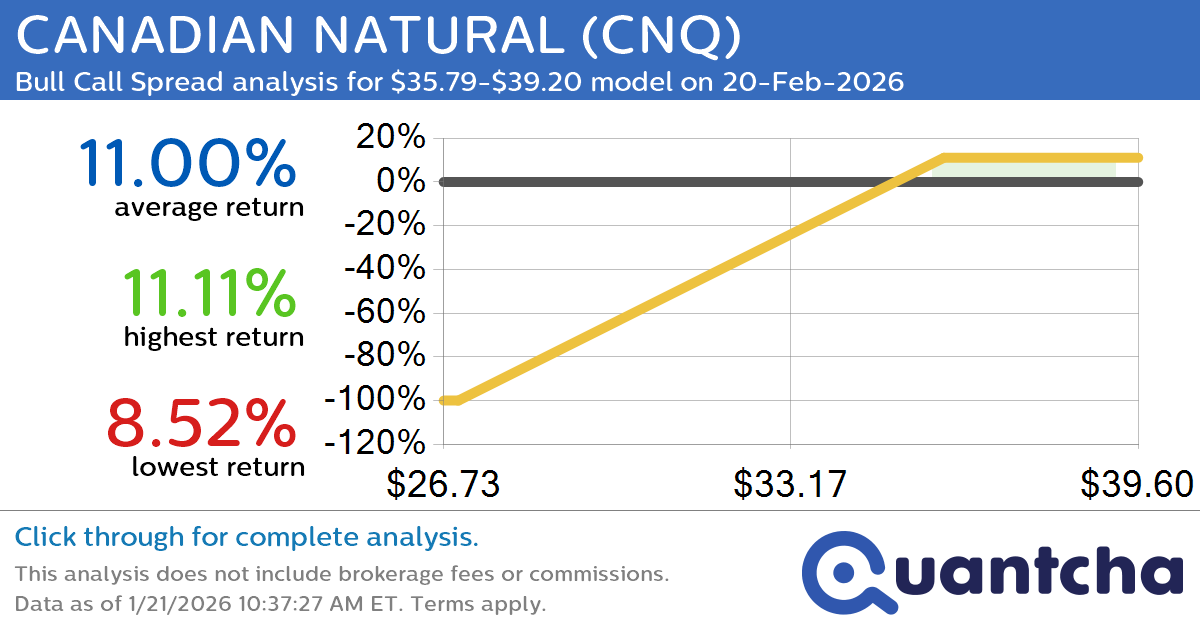

52-Week High Alert: Trading today’s movement in CANADIAN NATURAL $CNQ

Quantchabot has detected a new Bull Call Spread trade opportunity for CANADIAN NATURAL (CNQ) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CNQ was recently trading at $35.67 and has an implied volatility of 31.40% for this period. Based on an analysis of the…

