Author: Quantcha Trade Ideas

-

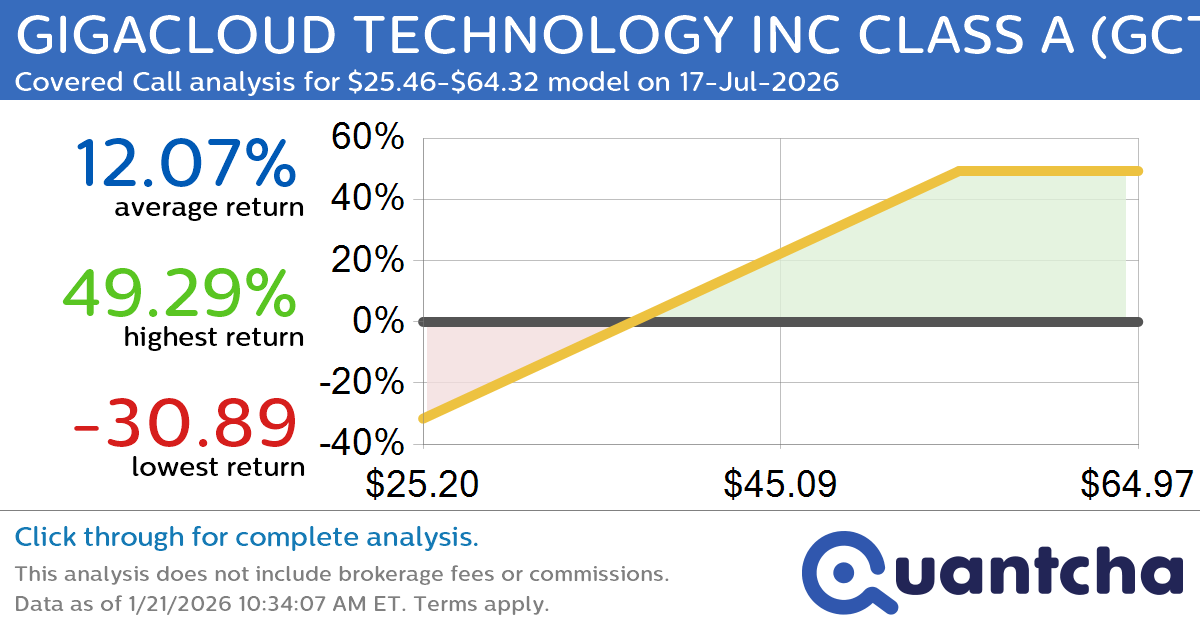

Covered Call Alert: GIGACLOUD TECHNOLOGY INC CLASS A $GCT returning up to 49.29% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for GIGACLOUD TECHNOLOGY INC CLASS A (GCT) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GCT was recently trading at $39.73 and has an implied volatility of 66.40% for this period. Based on an analysis…

