Author: Quantcha Trade Ideas

-

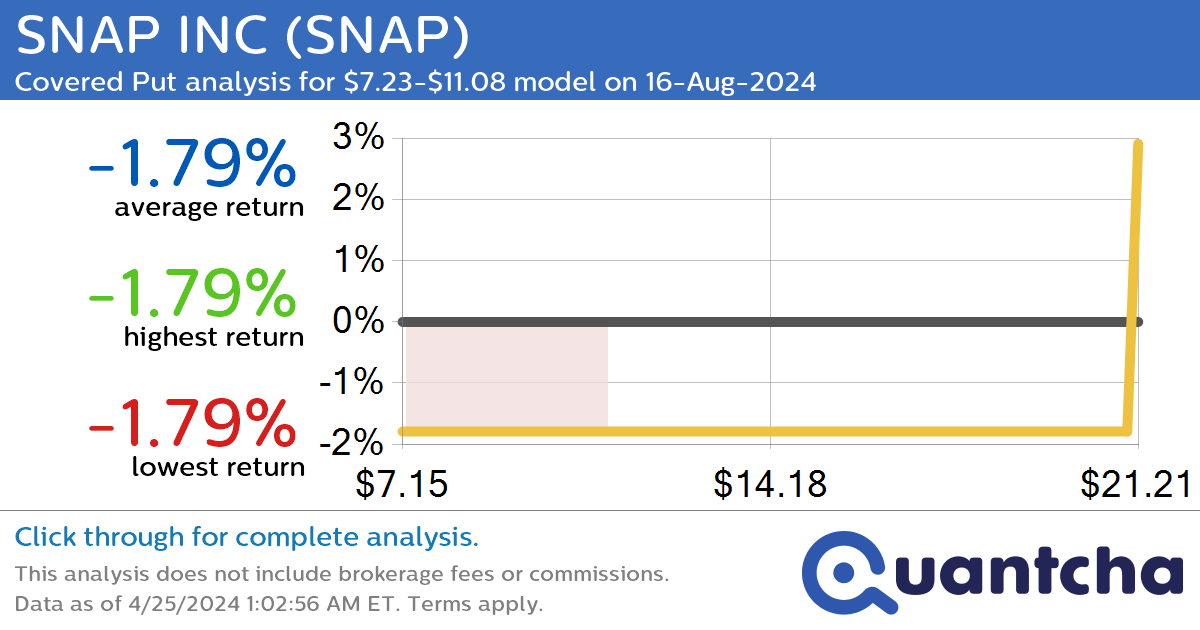

StockTwits Trending Alert: Trading recent interest in SNAP INC $SNAP

Quantchabot has detected a new Covered Put trade opportunity for SNAP INC (SNAP) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SNAP was recently trading at $11.08 and has an implied volatility of 79.42% for this period. Based on an analysis of the options…

