Author: Quantcha Trade Ideas

-

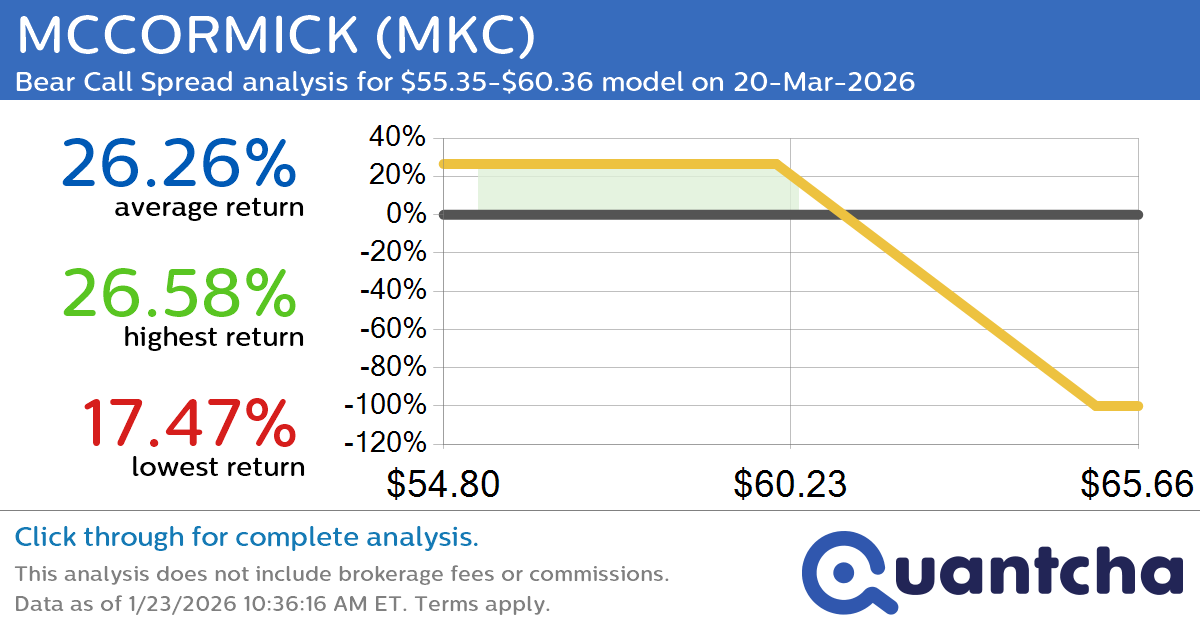

52-Week Low Alert: Trading today’s movement in MCCORMICK $MKC

Quantchabot has detected a new Bear Call Spread trade opportunity for MCCORMICK (MKC) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MKC was recently trading at $60.00 and has an implied volatility of 21.96% for this period. Based on an analysis of the options…

