Category: Trade Ideas

-

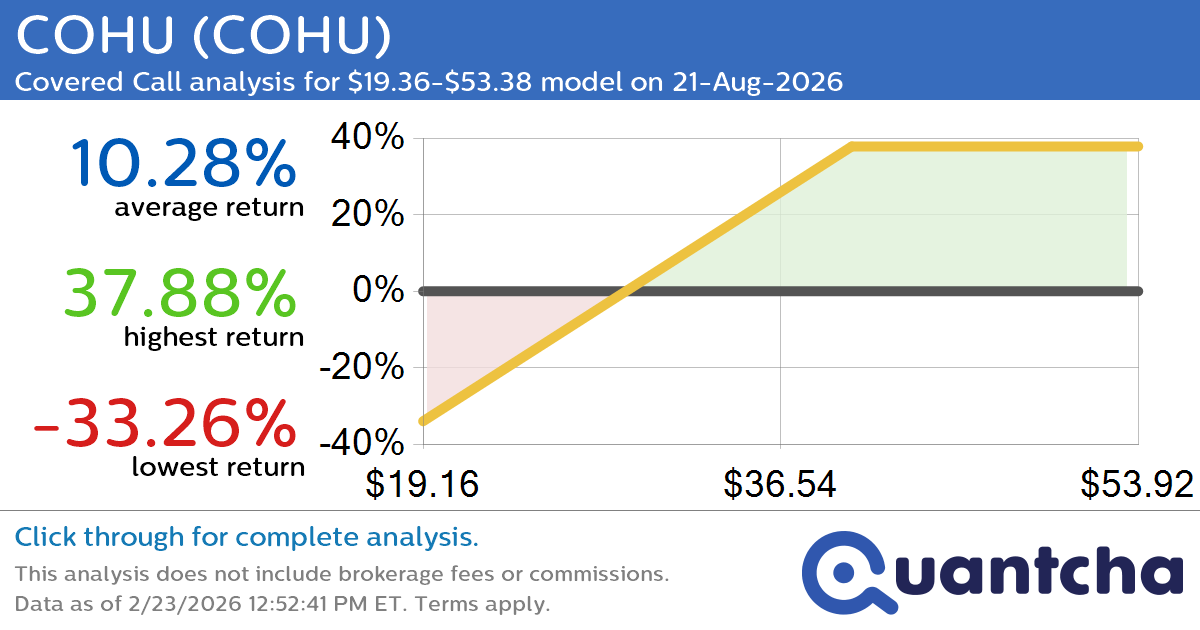

Covered Call Alert: COHU $COHU returning up to 37.88% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for COHU (COHU) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. COHU was recently trading at $31.56 and has an implied volatility of 72.28% for this period. Based on an analysis of the options available…

