Author: Quantcha Trade Ideas

-

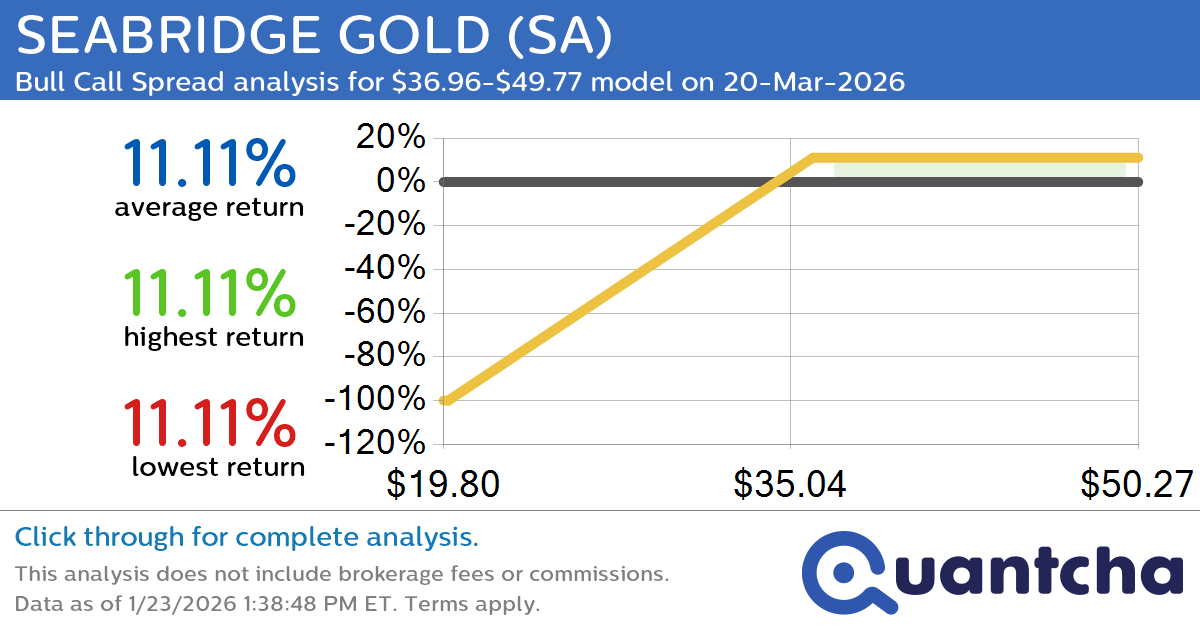

52-Week High Alert: Trading today’s movement in SEABRIDGE GOLD $SA

Quantchabot has detected a new Bull Call Spread trade opportunity for SEABRIDGE GOLD (SA) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SA was recently trading at $36.74 and has an implied volatility of 75.53% for this period. Based on an analysis of the…