-

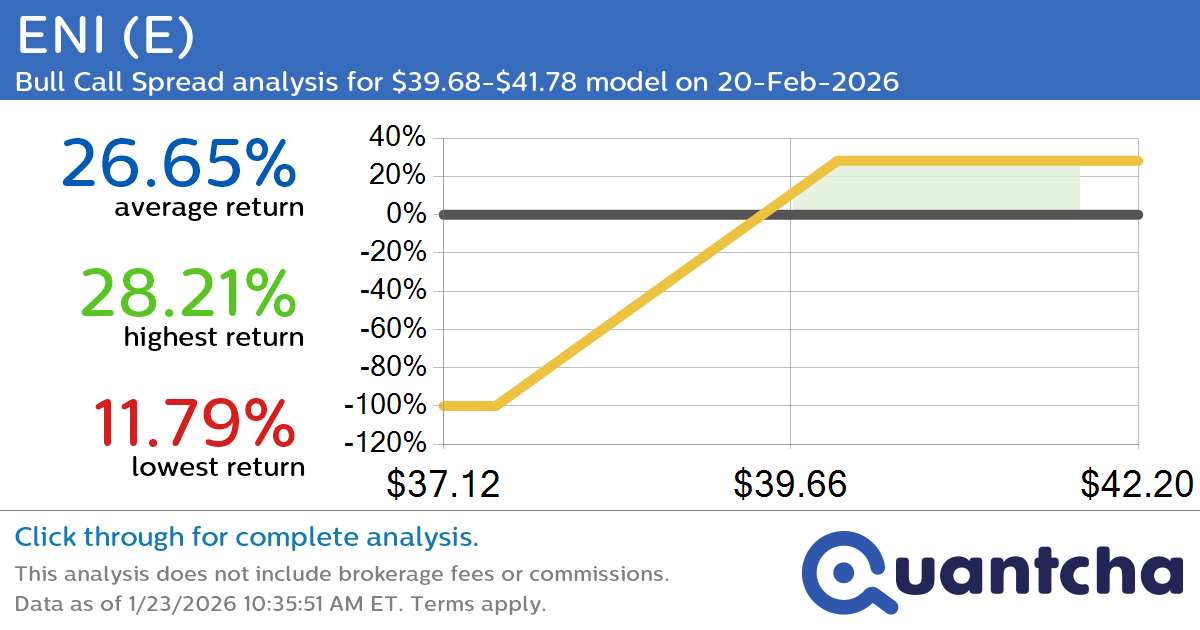

52-Week High Alert: Trading today’s movement in ENI $E

Quantchabot has detected a new Bull Call Spread trade opportunity for ENI (E) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. E was recently trading at $39.56 and has an implied volatility of 18.37% for this period. Based on an analysis of the options…

-

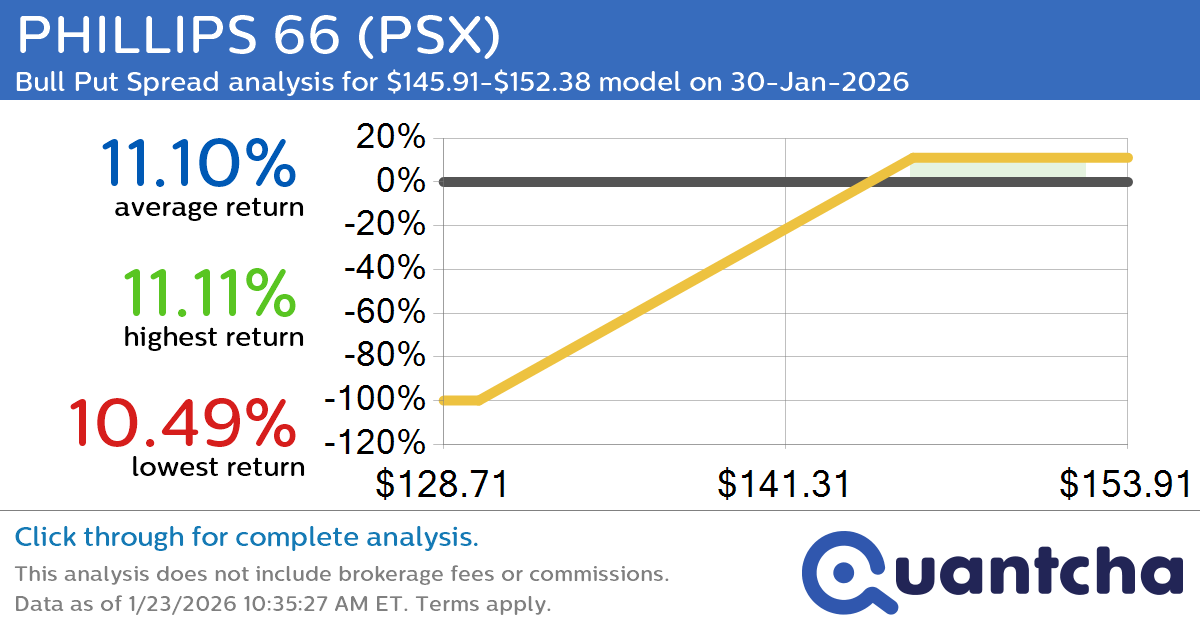

52-Week High Alert: Trading today’s movement in PHILLIPS 66 $PSX

Quantchabot has detected a new Bull Put Spread trade opportunity for PHILLIPS 66 (PSX) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PSX was recently trading at $145.79 and has an implied volatility of 29.76% for this period. Based on an analysis of the…