-

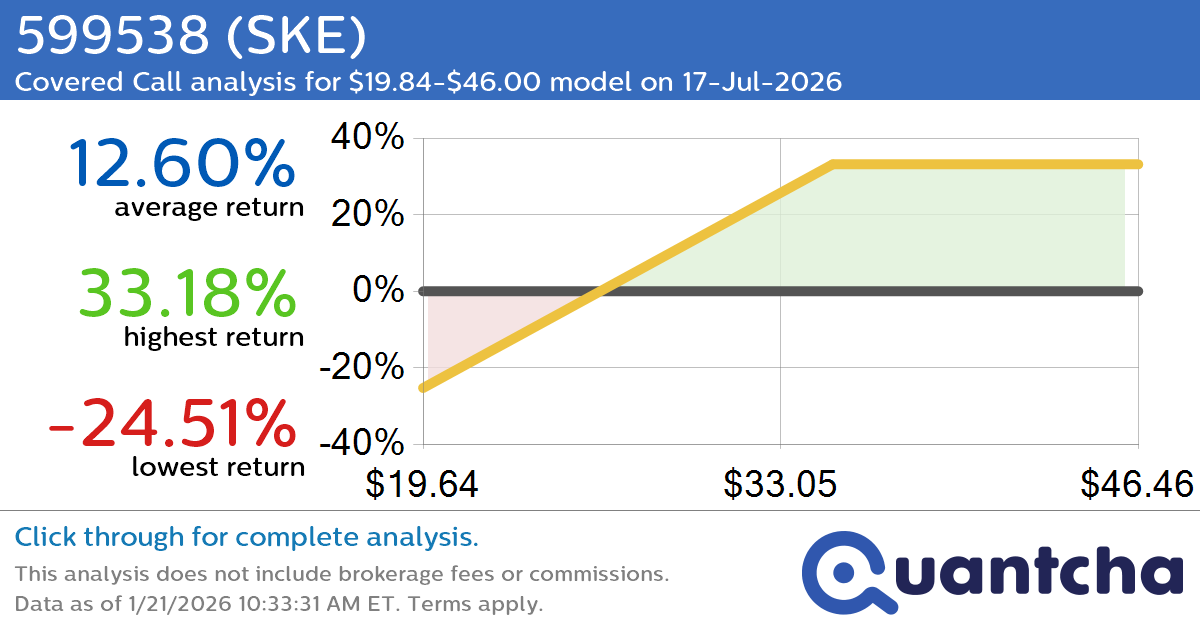

Covered Call Alert: 599538 $SKE returning up to 33.18% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for 599538 (SKE) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SKE was recently trading at $29.66 and has an implied volatility of 60.26% for this period. Based on an analysis of the options available…

-

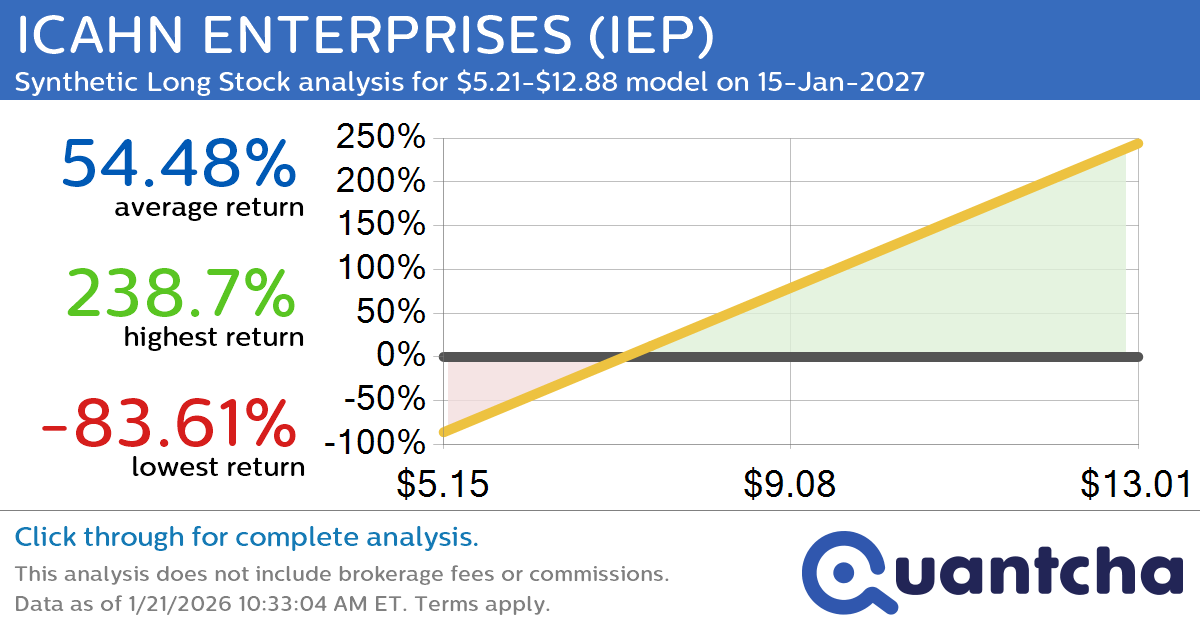

Synthetic Long Discount Alert: ICAHN ENTERPRISES $IEP trading at a 10.13% discount for the 15-Jan-2027 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ICAHN ENTERPRISES (IEP) for the 15-Jan-2027 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IEP was recently trading at $7.90 and has an implied volatility of 45.55% for this period. Based on an analysis of the…

