Category: Trade Ideas

-

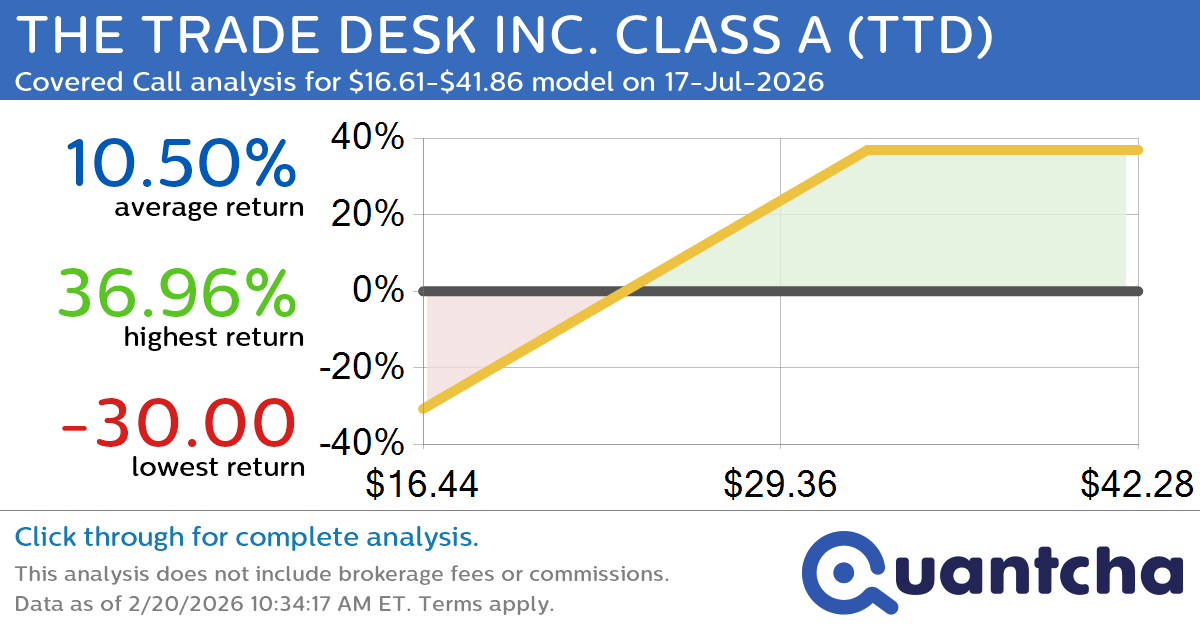

Covered Call Alert: THE TRADE DESK INC. CLASS A $TTD returning up to 39.66% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for THE TRADE DESK INC. CLASS A (TTD) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTD was recently trading at $25.97 and has an implied volatility of 72.64% for this period. Based on an…