-

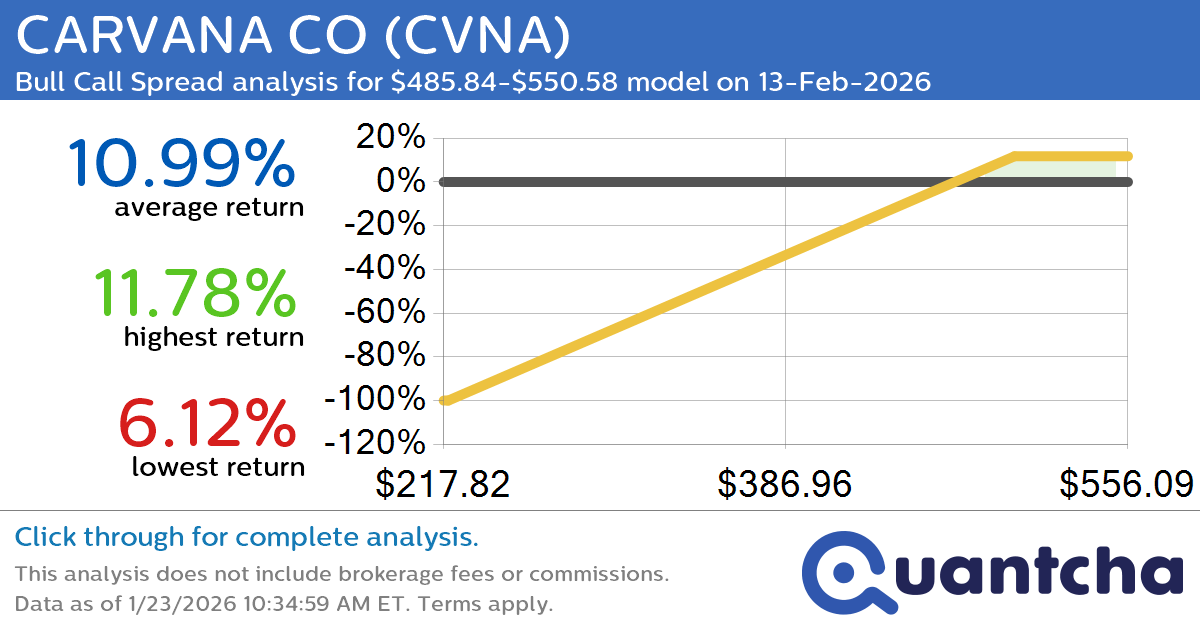

52-Week High Alert: Trading today’s movement in CARVANA CO $CVNA

Quantchabot has detected a new Bull Call Spread trade opportunity for CARVANA CO (CVNA) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CVNA was recently trading at $484.72 and has an implied volatility of 51.23% for this period. Based on an analysis of the…