-

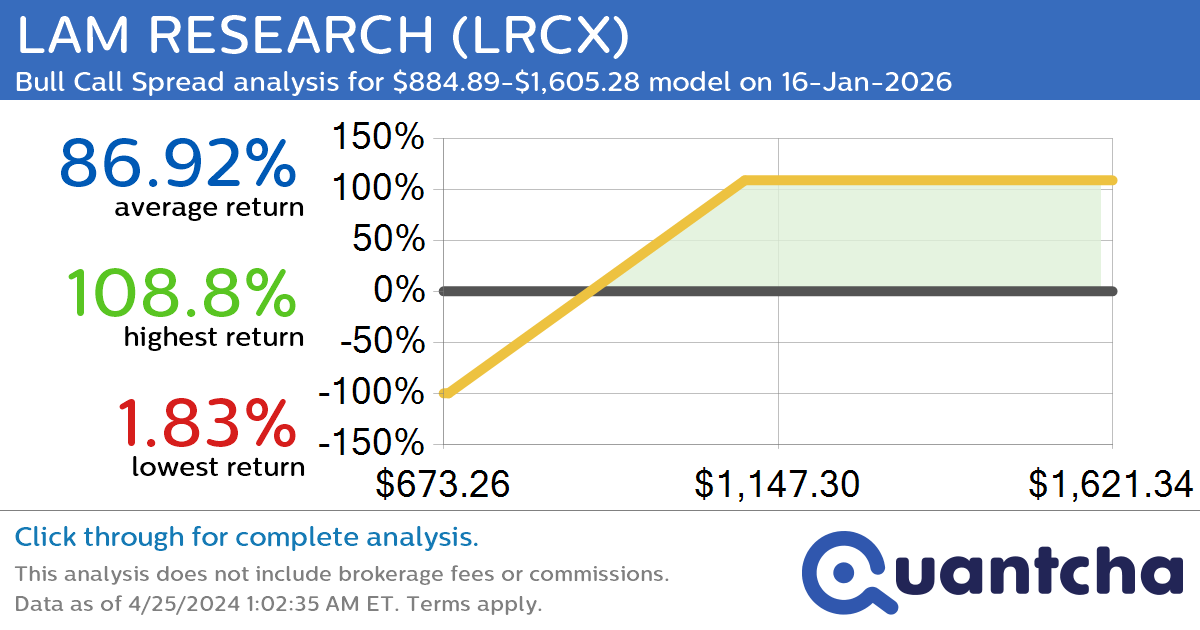

StockTwits Trending Alert: Trading recent interest in LAM RESEARCH $LRCX

Quantchabot has detected a new Bull Call Spread trade opportunity for LAM RESEARCH (LRCX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LRCX was recently trading at $884.89 and has an implied volatility of 38.28% for this period. Based on an analysis of the…

-

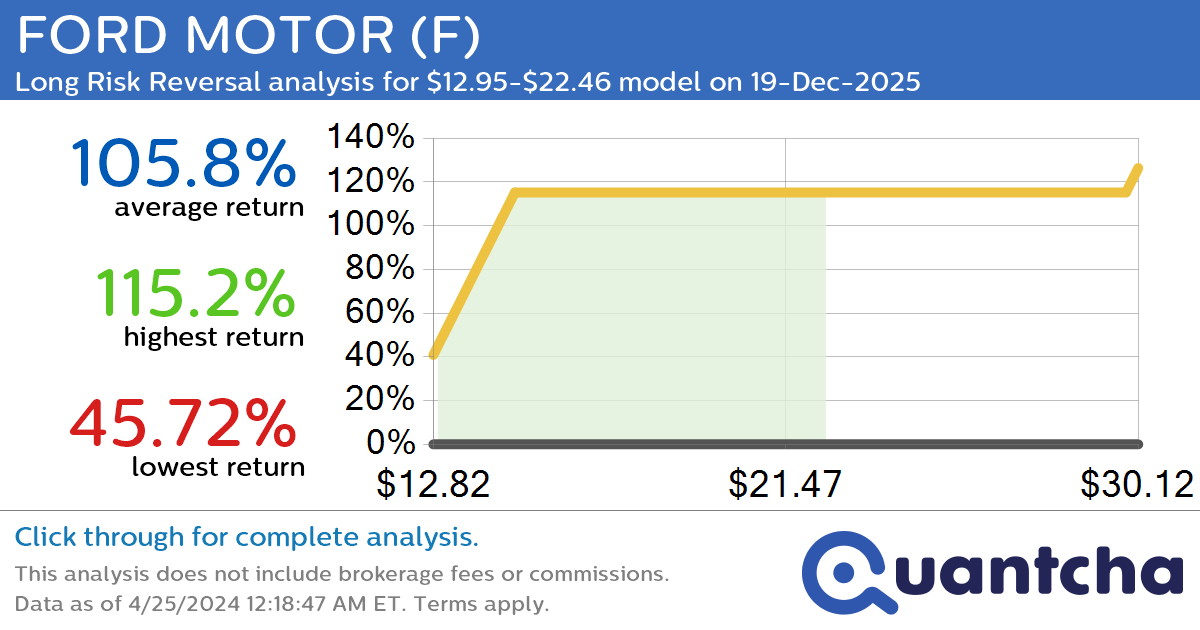

StockTwits Trending Alert: Trading recent interest in FORD MOTOR $F

Quantchabot has detected a new Long Risk Reversal trade opportunity for FORD MOTOR (F) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. F was recently trading at $12.95 and has an implied volatility of 35.98% for this period. Based on an analysis of the…

