Author: Quantcha Trade Ideas

-

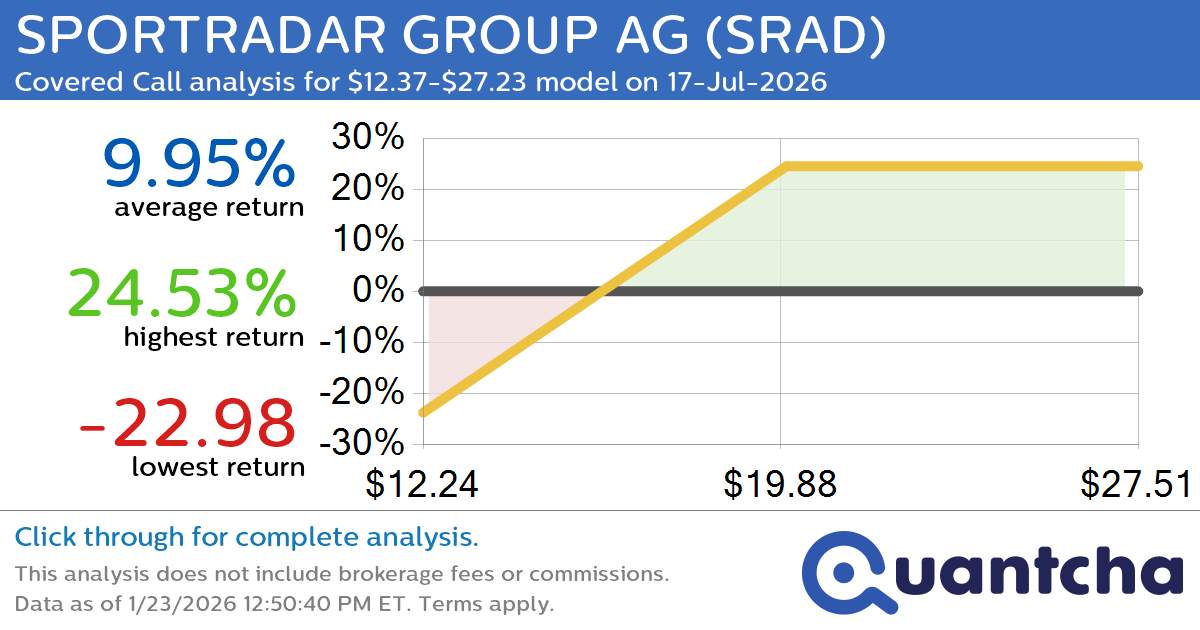

Covered Call Alert: SPORTRADAR GROUP AG $SRAD returning up to 25.39% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for SPORTRADAR GROUP AG (SRAD) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SRAD was recently trading at $18.02 and has an implied volatility of 56.90% for this period. Based on an analysis of the…

