Author: Quantcha Trade Ideas

-

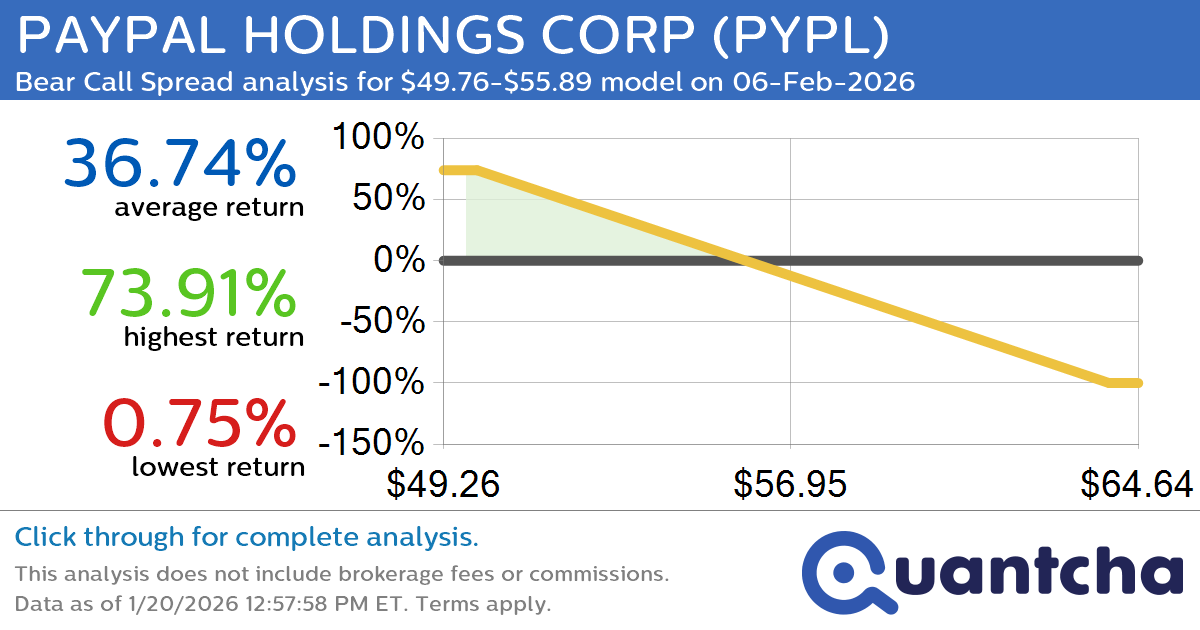

52-Week Low Alert: Trading today’s movement in PAYPAL HOLDINGS CORP $PYPL

Quantchabot has detected a new Bear Call Spread trade opportunity for PAYPAL HOLDINGS CORP (PYPL) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PYPL was recently trading at $55.78 and has an implied volatility of 52.77% for this period. Based on an analysis of…

