Author: Quantcha Trade Ideas

-

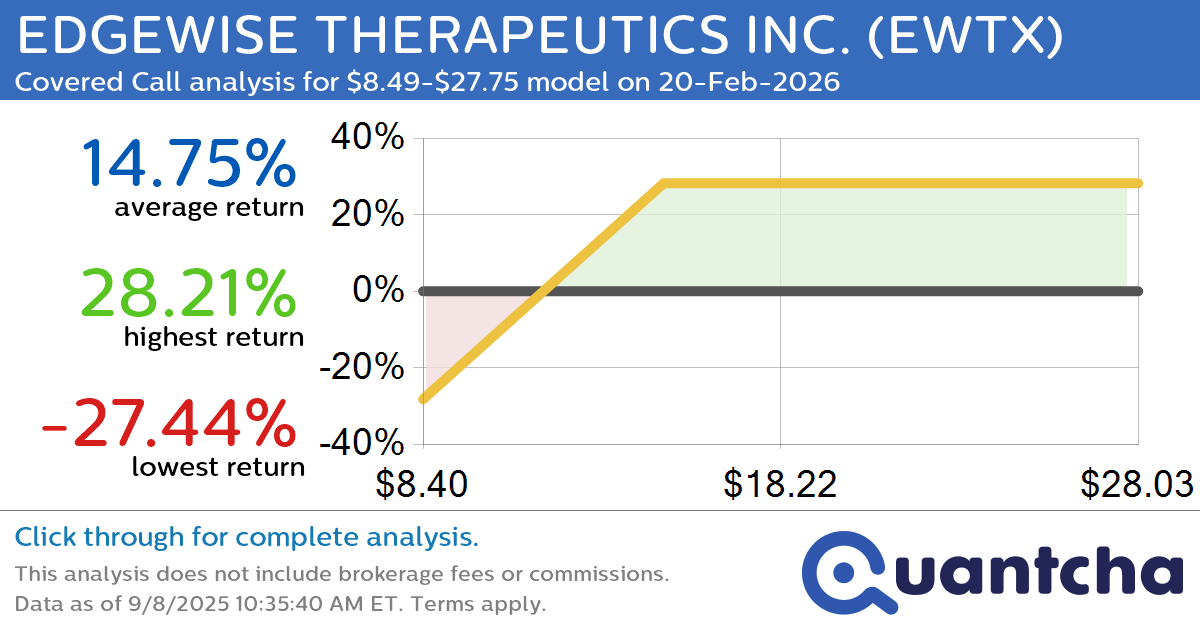

Covered Call Alert: EDGEWISE THERAPEUTICS INC. $EWTX returning up to 28.31% through 20-Feb-2026

Quantchabot has detected a new Covered Call trade opportunity for EDGEWISE THERAPEUTICS INC. (EWTX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EWTX was recently trading at $15.06 and has an implied volatility of 87.89% for this period. Based on an analysis of the…