-

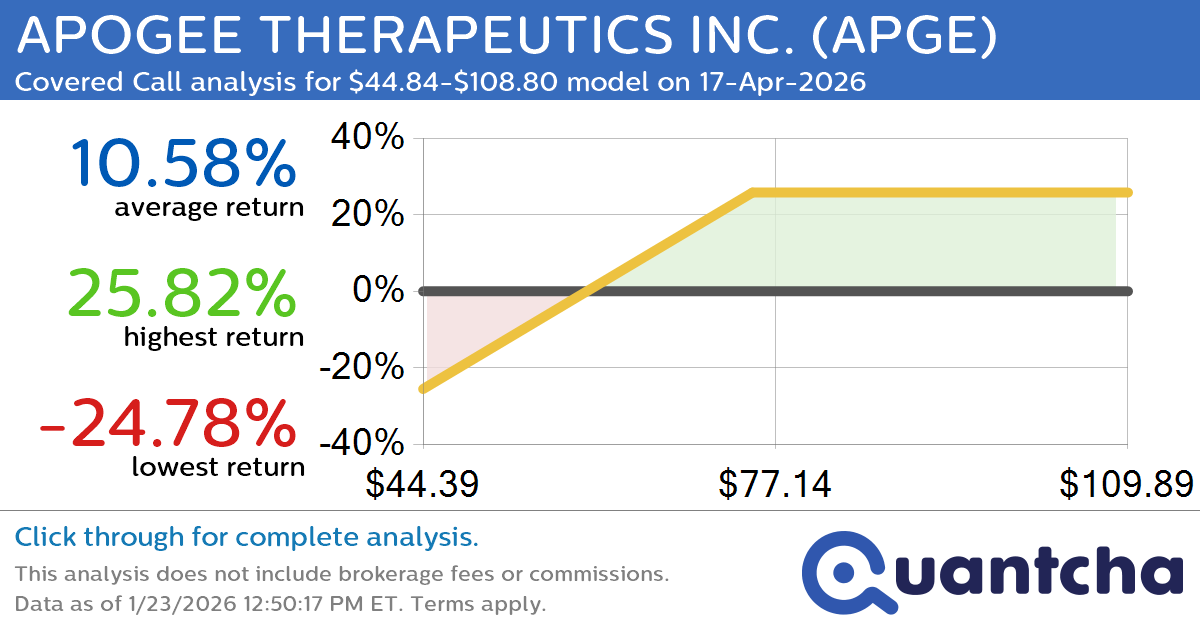

Covered Call Alert: APOGEE THERAPEUTICS INC. $APGE returning up to 25.71% through 17-Apr-2026

Quantchabot has detected a new Covered Call trade opportunity for APOGEE THERAPEUTICS INC. (APGE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. APGE was recently trading at $69.22 and has an implied volatility of 92.03% for this period. Based on an analysis of the…

-

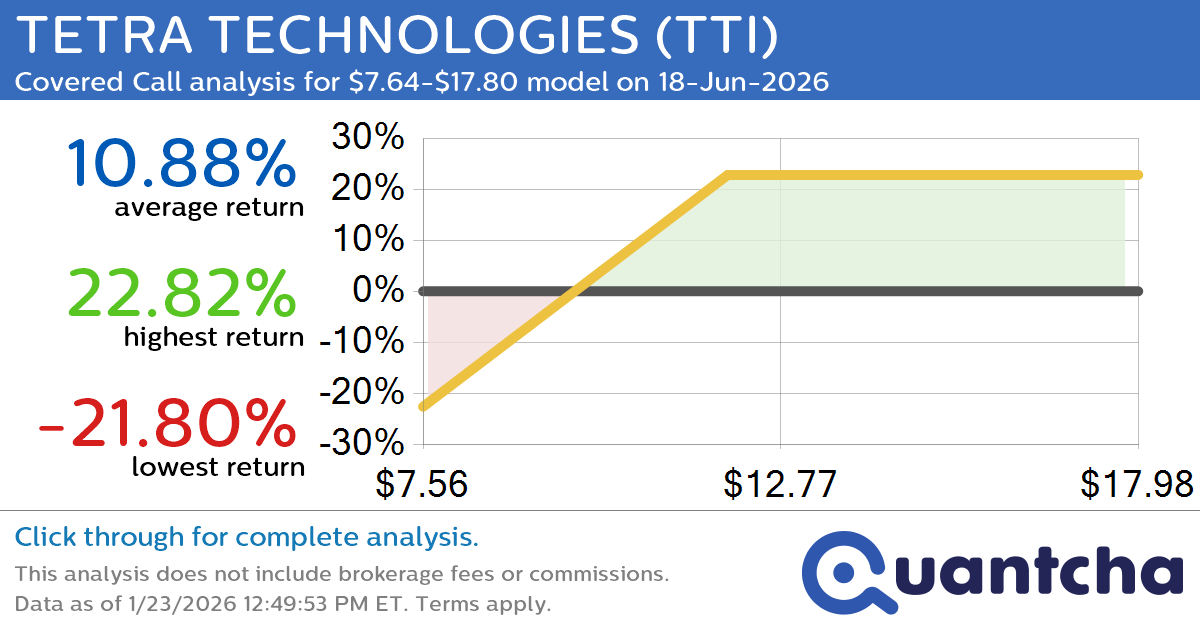

Covered Call Alert: TETRA TECHNOLOGIES $TTI returning up to 22.57% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for TETRA TECHNOLOGIES (TTI) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTI was recently trading at $11.48 and has an implied volatility of 66.73% for this period. Based on an analysis of the options…