-

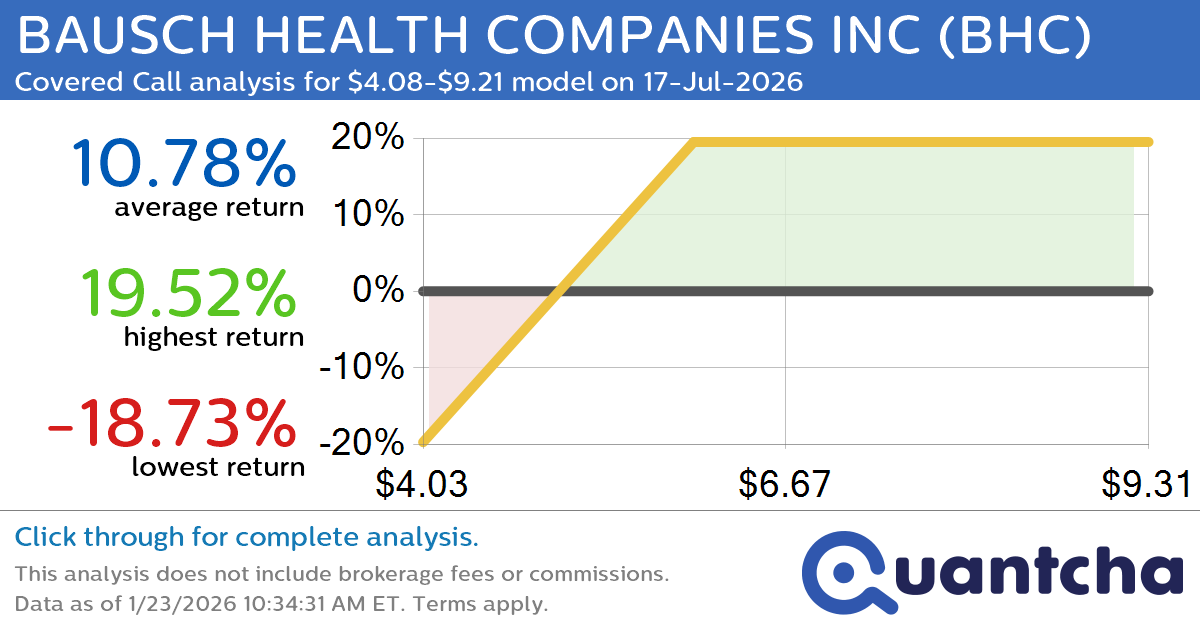

Covered Call Alert: BAUSCH HEALTH COMPANIES INC $BHC returning up to 19.52% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for BAUSCH HEALTH COMPANIES INC (BHC) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BHC was recently trading at $6.02 and has an implied volatility of 58.65% for this period. Based on an analysis of…