-

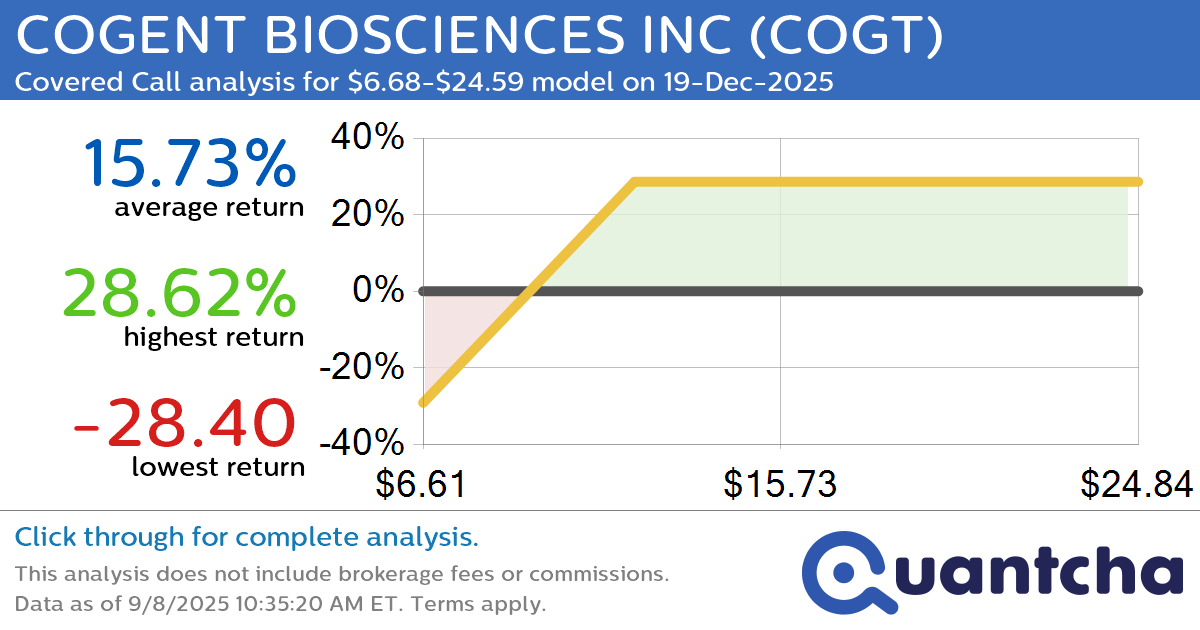

Covered Call Alert: COGENT BIOSCIENCES INC $COGT returning up to 29.31% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for COGENT BIOSCIENCES INC (COGT) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. COGT was recently trading at $12.67 and has an implied volatility of 122.77% for this period. Based on an analysis of the…

-

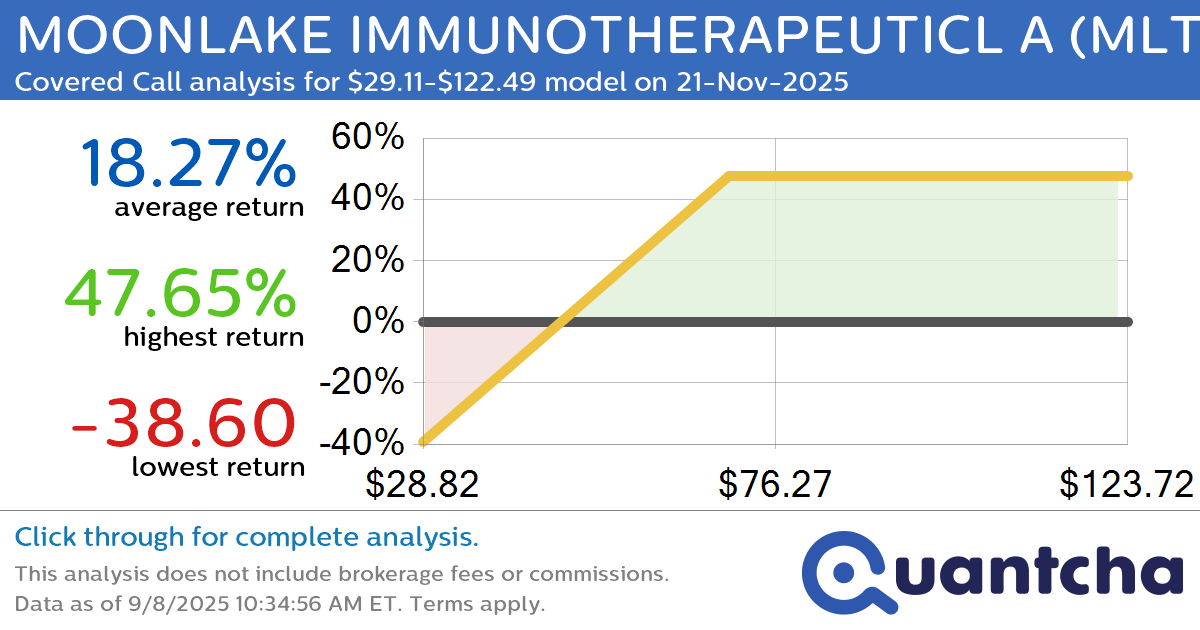

Covered Call Alert: MOONLAKE IMMUNOTHERAPEUTICL A $MLTX returning up to 46.66% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for MOONLAKE IMMUNOTHERAPEUTICL A (MLTX) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MLTX was recently trading at $59.18 and has an implied volatility of 158.78% for this period. Based on an analysis of the…