-

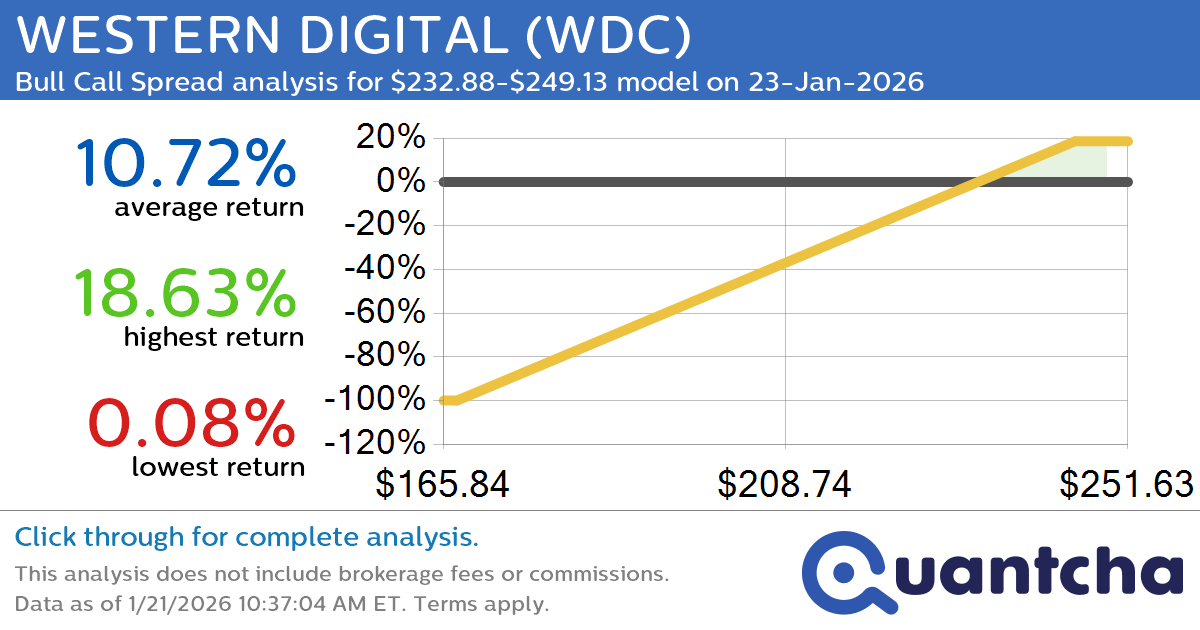

52-Week High Alert: Trading today’s movement in WESTERN DIGITAL $WDC

Quantchabot has detected a new Bull Call Spread trade opportunity for WESTERN DIGITAL (WDC) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WDC was recently trading at $232.81 and has an implied volatility of 77.40% for this period. Based on an analysis of the…

-

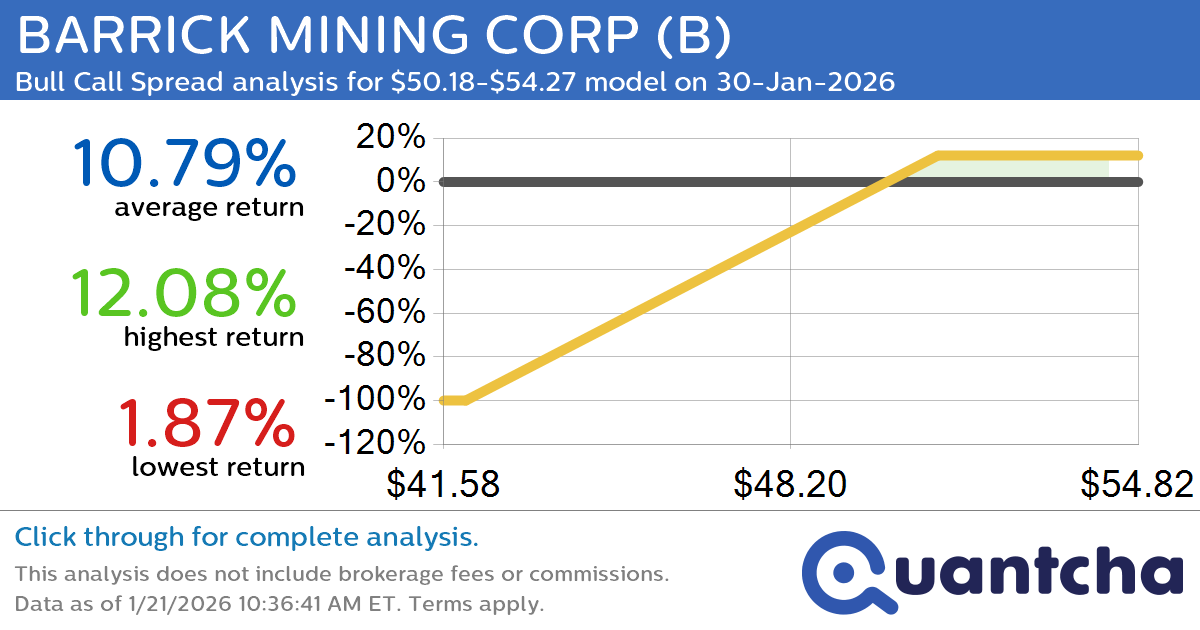

52-Week High Alert: Trading today’s movement in BARRICK MINING CORP $B

Quantchabot has detected a new Bull Call Spread trade opportunity for BARRICK MINING CORP (B) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. B was recently trading at $50.13 and has an implied volatility of 47.83% for this period. Based on an analysis of…