-

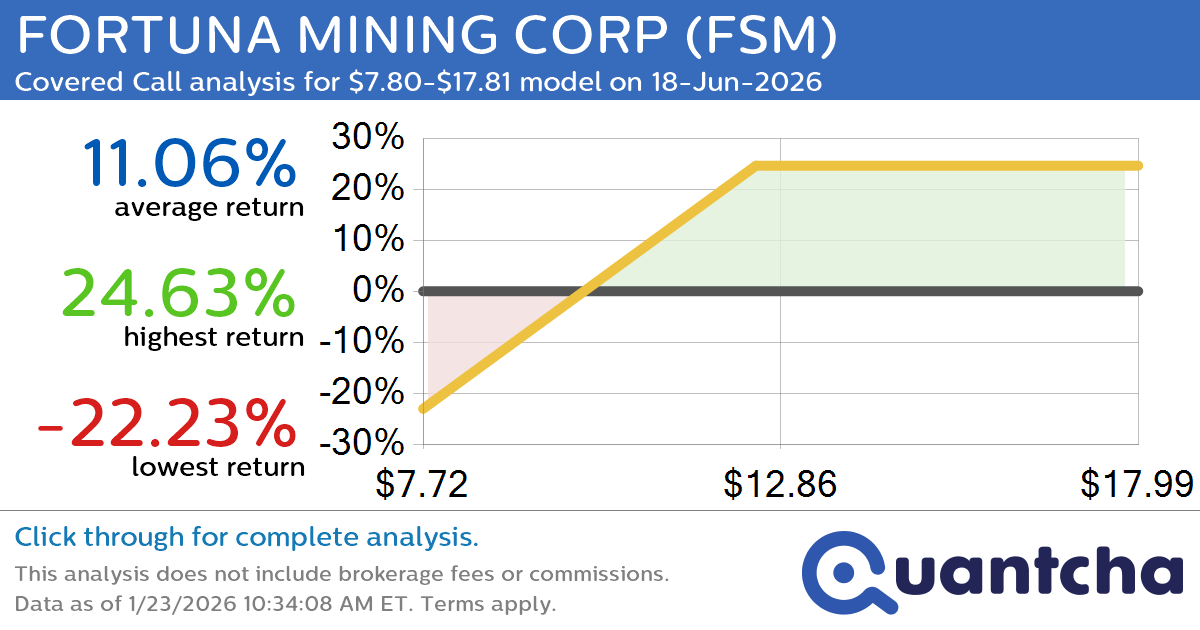

Covered Call Alert: FORTUNA MINING CORP $FSM returning up to 24.63% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for FORTUNA MINING CORP (FSM) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FSM was recently trading at $11.61 and has an implied volatility of 65.09% for this period. Based on an analysis of the…

-

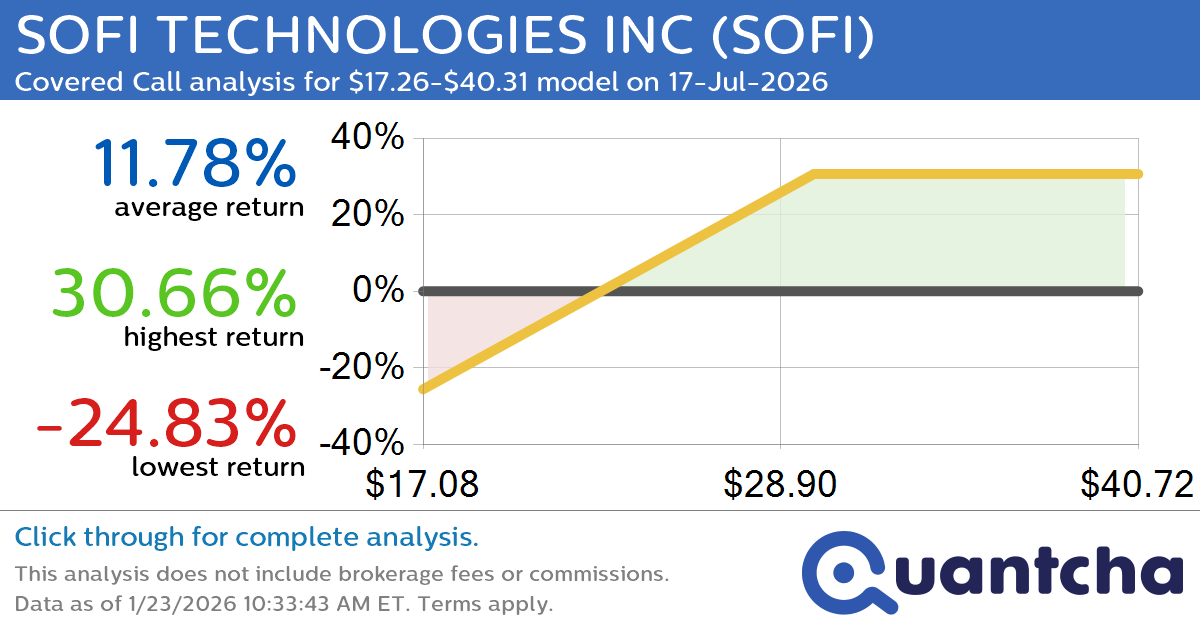

Covered Call Alert: SOFI TECHNOLOGIES INC $SOFI returning up to 30.66% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for SOFI TECHNOLOGIES INC (SOFI) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SOFI was recently trading at $25.91 and has an implied volatility of 61.11% for this period. Based on an analysis of the…

