Author: Quantcha Trade Ideas

-

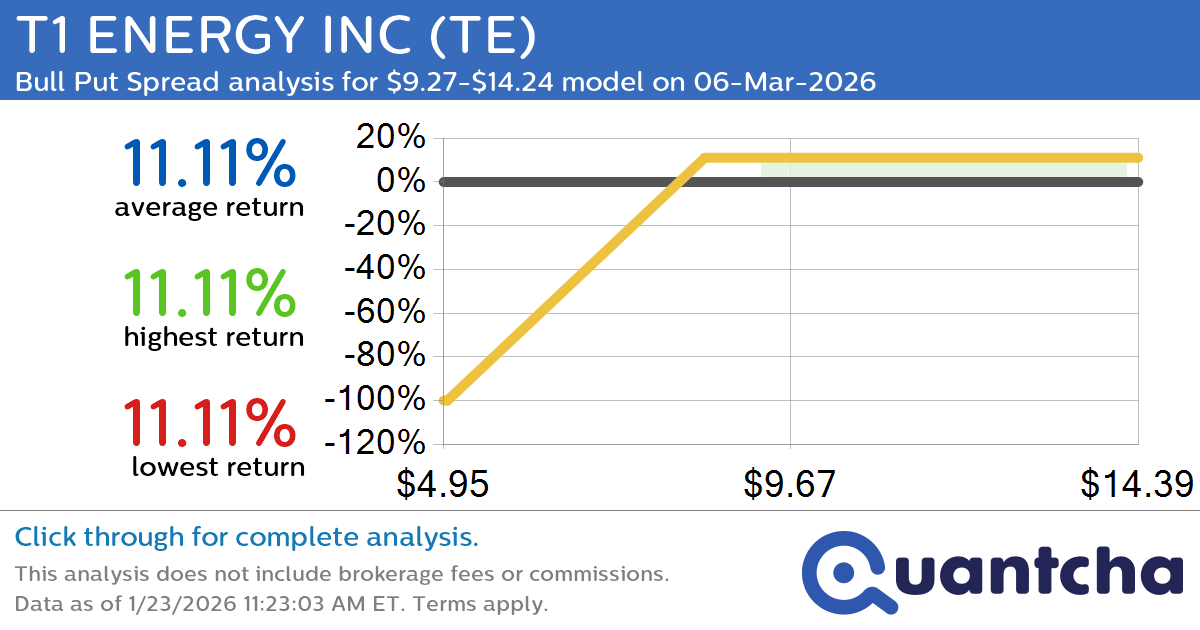

Big Gainer Alert: Trading today’s 10.2% move in T1 ENERGY INC $TE

Quantchabot has detected a new Bull Put Spread trade opportunity for T1 ENERGY INC (TE) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TE was recently trading at $9.22 and has an implied volatility of 125.47% for this period. Based on an analysis of…