-

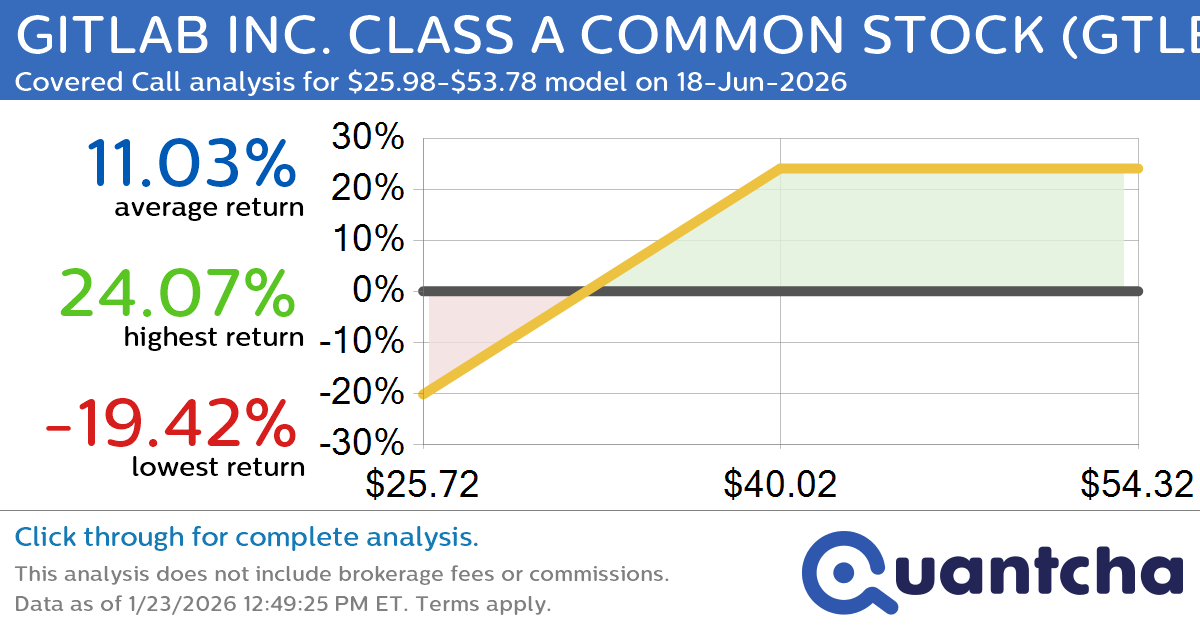

Covered Call Alert: GITLAB INC. CLASS A COMMON STOCK $GTLB returning up to 23.69% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for GITLAB INC. CLASS A COMMON STOCK (GTLB) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GTLB was recently trading at $36.82 and has an implied volatility of 57.38% for this period. Based on an…