-

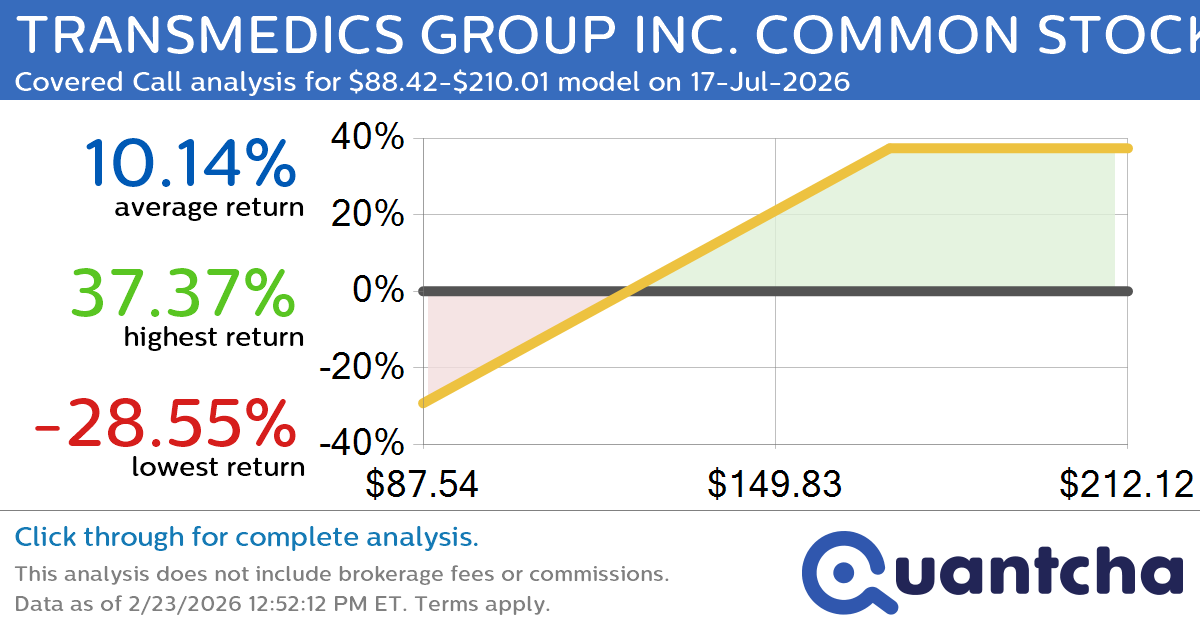

Covered Call Alert: TRANSMEDICS GROUP INC. COMMON STOCK $TMDX returning up to 37.37% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for TRANSMEDICS GROUP INC. COMMON STOCK (TMDX) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TMDX was recently trading at $134.25 and has an implied volatility of 68.71% for this period. Based on an analysis…

-

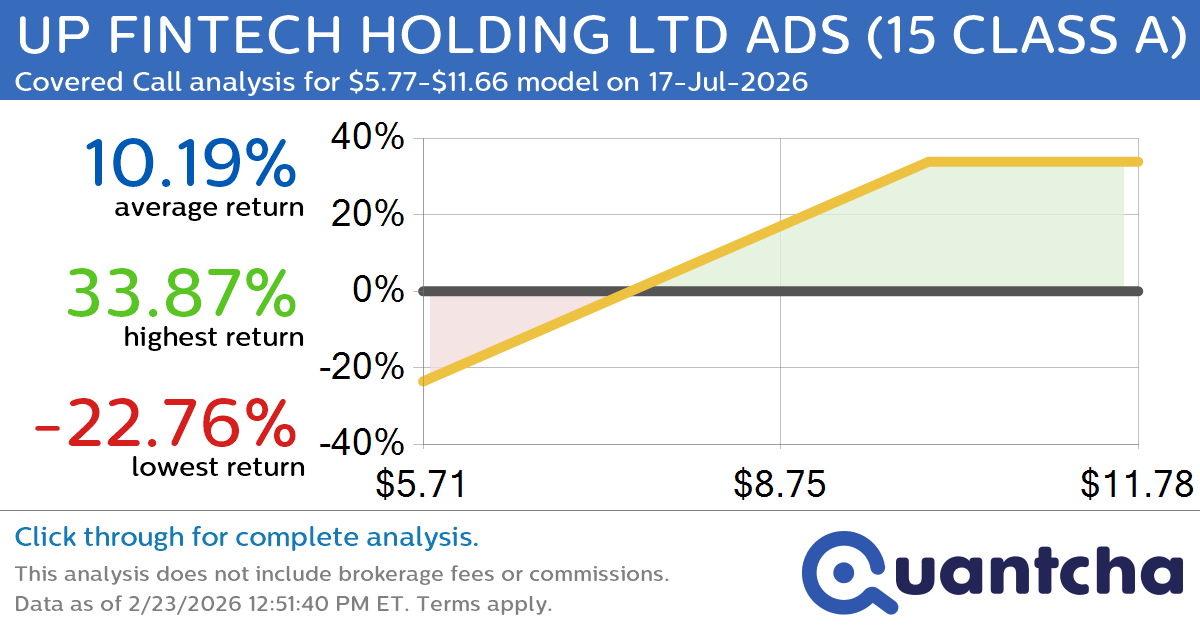

Covered Call Alert: UP FINTECH HOLDING LTD ADS (15 CLASS A) $TIGR returning up to 33.87% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for UP FINTECH HOLDING LTD ADS (15 CLASS A) (TIGR) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TIGR was recently trading at $8.08 and has an implied volatility of 55.93% for this period. Based…