-

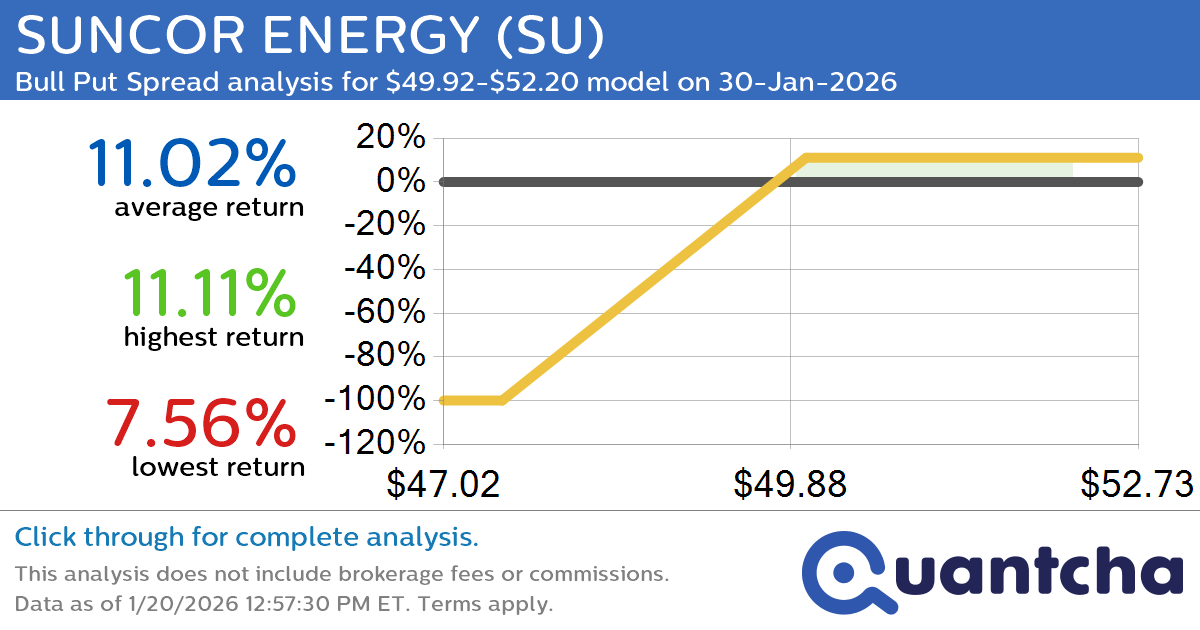

52-Week High Alert: Trading today’s movement in SUNCOR ENERGY $SU

Quantchabot has detected a new Bull Put Spread trade opportunity for SUNCOR ENERGY (SU) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SU was recently trading at $49.86 and has an implied volatility of 26.15% for this period. Based on an analysis of the…

-

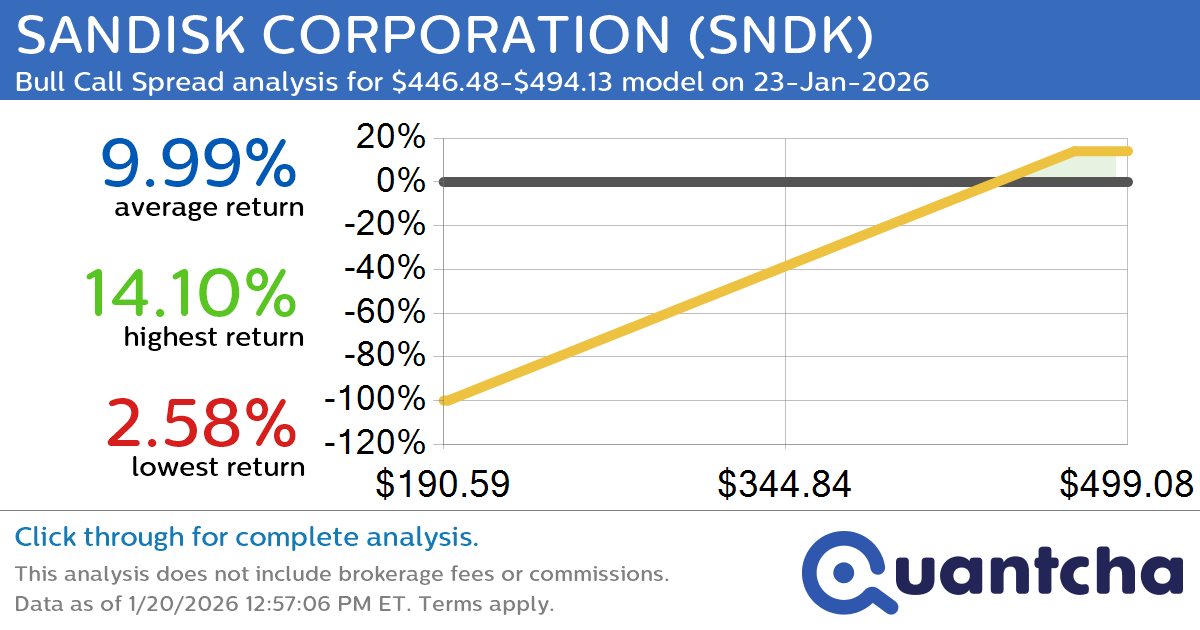

52-Week High Alert: Trading today’s movement in SANDISK CORPORATION $SNDK

Quantchabot has detected a new Bull Call Spread trade opportunity for SANDISK CORPORATION (SNDK) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SNDK was recently trading at $446.31 and has an implied volatility of 101.08% for this period. Based on an analysis of the…