-

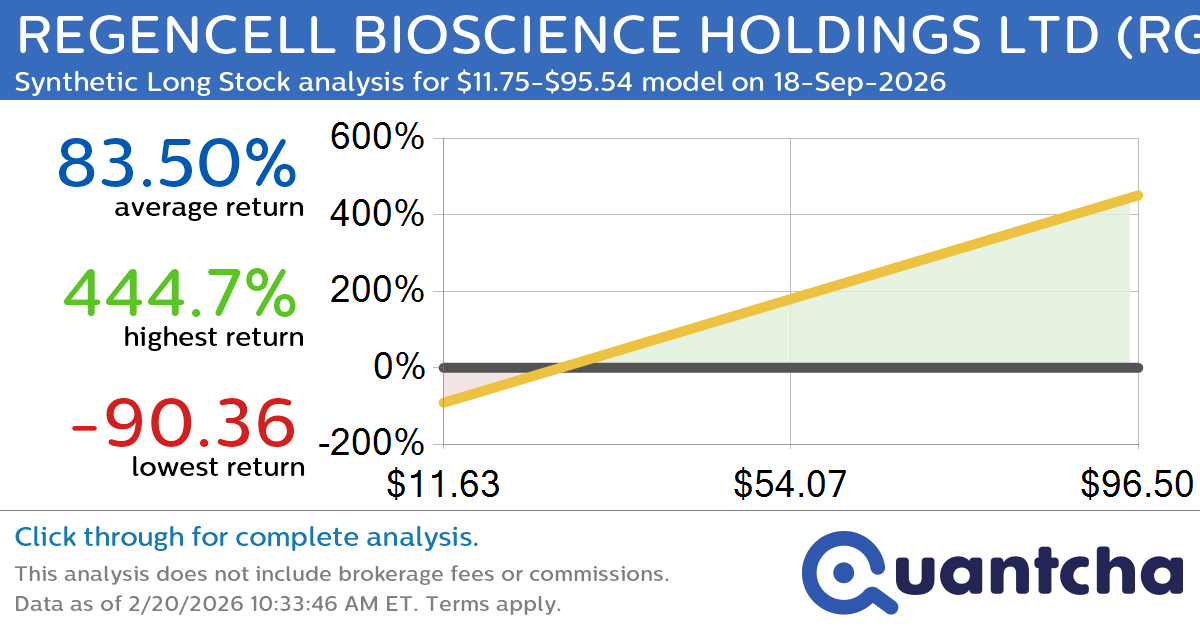

Synthetic Long Discount Alert: REGENCELL BIOSCIENCE HOLDINGS LTD $RGC trading at a 19.82% discount for the 18-Sep-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for REGENCELL BIOSCIENCE HOLDINGS LTD (RGC) for the 18-Sep-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGC was recently trading at $32.80 and has an implied volatility of 137.90% for this period. Based on an analysis…

-

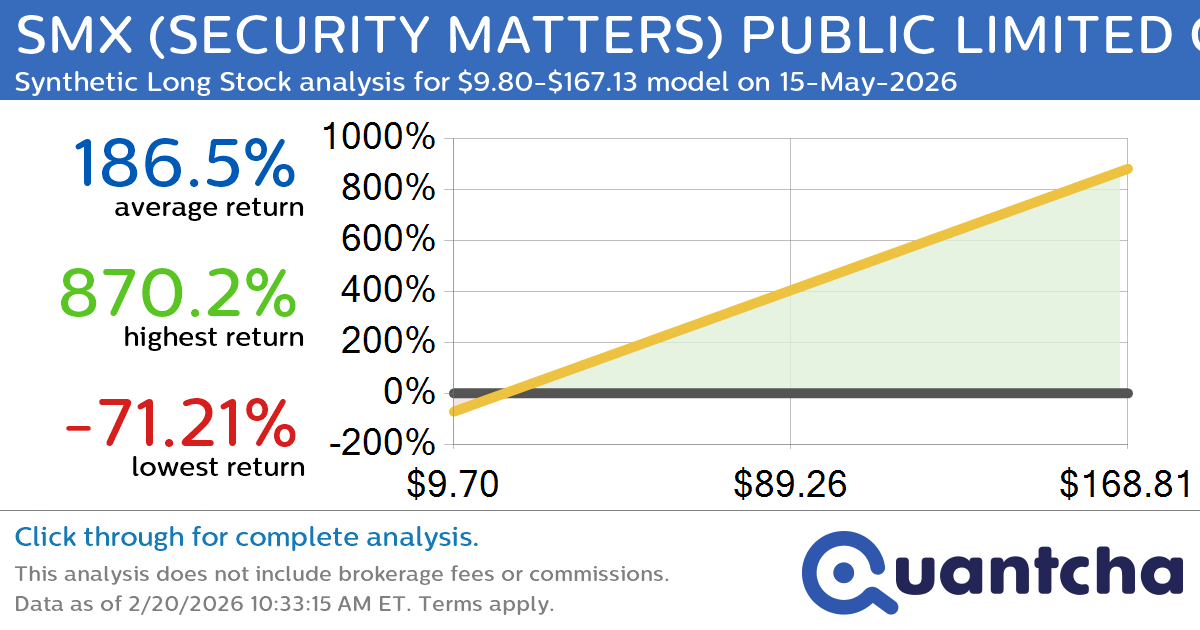

Synthetic Long Discount Alert: SMX (SECURITY MATTERS) PUBLIC LIMITED COMPANY $SMX trading at a 45.90% discount for the 15-May-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for SMX (SECURITY MATTERS) PUBLIC LIMITED COMPANY (SMX) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMX was recently trading at $40.11 and has an implied volatility of 294.31% for this period. Based on…