-

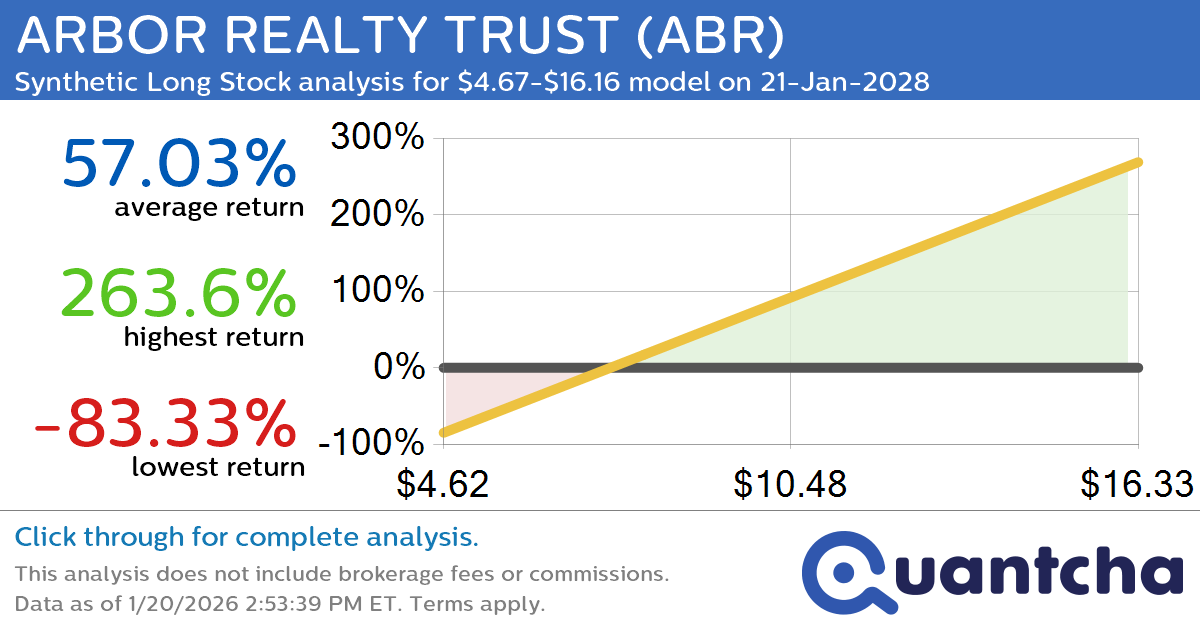

Synthetic Long Discount Alert: ARBOR REALTY TRUST $ABR trading at a 13.42% discount for the 21-Jan-2028 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ARBOR REALTY TRUST (ABR) for the 21-Jan-2028 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABR was recently trading at $8.09 and has an implied volatility of 43.82% for this period. Based on an analysis of…

