Category: Trade Ideas

-

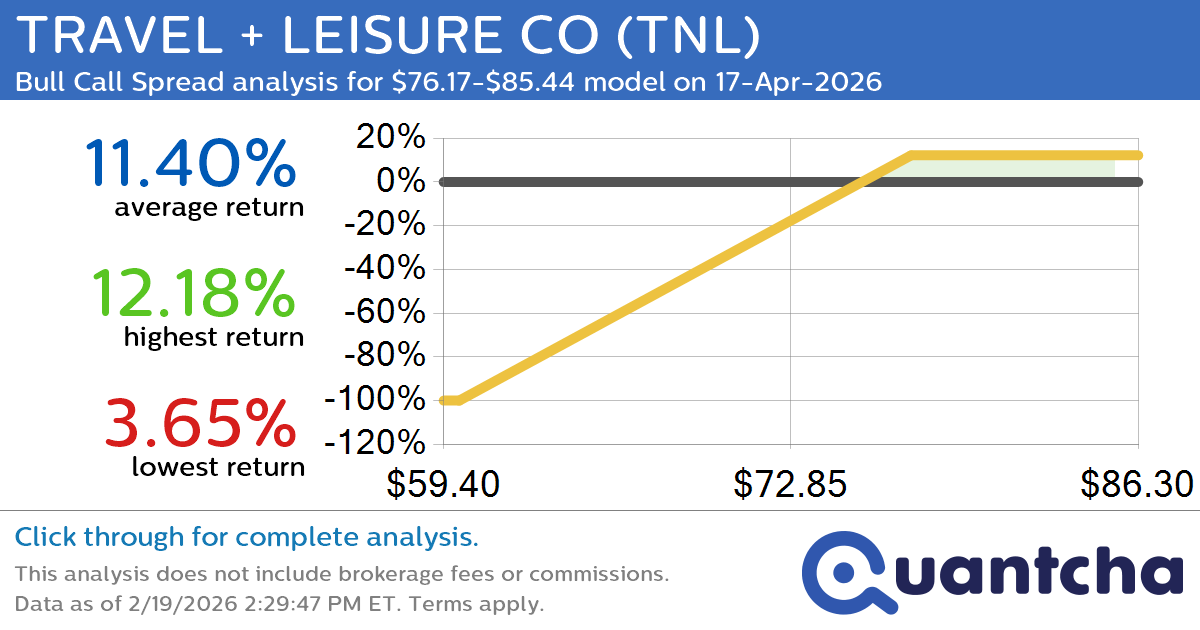

52-Week High Alert: Trading today’s movement in TRAVEL + LEISURE CO $TNL

Quantchabot has detected a new Bull Call Spread trade opportunity for TRAVEL + LEISURE CO (TNL) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TNL was recently trading at $75.72 and has an implied volatility of 28.90% for this period. Based on an analysis…