-

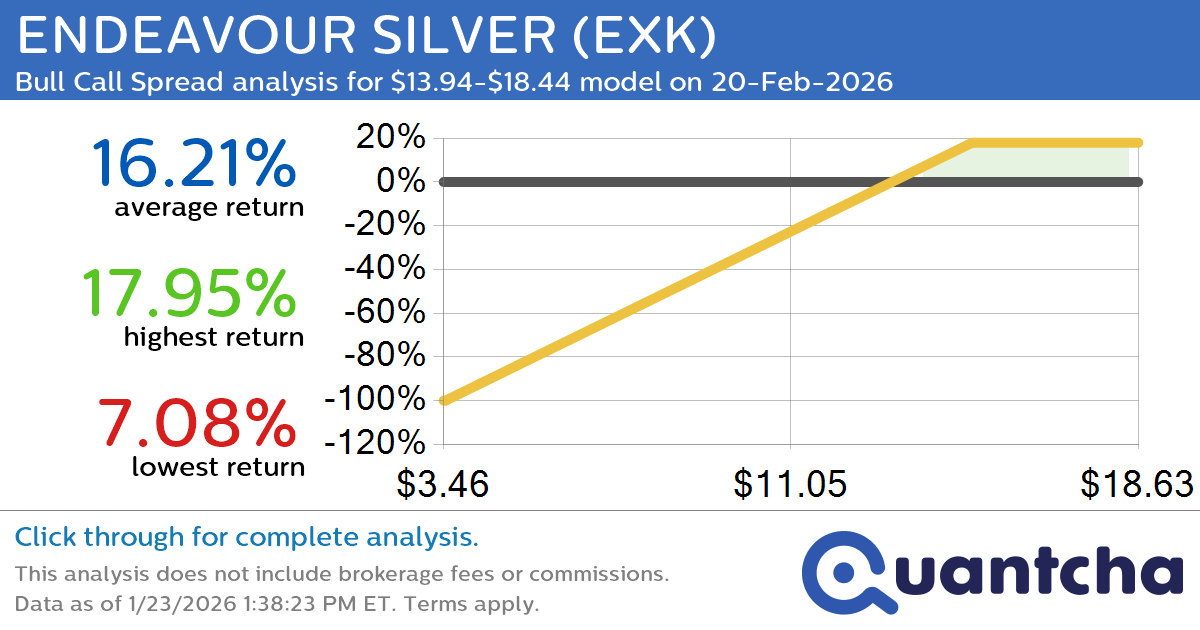

52-Week High Alert: Trading today’s movement in ENDEAVOUR SILVER $EXK

Quantchabot has detected a new Bull Call Spread trade opportunity for ENDEAVOUR SILVER (EXK) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EXK was recently trading at $13.89 and has an implied volatility of 99.86% for this period. Based on an analysis of the…

-

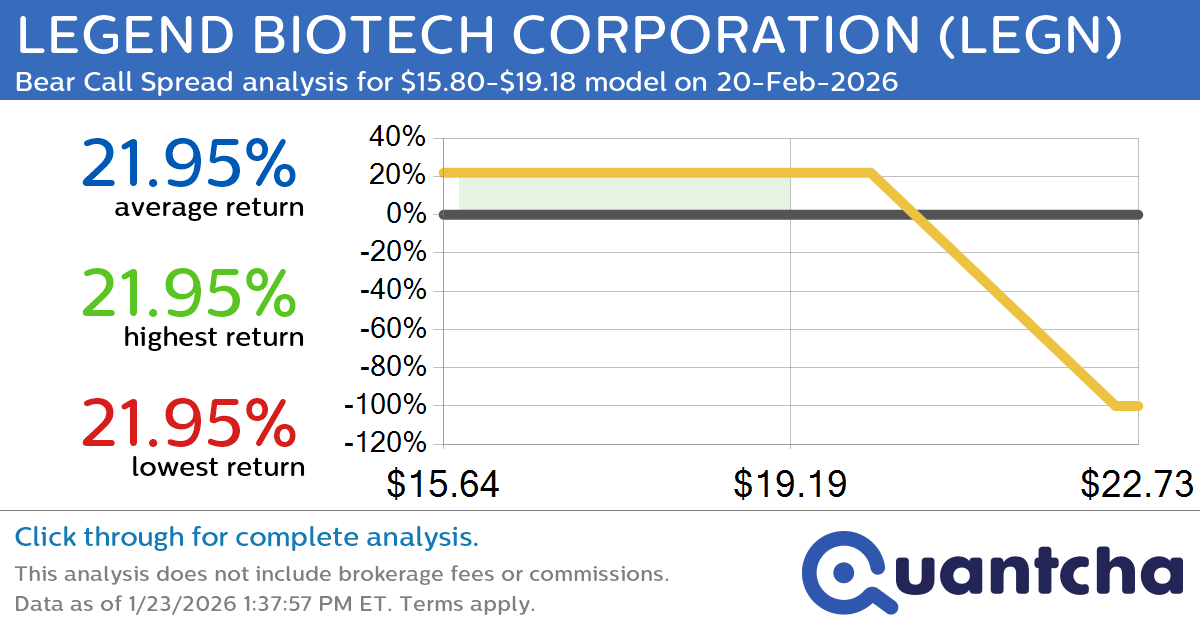

52-Week Low Alert: Trading today’s movement in LEGEND BIOTECH CORPORATION $LEGN

Quantchabot has detected a new Bear Call Spread trade opportunity for LEGEND BIOTECH CORPORATION (LEGN) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LEGN was recently trading at $19.12 and has an implied volatility of 69.19% for this period. Based on an analysis of…