-

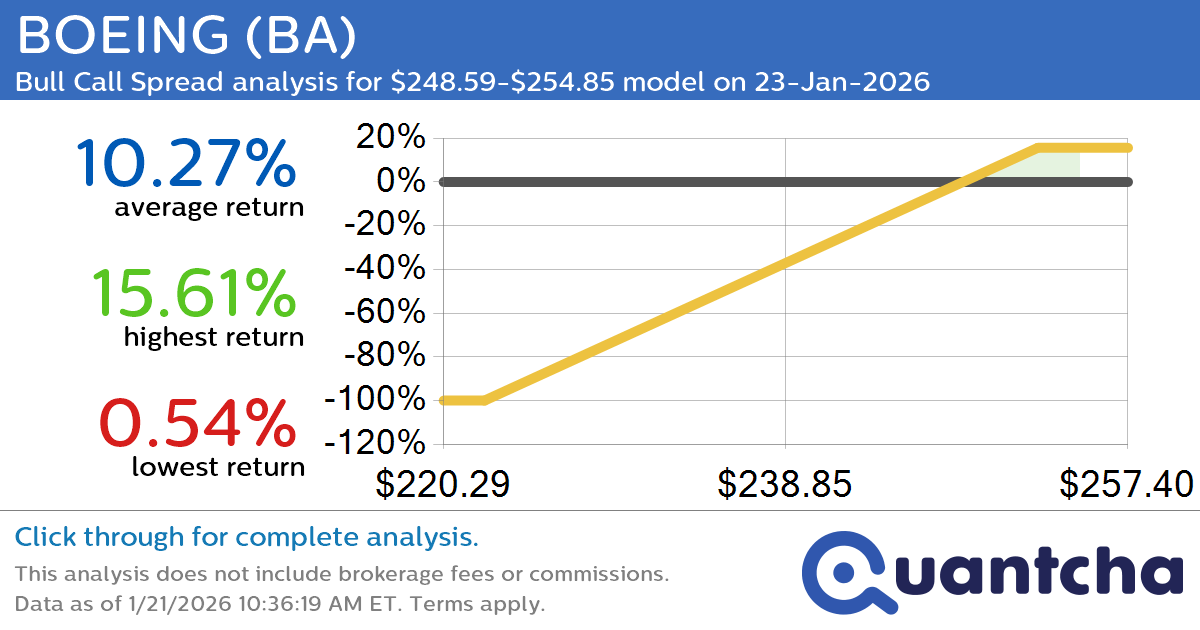

52-Week High Alert: Trading today’s movement in BOEING $BA

Quantchabot has detected a new Bull Call Spread trade opportunity for BOEING (BA) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BA was recently trading at $248.51 and has an implied volatility of 28.57% for this period. Based on an analysis of the options…

-

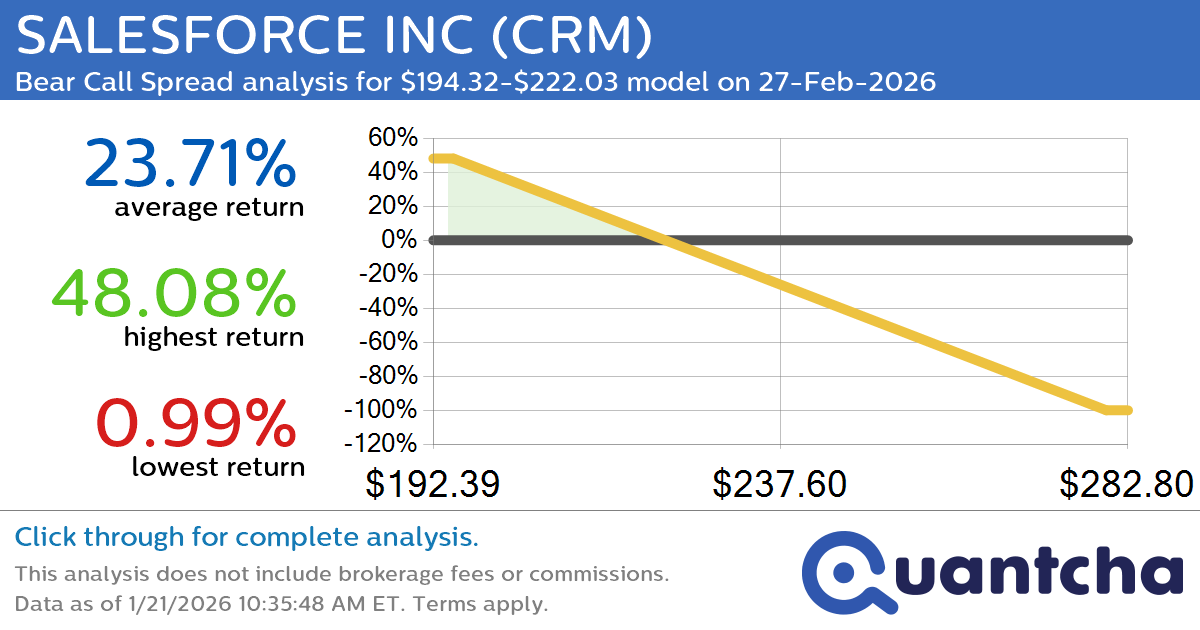

52-Week Low Alert: Trading today’s movement in SALESFORCE INC $CRM

Quantchabot has detected a new Bear Call Spread trade opportunity for SALESFORCE INC (CRM) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRM was recently trading at $221.16 and has an implied volatility of 41.44% for this period. Based on an analysis of the…