-

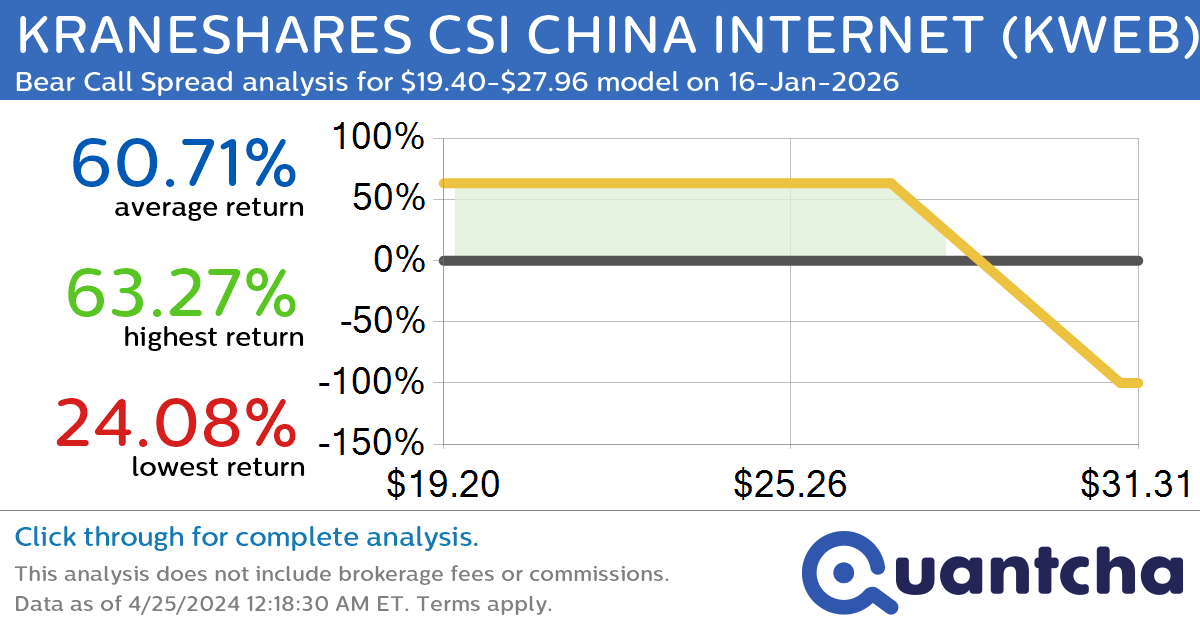

StockTwits Trending Alert: Trading recent interest in KRANESHARES CSI CHINA INTERNET $KWEB

Quantchabot has detected a new Bear Call Spread trade opportunity for KRANESHARES CSI CHINA INTERNET (KWEB) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KWEB was recently trading at $27.96 and has an implied volatility of 34.77% for this period. Based on an analysis…