-

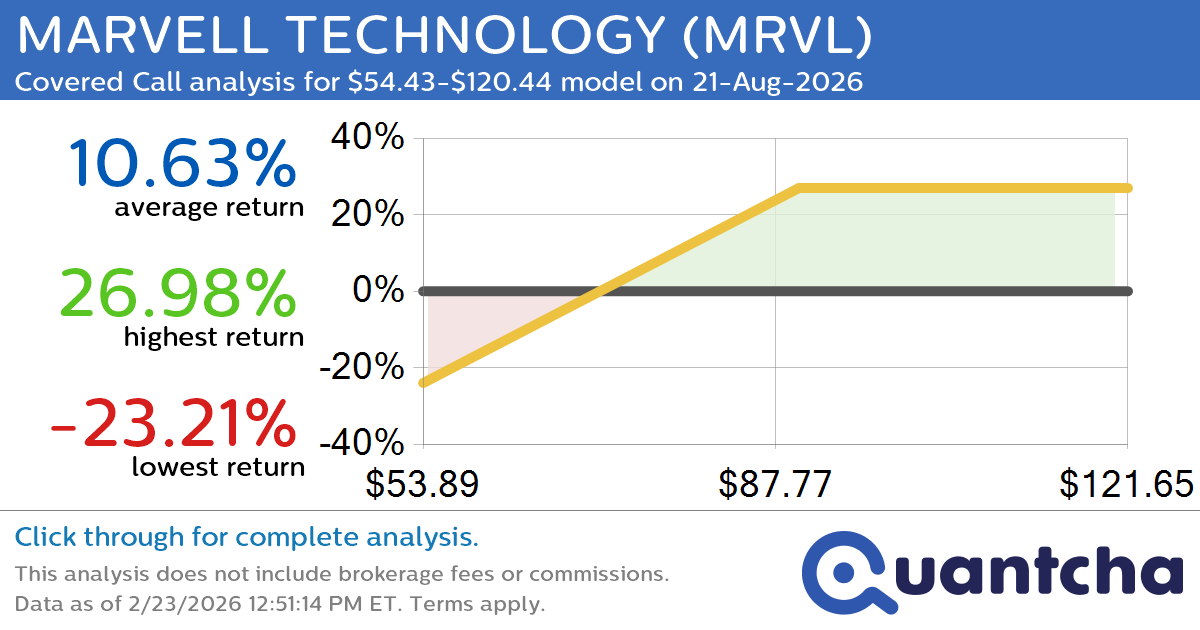

Covered Call Alert: MARVELL TECHNOLOGY $MRVL returning up to 26.98% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for MARVELL TECHNOLOGY (MRVL) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MRVL was recently trading at $79.48 and has an implied volatility of 56.60% for this period. Based on an analysis of the options…