-

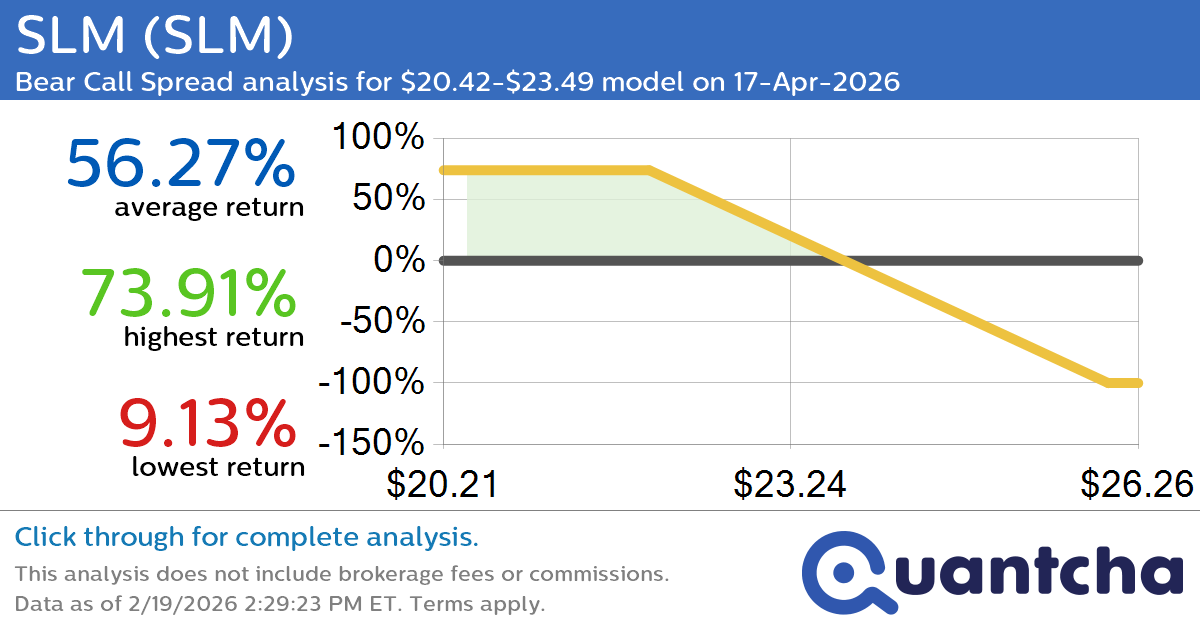

52-Week Low Alert: Trading today’s movement in SLM $SLM

Quantchabot has detected a new Bear Call Spread trade opportunity for SLM (SLM) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SLM was recently trading at $23.48 and has an implied volatility of 35.25% for this period. Based on an analysis of the options…

-

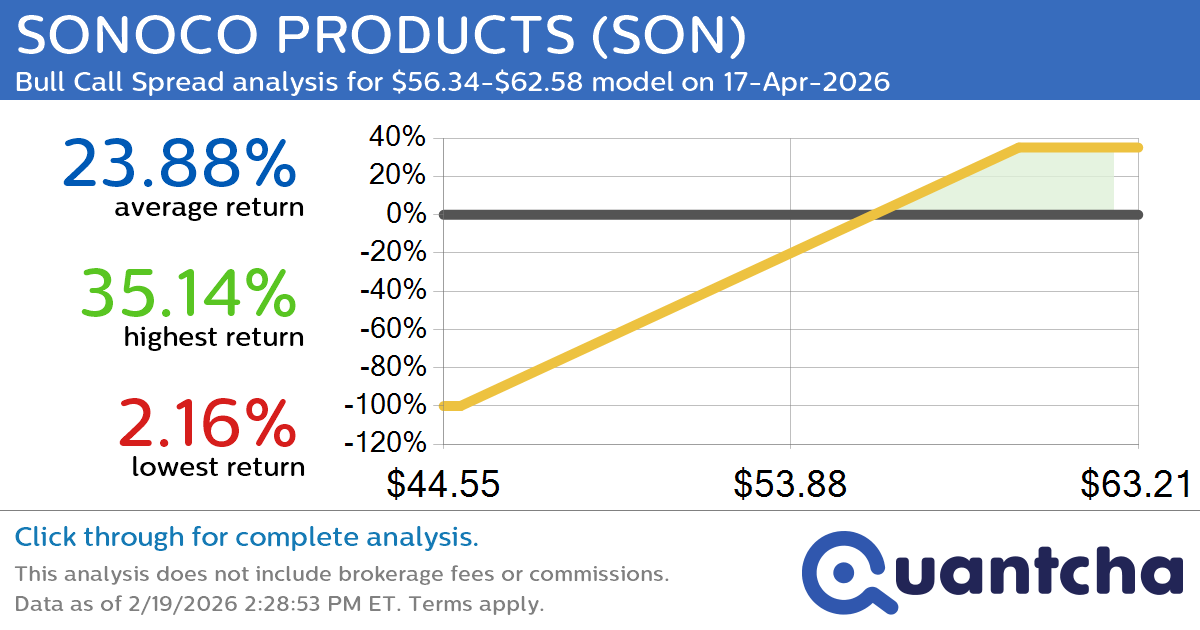

52-Week High Alert: Trading today’s movement in SONOCO PRODUCTS $SON

Quantchabot has detected a new Bull Call Spread trade opportunity for SONOCO PRODUCTS (SON) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SON was recently trading at $56.53 and has an implied volatility of 26.47% for this period. Based on an analysis of the…

