Author: Quantcha Trade Ideas

-

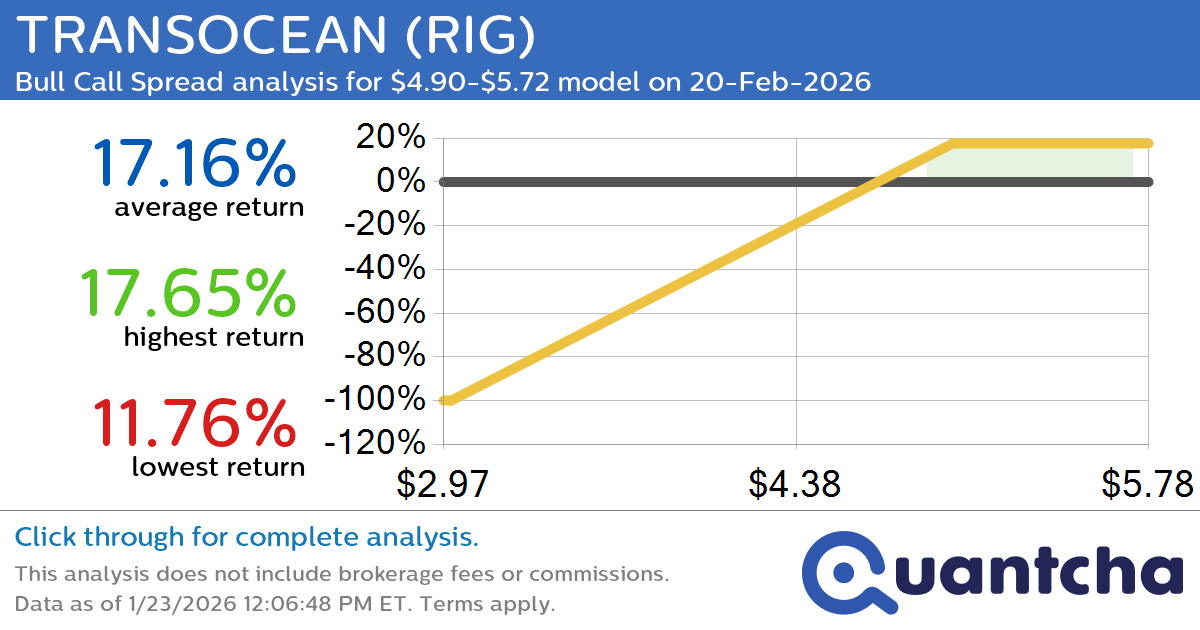

52-Week High Alert: Trading today’s movement in TRANSOCEAN $RIG

Quantchabot has detected a new Bull Call Spread trade opportunity for TRANSOCEAN (RIG) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RIG was recently trading at $4.89 and has an implied volatility of 54.64% for this period. Based on an analysis of the options…

