Author: Quantcha Trade Ideas

-

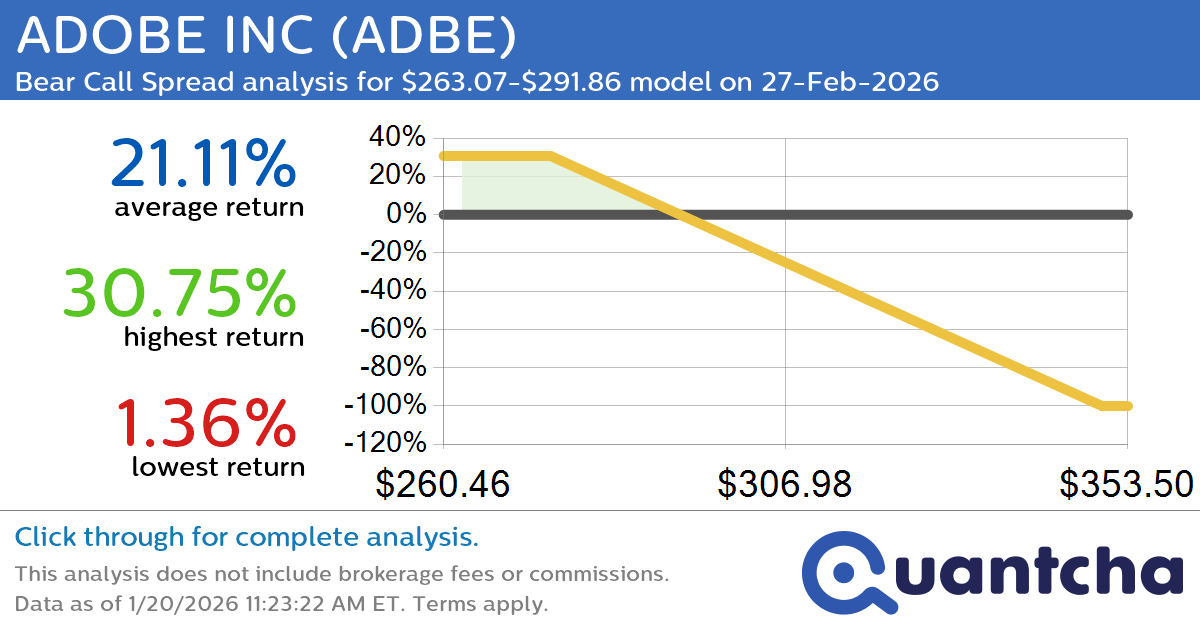

52-Week Low Alert: Trading today’s movement in ADOBE INC $ADBE

Quantchabot has detected a new Bear Call Spread trade opportunity for ADOBE INC (ADBE) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ADBE was recently trading at $290.68 and has an implied volatility of 31.89% for this period. Based on an analysis of the…