-

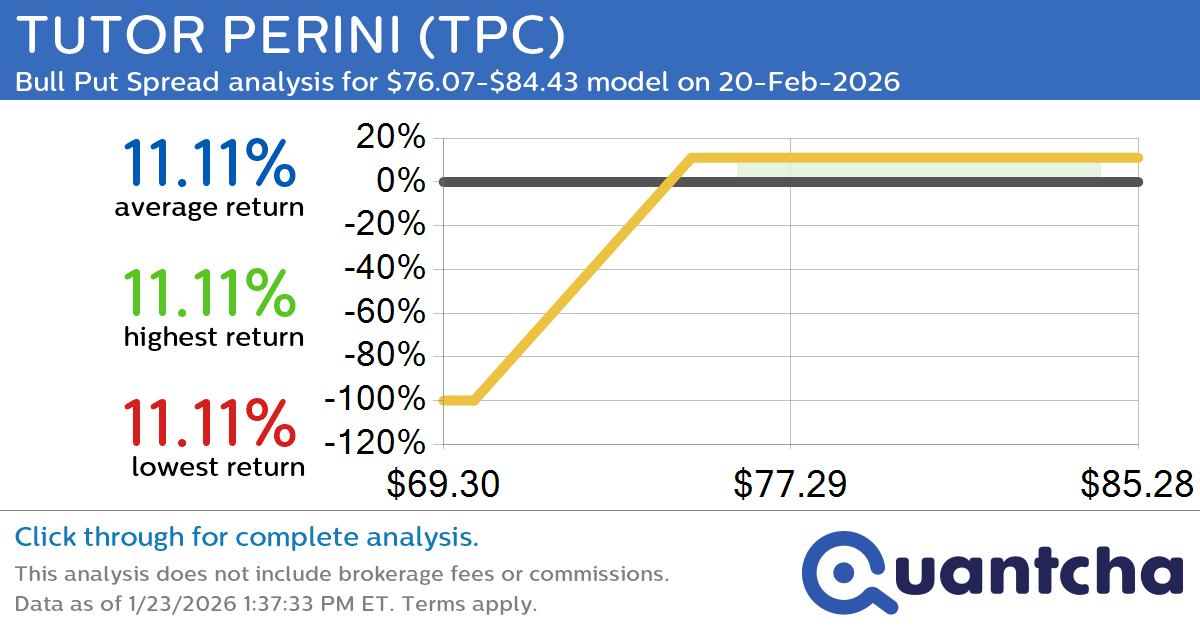

52-Week High Alert: Trading today’s movement in TUTOR PERINI $TPC

Quantchabot has detected a new Bull Put Spread trade opportunity for TUTOR PERINI (TPC) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TPC was recently trading at $75.84 and has an implied volatility of 37.20% for this period. Based on an analysis of the…