-

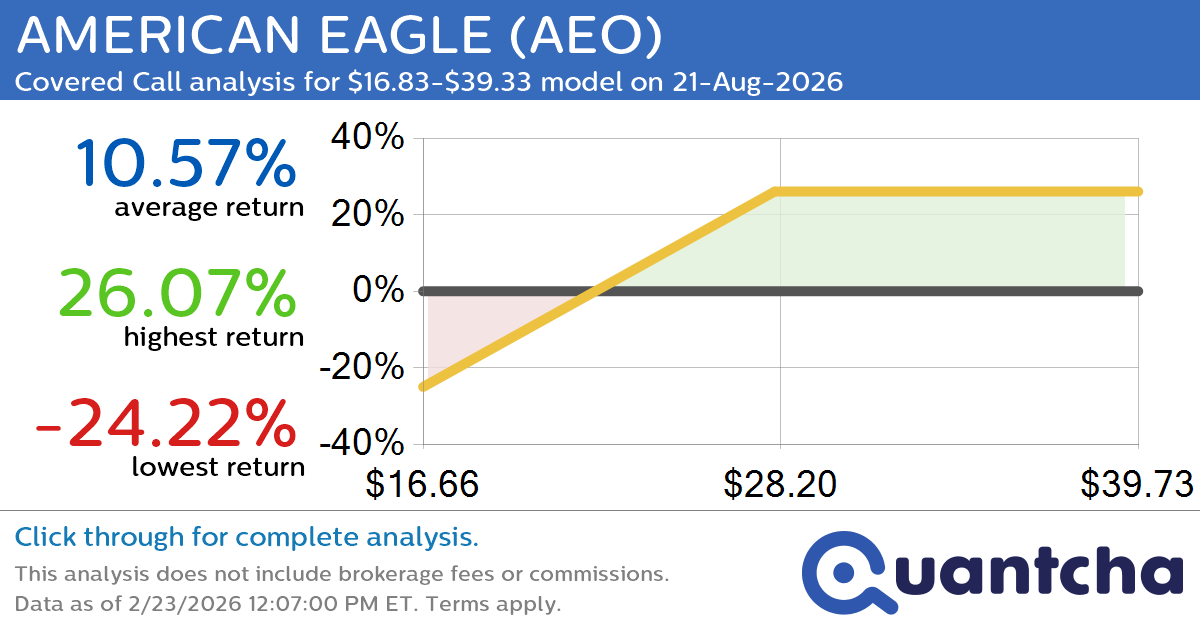

Covered Call Alert: AMERICAN EAGLE $AEO returning up to 26.07% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for AMERICAN EAGLE (AEO) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AEO was recently trading at $25.26 and has an implied volatility of 60.47% for this period. Based on an analysis of the options…