-

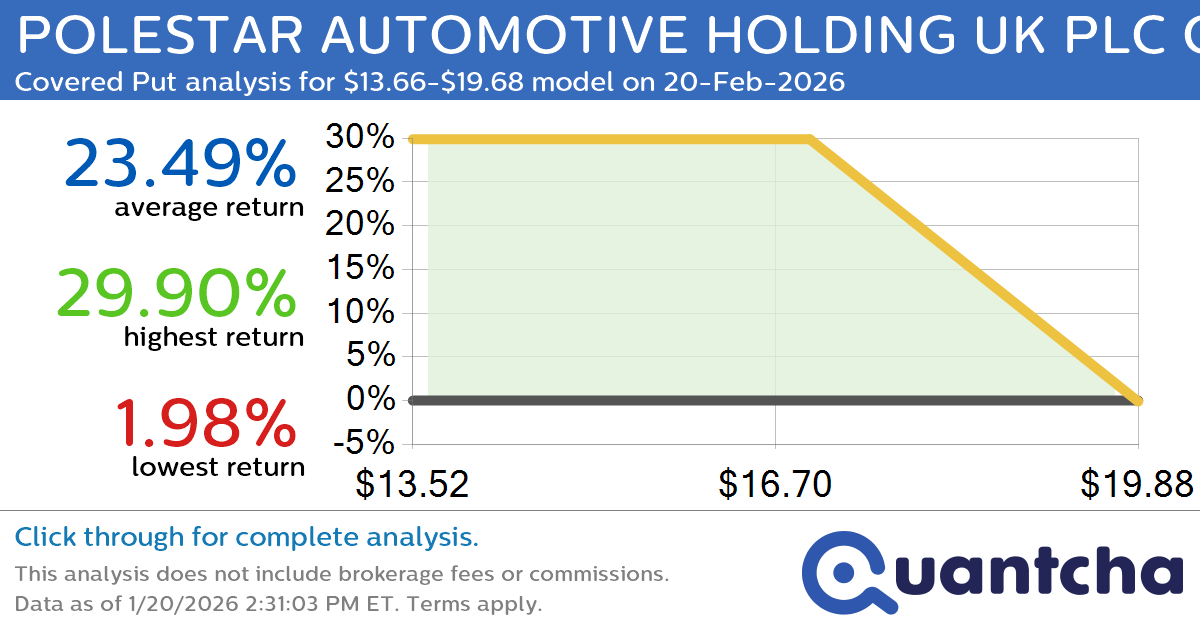

Big Loser Alert: Trading today’s -11.8% move in POLESTAR AUTOMOTIVE HOLDING UK PLC CLASS A ADS $PSNY

Quantchabot has detected a new Covered Put trade opportunity for POLESTAR AUTOMOTIVE HOLDING UK PLC CLASS A ADS (PSNY) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PSNY was recently trading at $19.62 and has an implied volatility of 124.13% for this period. Based…