-

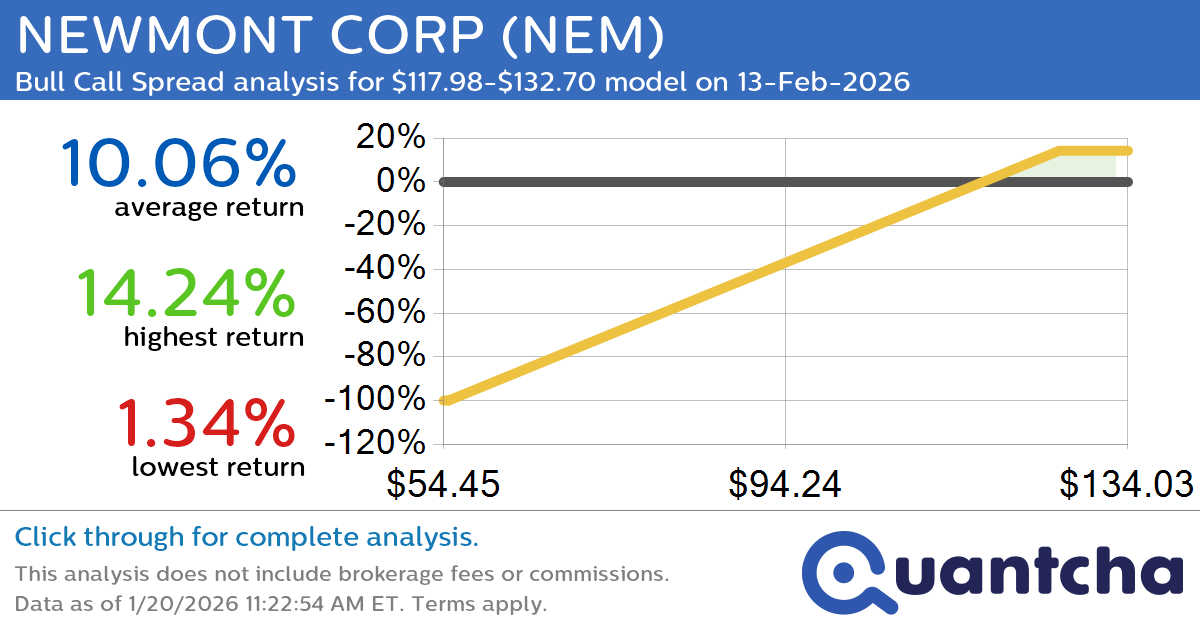

52-Week High Alert: Trading today’s movement in NEWMONT CORP $NEM

Quantchabot has detected a new Bull Call Spread trade opportunity for NEWMONT CORP (NEM) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NEM was recently trading at $117.67 and has an implied volatility of 45.19% for this period. Based on an analysis of the…

-

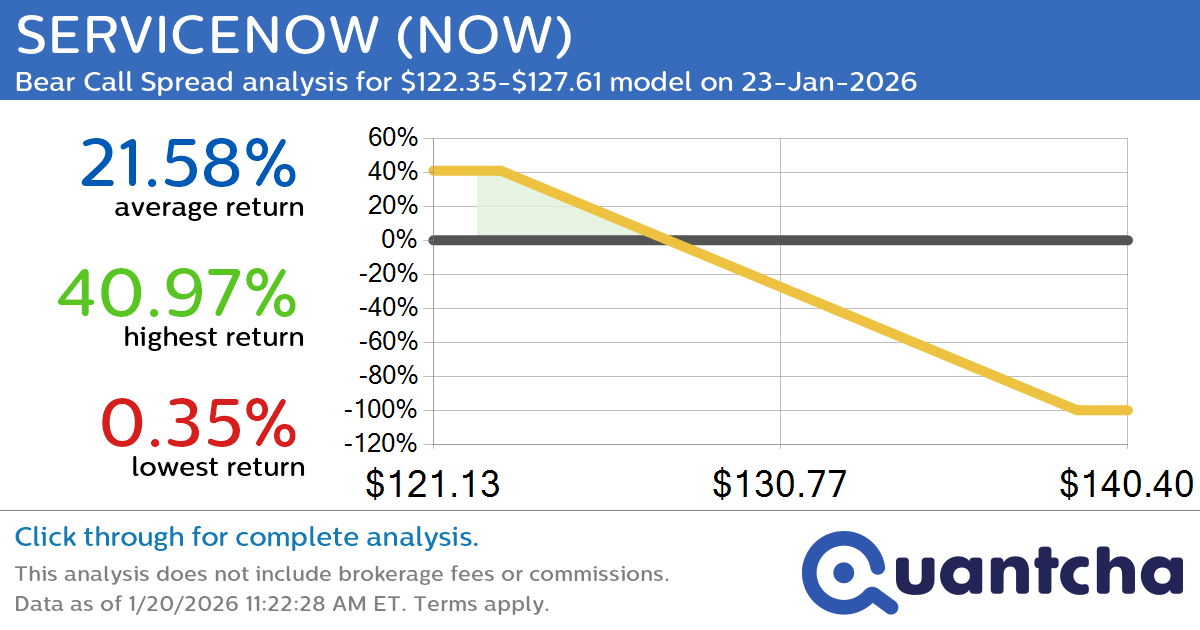

52-Week Low Alert: Trading today’s movement in SERVICENOW $NOW

Quantchabot has detected a new Bear Call Spread trade opportunity for SERVICENOW (NOW) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NOW was recently trading at $127.56 and has an implied volatility of 41.61% for this period. Based on an analysis of the options…