-

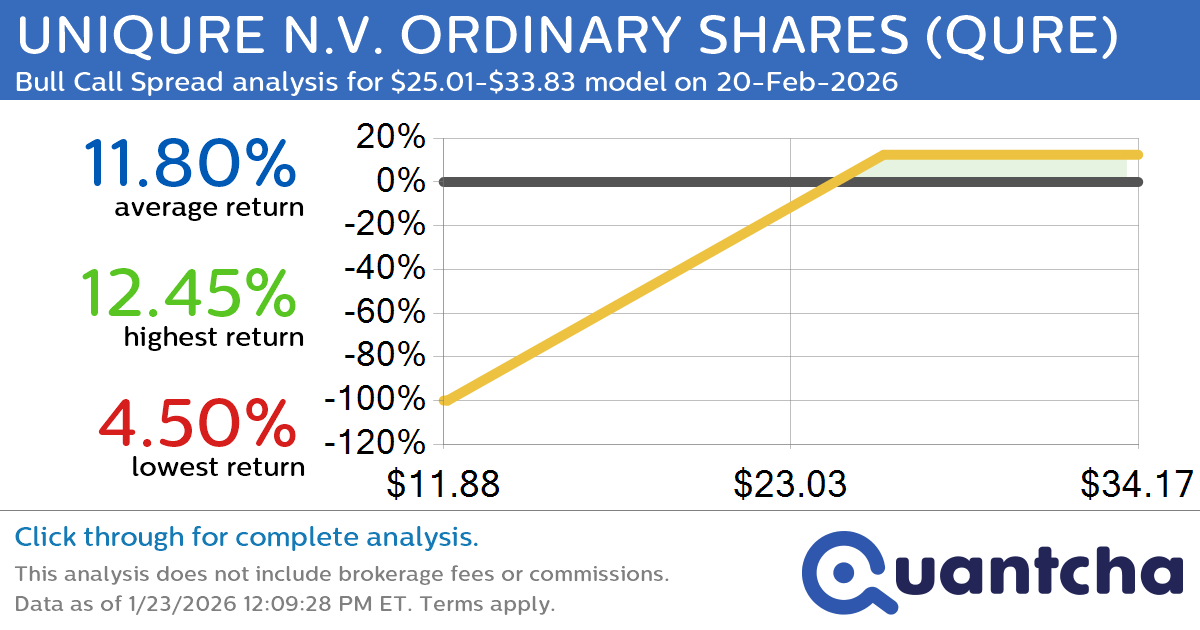

Big Gainer Alert: Trading today’s 9.9% move in UNIQURE N.V. ORDINARY SHARES $QURE

Quantchabot has detected a new Bull Call Spread trade opportunity for UNIQURE N.V. ORDINARY SHARES (QURE) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. QURE was recently trading at $24.93 and has an implied volatility of 107.71% for this period. Based on an analysis…