-

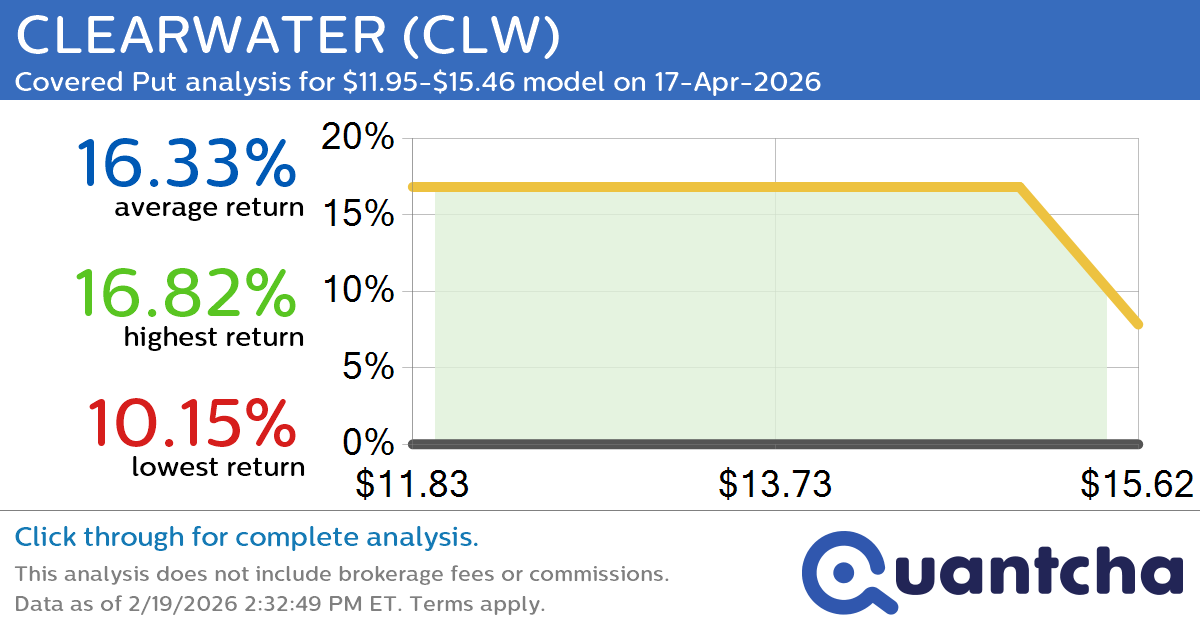

Big Loser Alert: Trading today’s -9.3% move in CLEARWATER $CLW

Quantchabot has detected a new Covered Put trade opportunity for CLEARWATER (CLW) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CLW was recently trading at $15.37 and has an implied volatility of 64.90% for this period. Based on an analysis of the options available…