-

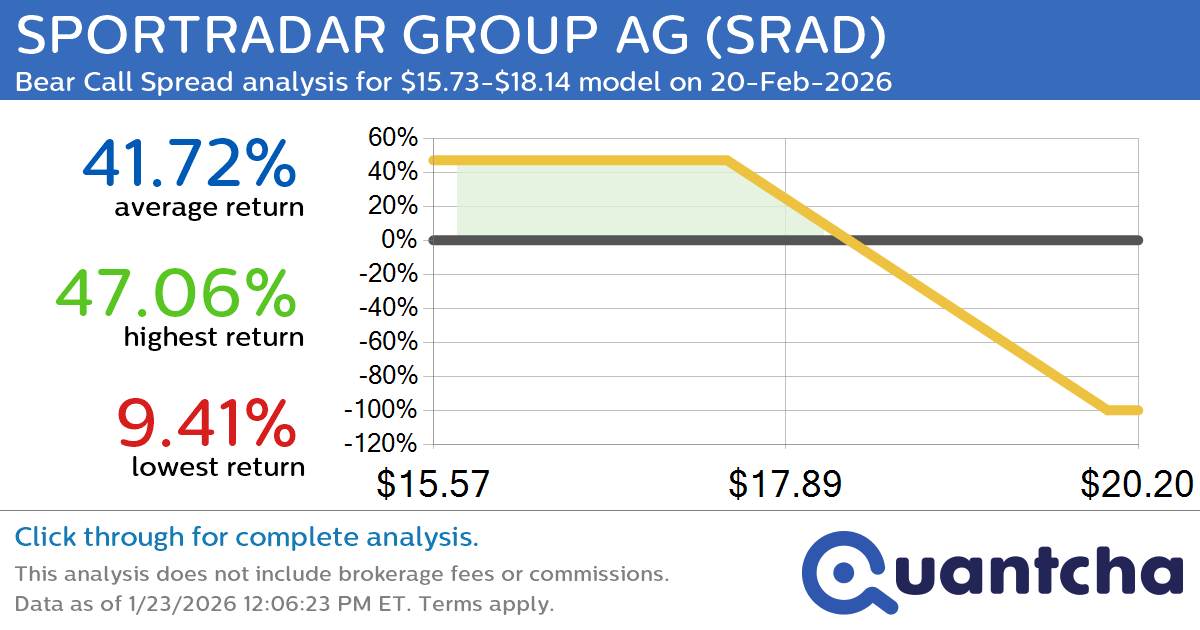

52-Week Low Alert: Trading today’s movement in SPORTRADAR GROUP AG $SRAD

Quantchabot has detected a new Bear Call Spread trade opportunity for SPORTRADAR GROUP AG (SRAD) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SRAD was recently trading at $18.08 and has an implied volatility of 50.62% for this period. Based on an analysis of…

-

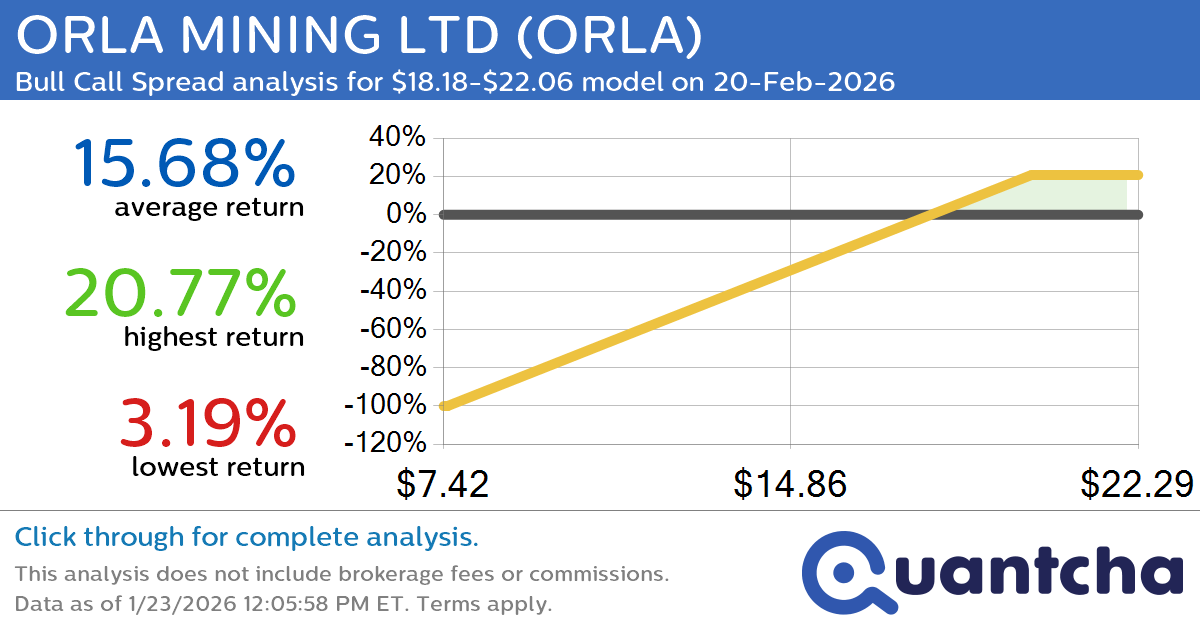

52-Week High Alert: Trading today’s movement in ORLA MINING LTD $ORLA

Quantchabot has detected a new Bull Call Spread trade opportunity for ORLA MINING LTD (ORLA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ORLA was recently trading at $18.13 and has an implied volatility of 68.86% for this period. Based on an analysis of…