-

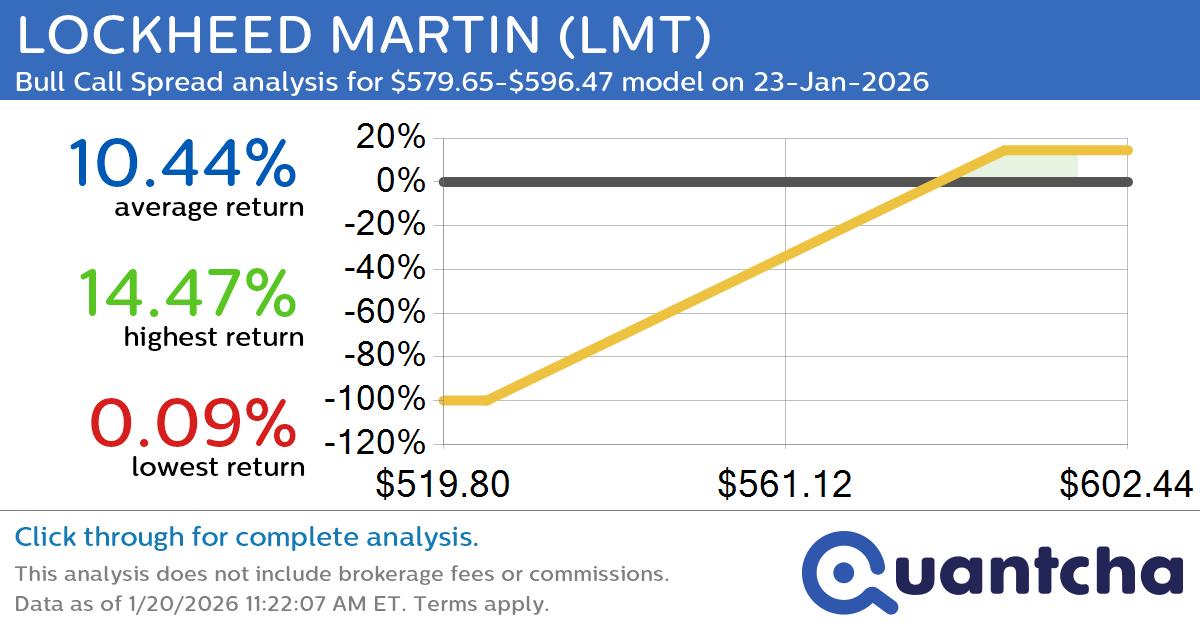

52-Week High Alert: Trading today’s movement in LOCKHEED MARTIN $LMT

Quantchabot has detected a new Bull Call Spread trade opportunity for LOCKHEED MARTIN (LMT) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LMT was recently trading at $579.42 and has an implied volatility of 28.28% for this period. Based on an analysis of the…