-

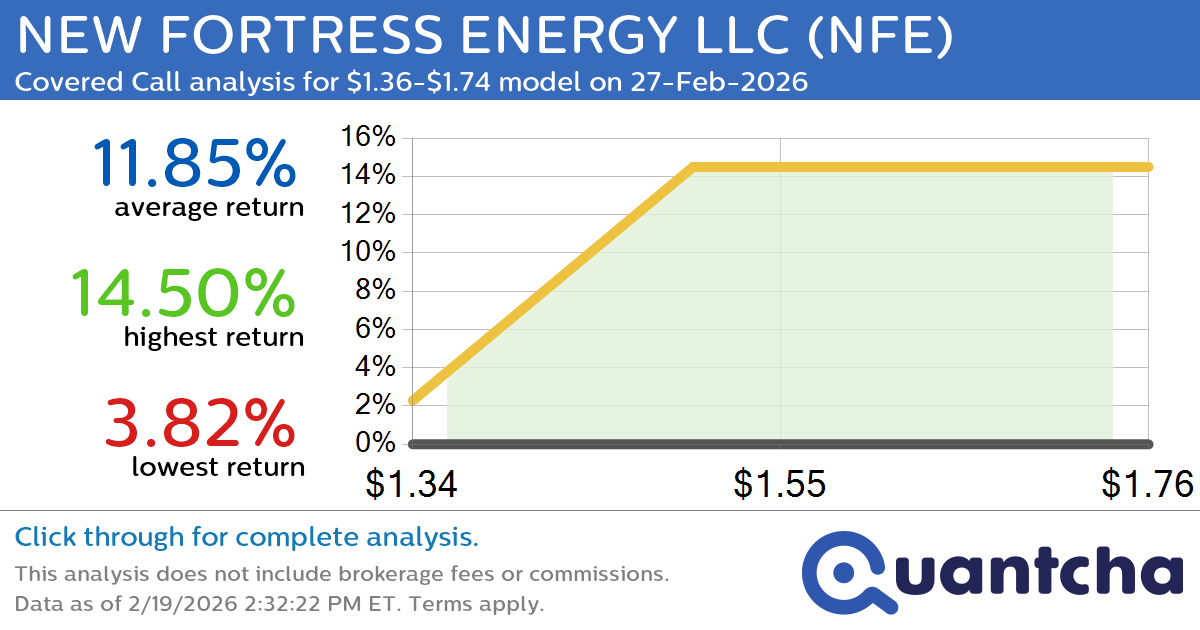

Big Gainer Alert: Trading today’s 7.8% move in NEW FORTRESS ENERGY LLC $NFE

Quantchabot has detected a new Covered Call trade opportunity for NEW FORTRESS ENERGY LLC (NFE) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NFE was recently trading at $1.36 and has an implied volatility of 162.08% for this period. Based on an analysis of…

-

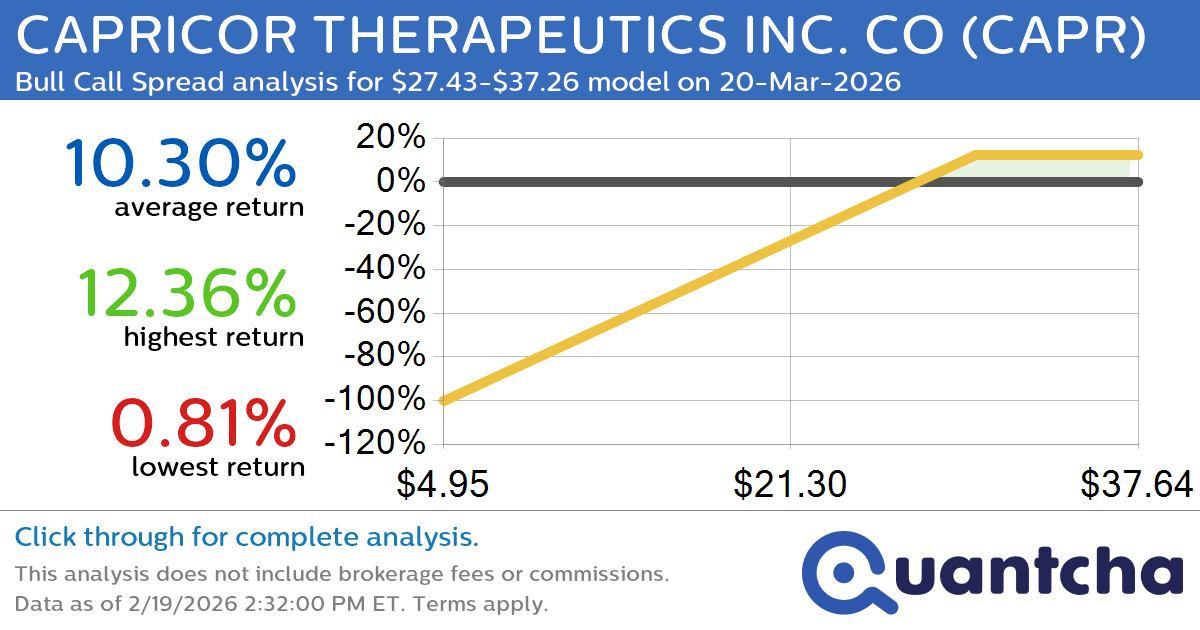

Big Gainer Alert: Trading today’s 7.1% move in CAPRICOR THERAPEUTICS INC. CO $CAPR