-

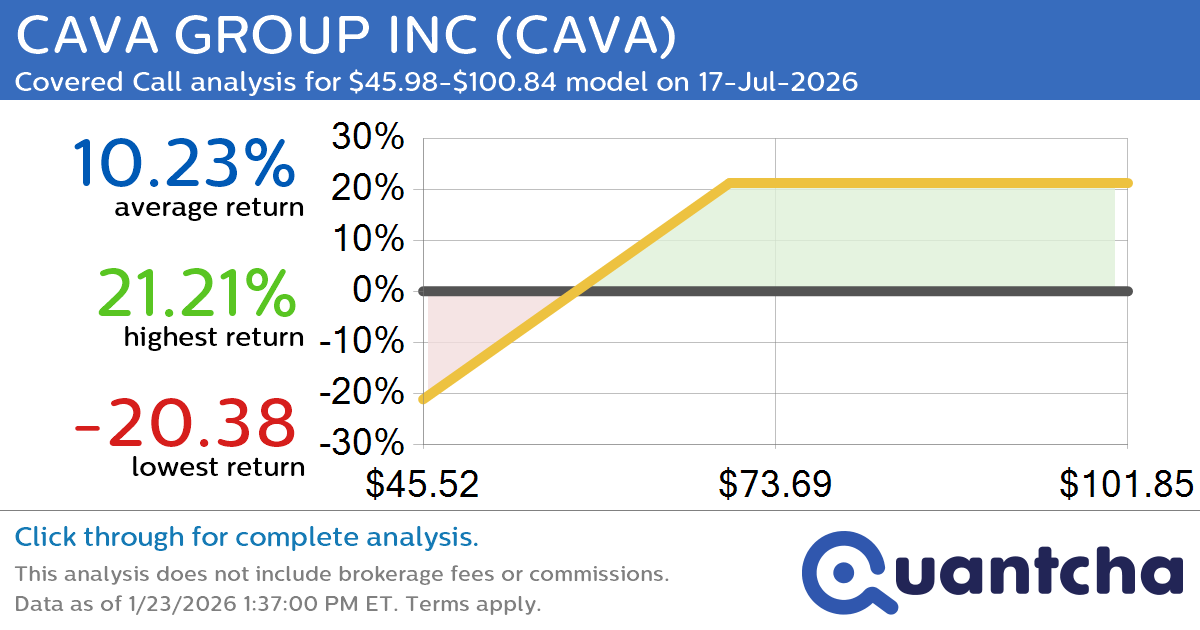

Covered Call Alert: CAVA GROUP INC $CAVA returning up to 21.21% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for CAVA GROUP INC (CAVA) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAVA was recently trading at $66.86 and has an implied volatility of 56.62% for this period. Based on an analysis of the…