-

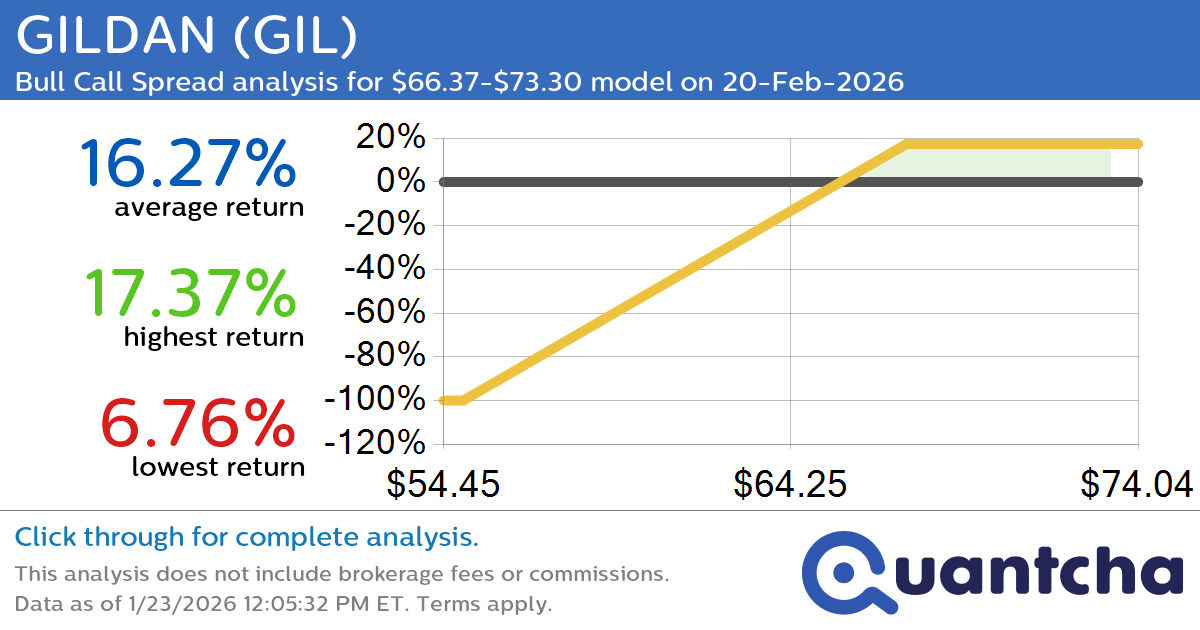

52-Week High Alert: Trading today’s movement in GILDAN $GIL

Quantchabot has detected a new Bull Call Spread trade opportunity for GILDAN (GIL) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GIL was recently trading at $66.17 and has an implied volatility of 35.40% for this period. Based on an analysis of the options…