-

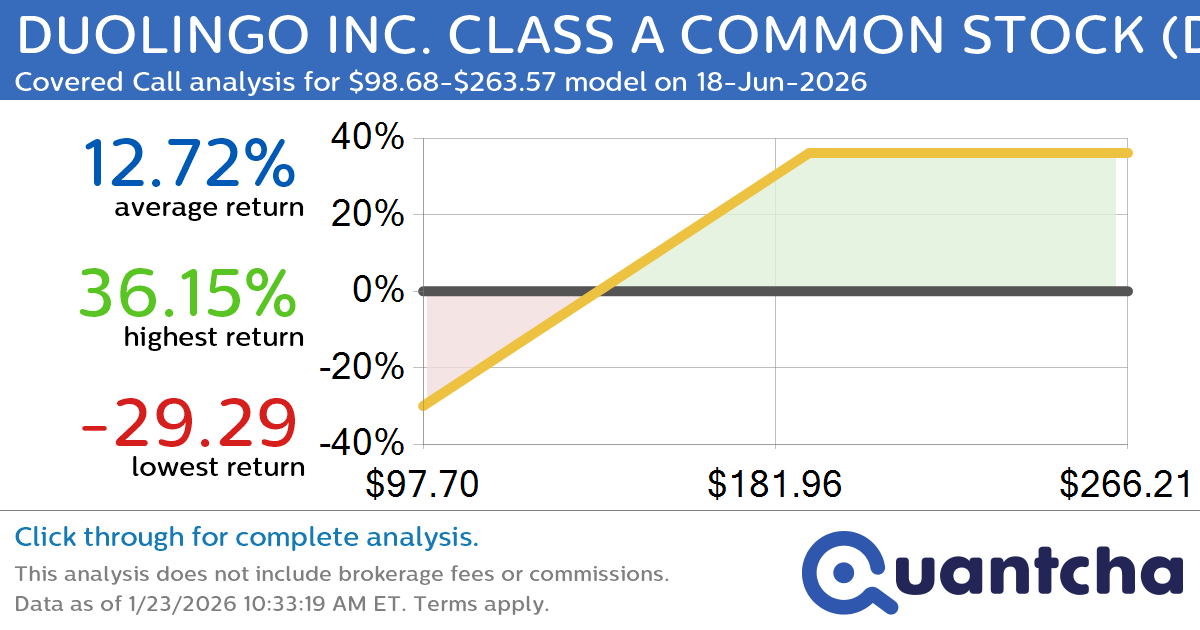

Covered Call Alert: DUOLINGO INC. CLASS A COMMON STOCK $DUOL returning up to 36.05% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for DUOLINGO INC. CLASS A COMMON STOCK (DUOL) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DUOL was recently trading at $158.84 and has an implied volatility of 77.46% for this period. Based on an…