-

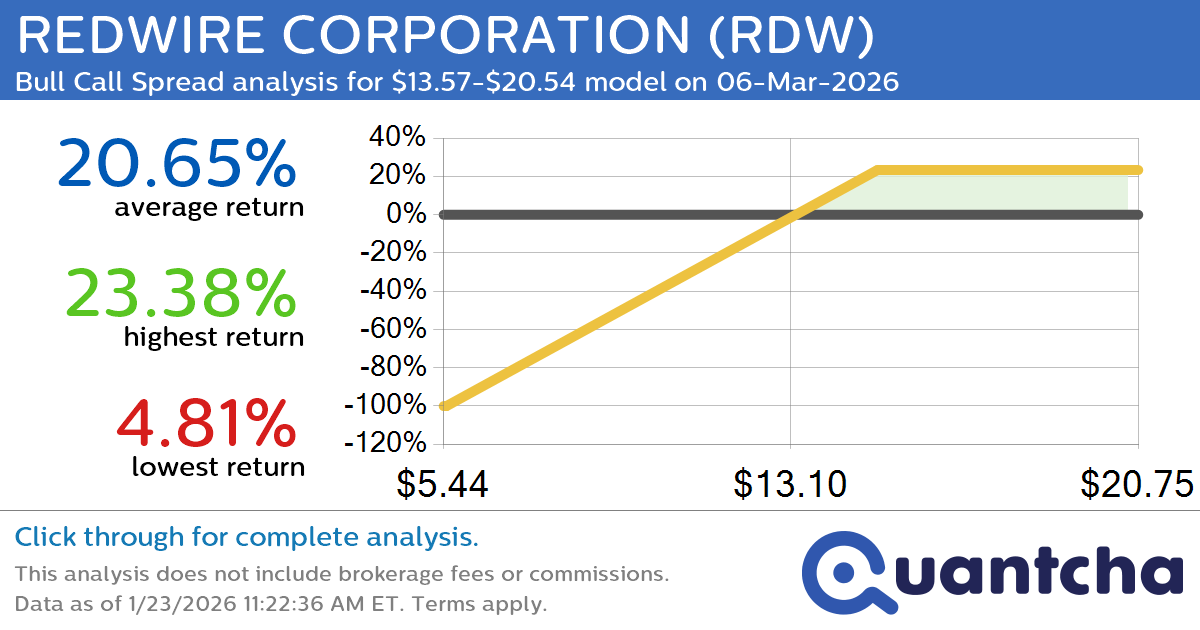

Big Gainer Alert: Trading today’s 12.7% move in REDWIRE CORPORATION $RDW

Quantchabot has detected a new Bull Call Spread trade opportunity for REDWIRE CORPORATION (RDW) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RDW was recently trading at $13.51 and has an implied volatility of 121.26% for this period. Based on an analysis of the…

-

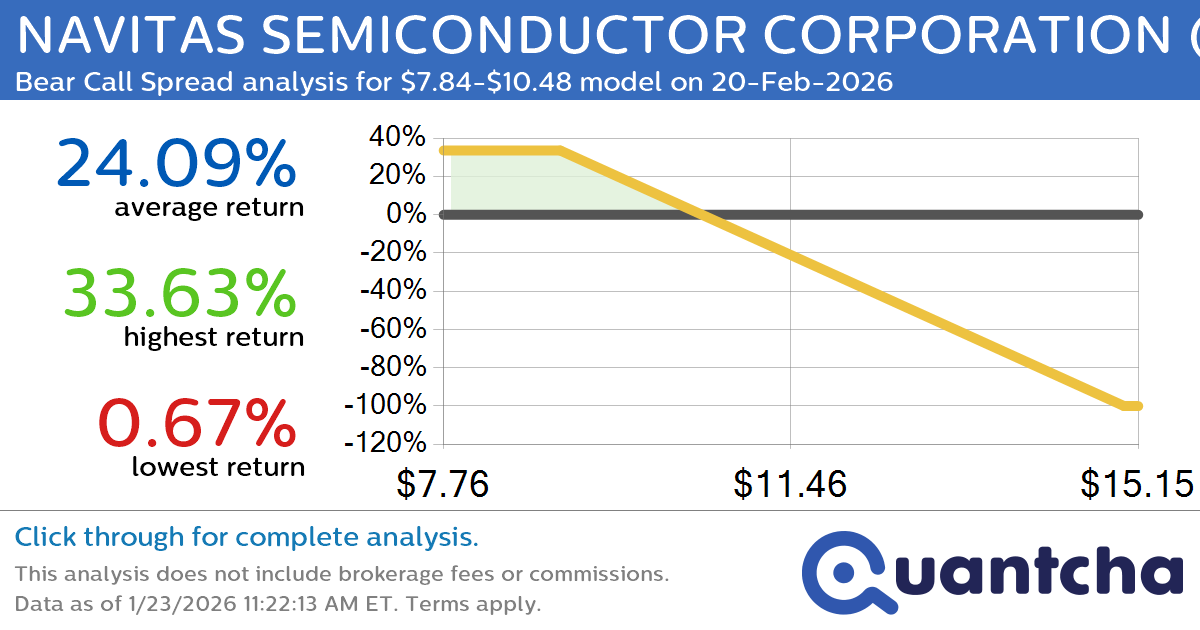

Big Loser Alert: Trading today’s -7.5% move in NAVITAS SEMICONDUCTOR CORPORATION $NVTS