-

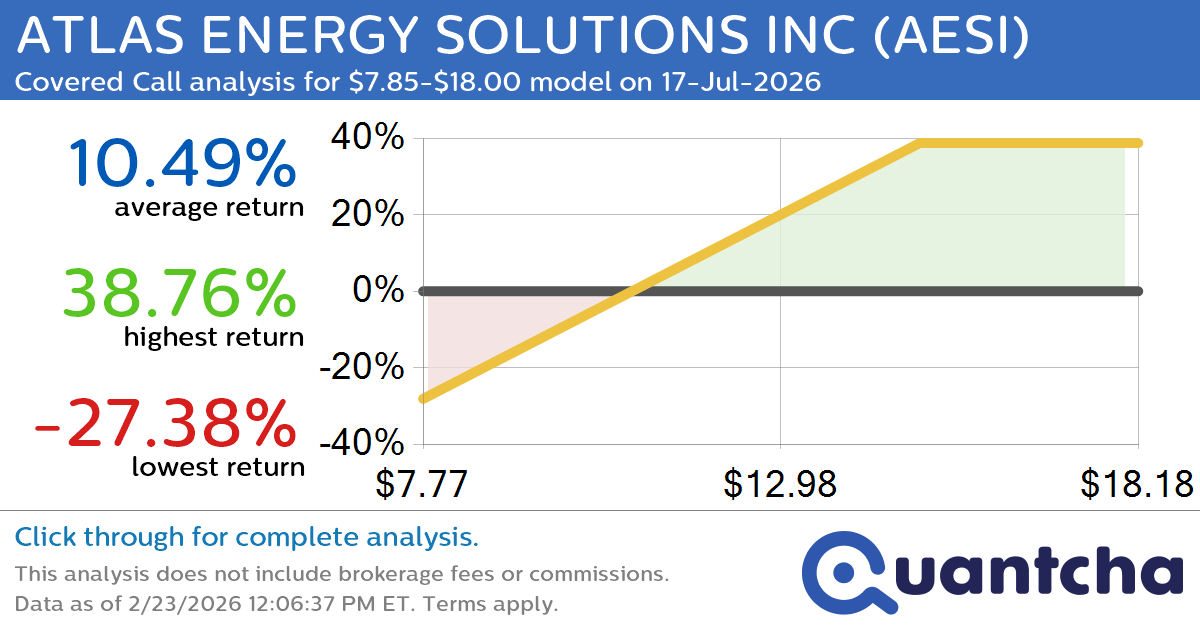

Covered Call Alert: ATLAS ENERGY SOLUTIONS INC $AESI returning up to 38.76% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for ATLAS ENERGY SOLUTIONS INC (AESI) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AESI was recently trading at $11.71 and has an implied volatility of 65.89% for this period. Based on an analysis of…

-

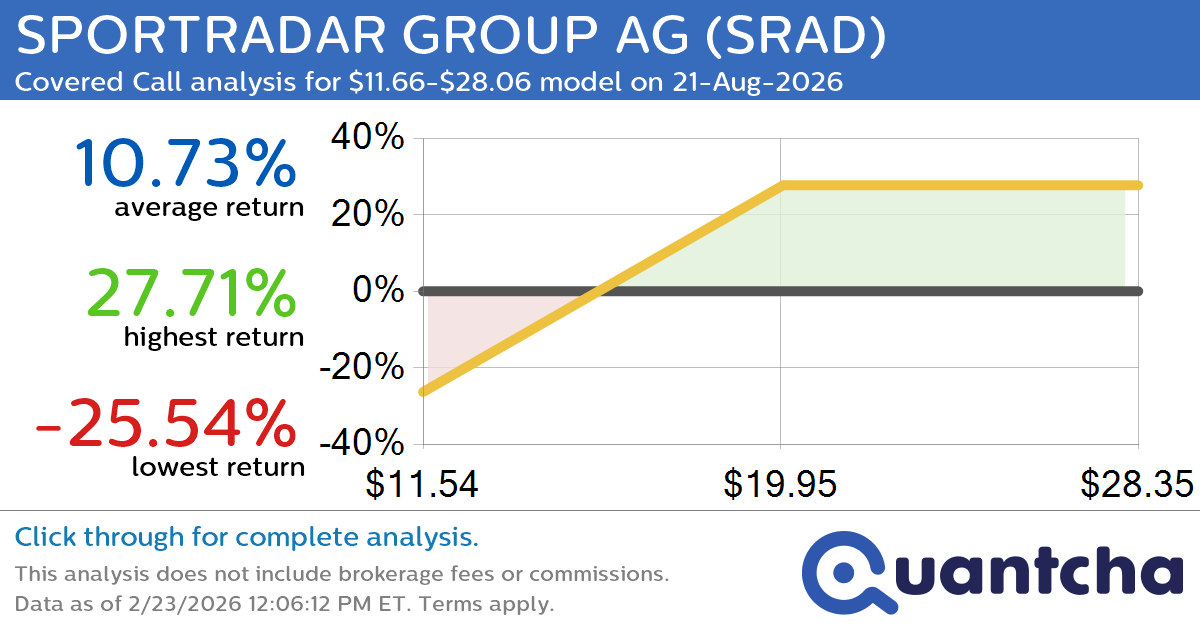

Covered Call Alert: SPORTRADAR GROUP AG $SRAD returning up to 27.71% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for SPORTRADAR GROUP AG (SRAD) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SRAD was recently trading at $17.76 and has an implied volatility of 62.56% for this period. Based on an analysis of the…