-

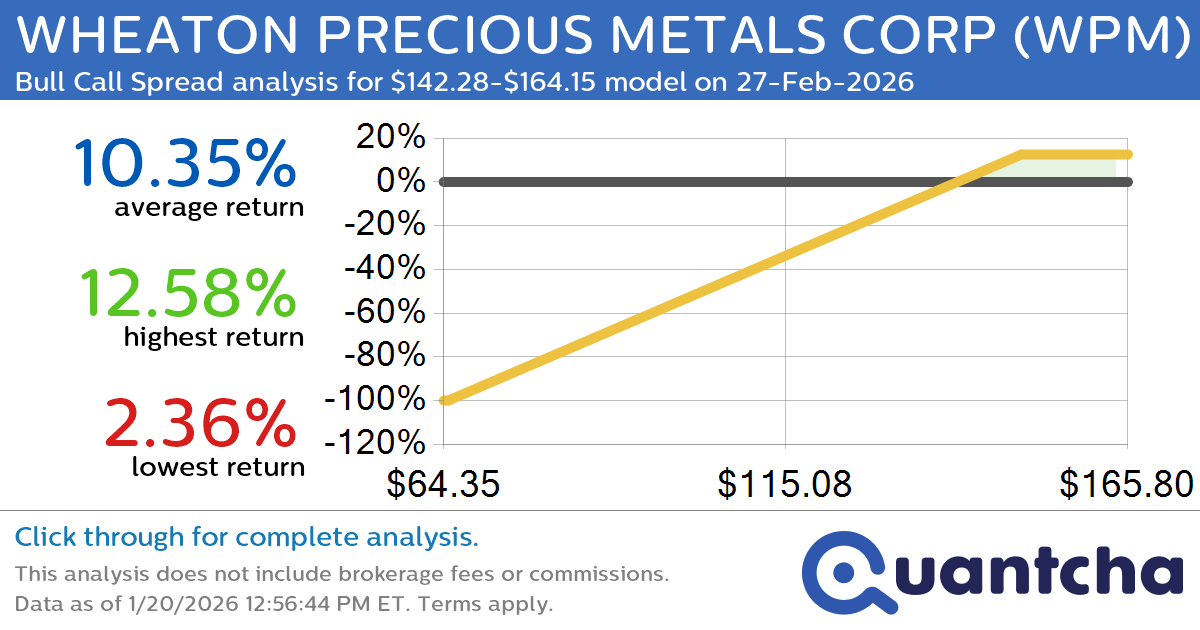

52-Week High Alert: Trading today’s movement in WHEATON PRECIOUS METALS CORP $WPM

Quantchabot has detected a new Bull Call Spread trade opportunity for WHEATON PRECIOUS METALS CORP (WPM) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WPM was recently trading at $141.71 and has an implied volatility of 43.91% for this period. Based on an analysis…