-

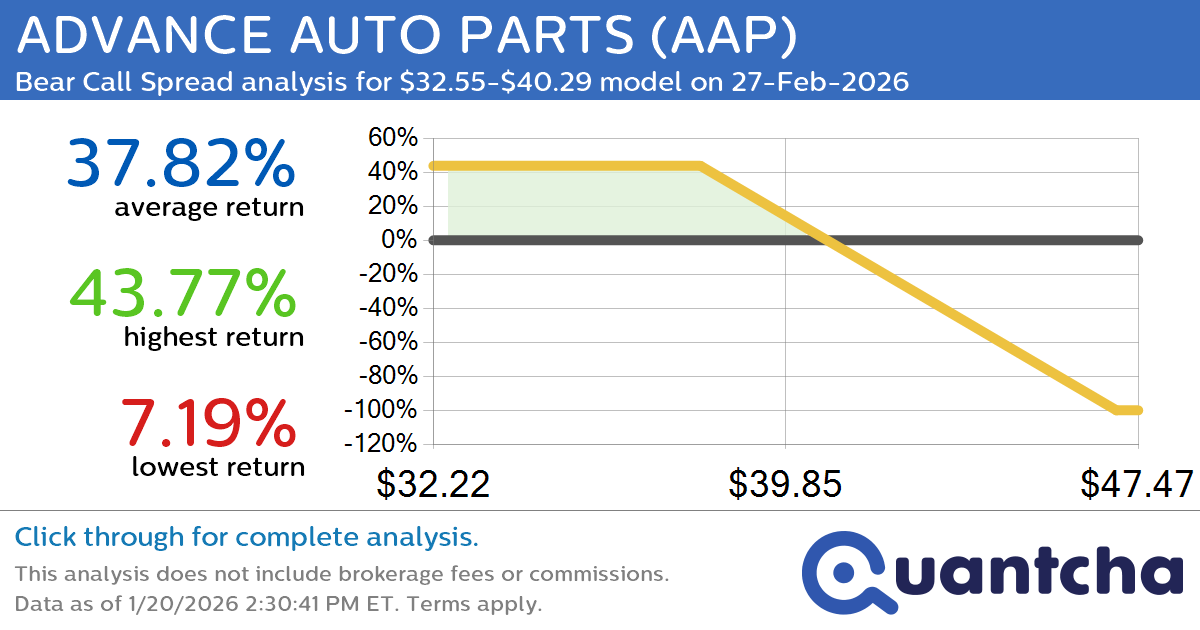

Big Loser Alert: Trading today’s -7.1% move in ADVANCE AUTO PARTS $AAP

Quantchabot has detected a new Bear Call Spread trade opportunity for ADVANCE AUTO PARTS (AAP) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AAP was recently trading at $40.13 and has an implied volatility of 65.61% for this period. Based on an analysis of…

-

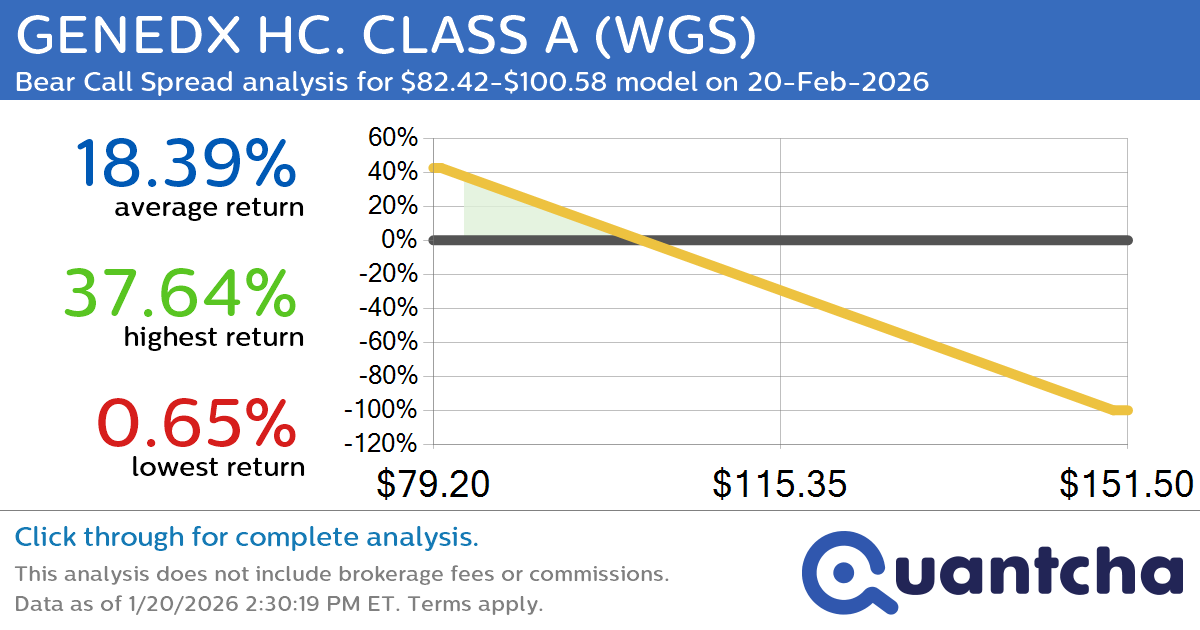

Big Loser Alert: Trading today’s -7.2% move in GENEDX HC. CLASS A $WGS

Quantchabot has detected a new Bear Call Spread trade opportunity for GENEDX HC. CLASS A (WGS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WGS was recently trading at $100.25 and has an implied volatility of 67.65% for this period. Based on an analysis…