-

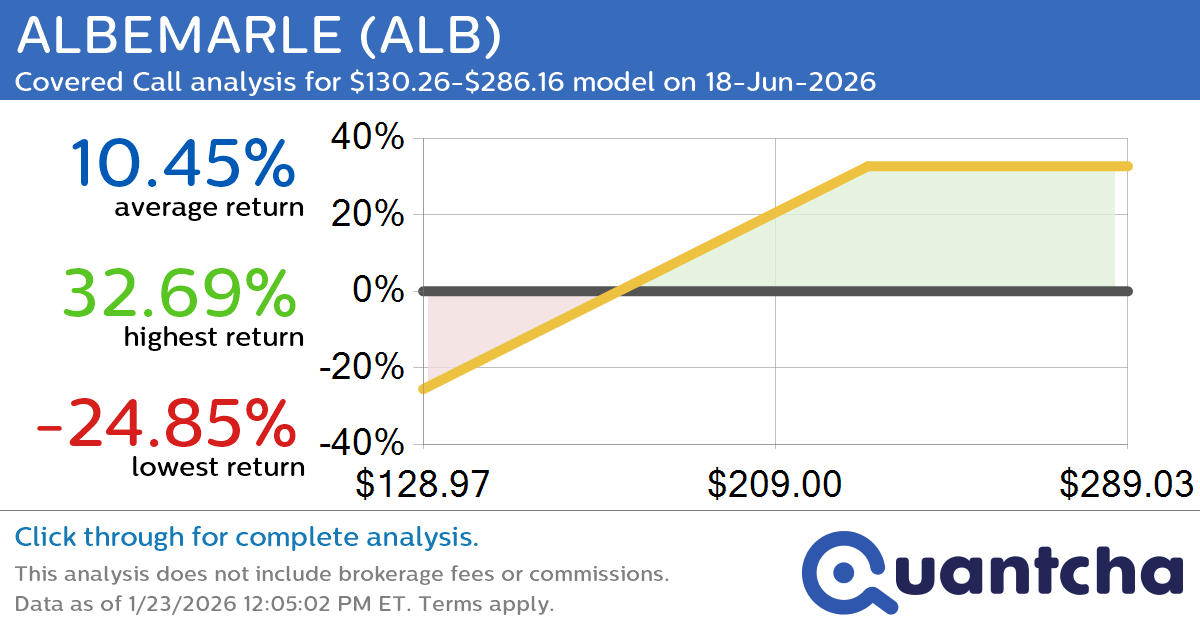

Covered Call Alert: ALBEMARLE $ALB returning up to 32.81% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ALBEMARLE (ALB) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ALB was recently trading at $190.16 and has an implied volatility of 62.07% for this period. Based on an analysis of the options available…