-

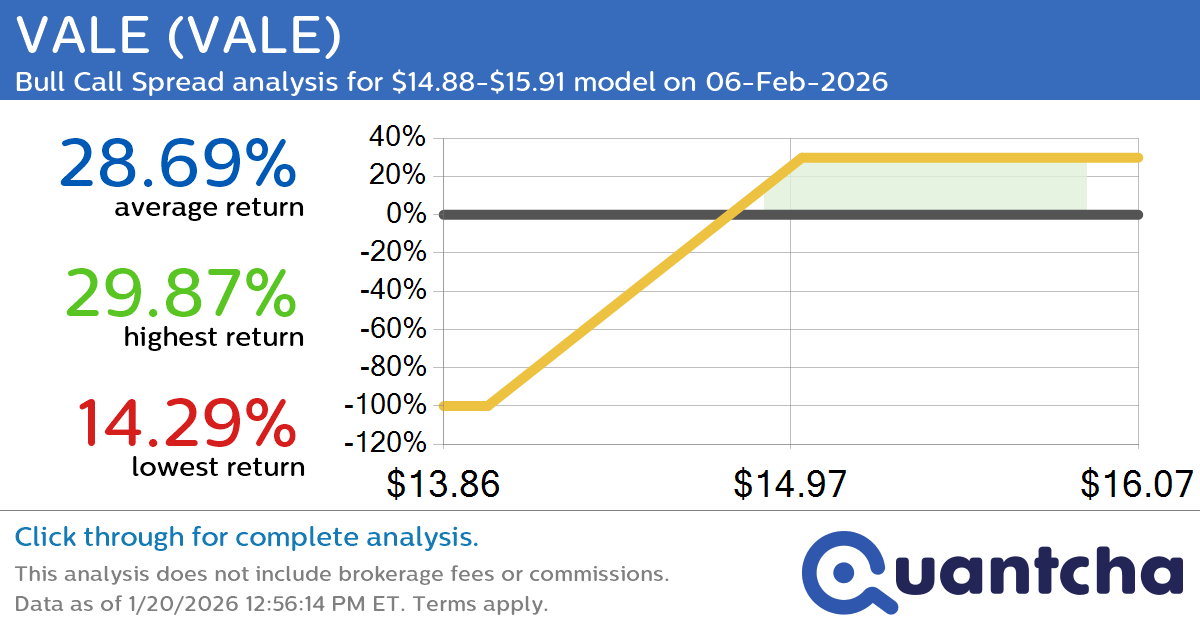

52-Week High Alert: Trading today’s movement in VALE $VALE

Quantchabot has detected a new Bull Call Spread trade opportunity for VALE (VALE) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VALE was recently trading at $14.86 and has an implied volatility of 30.33% for this period. Based on an analysis of the options…