-

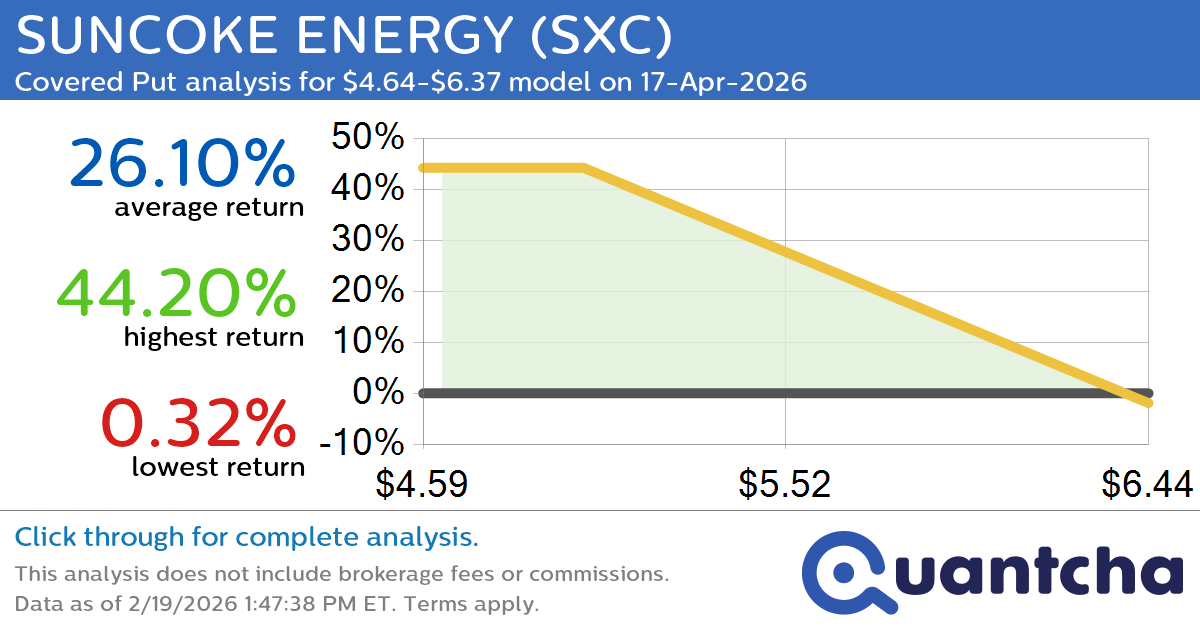

Big Loser Alert: Trading today’s -7.1% move in SUNCOKE ENERGY $SXC

Quantchabot has detected a new Covered Put trade opportunity for SUNCOKE ENERGY (SXC) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SXC was recently trading at $6.33 and has an implied volatility of 80.07% for this period. Based on an analysis of the options…