-

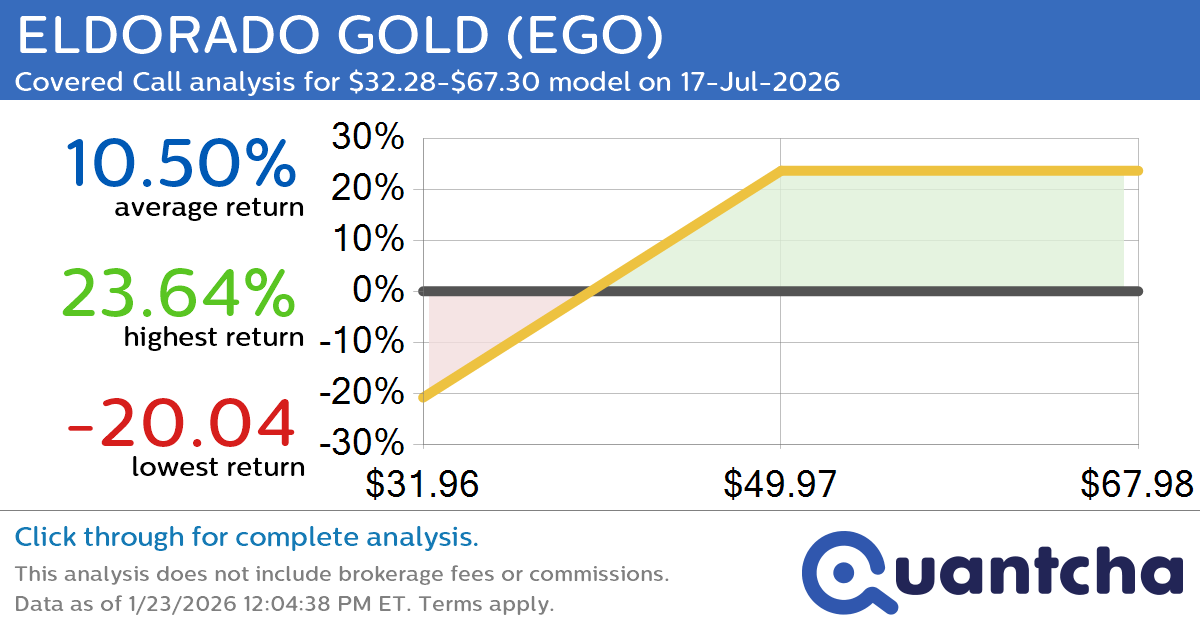

Covered Call Alert: ELDORADO GOLD $EGO returning up to 23.64% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for ELDORADO GOLD (EGO) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EGO was recently trading at $45.92 and has an implied volatility of 52.93% for this period. Based on an analysis of the options…

-

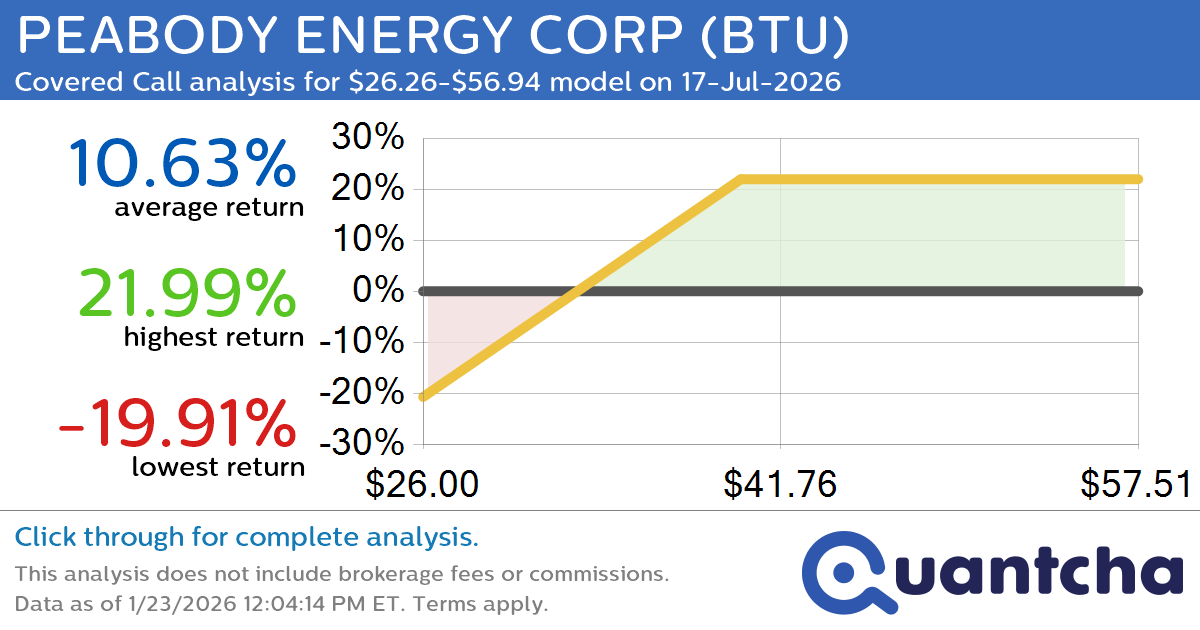

Covered Call Alert: PEABODY ENERGY CORP $BTU returning up to 21.99% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for PEABODY ENERGY CORP (BTU) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BTU was recently trading at $37.97 and has an implied volatility of 55.79% for this period. Based on an analysis of the…