-

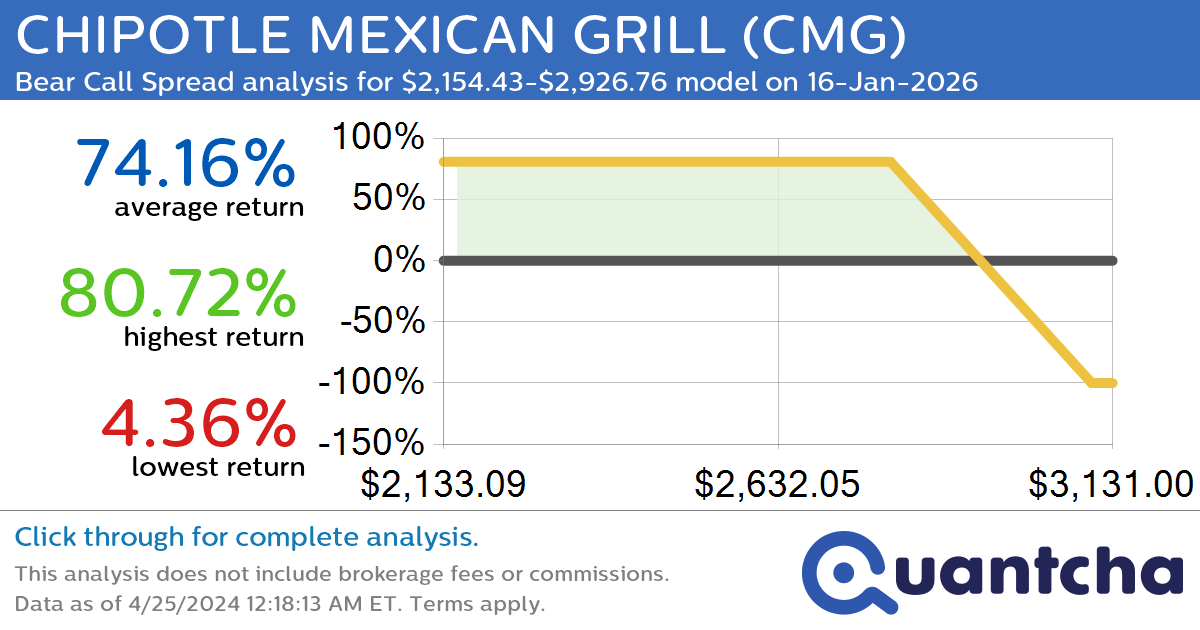

StockTwits Trending Alert: Trading recent interest in CHIPOTLE MEXICAN GRILL $CMG

Quantchabot has detected a new Bear Call Spread trade opportunity for CHIPOTLE MEXICAN GRILL (CMG) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CMG was recently trading at $2,926.76 and has an implied volatility of 30.26% for this period. Based on an analysis of…