-

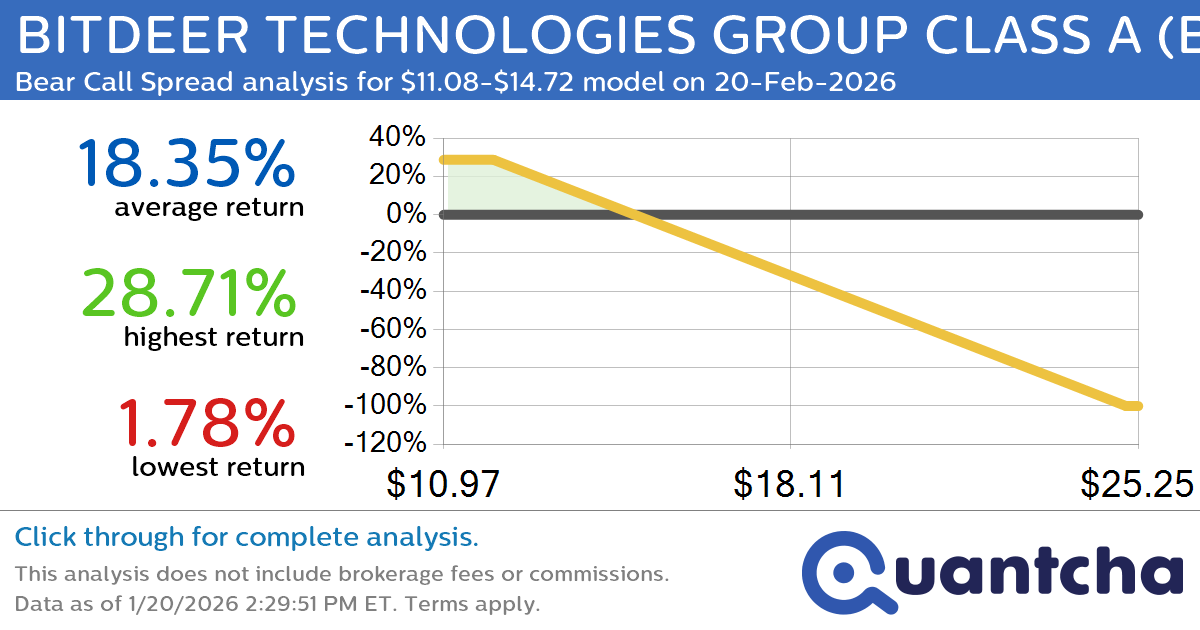

Big Loser Alert: Trading today’s -7.4% move in BITDEER TECHNOLOGIES GROUP CLASS A $BTDR

Quantchabot has detected a new Bear Call Spread trade opportunity for BITDEER TECHNOLOGIES GROUP CLASS A (BTDR) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BTDR was recently trading at $14.67 and has an implied volatility of 96.52% for this period. Based on an…