-

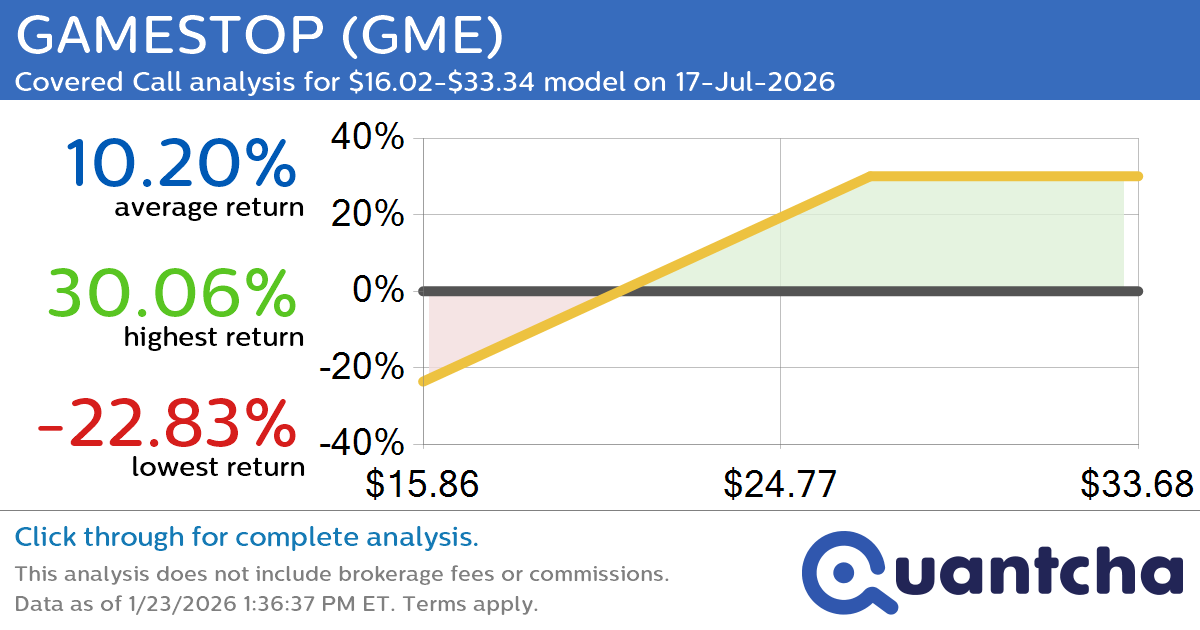

Covered Call Alert: GAMESTOP $GME returning up to 30.06% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for GAMESTOP (GME) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GME was recently trading at $22.69 and has an implied volatility of 52.83% for this period. Based on an analysis of the options available…

-

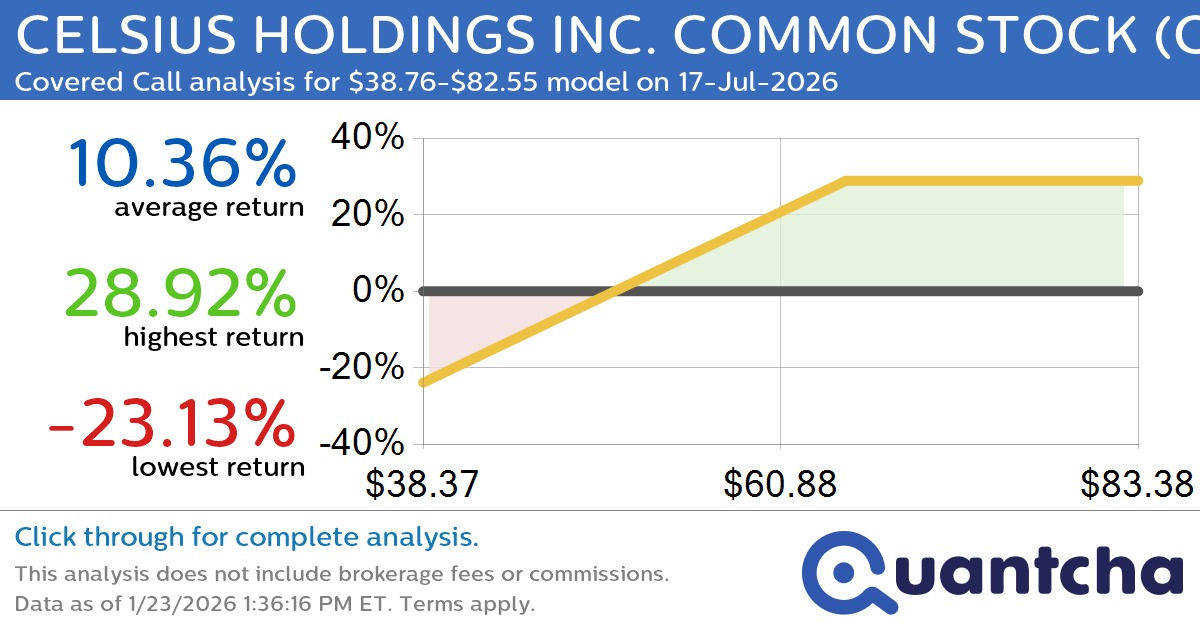

Covered Call Alert: CELSIUS HOLDINGS INC. COMMON STOCK $CELH returning up to 28.92% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for CELSIUS HOLDINGS INC. COMMON STOCK (CELH) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CELH was recently trading at $55.55 and has an implied volatility of 54.50% for this period. Based on an analysis…