-

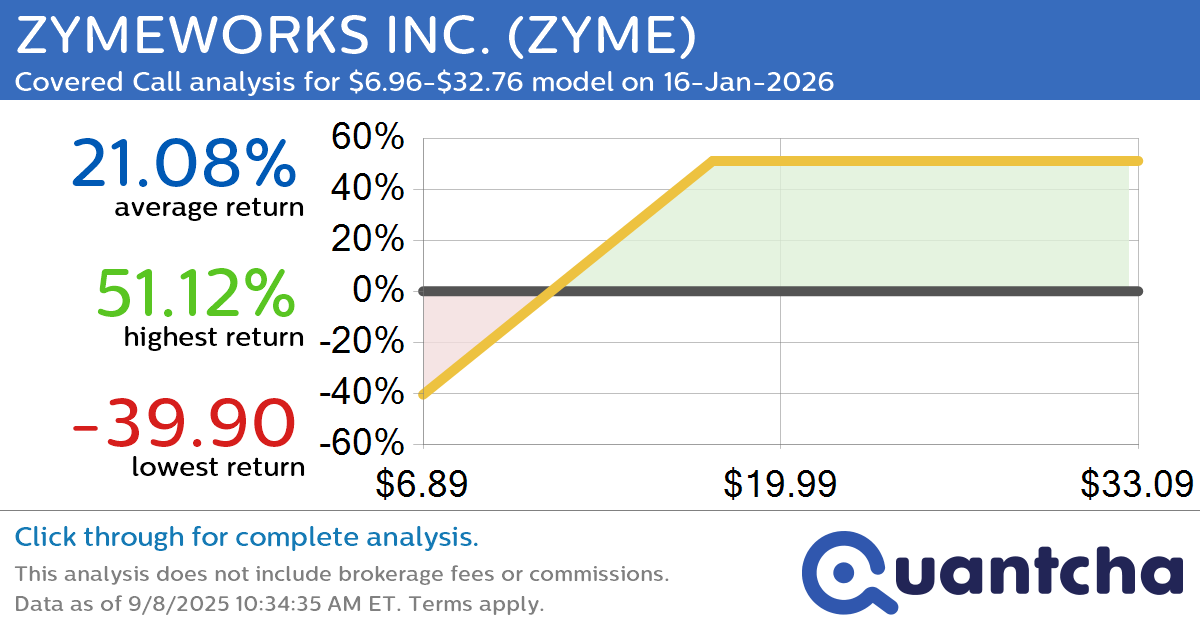

Covered Call Alert: ZYMEWORKS INC. $ZYME returning up to 52.17% through 16-Jan-2026

Quantchabot has detected a new Covered Call trade opportunity for ZYMEWORKS INC. (ZYME) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ZYME was recently trading at $14.88 and has an implied volatility of 129.42% for this period. Based on an analysis of the options…