-

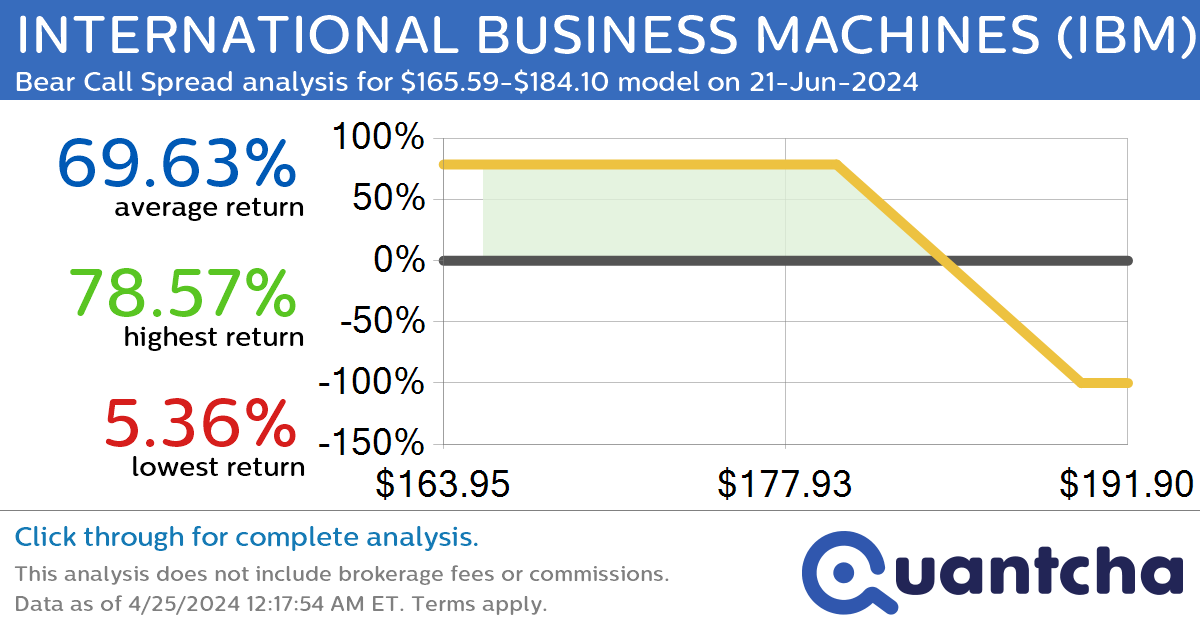

StockTwits Trending Alert: Trading recent interest in INTERNATIONAL BUSINESS MACHINES $IBM

Quantchabot has detected a new Bear Call Spread trade opportunity for INTERNATIONAL BUSINESS MACHINES (IBM) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IBM was recently trading at $184.10 and has an implied volatility of 28.80% for this period. Based on an analysis of…

-

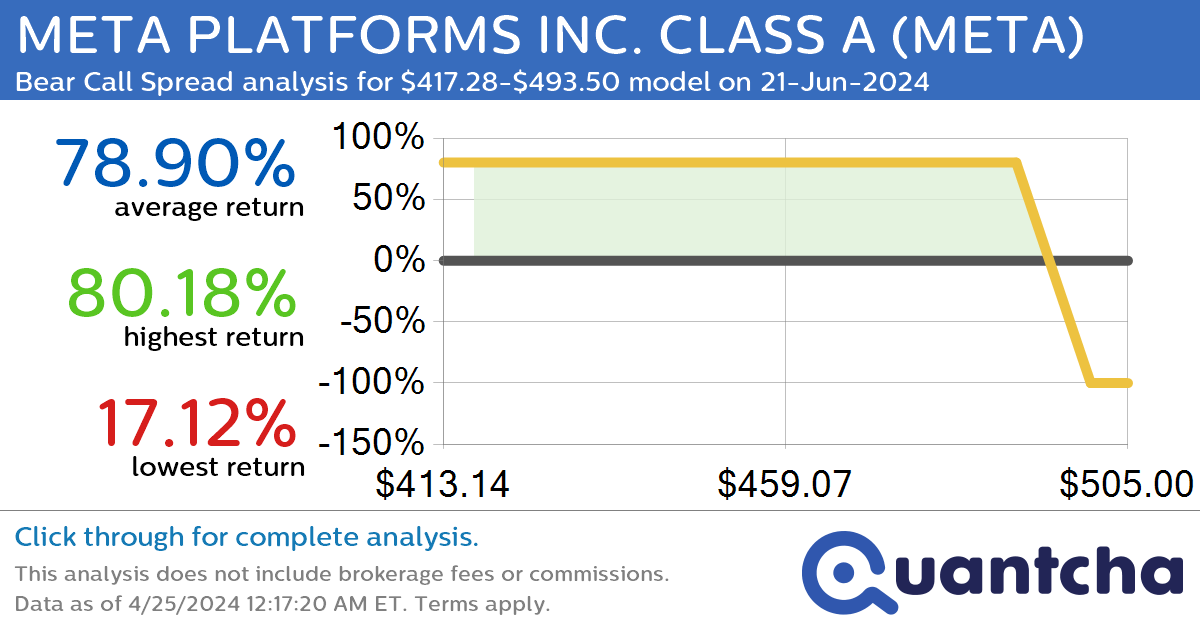

StockTwits Trending Alert: Trading recent interest in META PLATFORMS INC. CLASS A $META

Quantchabot has detected a new Bear Call Spread trade opportunity for META PLATFORMS INC. CLASS A (META) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. META was recently trading at $493.50 and has an implied volatility of 44.29% for this period. Based on an…