Quantchabot has detected a new Bull Call Spread trade opportunity for CAPRICOR THERAPEUTICS INC. CO (CAPR) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAPR was recently trading at $27.35 and has an implied volatility of 107.52% for this period. Based on an analysis…

-

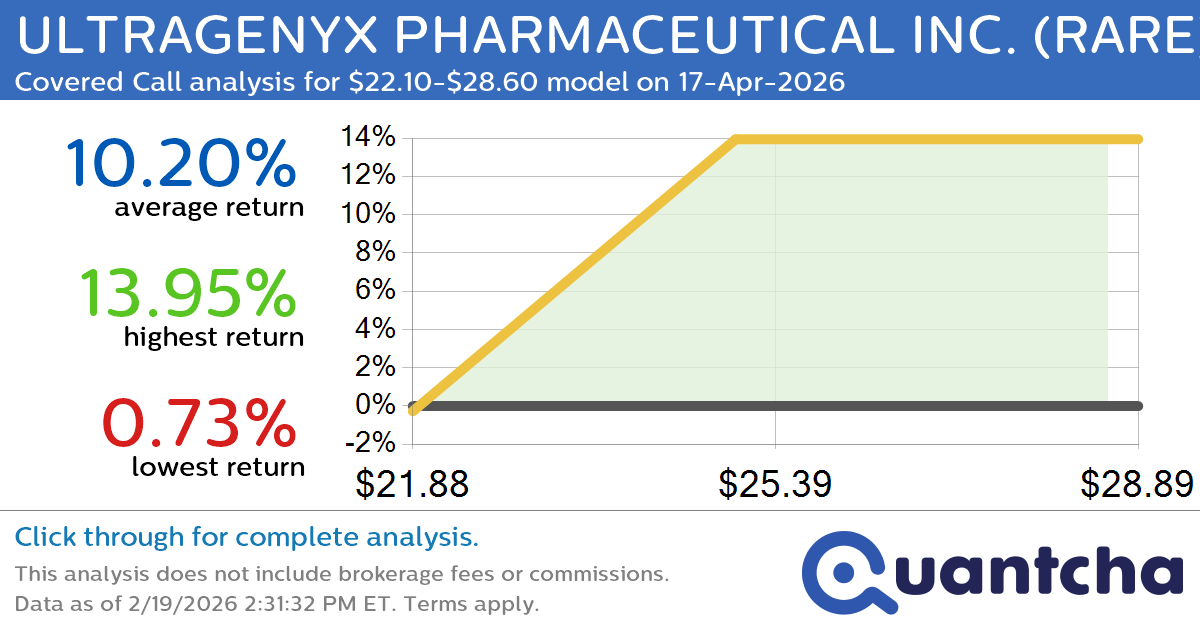

Big Gainer Alert: Trading today’s 7.4% move in ULTRAGENYX PHARMACEUTICAL INC. $RARE

Quantchabot has detected a new Covered Call trade opportunity for ULTRAGENYX PHARMACEUTICAL INC. (RARE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RARE was recently trading at $21.96 and has an implied volatility of 64.96% for this period. Based on an analysis of the…