-

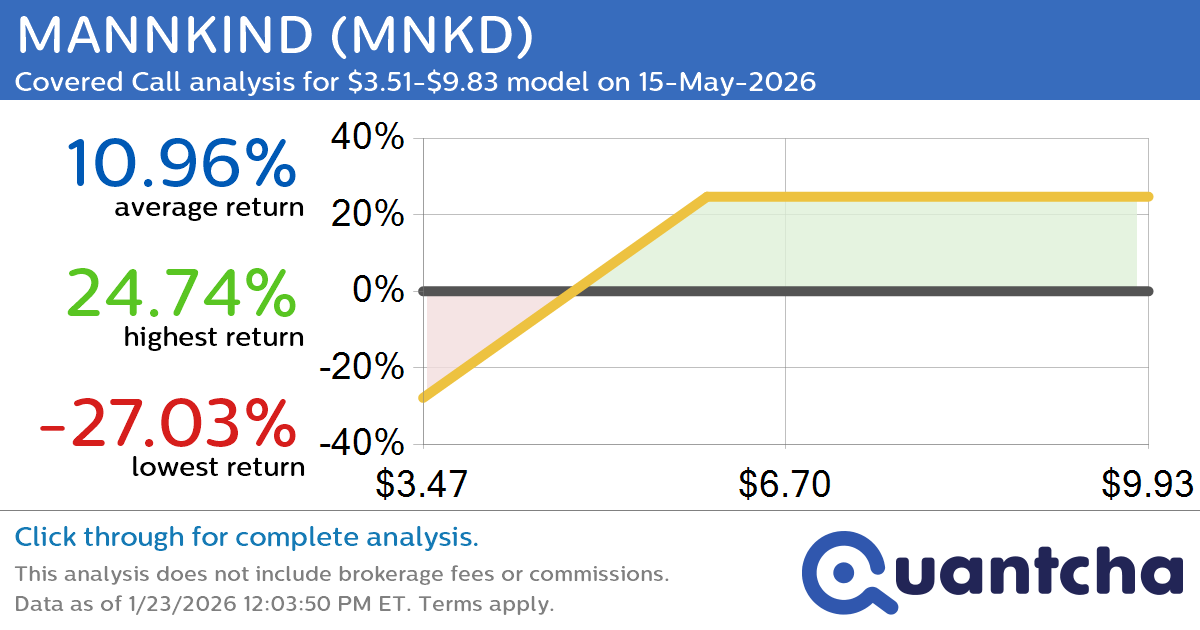

Covered Call Alert: MANNKIND $MNKD returning up to 24.74% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for MANNKIND (MNKD) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MNKD was recently trading at $5.80 and has an implied volatility of 92.61% for this period. Based on an analysis of the options available…