-

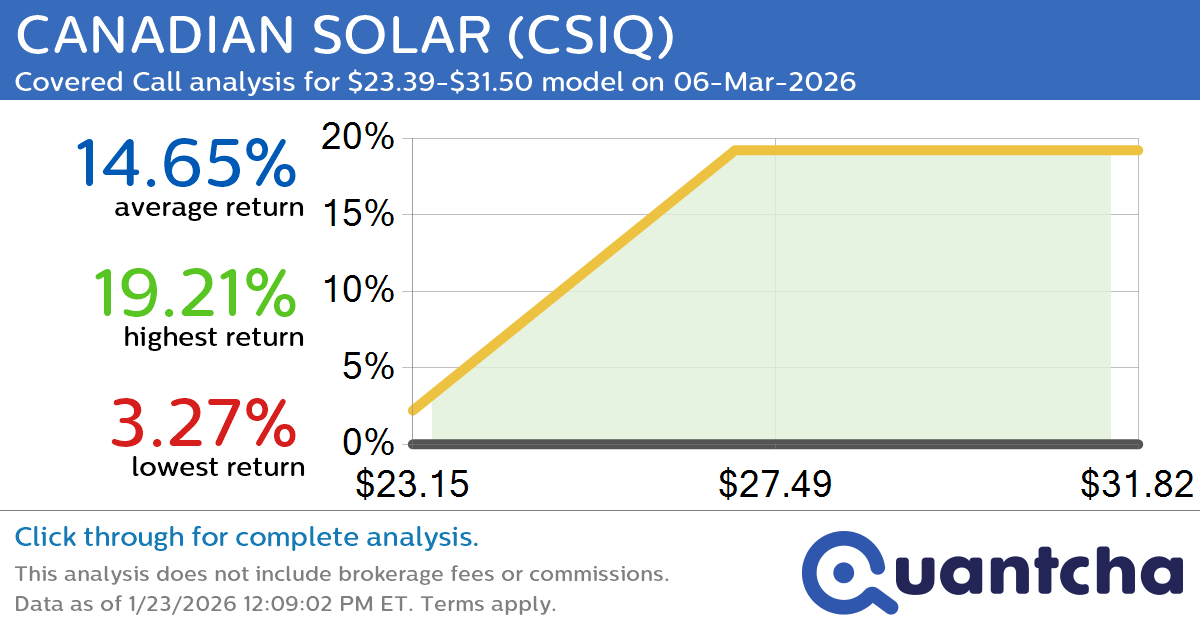

Big Gainer Alert: Trading today’s 8.6% move in CANADIAN SOLAR $CSIQ

Quantchabot has detected a new Covered Call trade opportunity for CANADIAN SOLAR (CSIQ) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CSIQ was recently trading at $23.29 and has an implied volatility of 86.98% for this period. Based on an analysis of the options…

-

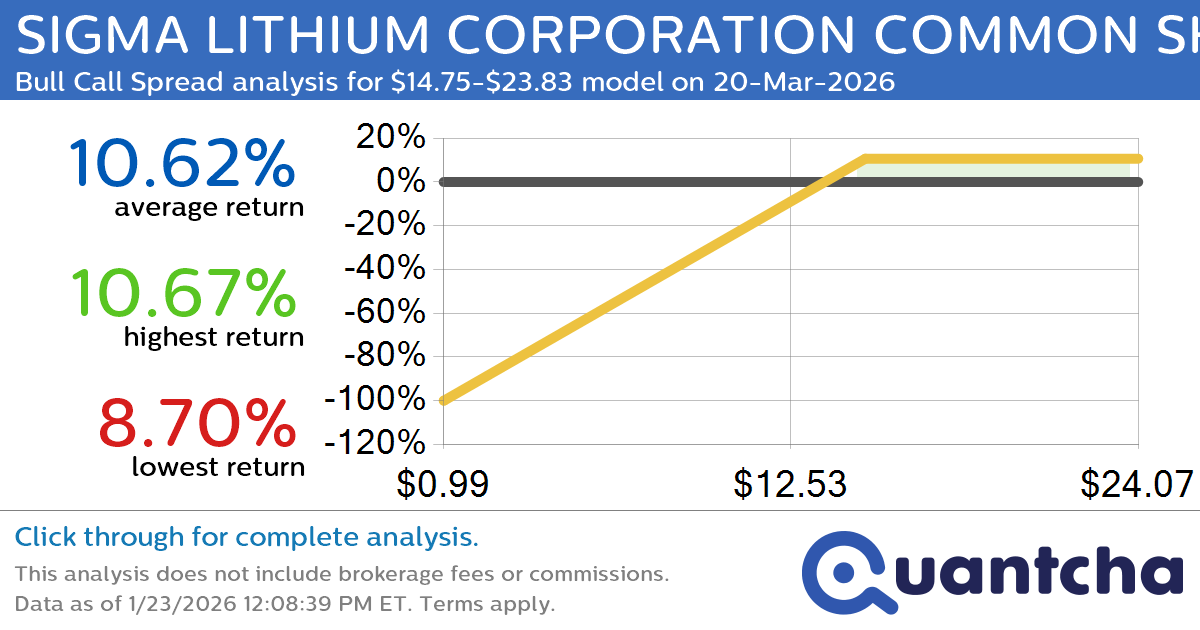

Big Gainer Alert: Trading today’s 16.9% move in SIGMA LITHIUM CORPORATION COMMON SHARES $SGML

Quantchabot has detected a new Bull Call Spread trade opportunity for SIGMA LITHIUM CORPORATION COMMON SHARES (SGML) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SGML was recently trading at $14.66 and has an implied volatility of 121.66% for this period. Based on an…