-

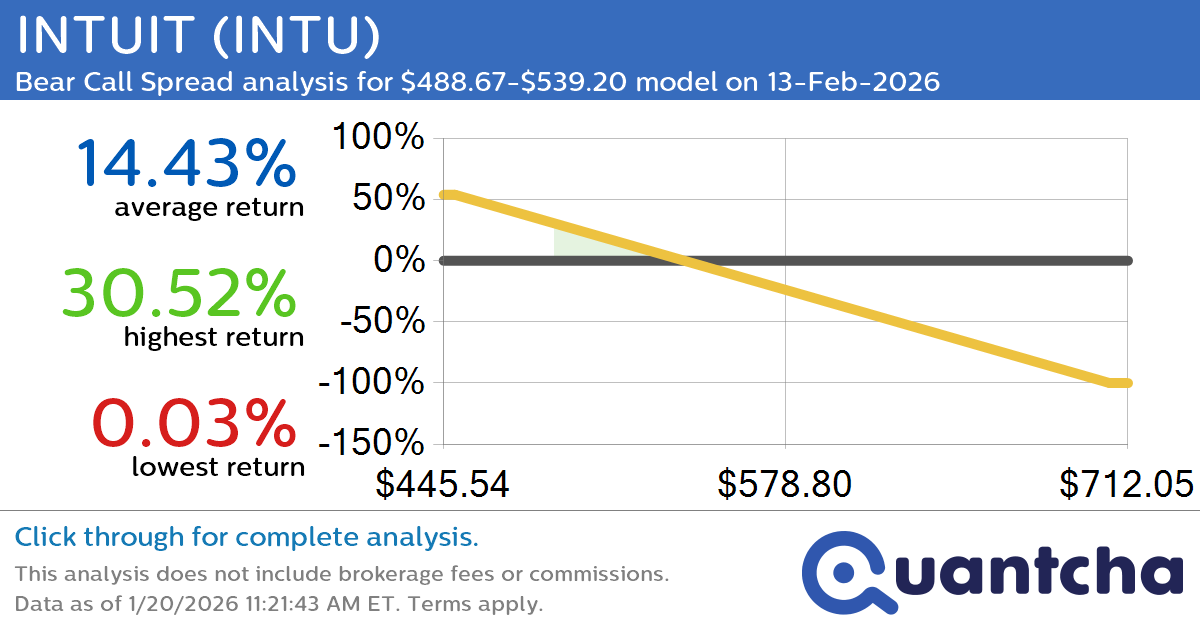

52-Week Low Alert: Trading today’s movement in INTUIT $INTU

Quantchabot has detected a new Bear Call Spread trade opportunity for INTUIT (INTU) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INTU was recently trading at $537.81 and has an implied volatility of 37.80% for this period. Based on an analysis of the options…