-

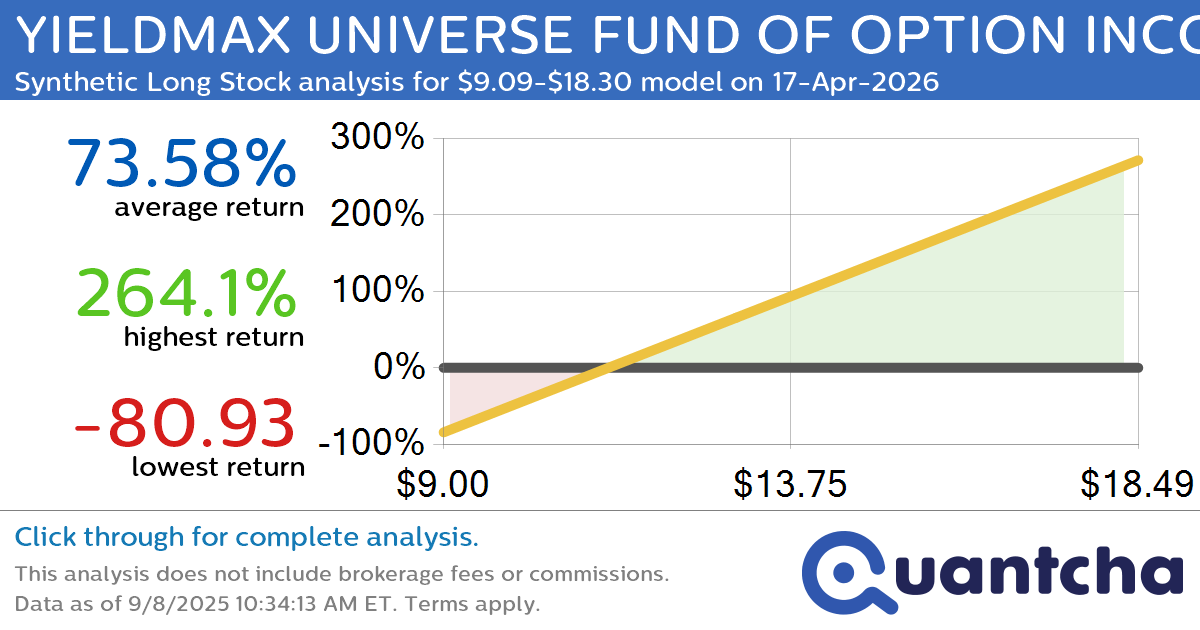

Synthetic Long Discount Alert: YIELDMAX UNIVERSE FUND OF OPTION INCOME ETFS $YMAX trading at a 10.68% discount for the 17-Apr-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for YIELDMAX UNIVERSE FUND OF OPTION INCOME ETFS (YMAX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. YMAX was recently trading at $12.60 and has an implied volatility of 44.90% for this period. Based…

-

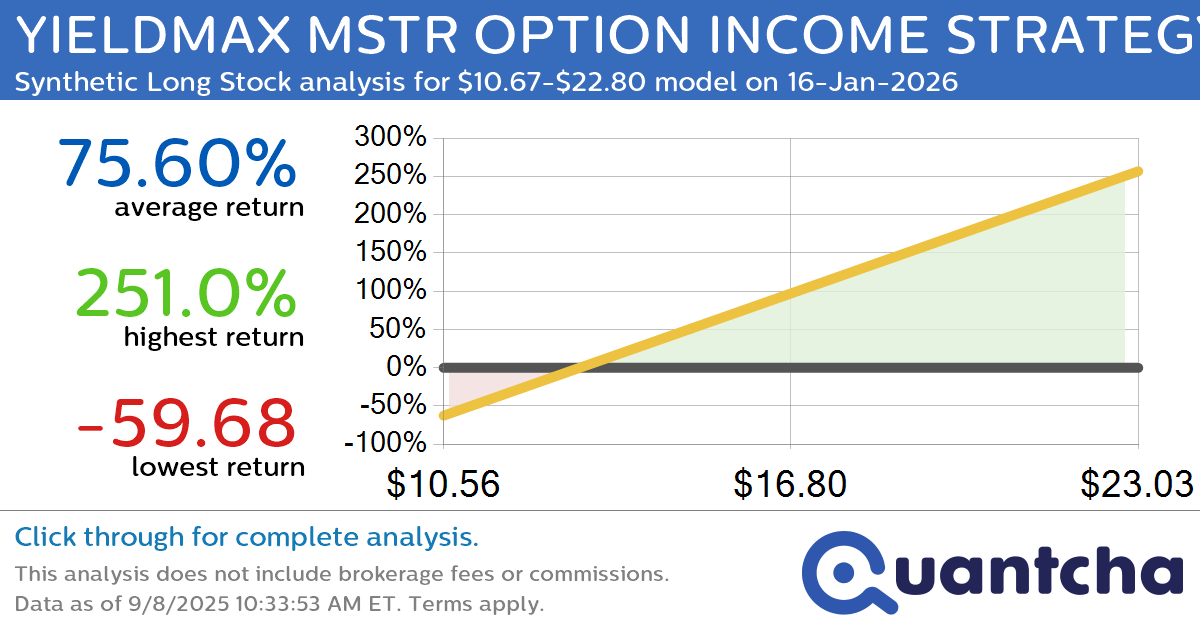

Synthetic Long Discount Alert: YIELDMAX MSTR OPTION INCOME STRATEGY ETF $MSTY trading at a 15.42% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for YIELDMAX MSTR OPTION INCOME STRATEGY ETF (MSTY) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MSTY was recently trading at $15.37 and has an implied volatility of 63.40% for this period. Based on…