-

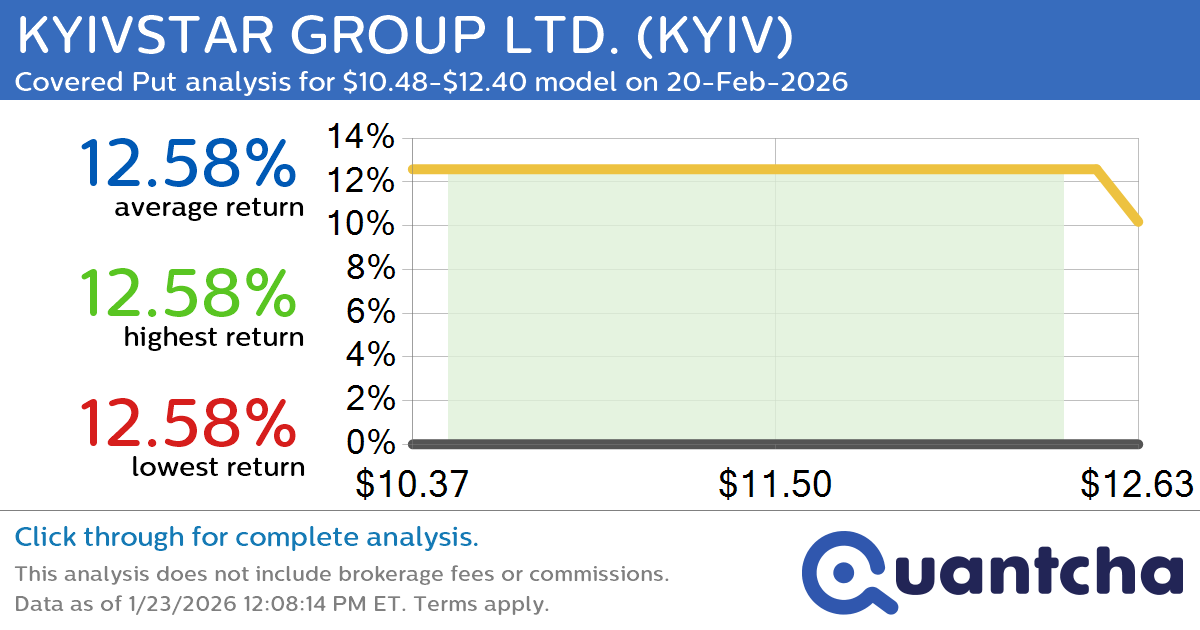

Big Loser Alert: Trading today’s -7.7% move in KYIVSTAR GROUP LTD. $KYIV

Quantchabot has detected a new Covered Put trade opportunity for KYIVSTAR GROUP LTD. (KYIV) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KYIV was recently trading at $12.36 and has an implied volatility of 59.85% for this period. Based on an analysis of the…