-

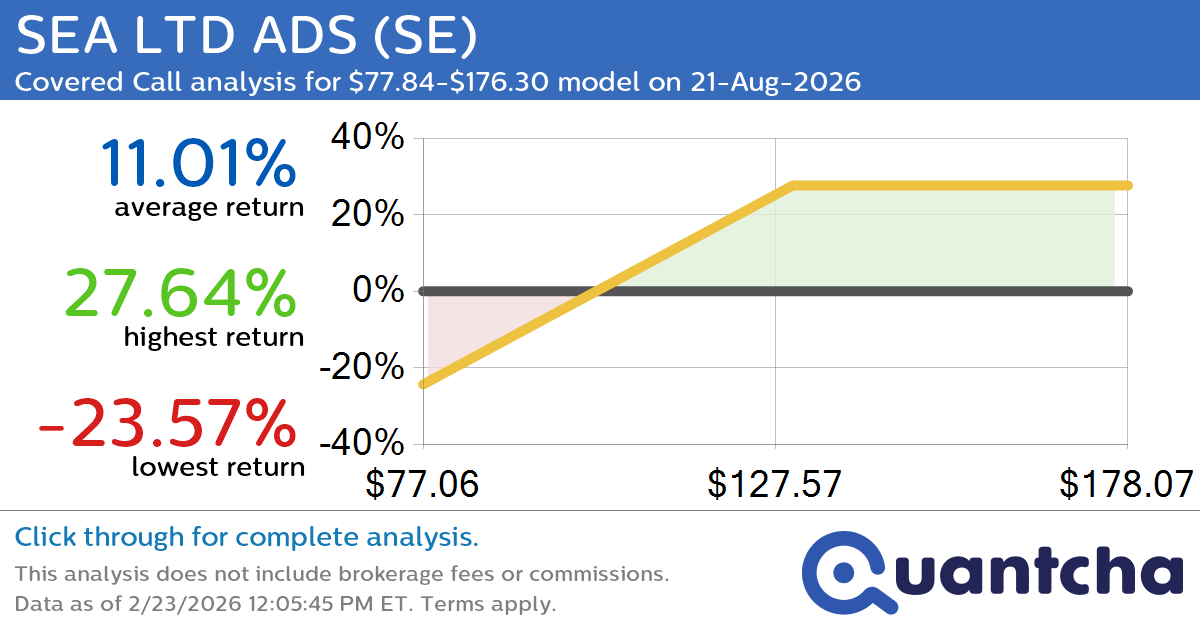

Covered Call Alert: SEA LTD ADS $SE returning up to 27.64% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for SEA LTD ADS (SE) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SE was recently trading at $115.00 and has an implied volatility of 58.25% for this period. Based on an analysis of the…