-

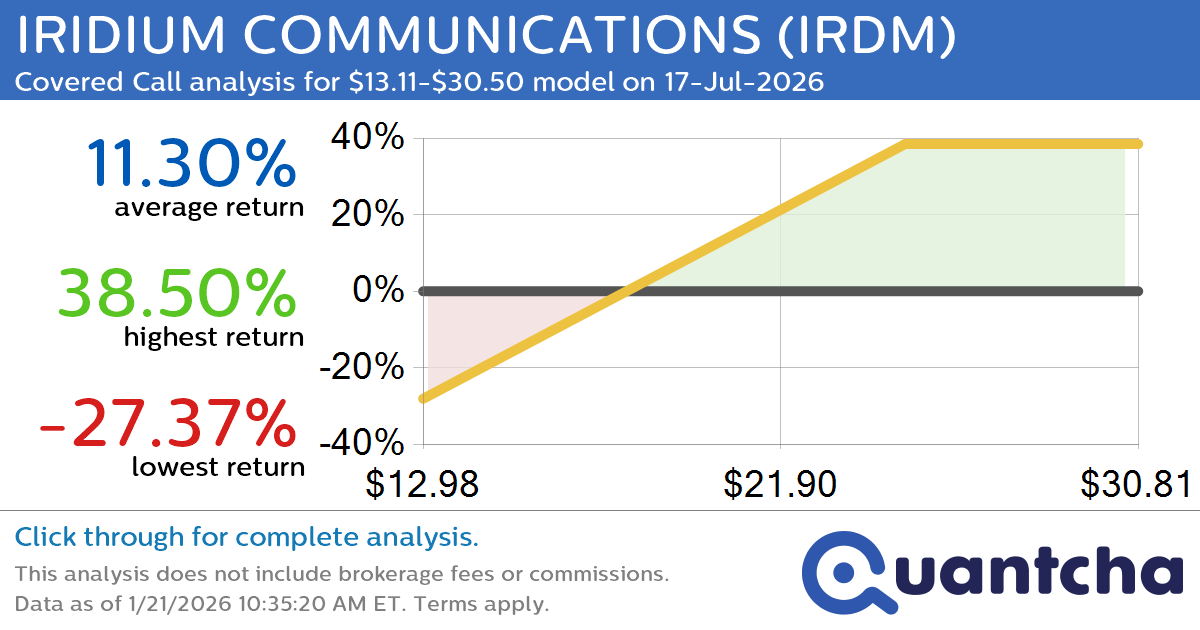

Covered Call Alert: IRIDIUM COMMUNICATIONS $IRDM returning up to 39.28% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for IRIDIUM COMMUNICATIONS (IRDM) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IRDM was recently trading at $19.63 and has an implied volatility of 60.53% for this period. Based on an analysis of the options…