-

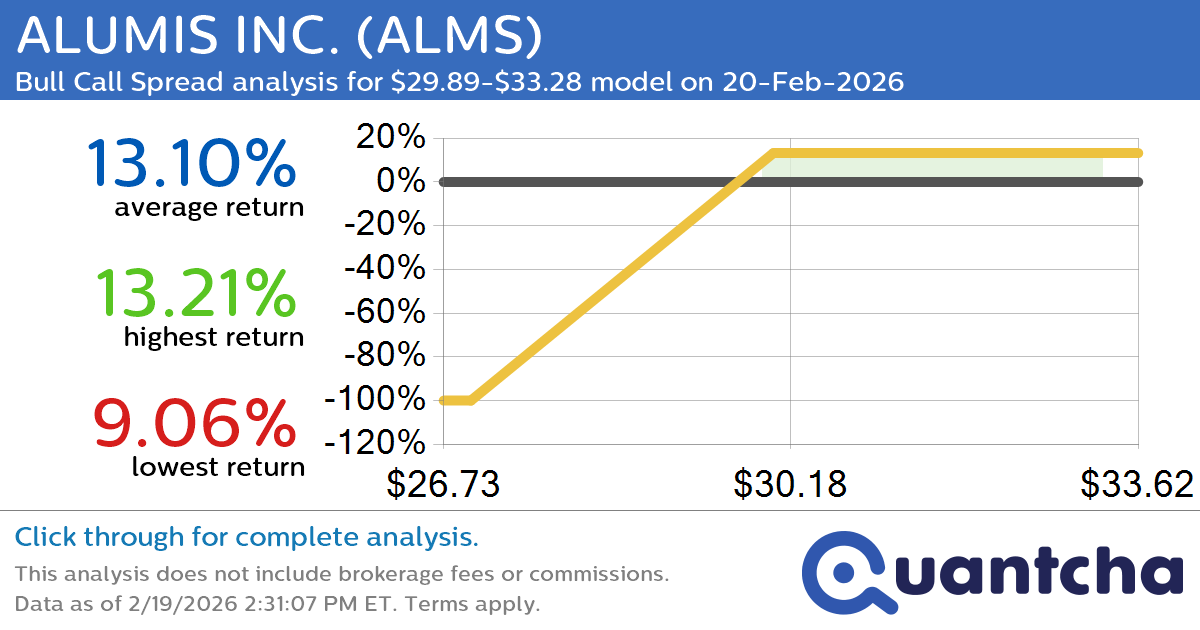

Big Gainer Alert: Trading today’s 8.7% move in ALUMIS INC. $ALMS

Quantchabot has detected a new Bull Call Spread trade opportunity for ALUMIS INC. (ALMS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ALMS was recently trading at $29.89 and has an implied volatility of 161.69% for this period. Based on an analysis of the…