-

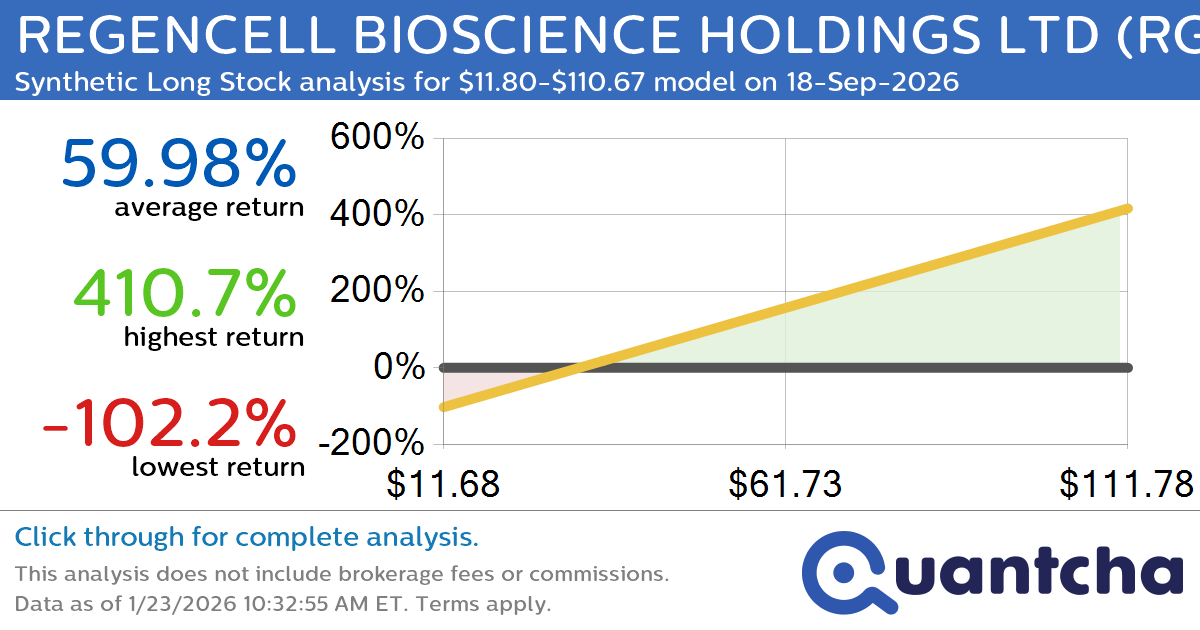

Synthetic Long Discount Alert: REGENCELL BIOSCIENCE HOLDINGS LTD $RGC trading at a 10.71% discount for the 18-Sep-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for REGENCELL BIOSCIENCE HOLDINGS LTD (RGC) for the 18-Sep-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGC was recently trading at $35.28 and has an implied volatility of 138.38% for this period. Based on an analysis…

-

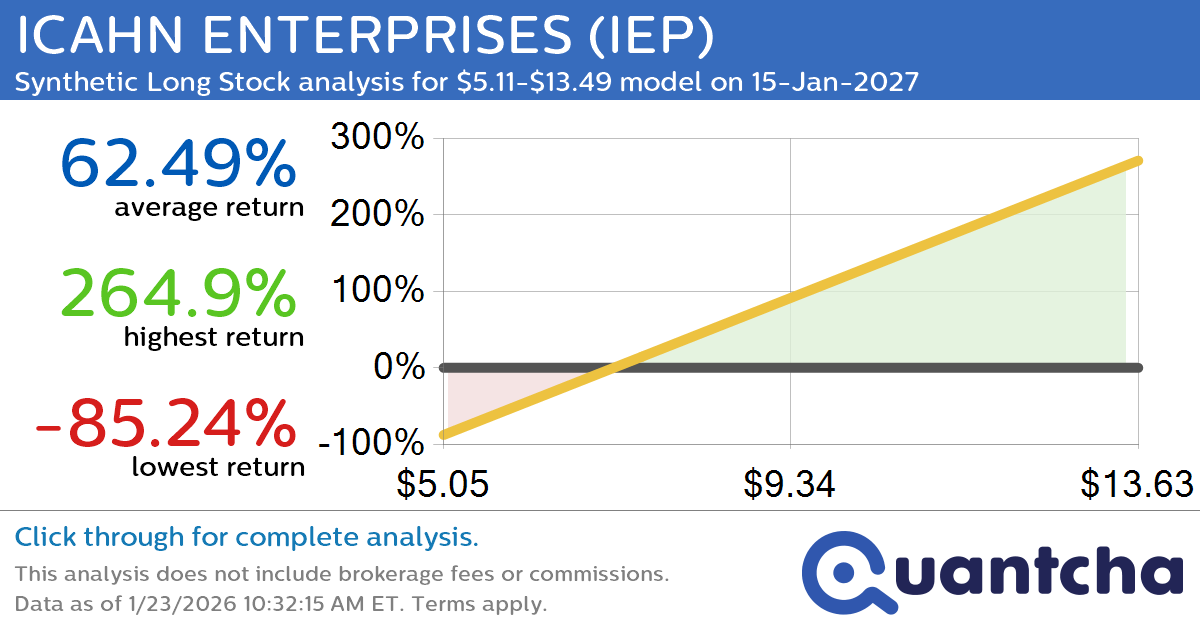

Synthetic Long Discount Alert: ICAHN ENTERPRISES $IEP trading at a 10.72% discount for the 15-Jan-2027 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ICAHN ENTERPRISES (IEP) for the 15-Jan-2027 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IEP was recently trading at $8.01 and has an implied volatility of 49.05% for this period. Based on an analysis of the…