Quantchabot has detected a new Bear Call Spread trade opportunity for NAVITAS SEMICONDUCTOR CORPORATION (NVTS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NVTS was recently trading at $10.45 and has an implied volatility of 103.43% for this period. Based on an analysis of…

-

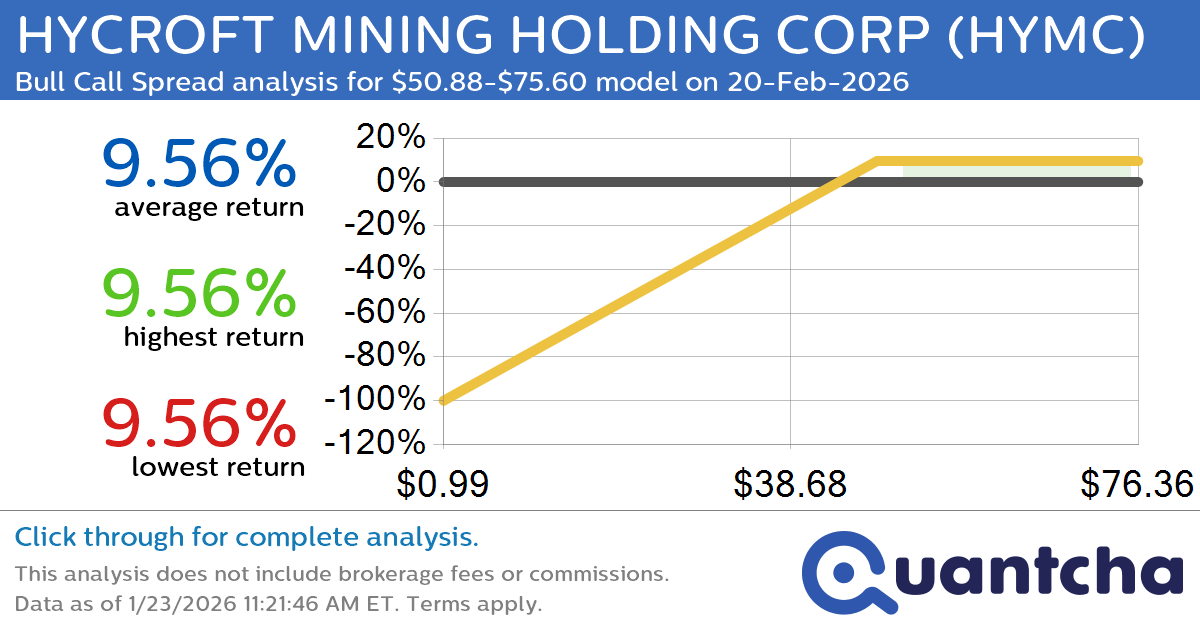

Big Gainer Alert: Trading today’s 8.7% move in HYCROFT MINING HOLDING CORP $HYMC

Quantchabot has detected a new Bull Call Spread trade opportunity for HYCROFT MINING HOLDING CORP (HYMC) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HYMC was recently trading at $50.73 and has an implied volatility of 141.10% for this period. Based on an analysis…