-

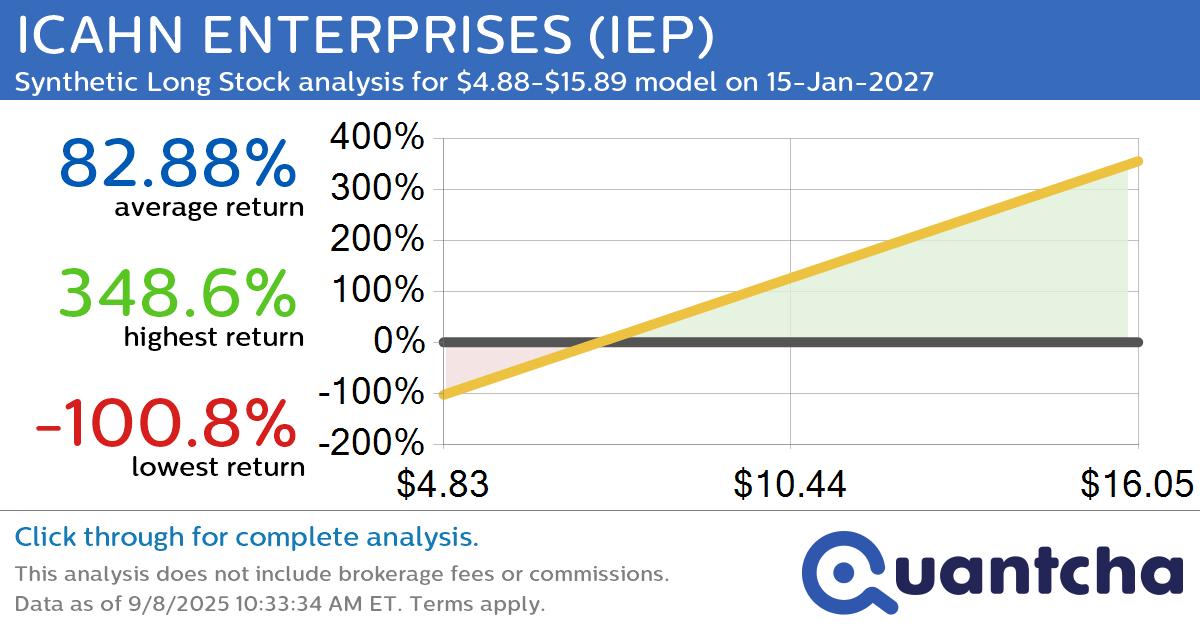

Synthetic Long Discount Alert: ICAHN ENTERPRISES $IEP trading at a 12.24% discount for the 15-Jan-2027 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ICAHN ENTERPRISES (IEP) for the 15-Jan-2027 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IEP was recently trading at $8.38 and has an implied volatility of 50.71% for this period. Based on an analysis of the…