-

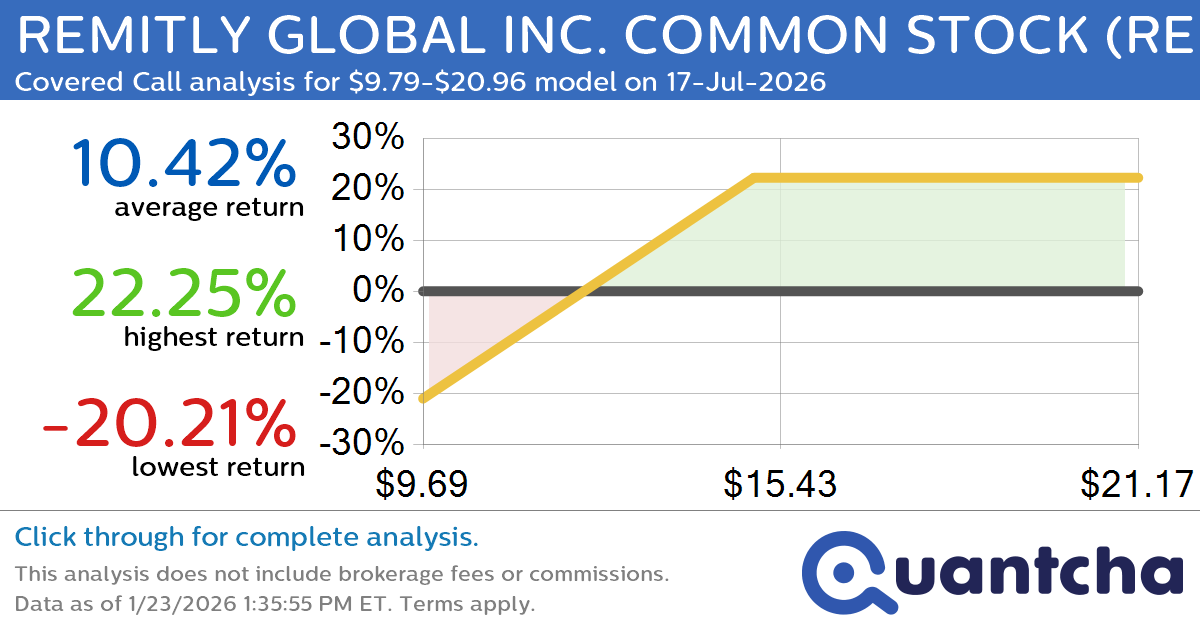

Covered Call Alert: REMITLY GLOBAL INC. COMMON STOCK $RELY returning up to 22.25% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for REMITLY GLOBAL INC. COMMON STOCK (RELY) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RELY was recently trading at $14.07 and has an implied volatility of 54.86% for this period. Based on an analysis…