-

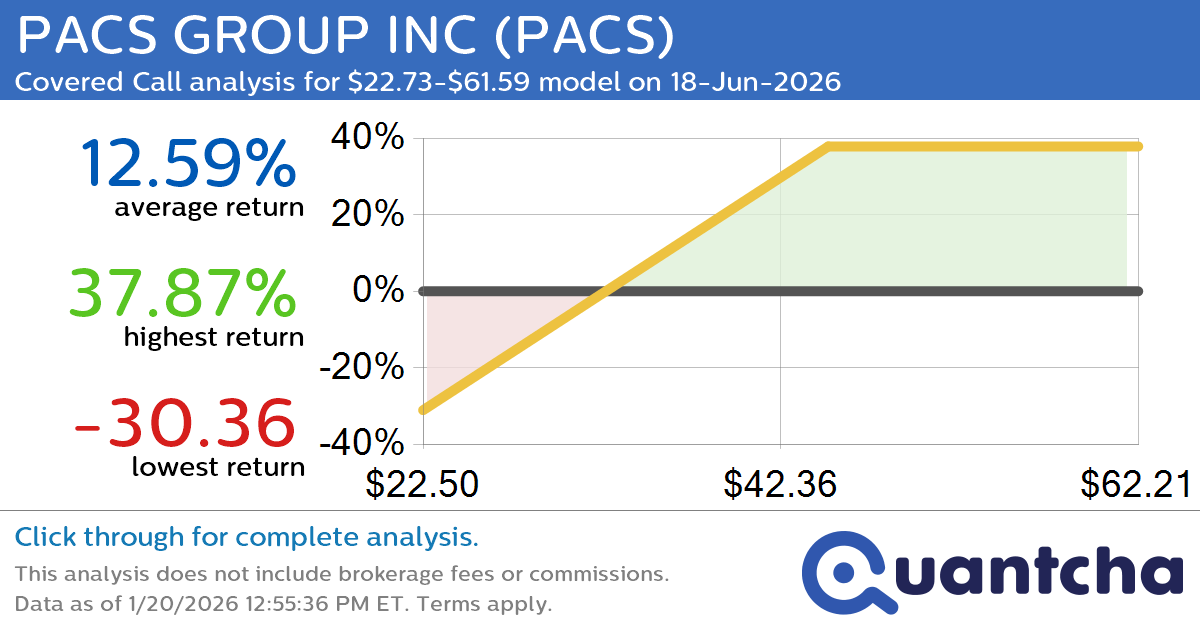

Covered Call Alert: PACS GROUP INC $PACS returning up to 37.99% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for PACS GROUP INC (PACS) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PACS was recently trading at $36.85 and has an implied volatility of 77.81% for this period. Based on an analysis of the…

-

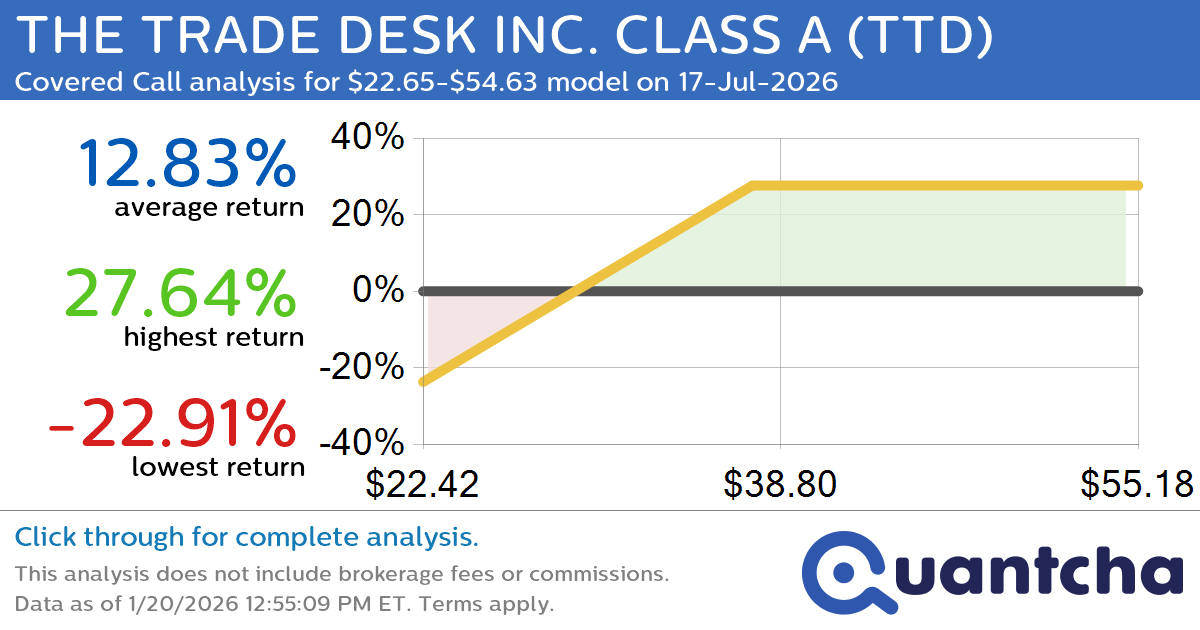

Covered Call Alert: THE TRADE DESK INC. CLASS A $TTD returning up to 27.38% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for THE TRADE DESK INC. CLASS A (TTD) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTD was recently trading at $34.54 and has an implied volatility of 62.93% for this period. Based on an…