-

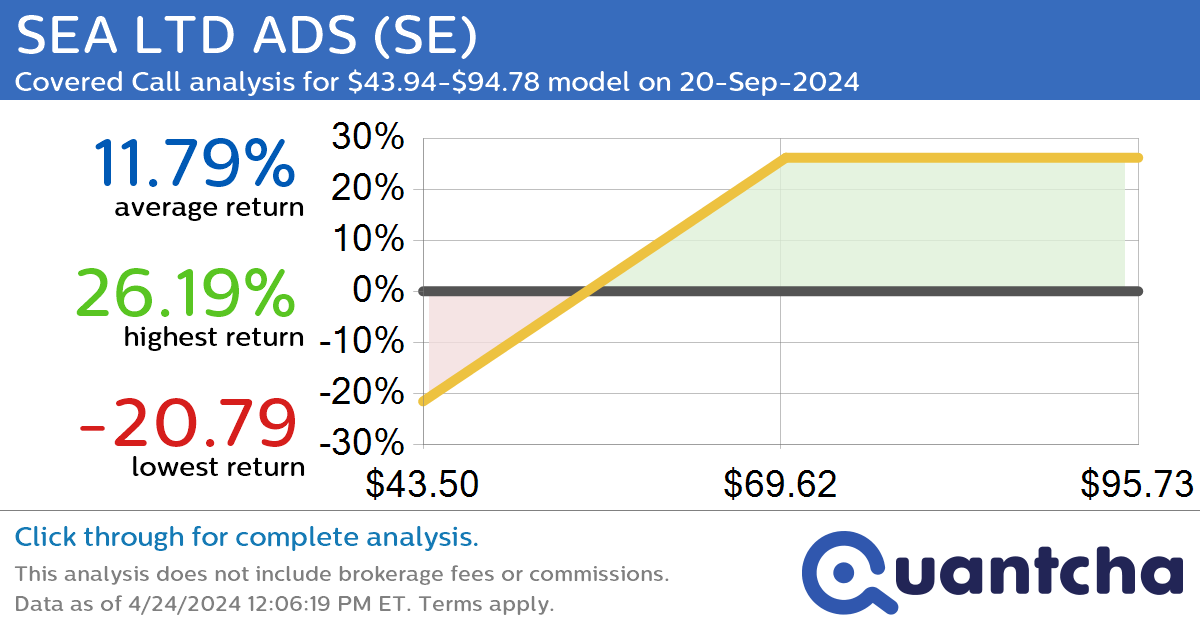

Covered Call Alert: SEA LTD ADS $SE returning up to 25.67% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for SEA LTD ADS (SE) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SE was recently trading at $63.07 and has an implied volatility of 60.02% for this period. Based on an analysis of the…