-

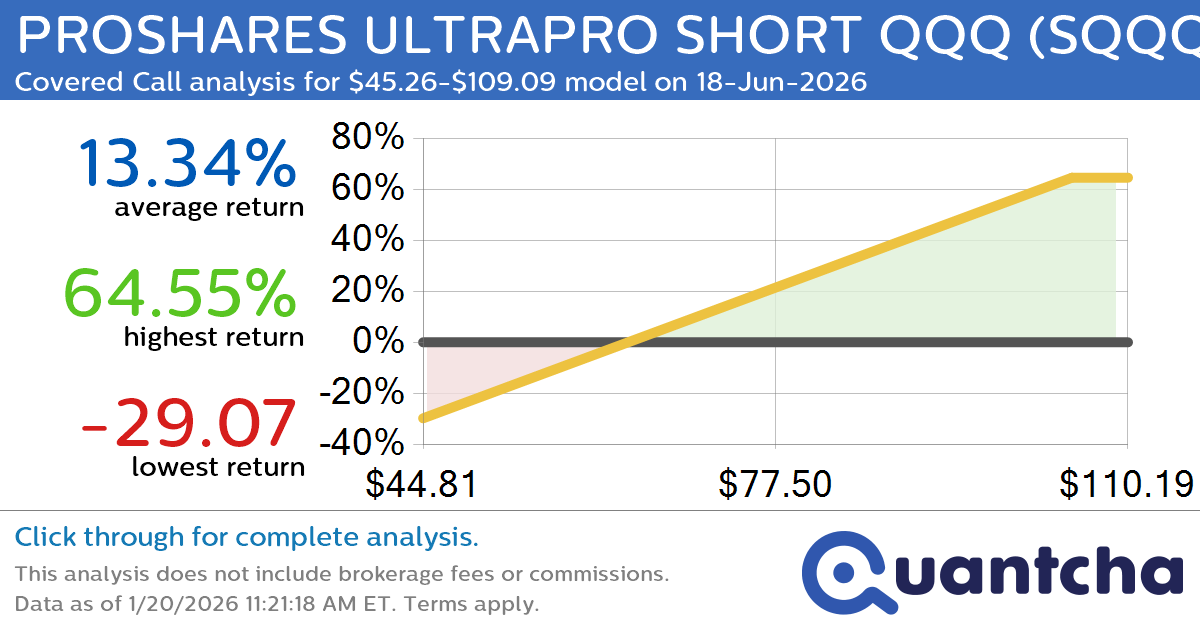

Covered Call Alert: PROSHARES ULTRAPRO SHORT QQQ $SQQQ returning up to 64.81% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for PROSHARES ULTRAPRO SHORT QQQ (SQQQ) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SQQQ was recently trading at $69.20 and has an implied volatility of 68.67% for this period. Based on an analysis of…

-

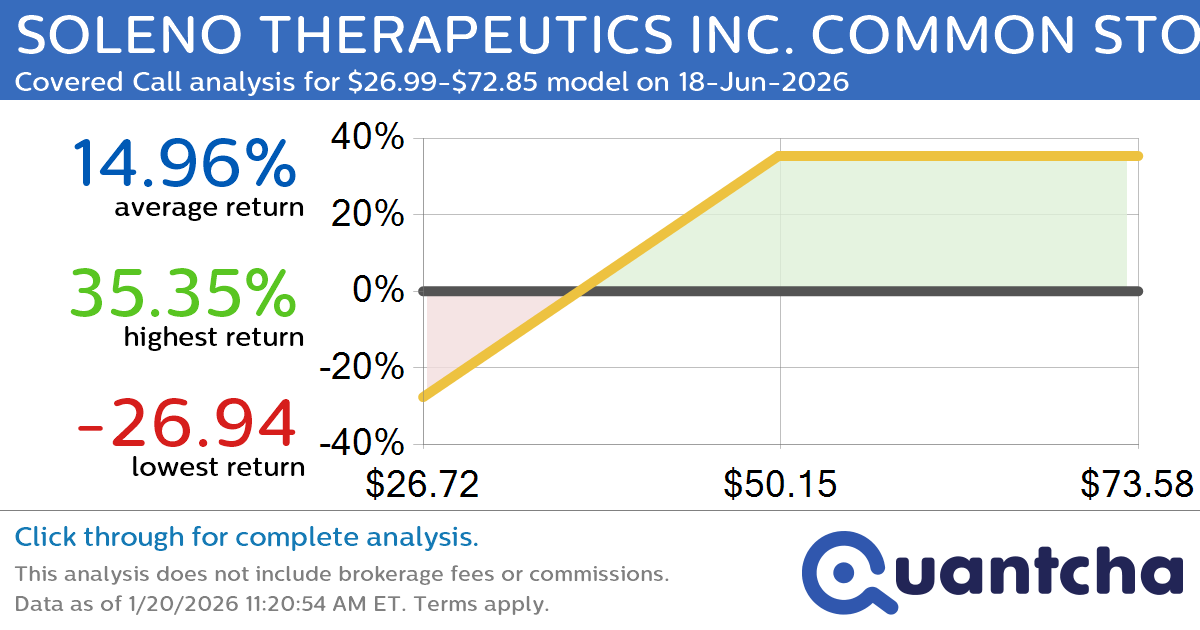

Covered Call Alert: SOLENO THERAPEUTICS INC. COMMON STOCK $SLNO returning up to 35.32% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for SOLENO THERAPEUTICS INC. COMMON STOCK (SLNO) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SLNO was recently trading at $43.67 and has an implied volatility of 77.50% for this period. Based on an analysis…