-

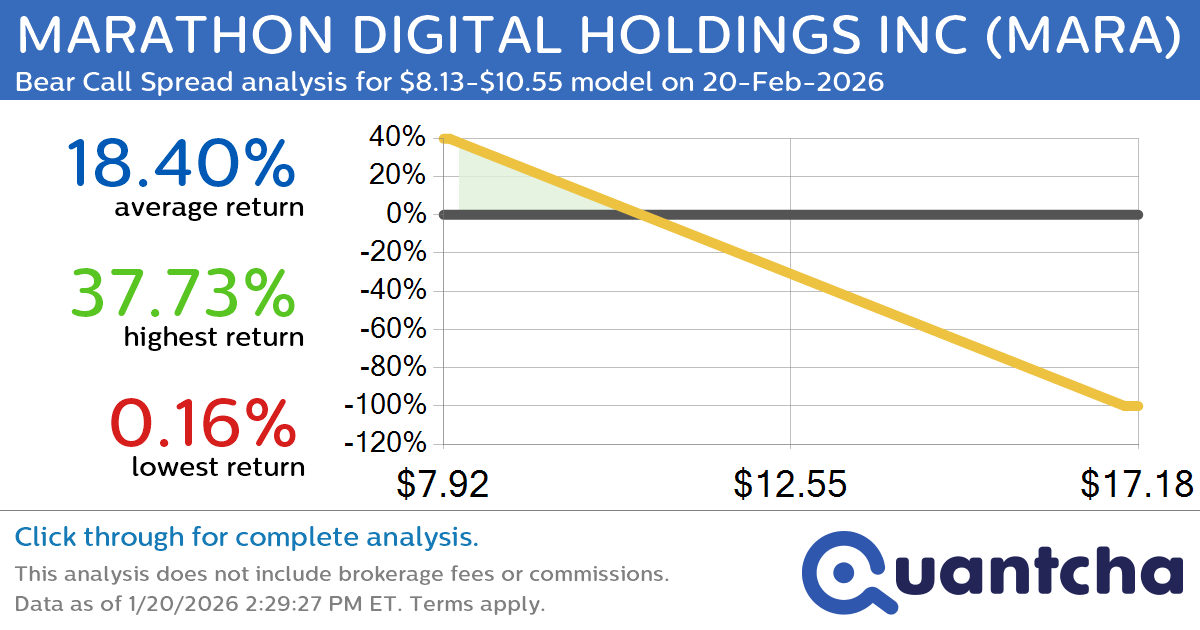

Big Loser Alert: Trading today’s -7.4% move in MARATHON DIGITAL HOLDINGS INC $MARA

Quantchabot has detected a new Bear Call Spread trade opportunity for MARATHON DIGITAL HOLDINGS INC (MARA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MARA was recently trading at $10.52 and has an implied volatility of 88.57% for this period. Based on an analysis…

-

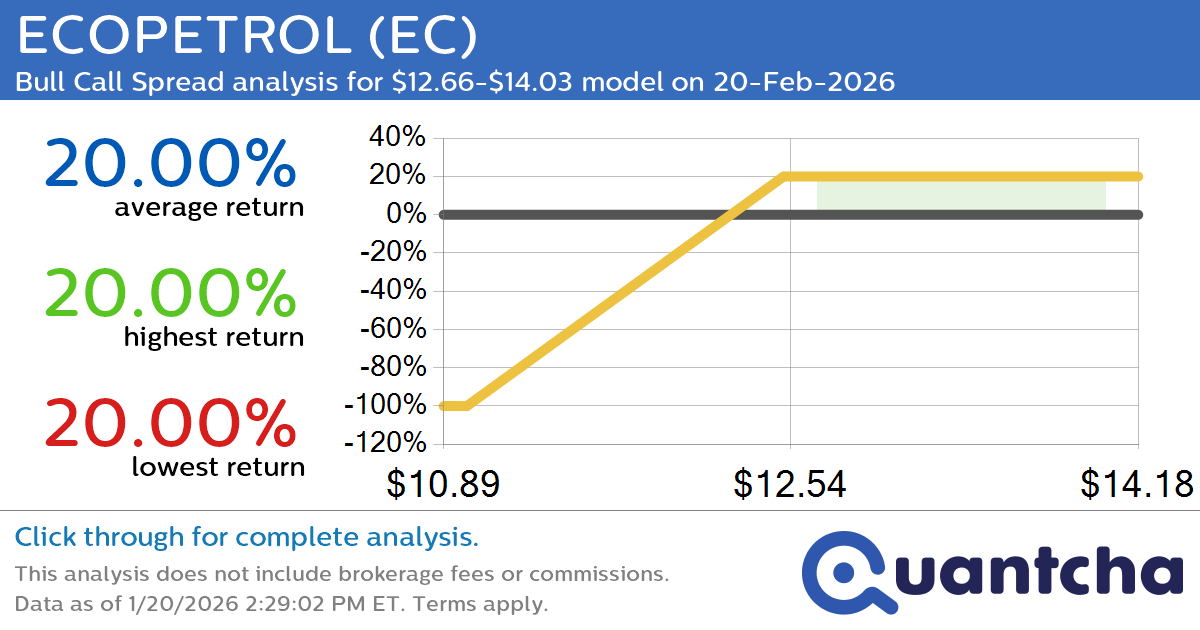

52-Week High Alert: Trading today’s movement in ECOPETROL $EC

Quantchabot has detected a new Bull Call Spread trade opportunity for ECOPETROL (EC) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EC was recently trading at $12.62 and has an implied volatility of 34.94% for this period. Based on an analysis of the options…