-

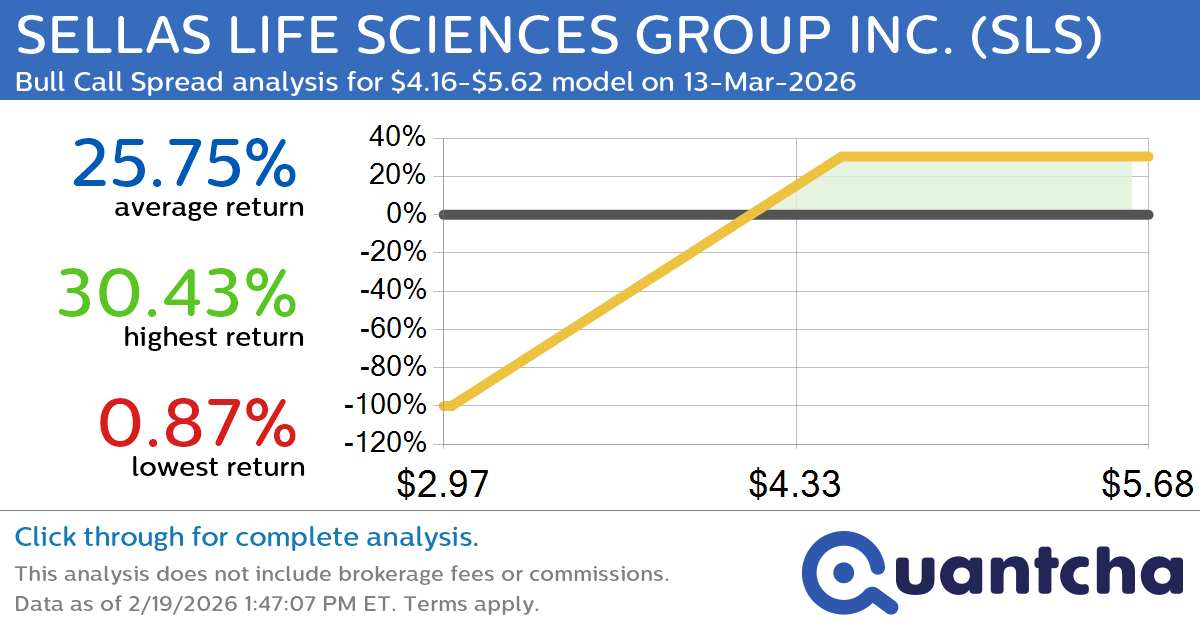

Big Gainer Alert: Trading today’s 9.6% move in SELLAS LIFE SCIENCES GROUP INC. $SLS

Quantchabot has detected a new Bull Call Spread trade opportunity for SELLAS LIFE SCIENCES GROUP INC. (SLS) for the 13-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SLS was recently trading at $4.16 and has an implied volatility of 120.09% for this period. Based on an…

-

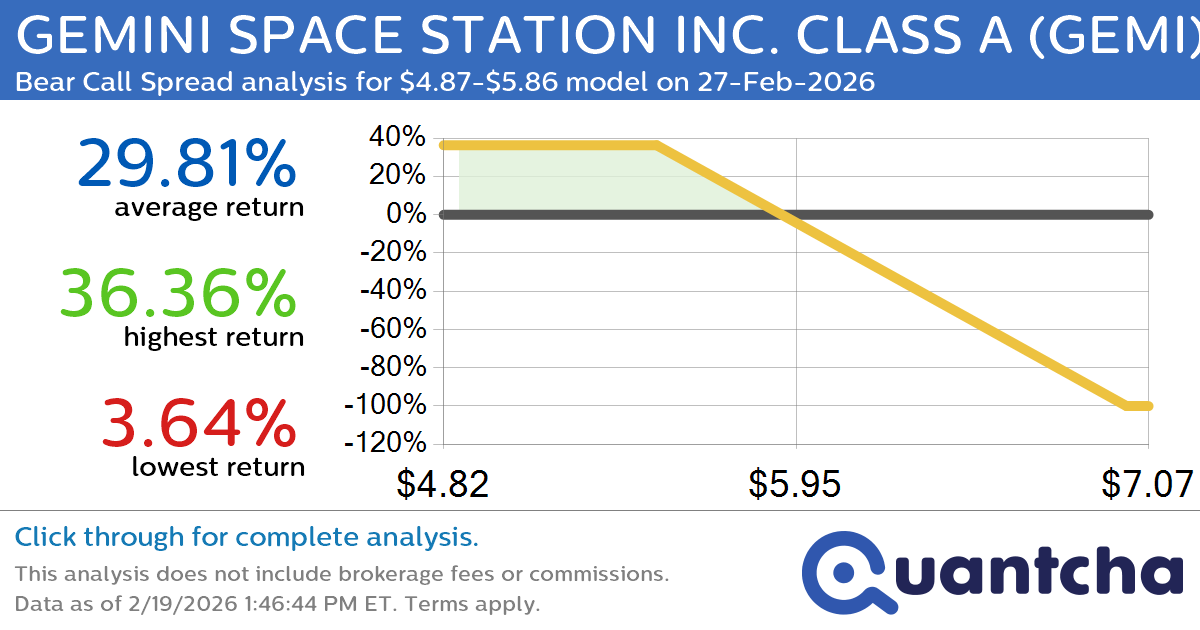

Big Loser Alert: Trading today’s -8.2% move in GEMINI SPACE STATION INC. CLASS A $GEMI