-

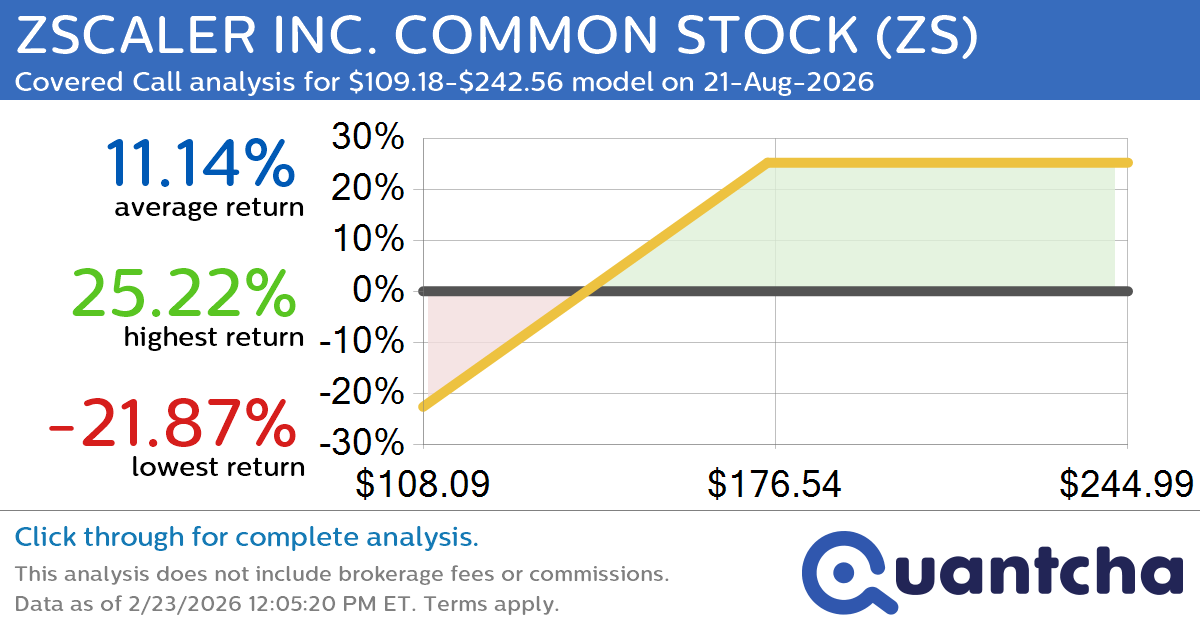

Covered Call Alert: ZSCALER INC. COMMON STOCK $ZS returning up to 25.22% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for ZSCALER INC. COMMON STOCK (ZS) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ZS was recently trading at $159.75 and has an implied volatility of 56.88% for this period. Based on an analysis of…

-

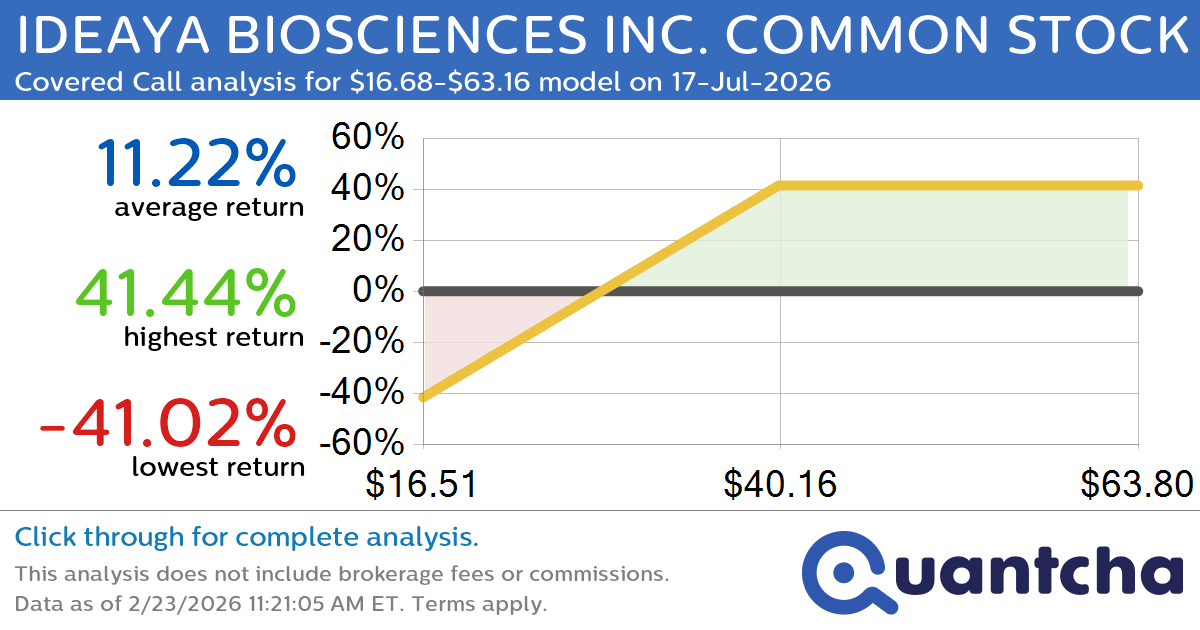

Covered Call Alert: IDEAYA BIOSCIENCES INC. COMMON STOCK $IDYA returning up to 41.44% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for IDEAYA BIOSCIENCES INC. COMMON STOCK (IDYA) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IDYA was recently trading at $31.98 and has an implied volatility of 105.71% for this period. Based on an analysis…