-

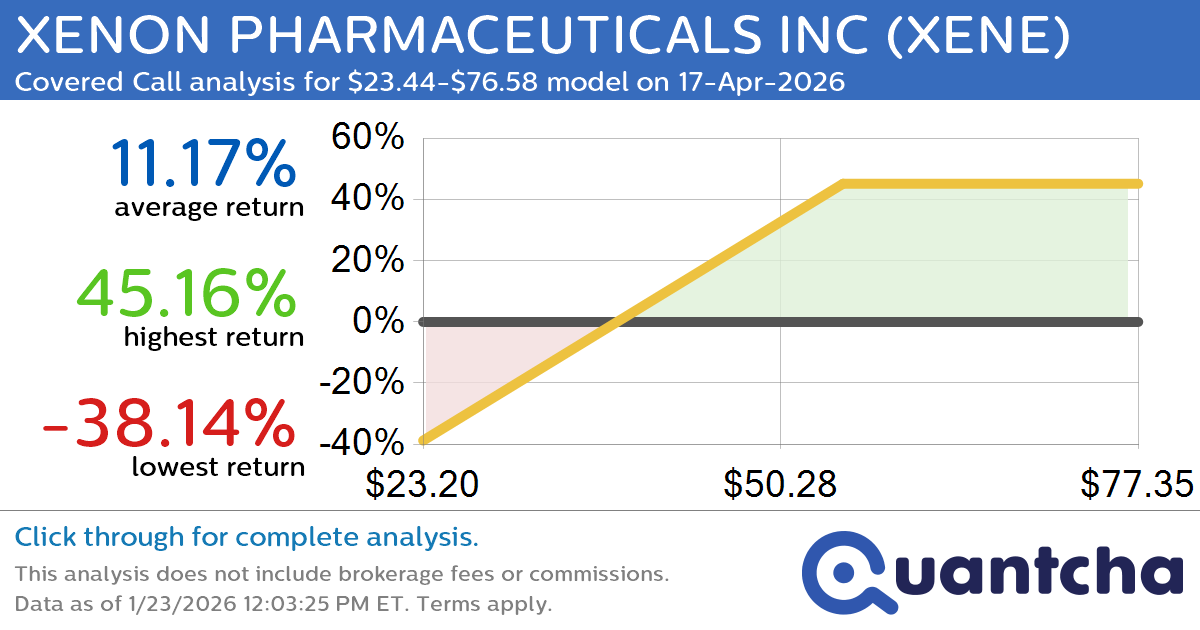

Covered Call Alert: XENON PHARMACEUTICALS INC $XENE returning up to 45.16% through 17-Apr-2026

Quantchabot has detected a new Covered Call trade opportunity for XENON PHARMACEUTICALS INC (XENE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XENE was recently trading at $41.99 and has an implied volatility of 122.87% for this period. Based on an analysis of the…

-

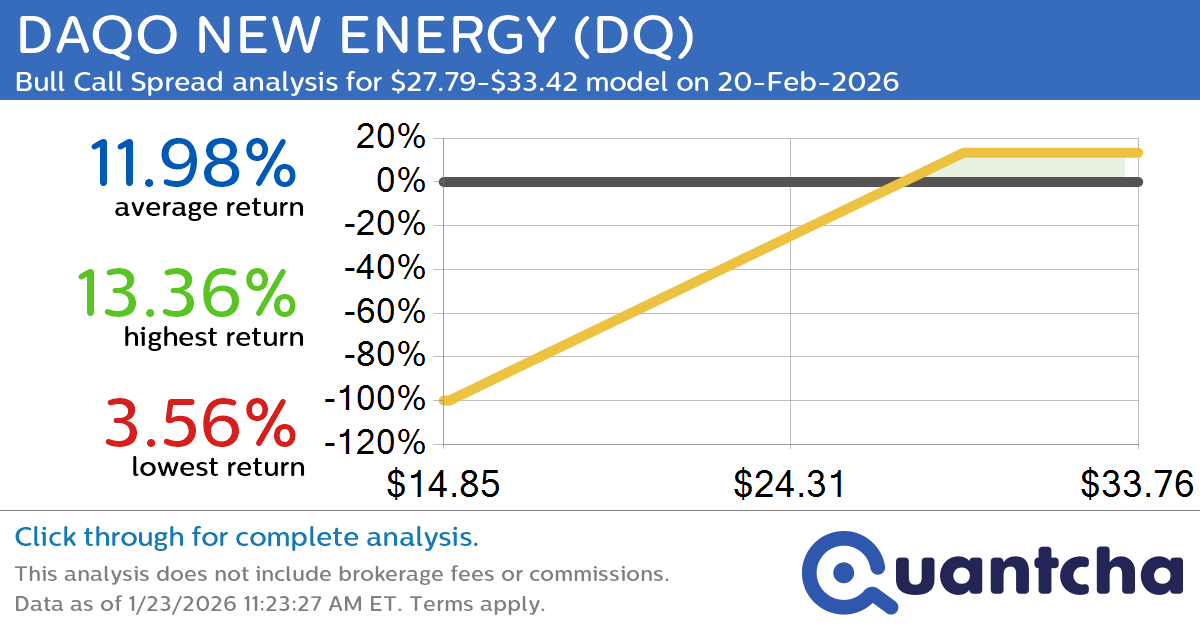

Big Gainer Alert: Trading today’s 10.1% move in DAQO NEW ENERGY $DQ

Quantchabot has detected a new Bull Call Spread trade opportunity for DAQO NEW ENERGY (DQ) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DQ was recently trading at $27.71 and has an implied volatility of 65.70% for this period. Based on an analysis of…