-

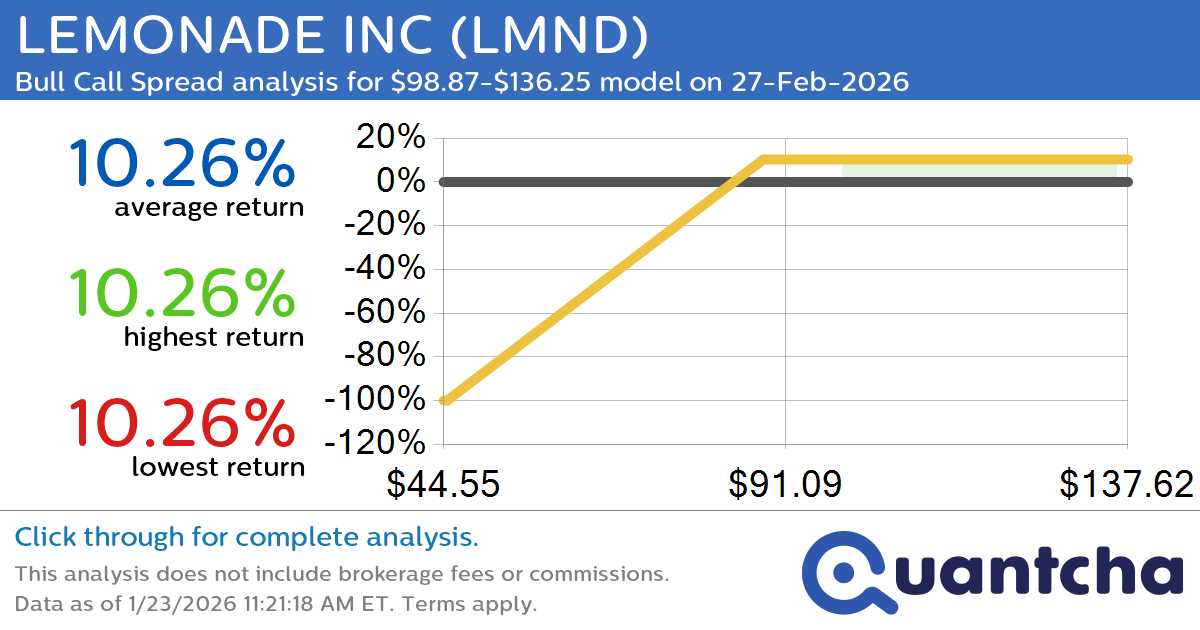

52-Week High Alert: Trading today’s movement in LEMONADE INC $LMND

Quantchabot has detected a new Bull Call Spread trade opportunity for LEMONADE INC (LMND) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LMND was recently trading at $98.50 and has an implied volatility of 102.47% for this period. Based on an analysis of the…