-

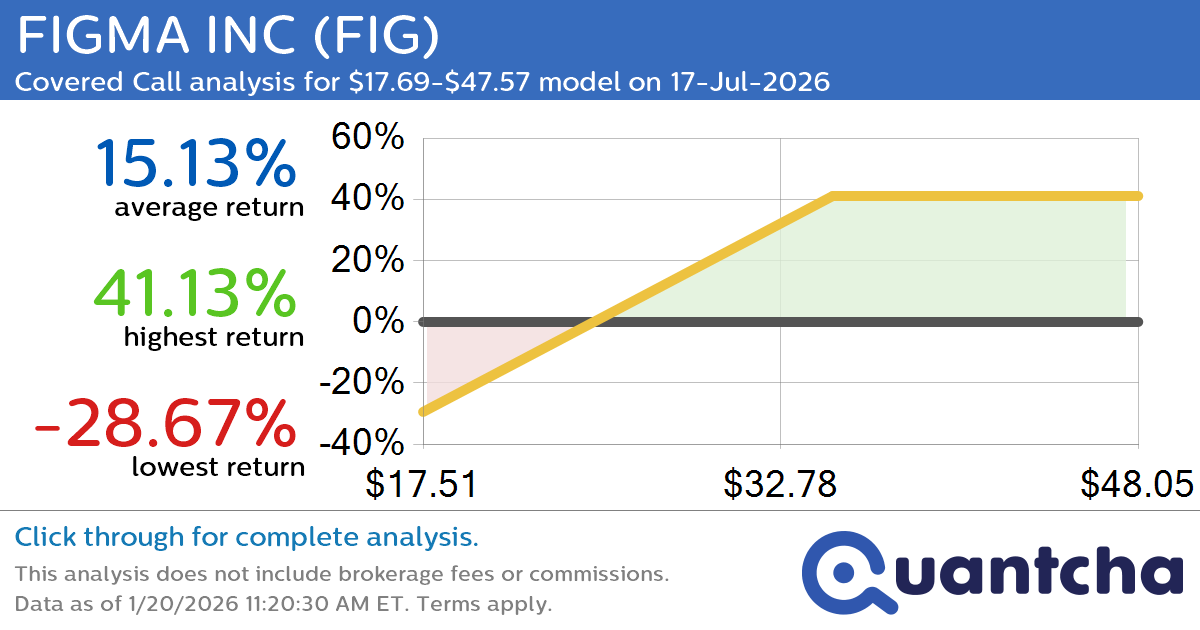

Covered Call Alert: FIGMA INC $FIG returning up to 41.13% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for FIGMA INC (FIG) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIG was recently trading at $28.48 and has an implied volatility of 70.68% for this period. Based on an analysis of the options…