-

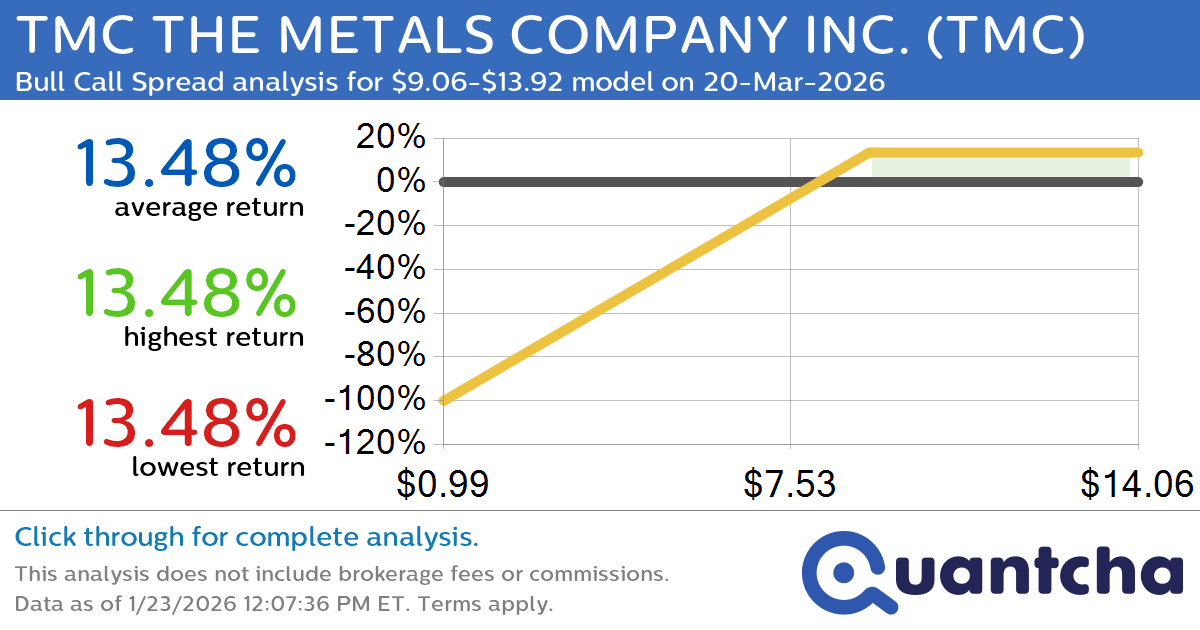

Big Gainer Alert: Trading today’s 8.3% move in TMC THE METALS COMPANY INC. $TMC

Quantchabot has detected a new Bull Call Spread trade opportunity for TMC THE METALS COMPANY INC. (TMC) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TMC was recently trading at $9.01 and has an implied volatility of 108.75% for this period. Based on an…

-

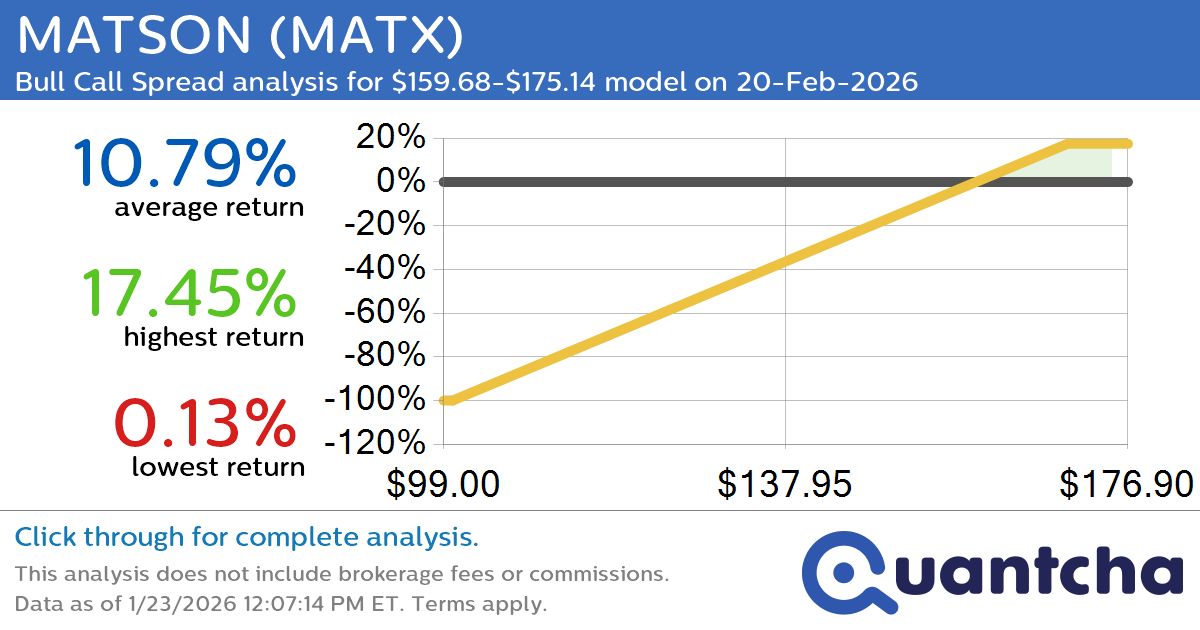

52-Week High Alert: Trading today’s movement in MATSON $MATX

Quantchabot has detected a new Bull Call Spread trade opportunity for MATSON (MATX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MATX was recently trading at $159.56 and has an implied volatility of 32.96% for this period. Based on an analysis of the options…