-

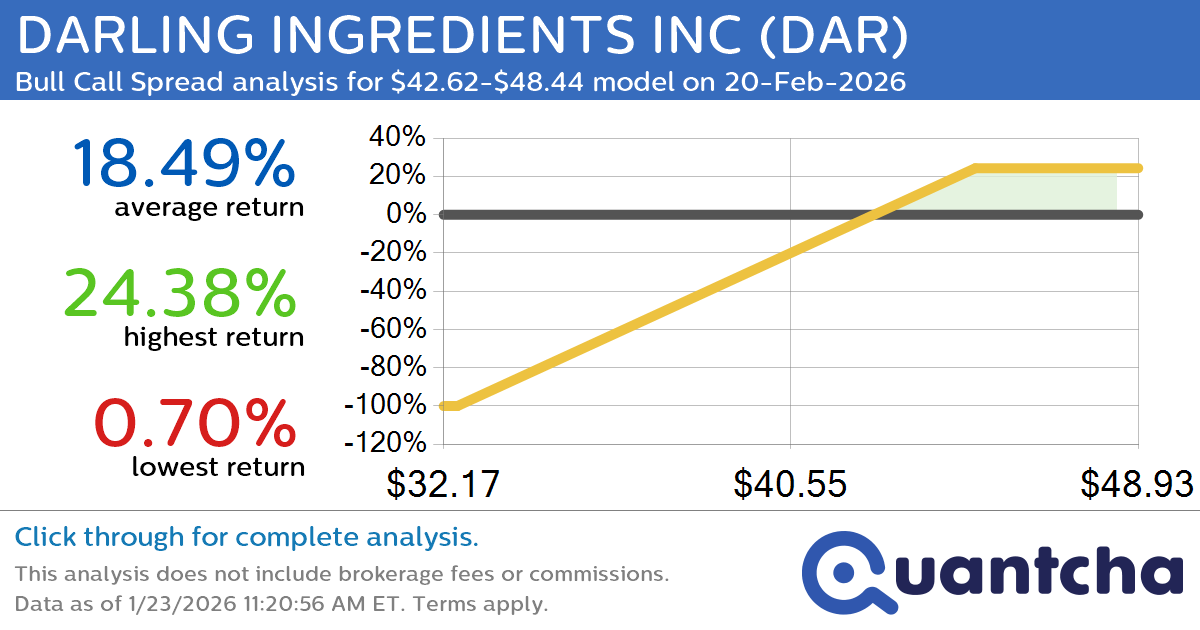

52-Week High Alert: Trading today’s movement in DARLING INGREDIENTS INC $DAR

Quantchabot has detected a new Bull Call Spread trade opportunity for DARLING INGREDIENTS INC (DAR) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DAR was recently trading at $42.49 and has an implied volatility of 45.60% for this period. Based on an analysis of…

-

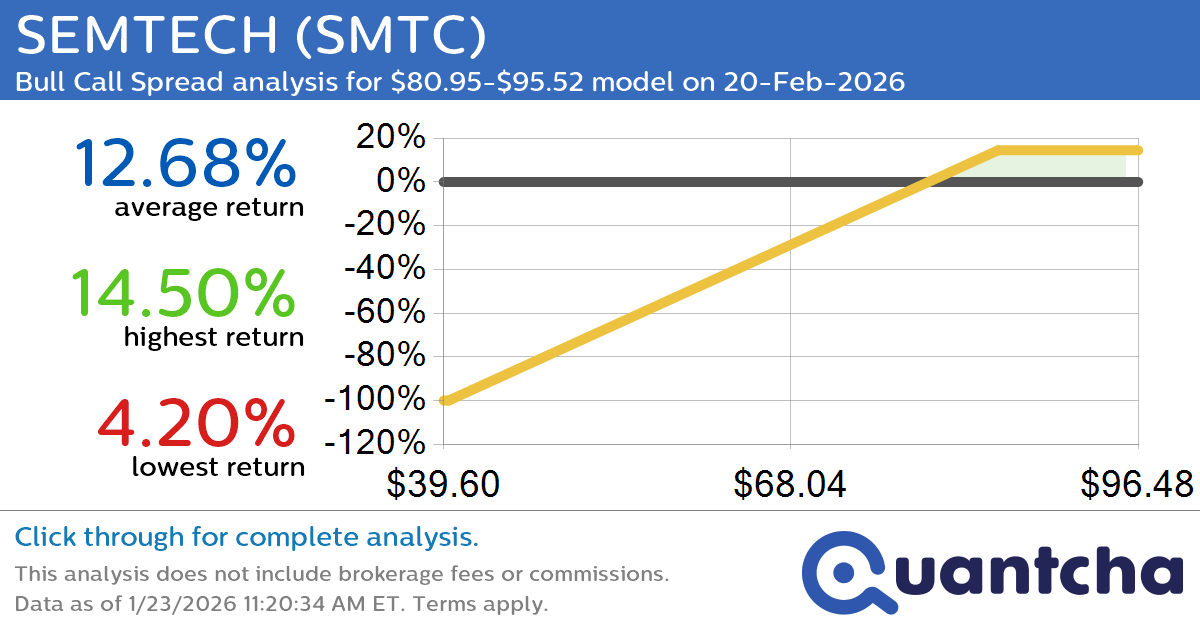

52-Week High Alert: Trading today’s movement in SEMTECH $SMTC

Quantchabot has detected a new Bull Call Spread trade opportunity for SEMTECH (SMTC) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMTC was recently trading at $80.70 and has an implied volatility of 59.02% for this period. Based on an analysis of the options…