-

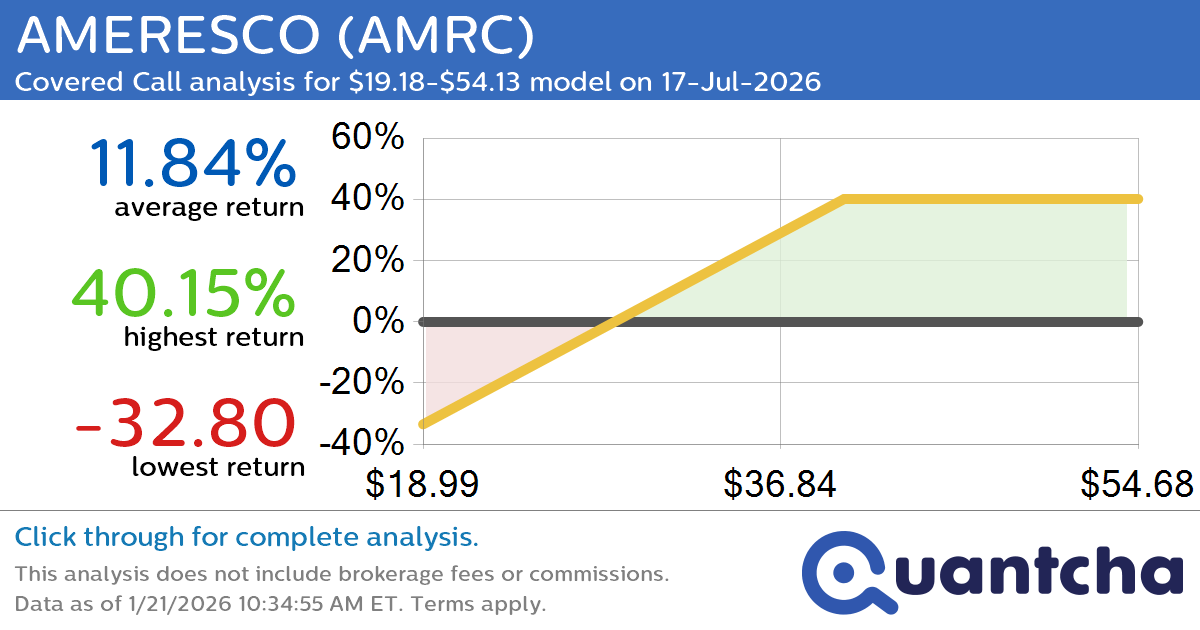

Covered Call Alert: AMERESCO $AMRC returning up to 40.15% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for AMERESCO (AMRC) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMRC was recently trading at $31.64 and has an implied volatility of 74.32% for this period. Based on an analysis of the options available…

-

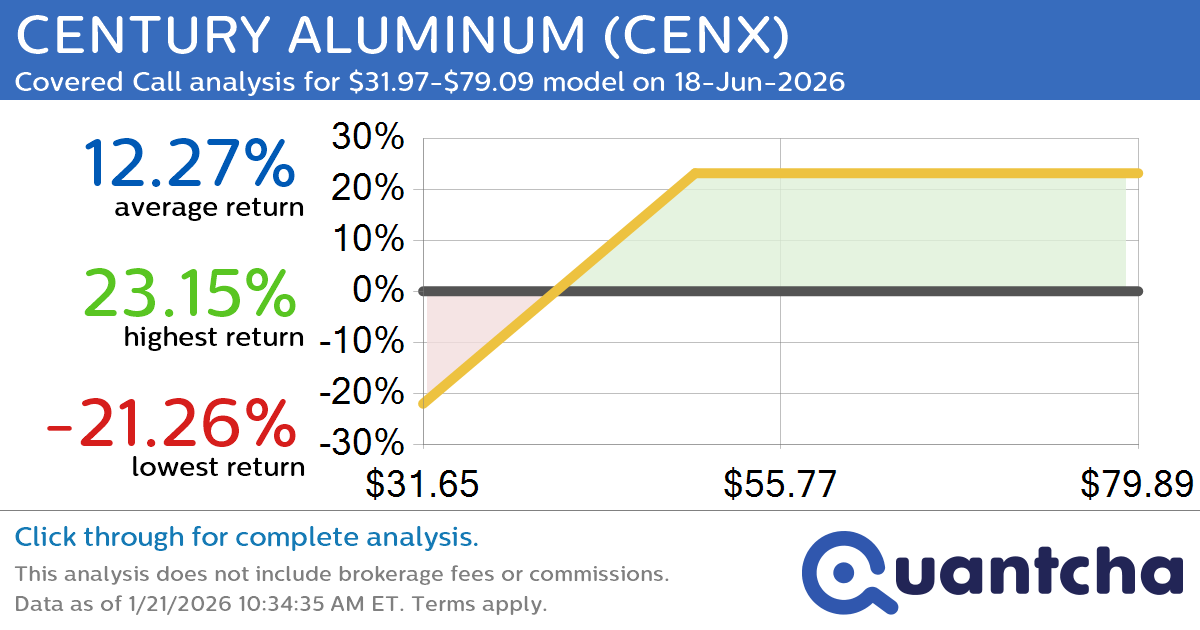

Covered Call Alert: CENTURY ALUMINUM $CENX returning up to 22.82% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for CENTURY ALUMINUM (CENX) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CENX was recently trading at $49.52 and has an implied volatility of 70.92% for this period. Based on an analysis of the options…