-

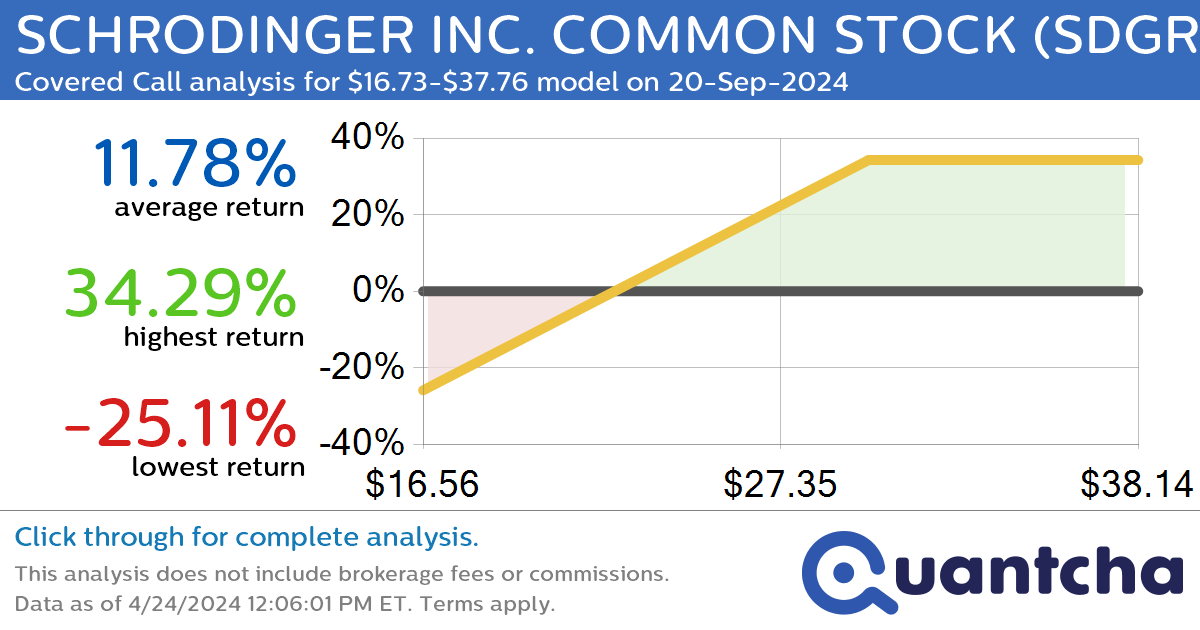

Covered Call Alert: SCHRODINGER INC. COMMON STOCK $SDGR returning up to 34.05% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for SCHRODINGER INC. COMMON STOCK (SDGR) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SDGR was recently trading at $24.56 and has an implied volatility of 63.58% for this period. Based on an analysis of…

-

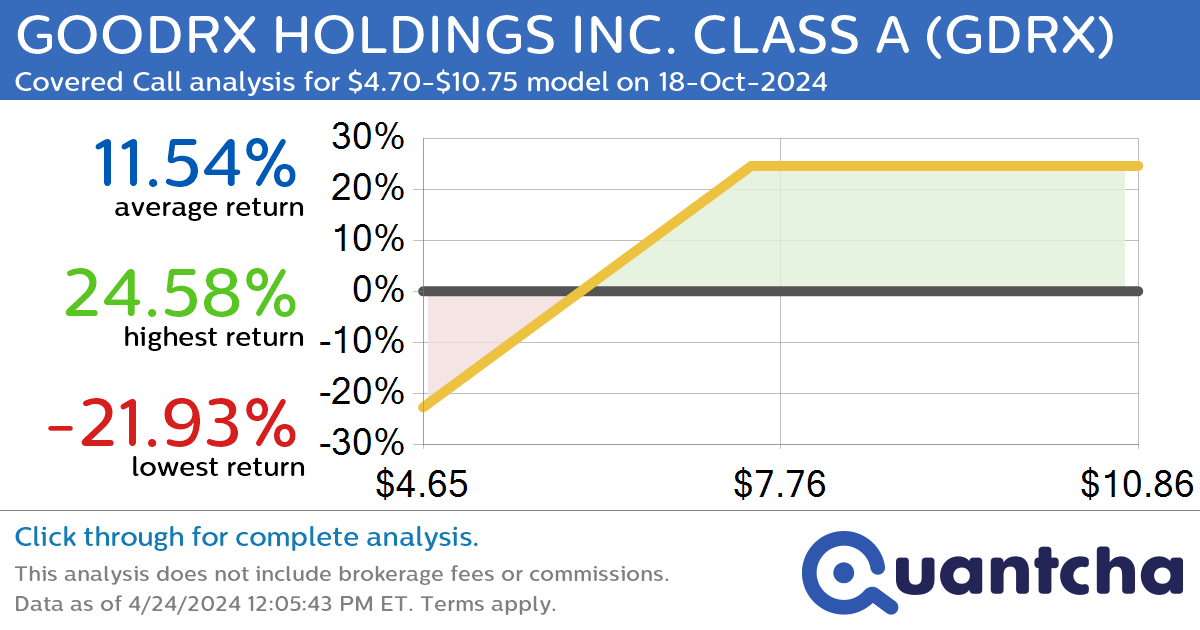

Covered Call Alert: GOODRX HOLDINGS INC. CLASS A $GDRX returning up to 24.58% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for GOODRX HOLDINGS INC. CLASS A (GDRX) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GDRX was recently trading at $6.92 and has an implied volatility of 59.29% for this period. Based on an analysis…