-

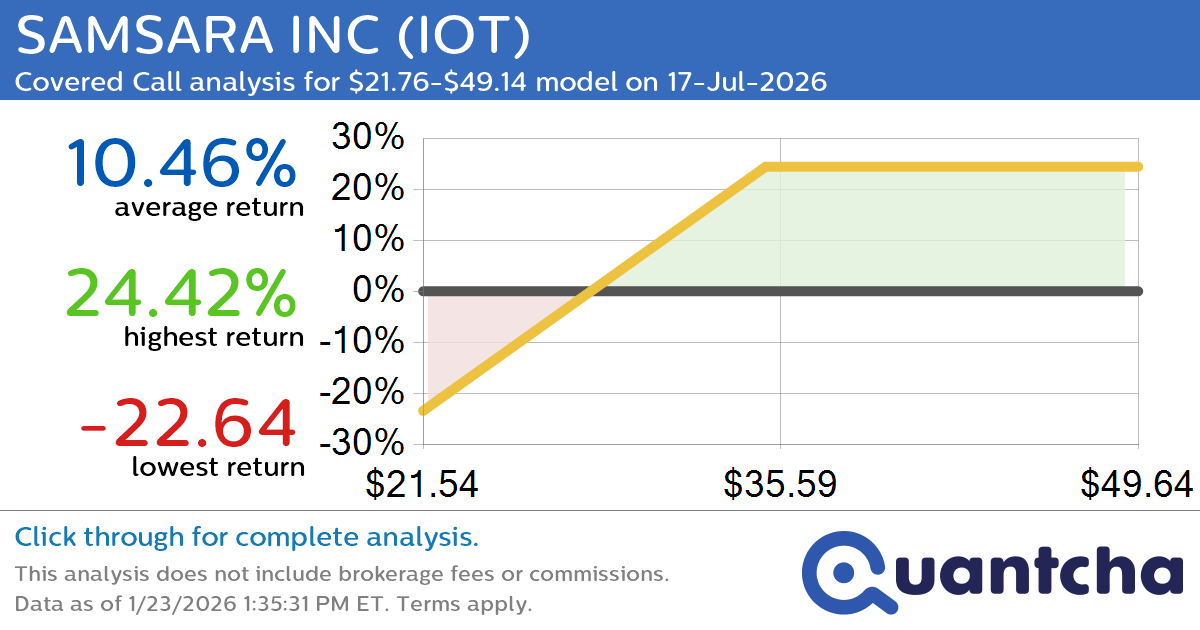

Covered Call Alert: SAMSARA INC $IOT returning up to 24.42% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for SAMSARA INC (IOT) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IOT was recently trading at $32.11 and has an implied volatility of 58.72% for this period. Based on an analysis of the options…

-

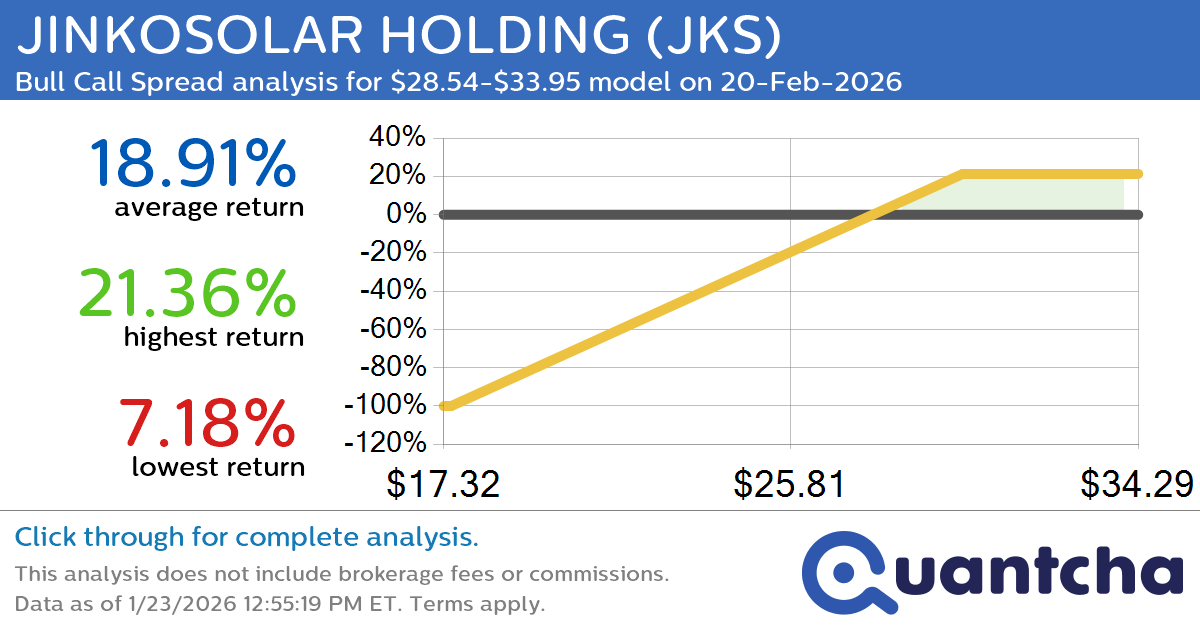

Big Gainer Alert: Trading today’s 11.7% move in JINKOSOLAR HOLDING $JKS

Quantchabot has detected a new Bull Call Spread trade opportunity for JINKOSOLAR HOLDING (JKS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JKS was recently trading at $28.45 and has an implied volatility of 61.96% for this period. Based on an analysis of the…