-

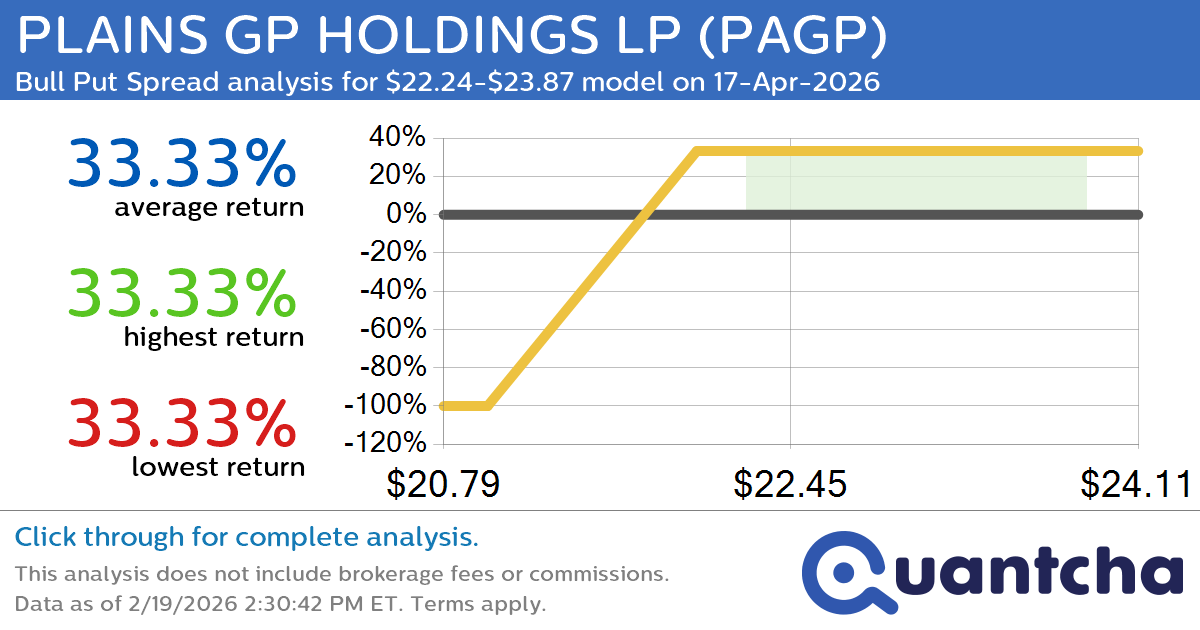

52-Week High Alert: Trading today’s movement in PLAINS GP HOLDINGS LP $PAGP

Quantchabot has detected a new Bull Put Spread trade opportunity for PLAINS GP HOLDINGS LP (PAGP) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PAGP was recently trading at $22.11 and has an implied volatility of 17.88% for this period. Based on an analysis…

-

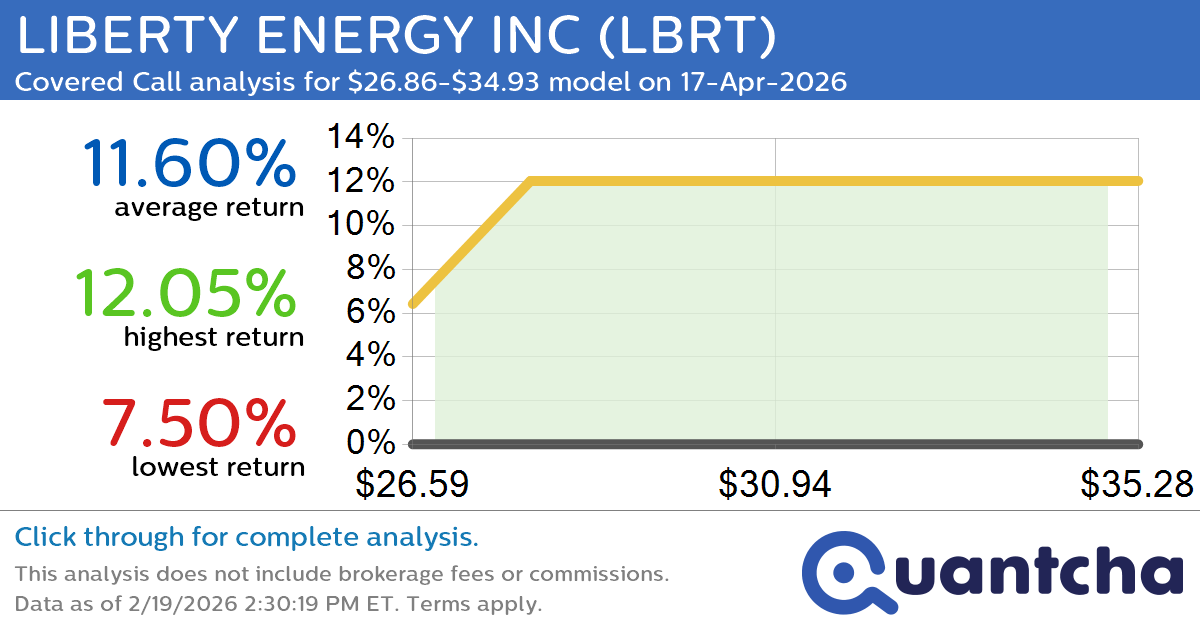

52-Week High Alert: Trading today’s movement in LIBERTY ENERGY INC $LBRT

Quantchabot has detected a new Covered Call trade opportunity for LIBERTY ENERGY INC (LBRT) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LBRT was recently trading at $26.80 and has an implied volatility of 66.07% for this period. Based on an analysis of the…