-

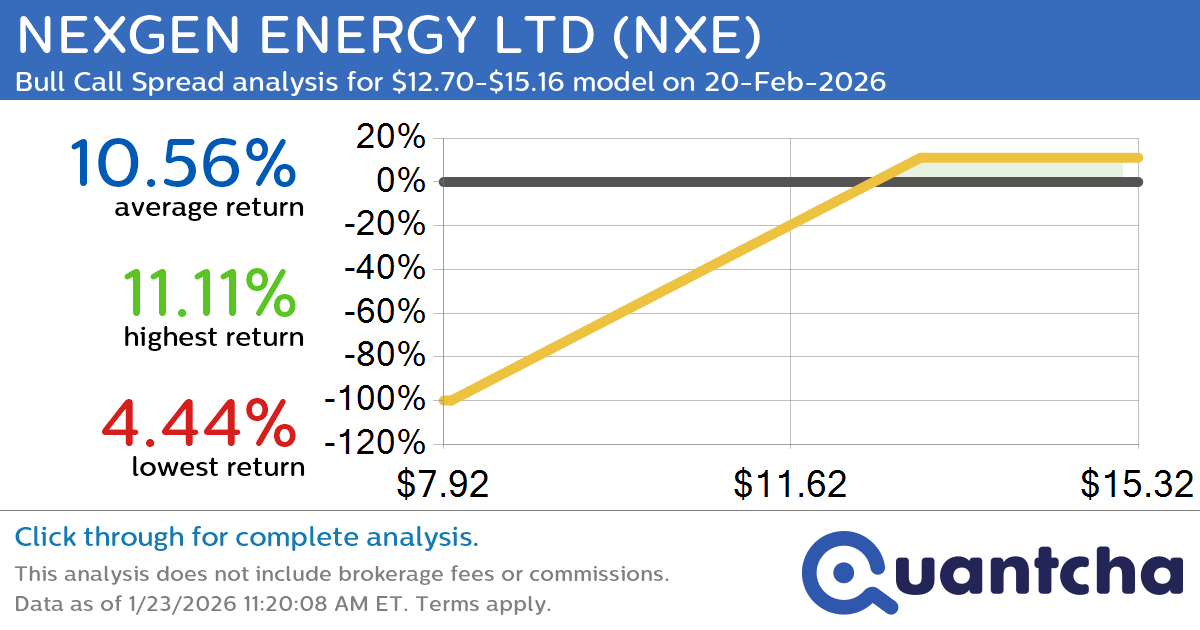

52-Week High Alert: Trading today’s movement in NEXGEN ENERGY LTD $NXE

Quantchabot has detected a new Bull Call Spread trade opportunity for NEXGEN ENERGY LTD (NXE) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NXE was recently trading at $12.66 and has an implied volatility of 63.04% for this period. Based on an analysis of…