-

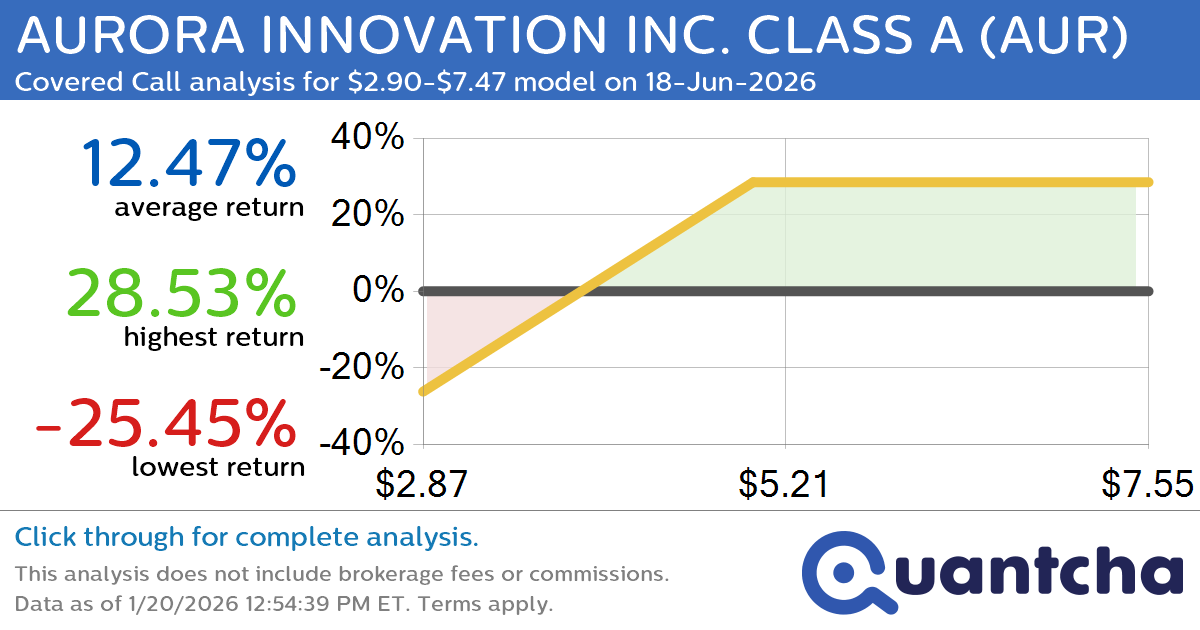

Covered Call Alert: AURORA INNOVATION INC. CLASS A $AUR returning up to 28.87% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for AURORA INNOVATION INC. CLASS A (AUR) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AUR was recently trading at $4.58 and has an implied volatility of 73.92% for this period. Based on an analysis…