-

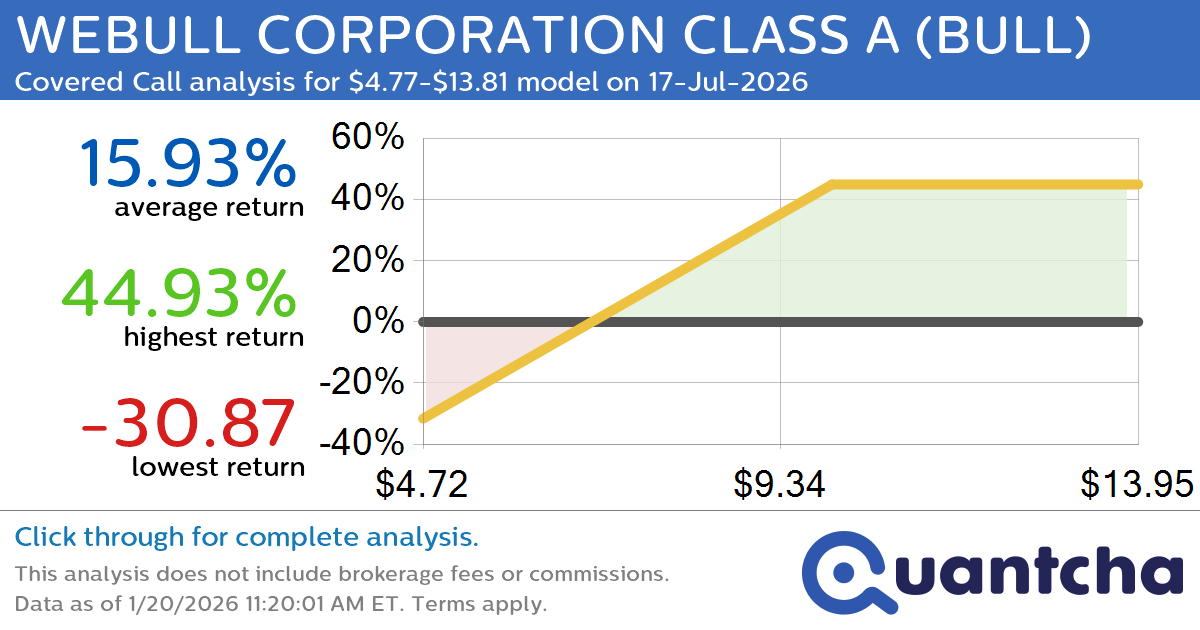

Covered Call Alert: WEBULL CORPORATION CLASS A $BULL returning up to 44.93% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for WEBULL CORPORATION CLASS A (BULL) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BULL was recently trading at $7.96 and has an implied volatility of 76.00% for this period. Based on an analysis of…

-

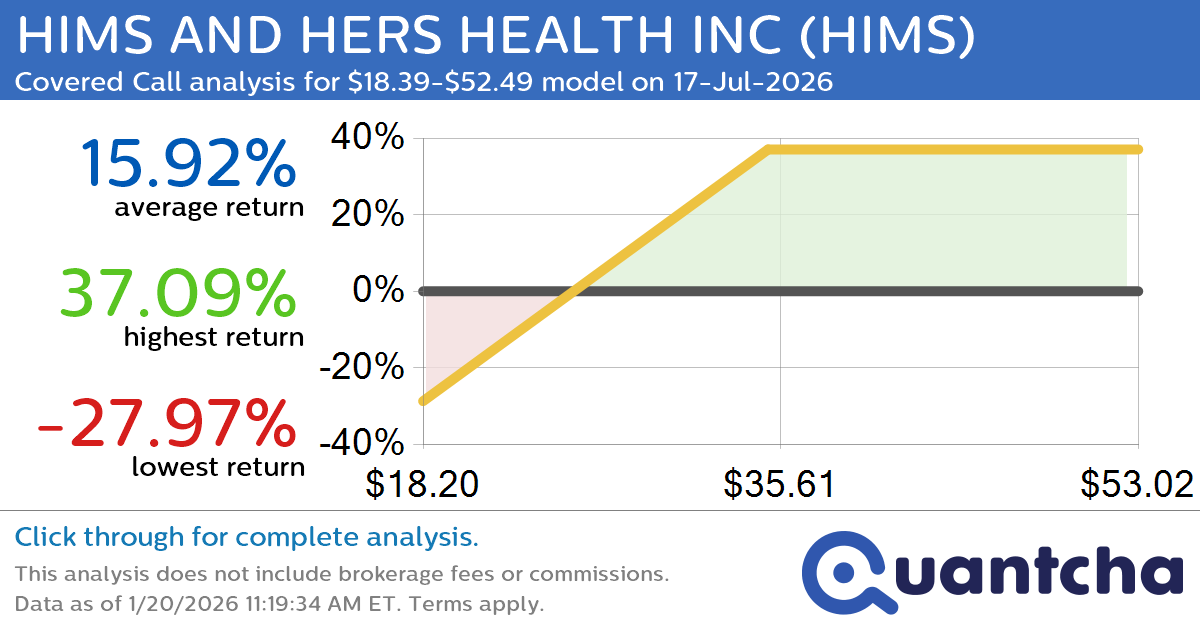

Covered Call Alert: HIMS AND HERS HEALTH INC $HIMS returning up to 37.36% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for HIMS AND HERS HEALTH INC (HIMS) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HIMS was recently trading at $30.51 and has an implied volatility of 74.93% for this period. Based on an analysis…