Quantchabot has detected a new Bear Call Spread trade opportunity for GEMINI SPACE STATION INC. CLASS A (GEMI) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GEMI was recently trading at $5.85 and has an implied volatility of 119.15% for this period. Based on…

-

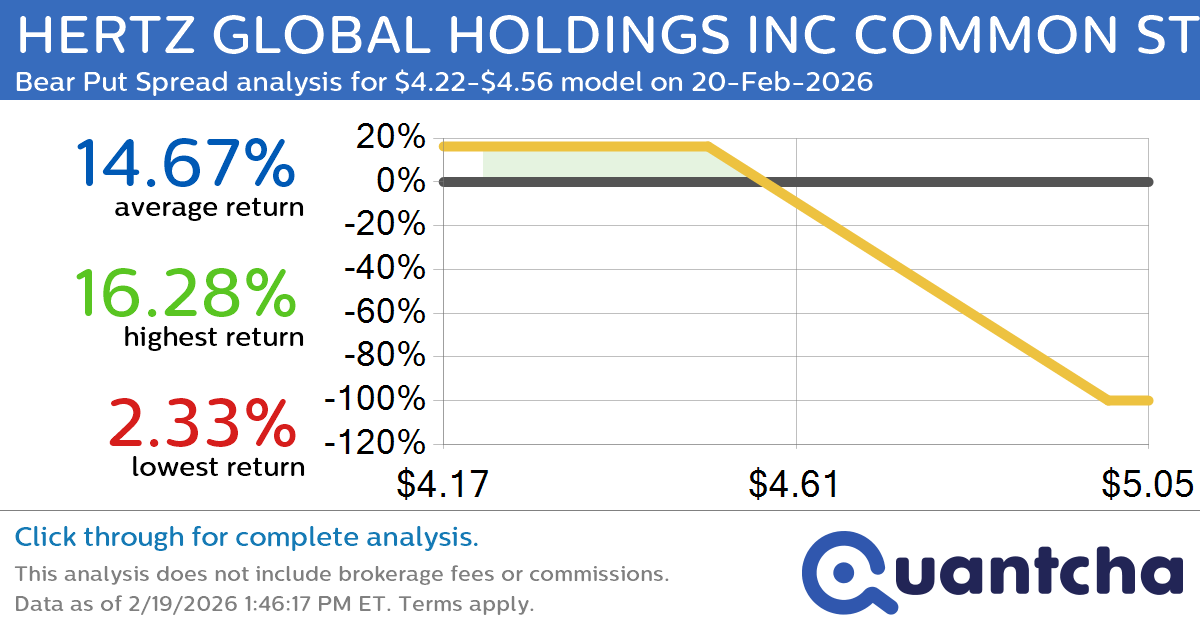

Big Loser Alert: Trading today’s -14.1% move in HERTZ GLOBAL HOLDINGS INC COMMON STOCK $HTZ

Quantchabot has detected a new Bear Put Spread trade opportunity for HERTZ GLOBAL HOLDINGS INC COMMON STOCK (HTZ) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HTZ was recently trading at $4.55 and has an implied volatility of 115.90% for this period. Based on…