-

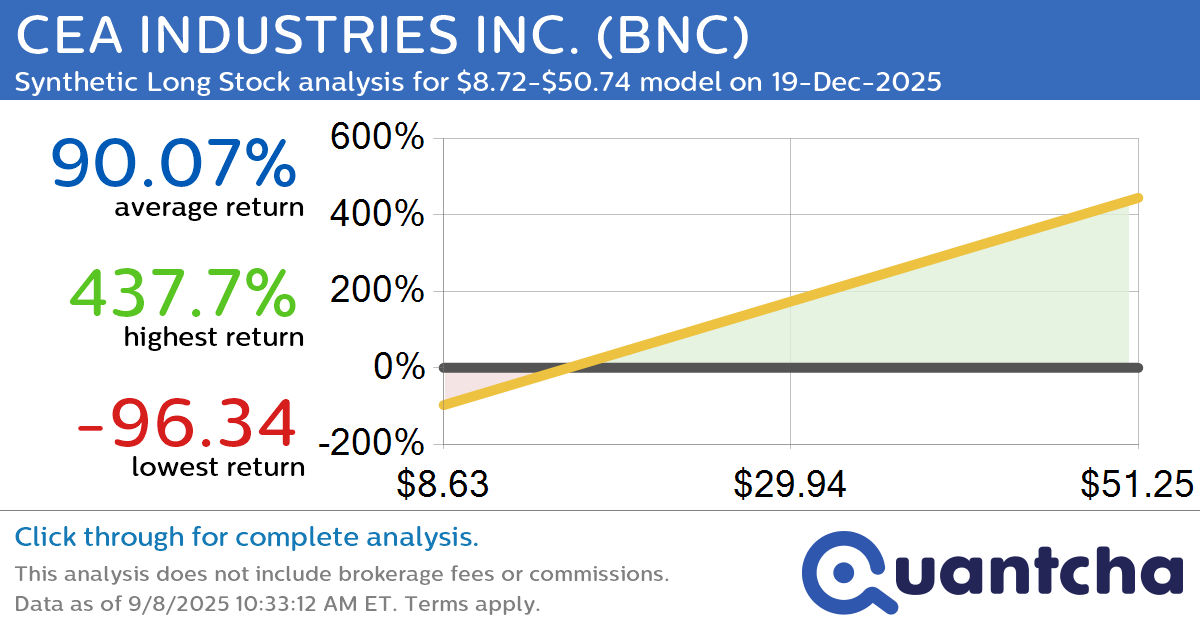

Synthetic Long Discount Alert: CEA INDUSTRIES INC. $BNC trading at a 21.60% discount for the 19-Dec-2025 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for CEA INDUSTRIES INC. (BNC) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BNC was recently trading at $20.79 and has an implied volatility of 165.97% for this period. Based on an analysis of…

-

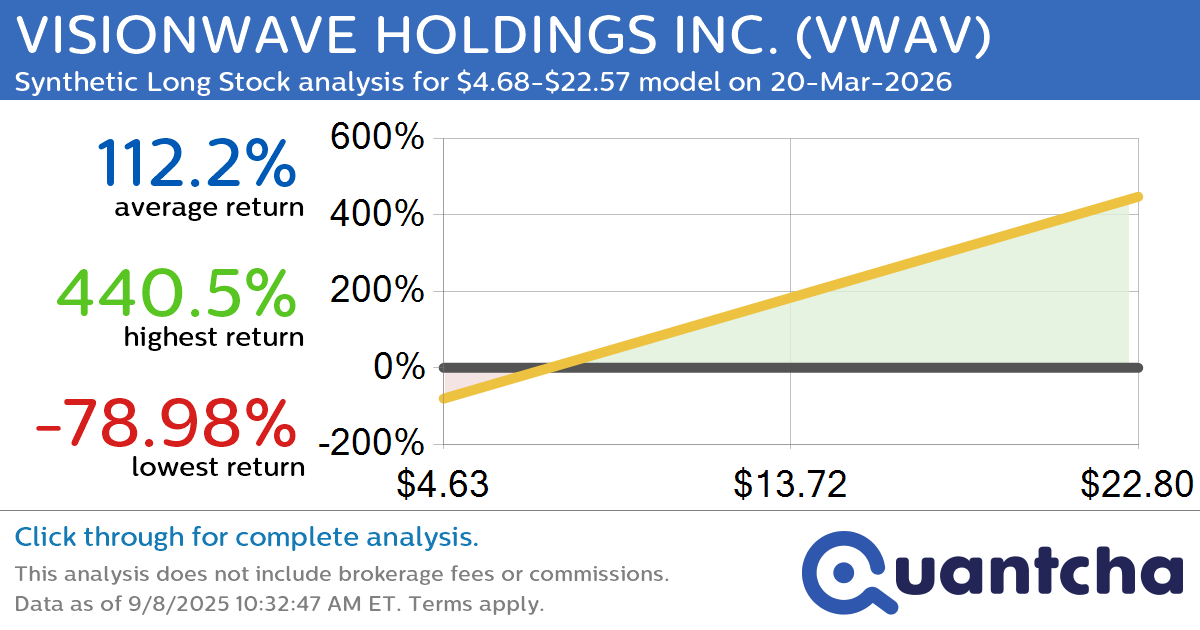

Synthetic Long Discount Alert: VISIONWAVE HOLDINGS INC. $VWAV trading at a 26.51% discount for the 20-Mar-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for VISIONWAVE HOLDINGS INC. (VWAV) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VWAV was recently trading at $10.07 and has an implied volatility of 107.95% for this period. Based on an analysis of…