-

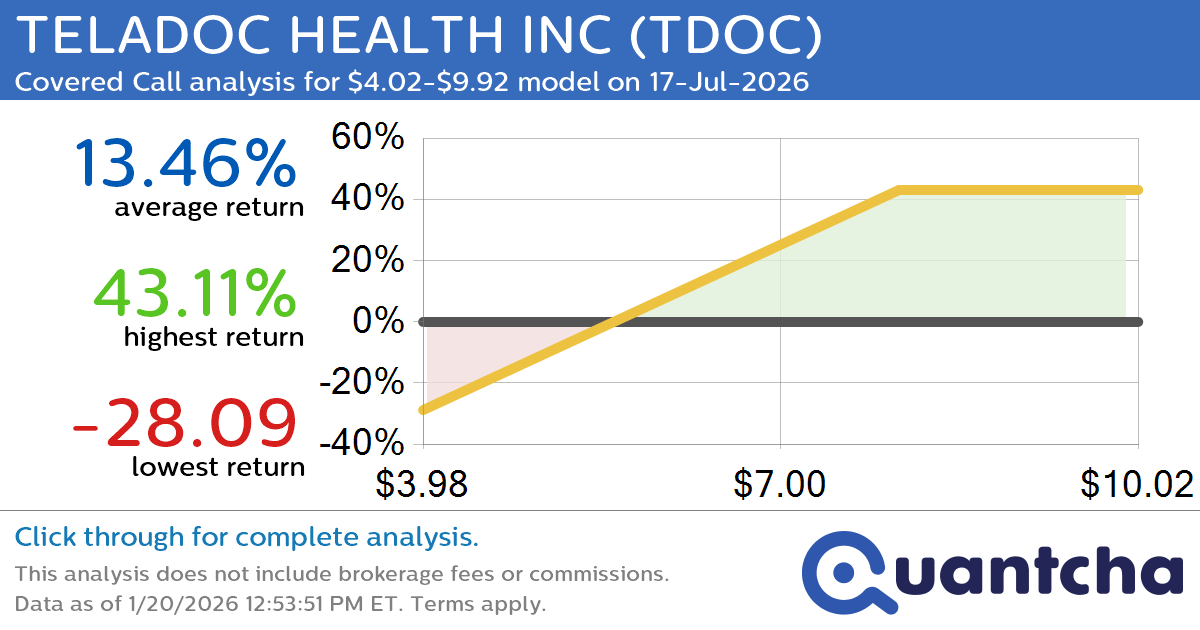

Covered Call Alert: TELADOC HEALTH INC $TDOC returning up to 42.86% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for TELADOC HEALTH INC (TDOC) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TDOC was recently trading at $6.20 and has an implied volatility of 64.55% for this period. Based on an analysis of the…

-

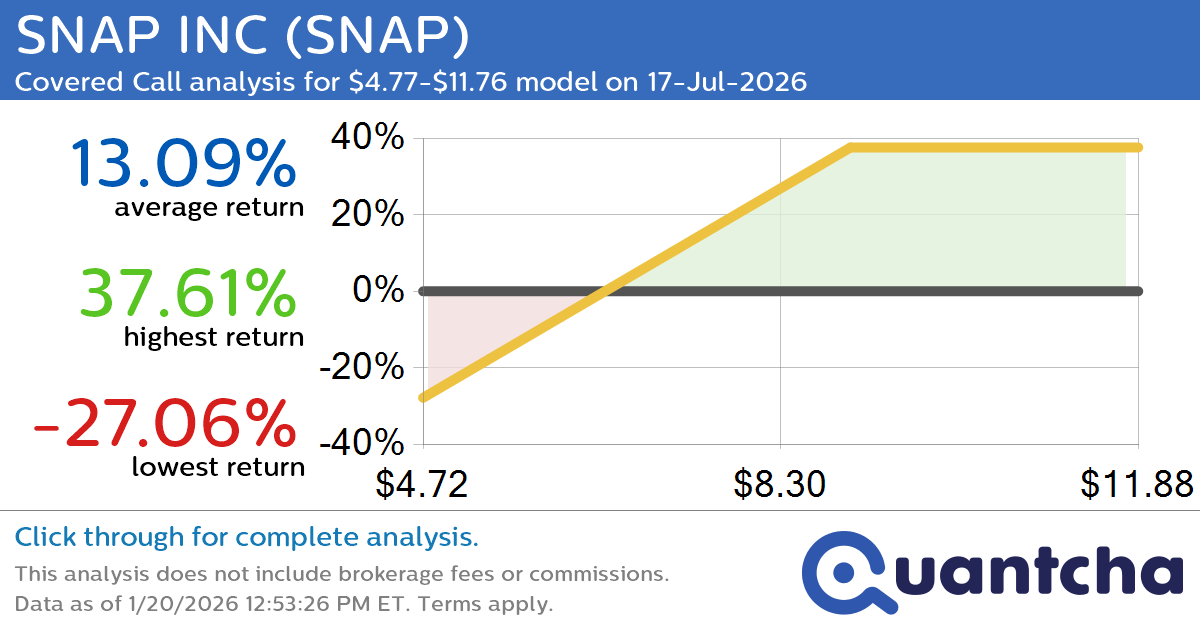

Covered Call Alert: SNAP INC $SNAP returning up to 37.61% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for SNAP INC (SNAP) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SNAP was recently trading at $7.35 and has an implied volatility of 64.49% for this period. Based on an analysis of the options…