-

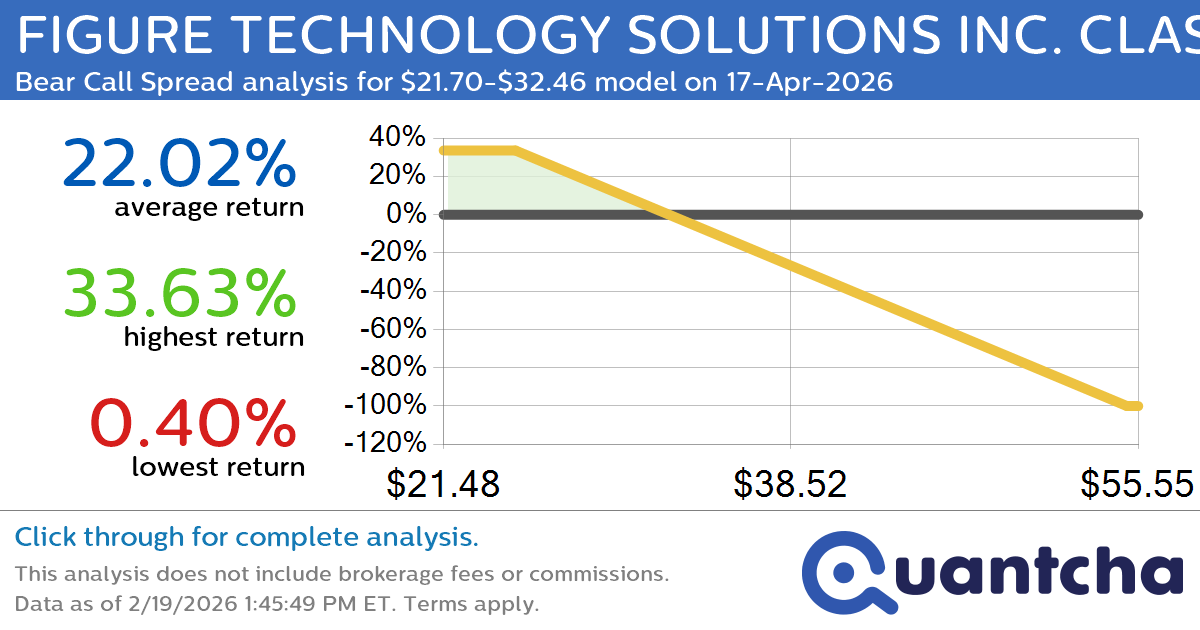

Big Loser Alert: Trading today’s -9.1% move in FIGURE TECHNOLOGY SOLUTIONS INC. CLASS A $FIGR

Quantchabot has detected a new Bear Call Spread trade opportunity for FIGURE TECHNOLOGY SOLUTIONS INC. CLASS A (FIGR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIGR was recently trading at $32.27 and has an implied volatility of 101.34% for this period. Based on…