-

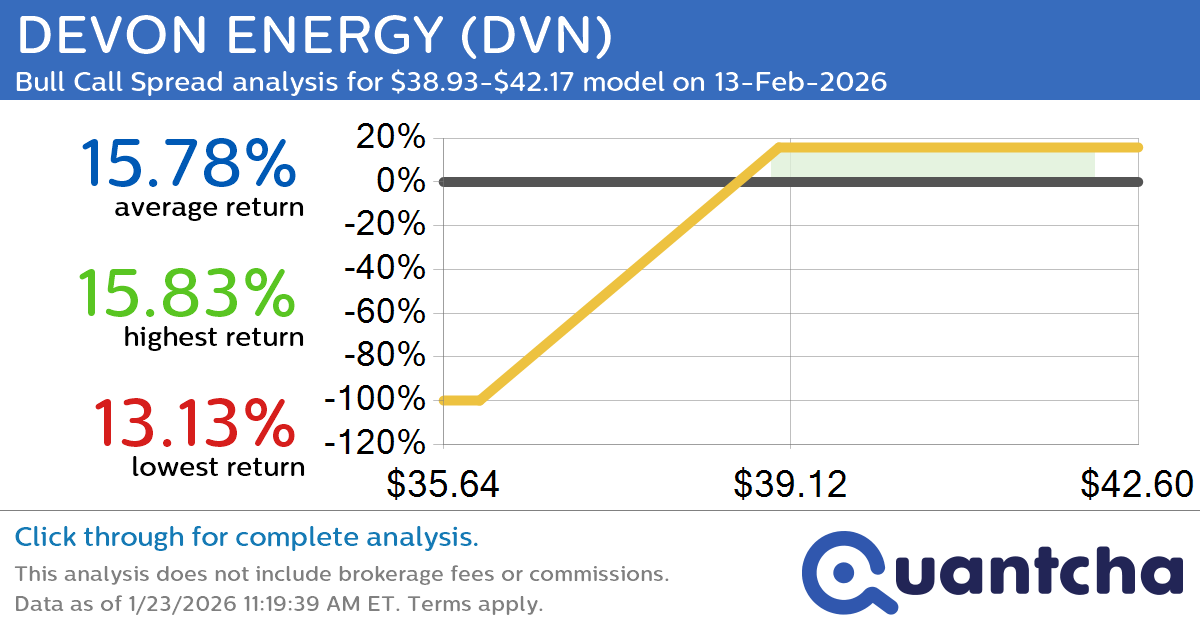

52-Week High Alert: Trading today’s movement in DEVON ENERGY $DVN

Quantchabot has detected a new Bull Call Spread trade opportunity for DEVON ENERGY (DVN) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DVN was recently trading at $38.84 and has an implied volatility of 32.72% for this period. Based on an analysis of the…

-

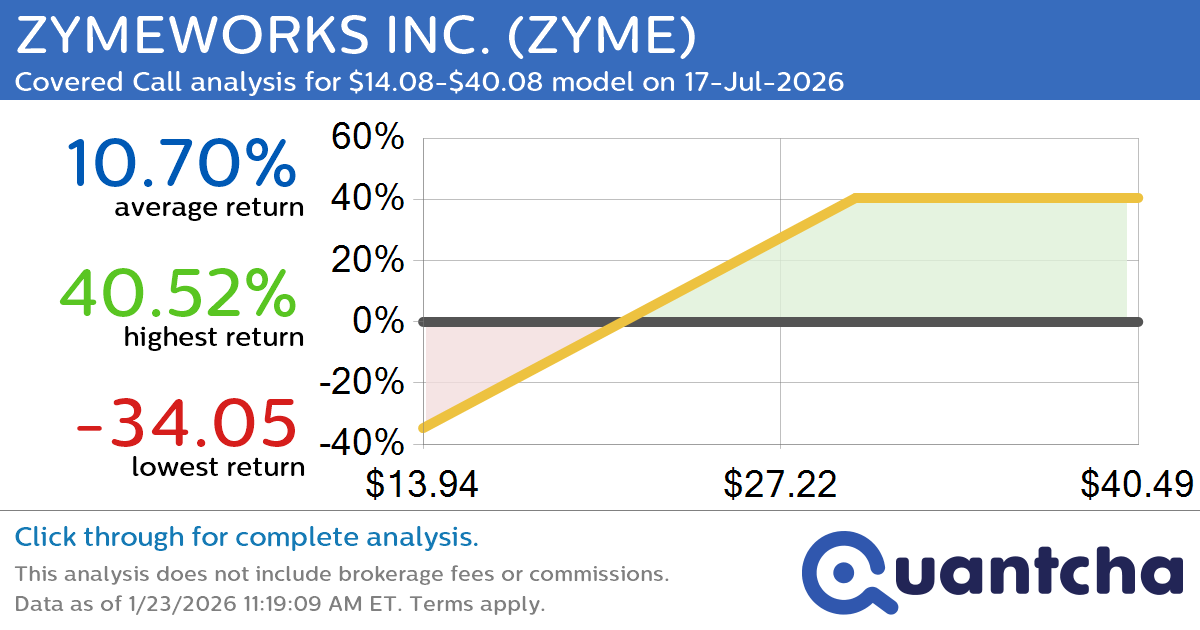

Covered Call Alert: ZYMEWORKS INC. $ZYME returning up to 40.52% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for ZYMEWORKS INC. (ZYME) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ZYME was recently trading at $23.33 and has an implied volatility of 75.36% for this period. Based on an analysis of the options…