-

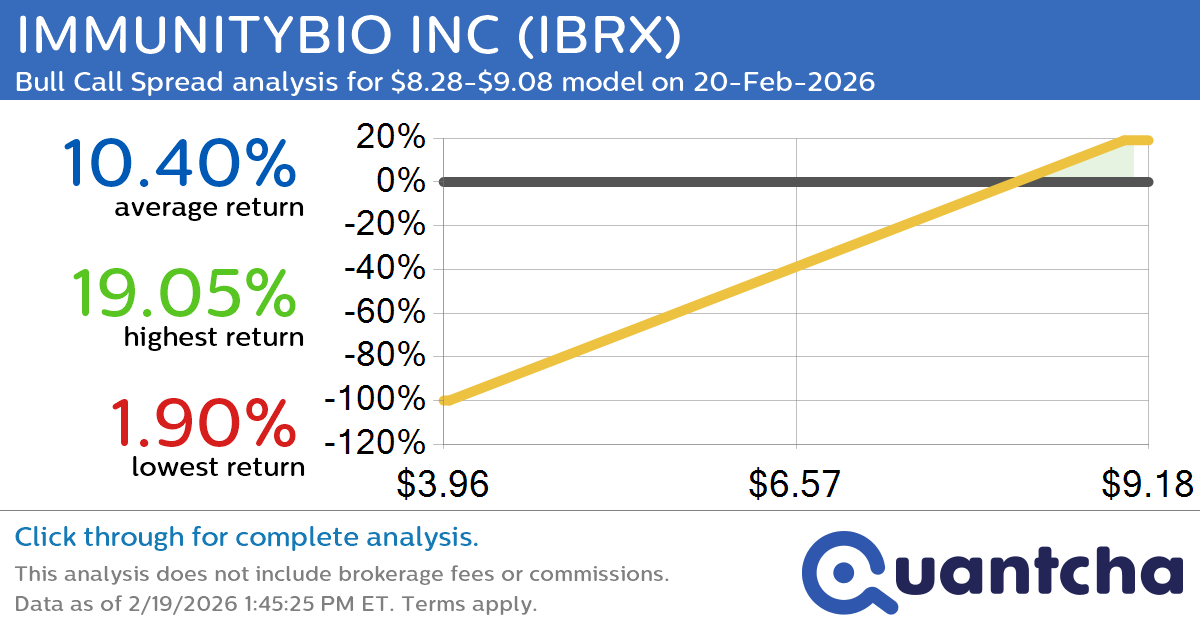

52-Week High Alert: Trading today’s movement in IMMUNITYBIO INC $IBRX

Quantchabot has detected a new Bull Call Spread trade opportunity for IMMUNITYBIO INC (IBRX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IBRX was recently trading at $8.28 and has an implied volatility of 137.29% for this period. Based on an analysis of the…

-

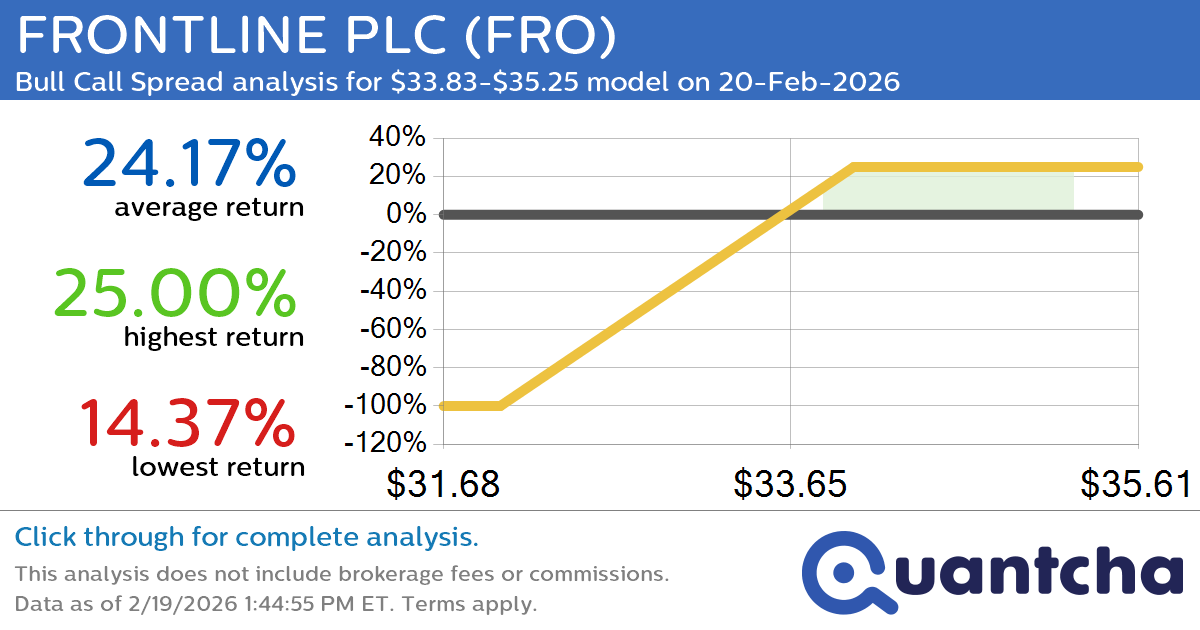

52-Week High Alert: Trading today’s movement in FRONTLINE PLC $FRO

Quantchabot has detected a new Bull Call Spread trade opportunity for FRONTLINE PLC (FRO) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FRO was recently trading at $33.83 and has an implied volatility of 61.27% for this period. Based on an analysis of the…